Professional Documents

Culture Documents

Module 1 2010

Uploaded by

AJay ModiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 1 2010

Uploaded by

AJay ModiCopyright:

Available Formats

Financial Planning Association of Malaysia Web Sample

Module 1 Sample Questions

Q1. A. B. C. D. The body responsible for the formulation and implementation of monetary policy in Malaysia is ___________________________. Bank Negara Malaysia. Securities Commission. Bursa Malaysia. Malaysian Institute of Economic Research.

Q2. What is the current purchasing power of an investment that will be worth `````````RM10,000 in 10 years based on an inflation rate of 4% per annum? A. B. C. D. RM6,708 RM6,246 RM6,756 RM14,803

Answer: FV= PV (1+i) ^ n 10,000 = PV (1.04^10) PV = 10,000/1.48 = $6,756

Q3. A. B. C. D. Q4. A. B. C. D.

Which of the following statements correctly explains why it is important for a financial planner to personalize communications with clients? It helps the clients to better understand the planners values. It helps the clients to move directly towards the necessary decisions. It enhances the quality of the relationship with the client. It is consistent with the fiduciary status of the planner. Which of the following statements about inflation is not true? It hurts a fixed salaried person more than a businessman. Portfolio investments normally provide a good hedge against inflation. It is normally measured from the Production Price Index. It reduces the purchasing power of your cash income.

Financial Planning Association of Malaysia Web Sample

Q5.

What is meant by Fiscal policy? A. It is a policy used by the government through its expenditure and taxation practices to spur or inhibit economic activity. B. It is a policy used by the government through direct control on interest rates or money supply in order to achieve certain economic objectives. C. It is a policy designed to transfer ownership of public enterprises to the private sector. D. It is a policy used to encourage smart partnerships between financial institutions and conglomerates.

Q6.

Buying a car through Islamic financing would involve a deferred sale transaction where payments are made by installments. This transaction is called __________________. A. B. C. D. Bai-bithaman ajil. Mudharabah. Rahn. Ijarah.

Q7.

For the purpose of costing a risk, an insurer usually measures the following characteristic(s) of a risk: I. II. expenses. III. IV. A. B. C. D. I I, IV II, III I, II, III Its frequency. The management and claims settlement

Its severity. The dates when it occurs.

Financial Planning Association of Malaysia Web Sample

Q8.

Claims arising under the following circumstance(s) is/are likely to be denied if the insured had: I. Committed suicide after the policys suicide exclusion period had expired. II. Died during the policys contestable period and material information was not furnished at the time of the proposal. III. Not paid the premium due but died before the expiry of the grace period. A. B. C. D. I, II I II II, III

Q9.

What type of insurance provides benefits to an insured person who is unable to work because of sickness or injury? A. B. C. D. Disability income insurance. Term insurance. Whole-of-life insurance. Medical expense insurance.

Q10. Given the four portfolios below, which is the most efficient? Portfolio Return (%) Risk (Beta) Return/Risk A. B. C. D. I II III IV I 20 1.5 13.3 II 15 1.1 13.6 III 10 0.8 12.5 IV 6 0.6 10.0

Q11. A bond is deemed to be more risky due to ____________________. A. B. C. D. The year it is issued. The longer the period to maturity. The way it is promoted None of the above.

Financial Planning Association of Malaysia Web Sample

Q12. Which of the following statements describes a unit trust fund as being similar to a portfolio? A. B. C. D. A unit trust fund consists of various stocks. A unit trust fund consists of various bonds. A unit trust fund consists of various stocks and fixed income securities. All of the above.

Q13. Which of the following statements concerning retirement planning during the portfolio restructuring period as one nears retirement is/are correct? I. Annual retirement funding is directed into lower-risk type investments. II. It is aimed at acquiring assets whose main attraction is capital preservation. III. A persons risk appetite becomes greater. A. B. C. D. II I, II I, III II, III

Q14. Which of the following is not one of the subject areas in financial planning? A. B. C. D. Cash management. Investment. Insurance. Education.

Q15. If there exists a significant deviation between actual results and planned results, what is/are the possible course(s) of action than can be taken? I. Restart the planning process. II. Revise targets. III. Take corrective actions. A. B. C. D. I I, II II, III III

Financial Planning Association of Malaysia Web Sample

Q16. Which of the following is not a violation of the Principle of Integrity in the performance of a `planners professional service? A. Exercising reasonable and prudent judgment in dealing with a client. B. Making misleading claims about the scope and areas of competence. C. Giving the impression that the planner is representing the views of FPAM. D. Engaging in conduct involving dishonesty, fraud, deceit or misrepresentation. Q17. Which of the following is a reason for constructing a budget? A. To assist you to plan and control your expenditure to match your earnings. B. To assist you to extend your borrowing capacity. C. To assist you in increasing your net worth value. D. To be used as a tool to obtain refinancing for your home loan.

Q18. A CFP designees use of the CFP mark is a proclamation to the public that he: I. Can be trusted with the clients financial affairs with confidence. II. Will competently fulfill the responsibilities owed to the client. III. Is governed by a professional Code of Ethics. IV. Possesses all the necessary expertise in financial matters. A. B. C. D. I, II I, II, III I, III, IV All of the above.

Financial Planning Association of Malaysia Web Sample

Q19. The financial planner is required to exercise objectivity in providing services to clients. This means he is __________________. A. B. C. D. Impartial. Honest. Competent. Diligent.

Q20. Which of the following is not a risk management tool? A. B. C. D. Options and Futures. Insurance. Sinking Fund. Stable dividend policies.

Q21. A Malaysian unit trust manager has 200 stocks in his portfolio. Which of the following statements is true? A. Systematic risk is at a minimum. B. The Beta of the portfolio is near zero. C. As many of the stocks are negatively correlated, its systematic risk has been reduced. D. As many of the stocks are positively correlated, its unsystematic risk has been reduced. Q22. By expanding a stock portfolio invested solely in the Bursa Malaysia with regional stocks, a manager can: A. B. C. D. Increase the correlation of the portfolio. Raise the beta of the portfolio. Enhance the liquidity of the portfolio. Produce higher returns at a given level of risk.

Q23. Which of the following is false concerning the comparative sales approach to valuing real estate? A. B. C. D. It results in overvaluation in bull markets. The cash generation ability of the property has little relevance. It uses a comparison of market capitalization rates. None of the above.

Financial Planning Association of Malaysia Web Sample

Q24. Which of the following statement(s) is/are false? I. II. III. IV. A. B. C. D. A Muslim in West Malaysia can will away two thirds of his estate. A Muslim in West Malaysia cannot will away any of his estate. A Muslim in East Malaysia can will away half of his estate if it complies with the East Malaysia Testacy Law. A Muslim in West Malaysia can will away one third of his estate to whomever he likes. I I, III I, II, III All of the above.

Q25. A person can set up a _____________ to safeguard the well being of an irresponsible beneficiary. A. B. C. D. Discretionary trust. Resulting trust. Protective trust. Conditional trust.

Q26. In what circumstances can a statutory trust be created when a person dies intestate? A. Where there is a minor inheriting. B. In the event that the administrators appointed failed to carry out their duties properly. C. As stated in the Will of a deceased that he wants to have a statutory trust created. D. None of the above. Q27. Which of the following is not a requirement of a valid Will? A. The Will has to fulfill the conditions set out in the Distribution Act 1958. B. The testator must be over the age of majority. C. The Will has to fulfill the requirements of the Wills Act 1959. D. The testator must have testamentary capacity.

Financial Planning Association of Malaysia Web Sample

Q28. The following is most important in determining the beginning of the basis period of a company: A. B. C. D. Incorporation date of the business. Financial year end of the business. Commencement date of the business. Accounting date of the business.

Q29. The annual allowance of a qualifying asset is calculated based on the qualifying ______________. A. Cost of the asset. B. Residual value of the asset. C. Expenditure apportioned based on the period of time the asset is being used. D. Expenditure for the period 1 January to 31 December in a calendar year.

End of Sample Questions

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- LDU Pitch DeckDocument16 pagesLDU Pitch DeckAJay ModiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Native Credentials-VC AMC Operations PDFDocument18 pagesNative Credentials-VC AMC Operations PDFAJay ModiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 404PCB Slidesnew09Document32 pages404PCB Slidesnew09AJay ModiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- IndiaMART InterMESH Initiating Coverage Sep 19 EDELDocument73 pagesIndiaMART InterMESH Initiating Coverage Sep 19 EDELAJay ModiNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Learning Redefined!: WWW - Imiedu.inDocument19 pagesLearning Redefined!: WWW - Imiedu.inAJay ModiNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- T.E. (E &TC/Electronics) (Semester II) Examination, 2009 Information Theory and Coding Techniques (2003 Course)Document43 pagesT.E. (E &TC/Electronics) (Semester II) Examination, 2009 Information Theory and Coding Techniques (2003 Course)Tanveer JjNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

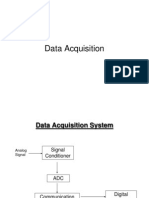

- Data AcquisitionDocument13 pagesData AcquisitionAJay ModiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- C2 MidTestDocument9 pagesC2 MidTesttien nguyenNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- GRAMMAR POINTS and USEFUL ENGLISHDocument197 pagesGRAMMAR POINTS and USEFUL ENGLISHMiguel Andrés LópezNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Major Petroleum CompaniesDocument75 pagesMajor Petroleum CompaniesShaho Abdulqader MohamedaliNo ratings yet

- Ramya Pabbisetti: Consultant, OAS - UHG - IIM IndoreDocument2 pagesRamya Pabbisetti: Consultant, OAS - UHG - IIM IndoreJyotirmoy GhoshNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Rules and Regulations For Cottage Booking PDFDocument1 pageRules and Regulations For Cottage Booking PDFmrinmoy chakrabortyNo ratings yet

- Angara V. Electoral Commission G.R. NO. L-45081. JULY 15, 1936 Laurel, JDocument7 pagesAngara V. Electoral Commission G.R. NO. L-45081. JULY 15, 1936 Laurel, JOppa KyuNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Why Study Business?: What Are The Advantages of A Business Diploma?Document5 pagesWhy Study Business?: What Are The Advantages of A Business Diploma?rodinibNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- HSM340 Week 4 Homework 1 2 3Document3 pagesHSM340 Week 4 Homework 1 2 3RobynNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Tin Industry in MalayaDocument27 pagesTin Industry in MalayaHijrah Hassan100% (1)

- Ucsp Week 7Document10 pagesUcsp Week 7EikaSoriano100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chandrababu NaiduDocument4 pagesChandrababu NaiduSneha More PandeyNo ratings yet

- Torbela Vs Sps RosarioDocument2 pagesTorbela Vs Sps RosarioJoshua L. De Jesus100% (2)

- Schiffman CB10 PPT 09Document39 pagesSchiffman CB10 PPT 09chawla_sonam0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pattaya Today Volume 8 Issue 24 PDFDocument52 pagesPattaya Today Volume 8 Issue 24 PDFpetereadNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- G O Ms NoDocument2 pagesG O Ms NoMuralidhar MogalicherlaNo ratings yet

- Bilal Islamic Secondary School-Bwaise.: Rules Governing PrepsDocument2 pagesBilal Islamic Secondary School-Bwaise.: Rules Governing Prepskakembo hakimNo ratings yet

- Co ownershipQ3ZB2009 PDFDocument4 pagesCo ownershipQ3ZB2009 PDFsting1093No ratings yet

- CLIFFORD PROCTOR'S NURSERIES LIMITED - Company Accounts From Level BusinessDocument7 pagesCLIFFORD PROCTOR'S NURSERIES LIMITED - Company Accounts From Level BusinessLevel BusinessNo ratings yet

- Data-Modelling-Exam by NaikDocument20 pagesData-Modelling-Exam by NaikManjunatha Sai UppuNo ratings yet

- Group Session-Week 2 - Aldi Case StudyDocument8 pagesGroup Session-Week 2 - Aldi Case StudyJay DMNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Educ 60 ReviewerDocument6 pagesEduc 60 ReviewerJean GuyuranNo ratings yet

- AbramelinDocument340 pagesAbramelinMarvin BurenNo ratings yet

- A Deal Making Strategy For New CEOsDocument4 pagesA Deal Making Strategy For New CEOsTirtha DasNo ratings yet

- Hajireswme BVV PDFDocument3 pagesHajireswme BVV PDFPradeep KumarNo ratings yet

- 1) Morales Vs Court of Appeals (d2017)Document2 pages1) Morales Vs Court of Appeals (d2017)Pau SaulNo ratings yet

- Workweek Plan Grade 6 Third Quarter Week 2Document15 pagesWorkweek Plan Grade 6 Third Quarter Week 2Lenna Paguio100% (1)

- District MeetDocument2 pagesDistrict MeetAllan Ragen WadiongNo ratings yet

- Vol 1 CLUP (2013-2022)Document188 pagesVol 1 CLUP (2013-2022)Kristine PiaNo ratings yet

- Cases:-: Mohori Bibee V/s Dharmodas GhoseDocument20 pagesCases:-: Mohori Bibee V/s Dharmodas GhoseNikhil KhandveNo ratings yet

- Winning The LotteryDocument3 pagesWinning The Lotterysantosh mizarNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)