Professional Documents

Culture Documents

At A Glance Budget 2012

Uploaded by

Rashedul Hasan RashedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

At A Glance Budget 2012

Uploaded by

Rashedul Hasan RashedCopyright:

Available Formats

At A Glance Budget 2012-13

0digg The National Budget of Bangladesh for 2012-13 fiscal year presented by Finance Minister Abul Maal Abdul Muhith on June 7, 2012 titled as 'A Chronicle of Last Three Years: Building the Future' and it was finalized on in Parliament on June 30, 2012 after a long discussion of Parliament Members. Basically, in June and July Budget is the most important subject in the country. Due to World Bank loan cancellation for Padma Bridge, it was diverted to that. This is fourth budget of present ruling party and it was a reflection what they did in last three years.

Towards Building A Happy, Prosperous and Caring Bangladesh, with this title Finance Minister Abul Maal Abdul Muhith presented on 9 June in Jatiya Sangsad a Taka 163,589 crore national budget for fiscal year (FY) 2011-12 with focus on three major areas - poverty reduction, employment generation and power and energy sector development. BUDGET AT A GLANCE (Taka in Crore) Description Budget 2011-12 Revised 2010-11 Budget 2010-11 Actual 200910

Revenue and Foreign Grants

Revenues Tax Revenue NBR Tax Revenue Non-NBR Tax Revenue Non-Tax Revenue Foreign Grants/1 1,18,385 95,785 91,870 3,915 22,600 4,938 Total 1,23,323 95,187 79,052 75,600 3,452 16,135 4,224 99,411 92,847 76,042 72,590 3,452 16,805 4,809 97,656 75,905 62,465 59,742 2,743 13,420 3,218 79,123

Expenditure Non-Development Expenditure Non-Development Revenue Expenditure of which Domestic Interest Foreign Interest Non-Development Capital Expenditure/2 Net outlay for Food Account Operation 16,519 1,478 15,052 631 13,156 1,422 6,074 351 13,271 1,438 10,556 241 13,497 1,371 6,155 -849 1,02,903 87,851 83,177 77,103 85,786 75,230 79,123 67,013

Description Loans and Advances (Net)/3

Budget 2011-12 9,413

Revised 2010-11 6,718 150 39,615 1,011 1,430 35,800 1,294 1,30,011 -30,600 -3.8 -34,824 -4.4

Budget 2010-11 3,223 150 42,770 1,498 1,578 38,500 1,194 1,32170 -34,323 -4.4 -39,323 -5.0

Actual 200910 930 244 28,115 803 831 25,553 928 1,01,608 -22,485 -3.3 -25,703 -3.7

Structural Adjustment Expenditure 0 Development Expenditure Development Programmes Financed from Revenue Budget/4 Non-ADP Project Annual Development Programme Non-ADP FFW and Transfer/5 50,642 1,331 2,035 46,000 1,276

Total Expenditure 1,63,589 Overall Deficit (Including Grants) -40,266 (In Percent of GDP) -4.4 Overall Deficit (Excluding Grants) -45,204 (In percent of GDP) -5.0

Financing

Foreign Borrowing-Net Foreign Borrowing Amortization Domestic Borrowing Borrowing from Banking System Long-Term Debt (Net) Short-Term Debt (Net) Non-Bank Borrowing (Net) Others/6 13,058 18,685 -5,627 27,208 18,957 17,878 1,079 8,251 2,251 5,783 10,920 -5,137 24,817 18,379 16,062 2,317 6,438 519 10,834 15,968 -5,134 23,680 15,680 12,570 3,110 8,000 523 6,036 11,004 -4,968 15,820 -2,092 5,769 -7,861 17,912 6,213

Description

Budget 2011-12

Revised 2010-11 30,600 7,87,495

Budget 2010-11 34,514 7,80,290

Actual 200910 21,856 6,90,57

Total Financing: 40,266 Memorandum Item: GDP 8,99,670

Finance Minister have set targets of economic and fiscal indicators for the next fiscal year. Non development and development budget revenue set Taka 1,635.89 billion where tax revenue from National Board of Revenue (NBR) is Taka 918.70 billion (56.2%).

In FY 2011-12, aggregate revenue mobilization has been estimated at Tk. 1,18,385 crore which is 13.2 percent of GDP It includes NBR Tax revenue of Tk. 91,870 crore (10.2 percent of GDP) Non-NBR Tax revenue of Tk. 3,915 crore (0.4 percent of GDP)

Non-Tax revenue of Tk. 22,600 crore (2.5 percent of GDP).

Finance Minister said, we will be able to achieve a 7 percent economic growth in FY 2011-12. He shows some indicator as robust export position, satisfactory growth in revenue mobilisation, uninterrupted growth in the agricultural sector, growth of credit outflow to the private sector and high growth of term loans, which help to achieve the target.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Course: Introduction To Industrial Social Work (101) : Globalization: Opportunities in Industrial Sector in BangladeshDocument19 pagesCourse: Introduction To Industrial Social Work (101) : Globalization: Opportunities in Industrial Sector in BangladeshRashedul Hasan RashedNo ratings yet

- How To Different Factors Play A Role in Industrialization of A CountryDocument11 pagesHow To Different Factors Play A Role in Industrialization of A CountryRashedul Hasan RashedNo ratings yet

- Challenges of Globalization For BangladeshDocument11 pagesChallenges of Globalization For Bangladeshziaulh23No ratings yet

- FR - 30 - Globalization - Opportunities in Industrial Sector in BangladeshDocument19 pagesFR - 30 - Globalization - Opportunities in Industrial Sector in BangladeshRashedul Hasan RashedNo ratings yet

- Course: Introduction To Industrial Social Work (101) : Globalization: Opportunities in Industrial Sector in BangladeshDocument19 pagesCourse: Introduction To Industrial Social Work (101) : Globalization: Opportunities in Industrial Sector in BangladeshRashedul Hasan RashedNo ratings yet

- Industrial Revolution and Changing Role of Social WorkDocument57 pagesIndustrial Revolution and Changing Role of Social WorkRashedul Hasan RashedNo ratings yet

- 21 CompetenciesDocument2 pages21 CompetenciesRashedul Hasan RashedNo ratings yet

- To Whom& Advance - ForwadingDocument17 pagesTo Whom& Advance - ForwadingRashedul Hasan RashedNo ratings yet

- Industrial Sector in Bangladesh: Title: Globalization: Opportunities inDocument3 pagesIndustrial Sector in Bangladesh: Title: Globalization: Opportunities inRashedul Hasan RashedNo ratings yet

- M 6 Interview TechniquesDocument8 pagesM 6 Interview TechniquesRashedul Hasan RashedNo ratings yet

- Taking It Easy, 46 X 46 CM, Acrylic & Sand On Canvas, 2014Document48 pagesTaking It Easy, 46 X 46 CM, Acrylic & Sand On Canvas, 2014Rashedul Hasan RashedNo ratings yet

- My Industrial TourDocument21 pagesMy Industrial TourRashedul Hasan RashedNo ratings yet

- Report Mam 190219Document39 pagesReport Mam 190219Rashedul Hasan RashedNo ratings yet

- SQ Interview Rating Sheet - MGMNT StaffDocument3 pagesSQ Interview Rating Sheet - MGMNT StaffRashedul Hasan RashedNo ratings yet

- Disciplinary ActionDocument3 pagesDisciplinary ActionRashedul Hasan RashedNo ratings yet

- SQ Job Confirmation 10-1-FDocument2 pagesSQ Job Confirmation 10-1-FRashedul Hasan RashedNo ratings yet

- 21 CompetenciesDocument2 pages21 CompetenciesRashedul Hasan RashedNo ratings yet

- AssignmentDocument23 pagesAssignmentRashedul Hasan RashedNo ratings yet

- Business PlanDocument33 pagesBusiness PlanRashedul Hasan RashedNo ratings yet

- Employee Information Annex 10-1-DDocument2 pagesEmployee Information Annex 10-1-DRashedul Hasan RashedNo ratings yet

- Job Analysis: Job Description: A List of A Jobs Duties, Responsibilities, Reporting Relationships. Work ConditionDocument15 pagesJob Analysis: Job Description: A List of A Jobs Duties, Responsibilities, Reporting Relationships. Work ConditionRashedul Hasan RashedNo ratings yet

- Human Resource Management2003Document9 pagesHuman Resource Management2003Rashedul Hasan RashedNo ratings yet

- Training and Development2003Document11 pagesTraining and Development2003Rashedul Hasan RashedNo ratings yet

- Employee - Information - Annex 10-1-D PDFDocument2 pagesEmployee - Information - Annex 10-1-D PDFRashedul Hasan RashedNo ratings yet

- ReportDocument39 pagesReportRashedul Hasan Rashed0% (1)

- The Global EnvironmentDocument7 pagesThe Global EnvironmentRashedul Hasan RashedNo ratings yet

- Causal Links Between Trade FD I and EgDocument6 pagesCausal Links Between Trade FD I and EgRashedul Hasan RashedNo ratings yet

- Features of Business EnvironmentDocument1 pageFeatures of Business EnvironmentRashedul Hasan RashedNo ratings yet

- FDI Lanzet.2Document96 pagesFDI Lanzet.2Rashedul Hasan RashedNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Taxation Quiz - ADocument2 pagesTaxation Quiz - AKenneth Bryan Tegerero TegioNo ratings yet

- Sustainability of A Beach Resort A Case Study-1Document6 pagesSustainability of A Beach Resort A Case Study-1abhinavsathishkumarNo ratings yet

- Christmas Tree LCA - EllipsosDocument91 pagesChristmas Tree LCA - EllipsoscprofitaNo ratings yet

- Beston Global AssignmentDocument13 pagesBeston Global AssignmentTayyaba TariqNo ratings yet

- Tracklayer ENDocument20 pagesTracklayer ENAdenilson RibeiroNo ratings yet

- Five Year Plans of IndiaDocument18 pagesFive Year Plans of IndiaYasser ArfatNo ratings yet

- Characteristics of The Industrial RevolutionDocument5 pagesCharacteristics of The Industrial RevolutionShyamsunder SharmaNo ratings yet

- Theory of Cost and ProfitDocument11 pagesTheory of Cost and ProfitCenniel Bautista100% (4)

- Horasis Global India Business Meeting 2010 - Programme BrochureDocument32 pagesHorasis Global India Business Meeting 2010 - Programme BrochuresaranshcNo ratings yet

- سياسات بنك السودان المركزي للعام 2022مDocument12 pagesسياسات بنك السودان المركزي للعام 2022مAhmed IbrahimNo ratings yet

- 14 - Splendour at 3950 - 1Document1 page14 - Splendour at 3950 - 1Purva PatilNo ratings yet

- Acd (Microproject Report)Document42 pagesAcd (Microproject Report)Gaurav SapkalNo ratings yet

- g1 - Hss3013 Presentation in English (British Presence To India)Document26 pagesg1 - Hss3013 Presentation in English (British Presence To India)veniNo ratings yet

- Institutionalism Vs MarxismDocument16 pagesInstitutionalism Vs Marxismidb34No ratings yet

- Annual Report 2011 Beximco PharmaDocument91 pagesAnnual Report 2011 Beximco PharmaMD ABUL KHAYERNo ratings yet

- Case Study Japanese Intervention in Foreign Exchange MarketsDocument6 pagesCase Study Japanese Intervention in Foreign Exchange Marketsnxhong93No ratings yet

- Executive SummaryDocument21 pagesExecutive SummaryAbhijeet TaliNo ratings yet

- Akrigg, Population and Economy in Classical Athens PDFDocument286 pagesAkrigg, Population and Economy in Classical Athens PDFJulian Gallego100% (3)

- Reimbursement Expense Receipt Reimbursement Expense ReceiptDocument2 pagesReimbursement Expense Receipt Reimbursement Expense Receiptsplef lguNo ratings yet

- Town of Rosthern Coucil Minutes October 2008Document4 pagesTown of Rosthern Coucil Minutes October 2008LGRNo ratings yet

- López Quispe Alejandro MagnoDocument91 pagesLópez Quispe Alejandro MagnoAssasin WildNo ratings yet

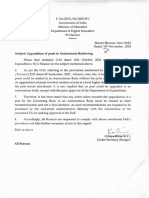

- Upgradation of Posts in Autonomous BodiesDocument2 pagesUpgradation of Posts in Autonomous BodiesNaveen KumarNo ratings yet

- Mercantil Financiero Precios Titulos ValoresDocument3 pagesMercantil Financiero Precios Titulos ValoresEvelyn MantillaNo ratings yet

- Globalization L7Document42 pagesGlobalization L7Cherrie Chu SiuwanNo ratings yet

- Esg DataDocument1 pageEsg DataRobertus Wisnu WijayaNo ratings yet

- NGOS in Human RightsDocument6 pagesNGOS in Human RightsjkscalNo ratings yet

- LKTW1 Mar 2008Document94 pagesLKTW1 Mar 2008DewiNo ratings yet

- 0 Method Statement-Trench Cutter FinalDocument36 pages0 Method Statement-Trench Cutter FinalGobinath GovindarajNo ratings yet

- FOE: Session 5: Economic Systems Capitalism Socialism Communism Mixed EconomyDocument4 pagesFOE: Session 5: Economic Systems Capitalism Socialism Communism Mixed EconomylulughoshNo ratings yet

- Designing Grease Distribution Systems: Is Bigger Always Better?Document2 pagesDesigning Grease Distribution Systems: Is Bigger Always Better?José Cesário NetoNo ratings yet