Professional Documents

Culture Documents

WORKING CAPITAL ANALYSIS

Uploaded by

Parveen NarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WORKING CAPITAL ANALYSIS

Uploaded by

Parveen NarwalCopyright:

Available Formats

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

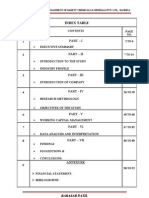

CONTENTS SL.NO

01 02 03 04 05 06 07 08 09 10 11 12 13

TITLE

EXICUTIVE SUMMARY INDUSTRY PROFILE COMPANY PROFILE PRODUCT PROFILE WORK FLOW MODEL MCKINSEYS 7S FRAMEWORK SWOT ANALYSIS ANALYSIS AND INTERPRETATION RATIO ANALYSIS FINDINGS SUGGESTIONANDRECOMMENDATION CONCLUSION BIBLOGRAPH

PAGE NO

05-10 11-12 13-15 16-20 21-22 23-48 49-52 53-69 70-79 80 81 82 83

Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Executive Summary

Introduction: One of the important areas in the day-to-day management of the affairs of a firm is the management of Working Capital. Working Capital is used for financing day-to-day business operations. An organization whether it is manufacturing or trading, requires adequate funds for acquiring the stock of materials, marketable securities, stores materials etc., apart from land, building, machinery furniture etc. The funds invested in current assets such as, stock of materials work in process, investments, bills receivables, debtors, bank balance etc., is known as Working Capital. Success or otherwise of any enterprise depends upon efficient management of working capital and hence, working capital is often described as life-blood of business In simple terms, all current assets used in daily operations represent working capital. Current assets are cash or near cash resources. Working Capital is also known as Circulating or revolving capital, because the current assets are of nature of circulation. They keep on moving from one form to another. For example, cash is used for purchasing merchandise which then takes the form of stock-in-trade or inventories, when the inventories are sold out cash or debtors are created, when debtors are collected cash is accumulated and this process continues. Thus, its flow is circular in nature. In, accounting Working Capital is taken to mean the difference between current assets and current liabilities.

Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Objectives of the Study:

1. To know the financial position of the company access. 2. To assess the financial strengths and weakness of the company to give valuable suggestions to attain operational excellence. 3. To study the importance of Working Capital Management in a manufacturing concern. 4. To study and evaluate the present Cash Management system of the company.

Methodology of Data Collection

Research methodology is a systematic way for solving any research problem. Its a science of analyzing how research is done scientifically. It studies the various steps that are generally adopted by a researcher in studying the research problem.

Sources of Data: There are 2 types of data: 1. 2. Primary Data Secondary Data 3

Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Primary Data The primary data are those which are collected fresh for the first time and thus happen to be original in character. The primary data collection involves the collecting of information for the first time by observation, experimentation, questionnaire and through interview schedule in the original form by the researcher himself or his nominees. Plan of action: The primary data was collected through discussion with the finance manager using the interview schedule. This data was obtained to study the latest procedures relating to working capital management and cash management system followed by the company.

Secondary Data The secondary data are those which have been collected by some other and which have been processed. Generally speaking secondary data are information, which have been previously collected by some organization to satisfy its own need. But the department under reference for an entirely different reason is using it. There are two main sources for Secondary Data: Published Data: Data that is already available in books, magazines, trade journals, newspapers, reports, prepared by research scholar etc. Unpublished Data: This is not published; it can be found in unpublished biographies, autobiographies, some governmental aspects and private individual organizations etc.

Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

The Secondary data used in the study are: o Annual Report of the company. o Published financial reports of the company. o Financial records and stores manual of the company. o Directors reports, auditors report and other schedules.

Limitations of the Study:

The span of study is confined to only 5 years. The comparison of various ratios may not have the same conditions, which may result in unrelated comparisons. DIPL depends completely on Divgi Warner Pvt. Ltd (Pune) for procurement of raw materials & supply of finished goods. Hence the Working Capital Inventory management techniques have to be adjusted on a timely basis, based on DWPLs needs. In this project report the Working Capital Management & Cash Management system followed during the time of doing the project is recorded and analyzed.

Need and Importance of Working Capital:

To fulfill its endeavor to maximize the shareholders wealth, firm has to earn sufficient return from its operations, which needs a successful sales activity. The firm has to invest sufficient funds in current asset to succeed in sales, as the sales do not convert into cash instantaneously because of time gap between the sale of goods and actual receipt in cash. Hence there is a need for Working Capital in the form of current assets to sustain sales activity during that period. Babasabpatilfreepptmba.com 5

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Findings:

1. View of financial position: The Company was incorporated in the year 2000, its actual commercial work started in the year 2003 April 1 st.The Company had not started any business, so there is no question of profit from the year 2000 to 2003. But however as a first step towards the commencement of commercial activity the company has taken over the business of timing gear blanker on April 2003. 2. In 2003-04 the Company started commercial activity by acquiring the building, plant & machinery from Divgi Metal Ware Pvt. Ltd., on an annual lease of Rs.9,00,000/- plus taxes of Rs.51,750/-. Using these leased assets the company carried out job work for Divgi Warner Pvt. Ltd. After expenses the company made a modest profit of Rs.3,745/before depreciation. 3. The debtors component in the composition of current assets is the highest. It was 87.77% in the year 2003-04, 79.38% in 2004-05, 73.63% in 2005-06, 70.87% in 2006-07 and 69.43% for the year 2007-08. It may be noted that debtors components in current assets is decreasing over the years. 4. The cash and bank component for the year 2003-04 was 2.19%.it was 1.71% in 2004-05, 7.11% in 2005-06, 1.16% in 2006-07, 0.27% in 200708. The loans and advances component was 10.04% in the year 200304, 18.91% in 2004-05, 19.26% 2005-06, 27.97% in 2006-07, 30.30% in 2007-08. The debtors component in the composition of current assets decrease the loans and advance component is on an increase. 5. In the years 2003-04 and 2004-05, the company had a negative working capital of Rs.1,35,169.09 and Rs.1,95,076.75 respectively which is not a favorable position to the company. Then in the year 2005-06, 2006-07 Babasabpatilfreepptmba.com 6

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

and 2007-08 the Net Working Capital has improved drastically to Rs.9,78,370.64 ,.Rs9,86,858.40, and Rs 35,02,104.84 respectively.

Suggestions and Recommendations:

1. The Debtors component is the highest among the five years and it amounted to nearly 76% of the total current assets. But the percentage has decreased over the year which is a good sign of improvement. The second highest element is the loans and advances component which has increased over the years because of the expansion programmes undertaken by the company. In the initial years the company had not maintained a considerable amount of cash and bank balances, but over the years the company is maintaining adequate cash so as to meet its immediate cash requirements. 2. The working capital of the company should be always positive. It should not be negative. In the years 2003-04 and 2004-05, the company had a negative working capital which is not a favorable position to the company. Then again in the year 2005-06, 2006-07, and 2007-08 DIPLs net working capital has increased to Rs.9, 78,370.64, RS9,86,858.40, and Rs 35,02,104.84 which is a very positive sign of prosperity and it will help the company to sustain its expansion programmes. It also shows that the liquidity position of the company has improved. Hence there is much capital available with the company to pay off the current liabilities. 3. In order to ensure liquidity and quick cash collection the company can go for factoring technique, through which the company can get immediate cash for its accounts receivables and employ it in business and there by Babasabpatilfreepptmba.com 7

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

improve its profitability.

INDUSTRY PROFILE

Indian Auto Components Industry:

The Indian auto ancillary industry has come a long way since it had its small beginnings in the 1940s. If the evolution of the industry is traced in India, it can be classified into three distinct phases namely: Period prior to the entry of Maruti Udhyog Ltd, period after the entry of Maruti Udhyog Ltd and Period post Liberalization. The period prior to the entry of Maruti Udhyog Ltd was characterized by small number of auto majors like Hindustan Motors, Premier Automobiles, Telco, Bajaj, Mahindra & Mahindra, low technology and assured business for most of the auto component manufacturers. The entry of Maruti in the 1980s marked the beginning of the second phase of the industry. The auto ancillary industry in the country really showed a spurt in growth during this period. This period witnessed the emergence of a new generation of auto ancillary manufacturers who were required to meet the stringent quality standard of Marutis Korean collaborator Suzuki of Japan. The good performance of Maruti resulted in an upswing for the domestic auto ancillary industry. It was during this period that auto components from India began to be exported. The entry of foreign automobile manufactures ranging from Mercedes Benz, Ford and General Motors to Daewoo following the government liberalizing the foreign investment limits saw the beginning of the third phase of the evolution of the industry. The auto ancillary industry witnessed huge capacity expansions and modernization initiatives in the post liberalization period. Technological collaborations and equity partnerships with world Babasabpatilfreepptmba.com 8

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

leaders in auto components became a common affair. However, the global automobile majors soon realized the folly of their estimations in India. The market did not seem to be as big as it appeared to be. Hence, sales targets went away. The tough competitive scenario saw a lot of consolidation in the industry and it still continues unabated.

Global Scenario;

Prior to 2000, it had been almost ten years since TTS (torq transfer systems) had been awarded any new transfer case business for the European market (Land Rover). Then concerted efforts were made to re-enter that market & attain new business with improved technologies such as high output transfer cases & Torsen Torque Differential technology which broadens the industries offering in the transfer case market place. In the global Scenario of transfer case industry there are significant differences between the American & European Markets. While the American car-buyer is primarily interested in traction & larger, more powerful vehicles, the European driver is more interested in vehicle handling, stability & safety. Therefore for their home markets, European auto makers are producing smaller, front wheel drive vehicles. But as the American car buyers are more interested in powerful engines the automakers are offering a wide range of SUVs for which the Torq transfer System ( TTS) is particularly well suited making the 2 wheel drive into 4 wheel drive ( 4 x 4 ). The vehicles tend to be technically more sophisticated creating new market potential for TTS. Borg Warner & TTS (Torq Transfer Systems) The Company engineers work closely with the Drivetrain group in engineering strategy & provide many opportunities for collaboration & learning of TTS. TTS engineers frequently make customer presentations along with colleagues from TS. This collaboration allows the Company to talk about the companys all-wheel drive products while TS engineers present other Drive train technologies that Borg Warner has to offer, including the very successful Dual Clutch Technology, which is generating much attention in Global Babasabpatilfreepptmba.com 9

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

markets.Other Borg Warner business groups have helped to establish a great reputation for Borg Warner at the Global level. The companys commitment to new technologies & new products for the automakers will help TTS become a future Product Leader in Auto industry.

Company Profile

Divgi Industries Private Limited (DIPL) is situated at Banavasi Road, Sirsi in North Kanara District of Karnataka State. It is a medium scale engineering industry of prestigious city SIRSI. DIPL was incorporated in the year 2000.Its actual commercial activities started in April 2003. Its registered office is in Sirsi (Karnataka). It is certified with ISO/TS 16949 quality system in 2005. There is another industry in the campus of DIPL known as Divgi Warner Babasabpatilfreepptmba.com 10

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Pvt. Ltd. (DWPL) which is a sister concern. Divgi Warner Private Limited was established in the year 1995 as a joint venture company between Borg Warner Torq Transfer Systems USA, a global leader in automotive power technology with history going back over a hundred years & Divgi Metal Wares Limited, India. DIPL does the job work for DWPL. Actually buildings and machineries are taken on Lease basis from Divgi Metal Wares Pvt. Ltd. Raw materials come from DWPL (Pune) to DWPL (Sirsi). Again these raw materials supplied to DIPL from DWPL (Sirsi). After the job work is completed & the raw materials are converted into semi-finished products, it is again supplied to DWPL (Sirsi) & after some value addition works these products are sent to DWPL (Pune) for exporting it to Borg Warner (U.S.A.). It has following alliances for the product range. Alliance for 4 WD technology & products. Manual transmission technology & products. Synchronizer technology & products

They design & manufacture the auxiliary transfer cases (required for 4x4 vehicles) & components required for automotive torque transfer applications. The transfer case & the parts fit on the 4x4 vehicles & their products, end customer base covers Tata Motors Mahindra & Mahindra The product range of DIPL includes turned Flange families, turned, hobbed, rolled, ground shafts and gear families used in auto transmission systems. The usage of their products on vehicle: Transfer Case ALH (automatic locking hub) Companion Flange Families There are 120 employees working in DIPL. The workers have shift basis work Babasabpatilfreepptmba.com 11

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

with specified target. The company provides them with good salary, better facilities and motivational programs.

Vision:

To be catalytic and innovative organization in the society that supplies goods and services that are of superior value to those who use them, create jobs that provide meaning for those who do them and offer our talents & wealth to help & reward all who invest in us their time money & trust.

Goals:

To become Indias prominent & perfect technology & in crate based solution provide in automotive transmission & power train application for on & off highway usage to achieve world class standard in spheres of our business activities.

Mission:

Our Mission is to assist our customer seek new frontiers of value for the continuously evolving needs of a globalizing market place in so doing, we seek to bring unique distinctive & superior value to those who use our products and services. We seek to provide our customers a continuous source of innovation by anticipating change & shaping it to our purpose.

Annual turnover of the company

For the year 2004-2005 Babasabpatilfreepptmba.com 90,88,000 12

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

2005-2006 2006-2007 2007-2008 2008-2009

1, 22, 60, 000 1, 33, 80,000 1, 70, 54,584 3, 00, 00,000

Board of Directors

SHRI JITENDRA DIVGI. SHRI HIRENDRA. DIVGI SHRI BHARATH DIVGI.

Product Profile

Divgi Industry Private Limited manufactures the spare components required transfer case. The raw materials are procured from Bhosari (Pune) and component parts are manufactured at DWPL (Sirsi) and they are assembled at DWPL (Pune).

Transfer Case: transfer case are used in 4*4 vehicles. It includes several

items made up of steel. They include: Front Adapter: It is an item made up of aluminum.

Shafts:

Babasabpatilfreepptmba.com 13

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

1. Upper output Shafts. 2. Lower output Shafts.

Upper output shaft

lower output shaft

Yokes:

The yokes are classified as single chorden and double chorden that are supplied to Mahindra & Mahindra and Tata motors. These are also exported to Borg Warner Torq Transfer Systems.

Babasabpatilfreepptmba.com

14

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Gear: These items include: Ring Gear

Sprocket drive Sprocket driven Hub Sleeve Hub lock up Collar lockup Babasabpatilfreepptmba.com 15

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Hub reduction Clutch Gear Planet penion Gear Companion Flange:

Quality Objectives:

To continually enhance customer satisfaction by monitoring the customer satisfaction index. To improve productivity, achieve higher process capabilities with a focus to achieve ZERO detect in all out business activities. To achieve OPTIMUM INVENTORY LEVELS through ON TIME PROCUREMENT (JIT) of quality material at competitive prices. To improve the overall inventory effectiveness To develop a motivated, committed and effective team by providing the necessary resources, good training programs and a congenial atmosphere for overall growth of the employees. . . Types of Transfer Case: Mechanical Shift Transfer Case Babasabpatilfreepptmba.com 16

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Electrical Shift TC Features and Benefits of Mechanical Shift Transfer Case and Electric Shift Transfer Case: Part-time System: - Allows driver to select two or four wheel operation. Light Weight Construction: - Reduces total vehicle weight to enhance fuel use efficiency. Upper Disconnect to Chain: - Stops unnecessary parasitic losses in two wheel drive. Positive Displacement to Oil Pump and Filter : - Assures full liberation when driving or towing. Reduces maintenance needs. Helical Gearing: - Delivers quiet, low range operation. Four-wheel Drive Indicator Light Switch : - Indicates four wheel drive mode for driver convenience.

Single lever Shift Control: - Simplifies selection of transfer case operating modes. Electromagnetic shift on the fly (optional) : - Provides smooth engagement of four wheel drive at highway speeds.

Functions of Transfer Case: To convert 2 x 2 drive into 4 x 4 drive To amplify Torque

AREA OF OPERATION

Babasabpatilfreepptmba.com 17

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

The area of operation of DIPL is done in DIVGI WARNER PRIVATE LTD, which caters to domestic, and global customer base includes: Auto Alliance (thailand) Ford (usa) Hyudai (japan) Great wall (china) General motors (usa). Domestic customers Mahindra & Mahindra Tata motors Telco.

OWNERSHIP PATTERN

DIVGI Industries is a VENDOR company which is owned by share holders of the same company with a number of shares rupees 49, 53,000 (equity shares rupee 100 each)

COMPETITORS INFORMATION

There are no competitors to DIPL as it does only job work for DWPL as it does not undertake a trading or marketing activity.

ACHIEVEMENT/AWARD

DIPL is awarded with ISO/TS-16949-Quality certificate in the year 2002.For every 3 year it should be recertified. Recently it is recertified in the year 2009. Babasabpatilfreepptmba.com 18

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Work Flow Model

CAD

Order specification DESIGN PRODN DEPT Material Design WASTE TO SCARP

DWPL DW

Order

Material

DIPL MDT

FINAL INSPECTI ON

FEEDBACK

Business Process Approach: The various business processes, their interaction & sequences are identified on the basis of nature of our business. Following business processes are performed in the organization, classified into various functions:Top Management: The MD of the company is CEO for the quality Management System. He is overall overseeing the overall growth of the company whereas day to day operations are looked upon by Plant Head.

Sales & Customer Support: This business process communicates with customer to identify customer requirements & assures customers in increasing Babasabpatilfreepptmba.com 19

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

customer satisfaction by interacting with other business processes in the company. They give inputs to Engineering about customer needs of new / modified product / system requirements. This business process also supports customer for line & warranty related issues. This activity is carried by Marketing Department. Product Design & Development: Engineering department is responsible for designing the product / part as per the customer requirement. The customer requirements are translated into the product realization plan through APQP (Advanced Product Quality Planning) steps. Product leader convinces multi disciplinary actions consisting of various business processes who act as a board of decisions for design activity planning. This business process ensures that company confirms to all the agreed customer requirements. .

McKinseys 7S Framework

The 7S model is better known as McKinseys 7-S. This is because two persons who developed this model, Tom Peters & Robert Waterman, have been consultants to McKinsey & Co, at that time they published their 7-S model in their article Structure in not organization ( 1980 ) & in their book The Art of Japanese Management (1981) In search of Excellence ( 1982). The model starts on the precise that an organization is not just structure, but consist of 7 elements: Strategy, Structure, System, Style, Staff, Skill and Shared values. Babasabpatilfreepptmba.com 20

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Strategy :

Actions company plans in response to or anticipation of

changes in its external environment. Structure : Basis for specialization & coordination influenced primarily by

strategy & by organization size and diversity. Systems : Structure. Style : The culture of the organization consists of 2 components:enduring features of organization 21 Formal and informal procedures that support the strategy and

o Organization Culture: The dominant values and norms which develop over time & become relatively Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

life.Management Style More a matter of what focusing attention on?

manager do than what

they say; how do a companies managers spend time? What are they

o Symbolism:

The

creation

and

maintenance

(or

sometimes

deconstruction) of meaning is a fundamental responsibility of mangers. Staff : The people / human resource management processes use to

develop mangers socialization processes, ways of shaping basic values of management cadre, ways of introducing young recruits to the Co., ways of helping to manage the career of employees. Skills : The distinctive competencies what the company does best, ways

of expanding or shifting competencies.

Shared values : Guiding concepts, fundamental ideas around which a business is built must be simple , usually stated at abstract level, have great meaning inside the organization even though outsiders may not see to understand them. The 7-S model is a valuable tool to initiate change processes & to give them direction. A helpful application is to determine the current state of each element and to compare this with the ideal state. Based on this its possible to develop action plan to achieve the intended state.

Babasabpatilfreepptmba.com

22

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Application of McKinseys 7S:

STRUCTURE

Organizations are economic & social entities in which a number of persons perform multifarious tasks in order to attain common goals. L. A. Allen defines an organization as the process of identifying & grouping the work to be performed, defining & delegating responsibility & authority & establishing relationship for the purpose of enabling to people to work most effectively together in accomplishing objectives. Organization structure can be designed on the basis of departmentalization and relationships. Departmentalization is the process of dividing work of an organization into various units or departments. Relationship is the process of organization brings relationship among employees at different levels, materials, money & machines.

Babasabpatilfreepptmba.com

23

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

FUNCTIONAL AREAS AT DIPL

The various business processes, their interaction and sequences are identified on the nature of business. Following business processes are performed in the organization, classified into various function:1.Production, Planning and Control 2. Stores and Materials 3. Human Resource (HRD) 4. Quality System 5. Maintenance 6. Manufacturing 7. Quality Assurance Babasabpatilfreepptmba.com 24

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

8. Finance and Accounts

1. Production, Planning and Control Department

This business process receives customer schedule details from marketing considering inventories at raw material, work-in-progress and finished goods, they prepare production plan is a base for manufacturing process. This business process also controls outsourcing of products/ processes. This process strives for 100% on time delivery performance of company. Responsibilities and Authorities of Production, Planning and control: Prepare dispatch plans / schedules based on scheduled requirements. To-coporate with Bhosari ( Pune ) for the following: o Raw materials o Tooling / insert s o Mobilizing empty trays for material handling o Preparing dispatch schedule

Other requirements like consumables To organize inputs to Sirsi plant such as: o Trays or guards on machines o Displaying information at info center o Providing racks for storing various materials Organizing dispatch co-ordination with individual engineer for component for final inspection and further dispatch. To take the work-in progress statement for production material within the Babasabpatilfreepptmba.com 25

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

plant. To negotiate and finalize rates for scrap (steel/aluminum) and take approval from VP (operations). Development of new tools/ inserts and conduct trails for productivity improvement with reducing the cost per component. Key Performance Indicators (KPIs) Analysis: Manufacturing effectiveness: Work out standard man- hours Work out available man-hours On Time delivery Work out dispatches against planned quantity split into three halves ( 1 st to 10th , 11th to 20th , 21st to 31st .

2. Stores and Materials Department

This business process procures raw material / products / consumables as per procurement plan based on production requirement schedule. They also procure indirect parts / products / consumables or services needed for all other processes. This business process receives and preserves the raw material till it is consumed during manufacturing. The two types of items under the stores department are: a. Billable items Babasabpatilfreepptmba.com 26

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

b. Non- billable items a. Billable items Billable items are those, which are procured from outside sources. They include machine spares, gear parts, tool holders, cutting tools, grinding mills and consumables. b. Non- billable items Non- billable items are the items, which are procured Bhosari (Pune). They include forging (shaft, flange), gear blanks, sun gear, ring gear, hub reduction, sprocket drive, sprocket driven, hub sleeve etc. The Key performance indicator of stores departments is Material Yield of month. Receipt of material and preparation of GRR (Goods received cum inspection report) Receive the material: The material from vendors/ suppliers / sub-contractors are received Check for correctness of received material Identification of received material Preparation of goods received cum inspection report. Storage and handling: Arranging to store the semi-finished components in the respected allocated areas. Arrange to stores the consumables in allocated respective bins in the racks Forgings issued to sub contractor for roughing operations are to be unloaded. Ion forgings areas allocated in respective containers Babasabpatilfreepptmba.com 27

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Preservation: Check periodically once in three months i.e., quarterly for deterioration of materials. Check for expiry date items etc, and prepare list of expiry date items

Dispatch of finish components: Collect details of components to be dispatched from daily standing meeting with production, planning and control (PPC) department. Arrange for transit insurance; collect material return to stores (MRS) from manufacturing department. Prepare non returnable delivery challan, while preparing the above challan check for serial number, P.O. number, quantity, rate, amount and tempo details in which components are being loaded. Dispatch of components are made in dedicated trays and transported to Pune in LCV (Light commercial vehicle). Arrange for loading in the vehicle such that no space is left between trays to avoid transit damages.

The material yield of month is calculated as follows: Total dispatches Line rejection note + closing stock Opening balance + receipts = Percentage of material yield for month Responsibilities and Authorities of Stores Department: Babasabpatilfreepptmba.com 28 x 100

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

To ensure packing / packing of finished products, being dispatched to customers To maintain stocks of material while working towards minimizing the inventory levels and maintaining First in First out movements of materials.

Ensure strict compliance of rules of government authorities, in excise, octroi procedures. Maintain accounts of material Ensure return of rejected material time to time and preparation of RGN (rejected goods note). Preparation of GRR (Goods received cum inspection report) of receipt material.

Procedure for Budget: In order to control the annual budget, the management has budget the expenses for each department. The Managing Director approves annual budget and it is responsibility to manage within the budget by the concerned head of the department. All head of the departments are empowered to manage their department budget. Implementation of annual budget procedure is as under: Every year in 1st week of January, each department is given headcount wise annual budget to Accounts Department. HR department budgets, the expenses under the following heads: 1. Training 2. Housekeeping 3. Vehicle maintenance Babasabpatilfreepptmba.com 29

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

4. Vehicle fuel 5. Staff welfare 6. Telecommunication 7. Other expenses. Finance department puts up all departments annual budget to managing director for review and final approval. After approval of Managing Director, Finance department informs the allocation of budget to each department head. The Finance department organizes a monthly review meeting, named as Budget Review Meeting.

3.Human Resource (HRD)

This business process maintains the details of Human Resource. They help other business to acquire new personnel and improve competence of employees. This is done by way of effective training activity as per the needs specified by other business processes. Induction Training Programme At Divgi Warner Private Limited four days induction training programme is conducted for all new employees. All new employees must undergo an induction training programme. The purpose of induction training programme is to ensure that the new employee gets familiar with the companys day -to-day operations. Cleanliness of Premises: HOD (HR) ensures that premises are neat & clean. Any material available is neatly placed & duly identified. Any repairs to building & infrastructure required to fulfill product & manufacturing process needs are timely carried out. Any material is promptly removed. Every month, any deterioration in material is brought to notice of CEO for further actions

Babasabpatilfreepptmba.com

30

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Employee Training: I. II. III. Basic Job Training General Training Further Training Basic Job Training: All employees will be trained in the operation of machinery & equipment specific to their function. Before using such machines or equipments, employees are to be informed of the hazards that are likely to occur. General Training: All employees will be briefed & receive training in the following: Accident prevention in the operation of machinery & equipment. Accident reporting Good Housekeeping Company safety, health & environment policy. Responsibilities under the current safety, health & environment legislation. Further Training: On site emergency plan Emergency Skills Safety, health & environment audit

Performance Appraisal

Once the employee is confirmed he shall be considered for an annual appraisal every year effective 1st of January. Appraisal will be based on his overall performance including attendance; sincerity to meet his pre agreed key performance areas & objectives. Babasabpatilfreepptmba.com 31

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

At the time of appraisal employee is required to give certain KPAs (Key performance areas) for next year with specific targets. It is expected the employee shall monitor his KPAs. Depending on performance of KPAs employee will be considered for annual increments. Leave Policy: In order to control the absenteeism in day to day working and avoid unplanned leave, management has made certain rules and regulations as under Entitlement of Leave: Every employee other than managers and above will be granted, in each calendar year, the following leave. o Earned Leave( E.L.) 15 days o Casual leaves ( C.L.) 10 days o Sick leave ( S.L.) 5 days Leave for managers and, above will be as per the terms of appointment letters issued to individual employees.

Functions of HR Department:

To organize necessary training programs Assist HOD for human resource acquisition Maintain all statutory requirements on time, as given out in Gazette notification and government orders from time to time. This also involves compliance and renewal of various licenses under Factories Act, Babasabpatilfreepptmba.com 32

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Minimum wages Act, Payment of wages Act, Workmens Compensation Act, Gratuity Act etc. Maintain records of employees including attendance, leave record and training record. To collect training needs through skill matrix from various functions and prepare training plan. Upkeep of factory premises. Arranging and up keeping of company vehicles Providing and maintaining a conducive atmosphere for work and enhances performance of employees. Plan and arrange sports as a part of employee motivation.

Health and Safety Policy :

It is the policy of Divgi Warner Limited to ensure as is reasonably practicable, the health, safety and welfare of all its employees, contractors and other persons who may be affected by its operations. The policy is applied equally, fairly and without exception. The companys policy aims to achieve this by providing and maintaining places of work and equipment which are safe, by the operation of system of work, which are free from risks to health and also provide suitable arrangements for the safety and protection of employees.

SkillS I - Informed Training.

L Learned Training Evaluation. U Understand Minor supports from others. O Operating Independent. Babasabpatilfreepptmba.com 33

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

M Master Train to others. ISO 9001 certified and in May 2002, DIPL got TS (Technical Specification) 16949 certification. Under Writers Laboratories Inc. has issued TS 16949 certification to DIPL after assessing the firms quality system & finding it in compliance with ISO / TS 16949 : 2002.

4. Quality System

It consists of four Quality Management Systems: a) ISO-9001 b) ISO-9002 c) ISO-9003 d) ISO-9004 ISO-9001 is given to those companies that will do designing as well as manufacturing, marketing and service. ISO-9002 is given to those companies that will do only manufacturing, marketing and service. ISO-9003 is given to those companies for servicing, calibration and testing. ISO-9004 is given only for service. It is vocabulary (guidelines for above systems).

After 1994 a new system was incorporated QS-9000. It consists of two sections. Section I includes basic segments of ISO series and Section II is customer specific requirements QS- 9000 is basically formed the big 3s viz., General Motors, Chrysler, Babasabpatilfreepptmba.com 34

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Ford and other manufactures. Later in 2000 they formed TS-16949 and the latest updation is of version TS16949, 2002 the fundamentals for this system is ISO- 9001, 2000 and ISO9004, 2000. Why go for TS-16949? TS-16949 is a license for doing business with the customers and implementation of TS-16949 develops a common understating of quality related expectations, methods and practices with the customers. The common understanding and assurance it brings leads to: Simplifying many different detailed decisions and work methods in managing and continually improving quality Motivating and empowering people to take action to improve effectiveness and efficiency of their work processes in disciplined way. Co-coordinating the actions of different people in an efficient way to give customers a defect and hassle free experience.

TS-16949 standard belief: TS-16949 is a quality management system that helps us continually improve the effectiveness and efficiency of our processes for products and services to our customers by emphasizing. Defect prevention Reduction in variation and waste in our supply chain.

Functions of Quality System:

To co-ordinate the (APQP) advanced production quality planning meeting. To maintain the distribution control of quality system documents Babasabpatilfreepptmba.com 35

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Execute IQAs ( Internal quality audits) as per plan Maintain IQA ( Internal Quality audit ) reports and analyze the findings and monitor the target dates of action Arrange for plant level operation review meeting Maintain relevant quality system records.

5. Maintenance Department

The Maintenance Department is concerned with the Maintenance of machines utilities like air compressor, diesel generator set, and IT equipments like computer fax machines, scanner and printers. There are three type of Maintenance : a. Breakdown Maintenance b. Preventive Maintenance c. Predictive Maintenance

a). Breakdown Maintenance: In the case of breakdown maintenance the machines are attended only when the process has stopped or after the breakdown.

b). Preventive Maintenance In the case of preventive maintenance machines are maintained in such a way to prevent occurrence by regular inspection, cleaning, greasing etc, as the case may be. Babasabpatilfreepptmba.com 36

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

c). Predictive Maintenance Predictive Maintenance is where the life of each spare part is determined and at the end of the period spare part is replaced with new one whether it is damaged or not. Maintenance schedule are prepared on monthly, quarterly, semiquarterly and yearly basis.

Functions of Maintenance Department:

To identify key process equipments To rectify day- to day breakdown of the equipments To plan and procure the spare parts equipments Maintenance To maintain and update all records related to breakdown/ calibration/ installation and commissioning / retrofitting/ spare parts etc. Provide adequate support to organization by keeping the equipments under proper working condition, to support qualitative and cost effective manufacturing of products. Design and implement an effective preventive and predictive maintenance system so as to keep high uptime for equipment Recondition old equipments to effectively maintain machine capability and retrofit the new technology to enable more effective capital deployment for minimizing unscheduled downtime and maintain machine capability.

6. Manufacturing Department

This business process manufactures product as per production orders released by planning. They follow the entire standard, i.e. quality and process Babasabpatilfreepptmba.com 37

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

to realize the products. They assist manufacturing engineering to establish the new manufacturing process. They develop various job/ work instructions to guide operations to perform better and better. They plan and accomplish manufacturing of products so that customer requirements are fulfilled. This business process ensures maintenance of manufacturing fixtures and tooling required for product realization. Monitoring and Measurement of Manufacturing processes : 1. During initial process approvals, the new processes are studied with the help of PFMEA (Process Failure Mode Effective Analysis) to establish process controls to achieve process capability. The results o such process studies are documented in PFMEA ( Process Failure Mode Effective Analysis) and developed to further documents like process plans, maintenance check sheets tooling 2. We achieve and maintain manual. These documents process performance also contain acceptance criteria of relevant process parameters. manufacturing capabilities, functional heads of manufacturing and quality assurance ensure that PFD (Process Flow Diagram), CP (control Plan), process plan when acceptance criteria is not met with. 3. Significant process events such as tool change, machine repair etc. are recorded in process monitoring charts. 4. 100% inspection of products is done at stages for critical special characteristics whenever process becomes unstable or process capability is lower then target. For other characteristics 100% inspection decision is taken depending upon making on further process in house or customer end, results are recorded in inspection reports.

Functions of Manufacturing Department:

To identify the tooling resources. To identify process special characteristics as per (production part Babasabpatilfreepptmba.com 38

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

approval process) PPAP and company procedures. To prepare process maintaining and operator instructions To Identity manpower requirements To maintain the process control in manufacturing Provide smooth flow of production as per schedule, under the overall guidance of plant in charge. Execution of development activity by participating in APQP (Advanced Production Quality Planning) System. Optimize utilization of manpower and machines as per production plan. Ensure safety and cleanness of plant and machine. Plan and procure jigs, fixtures and tooling required for production function. Maintaining and updating all records related to process charge. Co-ordinate with other works functionaries to ensure effective on going production Work towards zero defect production system with the help of predestinated process. Adoption of new technology for manufacturing process to improve the quality and cost effectiveness.

7. Quality Assurance

Babasabpatilfreepptmba.com 39

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Quality Assurance is given for finished products. For every machine Quality audit report is prepared and certain observations are noted down. Statistical process control is carried out by once in 15 days. It is an important tool in the machine shop. Different products/ processes are evaluated through audits and feed back is given to the manufacturing management for further improvements.

Function of Quality Assurance:

To identify the acceptance criteria of receipt stage ( for attribute characteristics visual inspection ) To prepare receipt and final product Quality plan. To maintain all inspection and test records. To select appropriate IMTE (Instrument Measuring Test Equipment) and calibrate all IMTE at prescribed interval. To maintain all calibration records. To prepare and execute plan. Ensure non- confirming products are not supplied to customers and also ensure proper identification at all stages of manufacturing. Verification and control of PPAP (Production Part Approval Process) reports and samples. Analyze monthly rejection data on LRN ( Line Rejection Note ) Basis Ensure calibrated and capable inspection, measuring and test

equipments are available for accurate evaluation of products. Evaluate different products/ processes through audits and give feedback to manufacturing/ management for improvements. Ensure planning for product quality from Development stage. APQP (Advanced Production Quality Planning), with the use of proper gauging and process control techniques.

Babasabpatilfreepptmba.com

40

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

8. Finance and Accounts Department:

Finance is essential component of the business. To maintain this effectively a specialized department is there i.e. Finance Department. This department is concerned with the day to day financial activities like consumable purchase, sale, payments, receipts etc. It properly manages the accounts of concerned year. Functions: Cash handling petty cash handlings Bank transactions cash withdrawals, maintaining record of bank balance, details of check payments. Preparation of statements for funds requirements of the month including statutory and supplier payments. Recording of all the transactions in the books of accounts Preparation of cash flow statement budget. .

SKILLS

The skills required for every level in the organization are well defined through a skill matrix exhaustively. For example in the stores department the skills identified by Manager are communication skills, negotiation skills, interpersonal skills, Managerial skills, computational skills and problem solving skills. A team of top management assesses these skills through a competency matrix & training needs are recommended by the respective section heads in order to improve the weak areas. For top management, wherever necessary the company employs outside agencies to assess the skills & competency levels. Training is given to the identified employees in all the levels in house, Babasabpatilfreepptmba.com 41

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

outside as well as on job.

STYLE

The organization style of management can be described as to participative in nature at various levels. Every day representatives from the all the departments meet together & discuss the progress of the jobs & any difficulties faced. Decisions to solve the bottlenecks are taken & time frames are fixed with specific responsibilities to the person of related department. However the management gives all the support to sole the problem. On a weekly basis the progress of the job is reviewed by the section heads, which is chaired by the head of the plant. Major decisions related to project status, customer readiness, site condition, status of the component parts etc. shall be discussed & appropriate decisions are taken. Employees are treated in a most friendly way rather than boss subordinate way & suggestions are taken from all the level for improving the process however trivial it may be. Top management always encourages changes for betterment of the organization. The staff is also given continual training to cope up with the changing scenario & to keep their skills abreast with the latest technology & methods. Apart from regular official work, the employees participate in various recreational activities during festivals by organizing sports, competitions etc. The success of the organization is attributed to each & every person & not a single key person as DWPL gives importance to the efforts of the entire staff.

Babasabpatilfreepptmba.com

42

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

STRATEGY

The company has adopted the strategy of Continual Improvement. Continual improvement is a way of life and part of DIPLs culture. It is comprehensive & all encompassing system of methods & practices based on continuous learning to achieve greater effectiveness & efficiency of the business processes. It is driven by a close understanding of our customers to give them a defect & hassle free experience, disciplined use of facts, data & analysis and diligent business processes to reduce variation & waste. Continual Improvement helps to: Continually improve the effectiveness and efficiency of the organizations processes for its products and services Enhance Customer Satisfaction by emphasizing the fundamental principle of : Defect Prevention Reduction of variation and waste in Supply chain.

SYSTEM

System followed by DIPL to Improve the Work Place - JAPANESE 5S 5S is a system of steps and procedures that can be used by individuals and teams to arrange work areas in the manner to optimize performance, comfort, safety and cleanliness. '5S' driven workplace enhances productivity and competitiveness and fosters a productivity culture through a continual process of identifying, reducing and eliminating Waste.'5S' helps: Babasabpatilfreepptmba.com 43

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Identify, Reduce and Eliminate Waste Organized & World Class Workplace Enhancement in Productivity & Competitiveness Better Living and improved work life 5S'' is a tool with Japanese roots, focused on fostering and sustaining high quality house keeping, Safety (preventing accidents). Quality (preventing errors) and equipment maintenance (reduction in breakdowns). Safety (preventing accidents), Inculcates in the employees a mentality for continuous improvement.

A place for every thing and every thing in its place.

JAPAN Seivi Seiton Seiso Seiketsu Shitsuke

TRANSLATION Organization Neatness Cleaning Standardization Discipline

ENGLISH WORD Sorting Simplifying Access Sweeping Standardization Self Discipline

Seiri : Sorting out - "When in doubt, throw it out" Seiton : Systematic Arrangement Straighten - Everything has a place, everything in its place Seiso : Spic and Span Scrub - Clean it up 44

Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Seiketsu : Standardizing- Stabilize - Standardized cleaning and housekeeping Shitsuke : Self-discipline -Sustain - Make it a way of life .

''5S'' is the beginning of a productive life for everyone in DWPL and is fundamental to productivity improvement. A clean, organized and systematic workplace directly impacts Waste and thus impacts Productivity, Quality, Costs and other factors.5Sis a time tested and proven approach (infact a stepping stone) to achieving World-Class status.

STAFF

The staff of DIPL Top, middle and lower management have nurtured following qualification thereby being able to meet the expectations of their valuable customers. Quality: DIPL staff maintains professional attitude among all employees. Line & Staff Relationship: Line refers to those positions of an organization, which have responsibility, authority and is accountable for accomplishment of primary objectives. The relationship existing between two managers due to delegations of authority and responsibility and giving or receiving instructions or orders is called line relationship. Line authority represents uninterrupted series of authority and responsibility delegating down the management hierarchy. DIPL has adopted Line & Staff organizational structure that offers Babasabpatilfreepptmba.com 45

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

individual the opportunity to meaningfully learn & participate across diverse business processes. The Managing Director of this company is CEO for the Quality Management System. He is overall in-charge overseeing the overall growth of the company, whereas plant heads look after day -to -day activities. The business process heads, as shown in overall organization chart, are treated as top management to establish, implement, maintain & continually improve effectiveness of Quality management to establish, implement, maintain & continually improve effectiveness of Quality Management System. The Deputy General Manager follows the Managing Director. The team leaders of various departments report to the Deputy General Manager.

SHARED VALUES

Organization Purpose:

To pursue excellence in all spheres of our business activity through a process of continual improvement To produce detect and hassle free quality products & services to meet or exceed customer expectations. To attain leadership in the market. Commitment to high standards of motivation & competency that is essential to the persuit of excellence. The company is achieving its objectives through Key Performance Indicators (KPIs). Top management has defined measurable KPIs for each business process which are also Quality objectives for the company. Each Babasabpatilfreepptmba.com 46

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

business process owner utilizes Multi-disciplinary action approach to measure and analyze the data & information to arrive at a action plan which is implemented & reviewed every month. This monthly review also serves as one activity to improve & maintain internal communication. These KPIs are for overall functioning of business processes. Quality objectives are deployed within the organization through KPIs. While defining KPIs company ensures that all KPIs are: S M A R T Specific Measurable Achievable Realistic Time Bound

The status of KPIs is shared within the team for sustaining or improving the performance. The status of KPI with the action plan is shared with the management in various forums, which range from weekly to quarterly forums.

SWOT Analysis

Strengths of DIPL:

The quality management system is in Corporate Culture: DIPL are committed to customer satisfaction at all levels in the organization. DIPL has Quality Assurance and QMS departments where in all the queries, difficulties or any type of assistance required by customer is taken care. The issues relating to customer complaints, resolutions, corrective actions etc., suggestions by customers for improvement in processes / products are discussed on weekly basis and actions are initiated to resolve the Babasabpatilfreepptmba.com 47

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

problems. DIPL provides total transparency in dealing with its customers and are committed to enhance their capabilities, by providing them with latest technological advantage and utilizing maximum capacity to meet their requirements. They process the knowledge and the technology that is relevant to the products being designed, manufactured and supplied. Company has On-line communication system, capable to be linked with customers On-line system. line with QS-TS-16949 certification, which can achieve a good market for its product at global level. The company has adopted Continual Improvement philosophy, which helps to achieve greater effectiveness & efficiency in all the business processes. Customer complaints are systematically handled through team oriented problem solving 8 D methodology for internal as well as external concerns. There is well- designed automation & workstation near every machine, which are operator friendly. There is teamwork among the employees in the company. Each process (activity) is measured for effectiveness & efficiency to meet quality objectives. Competency to adopt new system, implementation, practice & sustenance. Most of the workforce comprises of well informed, competent youngsters qualified with diploma or graduation in engineering. Global Scenario: Divgi is one among the world class competitors at global level. DIPL works with worlds best logistics agencies to bring unbeatable value & supply chain management capabilities from India to right at your door Babasabpatilfreepptmba.com 48

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

step across the globe. Packaging developed to minimize dunnage at assembly plants while protecting materials in transit to any part of world.

\ Weakness of DIPL:

1. DIPL is situated in a remote place or area, which is far away from metropolitan cities, and it is not connected with national or state highways. 2. The lack of connectivity with proper roads & highways leads to the problem of procuring inputs & delivery of outputs. 3. There is transportation problem because Sirsi is a hilly region above sea level so there is no facility of railways, which is the faster means of transportation than roadways. 4. The company hires employees on contract basis, which makes rigorous training essential.

Opportunities at DIPL:

1. There is a scope for making final products instead of component parts and make it available for profit & loss. 2. There is an opportunity for making future expansion in business by going for joint ventures & tie-ups with other companys also. 3. The company provides various employment opportunities to new graduates & local people of Sirsi. 4. By adopting QMS ISO 14001, the next aim of the company is to Babasabpatilfreepptmba.com 49

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Deming Award of certified by Japanese, which is given for quality management systems. 5. The vast area of land & space of building can be effectively used for future expansions.

Threats of DIPL:

DIPL, Sirsi mainly depends on the parent company i.e. DWPL,Sirsi and Pune. The parent may change its base of manufacturing for marketing its products outside India. The major raw material used in the production is steel, presently there is a huge demand for steel & there is rise in the price of steel for last few years in India & all over the world. The rise in the input cost will reduce the margin of the company. There is always a risk of change in Government Policies.

Babasabpatilfreepptmba.com

50

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Title of the Study: A Study on Working Capital Management with reference to Divgi Industries Private Ltd. SIRSI.

Working Capital Management

Definition: Working Capital Management is defined as, a process of determining quantum of current of assets to be held at a right time, so as to discharge current liabilities and thereby utilizing them to their maximum extent, and at the same time increasing over all value of the firm keeping the liquidity position intact. Working capital management is the functional area of finance. It involves the formulation of policies for managing the current assets and current liabilities so as to maximize the benefits arising there from. Management of working capital involves deciding upon the amount and composition of current assets and tapping proper sources of finance for acquiring current assets. Hence proper management of working capital ensures adequate investments in current assets avoiding the possible losses arising out of deficit or excess funds.

Objectives of the Study:

1. To know the financial position of the company access. 2. To assess the financial strengths and weakness of the company to give valuable suggestions to attain operational excellence. 3. To study the importance of Working Capital Management in a Babasabpatilfreepptmba.com 51

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

manufacturing concern. 4. To study and evaluate the present Cash Management system of the company. 5. To suggest strategies to improve the liquidity position of the company.

Methodology of Data Collection

Research methodology is a systematic way for solving any research problem. Its a science of analyzing how research is done scientifically. It studies the various steps that are generally adopted by a researcher in studying the research problem. Sources of Data: There are 2 types of data: 1. 2. Primary Data Secondary Data

Primary Data The primary data are those which are collected fresh for the first time and thus happen to be original in character. The primary data collection involves the collecting of information for the first time by observation, experimentation, questionnaire and through interview schedule in the original form by the researcher himself or his nominees. Plan of action: The primary data was collected through discussion with the finance manager using the interview schedule. This data was obtained to study the latest procedures relating to working capital management and cash management system followed by the company. Secondary Data The secondary data are those which have been collected by some other Babasabpatilfreepptmba.com 52

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

and which have been processed. Generally speaking secondary data are information, which have been previously collected by some organization to satisfy its own need. But the department under reference for an entirely different reason is using it.

There are two main sources for Secondary Data: Published Data: Data that is already available in books, magazines, trade journals, newspapers, reports, prepared by research scholar etc. Unpublished Data: This is not published; it can be found in unpublished biographies, autobiographies, some governmental aspects and private individual organizations etc. The Secondary data used in the study are: 1. Annual Report of the company. 2. Published financial reports of the company. 3. Financial records and stores manual of the company. 4. Directors reports, auditors report and other schedules.

Statement of the Problem:

Financial statements can provide valuable insights into a firms performance. Analysis of financial statements is useful for the company to evaluate its own performance and also it is of interest to lenders (short term as well as long term), investors, security analysts, managers and others. To evaluate the effectiveness of operations and to determine its success an analyst has to combine quantitative results with qualitative factors. For instance a companys current profitability may be low. However, because of actions initiated by the management like technology up gradation, joint venture and collaboration with a foreign partner, etc. The prospects for better performance of the company in future may be bright. To fulfill its endeavor to maximize the shareholders wealth, firm has to Babasabpatilfreepptmba.com 53

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

earn sufficient return from its operations, which needs a successful sales activity. The firm has to invest sufficient funds in current asset to succeed in sales, as the sales do not convert into cash instantaneously because of time gap between the sale of goods and actual receipt in cash. Hence there is a need for Working Capital in the form of current assets to sustain sales activity during that period.

Limitations of the Study:

The span of study is confined to only 5 years. The comparison of various ratios may not have the same conditions, which may result in unrelated comparisons. DIPL depends completely on Divgi Warner Pvt. Ltd (Pune) for procurement of raw materials & supply of finished goods. Hence the Working Capital Inventory management techniques have to be adjusted on a timely basis, based on DWPLs needs. In this project report the Working Capital Management & Cash Management system followed during the time of doing the project is recorded and analyzed.

Need and Importance of Working Capital:

To fulfill its endeavor to maximize the shareholders wealth, firm has to earn sufficient return from its operations, which needs a successful sales activity. The firm has to invest sufficient funds in current asset to succeed in Babasabpatilfreepptmba.com 54

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

sales, as the sales do not convert into cash instantaneously because of time gap between the sale of goods and actual receipt in cash. Hence there is a need for Working Capital in the form of current assets to sustain sales activity during that period.

The need for Working Capital arises for following reasons: To purchase raw-materials, spare parts and other components To pay wages and salaries and other charges To meet over-head expenses To pay selling and distribution expenses To grant credit facility to customers To hold adequate stock of raw-materials finished goods, spare parts, etc. To provide for Contingencies.

Principles of Working Capital:

Principle of Risk Assumption Principle of Net Worth Position Principle of Maturity of Payment Principle of Cost of Capital

Classification of Working Capital: Babasabpatilfreepptmba.com 55

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

1. Gross Working Capital 2. Net Working Capital 3. Permanent Working Capital 4. Temporary or Fluctuating Working Capital 5. Negative Working Capital

1. Gross Working Capital: The gross working capital consists of total current assets. It provides the correct amount of working capital required at the right time. In financial management, the major thrust is upon the management of current assets. It tries to maximize return on investment by avoiding two extremes. Excessive investment in current assets simply reduces the profitability of an enterprise, since, the investment becomes idle. Whereas, inadequate working capital effects the solvency of the company negatively. 2. Net Working Capital: Net working capital is defined as the difference between current assets and current liabilities. A company has to give more importance to liquidity, because inability to pay short-term creditors may prove Babasabpatilfreepptmba.com 56

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

to be dangerous to the organization. Current assets should be sufficiently above the current liabilities low liquidity is harmful to the solvency of the company. 3. Permanent Working Capital: It refers to the current assets that are required to be maintained continuously throughout the year to carry on the business operations. In other words, it represents that part of the working capital which remains permanent in the business, in one form or the other in the same way as the fixed assets. For e.g. Cash or bank balance, stock-intrade to be maintained as minimum to carry on business operations at any time. 4. Temporary or Fluctuating Working Capital: It refers to the additional current assets required to meet the changing demands of an industrial or business enterprise caused by seasonal change. During peak season, a company requires additional funds to hold extra stock of goods. Thus, fluctuating working capital is not permanently locked up unlike the fixed working capital. It varies according to the changes in the volume of business caused by seasonal changes or any other factors. 5. Negative Working Capital: It refers to the deficit working capital. When the current liabilities exceed the current assets it is known as negative working capital. Under this situation a firm actually suffers from the shortage of funds and is a sign of unhealthy developments in business. It results in damage to the reputation of a concern. Current Assets Current assets are those assets, which in the normal course of business, convertible into cash within a short period of time i.e. an accounting year (or operating cycle) Components of Current Assets: Stock of materials in trade and in transit Babasabpatilfreepptmba.com 57

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Stores and spare parts Bills of exchange Loans and advances Deposits Cash and Bank bal Investment in Govt. and other securities Amount due from subsidiary Companies etc. Prepaid expenses Outstanding Incomes. Current Liabilities Current Liabilities include all the obligations of the concern that are maturing within an accounting year. Components of Current Liabilities: Sundry Creditors. Loans from bank & others Provision for taxation, dividend etc. Liabilities towards gratuity etc Outstanding expenses Incomes received in advance. Operating Cycle of Working Capital Operating cycle refers to the length of time involved between the sales & their actual realization in cash. In other words, it is the cycle time required in conversion of: a. b. c. Cash to raw materials Raw materials to work in process Work in process to finished goods 58

d. Finished goods to Accounts Receivables(A / R) Babasabpatilfreepptmba.com

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

e.

A / R to Cash

The operating cycle of DIPL is as follows: Purchase of resources such as Raw Material, labour, power and fuel etc. with cash. Conversion of Raw Material into Work-in-Process into finished goods. Sale of finished product either for cash or on credit. Credit sale create book debts for collection. Conversion of book debt (Accounts Receivables) into cash.

The operating cycle of DIPL may be diagrammatically shown as:

CASH

RAW MATERIAL Work in Process

Accounts Receivables

FINISHED GOODS

The above phases affect the cash flows. The cash inflows and cash outflows are neither synchronized nor certain. The firm needs to maintain liquidity to purchase raw material and pay expenses such as wages. Salaries other manufacturing and administration & selling expenses and taxes, as the cash outflows are certain. It surplus cash is available at any time in an Babasabpatilfreepptmba.com 59

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

intermediary state should be invested in short term securities without keeping it idle. Longer the duration of the operating cycle greater is the extent of working capital requirements. Generally, the operating cycle is lengthier in case of manufacturing industries. Operating Cycle with reference to DIPL may be calculated as follows: Operating Cycle = Inventory Period + A / R Period Accounts Payable Period. = 2 Days + 60 Days 60 Days = 2 Days. Financial Sources for Working Capital The firm can finance its Working Capital needs from different sources of funds using different approaches. The sources of funds are categorized as: Long term financial sources Short term financial sources Spontaneous sources.

Long Term Financial Sources: Long term financial sources are sources through which funds are raised for a longer period of time i.e. more than 1 year. It is used mainly to finance permanent assets. Following are the long term financial sources: Equity Shares Preference Shares Debentures Retained Earnings Loans and advances from banks and specialized financial institutions. Babasabpatilfreepptmba.com 60

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Public Deposits Short Term Financial Sources: Short term financial sources provide financial assistance for a shorter period of less that one year. The firm must arrange these sources in advance to meet day-to-day operational expenses. Following are the short term financial sources: Trade Credit Customers Advance Installment Credit Discounting of bills Bank Finance Factoring Spontaneous Sources: Spontaneous sources refer to the automatic or instant funds which arise in the regular courses of business operation. The major sources of such financing are trade credit & outstanding expenses.

Analysis of Gross Working Capital

Concept: Gross working capital refers to the total current assets which include debtors, cash and bank balances and loans and advances. 2003-04 Debtors Cash and Bank balances Loans and Advances Babasabpatilfreepptmba.com 61 2,32,801 3,61,417 6,24,889 9,80,256 14,45,510 20,35,974 50,913 2004-05 15,17,190 32,588 2005-06 23,88,962 2,30,605 2006-07 24,83,950 40,694 2007-08 33,12,312 12,913

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Total

23,19,688

19,11,195

32,44,456

35,04.900

47,70,735

Table 1: Composition of Gross Working Capital

Interpretation: The debtors balance has increased over the years which

shows that lot of funds have been blocked up in the debtors and where the company needs to improve its credit policy. The cash and bank balances has increased considerably in the year 2005-06 which shows that the company is trying to maintain a good liquidity position. The gross working capital is increasing over the years mainly because of increase in the debtors and loans and advances. But in the year 2005-06 less than 75% of the gross working capital is made up by debtors which is a sign of improvement compared to the previous years.

NET WORKING CAPITAL

Concept: Net working capital is the difference between current assets and current liabilities.

Year 2003-04 2004-05 2005-06

Current Assets 23,19,688.84 19,11,194.6 32,44,456.39

Current Liabilities 24,54,857.93 21,06,271.35 22,66,085.75

Networking Capital (1,35,169.09) (1,95,076.75) 9,78,370.64

Babasabpatilfreepptmba.com

62

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

2006-07 2007-08

35,04,899.10 47,70,735.74

25,18,040.70 12,68,630.90

9,86,858.40 35,02,104.84

Table 2: Net Working Capital

Interpretation:

In the years 2003-04 and 2004-05, DIPL had a negative working capital which is not a favorable position to the company. But in the year 2005-06, 2006-07 and 2007-08 the net working capital has improved drastically compared to previous years, which shows that the liquidity position of the company has improved. Hence there is much capital available with the company to pay off the current liabilities.

Statement of Changes in Working Capital for year 2003-04

Particulars Current Assets Debtors Divgi Warner Pvt. Ltd. Cash and Bank Balance Cash in Hand Sirsi Urban Coop, Bank Sirsi Urban Coop, Bank 31.3.04 20,35,974.00 31.3.03 Increase 20,35,974.00 Decrease

40,022.87 8,980.00 1,910.17

4,686.00 85.00 -

35,336.87 8,895.00 1,910.17

Babasabpatilfreepptmba.com

63

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Loans and Advances Advance Modi Xerox Centre Divgi Metal Ware Pvt., Ltd. Pune Advanced Partnership in which directors are interested. Other Advances Electricity Deposit Advanced to Staff & Workers T.D.S. Total Current Liabilities Creditors for suppliers & services Creditors for outstanding expenses Total Net Working Capital (Current Asset Current Liability)

5,340.00 26,093.00 76,619.00 66,890.00 42,486.00 91,992.00 48,170.00

5,340.00 26,093.00

18,720.00 42,486.00 91,992.00

23,19,688.84 21,40,125.93 3,14,732.00

2,41,654.00 1,55,912.00 11,261.00

20,78,034.80 19,84,213.93 3,03,471.00

24,54,857.93 (1,35,169.09)

1,67,173.00 74,481.00 (2,09,650.09)

22,87,684.93

Table 3: Statement of changes in Working Capital for the year 2003-04

Statement of Changes in Working Capital for year 2004-05

Particulars 31.3.05 31.3.04 Increase Decrease

Babasabpatilfreepptmba.com

64

ANALYSIS OF WORKING CAPITAL MANAGEMENT AT DIVGI INDUSTRIES PVT. LTD.

Current Assets Debtors Divgi Warner Pvt. Ltd. Cash and Bank Balance Cash in Hand Sirsi Urban Coop, Bank Sirsi Urban Coop, Bank Loans and Advances Advance Modi Xerox Centre Divgi Metal Ware Pvt., Ltd. Pune Other Advances Electricity Deposit Advanced to Staff & Workers U.L. India Pvt. Ltd., Bangalore Gagni International, Hubli T.D.S. Total Current Liabilities Creditors for suppliers & services Creditors for outstanding expenses Total Networking Capital (Current Asset Current Liability)

15,17,190.00

20,35,974.00

5,13,784.00

21,384.70 9,980.00 1,223.27

40,022.87 8,980.00 1,910.17

18,638.17 1,000.00 686.9