Professional Documents

Culture Documents

DR Reddys Lab 4Q FY 2013

Uploaded by

Angel BrokingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DR Reddys Lab 4Q FY 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

4QFY2013 Result Update | Pharmaceutical

May 14, 2013

Dr Reddys Laboratories

Performance Highlights

Y/E March (` cr) Net sales Gross profit Operating profit Adj. net profit 4QFY2013 3,340 1,685 580 571 3QFY2013 2,865 1,967 429 363 % chg (qoq) 16.6 (14.4) 35.1 57.2 4QFY2012 2,658 1,397 501 431 % chg (yoy) 25.6 20.6 15.7 32.5

BUY

CMP Target Price Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Pharmaceutical 34,400 3,162 0.3 2,151/1,528 25,295 5 19,722 5,995 REDY.BO DRRD@IN

`2,026 `2,535 12 months

Source: Company, Angel Research

Dr Reddys Laboratories (DRL) reported better than expected numbers for 4QFY2013 on the top-line and bottom-line fronts. The EBIT margin came in at 17.4% vs 18.9%.Consequently, the Adj. net profit came in at `571cr, a growth of 32.5%, much higher than our expectation of `313cr. Along with the , higher than expected EBIT margins, the other income, which came in at `163cr, aided higher than expected net profit during the quarter. We recommend a buy on the stock with a price target of `2,535. Results better than expectations: DRL posted numbers better than expected. The sales came in at `3,340cr is V/s `2,409cr, registering a growth of 26%yoy. The growth was mainly driven by PSAI segment, which grew by 44.6% yoy, while the generic segment grew by 18.2% yoy. While, all the regions grew at robust growth in PSAI, the generic segment growth was driven by the USA market, which grew by 30.7%. The company posted an EBIT margins of 17.4% V/s 18.9% in the last corresponding period. Higher than expected EBIT Margins during the period aided the net profit to come in at `571cr, V/s expectation of `313cr. Also the net profit was aided by higher income during the quarter, which came in `163cr. Outlook and valuation: For DRL, we expect net sales to report a 14.9% CAGR to `15,350cr and adjusted EPS to record a 10.8% CAGR to `126.8 over FY2013-15. We recommend a buy on the stock with a price target of `2,535.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 25.6 18.3 47.9 8.2

Abs. (%) Sensex Dr Reddy

3m 1.2 7.9

1yr 21.6 21.2

3yr 16.1 56.7

Key financials (IFRS Consolidated)

Y/E March (` cr) Net sales % chg Net profit % chg Adj net profit % chg Adj. EPS (`) EBITDA margin (%) P/E (x) RoE (%) RoCE (%) P/BV (x) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2012 9,674 29.5 1,426 29.2 1,496 39.0 88.2 26.9 23.0 28.9 20.9 6.0 4.0 14.8

FY2013 11,627 20.2 1,678 17.6 1,750 17.0 103.2 23.0 19.6 26.8 17.8 4.7 3.2 14.0

FY2014E 13,377 15.1 1,903 13.5 1,903 8.8 112.3 20.4 18.0 23.5 18.3 3.9 2.8 13.6

FY2015E 15,350 14.7 2,149 12.9 2,149 12.9 126.8 20.1 16.0 21.8 18.3 3.2 2.4 11.9

Sarabjit Kour Nangra

+91 2 39357600 Ext: 6806 sarabjit@angelbroking.com

Please refer to important disclosures at the end of this report

Dr. Reddys Laboratories | 4QFY2013 Result Update

Exhibit 1: 4QFY2013 performance (IFRS, consolidated)

Y/E March (` cr) Net sales Other income Total income Gross profit Gross margin (%) SG&A expenses R&D expenses EBIT EBIT (%) Interest PBT Tax Net Profit Share of profit/ (loss) in asso. Reported net profit before excep. Exceptional items Reported PAT Adj. Net Profit EPS (`)

Source: Company, Angel Research

4QFY2013 3,340 163 3,503 1,685 50.4 872 233 580 17.4 (40) 783 214 569 2.6 571 571 571 33.7

3QFY2013 2,865 26 2,892 1,967 68.7 1,335 203 429 15.0 10 446 83 363 363 363 363 21.4

% chg (qoq) 16.6 517 21.1 (14.4) (26.5) (34.7) 14.8 35.1 75.5 159.0 56.5 57.2 57.2 57.2

4QFY2012 2,658 20 2,678 1,397 52.6 722 174 501 18.9 (8) 529 84 446 1.1 447 104 343 431 25.4

% chg (yoy) 25.6 720 30.8 20.6 (4.0) 20.9 33.6 15.7

FY2013 11,627 248 11,875 6,058 52.1 3,358 767 1,932 16.6 (46)

FY2012 9,674 77 9,750 5,331 55.1 2,887 591 1,853 19.2 (16.0) 1,945 420 1,525 5.4 1,530 104 1,426 1,496 88.2

% chg 20.2 224.1 21.8 13.6 (5.4) 16.3 29.8 4.3 (72.8) 16.6 13.9 (79.6) 14.1 (33.8) 17.6 17.0 -

47.9 155.5 27.6 27.9 66.7 32.5 -

2,226 490 1,736 10.4 1,747 69 1,678 1,750 103.2

Exhibit 2: Actual vs Estimates

(` cr) Net sales Other income Operating profit Interest Tax Net profit

Source: Company, Angel Research

Actual 3,340 163 580 (40) 214 571

Estimates 2,409 3 388 78 313

Variation (%) 38.6 5,336.7 49.3 173.6 82.4

Revenue growth higher than expected: DRL posted numbers better than

expected. The sales came in at `3,340cr is V/s `2,409cr, registering a growth of 26%yoy. The growth was mainly driven by PSAI segment, which grew by 44.6% yoy, while the generic segment grew by 18.2% yoy. While, all the regions grew at robust growth in PSAI, the generic segment growth was driven by the USA market, which grew by 30.7%. Formulations in the ROW also registered a robust growth of 18.8% yoy to end the quarter at `133cr. Russia grew only by 4.5% yoy growth. The domestic market reported a single-digit growth of 8.6% yoy. Sales from Europe grew only by 1.7% yoy during the quarter. DRL filed 19 ANDAs during the quarter. The company has 65 ANDAs pending for approval with the USFDA, of which 38 are Para IVs and 8 are FTFs. During the quarter, the company launched 24 products in the domestic market.

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

Exhibit 3: Global generic trend

2,500

2,000

1,500

(` cr)

355

320 180

417

349

384 388

438 372 193

370

348 183 178

1,000

218 792

500 0

873

927

924

1,141

4QFY2012 Others

1QFY2013 Russia & CIS

2QFY2013 India

3QFY2013 4QFY2013 Europe North America

Source: Company, Angel Research

The PSAI segment registered a 44.6% yoy growth. Europe and India grew by 58.3% yoy and 58.3% yoy growth in the Europe and India, respectively. The US and ROW (PSAI segment) grew by 72.9% yoy and (4.6) % yoy, respectively.

Exhibit 4: PSAI trend

1,200

1,000 210.4

800

(` cr)

600 221 86 162 247 115 212

161.1

400

200

61

223

127 247 127

439.6

278 119

291 135 2QFY2013 Europe

106

206.1

4QFY2012 1QFY2013 Others India

Source: Company, Angel Research

3QFY2013 4QFY2013 North America

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

EBIT expands on yoy basis: DRL reported a gross margin of 50.4% quarter V/s 52.6% during the last corresponding period. However, the EBIT margin came in at 17.4% V/s 18.9%. The key expenditure areas which grew by 33.6% yoy, and S&GA expenses, which grew by 20.9% the quarter.

during the companys were R&D, yoy during

Exhibit 5: EBIT margin trend

20

18.9

19.2

18

17.4

(%)

16

15.0 14.6

14

12 4QFY2012 1QFY2013 2QFY2013 3QFY2013 4QFY2013

Source: Company, Angel Research

Adjusted net profit grew by 32.5% yoy during the quarter: Higher than expected

OPMs during the period aided the net profit to come in at `571cr, V/s expectation of `313cr. Also the net profit was aided by higher income during the quarter, which came in `163cr, aided by the US $ 22.5mn as one time settlement done with Nordion Inc., towards the damages sustained by the Company due to the breach by Nordion of the then existing Laboratory services agreement for bioequivalence studies.

Exhibit 6: Adjusted net profit trend

600 571 494

550 500 450 400 350 300 250 200 150 100 50 0

343

336

363

(` cr)

4QFY2012

1QFY2013

2QFY2013

3QFY2013

4QFY2013

Source: Company, Angel Research

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

Concall takeaways

To file 15-20 ANDAs in the US market in FY2014. Management sees higher pace of growth over FY15 17E based on its strategy to focus on complex generics. R&D spend is expected to be around 7.1% of sales. FY2014 capex to be around US $100-115mn. Tax as a % of PBT is guided towards 22-23%.

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

Investment arguments

Robust growth in the US ahead: After attaining a critical mass (US$693mn in FY2013), DRL aims to scale up its business to the next orbit in the US market on the back of a strong product pipeline (65 ANDAs are pending approval, of which 38 are Para IVs and 8 are FTFs). The Management has guided for a robust growth in the US, driven by introduction of new products, some of which are also Para IV opportunities. Overall, we expect the ex-exclusivity US sales to post a CAGR of ~18% during FY2013-15. Domestic back in focus: After a below-industry average growth on the domestic formulation front since the last three years, DRL reported a modest 13.0% growth in FY2013. The Management expects the companys performance to rebound and targets to achieve 15% growth going ahead, driven by a) field force expansion and improvement in productivity, b) new product launches (including biosimilars) and c) focus on brand building. Strategic alliances to provide long-term growth: In order to tap the emerging market opportunities, DRL entered into an alliance with GSK in FY2011 to develop and market branded formulations across emerging markets. On the biogeneric front, the company has developed nine products (four products launched in India) on mammalian cell culture with global brand sales of US$30bn. The company has also entered into a marketing agreement with Valent Pharma to market Cloderm cream in the US market. This deal is expected to provide an impetus to the proprietary products business going forward. Valuation: We expect the companys net sales to post a 14.9% CAGR to `15,350cr and adjusted EPS to record a 10.8% CAGR to `126.8 over FY2013-15. Growth would be driven by the US business, uptick in domestic formulations, and Russian markets. At the current market price, the stock is trading at 18.0x FY2014E and 16.0x FY2015E earnings. We recommend a buy on the stock with a price target of

Exhibit 7: Key assumptions

FY2014E PSAI segment growth (%) Generics segment growth (%) Operating margin (%) Capex (` cr)

Source: Company, Angel Research

FY2015E 4.8 17.3 20.1 900

4.5 17.0 20.4 900

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

Exhibit 8: One-year forward PE chart

3,000 2,500 2,000 1,500 1,000 500 0

Aug-08

Aug-09

Aug-12

Aug-10

Aug-11

Feb-08

Feb-09

Feb-10

Feb-11

Feb-12

Nov-08

Nov-09

Nov-10

Nov-11

May-08

May-12

Nov-12

Feb-13

Price

5x

10x

15x

20x

Source: Company, Angel Research

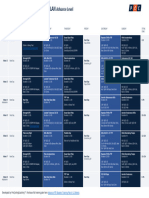

Exhibit 9: Recommendation summary

Company Alembic Pharma. Aurobindo Pharma Cadila Healthcare Cipla Dr Reddy's Dishman Pharma GSK Pharma* Indoco Remedies Ipca labs Lupin Ranbaxy* Sanofi India* Sun Pharma Reco Accumulate Buy Buy Buy Buy Buy Neutral Buy Buy Buy Neutral Neutral Neutral CMP (`) 123 190 832 399 2,026 75 2,324 64 545 752 456 2,500 946 Tgt. price Upside (`) 139 264 962 463 2,535 206 90 676 877 % PE (x) 13.2 38.9 15.6 16.2 25.1 175.2 40.6 24.1 16.6 8.8 9.9 17.3 17.2 16.0 3.6 27.9 7.1 12.1 18.0 20.2 25.2 27.1 FY2015E EV/Sales (x) 1.2 1.2 2.1 2.7 2.4 0.8 5.4 0.8 1.8 2.4 1.5 2.5 6.1 EV/EBITDA (x) 6.0 7.4 11.8 11.6 11.9 4.0 18.9 5.4 8.4 11.2 14.2 15.0 14.0 FY12-15E CAGR in EPS (%) 26.1 58.2 14.8 17.6 10.8 47.9 4.8 21.5 30.6 29.1 (6.8) 13.4 0.2 FY2015E RoCE (%) 34.0 12.0 18.5 17.4 18.3 12.0 36.1 14.6 26.0 28.5 13.1 15.9 27.0 RoE (%) 34.7 18.0 24.7 16..2 21.8 13.7 31.0 15.8 25.3 24.8 19.1 16.7 19.3

Source: Company, Angel Research; Note: *December year ending

Company Background

Established in 1984, Dr Reddy's Laboratories is an integrated global pharmaceutical company, through its three businesses - Pharmaceutical Services and Active Ingredients, Global Generics and Proprietary Products. The key therapeutic focus is on gastro-intestinal, cardiovascular, diabetology, oncology, pain management, anti-infective and paediatrics. The key markets for DRL include India, USA, Russia & CIS, and Germany.

May 14, 2013

May-13

May-09

May-10

May-11

Dr. Reddys Laboratories | 4QFY2013 Result Update

Profit & loss statement (IFRS Consolidated)

Y/E March Net sales Other operating income Total operating income % chg Total expenditure Cost of revenues SG&A expenses R&D expenses EBITDA % chg (% of Net Sales) Depreciation & amortisation EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of PBT) Share in profit of associates Recurring PBT % chg Extraordinary expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Exceptional items PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2011 7,469 75.0 7,544 6.5 5,903 3,028 2,369 506.0 1,566 10.3 21.0 414.7 1,151 14.6 15.4 28.3 9.4 0.8 0.3 1,208 13.3 (37) 1,244.2 140.3 11.3 1,104 9 1,104 1,076 16.8 14.8 63.8 63.8 16.8 FY2012 9,674 76.5 9,750 29.2 7,076 3,598 2,887 591.1 2,598 65.9 26.9 745.4 1,853 60.9 19.2 (16.0) 5.4 1,951 61.5 104.0 1,846.6 420.4 22.8 1,426.2 1,426.2 1,496.0 39.0 14.7 88.2 88.2 38.4 FY2013 11,627 247.9 11,875 21.8 8,951 4,825 3,358 767.3 2,676 3.0 23.0 743.7 1,932 4.3 16.6 46.0 2.1 10.4 2,237 14.7 68.8 2,167.7 490.0 22.6 1,677.7 1,677.7 1,750.0 17.0 14.4 103.2 103.2 17.0 FY2014E 13,377 247.9 13,625 14.7 10,647 5,457 4,281 909.7 2,730 2.0 20.4 562.7 2,167 12.2 16.2 46.0 1.9 10.4 2,471 10.5 2,471.4 566.0 22.9 1,905.4 1,903.4 1,903.4 8.8 14.2 112.3 112.3 8.8 FY2015E 15,350 247.9 15,598 14.5 12,260 6,304 4,912 1,043.8 3,090 13.2 20.1 603.4 2,487 14.7 16.2 46.0 1.6 10.4 2,791 12.9 2,791.0 639.5 22.9 2,151.5 2,149.5 2,149.5 12.9 14.0 126.8 126.8 12.9

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

Balance sheet (IFRS Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity share capital Reserves & surplus Shareholders funds Total loans Deferred tax liability Total liabilities APPLICATION OF FUNDS Net fixed assets Goodwill /other intangibles Capital Work-in-Progress Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 2,478 1,549 486.7 31.0 4,832 572.9 448.2 3,811 2,276 2,556 7,100 3,325 1,353 520.8 1,077 6,995 737.9 580.4 5,677 2,613 4,382 10,659 3,781 1,402 495.2 1,764 6,875 513.6 697.6 5,664 3,252 3,623 11,068 12,677 14,530 4,681 1,402 495.2 1,764 8,064 763 802.6 6,498 3,733 4,330 5,581 1,402 495.2 1,764 9,557 1,197 921.0 7,439 4,274 5,283 84.4 4,515 4,599 2,357.2 143.8 7,100 84.8 5,660 5,744 4,831.2 83.3 10,659 84.8 7,224 7,309 3,676.0 83.3 11,068 84.8 8,830 8,917 3,676.0 83.3 12,677 84.8 10,681 10,770 3,676.0 83.3 14,530 FY2011 FY2012 FY2013 FY2014E FY2015E

Cash flow statement (IFRS Consolidated)

Y/E March (` cr) Profit before tax Depreciation (Inc)/Dec in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec.in Fixed Assets (Inc.)/Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2011 1,208 415 (439) 9 140 1,034 (718) 9 (709) 892 221 (1,081) (410) (86) 658 573 FY2012 1,951 745 (1,661) 420 614 (881) (1,046) (1,928) 0 2,474 259 (736) 1,478 165 573 738 FY2013 2,237 744 535 46 490 2,980 (431) 687 46 302 (1,155) 298 (2,053) (3,506) (224) 738 514 FY2014E 2,471 563 (458) 46 566 1,964 (900) 46 (854) 298 (563) (860) 250 514 763 FY2015E 2,791 603 (519) 46 640 2,190 (900) 46 (854) 298 (604) (902) 434 763 1,197

May 14, 2013

Dr. Reddys Laboratories | 4QFY2013 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) 0.4 1.1 40.7 0.7 1.6 0.4 1.2 0.3 1.1 0.2 0.8 3.6 71 72 55 85 3.4 66 80 46 105 3.3 63 88 44 104 3.2 63 91 41 89 3.0 65 94 41 90 17.7 29.4 24.2 20.9 29.6 28.9 17.8 23.1 26.8 18.3 23.2 23.5 18.3 23.2 21.8 15.4 88.7 1.3 17.5 1.3 0.3 22.2 19.2 77.2 1.2 17.5 -0.3 0.6 27.4 16.6 77.4 1.2 14.9 0.0 0.6 23.5 16.2 77.1 1.2 15.1 0.0 0.4 20.9 16.2 77.1 1.2 15.4 0.0 0.3 19.7 63.8 63.8 90.0 11.0 272.5 88.2 88.2 128.1 14.0 338.8 103.2 103.2 142.8 15.0 431.0 112.3 112.3 145.4 15.0 525.9 126.8 126.8 162.4 15.0 635.2 31.8 22.9 7.4 0.5 4.8 23.0 5.1 23.0 15.8 6.0 0.7 4.0 14.8 3.6 19.6 14.2 4.7 0.7 3.2 14.0 3.4 18.0 13.9 3.9 0.7 2.8 13.6 2.9 16.0 12.5 3.2 0.7 2.4 11.9 2.5 FY2011 FY2012 FY2013 FY2014E FY2015E

May 14, 2013

10

Dr. Reddys Laboratories | 4QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report . Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Dr. Reddys Laboratories No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 14, 2013

11

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unit-4.Vector CalculusDocument32 pagesUnit-4.Vector Calculuskhatua.deb87No ratings yet

- UX-driven Heuristics For Every Designer: OutlineDocument7 pagesUX-driven Heuristics For Every Designer: OutlinemuhammadsabirinhadisNo ratings yet

- DSE4610 DSE4620 Operators ManualDocument86 pagesDSE4610 DSE4620 Operators ManualJorge Carrasco100% (6)

- Ebook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFDocument67 pagesEbook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFjanet.cochran431100% (19)

- Chemical Recycling of Textile PolymersDocument8 pagesChemical Recycling of Textile PolymersVaishali RaneNo ratings yet

- WRhine-Main-Danube CanalDocument6 pagesWRhine-Main-Danube CanalbillNo ratings yet

- Banana Stem Patty Pre Finale 1Document16 pagesBanana Stem Patty Pre Finale 1Armel Barayuga86% (7)

- Radiology PearlsDocument2 pagesRadiology PearlsSalman Rashid100% (2)

- Chen Probable Cause Affidavit 050714Document7 pagesChen Probable Cause Affidavit 050714USA TODAYNo ratings yet

- Genie Awp SpecsDocument4 pagesGenie Awp SpecsIngrid Janet GuardadoNo ratings yet

- Nurse Education Today: Natalie M. Agius, Ann WilkinsonDocument8 pagesNurse Education Today: Natalie M. Agius, Ann WilkinsonSobiaNo ratings yet

- Buncefield Volume 2Document208 pagesBuncefield Volume 2Hammy223No ratings yet

- Eastern Europe SourcebookDocument110 pagesEastern Europe SourcebookDaniel Alan93% (15)

- Industrial SafetyDocument5 pagesIndustrial Safetykamujula reddyNo ratings yet

- Manual de Caja Eaton Fuller ET20113Document22 pagesManual de Caja Eaton Fuller ET20113Juan Gomez100% (3)

- RHEL 9.0 - Configuring Device Mapper MultipathDocument59 pagesRHEL 9.0 - Configuring Device Mapper MultipathITTeamNo ratings yet

- Lesson PlansDocument12 pagesLesson Plansapi-282722668No ratings yet

- Attention: 6R60/6R75/6R80 Installation GuideDocument4 pagesAttention: 6R60/6R75/6R80 Installation GuideEdwinferNo ratings yet

- Building A Vacuum Forming TableDocument9 pagesBuilding A Vacuum Forming TableWil NelsonNo ratings yet

- The Eclectic (OLI) Paradigm of International Production - Past, Present and FutureDocument19 pagesThe Eclectic (OLI) Paradigm of International Production - Past, Present and FutureJomit C PNo ratings yet

- Orchid Group of Companies Company ProfileDocument3 pagesOrchid Group of Companies Company ProfileAngelica Nicole TamayoNo ratings yet

- Transcendental Meditaton ProgramDocument3 pagesTranscendental Meditaton Programacharyaprakash0% (3)

- Euronext Derivatives How The Market Works-V2 PDFDocument106 pagesEuronext Derivatives How The Market Works-V2 PDFTomNo ratings yet

- Win Darab V7 DatasheetDocument3 pagesWin Darab V7 DatasheetPatrick StivénNo ratings yet

- FTP Booster Training Plan OverviewDocument1 pageFTP Booster Training Plan Overviewwiligton oswaldo uribe rodriguezNo ratings yet

- Pte Lastest QuestionsDocument202 pagesPte Lastest QuestionsIelts Guru ReviewNo ratings yet

- Financial Statements Ias 1Document34 pagesFinancial Statements Ias 1Khalid AzizNo ratings yet

- Box Transport MechanismDocument36 pagesBox Transport MechanismInzi Gardezi81% (16)

- RTOS6Document20 pagesRTOS6Krishna ChaitanyaNo ratings yet

- GlobalisationDocument8 pagesGlobalisationdummy12345No ratings yet