Professional Documents

Culture Documents

Eq PATNI Base

Uploaded by

Amar KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eq PATNI Base

Uploaded by

Amar KumarCopyright:

Available Formats

GICS Industry : IT Services l Sub Industry : IT Consulting & Other Services l Website : www.patni.

com

Patni Computer Systems Limited

Key Stock Indicators

NSE Ticker : Bloomberg Ticker : Face value / Share: Div. Yield (%): PATNI PATNI:IN 2.0 0.6 CMP (as on 01 Feb 2011 Rs/Share) 52-weekrange up to 01 Feb 2011 (Rs)(H/L): Market Cap as on 01 Feb 2011 (Rs Mn): Enterprise Value as on 01 Feb 2011 (Rs Mn): Div. Yield (%): 0.0 466.1 608.5/414.7 61,041 57,633 Shares outstanding (mn) : Free Float (%) : Average daily volumes (12 months) : Beta (2 year) : 131 54.1 586,876 0.6

Patni Computer Systems Limited (PCSL) is a provider of information technology services and business solutions. PCSL provides solutions to industries such as insurance, manufacturing, retail and distribution, financial services, product engineering, communication, media and utilities. It provides services in the areas of application development and maintenance and support, infrastructure management services, product engineering services and business process outsourcing. The company has facilities in Noida, Navi Mumbai, Chennai, Pune, Hyderabad and Kolkata. It employed close to 14,000 people, as of end-December 2009.

Key Financial Indicators

Revenue (Rs mn) EBITDA ma rgins (%) PAT (Rs mn) PAT ma rgins (%) Gea ring (x) EPS (Rs /s ha re) PE (x) P/BV (x) RoCE (%) RoE (%) EV/EBITDA (x)

n.m. : Not meaningful

KEY HIGHLIGHTS

PCSL has a diversified portfolio PCSL obtains revenues from diversified industry segments. The contribution of each segment to total revenues in CY09 is as follows: Insurance 30%, manufacturing, retail and distribution 29%, financial services 13%, communications, media and utilities 13%, product engineering 15%. The contribution of various segments to the revenue, with respect to service mix, is as follows: Application development and maintenance and support 65%, packaged software implementation 13%, infrastructure management services 5%, product engineering services 11%, business process outsourcing (BPO) 6%. Revenue break-up by region is: EMEA 14%, Asia-Pacific 6% and Americas 80%. Diversification helps the company to mitigate risk in the event of a downturn in any one of the segments. Acquisition of US-based CHCS Services, Inc In April 2010, PCSL acquired US-based CHCS Services, Inc, a wholly-owned subsidiary of Universal American Corp and a leading third-party administrator (TPA) in the seniors health market and eldercare programs, through its wholly-owned subsidiary, Patni Americas, Inc. This transaction helps PCSL enhance its existing BPO capabilities and TPA solutions to insurance companies and also provides end-to-end platform-based solutions.

Dec-07 26,956.2 19.9 4,803.7 17.8 34.6 9.6 2.1 24.3 22.8 8.4

Dec-08 31,211.8 17.8 4,380.1 14.0 34.2 3.8 0.7 25.8 19.6 2.5

Dec-09 31,608.9 21.5 5,866.1 18.6 45.4 10.3 2.0 25.6 22.2 8.3

Shareholding (As on Dec 31,2010)

Others 36%

DII 4% FII 13%

KEY RISKS

. Country concentration risk as majority of revenue comes from USA Intense competition from Indian and multinational IT service companies

Promoter 47%

Indexed price chart Stock Performances vis--vis market

Returns (%) YTD PATNI NI FTY -3 4 1-m -1 -12 3-m 0 -11 12-m -1 11

(index) 140 120 100 80 60 40 20 0 Nov-10 Apr-10 Mar-10 May-10 Dec-10 Aug-10 Feb-10 Sep-10 Jun-10 Oct-10 Jul-10

('000) 25000 20000 15000 10000 5000 0 Jan-11 NIFTY

Note: 1) YTD returns are since Jan 04, 2010 to Feb 01, 2011. 2) 1-m, 3-m and 12-m returns are up to Feb 01, 2011.

Volumes (RHS)

PATNI

CRISIL COMPANY REPORT | 1

Patni Computer Systems Limited

BACKGROUND

PCSL is a provider of information technology services and business solutions. It provides solutions to a variety of industries such as insurance, manufacturing, retail and distribution, financial services, product engineering, communication, media and utilities. PCSL is also into providing services in the areas of application development and maintenance and support, infrastructure management services, product engineering services and BPO. Exports account for around 94% of sales; the company exports to Asia-Pacific, the Americas, Europe, Middle East and Africa. PCSL has constructed 3 knowledge parks at Navi Mumbai, Chennai and Noida with capacities of 4,300, 1,200 and 3,200 seats, respectively. It has also acquired 18.75 acres of land in Chennai on a 99-year lease for a software development project and support services, in CY09. Also in CY09, the company acquired licenses to establish working facilities on 50 acres of land in Navi Mumbai. Among the clients of PCSL are CIO Electrolux, McCormick & Co Inc and Schindler India Pvt Ltd. The company has over 30 international service clients. It has 22 global delivery centers across the world. In April 2010, PCSL acquired CHCS Services, Inc, a leading US-based TPA in the seniors health market and eldercare programs.

COMPETITIVE POSITION

Peer Comparison

Patni Computer Systems Limited Dec-09 31,608.9 21.5 5,866.1 18.6 45.4 10.3 2.0 25.6 22.2 8.3

Wipro Limited

KPIT Cummins Infosystems Limited Mar-10 7,320.8 22.4 857.3 11.7 0.4 10.9 14.4 4.3 41.1 41.1 7.6

Revenue (Rs mn) EBITDA ma rgins (%) PAT (Rs mn) PAT ma rgins (%) Gea ring (x) EPS (Rs /s ha re) PE (x) P/BV (x) RoCE (%) RoE (%) EV/EBITDA (x)

n.m: Not meaningful

Mar-10 272,687.0 22.0 46,495.0 17.1 0.5 31.7 13.8 5.0 35.4 45.2 10.5

Infosys Technologies Limited Mar-10 227,650.0 34.6 62,660.0 27.5 109.5 28.2 8.0 40.2 31.6 20.9

FINANCIAL PROFILE

Increase in top-line, operating margin and PAT in CY09

Key Financial Indicators Units Revenue Rs mi ll ion Rs mi ll ion Per cent Per cent Per cent Times Per cent Per cent EBITDA ma rgins Per cent PAT PAT ma rgins EBITDA growth PAT growth Gea ring RoCE RoE

Dec-07

26,956.2 19.9 4,803.7 17.8 3.1 -7.2 96.2 0.0 24.3 22.8

Dec-08

31,211.8 17.8 4,380.1 14.0 15.8 3.6 -8.8 0.0 25.8 19.6

Dec-09

31,608.9 21.5 5,866.1 18.6 1.3 22.7 33.9 0.0 25.6 22.2

The companys top-line registered a CAGR of 9.2% from CY07 to CY09. The rise is attributed to the increased geographical diversification and sale of investments. The operating margin increased by 370 basis points year-on-year (y-o-y) in CY09, because of increase in operational efficiency. The companys PAT increased by 34% y-o-y in CY09 because of tax reversals in the year.

Revenue growth Per cent

INDUSTRY PROFILE

IT services Indian IT services revenues are estimated to be around $34 billion in 2009-10, registering a CAGR of 20 per cent from 2004-05 to 2009-10. During the same period, IT services exports, which accounted for 80 per cent of the revenues, are estimated to have grown at a CAGR of 22 per cent to $27 billion in 2009-10. The industry is highly dependent on the US and UK markets, which contribute to around 75 per cent of export revenues. With IT services deriving a large portion of its revenues from exports, the sector`s profitability is highly correlated to foreign exchange movements. An appreciating rupee is thus a key risk factor. Also, as human resource is the main input in IT services, issues related to non-availability of skilled labor, attrition and wage inflation would also impact Indian IT players. IT enabled services ITeS is a term used to describe a range of IT-intensive processes and services, which includes business process outsourcing (BPO) and knowledge process outsourcing (KPO), provided from a distant location and delivered over telecom networks. The Indian ITeS industry grew at a healthy CAGR growth of 30 per cent over 2003-04 to 2008-09, driven by demand from developed economies like USA and UK. However, the y-o-y revenue growth had significantly declined to 7 per cent in 2009-10 and is estimated at $ 14.6 billion .The slowdown was a result of weak demand from key markets, protectionist measures by developed countries, and delay in decision making cycles during the downturn. The revival in the global economy, along with the continuing maturity of the offshore global delivery models, process innovation and inherent need of clients to reduce costs would continue to propel export growth.

CRISIL COMPANY REPORT | 2

Patni Computer Systems Limited

ANNUAL RESULTS

Income Statement (Rs million ) Net Sales Operating Income EBITDA EBITDA Margin Depreciation Interest Other Income PBT PAT PAT Margin No. of shares (Mn No.) Earnings per share (EPS) Cash flow (Rs million ) Pre-tax profit Total tax paid Depreciation Change in working capital Cash flow from operating activities Capital Expenditure Investments and others Cash flow from investing activities Equity raised/(repaid) Debt raised/(repaid) Dividend (incl. tax) Others (incl extraordinaries) Cash flow from financing activities Change in cash position Opening cash Closing cash Balance sheet (Rs million ) Equity share capital Reserves and surplus Tangible net worth Deferred tax liablity:|asset| Long-term debt Short-term-debt Total debt Current liabilities Total provisions Total liabilities Gross block Net fixed assets Investments Current assets Receivables Inventories Cash Total assets Ratio Dec-07 5,989.3 -1,064.9 984.7 -603.8 5,305.3 -4,318.7 -818.9 -5,137.6 133.6 -6.9 -501.6 -567.6 -942.5 -774.8 2,060.6 1,285.9 Dec-08 4,857.3 -644.6 1,141.5 2,404.4 7,758.6 -2,438.7 -254.6 -2,693.3 -2,362.4 -6.2 -449.8 -601.1 -3,419.5 1,645.8 1,285.9 2,931.8 Dec-09 6,054.8 -224.3 1,420.8 -1,942.0 5,309.3 -562.4 -5,980.6 -6,543.0 273.0 -8.1 -453.2 1,442.8 1,254.5 20.8 2,931.8 2,952.6 Revenue growth (%) EBITDA growth(%) PAT growth(%) EBITDA margins(%) Tax rate (%) PAT margins (%) Dividend payout (%) Return on Equity (%) Return on capital employed (%) Gearing (x) Interest coverage (x) Debt/EBITDA (x) Asset turnover (x) Current ratio (x) Gross current assets (days) Dec-07 3.1 -7.2 96.2 19.9 18.4 17.8 8.7 22.8 24.3 0.0 0.0 0.0 3.3 3.1 121 Dec-08 15.8 3.6 -8.8 17.8 9.0 14.0 8.8 19.6 25.8 0.0 6.8 0.0 3.1 2.6 125 Dec-09 1.3 22.7 33.9 21.5 4.3 18.6 6.6 22.2 25.6 0.0 14.6 0.0 2.8 4.4 115

Dec-07 26,885.5 26,956.2 5,357.2 19.9 984.7 -822.6 794.1 5,812.1 4,803.7 17.8 139.0 34.6

Dec-08 31,172.7 31,211.8 5,548.0 17.8 1,141.5 813.5 1,264.3 4,784.5 4,380.1 14.0 128.1 34.2

Dec-09 31,461.5 31,608.9 6,808.1 21.5 1,420.8 467.9 1,135.4 6,075.2 5,866.1 18.6 129.1 45.4

Dec-07 279.8 21,934.8 22,214.6 -571.3 12.8 10.9 23.8 4,295.0 2,517.5 28,479.6 9,331.2 7,448.9 11,516.8 9,513.9 5,316.5 0.0 1,285.9 28,479.6

Dec-08 256.2 22,293.7 22,549.9 -811.5 9.0 8.6 17.5 6,327.8 2,395.6 30,479.3 10,556.7 8,041.7 11,771.3 10,666.3 5,450.9 0.0 2,931.8 30,479.3

Dec-09 258.3 29,946.9 30,205.2 -826.7 4.2 5.2 9.4 4,650.4 1,663.5 35,701.8 12,073.5 7,730.2 17,751.9 10,219.6 5,089.7 0.0 2,952.6 35,701.7

QUARTERLY RESULTS

Profit and loss account (Rs million) No of Months Revenue EBITDA Interes t Depreci a tion PBT PAT Sep-10 3 8,715.8 2,045.4 12.8 314.2 1,718.4 1,444.5 100.0 23.5 0.1 3.6 19.7 16.6 % of Rev Sep-09 % of Rev 3 8,337.7 1,921.6 15.5 311.5 1,594.6 1,685.8 100.0 23.0 0.2 3.7 19.1 20.2 Jun-10 3 8,154.5 1,967.1 2.8 290.8 1,673.5 1,467.4 100.0 24.1 0.0 3.6 20.5 18.0 % of Rev Sep-10 % of Rev 9 25,208.6 6,220.7 37.5 891.3 5,291.9 4,482.3 100.0 24.7 0.1 3.5 21.0 17.8 Sep-09 9 24,659.5 5,382.9 63.7 1,140.4 4,178.8 3,810.6 100.0 21.8 0.3 4.6 16.9 15.5 % of Rev

CRISIL COMPANY REPORT | 3

Patni Computer Systems Limited

FOCUS CHARTS & TABLES

Rs mn 6,000 5,000 4,000 3,000 2,000 1,000 0 Dec-07 Dec-08 Dec-09 Sep-08 Sep-09 Mar-08 Mar-09 Mar-10 Sep-10 Jun-08 Jun-09 Jun-10

Quarterly sales & y-o-y growth

Per cent 40 30 20 10 0 -10 -20

Rs mn 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 Dec-07 Mar-08

Quarterly PAT & y-o-y growth

Per cent 100 80 60 40 20 0 -20 -40

Dec-08

Dec-09

Sep-08

Sep-09

Mar-09

Sales

Sales growth y-o-y (RHS)

Net Profit

Net profit growth y-o-y (RHS)

Rs/share 14 12 10 8 6 4 2 0 Dec-07 Dec-08

EPS

Per cent 50 45 40 35 30 25 20 15 10 5 0 Dec-07 Mar-08 Dec-09 Sep-09 Mar-10 Sep-10 Jun-09 Jun-10

Movement in operating and net margins

Dec-08

Dec-09

Sep-08

Sep-09

Mar-10

Sep-10

Sep-10 Jun-10

Jun-08

Jun-09

Jun-08

Mar-09

Jun-09

Mar-08

Sep-08

Jun-08

Mar-09

OPM

NPM

Shareholding Pattern (Per cent) Mar 2010 Jun 2010 Promoter 46.5 46.3 FII 13.0 12.3 DII 7.0 6.5 Others 33.6 35.0

Sep 2010 45.9 11.1 4.0 39.0

Board of Directors Dec 2010 Director Name 45.7 Arun Kuma r Dugga l (Mr.) 13.4 Wi ll i a m O. Gra be (Mr.) 4.5 Jeya Kuma r (Mr.) 36.4 As hok Kuma r Pa tni (Mr.) Na rendra Kuma r Pa tni (Mr.) Pra dip Ba ija l (Mr.) Vima l Ra njeet Bha nda ri (Mr.) Mi cha el A. Cus uma no (Dr.) Ga jendra Kuma r Pa tni (Mr.) Pra dip Pa na l a l Sha h (Mr.) Loui s Theodoor Va n Den Boog (Mr.) Ra mes h Venka tes wa ra n (Mr.)

Designation Non-Executi ve Di rector Nomi nee Di rector Di rector Non-Executi ve Di rector, Promoter-Di rector Executi ve Cha irma n, Promoter-Di rector Non-Executi ve Di rector Non-Executi ve Di rector Non-Executi ve Di rector Promoter-Di rector, Non-Executi ve Di rector Non-Executi ve Di rector Non-Executi ve Di rector Non-Executi ve Di rector

Additional Disclosure This report has been sponsored by NSE - Investor Protection Fund Trust (NSEIPFT). Disclaimer This report is based on data publicly available or from sources considered reliable. CRISIL Ltd. (CRISIL) does not represent that it is accurate or complete and hence, it should not be relied upon as such. The data / report is subject to change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this report constitutes investment, legal, accounting or tax advice or any solicitation, whatsoever. The subscriber / user assume the entire risk of any use made of this data / report. CRISIL especially states that, it has no financial liability whatsoever, to the subscribers / users of this report. This report is for the personal information only of the authorised recipient in India only. This report should not be reproduced or redistributed or communicated directly or indirectly in any form to any other person especially outside India or published or copied in whole or in part, for any purpose. CRISIL is not responsible for any errors and especially states that it has no financial liability whatsoever to the subscribers / users / transmitters / distributors of this report. For information please contact 'Client Servicing' at +91-22-33423561, or via e-mail: clientservicing@crisil.com.

CRISIL COMPANY REPORT | 4

Mar-10

Jun-10

You might also like

- Cheatsheet Supervised LearningDocument4 pagesCheatsheet Supervised LearningAmar Kumar100% (1)

- ARIMA Modelling and Forecasting: By: Amar KumarDocument22 pagesARIMA Modelling and Forecasting: By: Amar KumarAmar Kumar100% (1)

- Its About KIDS: Information Summary About Incredible Institute in PanvanDocument13 pagesIts About KIDS: Information Summary About Incredible Institute in PanvanAmar KumarNo ratings yet

- 12 Week A YearDocument9 pages12 Week A YearAmar Kumar67% (3)

- Random ForestDocument13 pagesRandom ForestAmar KumarNo ratings yet

- Rotation Shifts - SCNDocument6 pagesRotation Shifts - SCNAmar KumarNo ratings yet

- SAP MSS EHP6 POWL Based Leave Approval Refresh ..Document4 pagesSAP MSS EHP6 POWL Based Leave Approval Refresh ..Amar KumarNo ratings yet

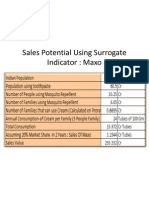

- Sales Potential Using Surrogate Indicator: MaxoDocument1 pageSales Potential Using Surrogate Indicator: MaxoAmar KumarNo ratings yet

- SAP Travel Management ..Document23 pagesSAP Travel Management ..Amar Kumar100% (1)

- EHP 5 New ProcurementiDocument5 pagesEHP 5 New ProcurementimkhicharNo ratings yet

- What Is Data ScienceDocument8 pagesWhat Is Data ScienceAmar KumarNo ratings yet

- Ifsc-Code of Icici Bank Branches in IndiaDocument10,725 pagesIfsc-Code of Icici Bank Branches in IndiaVenkatachalam KolandhasamyNo ratings yet

- Templates: Your Own Sub HeadlineDocument22 pagesTemplates: Your Own Sub HeadlineAmar KumarNo ratings yet

- QM OverviewDocument16 pagesQM Overviewrvk386No ratings yet

- Glimpse CertificateDocument1 pageGlimpse CertificateAmar KumarNo ratings yet

- LSCM: Individual Assignment-Analysis of IBM Global Supply ChainDocument7 pagesLSCM: Individual Assignment-Analysis of IBM Global Supply ChainAmar Kumar100% (1)

- SDM Presentation - Sales PotentialDocument6 pagesSDM Presentation - Sales PotentialAmar KumarNo ratings yet

- SPIL CaseDocument3 pagesSPIL CaseAmar KumarNo ratings yet

- Bright Engg CompDocument6 pagesBright Engg CompAmar KumarNo ratings yet

- Channel PartnerDocument7 pagesChannel PartnerAmar Kumar100% (1)

- Amar Kumar G12007 Ruchika GuptaDocument10 pagesAmar Kumar G12007 Ruchika GuptaAmar KumarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Boston ChickenDocument4 pagesBoston ChickenSaurabh SinghalNo ratings yet

- Market Risk Premium PDFDocument3 pagesMarket Risk Premium PDFmelinaguimaraesNo ratings yet

- Pulau Carey KenangaDocument17 pagesPulau Carey KenangaAzim FauziNo ratings yet

- Agile - 11 - A - Property HoldingsDocument211 pagesAgile - 11 - A - Property HoldingsMuteba NgongaNo ratings yet

- BOI - Promoting Investments Through ServicingDocument15 pagesBOI - Promoting Investments Through ServicingAnonymous yKUdPvwjNo ratings yet

- Top Ten Pitch Tips: Contact: Patrick Lor / Pat@lor - VC / WWW - Lor.vcDocument9 pagesTop Ten Pitch Tips: Contact: Patrick Lor / Pat@lor - VC / WWW - Lor.vcscribd2601RNo ratings yet

- ACCT 1005 Worksheet 1 Selected Solutions 2016 Practice QuestionsDocument2 pagesACCT 1005 Worksheet 1 Selected Solutions 2016 Practice QuestionsChan SynergisticNo ratings yet

- Freeport-McMoRan Annual Report 2018Document136 pagesFreeport-McMoRan Annual Report 2018kennygNo ratings yet

- Prospectus and Statement in Lieu of Prospectus:: How It Works (Example)Document13 pagesProspectus and Statement in Lieu of Prospectus:: How It Works (Example)Satyam PathakNo ratings yet

- Lecture 6: Valuation of Bonds and SharesDocument12 pagesLecture 6: Valuation of Bonds and SharesHabibullah SarkerNo ratings yet

- Rnis College of Financial Planning - 15 Mock-Test - Module-IVDocument10 pagesRnis College of Financial Planning - 15 Mock-Test - Module-IVAbhilash ParakhNo ratings yet

- Average Cost MethodDocument3 pagesAverage Cost MethodRaja MonemNo ratings yet

- Difference Between Large Mid Small Cap FundsDocument14 pagesDifference Between Large Mid Small Cap FundsNaresh KotrikeNo ratings yet

- Hedge Fund Book V3Document197 pagesHedge Fund Book V3http://besthedgefund.blogspot.comNo ratings yet

- Questions AFARDocument12 pagesQuestions AFARKatrina youngNo ratings yet

- Cash Flow Statement Disclosures A Study of Banking Companies in Bangladesh.Document18 pagesCash Flow Statement Disclosures A Study of Banking Companies in Bangladesh.MD. REZAYA RABBINo ratings yet

- GMR Finance ReportDocument14 pagesGMR Finance ReportsaranshjainNo ratings yet

- 1daily DerivativesDocument3 pages1daily DerivativesGauriGanNo ratings yet

- Answwr of Quiz 5 (MBA)Document2 pagesAnswwr of Quiz 5 (MBA)Wael_Barakat_3179No ratings yet

- May 2011 Strategic Financial ManagementDocument10 pagesMay 2011 Strategic Financial ManagementchandreshNo ratings yet

- Option Valuation ModelsDocument37 pagesOption Valuation ModelssakshiNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementAshish PrajapatiNo ratings yet

- Annual Reports - 2013 - Malaysia - Airports - Holding - Berhad PDFDocument373 pagesAnnual Reports - 2013 - Malaysia - Airports - Holding - Berhad PDFAnonymous 05Ra5rgNo ratings yet

- Act 701 Assignment 2Document3 pagesAct 701 Assignment 2Nahid HawkNo ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Approaches To Valuation Discounted Cashflow Relative Real OptionDocument29 pagesApproaches To Valuation Discounted Cashflow Relative Real OptionJNo ratings yet

- The Cost of Capital: © 2019 Pearson Education LTDDocument8 pagesThe Cost of Capital: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Existing International Arrangements, Globalization and Foreign Investment, Introduction To FDIDocument30 pagesExisting International Arrangements, Globalization and Foreign Investment, Introduction To FDIpranati sharmaNo ratings yet

- 54594bos43759 p3 PDFDocument23 pages54594bos43759 p3 PDFWaleed Bin RaoufNo ratings yet