Professional Documents

Culture Documents

Six Steps To Retire Rich: Simple Keys To Ensure Your Golden Years Are Spent Comfortably

Uploaded by

Jan BooysenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Six Steps To Retire Rich: Simple Keys To Ensure Your Golden Years Are Spent Comfortably

Uploaded by

Jan BooysenCopyright:

Available Formats

Six Steps to Retire Rich

Simple Keys to Ensure Your Golden Years are Spent Comfortably

1. Time is money; start today The most important key to retiring rich is to start saving as early as possible. Many workers, strapped for cash or eying a major purchase, tell themselves they can make up for lost time by making higher contributions in future years. Unfortunately, money doesnt work that way. Thanks to the power of compound interest, cash invested today has a disproportional impact on your wealth level at retirement. To put the matter into perspective, consider two possible scenarios; both assume a retirement age of 65 and an annual compounded rate of return of 10%. John is 40 years old and invests $20,000 a year for retirement. Charlotte is 21 years old and invests $5,000 a year for retirement. By the time each of these individuals retire, they will have invested $400,000 and $220,000 respectively. Yet, because of the power of compound interest, John would retire with half the money as Charlotte despite investing twice as much! (John would retire with $1.97 million, Charlotte with $3.26 million). The moral of the story? Stop robbing your future to pay for today. 2. Max out the annual contribution limit on your IRA When it comes to IRA contribution limits, Uncle Sams motto seems to be use it or lose it. Workers that havent made the maximum permissible contribution to their Traditional or Roth IRA by the cut-off date are flat out of luck unless they are in their mid-fifties and qualify for catch-up contributions. 3. Take full advantage of employer matching funds Many companies will match up to fifty-percent of the contributions employees make to their 401k and other retirement accounts. If you are fortunate enough to work for such a business (and millions of Americans are), take advantage to the fullest! If you dont, you are literally walking away from free money. 4. Dont cash out of your retirement when you change jobs. If you are anything like the average American worker, the odds are fairly substantial you are going to change jobs at some point during your career. When this occurs, the most foolish thing you could possibly do is to cash out of your retirement plan. Instead, roll over the proceeds into an IRA or your new employers 401k plan. In addition to avoiding the significant tax penalties, you will be able to keep your money working for you tax-free. Given enough time (you already saw the power a few decades can have on seemingly small amounts of money), this literally could mean the difference between vacationing in Tahiti and having to take a job at the Golden Arches to supplement your income 5. Avoid IRA withdrawal fees There are numerous ways to withdrawal money from your retirement account in the event of an emergency. Before you even think about doing so, make absolutely certain that you have done everything required to qualify - otherwise, you will get a very unpleasant and expensive wake up call when you are hit with possibly thousands of dollars in fees and penalties. 6. Expand the Pie Don't just cut expenses - find a way to make more money! By taking on side work or turning a hobby into a business enterprise, you can create additional streams of income to help fund your retirement. In many cases, this is an excellent alternative to cutting costs because it allows you to maintain your current standard of living while providing for your future.

Real Estate vs. Stocks - Which Is the Better Investment?

A Comparison of Real Estate Investments vs. Stocks

Asking the questions, Which is a better investment real estate or stocks? is like asking whether chocolate or vanilla is superior or if an Aston Martin is better than a Bentley. There really isnt an answer because a lot of it comes down to your personality, preferences, and style. It also comes down to the specifics of the individual investment. Very few stocks would have beat buying beachfront property in California in the 1970s using a lot of debt, and then cashing in twenty years later. Virtually no real estate could have beat the returns you earned if you invested in shares of Microsoft, Johnson & Johnson, Wal-Mart, Berkshire Hathaway, Dell or Southwest Airlines, especially if you reinvested your dividends. So the answer, as with many things in life, isnt as easy as it may seem. Lets begin by looking at each type of investment:

Real Estate: When you invest in real estate, you are buying physical land or property. Some real estate costs you money every month you hold it - think of a vacant parcel of land that you hope to sell to a developer someday but have to come up with cash out-of-pocket for taxes and maintenance. Some real estate is cash generating think of an apartment building, rental houses, or strip mall where the tenants are sending you checks each month, you pay the expenses, and keep the difference as the profit. Stocks: When you buy shares of stock, you are buying a piece of a company. Whether that company makes ice cream cones, sells furniture, manufacturers motorcycles, creates video games, or provides tax services, you are entitled to a cut of the profit, if any, for every share you own. If a company has 1,000,000 shares outstanding and you own 10,000 shares, you own 1% of the company. Wall Street makes it seem far more complicated than it is. The companys Board of Directors, who are elected by stockholders just like you to watch over the management, decides how much of the profit each year gets reinvested in expansion and how much gets paid out as cash dividends. If you are interested in this concept, read Investing Lesson 1. It will explain how a company sells stock in itself and how those shares end up being traded on Wall Street. You may even want to check out Investing Lesson 2 Why Stocks Become Over or Under Valued to understand what moves stock prices.

The Pros and Cons of Real Estate vs. Stocks Now, lets look at the pros and cons of each type of investments to better understand them. Pros of Investing in Real Estate

Real estate is often a more comfortable investment for the lower and middle classes because they grew up exposed to it (just as the upper classes often learned about stocks, bonds, and other securities during their childhood and teenage years). Its likely most people heard their parents talking about the importance of owning a home. The result is that they are more open to buying land than many other investments. When you invest in real estate, you invest in something tangible. You can look at it, feel it, drive by with your friends, point out the window, and say, I own that. For some people, thats important psychologically. Its more difficult to be defrauded in real estate compared to stocks if you do your homework because you can physically show up, inspect your property, run a background check on the tenants, make sure that the building is actually there before you buy it, do repairs yourself ... with stocks, you have to trust the management and the auditors.

Using leverage (debt) in real estate can be structured far more safely than using debt to buy stocks by trading on margin. Real estate investments have traditionally been a terrific inflation hedge to protect against a loss in purchasing power of the dollar.

Cons of Investing in Real Estate:

Compared to stocks, real estate takes a lot of hands-on work. You have to deal with the midnight phone calls about exploding sewage in a bathroom, gas leaks, the possibility of getting sued for a bad plank on the porch, and a whole host of things that you probably never even considered. Even if you hire a property manager to take care of your real estate investments, its still going to require occasional meetings and oversight. Real estate can cost you money every month if the property is unoccupied. You still have to pay taxes, maintenance, utilities, insurance, and more, meaning that if you find yourself with a higher-than-usual vacancy rate due to factors beyond your control, you could actually have to come up with money each month! As you learned in The Great Real Estate Myth, the actual value of real estate hardly ever increases in inflation-adjusted terms (there are exceptions, of course). This is made up for by the power of leverage. That is, imagine you buy a $300,000 property by putting in $60,000 of your own money, and borrowing the other $240,000. If inflation goes up 3% because the government printed more money and now each dollar is worth less, then the house would go up to $309,000 in value. Your actual value of the house hasnt changed, just the number of dollars it takes to buy it. Because you only invested $60,000, however, that represents a return of $9,000 on $60,000. Thats a 15% return. Backing out the 3% inflation, thats 12% in real gains before factoring in the costs of owning the property. That is what makes real estate so attractive.

Pros of Investing in Stocks

More than 100 years of research have proven that despite all of the crashes, buying stocks, reinvesting the dividends, and holding them for long periods of time has been the greatest wealth creator in the history of the world. Nothing, in terms of other asset classes, beats business ownership (remember when you buy a stock, you are just buying a piece of a business). Unlike a small business you start and manage on your own, your ownership of partial businesses through shares of stock doesnt require any work on your part (other than researching each company to determine if it is right for you). There are professional managers at headquarters that run the company. You get to benefit from the companys results but dont have to show up to work every day. High quality stocks not only increase their profits year after year, but they increase their cash dividends, as well. This means that every year that goes by, you will receive bigger checks in the mail as the companys earnings grow. As Fortune magazine pointed out, "If you'd bought a single share [of Johnson & Johnson] when the company went public in 1944 at its IPO price of $37.50 and had reinvested the dividends, you'd now have a bit over $900,000, a stunning annual return of 17.1%." On top of that, you'd be collecting somewhere around $34,200 per year in cash dividends! Thats money that would just keep rolling into your life without doing anything! Its much easier to diversify when you invest in stocks than when you invest in real estate. With some mutual funds, you can invest as little as $100 per month. With companies such as sharebuilder, a division of ING, you can buy dozens of stocks for a flat monthly fee of as little as a few dollars. Real estate requires substantially more money. Stocks are far more liquid than real estate investments. During regular market hours, you can sell your entire position, many times, in a matter of seconds. You may have to list real estate for days, weeks, months, or in extreme cases, years before finding a buyer. Borrowing against your stocks is much easier than real estate. If your broker has approved you for margin borrowing (usually, it just requires you fill out a form), its as easy as writing a check against your account. If the money isnt in there, a debt is created against your stocks and you pay interest on it, which is typically fairly low.

Cons of Investing in Stocks

Despite the fact that stocks have been proven conclusively to generate more wealth over the long run, most investors are too emotional, undisciplined, and fickle to benefit. They end up losing money because of psychological factors. Case in point: During the most recent collapse, the Credit Crisis of 2007-2009, well-known financial advisors were telling people to sell their stocks after the market had tanked 50%, at the very moment they should have been buying. The price of stocks can experience extreme fluctuations in the short-term. Your $40 stock may go to $10 or to $80. If you know why you own shares of a particular company, this shouldnt bother you in the slightest. You can use the opportunity to buy more shares if you think they are too cheap or sell shares if you think they are too expensive. As Benjamin Graham said, to get emotional about stock prices that you believe are wrong is to get upset by other peoples mistakes in judgment. On paper, stocks may not look like theyve gone anywhere for ten years or more during sideways markets. This, however, is often an illusion because charts dont factor in the single most important long-term driver of value for investors: reinvested dividends. If you use the cash a company sends you for owning its stock to buy more shares, over time, you should own far more shares, which entitles you to even more cash dividends over time. For more information, read the work of Ivy League professor Jeremy Siegel.

Why Building Equity at the Expense of Liquidity Can Lead to Bankruptcy

Don't Increase Your Risk by Lowering Your Liquidity

Everyone wants to own his or her home outright; real estate ownership, free and clear, is the American dream. Yet, unless you are in a position to wipe out the entire balance of the mortgage on your primary residence, making extra payments to lower the principal balance could lead to financial disaster. That may be hard to believe, but the numbers are convincing. Take a moment to let us illustrate how you can eventually achieve that dream of owning your property while reducing wipeout risk in the event of major illness or unemployment. The more equity you have in your home, the greater the likelihood that a bank will foreclose if you miss payments Imagine you own a bank. You have two customers John and Mary both of whom have own a house appraised at $200,000. John has become a total deadbeat, is up to his eyeballs in credit card debt, leases his car, has almost no liquid assets, and has an unstable employment history. Mary, on the other hand, has excellent credit, and although she doesnt have a lot of excess savings available, has faithfully made double or triple payments to lower the balance on her mortgage, which now stands at just $15,000. She is eagerly looking forward to the day when she can send that last voucher into the bank and know that her house is totally and completely her own. Now, imagine that both suffer disaster; perhaps they were in an accident and unable to work or were laid off due to a recession. As the bank, you arent going to notice until a payment is missed. Youre really going to perk up and pay attention when sixty days have passed and no checks have been received in the mail. At some point, a threshold is passed where banking laws and regulations require that you recognize it is possible you might not receive any more payments from either John or Mary. Of course, the bank employees want to avoid this because that lowers their reported profitability, lessens the strength of their balance sheet, makes their regulators upset, and gets the owners (or shareholders if the bank is publicly traded) gunning for them to change the situation or risk losing their jobs.

To avoid this, the bank staff is going to take proactive measures to get the lo an back on accrual status as quickly as possible so that it wont damage the financial statements. The main way this can be done is to foreclose on the property and auction it to a buyer. Now, sitting from your perspective as the bank owner, who are you more likely to go after first? John, who has almost no equity in his home, or Mary? If you were to foreclose on John, you are going to have to get nearly the full $200,000 asking price to wipe out the loan on your books. If you foreclose on Mary, however, you can liquidate the property at a steep discount very, very quickly and wipe out the full $15,000 loan. Yes, Mary has been a very good customer. Yes, she has done everything right. Perhaps its not fair that she is the first one you would go after but to understand why this is done, you must realize the incentive structure set in place for the employees by Wall Street which is, in turn, a result of investors wanting more profits. Who are the investors? You and me. In our 401k plans, IRA accounts, or just through outright ownership of stocks. Its the pension fund that pays the checks to your parents or grandparents. Its the insurance company that needs to generate funds to pay claims. With investors demanding profits, Wall Street doesnt want to see a bank own a lot of real estate. The employees at your bank will not risk their job by attempting to list Johns house for six months so that he can get a little of bit of equity out of it. They are only interested in protecting the funds they advanced John and he promised to repay. Thats why they turn to auctions. They cant afford to dump Johns house because the proceeds might not be sufficient to repay the loan. Marys house, on the other hand, can be listed for $125,000 at an auction. They get their $15,000 and keep a pristine balance sheet while she loses $75,000 in equity that could have been captured were she able to list the property on the market long enough to receive a respectable offer. What about John? you ask. Thats the cruel part. They are far more likely to restructure the payment terms to help him out of the situation because they could then legitimately keep it on the books as a good loan. They might offer a balloon payment at the end of the mortgage to lower present payments. They might permit two years of interest-only payments. The sky is the limit and it really depends upon how desperately the bank wants to avoid hits to its profit margins. How can you protect yourself from this situation? The biggest defense any investor has against foreclosure is liquidity. Say it over and over again. The bank is not concerned with the amount of money you owe them just that you continue to make payments on time, without delay. Instead, Mary would have been much better off by taking those double and triple payments she had been making and putting them into a tax-free money market account or fund earning four or five percentage points. Yes, her mortgage rate may be higher but that doesnt matter because if she is in a decent tax bracket, its likely that the after tax cost of the mortgage interest will wash with the tax-free interest rate shes earning on this investment fund. Why would I borrow money at a net 5% after the tax deduction and turn around and invest it at 4% to 5% tax-free? you might ask. Liquidity. When hard times hit, it wouldnt matter what her mortgage was, she could have drawn from that account and easily made the payment until she was able to get back on her feet. In fact, at the rate she had been putting aside excess funds, she could have probably made several years worth of payments! The single biggest danger with a strategy that focuses on liquidity is the risk that someone spends the cash while maintaining the debt. An account with a large sum of unrestricted cash is simply too great a temptation for a lot of people. Maybe they get behind on their credit card bills. Perhaps they want a new flat screen television and think theyll just dip into the fund and pay it back in a few months. (It never works that way.) If there is any possibility that you are inclined to spend the money on anything other than to make your house payment in the event of an emergency, its probably a bad idea. It really comes down to self-discipline and temperament. Another big danger is the temptation to go for a few extra percentage points of return by investing in riskier assets. This particular financial strategy depends upon safety of principle. For most people, this means highly liquid tax-advantaged securities such as a money market fund that invests in municipal bonds. In exceptional cases, those with highly specialized knowledge of specific markets (such as stocks or real estate) could invest these funds with reduced risk.

The Great Real Estate Myth

According to Research, Stocks Generate Higher Real Returns than Real Estate

This article was originally published on February 24th, 2007 Buying a primary residence is probably the single best decision someone can make for their financial future. However, when you get into second homes, vacation houses, rental properties, commercial buildings, and raw land held for potential appreciation, you are playing a whole new ball game. Thats because over long periods of time, the real returns (net of inflation) offered by common stocks has crushed those available by real estate ownership. Yep. You read that right. Americans have become so enthralled with ownership of real estate that they often dont realize a property increasing in value from $500,000 to $580,000 within five years, after backing out the after-tax interest expense on the mortgage, additional insurance, title costs, etc., doesnt even keep pace with inflation! That $80,000 gain isnt going to buy you any more goods and services; the same amount of hamburgers, swimming pools, furniture sets, grand pianos, cars, fountain pens, cashmere sweaters, or whatever else it is that you may want to acquire. Assuming a full mortgage at 6.25%, during those five years you would have paid $151,401 in gross interest, or roughly $93,870 after the appropriate tax deductions (and that assumes you are in the top brackets, the most favorable case.) Your mortgage balance would have been reduced to around $466,700, giving you equity of $113,300 ($580,000 market value $466,700 mortgage = $113,300 equity.) During that time, you would have shelled out $184,715 in payments. Factoring in property care, insurance, and other costs, your gross out-of-pocket expenses would have been at least $200,000. This should illustrate a fundamental principle all investors should remember: Real estate is often a way to keep the money you would have otherwise paid in rent expense, but it is not going to likely generate high enough rates of return to compound your wealth substantially. There are, of course, special operations that can and do generate high returns on a leveraged basis such as contractors with a low cost basis buying, rehabbing, and selling houses, hotel designers creating an exciting destination in a hot part of town (it must be pointed out that in this case, the wealth creation is coming not from the real estate, but from the business or common stock that is created through hotel operations), or storage units in a town with no other comparable properties (although, again, the real wealth comes not from the real estate but from the business that is created!) What caused this great real estate myth to develop? Why are we duped by it? Continue reading for insights, answers, and practical information you may be able to use. 1. To Many Investors, Real Estate Is More Tangible than Stocks The average investor probably doesnt look at his or her stock as a fraction of a real, bona fide business that has facilities, employees, and, one hopes, profits. Instead, they see it as a piece of paper that wiggles around on a chart. With no concept of the underlying owner earnings and the earnings yield, its understandable why they may panic when shares of Home Depot or Wal-Mart falls from $70 to $33. Blissfully unaware that price is paramount that is, what you pay is the ultimate determinant of your return on investment they think of equities as more of a lottery ticket than ownership, opening The Wall Street Journal and hoping to see some upward movement. You can walk into a rental property; run your hands along the walls, turn on and off the lights, mow the lawn, and greet your new tenants. With shares of Bed, Bath, and Beyond sitting in your brokerage account, it may not seem as real. Even the dividend checks that would ordinarily be mailed to your home, business, or bank, are often now electronically deposited into your account

or automatically reinvested. Although, statistically over the long term you are more likely to build your net worth through this type of ownership, it doesnt feel as real as property. 2. Real Estate Doesnt Have a Daily Quoted Market Value Real estate, on the other hand, may offer far lower after-tax, after-inflation returns, but it spares those who havent a clue what theyre doing from seeing a quoted market value every day. They can go on, holding their property and collecting rental income, completely ignorant to the fact that every time interest rates move, the intrinsic value of their holdings is affected, just like stocks and bonds. This mistake was addressed when Benjamin Graham taught investors that the market is there to serve them, not instruct them. He said that getting emotional about movements in price was tantamount to allowing yourself mental and emotional anguish over other peoples mistakes in judgment. Coca-Cola may be trading at $50 a share but that doesnt mean that price is rational or logical, nor does it mean if you paid $60 and have a paper loss of $10 per share that you made a bad investment. Instead, the investor should compare the earnings yield, the expected growth rate, and current tax law, to all of the other opportunities available to them, allocating their resources to the one that offers the best, risk-adjusted returns. Real estate is no exception. Price is what you pay; value is what you get. 3. Confusing That Which Is Near with That Which Is Valuable Psychologists have long told us that we overestimate the importance of what is near and readily at hand as compared to that which is far away. That may, in part, explain why so many people apparently cheat on their spouse, embezzle from a corporate conglomerate, or, as one business leader illustrated, a rich man with $100 million in his investment accounts may feel bitterly angry about losing $250 because he left the cash on the nightstand at a hotel. This principle may explain why some people feel richer by having $100 of rental income that shows up in their mailbox every day versus $250 of look-through earnings generated by their common stocks. It may also explain why many investors prefer cash dividends to share repurchases, even though the latter are more tax efficient and, all else being equal, result in more wealth created on their behalf. This is often augmented by the very human need for control. Unlike Worldcom or Enron, an accounting fraud by people whom youve never met cant make the commercial building you lease to tenants disappear overnight. Other than a fire or other natural disaster, which is often covered by insurance, you arent going to suddenly wake up and find that your real estate holdings have disappeared or that they are being shut down because they ticked off the Securities and Exchange Commission. For many, this provides a level of emotional comfort.

You might also like

- Should You Invest in Real Estate or StocksDocument3 pagesShould You Invest in Real Estate or StocksDark PrincessNo ratings yet

- Building Wealth: An Insider's Guide to Real Estate InvestingFrom EverandBuilding Wealth: An Insider's Guide to Real Estate InvestingNo ratings yet

- 20 Secrets How to Get Super Rich: The Smart Guide to High Net WorthFrom Everand20 Secrets How to Get Super Rich: The Smart Guide to High Net WorthRating: 1 out of 5 stars1/5 (1)

- Investing for Beginners: The Ultimate Stock Market Guide to Teach You How to Make Money (Achieve Financial Freedom by Investing Like the Best in the World)From EverandInvesting for Beginners: The Ultimate Stock Market Guide to Teach You How to Make Money (Achieve Financial Freedom by Investing Like the Best in the World)No ratings yet

- The Leveraged Millionaire: Increase Your Risk, Income Your Returns… Maybe: Financial Freedom, #108From EverandThe Leveraged Millionaire: Increase Your Risk, Income Your Returns… Maybe: Financial Freedom, #108No ratings yet

- Your Little Book of Real Estate Investment: From Direct Investment to Real Estate Stocks and CrowdfundingFrom EverandYour Little Book of Real Estate Investment: From Direct Investment to Real Estate Stocks and CrowdfundingNo ratings yet

- The Best Real Estate Book for Beginners: Winning in the game of Real estate investmentsFrom EverandThe Best Real Estate Book for Beginners: Winning in the game of Real estate investmentsNo ratings yet

- Real Estate Investing Online for Beginners: Build Passive Income from Home: 3 Hour Crash CourseFrom EverandReal Estate Investing Online for Beginners: Build Passive Income from Home: 3 Hour Crash CourseNo ratings yet

- Property Profits: A Lazy Investor's Guide to Making Money in Real Estate Even if You Don't Have Time or Patience for All the B.S.From EverandProperty Profits: A Lazy Investor's Guide to Making Money in Real Estate Even if You Don't Have Time or Patience for All the B.S.No ratings yet

- Real Estate Investing For Beginners: The Number 1 Guide For Cash Flowing Your Way To Financial Freedom Through The Rental Property MarketFrom EverandReal Estate Investing For Beginners: The Number 1 Guide For Cash Flowing Your Way To Financial Freedom Through The Rental Property MarketNo ratings yet

- The 100 Year Savings Solution: How to Create the Financial Foundation for Yourself, Your Family, and Your LegacyFrom EverandThe 100 Year Savings Solution: How to Create the Financial Foundation for Yourself, Your Family, and Your LegacyNo ratings yet

- High-Yield Bond Reinvestment in Action!: Convert Bond Payments in High Income: Financial Freedom, #73From EverandHigh-Yield Bond Reinvestment in Action!: Convert Bond Payments in High Income: Financial Freedom, #73No ratings yet

- Investing - The Beginner's Guide to Investing: The Foundation of Knowledge That All Rich Investors HaveFrom EverandInvesting - The Beginner's Guide to Investing: The Foundation of Knowledge That All Rich Investors HaveRating: 4 out of 5 stars4/5 (2)

- 7 Critical MistakesDocument15 pages7 Critical MistakesTrịnh Minh TâmNo ratings yet

- Secrets To Positive CashflowDocument15 pagesSecrets To Positive CashflowSleepy Chinita100% (4)

- Robert Shemin Chapter 1 Why Real Estate Investement The Best Wealth Creator in UiniverseDocument14 pagesRobert Shemin Chapter 1 Why Real Estate Investement The Best Wealth Creator in UiniverseHenry CheahNo ratings yet

- Benjamin Graham Security Analysis PortfolioDocument4 pagesBenjamin Graham Security Analysis PortfolioSen LeeNo ratings yet

- Saving is Defense: Investing is Offense: Financial Freedom, #161From EverandSaving is Defense: Investing is Offense: Financial Freedom, #161No ratings yet

- Investing for Interest 13: Baby Bonds vs. Treasury Bonds: Financial Freedom, #169From EverandInvesting for Interest 13: Baby Bonds vs. Treasury Bonds: Financial Freedom, #169No ratings yet

- How To Invest $100 (Test)Document1 pageHow To Invest $100 (Test)Lucky LyonNo ratings yet

- Absolute Wealth The Secrets To Positive Cash FlowDocument16 pagesAbsolute Wealth The Secrets To Positive Cash Flowoair2000No ratings yet

- Online Trading and Stock Investing for Beginners: The Easy Way to Start Trading and Getting Rich in the Stock MarketFrom EverandOnline Trading and Stock Investing for Beginners: The Easy Way to Start Trading and Getting Rich in the Stock MarketRating: 5 out of 5 stars5/5 (1)

- Summary: How to Make It When You're Cash Poor: Review and Analysis of Norton's BookFrom EverandSummary: How to Make It When You're Cash Poor: Review and Analysis of Norton's BookNo ratings yet

- Financial Security vs. Financial Freedom 2: The Difference Between Saving and Investing: Financial Freedom, #171From EverandFinancial Security vs. Financial Freedom 2: The Difference Between Saving and Investing: Financial Freedom, #171No ratings yet

- Investing in Yourself: Financial Riches for a Lifetime and BeyondFrom EverandInvesting in Yourself: Financial Riches for a Lifetime and BeyondRating: 5 out of 5 stars5/5 (2)

- 21 Keys BookDocument8 pages21 Keys Bookajiargoputro100% (2)

- Real Estate Investing: Strategies for Building a Profitable Portfolio of Investment Properties with Insights on Market Analysis, REITS, Rental Property Management, Flipping, Taxation, and More.From EverandReal Estate Investing: Strategies for Building a Profitable Portfolio of Investment Properties with Insights on Market Analysis, REITS, Rental Property Management, Flipping, Taxation, and More.Rating: 5 out of 5 stars5/5 (40)

- Your Little Book of Asset Allocation: Everything You Need For Worry-Free InvestmentFrom EverandYour Little Book of Asset Allocation: Everything You Need For Worry-Free InvestmentNo ratings yet

- Diversify Your Home Equity: Protect Yourself with Multiple Investment Strategies: Financial Freedom, #99From EverandDiversify Your Home Equity: Protect Yourself with Multiple Investment Strategies: Financial Freedom, #99No ratings yet

- Muslim Investor: The Stock Market Made SimpleFrom EverandMuslim Investor: The Stock Market Made SimpleRating: 5 out of 5 stars5/5 (1)

- Acquiring Rental Property: Learning Your Options for Starting Your Investment Portfolio: Real Estate Knowledge Series, #2From EverandAcquiring Rental Property: Learning Your Options for Starting Your Investment Portfolio: Real Estate Knowledge Series, #2No ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- The Everything Guide to Investing in Your 20s & 30s: Your Step-by-Step Guide to: * Understanding Stocks, Bonds, and Mutual Funds * Maximizing Your 401(k) * Setting Realistic Goals * Recognizing the Risks and Rewards of Cryptocurrencies * Minimizing Your Investment Tax LiabilityFrom EverandThe Everything Guide to Investing in Your 20s & 30s: Your Step-by-Step Guide to: * Understanding Stocks, Bonds, and Mutual Funds * Maximizing Your 401(k) * Setting Realistic Goals * Recognizing the Risks and Rewards of Cryptocurrencies * Minimizing Your Investment Tax LiabilityNo ratings yet

- Creating Residential Income: How to Get Your Money to Work For YouFrom EverandCreating Residential Income: How to Get Your Money to Work For YouNo ratings yet

- The Magic of Income Investing 2: Your Household Runs on Income: Financial Freedom, #149From EverandThe Magic of Income Investing 2: Your Household Runs on Income: Financial Freedom, #149No ratings yet

- Investing for Interest 10: Bond Buying is Back Baby!: Financial Freedom, #61From EverandInvesting for Interest 10: Bond Buying is Back Baby!: Financial Freedom, #61No ratings yet

- Stock Market Investing For Beginners - Fundamentals On How To Successfully Invest In StocksFrom EverandStock Market Investing For Beginners - Fundamentals On How To Successfully Invest In StocksNo ratings yet

- Smart Investors Keep it Simple: Creating Passive Income with Dividend StocksFrom EverandSmart Investors Keep it Simple: Creating Passive Income with Dividend StocksNo ratings yet

- Investing for Beginners: Minimize Risk, Maximize Returns, Grow Your Wealth, and Achieve Financial Freedom Through The Stock Market, Index Funds, Options Trading, Cryptocurrency, Real Estate, and More.From EverandInvesting for Beginners: Minimize Risk, Maximize Returns, Grow Your Wealth, and Achieve Financial Freedom Through The Stock Market, Index Funds, Options Trading, Cryptocurrency, Real Estate, and More.Rating: 5 out of 5 stars5/5 (49)

- The Road to Homeownership #3: Saving for the Down Payment: Financial Freedom, #184From EverandThe Road to Homeownership #3: Saving for the Down Payment: Financial Freedom, #184No ratings yet

- Timeless Millionaire Secrets: What Rich and Wealthy People Don't Want You to KnowFrom EverandTimeless Millionaire Secrets: What Rich and Wealthy People Don't Want You to KnowNo ratings yet

- WealthDocument2 pagesWealthEkle Onoja WilliamsNo ratings yet

- 7 Days SafetyDocument1 page7 Days SafetyJan BooysenNo ratings yet

- Alignment InfoDocument2 pagesAlignment InfoJan BooysenNo ratings yet

- Birthday Logic PuzzleDocument2 pagesBirthday Logic PuzzleMichelle DamentNo ratings yet

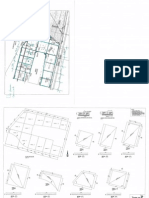

- Centre LineDocument1 pageCentre LineJan BooysenNo ratings yet

- Summary of Shape Codes (Reference: SANS 282:2004, Edition 5.1 - Bending Dimensions and Scheduling of Steel Reinforcement For Concrete)Document1 pageSummary of Shape Codes (Reference: SANS 282:2004, Edition 5.1 - Bending Dimensions and Scheduling of Steel Reinforcement For Concrete)Sakthi KuppusamyNo ratings yet

- Road AlgDocument2 pagesRoad AlgJan BooysenNo ratings yet

- Budget Overruns and Late CompletionDocument4 pagesBudget Overruns and Late CompletionJan BooysenNo ratings yet

- Cost ControlDocument2 pagesCost ControlJan BooysenNo ratings yet

- Developing Worl Role CEDocument4 pagesDeveloping Worl Role CEJan BooysenNo ratings yet

- Contract Selection - Factors 2Document4 pagesContract Selection - Factors 2Jan BooysenNo ratings yet

- Contract Selection - FactorsDocument4 pagesContract Selection - FactorsJan BooysenNo ratings yet

- Suwp Consul10061108300Document3 pagesSuwp Consul10061108300Jan BooysenNo ratings yet

- Definitions: Continued Professional DevelopmentDocument1 pageDefinitions: Continued Professional DevelopmentJan BooysenNo ratings yet

- Contract DBFODocument4 pagesContract DBFOJan BooysenNo ratings yet

- Suwp Consul10061108530Document2 pagesSuwp Consul10061108530Jan BooysenNo ratings yet

- Sustainable Development Strategy July 07Document20 pagesSustainable Development Strategy July 07Jan BooysenNo ratings yet

- Generalist or Specialist: Which Do I Consult?Document4 pagesGeneralist or Specialist: Which Do I Consult?Jan BooysenNo ratings yet

- Suwp Consul10061109100Document6 pagesSuwp Consul10061109100Jan BooysenNo ratings yet

- Suwp Consul10061109112Document1 pageSuwp Consul10061109112Jan BooysenNo ratings yet

- Suwp Consul10061108530Document2 pagesSuwp Consul10061108530Jan BooysenNo ratings yet

- Suwp Consul10061108440Document3 pagesSuwp Consul10061108440Jan BooysenNo ratings yet

- Suwp Consul10061108361Document3 pagesSuwp Consul10061108361Jan BooysenNo ratings yet

- Landfill Directive - Task Force Report 1Document19 pagesLandfill Directive - Task Force Report 1Jan BooysenNo ratings yet

- Suwp Consul10061109111Document1 pageSuwp Consul10061109111Jan BooysenNo ratings yet

- Suwp Consul10061112270Document3 pagesSuwp Consul10061112270Jan BooysenNo ratings yet

- Suwp Consul10083109030Document6 pagesSuwp Consul10083109030Jan BooysenNo ratings yet

- Vandex CemelastDocument2 pagesVandex CemelastJan BooysenNo ratings yet

- Suwp Consul10061111430Document5 pagesSuwp Consul10061111430Jan BooysenNo ratings yet

- Suwp Consul10061111420Document1 pageSuwp Consul10061111420Jan BooysenNo ratings yet

- Hudson Litchfield News 9-16-2016Document16 pagesHudson Litchfield News 9-16-2016Area News GroupNo ratings yet

- Noble Gold InvestmentsDocument16 pagesNoble Gold Investmentsime858218No ratings yet

- The Abington Journal 07-24-2013Document20 pagesThe Abington Journal 07-24-2013The Times LeaderNo ratings yet

- Poder NotarialDocument6 pagesPoder Notarialmanuel ruso rojasNo ratings yet

- Personal Finance Study Guide PDFDocument24 pagesPersonal Finance Study Guide PDFJager HunterNo ratings yet

- TSP 70Document15 pagesTSP 70onetimer64100% (1)

- Kardashian West v. WestDocument40 pagesKardashian West v. WestBillboardNo ratings yet

- WSJ+ Tax-Guide 2020 Updated PDFDocument58 pagesWSJ+ Tax-Guide 2020 Updated PDFLan NguyenNo ratings yet

- Your Information: SIMPLE IRA Contribution Form Qualified Retirement Plan Loan Repayment Deposit SlipDocument1 pageYour Information: SIMPLE IRA Contribution Form Qualified Retirement Plan Loan Repayment Deposit SlipJitendra SharmaNo ratings yet

- Shooting Sports USA August 2014 IssueDocument40 pagesShooting Sports USA August 2014 IssueAmmoLand Shooting Sports NewsNo ratings yet

- USLS REPORTER MANUAL Rev. 03.2017 PDFDocument153 pagesUSLS REPORTER MANUAL Rev. 03.2017 PDFAndy AnthonyNo ratings yet

- General Information Booklet: This Booklet Is Updated Yearly On September 1Document41 pagesGeneral Information Booklet: This Booklet Is Updated Yearly On September 1Mike RileyNo ratings yet

- Gemini and IRA Financial Class ActionDocument42 pagesGemini and IRA Financial Class ActionGMG EditorialNo ratings yet

- Individual Retirement Accounts - Backdoor Roth IRA 2021Document2 pagesIndividual Retirement Accounts - Backdoor Roth IRA 2021Finn KevinNo ratings yet

- PDF Document 2Document2 pagesPDF Document 22x79ttmmmwNo ratings yet

- FATCA W9 + Carta para Compartir Información (FATCA)Document2 pagesFATCA W9 + Carta para Compartir Información (FATCA)CarrilloyLawNo ratings yet

- 1398155221sva pgs042314Document12 pages1398155221sva pgs042314CoolerAdsNo ratings yet

- Scarlet Matador Fund - PPMDocument68 pagesScarlet Matador Fund - PPMteri84480% (1)

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyNo ratings yet

- IRA Contribution and RolloverDocument4 pagesIRA Contribution and Rolloverja leeNo ratings yet

- Concepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDocument102 pagesConcepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDavid Clark100% (21)

- 22 Wealth MultipliersDocument19 pages22 Wealth MultipliersShantrece MarshallNo ratings yet

- Family and Consumer Sciences Teacher Study GuideDocument50 pagesFamily and Consumer Sciences Teacher Study GuideRaquel Schwartz Vazquez100% (2)

- Allocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositDocument4 pagesAllocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositJahe FameNo ratings yet

- McKinsey Global Institute - Define Contributions MarketDocument37 pagesMcKinsey Global Institute - Define Contributions MarketHugh NguyenNo ratings yet

- Alvarez Vs Guingona 252 SCRA 695Document3 pagesAlvarez Vs Guingona 252 SCRA 695Denee Vem MatorresNo ratings yet

- Death ChecklistDocument4 pagesDeath ChecklistEvoni Soxfan100% (2)

- W 9 FormDocument3 pagesW 9 FormAlibe Yalibeth BrambilaNo ratings yet

- Winter 2011: Crossing The Big Wood RiverDocument12 pagesWinter 2011: Crossing The Big Wood RiverWood River Land TrustNo ratings yet