Professional Documents

Culture Documents

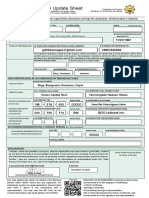

Bir Form 1901 Blank

Uploaded by

Lecel LlamedoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Form 1901 Blank

Uploaded by

Lecel LlamedoCopyright:

Available Formats

(To be filled-up by the BIR)

DLN:

Re publika ng Pilipi nas Kag awaran ng Pana nalap i

Kawanihan ng Rentas Internas For Self-Employed and Mixed Income Individuals, Estates and Trusts

Application for Registration

BIR Form No.

1901

New TIN to be issued, if applicable (To be fille d up by BIR)

January 2000 (ENCS)

Fill in all appropriate white spaces. Mark all appropriate boxes with an X.

Part I 1 Taxpayer Type Single Proprietorship Professional Taxpayer Information Estate 2 Registering Office Head Office Trust Branch Office 5 3 Date of Registration

(MM/ DD/ YYYY) (To be filled up by BIR)

4 Taxpayer Identification No.

(For taxpayers with existing TIN or applying for a branch)

RDO Code 8 Citizenship

6 9

Sex

(To be filled up by BIR)

Male Female

7 Taxpayer's Name Last Name First Name 10 Residence Address (Please indicate complete address) Middle Name

Date of Birth/ Organization Date

(Estates/ Trusts) ( MM / DD / YYYY )

11 Zip Code

12 Telephone Number

13 Business Address (Please indicate complete address) 14 Zip Code 17 Name of Administrator/Trustee (In case of Estate/Trust) 15 Municipality Code

(To be filled up by the BIR)

16 Telephone Number 18 Address of Administrator/Trustee

19 Primary/ Secondary Industries (Attach Additional Sheets, If Necessary) Facility Types : PP - Place of Production; SP - Storage Place; WH - Warehouse CODE Number Facility Type

(To be filled up by BIR) with no independent tax types

Industry Primary Primary Secondary Secondary

Business / Trade Names

PSIC

PSOC

Line of Business/ Occupation

PP

SP

WH

of Facilities

20 Contact Person/ Accredited Tax Agent (if different from taxpayer)

Last Name, First Name, Middle Name (if individual) / Registered Name (if non-individual)

21 Telephone Number

22

Tax Types (choose only the tax types that are applicable to you) Income Tax Value-added Tax Percentage Tax - Stocks Percentage Tax - Stocks (IPO) Other Percentage Taxes Under the National Internal Revenue Code (Specify) Percentage Tax Payable Under Special Laws Withholding Tax - Compensation Withholding Tax - Expanded Withholding Tax - Final Withholding Tax - Fringe Benefits Withholding Tax - Banks and Other Financial Institutions Withholding Tax - Others (One-time Transaction not subject to Capital Gains Tax) Withholding Tax - VAT and Other Percentage Taxes Withholding Tax - Percentage Tax on Winnings and Prizes Paid by Racetrack Operators Excise Tax - Ad Valorem Excise Tax - Specific Tobacco Inspection and Monitoring Fees Documentary Stamps Tax Capital Gains Tax - Real Property Capital Gains Tax - Stocks Estate Tax Donor's Tax Registration Fees Miscellaneous Tax (Specify) Others (Specify)

FORM TYPE

(To be filled up by the BIR)

ATC

(To be filled up by the BIR)

23 Registration of Books of Accounts PSIC TYPE OF BOOKS TO BE REGISTERED PSOC QNTY. FROM VOLUME TO

(To be filled up by BIR) (To be filled up by BIR)

NO. OF PAGES

plication for egistration

BIR Form No.

1901

New TIN to be issued, if applicable (To be fille d up by BIR)

January 2000 (ENCS)

Taxpayer Information

Male Female

Date of Birth/ Organization Date

(Estates/ Trusts) ( MM / DD / YYYY )

12 Telephone Number

ity Types : PP - Place of Production; SP - Storage Place; WH - Warehouse

Number of Facilities

(To be filled up by the BIR)

NO. OF PAGES

BIR Form No. 1901 (ENCS)-PAGE 2

Part II Personal Exemptions 24 25 Civil Status Employment Status of Spouse: Single/Widow/Widower/Legally Separated (No dependents) Unemployed Head of the Family Employed Locally Single with qualified dependent Legally separated with qualified dependent Employed Abroad Widow/Widower with qualified dependent Benefactor of a qualified senior citizen (RA No. 7432) Engaged in Business/Practice Married of Profession 26 Claims for Additional Exemptions/ Premium Deductions for husband and wife whose aggregate family income does not exceed P250,000.00 per annum. Husband claims additional exemption and any premium deductions Wife claims additional exemption and any premium deductions (Attach Waiver of the Husband) 27 Spouse Information Spouse Taxpayer Identification Number Spouse Name 27A 27B Spouse Employer's Taxpayer Identification Number 27C Part III Section A 28 Number of Qualified Dependent Children 29 Names of Qualified Dependent Children

Last Name

Last Name First Name Spouse Employer's Name 27D

Middle Name

Additional Exemptions Number and Names of Qualified Dependent Children

First Name

Middle Name

Date of Birth ( MM / DD / YYYY )

Mark if Mentally / Physically Incapacitated

29A 30A 31A 32A

29B 30B 31B 32B

29C 30C 31C 32C

29D 30D 31D 32D

29E 30E 31E 32E

Mark if Mentally / Physically Incapacitated

Section B Name of Qualified Dependent Other than Children

Last Name First Name Middle Name Date of Birth ( MM / DD / YYYY )

33A

33B

33C

33D

33E

33F Relationship Parent Brother Sister Qualified Senior Citizen Part IV For Employee With Two or More Employers (Multiple Employments) Within the Calendar Year Type of multiple employments 34 Successive employments (With previous employer(s) within the calendar year), for late registrants if applicable Concurrent employments (With two or more employers at the same time within the calendar year) [If successive, enter previous employer(s); if concurrent, enter secondary employer(s)] Previous and Concurrent Employments During the Calendar Year TIN Name of Employer/s

35 Declaration I declare, under the penalties of perjury, that this form has been made in good faith, verified by me and to the best of my knowledge and belief is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. TAXPAYER / AUTHORIZED AGENT

(Signature over printed name)

Part V 36 Taxpayer Identification Number

Current Main Employer Information 37 RDO Code

(To be filled up by BIR)

38 Employer's Name (Last Name, First Name, Middle Name, if Individual/ Registered Name, if non-Individuals)

39 Employer's Business Address 40 Zip Code 41 Municipality Code

(To be filled up by the BIR)

42 Effectivity Date

(Date when Exemption Information is applied)

43 Date of Certification

(Date of certification of the accuracy of the

exemption information)

44 Telephone Number

(MM/ DD/ YYYY) (MM/ DD/ YYYY)

45 Declaration I declare, under the penalties of perjury, that this form has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Stamp of BIR Receiving Office and Date of Receipt

Attachments Complete? (To be filled up by BIR) EMPLOYER / AUTHORIZED AGENT

(Signature over printed Name) ATTACHMENTS: (Photocopy only) A. For Self-employed/ Professionals/ Mixed Income Individuals 1- Birth Certificate or any document showing name, address and birth date of the applicant

Title / Position of Signatory Yes No

B. For Trust -Trust Agreement NOTE: 1. Update trade name upon receipt of DTI Certificate of Registration of Business Name. 2. Taxpayer should attend the required taxpayers briefing before the release of the BIR Certificate of Registration

2- Mayor's Permit - if applicable, 3- DTI Certificate of Registration of Business Name to be submitted prior to the issuance of to be submitted prior to the issuance of Certificate of Registration Certificate of Registration C. For Estate - Death Certificate of the deceased

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER(TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

Employment Status of Spouse:

Engaged in Business/Practice

nd and wife whose aggregate family income does not exceed P250,000.00 per annum. Wife claims additional exemption and any premium deductions

Last Name

First Name

Middle Name

dditional Exemptions

Mark if Mentally / Physically Incapacitated

Mark if Mentally / Physically Incapacitated

t Employments During the Calendar Year Name of Employer/s

s been made in good faith, verified by me and to the best of my knowledge

R / AUTHORIZED AGENT

ature over printed name)

(Date of certification of the accuracy of the

(MM/ DD/ YYYY)

Stamp of BIR Receiving Office and Date of Receipt

Attachments Complete? (To be filled up by BIR)

3- DTI Certificate of Registration of Business Name to be submitted prior to the issuance of

You might also like

- Promissory NoteDocument3 pagesPromissory NoteLecel Llamedo50% (2)

- Affidavit of Co-OwnershipDocument1 pageAffidavit of Co-OwnershipMarlon Gonzaga100% (1)

- Affidavit of EmploymentDocument1 pageAffidavit of EmploymentLecel LlamedoNo ratings yet

- Authorization Form For Querying FinalDocument1 pageAuthorization Form For Querying FinalApril NNo ratings yet

- Quality Assurance Process Manual FOR Sole Proprietor CpaDocument21 pagesQuality Assurance Process Manual FOR Sole Proprietor CpaAnasor GoNo ratings yet

- Notes To Financial Statements TemplateDocument2 pagesNotes To Financial Statements TemplateFlorendo Dauz Jr.100% (1)

- Affidavit of Non-Filing of ITRDocument1 pageAffidavit of Non-Filing of ITRLecel Llamedo100% (3)

- ACOP FormDocument3 pagesACOP FormSoc Sagum100% (1)

- Proof of Surviving Legal HeirsDocument3 pagesProof of Surviving Legal HeirsLecel Llamedo0% (1)

- Gift Passing GamesDocument25 pagesGift Passing GamesLecel Llamedo100% (1)

- Philippine Water Districts Information by RegionDocument1 pagePhilippine Water Districts Information by RegionLecel LlamedoNo ratings yet

- Motion To Set Aside 06:11 PDFDocument11 pagesMotion To Set Aside 06:11 PDFtravis taylor50% (2)

- BIR PaymentDocument2 pagesBIR Paymentachilles_0367% (15)

- EFI Application Form SUPPLEMENTARY PDFDocument1 pageEFI Application Form SUPPLEMENTARY PDFJhoie GeeCeeNo ratings yet

- BIR S1905 Registration Update SheetDocument1 pageBIR S1905 Registration Update Sheetjonely kantimNo ratings yet

- 13th Month Pay Report To DOLEDocument2 pages13th Month Pay Report To DOLEkristinne biares100% (1)

- BIR Form No. 0902 December 2020 Final3corrDocument3 pagesBIR Form No. 0902 December 2020 Final3corrJayson MercadoNo ratings yet

- SSSForm Member Loan Payment ReturnDocument1 pageSSSForm Member Loan Payment Returnrhod_bspt3251No ratings yet

- Application Letter For Authority To Establish and Operate As Money Service BusinessDocument2 pagesApplication Letter For Authority To Establish and Operate As Money Service Businesssubscription jdbsNo ratings yet

- RMC No 57 - Annexes A-CDocument13 pagesRMC No 57 - Annexes A-CRACNo ratings yet

- Leave FormDocument5 pagesLeave FormnielNo ratings yet

- Personal Data SheetDocument4 pagesPersonal Data SheetLeonil Estaño100% (7)

- Challenging Debt Claims - Pay Later and Litigate NowDocument3 pagesChallenging Debt Claims - Pay Later and Litigate NowjoanabudNo ratings yet

- Original Registration 13 Steps - Land TitlesDocument42 pagesOriginal Registration 13 Steps - Land TitlesBoy Kakak Toki100% (14)

- Bir Form 1901Document2 pagesBir Form 1901jaciemNo ratings yet

- Official Business FormDocument1 pageOfficial Business FormAnakataNo ratings yet

- HMODocument5 pagesHMOdocaisaNo ratings yet

- Sykes Hmo Benefit Plan 2016Document16 pagesSykes Hmo Benefit Plan 2016Secret SecretNo ratings yet

- Annex B-2Document1 pageAnnex B-2Von Virchel VallesNo ratings yet

- Eaínings Amount Deductions Amount: PayslipDocument1 pageEaínings Amount Deductions Amount: PayslipKuhramaNo ratings yet

- Tax Compliance MonitoringDocument44 pagesTax Compliance MonitoringAcademe100% (2)

- Registration Update Sheet: Taxpayer InformationDocument1 pageRegistration Update Sheet: Taxpayer InformationRCVZ BKNo ratings yet

- How To Fill-Out BIR Form 1905Document11 pagesHow To Fill-Out BIR Form 1905Jhon Michael VillafloresNo ratings yet

- 2307Document3 pages2307JUCONS ConstructionNo ratings yet

- Appendix 42 - Lddap-AdaDocument1 pageAppendix 42 - Lddap-AdaRogie Apolo100% (1)

- BIR's New Invoicing Requirements Effective June 30, 2013Document2 pagesBIR's New Invoicing Requirements Effective June 30, 2013lito77No ratings yet

- For AIRB Clearance 2020 Manila 2Document1 pageFor AIRB Clearance 2020 Manila 2Kenji ToleroNo ratings yet

- Membership Application Form: Philippine Chamber of Commerce and IndustryDocument2 pagesMembership Application Form: Philippine Chamber of Commerce and IndustryJ SalesNo ratings yet

- Citigroup Memo - Cut SpendingDocument4 pagesCitigroup Memo - Cut Spendingcutem100% (5)

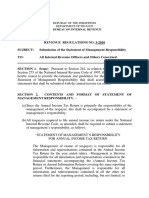

- Statement of MGT Responsibility ITRDocument1 pageStatement of MGT Responsibility ITRJasper Andrew AdjaraniNo ratings yet

- Ethical and Technical Standards-CpaDocument1 pageEthical and Technical Standards-CpaLuis Porras Jr.No ratings yet

- Bir Atp MemoDocument10 pagesBir Atp Memobge5No ratings yet

- Pasig BPLO Charter. Udate 12-6-2018Document7 pagesPasig BPLO Charter. Udate 12-6-2018Roy LataquinNo ratings yet

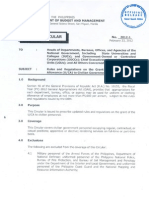

- Rmo 26-2016Document4 pagesRmo 26-2016Raniel MirandaNo ratings yet

- Subject: Authorization Letter Claiming (Documents)Document2 pagesSubject: Authorization Letter Claiming (Documents)Vian Madera100% (1)

- Memo Series No. HR2021-034: Jota Manilena Near Poly Subd., Matina Aplaya, Davao CityDocument1 pageMemo Series No. HR2021-034: Jota Manilena Near Poly Subd., Matina Aplaya, Davao CityRonel SibayNo ratings yet

- SEC-Cover-Sheet-for-AFS BlankDocument2 pagesSEC-Cover-Sheet-for-AFS BlankAljohn Sebuc100% (1)

- SMR - ItrDocument1 pageSMR - ItrJasper Andrew AdjaraniNo ratings yet

- Affidavit of Quitclaim ReleaseDocument1 pageAffidavit of Quitclaim ReleaseNasir Ahmed100% (2)

- Spa September 2015 PDFDocument1 pageSpa September 2015 PDFsilverwind0% (3)

- SampleResolutionRecognition AppreciationDocument2 pagesSampleResolutionRecognition AppreciationMarivie PandosenNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Geraldine BacoNo ratings yet

- Sworn Statement For Tax Clearance SampleDocument1 pageSworn Statement For Tax Clearance SampleRachel ChanNo ratings yet

- Standard InsuranceDocument1 pageStandard InsuranceArmie May RicoNo ratings yet

- 2016 Bir Form 2316 TransmittalDocument1 page2016 Bir Form 2316 Transmittalsegundo sanchezNo ratings yet

- New LogoDocument1 pageNew LogoAnonymous 6GfZdN89No ratings yet

- Special Power of Attorney BIRDocument1 pageSpecial Power of Attorney BIRJomielyn GaleraNo ratings yet

- Sample SMRDocument3 pagesSample SMRArjam B. BonsucanNo ratings yet

- 2 Policies and Guidelines On Overtime Services 2-22-19Document4 pages2 Policies and Guidelines On Overtime Services 2-22-19Tin EstrellaNo ratings yet

- Philhealth ER1-Employer FormDocument1 pagePhilhealth ER1-Employer FormAimee F67% (3)

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocument2 pagesRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake Mitsuki100% (1)

- Letter of EFPS For BIRDocument2 pagesLetter of EFPS For BIRLetty Tamayo100% (1)

- Updating of Registered Employees (SSS, PHIC, HDMF)Document9 pagesUpdating of Registered Employees (SSS, PHIC, HDMF)Carmina EdradanNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- MEMO 01 - Completion of Employment RequirementsDocument2 pagesMEMO 01 - Completion of Employment Requirementsjamilove20100% (1)

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- 1901 (Encs) 2000Document4 pages1901 (Encs) 2000Alvin John Benavidez Salvador50% (2)

- 1901 (Encs) 2000Document4 pages1901 (Encs) 2000Alvin John Benavidez SalvadorNo ratings yet

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesNo ratings yet

- Affidavit of Two Disinterested PersonsDocument1 pageAffidavit of Two Disinterested PersonsLecel Llamedo100% (3)

- Affidavit of Delayed Registration of BirthDocument1 pageAffidavit of Delayed Registration of BirthLecel LlamedoNo ratings yet

- Affidavit Car AccidentDocument2 pagesAffidavit Car AccidentLecel Llamedo100% (4)

- Acknowledgment: Name Identification Card No. Number Date & Place of IssueDocument1 pageAcknowledgment: Name Identification Card No. Number Date & Place of IssueTorni JoNo ratings yet

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityLecel Llamedo100% (1)

- Job Aid For The Use of Offline eBIRForms Package PDFDocument32 pagesJob Aid For The Use of Offline eBIRForms Package PDFJeremy SaileNo ratings yet

- Civil Registry RequirementsDocument5 pagesCivil Registry RequirementsmasterfollowNo ratings yet

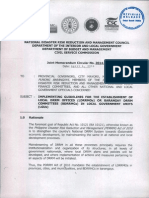

- DBM Joint Memo Circular 2014-1 jmc2014-1 LdrrmosDocument11 pagesDBM Joint Memo Circular 2014-1 jmc2014-1 Ldrrmosapi-280102701100% (5)

- 10 People You Meet in LawDocument4 pages10 People You Meet in LawLecel LlamedoNo ratings yet

- MC 22 S. 2013Document3 pagesMC 22 S. 2013Jonalyn Laroya ReoliquioNo ratings yet

- Uniform Clothing Allowance Government EmployeesDocument5 pagesUniform Clothing Allowance Government EmployeesRojan Alexei Granado67% (3)

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDocument3 pagesEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- 11 Easy Home Remedies For The Treatment of VertigoDocument4 pages11 Easy Home Remedies For The Treatment of VertigoLecel LlamedoNo ratings yet

- Common Objections: Page 1 of 2Document2 pagesCommon Objections: Page 1 of 2Lecel LlamedoNo ratings yet

- 2015 SALN FormDocument4 pages2015 SALN Formwyclef_chin100% (6)

- Ra 9262 Anti-Violence Against Women ActDocument14 pagesRa 9262 Anti-Violence Against Women Actapi-250425393No ratings yet

- Luna Vs IacDocument7 pagesLuna Vs IacLecel LlamedoNo ratings yet

- R.A. 8043Document26 pagesR.A. 8043Fernand Son Dela CruzNo ratings yet

- MC 22 S. 2013Document3 pagesMC 22 S. 2013Jonalyn Laroya ReoliquioNo ratings yet

- Perhaps LoveDocument2 pagesPerhaps LoveLecel LlamedoNo ratings yet

- Jasmen Basambekyan, A075 665 907 (BIA Nov. 28, 2017)Document9 pagesJasmen Basambekyan, A075 665 907 (BIA Nov. 28, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Written Work - REJOINDER (CA)Document12 pagesWritten Work - REJOINDER (CA)Ange Buenaventura SalazarNo ratings yet

- Draft Bureau of Customs Memo On Submission of E-ManifestDocument9 pagesDraft Bureau of Customs Memo On Submission of E-ManifestPortCallsNo ratings yet

- Sai Siddhi Hospital - B9 CareDocument11 pagesSai Siddhi Hospital - B9 Carehare_07No ratings yet

- Volume I - TENDER RANCHI MUNICIPAL CORPDocument85 pagesVolume I - TENDER RANCHI MUNICIPAL CORPStephen Rajkumar JayakumarNo ratings yet

- Insurance Digest CaseDocument6 pagesInsurance Digest CaseDelbertBaldescoNo ratings yet

- Rule 101, Rule 105 Special ProceedingsDocument4 pagesRule 101, Rule 105 Special ProceedingsIan Joshua RomasantaNo ratings yet

- Crim 2 OutlineDocument7 pagesCrim 2 OutlineKazumi ShioriNo ratings yet

- Tetangco, Jr. v. Commission On Audit, G.R. No. 244806, September 17, 2019Document3 pagesTetangco, Jr. v. Commission On Audit, G.R. No. 244806, September 17, 2019sophiaNo ratings yet

- Us MarshalsDocument3 pagesUs Marshalsapi-242818347No ratings yet

- Rizal Law and The Teaching of Rizal CourseDocument4 pagesRizal Law and The Teaching of Rizal CourseKayleen joy javierNo ratings yet

- L6U2 Contract Law January 2016 Suggested AnswersDocument16 pagesL6U2 Contract Law January 2016 Suggested Answers短视频抖音No ratings yet

- Rule 62 No. 2 Cebu Woman - S Club vs. de La VictoriaDocument2 pagesRule 62 No. 2 Cebu Woman - S Club vs. de La Victoriachris100% (1)

- Letter To Governor RellDocument1 pageLetter To Governor RellHelen BennettNo ratings yet

- ReconsideracionDocument4 pagesReconsideracionhenryNo ratings yet

- Form Grant DeedDocument2 pagesForm Grant DeedRobert100% (1)

- Republic Act No. 6679 - Amending R.A. No. 6653 (Re - Postponement of Barangay Elections To March 28, 1989)Document2 pagesRepublic Act No. 6679 - Amending R.A. No. 6653 (Re - Postponement of Barangay Elections To March 28, 1989)Kheem GinesNo ratings yet

- Lalakarin NG Reyna NG Kaplastikan at Reyna NG Payola Ang Kaso... Si ImeldaDocument33 pagesLalakarin NG Reyna NG Kaplastikan at Reyna NG Payola Ang Kaso... Si ImeldaSunny TeaNo ratings yet

- USCIS Draft SolicitationDocument65 pagesUSCIS Draft SolicitationZenger News100% (1)

- Constituional Law Powerpoint, 2012Document269 pagesConstituional Law Powerpoint, 2012Wubneh AlemuNo ratings yet

- HR Audit: Increasing Efficiency of Business by Managing HR RisksDocument4 pagesHR Audit: Increasing Efficiency of Business by Managing HR RisksRiddhi PatelNo ratings yet

- Franklin Circuit Court DecisionDocument34 pagesFranklin Circuit Court DecisionWKYTNo ratings yet

- ALEJANDRO NG WEE V TiankianseeDocument2 pagesALEJANDRO NG WEE V TiankianseeArjan Jay Arsol ArcillaNo ratings yet

- 09 1332Document64 pages09 1332ThinkProgressNo ratings yet

- Ucp 500&600Document35 pagesUcp 500&600ChiragDahiyaNo ratings yet

- Heirs of Jose Lim, Represented by ELENITO LIM, G.R. No. 172690Document9 pagesHeirs of Jose Lim, Represented by ELENITO LIM, G.R. No. 172690Niehr RheinNo ratings yet

- Group 2 Ra 6713Document57 pagesGroup 2 Ra 6713Resurreccion MajoNo ratings yet