Professional Documents

Culture Documents

Daily Metals and Energy Report, May 2

Uploaded by

Angel BrokingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Metals and Energy Report, May 2

Uploaded by

Angel BrokingCopyright:

Available Formats

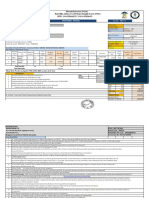

Commodities Daily Report

Thursday| May 2, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn :6130 Saif Mukadam Research Analyst saif.mukadam@angelbroking.com (022) 2921 2000 Extn :6136 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| May 2, 2013

International Commodities

Overview

US ADP Non-Farm Employment Change fell to 119,000 in April. UKs Manufacturing PMI increased to 49.8-mark in the prior month. US ISM Manufacturing PMI declined to 50.7-mark in the last month. Chinas HSBC Final Manufacturing PMI declined to 50.4-mark in April Asian markets are trading lower today on the back of unfavorable economic data from US in yesterdays trading session and decline in Chinas manufacturing data indicating a slowdown in the global economic growth. US Automatic Data Processing, Inc. (ADP) Non-Farm Employment Change declined by 12,000 to 119,000 in April as against a rise of 131,000 in March. Final Manufacturing Purchasing Managers' Index (PMI) increased by 0.1 points to 52.1-mark in April from rise of 52-level in last month. The Institute for Supply Management (ISM) Manufacturing PMI declined by 0.6 points to 50.7-mark in April as compared to rise of 51.3-level a month ago. Construction Spending declined by 1.7 percent in March with respect to rise of 1.5 percent in prior month. ISM Manufacturing Prices fell by 4.5 points to 50-level in April when compared to rise of 54.5-mark a month earlier. The US Dollar Index (DX) declined by 0.3 percent in the yesterdays trading session on the back of rise in risk appetite in the global market sentiments in the early part of the trade which led to decline in demand for the low yielding currency. However, sharp downside in the currency was cushioned as a result of unfavorable economic data from the US. Further, US equities traded on a negative note which also prevented sharp downside in the DX. The currency touched an intra-day low of 81.37 and closed at 81.52 on Wednesday. The Indian Rupee appreciated by 0.9 percent on Tuesday. The currency appreciated on account of cut in the tax on interest payments to foreigners on government and corporate debt from 20 percent to 5 percent. Additionally, expectations of cut in key rates by the central bank of the country in its monetary policy meeting on 3rd May also supported an upside in the currency. Further, upbeat global market sentiments coupled with weakness in the DX also acted as a positive factor for the Indian Rupee. The currency touched an intra-day high of 53.65 and closed at 53.68 against dollar on Tuesday. For the month of April 2013, FII inflows totaled at Rs.5,414.10 crores ($1,000.27 million) as on 30th April 2013. Year to date basis, net capital inflows stood at Rs.61,036.30 crores ($11,310.30 million) till 30th April 2013. Chinas HSBC Final Manufacturing Purchasing Managers' Index (PMI) declined by 0.1 points to 50.4-mark in April as against a rise of 50.5-level in March. www.angelcommodities.com

Market Highlights (% change)

Last INR/$ (Spot)** 53.68 Prev day 0.9

as on 1 May, 2013 w-o-w 1.1 m-o-m 1.1 y-o-y -1.9

$/Euro (Spot)

1.3177

0.1

1.2

2.5

-0.4

Dollar Index NIFTY**

81.52

-0.3

-1.8

-1.6

2.6

5930.2

0.4

1.6

4.4

14.2

SENSEX**

19504.2

0.6

1.7

3.5

6.6

DJIA

14701.0

-0.9

0.2

0.6

10.7

S&P

1582.7

-0.9

0.2

1.3

12.6

Source: Reuters (** Indian markets were closed on the occasion of Maharashtra Day)

The Euro appreciated by 0.1 percent in yesterdays trade on the back of weakness in DX. However, weak economic data from the US increased the worries over global economic growth which capped sharp gains in the currency. The Euro touched an intra-day high of 1.3242 and closed at 1.3177 against dollar on Wednesday. UKs Nationwide House Price Index (HPI) declined by 0.1 percent in April. Manufacturing Purchasing Managers' Index (PMI) increased by 1.2 points to 49.8-mark in April as against a rise of 48.6-level in March. Japans Monetary Base increased by 23.1 perc ent in April as against a rise of 19.8 percent in March.

Commodities Daily Report

Thursday| May 2, 2013

International Commodities

Bullion Gold

Spot gold prices decreased by 1.3 percent in the yesterdays trading session on the back of weak global market sentiments. Further, weak economic data from US added downside pressure. Additionally, Fed commented that it may raise or lower its monthly asset purchasing programme as economic condition advance kept the prices under pressure. SPDR gold trust holdings fell by 0.31 percent which acted as a negative factor for the prices. However weakness in DX prevented sharp fall in the prices. The yellow metal touched an intra-day low of $1439.74/oz and closed at $1456.7/oz in yesterdays trading session. In the Indian markets, prices ended on negative note in the yesterday trading session tracking spot gold prices and closed at Rs.26540/10 gms after touching an intra-day low of Rs. 26365/10 gms on Wednesday. Market Highlights - Gold (% change)

Gold Gold (Spot) Gold (Spot Mumbai) Gold (LBMA-PM Fix) Comex Gold (June13) MCX Gold (June13) Unit $/oz Rs/10 gms $/oz Last 1456.7 27100.0 Prev. day -1.3 0.4 as on 1 May, 2013 WoW 1.8 2.8 MoM -6.5 -7.4 YoY -12.2 -

1454.8

-1.0

1.8

-7.6

-12.6

$/oz

1446.3

-1.8

1.6

-6.8

-13.1

Rs /10 gms

26540.0

-1.4

0.6

-7.9

-8.9

Source: Reuters

Silver

Taking cues from decline in spot gold prices along with downside in the base metal packs, Spot silver prices decreased by 3.1 percent in the yesterdays trading session. Further, weak global market sentiments coupled with unfavourable economic data from US and China added downside pressure. However, weakness in DX cushioned sharp downside in the currency. The white metal prices touched an intra-day low of $23.21 /oz and closed at $23.5/oz in yesterdays trade. On the domestic front, prices declined by 2.6 percent taking cues from spot silver prices and closed at Rs. 43659/kg after touching an intraday low of Rs. 43172/kg on Wednesday.

Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (May13) MCX Silver (May13) Unit $/oz Rs/1 kg Last 23.5 45680.0 Prev day -3.1 -1.3

as on 1 May, 2013 WoW 1.9 1.2 MoM -12.6 -12.3 YoY -23.8 -19.8

$/oz $/ oz

2397.0 2330.5

-1.8 0.0

4.6 2.1

-11.8 -12.9

-22.1 -24.5

Rs / kg

43659.0

-2.6

1.8

-13.9

-21.1

Source: Reuters

Outlook

In the intraday, we expect precious metals to trade on a negative note on the back of rise in risk aversion in the global market sentiments coupled with strength in DX. Further, weak economic data from US and china may add downside pressure. Additionally, expectation of interest rate cut by European Central Bank (ECB) may keep prices under pressure. However, expectation of favourable economic data from Euro zone and UK may cushion sharp decline in the prices. In the Indian market appreciation in the Indian rupee may add downside pressure. Technical Outlook

Unit Spot Gold MCX Gold June13 Spot Silver MCX Silver May13 $/oz Rs/10 gms $/oz Rs/kg valid for May 2, 2013 Support 1439/1427 26300/26090 23.30/23.05 43700/43300 Resistance 1458/1466 26650/26800 23.70/23.95 44400/44900

Technical Chart Spot Gold

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Thursday| May 2, 2013

International Commodities

Energy Crude Oil

Nymex crude oil prices declined by 2.6 percent yesterday on the back of more than expected rise in the US crude oil inventories which are at highest level since 1982 and led to expectations of slowdown in the global economic growth. Further, US manufacturing data grew at a slower pace coupled with declined in payroll data which also exerted downside pressure on the crude prices. However, sharp downside in the prices was cushioned on account of weakness in the DX. Crude oil prices touched an intra-day low of $90.11/bbl and closed at $91/bbl in yesterdays trading session. On the domestic bourses, prices declined by 2.8 percent and closed at Rs.4,872/bbl after touching an intra-day low of Rs.4841/bbl on Wednesday. EIA Inventories Data As per the US Energy Department (EIA) report, US crude oil inventories increased more than expectations by 6.7 million barrels to 395.30 th million barrels for the week ending on 26 April 2013. Crude oil inventories are at the highest level in last 82 years. Gasoline stocks fell by 1.8 million barrels to 216.0 million barrels and whereas distillate stockpiles rose by 0.5 million barrels to 115.80 million barrels for the last week.

Natural Gas (NG) Nymex NG MCX NG (May 13) Unit $/mmbtu Rs/ mmbtu Last 4.314 233.6 Prev. day -0.7 0.4 WoW 3.50 2.77 MoM 7.07 6.13 YoY 82.80 87.18

Source: Reuters

Market Highlights - Crude Oil (% change)

Crude Oil WTI (Spot) Brent (Spot) Nymex Crude (May 13) ICE Brent Crude (May13) MCX Crude (May 13) Unit $/bbl $/bbl $/bbl Last 90.7 99.1 91.0 Prev. day -2.7 -3.5 -2.6 WoW -0.4 -2.7 -0.4

as on 1 May, 2013 MoM -6.5 -9.0 -2.4 YoY -14.5 -17.4 -14.3

$/bbl

100.0

-2.4

-1.7

-6.7

-16.5

Rs/bbl

4872.0

-2.8

-1.8

-6.3

-13.0

Source: Reuters

Market Highlights - Natural Gas (% change)

as on 1 May, 2013

Technical Chart NYMEX Crude Oil

Natural Gas

EIA Inventories Forecast US Energy Information Administration (EIA) is scheduled to release its weekly inventories and US natural gas inventory are expected to increase by 27 billion cubic feet (bcf) for the week ending on 26th April 2013 Outlook From the intra-day perspective, we expect crude oil prices to trade lower on the back of crude oil inventories at the highest level in last 82 years which led to expectations of decline in demand for the crude oil. Further, rise in risk aversion in the global market sentiments, unfavorable economic data from the US and China along with strength in the DX will add downside pressure on the currency. However, sharp downside in the prices will be cushioned on account of forecast for favorable economic data from the Euro Zone. In the Indian markets, appreciation in the Rupee will exert downside pressure on the crude oil prices. Technical Outlook

Unit NYMEX Crude Oil MCX Crude May13 $/bbl Rs/bbl valid for May 2, 2013 Support 89.90/88.60 4820/4750 Resistance 92.00/93.30 4930/5000

Source: Telequote Source: Telequote

Technical Chart NYMEX Natural Gas

www.angelcommodities.com

Commodities Daily Report

Thursday| May 2, 2013

International Commodities

Base Metals

The base metals pack traded on a negative note on the back of weak global market sentiments. Further, decline in US ADP Nonfarm employment change and weak ISM manufacturing PMI data added downside pressure on the prices. Additionally, weak Chinas Manufacturing PMI kept prices under pressure. However, weakness in DX along with favourable economic data from UK cushioned sharp downside in the prices. Apart from that, US Federal Reserve decided to continue with its bond purchase programme prevented sharp fall in the prices. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (April13) LME Aluminum (3 month) MCX Aluminum Rs /kg 97.2 -2.9 -4.8 -4.5 -12.4 $/tonne 1825.0 -2.4 -4.3 -2.5 -13.8 Rs/kg 368.0 -3.4 -2.8 -8.8 -17.8 $/tonne Last 6798.0 Prev. day -3.4 as on 1 May, 2013 WoW -2.9 MoM -13.4 YoY -19.4

Copper

Copper, the leader of the base metal pack decreased by 3.4 percent on the back of rise in risk aversion in the global market sentiments. Further, unfavourable economic data from US added downside pressure. Additionally, decline in Chinas Manufacturing PMI acted as a negative factor. However, weakness in DX, decline in LME inventories by 0.1 percent along with positive manufacturing data from UK cushioned sharp fall in the prices. The red metal touched an intra-day low of $6785.75/tonne and closed at $6798/tonne yesterdays trading session. On the domestic front, prices ended on negative note and closed at Rs. 368/kg on Wednesday after touching an intra-day low of Rs 366.4 kg. Outlook In the intra-day, we expect base metals prices to trade on the negative on the back of weak global market sentiments coupled with strength in DX. Further, weak economic data from US and China has increased the worries among the investors that the demand for base metals may go down. Additionally, weak HSBC manufacturing data from china and expectation of unfavourable economic data from US will add further downside pressure. However, expectation of favourable economic data from Euro zone and UK may prevent sharp downside in the pressure. In the Indian markets, appreciation in the Rupee will add downside pressure on the prices. Technical Outlook

Unit MCX Copper April13 MCX Zinc April 13 MCX Lead April 13 MCX Aluminum April13 MCX Nickel April 13 Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for May 2, 2013 Support 364/361 97/96 104.5/103.5 96.5/95.5 785/770 Resistance 372/377 99/100 106.5/107.5 98/99.8 804/815

(April13) LME Nickel (3 month) MCX Nickel (April13) LME Lead (3 month) MCX Lead (April13) LME Zinc (3 month) MCX Zinc (April13)

Source: Reuters

$/tonne

14760.0

-3.9

-3.2

-8.0

-16.9

Rs /kg

794.5

-3.6

-3.7

-9.6

-15.5

$/tonne

1969.5

-3.0

-3.7

-4.0

-9.1

Rs /kg

105.5

-3.6

-4.3

-5.7

-7.5

$/tonne

1839.0

-1.4

-4.0

-1.2

-10.6

Rs /kg

98.0

-2.2

-4.1

-3.0

-9.3

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 1st May 618,175 5,152,825 178,476 1,062,175 254,325 30th April 618,600 5,157,625 177,036 1,068,475 255,175 Actual Change -425 -4,800 1,440 -6,300 -850 (%) Change -0.1 -0.1 0.8 -0.6 -0.3

Source: Reuters

Technical Chart LME Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Thursday| May 2, 2013

International Commodities

Important Events for Today

Indicator Monetary Base y/y Monetary Policy Meeting Minutes HSBC Final Manufacturing PMI Spanish Manufacturing PMI Italian Manufacturing PMI Construction PMI French 10-y Bond Auction Minimum Bid Rate ECB Press Conference Trade Balance Unemployment Claims Prelim Nonfarm Productivity q/q Prelim Unit Labor Costs q/q Country Japan Japan China Europe Europe UK Europe Europe Europe US US US US Time (IST) 5:20am 5:20am 7:15am 12:45pm 1:15pm 2:00pm Tentative 5:15am 6:00pm 6:00pm 6:00pm 6:00pm 6:00pm Actual 23.1% 50.4 Forecast 50.6 44.6 44.9 48.1 0.50% -42.1B 346K 1.8% 0.8% Previous 19.8% 50.5 44.2 44.5 47.2 1.94/3.1 0.75% -43.0B 339K -1.9% 4.6% Impact Medium Medium Medium Medium Medium High Medium High High High High Medium Medium

www.angelcommodities.com

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Price Action Breakout StrategiesDocument7 pagesPrice Action Breakout StrategiesRamon CastellanosNo ratings yet

- Celtic Knot Fingerless GlovesDocument3 pagesCeltic Knot Fingerless GlovesNguyễn Thu ThuỷNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- May 6, 2022Document8 pagesMay 6, 2022Kriztin Janet LudoviceNo ratings yet

- Kiln Thermal LoadDocument33 pagesKiln Thermal Loadeng_mhassan1100% (1)

- Sales Contribution Margin Break Even AnalysisDocument10 pagesSales Contribution Margin Break Even AnalysisHarold Beltran DramayoNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- ASTM A563 - Portland BoltDocument6 pagesASTM A563 - Portland BoltJishnujayan33 9747883533No ratings yet

- Form 5a PDFDocument1 pageForm 5a PDFSarah Mea BalonzoNo ratings yet

- PI 012 - R1 L&T INNOVATION CAMPUS dt.17.04.2023Document2 pagesPI 012 - R1 L&T INNOVATION CAMPUS dt.17.04.2023Jayshree RAJU NAIKNo ratings yet

- Uts Inggris 3Document2 pagesUts Inggris 3Mukti UtamiNo ratings yet

- Polanyi - The Economy As An Instituted ProcessDocument19 pagesPolanyi - The Economy As An Instituted ProcessChristian JavierNo ratings yet

- Oh, Susanna: American Folk SongDocument1 pageOh, Susanna: American Folk SongDiego Smith SmithNo ratings yet

- Stainless Steel Pharmaceutical Drainage CompressedDocument15 pagesStainless Steel Pharmaceutical Drainage Compressedخبراء التصنيع الدوائي-اليمنNo ratings yet

- 1 2 Mme 2016Document4 pages1 2 Mme 2016Mathu rajiniNo ratings yet

- Tybcom Economics Sem V (Prelims-Heramb)Document2 pagesTybcom Economics Sem V (Prelims-Heramb)A BPNo ratings yet

- JuniDocument1 pageJuniWiwit KamsonoNo ratings yet

- Scadentar ImprumutDocument5 pagesScadentar ImprumutMihaela MaryNo ratings yet

- Positive AccountingDocument24 pagesPositive AccountingYuli SarahNo ratings yet

- TOTL-SP05-F02 Service Provider Evaluation 'ETPL'Document4 pagesTOTL-SP05-F02 Service Provider Evaluation 'ETPL'akloioNo ratings yet

- What Is Customer Lifetime Value (CLV) and How Do You Measure It?Document8 pagesWhat Is Customer Lifetime Value (CLV) and How Do You Measure It?darshan jainNo ratings yet

- Labsii 202 Bara 2009Document82 pagesLabsii 202 Bara 2009siraj liki100% (5)

- Abc - JeevanUmang - 30-3-2023 0.28.27Document7 pagesAbc - JeevanUmang - 30-3-2023 0.28.27Sandeep kumar TanwarNo ratings yet

- Curriculum Vitae: Deepak Kumar MittalDocument3 pagesCurriculum Vitae: Deepak Kumar MittalThe Cultural CommitteeNo ratings yet

- Vat Rates on Fuel by StationDocument4 pagesVat Rates on Fuel by StationomkargokhaleNo ratings yet

- Tax Invoice: GST DetailsDocument1 pageTax Invoice: GST DetailsglenniesamuelNo ratings yet

- 86Fb Football Trading: Everything You Need To Know About Your IncomeDocument5 pages86Fb Football Trading: Everything You Need To Know About Your IncomeMavixkeyz Onice IzoduwaNo ratings yet

- The Essence of Strategic Leadership: Managing Human and Social CapitalDocument14 pagesThe Essence of Strategic Leadership: Managing Human and Social CapitalFathan MubinaNo ratings yet

- NO. Perimeter Denah Rumah 6 X 8 H VDocument407 pagesNO. Perimeter Denah Rumah 6 X 8 H VrealtigtigrealNo ratings yet

- E.F. Schumacher: Idea of Development By:-Piyush RajDocument6 pagesE.F. Schumacher: Idea of Development By:-Piyush RajPiyush rajNo ratings yet

- Foreign AidDocument19 pagesForeign AidTyson HuffNo ratings yet

- Key Information and Funding Information:: View IFT /PQ / REOI / RFP Notice DetailsDocument3 pagesKey Information and Funding Information:: View IFT /PQ / REOI / RFP Notice DetailsImran HabibNo ratings yet