Professional Documents

Culture Documents

The End of Nexus

Uploaded by

avalaraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The End of Nexus

Uploaded by

avalaraCopyright:

Available Formats

THE END OF NEXUS

she said with a long pause as she settled into the chair across from the private detective. I thought I had a handle on it, but Im just not so sure anymore. She was just another out-of-state business owner tall and remote, a real cool customer. She sold furniture out of a New York storefront, and smaller housewares online. With her warehouse and distribution center in Ohio, a traveling sales force out of Colorado, and most of her customers on the West Coast, she was in a real sales tax compliance bind. And she knew it. He knew all about nexus that simple word with the troubled past. How since the early 90s, out-of-state sellers, including multi-state online retailers, only had to collect sales tax within a state if they demonstrated a significant physical presence like a warehouse or distribution center. He knew it was a game of cat and mouse. Out-of-state businesses trying to sidestep sales tax collection obligations, and states trying to enforce a broader definition of nexus to capture more sales tax revenue. How states had passed socalled Amazon laws to require more online retailers to collect sales tax, and that Amazon had finally agreed to start collecting sales tax for the first time in states like New York and California and Pennsylvania with other states in hot pursuit. He also knew that businesses often get caught in the nexus compliance net. They are the ones hung out to dry left holding the bag when the auditor comes knocking and fines them for not collecting sales tax correctly. The questions just keep piling up, she said, almost despondently. Do Amazon laws apply to me? And what about click-through and affiliate nexus? I need to get to the bottom of this. The detective gave her a long steely look before answering. After all, hed seen it all before. Most states need more money, see? he explained, And it looks like Internet sales tax is the way theyre going to get it. Pay attention and Ill give you the skinny, he said. Heres how it works.

Nexus

All fun aside, we know these are serious issues. So, now, just the facts, maam.

877.780.4848 www.avalara.com 2013 Avalara, Inc. All rights reserved

THE END OF NEXUS

The bottom line is that statutes are changing at the state and federal level to require more out-of-state retailers to collect sales tax. And its not just the online retailers or mail order companies that will feel the pinch. Any businesses that sell across state lines need to be paying close attention.

Amazon Laws

Since the early 90s, states havent required multi-state online retailers to collect sales tax, unless they had a significant physical presence within that state.1 Generally speaking, this significant physical presence included things like having a warehouse, store, office, sales force or other demonstrably direct connections with a state. Years of legal battles between multi-state online retailers like Amazon and states like California hinged on whether these retailers had enough of a connection to trigger a nexus obligation. Meanwhile, many states enacted Amazon laws to require more multi-state online retailers to collect sales tax for the first time. These laws expanded definitions of nexus to include online-specific relationships such as affiliate and web advertising. Multi-state online retailers, catalog retailers, and businesses that make significant sales over the phone must also keep track of proposals at the federal level that would allow all states to change nexus. The days of tax-free online shopping may be over, but the debates rage on. Amazon laws vary from state to state and typically contain one or more of the following elements.2,3 1. Affiliate & Related Entity Nexus 2. Click-Through Nexus 3. Consumer Use Notification By incorporating affiliate and click-through language within the statutes, Amazon laws effectively remove the traditional nexus loopholewherein a company without a significant physical presence is not obligated to collect sales tax.

Affiliate and Related Entity Nexus

One strategy states use to capture more sales tax revenue is to define the kinds of affiliate or subsidiary relationships that trigger nexus for out-of-state companies. Affiliate nexus describes a type of relationship between an out-of-state seller and its in-state affiliate that triggers a nexus obligation. An affiliate is usually considered an entity within a state with activities directly benefitting an out-of-state seller. Many state laws designate what kinds of affiliate relationships trigger sales tax collection obligations on remote sellers, so tracking each state is a good idea. Arkansas.* Out-of-state-retailers must collect sales tax if an affiliate delivers installs, assembles, or performs maintenance services for the sellers purchasers within the state. California.* Out-of-state retailers must collect sales tax if they are related in any way to any entity located in the state. This includes entities that conduct business on the out-of-state sellers behalf, as well as entities that use a similar patent or the same trademark. California considers affiliate nexus to apply even if the related business operations are utterly

877.780.4848 www.avalara.com 2013 Avalara, Inc. All rights reserved

THE END OF NEXUS

separate from the retail operation in another state. Georgia.* Out-of-state-retailers that make more than $50,000 in annual gross receipts from affiliate referrals must collect Georgia sales tax. North Carolina. Out-of-state retailers that make more than $10,000 in annual gross receipts from affiliate referrals must collect North Carolina sales tax. Oklahoma. In 2010, the Oklahoma legislature enacted laws to increase the amount of taxes collected on items purchased by Oklahoma residents from out-of-state Internet retailers. Rhode Island.* Out-of-state retailers that make more than $10,000 per year in gross receipts from affiliate referrals must collect Rhode Island sales tax. Pennsylvania. Out-of-state nexus includes storing property, having employees who travel to Pennsylvania on business, or having a contractual relationship with any entity located in Pennsylvania whose website has a link that encourages purchasers to place orders. Texas. Battles between Texas and Amazon culminated an agreement with the Lone Star State, under which it began collecting sales tax in Texas on July 1, 2012.

California. Californias click-through nexus law is similar to New Yorks. Affiliated companies that advertise on websites hosted in California might trigger nexus. In 2012, California hired 100 new state auditors, lawyers, and specialists to enforce its clickthrough nexus. Connecticut. Online retailers that use affiliates to advertise within the state, that result in direct sales to an out-of-state ecommerce portal, are required to collect sales tax from customers.

Some states that are currently proposing broader nexus provisions that will likely go into effect in 2013:

Michigan. Currently considering an Amazon Law that is likely to include click-through nexus language. Utah. Recently narrowly approved a bill requiring online retailers to collect and remit Utah sales tax, as brick-and-mortar retailers do. Vermont. Will institute click-through nexus after five more states adopt similar legislation.4

Consumer Use Notification

Some Amazon laws also include a consumer use tax notification component, which requires vendors to notify consumers of their use tax obligations and/or to report in-state sales to revenue authorities. Consumer use tax is a tax paid by the consumer on tangible items, for which they were not required to pay sales tax by out-of-state retailers. Technically speaking, there is no such thing as tax-free online shopping. Its just that rather than pay sales tax at the time of purchase, consumers are required to submit consumer use tax at a later date to the state. Theyre effectively paying tax on the use of the product. Consumer use tax is intended to offset sales tax revenue not collected by multi-state businesses. Very few consumers ever actually pay consumer use tax, but that is likely going to change soon. While most states dont yet require online retailers to

Click-Through Nexus

Click-through nexus is another method states employ to capture more sales tax revenue. It is specifically aimed at multi-state retailers that use web advertisingwhen that in-state web advertisement clicks through to a remote ecommerce portal in order to complete a sale. More states have adopted affiliate laws than click-through laws, but many are now considering click-through nexus legislation.

States with click-through nexus include:

New York.** The first state to establish clickthrough nexus. Under the New York legislation, web advertisements that promote in-state sales trigger nexus. The law was recently upheld by the New York Court of Appeals.

877.780.4848 www.avalara.com 2013 Avalara, Inc. All rights reserved

THE END OF NEXUS

send out use tax reminders to customers who dont pay sales tax, some do. Oklahoma. Out-of-state retailers that do not collect sales and use taxand that made more than $10,000 in gross receipts in Oklahoma the previous year, must notify Oklahoma purchasers that use tax is due on nonexempt items. Tennessee. For the second year in a row, Amazon has sent a friendly email reminderto its customers in Tennessee, reminding them to pay use tax on their purchases. Kentucky. Thelegislature has enactedHB 440, a bill that requires out-of-state retailers to provide Kentucky customers with ause taxnotification. The marketplace fairness bill currently before Congress would expand state authority beyond click-through, affiliate, or general Amazon laws. If it becomes law, the Marketplace Fairness Act of 2013 would allow states that adhere to sales tax simplification rules to require multistate online retailers to collect sales tax. In other words, the nexus net is growing larger.

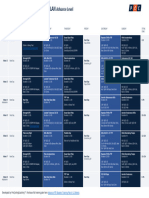

to collect sales tax from remote sellers, if they sign the Streamlined Sales Tax Agreement (SST) or if they implement a number of sales tax administration simplifications. The Streamlined Sales Tax Agreement (SST), currently signed by 22 states, works to simplify

Full member Associate member - ex to full Advisory - not conforming

Non-sales tax Project states - not advisory Non-participating

Figure 1: States by Membership Status (source: SST)

and create uniformity in sales tax administration rules. States adhering to the Streamlined Sales Tax Agreement follow guidelines intended to ease the burden of sales tax collection and remittance for multi-state businesses. These guidelines include: Uniform definitions within tax laws. Rate simplification. Uniform-sourcing rules. Simplified exemption administration. If federal legislation passes as proposed, SST states would have the authority to collect remote sales tax 180 days after passage. Non-Streamline states would get that authority 6 months from the day its enacted. Some states will be ready immediately, while it will take several years for other states to comply with federal requirements. Retailers need to be ready, but should carefully monitor which states have authority so they can start collecting when required.5

Marketplace Fairness 2013

According to many media outlets, states that let multistate online retailers out of collecting sales tax from customers, give those retailers an advantage over brickand-mortar stores. Cries of unfairness have resulted in a host of bills, notably this years Marketplace Fairness Act of 2013, which passed the Senate in early May, 2013 by a vote of 69 to 27. If the bill is eventually signed into law by the president, it would give states the authority to require remote retailers, such as online sellers, to collect sales tax. The bill would apply only to remote retailers who have annual remote sales in excess of $1 million (though this threshold is likely to change in the final legislation). The bill as written would give states the authority

877.780.4848 www.avalara.com 2013 Avalara, Inc. All rights reserved

THE END OF NEXUS

CONCLUSION

Its the end of nexus as we know it, the detective concluded, wrapping up the involved tale. Whether its affiliate and clickthrough nexus, or consumer use notification requirements or even through passage of a blanket federal law, its very likely that multi-state sellers will soon have to collect sales tax. Those are the facts, maam. Its up to you what you do with them. He paused, looking at her over the top of his glasses. You may or may not be ready for this. But Ill guarantee you one thing: The state auditors will be on this like white on rice.

1 US Supreme Court cases like Miller Bros. v. Maryland, 347 U.S. 340, 344-45 (1954), or National Bellas Hess, Inc. v. Department of Revenue, 386 U.S. 753, 756-57 (1967), or the most significant sales and use tax nexus case to date, Quill Corp. v. North Dakota, 504 U.S. 298 (1992). With sales tax, the question of nexus always comes down to whether there is physical presence. 2 3 *

Avalara blog, How Amazon Tax is Affecting Your Business These states also have click-through nexus. These states also have affiliate nexus. As of February 2013.

Weekly Tax Advisor, A Game of Cat and Mouse

** 4 5

Read more about: The Marketplace Fairness Act

877.780.4848 www.avalara.com 2013 Avalara, Inc. All rights reserved

THE END OF NEXUS

GET STARTED

For more information, visit us at www.avalara.com or call 1-877-780-4848

Founded in 2004, Avalara pioneered a service-based platform for sales tax and compliance automation and has been recognized for years as one of Americas fastest growing technology firms. The companys cloud solutions help thousands of customers stay focused on their core businesses by providing automated end to end compliance services including sales and use tax calculation, exemption certificate management, filing and remittance, and a broad array of related services.

877.780.4848 www.avalara.com 2013 Avalara, Inc. All rights reserved

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Japanese Mythology: 2 Kuniumi and KamiumiDocument12 pagesJapanese Mythology: 2 Kuniumi and KamiumipdekraaijNo ratings yet

- Banana Stem Patty Pre Finale 1Document16 pagesBanana Stem Patty Pre Finale 1Armel Barayuga86% (7)

- Seminar ReportDocument15 pagesSeminar ReportNipesh MAHARJANNo ratings yet

- Energy Management Assignment #01: Submitted BY Shaheer Ahmed Khan (MS2019198019)Document15 pagesEnergy Management Assignment #01: Submitted BY Shaheer Ahmed Khan (MS2019198019)shaheer khanNo ratings yet

- Module 1-Mathematics As A Language: Maribel D. Cariñ0Document4 pagesModule 1-Mathematics As A Language: Maribel D. Cariñ0KhalidNo ratings yet

- Ecoflam Burners 2014 enDocument60 pagesEcoflam Burners 2014 enanonimppNo ratings yet

- ToobaKhawar 6733 VPL Lab Sat 12 3 All TasksDocument38 pagesToobaKhawar 6733 VPL Lab Sat 12 3 All TasksTooba KhawarNo ratings yet

- PapernathazDocument26 pagesPapernathazAbelardo LapathaNo ratings yet

- Character AnalysisDocument3 pagesCharacter AnalysisjefncomoraNo ratings yet

- Prelims Reviewer Biochem LabDocument4 pagesPrelims Reviewer Biochem LabRiah Mae MertoNo ratings yet

- CV (Martin A Johnson)Document7 pagesCV (Martin A Johnson)kganesanNo ratings yet

- GlobalisationDocument8 pagesGlobalisationdummy12345No ratings yet

- LeaP Math G7 Week 8 Q3Document10 pagesLeaP Math G7 Week 8 Q3Reymart PalaganasNo ratings yet

- 2008 IASS SLTE 2008 Chi Pauletti PDFDocument10 pages2008 IASS SLTE 2008 Chi Pauletti PDFammarNo ratings yet

- Birth AsphyxiaDocument18 pagesBirth AsphyxiaKofi Yeboah50% (2)

- Form ConstructionDocument36 pagesForm ConstructionYhoga DheviantNo ratings yet

- Iecex Bas 13.0069XDocument4 pagesIecex Bas 13.0069XFrancesco_CNo ratings yet

- Particle FilterDocument16 pagesParticle Filterlevin696No ratings yet

- FTP Booster Training Plan OverviewDocument1 pageFTP Booster Training Plan Overviewwiligton oswaldo uribe rodriguezNo ratings yet

- Learning Activity Sheet Pre-Calculus: Science Technology Engineering and Mathematics (STEM) Specialized SubjectDocument26 pagesLearning Activity Sheet Pre-Calculus: Science Technology Engineering and Mathematics (STEM) Specialized SubjectJanet ComandanteNo ratings yet

- Linear Analysis of Concrete Frames Considering Joint FlexibilityDocument16 pagesLinear Analysis of Concrete Frames Considering Joint FlexibilityluffiM13No ratings yet

- Lesson PlansDocument12 pagesLesson Plansapi-282722668No ratings yet

- Antibiotics and Their Types, Uses, Side EffectsDocument4 pagesAntibiotics and Their Types, Uses, Side EffectsSpislgal PhilipNo ratings yet

- Plastics Library 2016 enDocument32 pagesPlastics Library 2016 enjoantanamal tanamaNo ratings yet

- Distance Relay Setting CalculationDocument8 pagesDistance Relay Setting Calculation1453h100% (7)

- Imamsha Maharaj Na Parcha NewDocument16 pagesImamsha Maharaj Na Parcha NewNARESH R.PATELNo ratings yet

- Fundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFDocument68 pagesFundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFbrainykabassoullw100% (10)

- Would You Like Eddy Current, Video & Strip Chart in One Portable Case?Document2 pagesWould You Like Eddy Current, Video & Strip Chart in One Portable Case?Daniel Jimenez MerayoNo ratings yet

- R820T Datasheet-Non R-20111130 UnlockedDocument26 pagesR820T Datasheet-Non R-20111130 UnlockedKonstantinos GoniadisNo ratings yet

- Cultures of The West A History, Volume 1 To 1750 3rd PDFDocument720 pagesCultures of The West A History, Volume 1 To 1750 3rd PDFtonnyNo ratings yet