Professional Documents

Culture Documents

PCube Questions

Uploaded by

Elgenia WongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PCube Questions

Uploaded by

Elgenia WongCopyright:

Available Formats

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Rationale The Pre-Prelims Preparation (P-cube) is a programme that aims to help students do well in the 2013 C2 Preliminary Examinations in September. The programme in Term 2 will expose students a variety of case study questions for the revision of Block Test 2 to be held in July 2013 P-cube for the entire C2 cohort All students may make use of the material for discussions with your tutor and/or for their selfpractise. Students are required to check the EMB and Moodle regularly for the answers to the questions. Answers will be made available within 1 week after the mass P-cube lectures. Mass P-cube Lecture Your tutor may have identified you to participate in the mass lecture P-cube lectures. For best results, you should attempt and complete the questions before attending the lecture. Students who have not been identified but are interested to learn more may attend the lectures on a voluntary basis. The dates and coverage are as below: Session / Date Venue / Time Coverage Micro Case Studies (Chapter #23 Parts 1-3) HCI TA2 2010 HCI TA2 2012 [Note: Timed Assignment 2 is on 7 May] Macro Case Study HCI Prelims 2009 Suitable for H1 students to attend Macro Case Study HCI BT2 2011 Q2 Suitable for H1 students to attend Macro Case Study HCI BT2 2012 Q2 Suitable for H1 students to attend Micro Case Study HCI BT2 2011 Q1 Micro Case Study HCI BT2 2012 Q1

Session 1 6 May (Mon)

LT3 4-530pm

Session 2 9 May (Thurs)

LT3 4-530pm

Session 3 14 May (Tues)

LT4 4-530pm

Session 4 16 May (Thurs) Session 5 23 May (Thurs) Session 6 30 May (Thurs)

LT3 4-530pm LT2 4-530pm LT3 4-530pm

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Session 1 (6 May 2013)

HCI TA2 2010 Table 1: Percentage of Global Usage of Internet Browsers Year (Q4) 2000 2001 2002 2003 2004 2005 2006 2007 (*) Free software Source: TheCounter.com Global Statistics Internet Explorer 83.95% 90.83% 93.94% 94.43% 90.98% 87.25% 84.11% 81.14% Netscape 12.61% 5.23% 2.31% 1.45% 0.18% 0.07% 0.05% 0.06% Firefox_Mozilla (*) 0.14% 0.71% 1.67% 2.22% 5.10% 8.60% 11.13% 13.81%

Extract 1: Peaks, Valleys and Vistas On January 30th Microsoft releases to consumers the newest version of its operating system, called Windows Vista. Vista is being released with Office 2007, an update to its universally employed suite of word-processing, spreadsheet and other applications. Windows and Office represent nearly 60% of sales and 80-90% of Microsofts profits. Close to 1 billion personal computers are now in use and Windows and Office sit on nearly all of them. Vista took five years and US$6 billion to develop. Some 8,000 people worked on it. Although the company said on January 17th that it would make Vista available for sale and download online, it seemed that few customers will be queuing up to buy a copy. This reflects the way in which Microsoft's dominance is slowly being eroded. Computing has changed radically since Microsoft rose to prominence 25 years ago with its operating system for IBM's personal computers. Both Windows and Office were employed by software developers as platforms for their own applications, enabling Microsoft to accumulate monopoly power in the market. Now three trends are changing this. First is the rise of open-source software, for example the Linus operating system. The code for this is written largely by volunteers rather than a single company. The programs are usually free to use and open to continual enhancements. However, the tedious bits of software development for open-source may not get much attention and programs end up too technical for the layman.

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

The second trend confronting Microsoft comes from online applications and the rise of software as a service. Instead of charging for each wrapped box, firms can now sell programs as a service, collecting monthly payments, or providing them free and earning money from advertisements. For example, Google offers free online word-processing and spreadsheet applications. The third difficulty facing Windows and Office is security. Governments and large businesses had voiced concern about the omnipresence of Microsoft products and a rash of hacks and viruses that exploited holes in the firm's software. And no matter how many resources Microsoft pours into making its software secure, some flaws are inevitable. But the company has also been trying to make security a source of revenue. Although Microsoft is defending itself against some of the biggest trends in computing, it will not be unseated anytime soon. Indeed, the company has often said its biggest competitor is itself: previous versions of its products worked well enough, so many customers would not bother to upgrade to newer ones. Source: Adapted from The Economist, 18th January 2007

Figure 1: Microsofts Sales and Profit, $bn

Revenue Profit

Source: Thomson Datastream; Company report

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Extract 2: A Matter of Sovereignty Back in 1998, the US government initiated its biggest competition case for 20 years: it sued Microsoft, the worlds largest software company. It accused Microsoft of abusing its market power to crush its rivals. By controlling Windows, it forced Internet Explorer on to consumers and personal computer manufacturers. Consumer welfare is supposed to be what this trial is all about. Under the law, anti-competitive tactics are bad mainly because they harm consumers in the form of higher prices, less choices or poorer services. With a new Republican president in power, America's competition authorities decided in 2002 not to pursue the case championed by the Clinton White House and instead negotiated a settlement with Microsoft. This consent decree, large parts of which will expire in November, amounted to little more than a slap on the wrist. It failed to administer any penalty and let Microsoft add new software elements to Windows so long as personal computer-makers were allowed to add rival products too. But recently, Microsoft was back in the dock in Europe. The European court argued, that withholding information that is needed for personal computers and servers to work together constitutes an abuse of a dominant position if it keeps others from developing rival software for which there is potential consumer demand. In such cases, the information cannot be refused even if it is protected by intellectual-property rights, as Microsoft had argued. There is the question of whether Microsoft should be forced to license the information to makers of open-source software. Microsoft argues that this would be tantamount to giving away the shop, but the commission thinks it would promote competition by advancing open-source rivals to Microsoft's products. And further investigations may yet follow into Office, Microsoft's dominant suite of business software, and Vista, the latest version of Windows. Source: Adapted from The Economist, 20th September 2007 Questions (a) (i) (ii) (b) (i) (ii) (c) Compare the trend in Microsofts profit level and revenue from 1995 to 2006. State a possible reason for the difference in the two trends. Explain what is meant by barriers to entry. To what extent could Microsoft maintain its monopoly position over time? [2] [1] [4] [5]

With the aid of a diagram, explain the likely impact on Microsofts profits following the [6] launch of its new product, Windows Vista. Evaluate the economic arguments for and against the legal actions to break up Microsofts [12] monopoly position.

(d)

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package HCI TA2 2012 The Market for Television

Extract 1: Is there room for government intervention? Radio and television broadcasts are traditionally important sources of information. Other than the newspapers, the population depends on broadcasts for updates and commentaries on issues related to the country. In economics textbooks, radio and television broadcasts are often given as examples of pure public goods. For once a broadcast has been transmitted to one household, it may be costlessly received by all other households. Moreover, it is quite costly for the provider to exclude others from receiving the broadcast. However, in sharp contrast to the predictions of economic theory, market provision of both radio and television broadcasting is observed in many countries. The key feature enabling such provision is that the consumer of the broadcast is not confined to the viewer. Firms advertise on the broadcast to attract potential customers. With higher viewership of the broadcast there will be more potential customers. While we cannot exclude viewers from broadcast, we can exclude firms who want to advertise on the broadcast. Source: Adapted from http://www.nber.org

Extract 2: Television broadcasting in Singapore Since privatisation, television broadcasting had been provided by Singapore Broadcasting Corporation (SBC). In 2001, restructuring of SBC led to the formation of MediaCorp and liberalisation of the market led to the introduction of a second broadcaster, Singapore Press Holdings (SPH) MediaWorks. However, after only 4 years of competition, MediaCorp and MediaWorks decided to merge to cut further losses. The Media Development Authority (MDA) gave the approval for MediaCorp and SPH to merge their free-to-air TV operations. However, this resulted in the closure of some channels and laying off of staff. The approval for the merger of MediaCorp and SPHs TV operations is subject to their acceptance of conditions, which were introduced to encourage and ensure the continued growth of the local production industry while meeting the viewing interests of local audiences by providing quality, diversity and choice in local programming. In evaluating the application, the MDA took into consideration the impact of the merger upon the media industry as well as public interests and also reviewed the efficiencies that will result from the consolidation. The MDA hopes that the consolidation will lead to better quality programmes and services for local audiences as well as markets overseas. The synergies created will benefit MediaCorp and SPH and allow both to work towards regionalisation. Source: www.mda.gov.sg

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package Table 1 Comparison of number of TV broadcaster and population by country, 2011 Country Population Number of TV broadcasters Singapore 5.1m 1 Hong Kong 7.1m 2 Australia 22.8m 3 UK 62.3m 4 US 313.1m 4 Source: CIA World Factbook, 2011

Extract 3: The birth and rise of Pay TV in Singapore The market for pay TV in Singapore had been dominated by StarHubs Cable TV until Singtels Mio TV entered the market in 2007. Multiple factors may be responsible for the vibrancy of the pay TV scene in Singapore. The increased competition led to greater variety and lower prices. Advancement in technology also allows Mio TV subscribers to schedule remote recordings via the internet and also record programmes, actions that would not have been possible a few years ago. Would the impending growth of pay TV mean the slow decline and ultimate death of free-to-air broadcasting? Pay TV penetration may be on the rise but it may be rather early in the day to put a finger on its future growth. In Singapore, free-to-air TV commands the lion's share of audience. The numbers are staggering - 53% or 1.8 million viewers only watch free-to-air TV. On the other hand 95% of cable TV viewers continue to watch free-to-air TV. While these numbers alone may not tell the real story, they are proof that free-to-air TV may not be ready to retire. Moreover, it is mandatory for pay TV to carry free-to-air channels on its platforms giving free-to-air TV an automatic foothold in this market. Pay TV by nature is specialised TV, catering to a niche audience and appeals to those with high purchasing power. It is also inherently personal, with individual TV homes electing content as opposed to free-to-air TV that dictates content from the onset. At the same time, free-to-air TV carries unique local content that addresses the needs of the local population. So what does the future hold? Can free-to-air TV reside alongside pay TV and which one of them will have the upper hand? There is room for different operators to cater to different segments of the population. However free-to-air TV will have to fight harder to retain its viewership. Source: www.marketing-interactive.com

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Figure 1: Percentage of Consumers Using Pay TV Service for selected countries, 2010

100% 0%

IndiaChina

Germany US Japan

UK

Indonesia

Source: DisplaySearch Global TV Replacement Study (2010) Table 2: Per capita Gross Domestic Product (GDP) in US$ by countries, 2010 Country US Germany UK Japan China Indonesia India Per capita GDP (PPP) 47360 37950 36410 34640 7640 4200 3550 World ranking 8 16 18 19 93 117 123 Source: World Bank (2011)

Figure 2: Percentage of households in Singapore subscribing to pay TV, 2009-2012

*Estimate

Source: www.singstat.com & www.casbaa.com

Hwa Chong Institution. All Rights Reserved. Students Copy

Questions (a) (i)

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

According to Extract 1, consider whether TV broadcasting is a public good.

[3]

(ii)

Explain the reason for TV broadcasting to be provided by the government.

[2]

(b)

(i)

Using economic analysis, explain the most likely relationship between demand for Pay TV and income. [2]

(ii)

Assess whether the data supports the relationship.

[3]

(c)

(i)

Describe the trend of percentage of households in Singapore subscribing to pay TV. [1] Discuss what might happen to demand by firms to advertise on free-to-air TV in Singapore with the entrance of pay TV. [6]

(ii)

(d)

Using a diagram, explain the change in profit of MediaCorp after the entrance of MediaWorks. [3]

(e)

Evaluate MDAs decision to approve the merger of MediaCorp and MediaWorks.

[10]

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Session 2 (9 May 2013)

HCI 2009 Prelims Q2 Dealing with the Global Recession Extract 4: Building Britains future In response to the steep and synchronised global downturn, the UK Budget 2009 announced a package of measures that will support the adjustment towards renewed economic growth and improve the UKs competitiveness. A 750 million Strategic Investment Fund is set up to support advanced industrial projects of strategic importance. Additionally, a package of reforms to the taxation of foreign profits, including the introduction of an exemption for foreign dividends, supported by a limited restriction to the interest deduction rules has been introduced. The current corporate tax rate remains unchanged at 21%. The UK Budget 2009 also announced further Government action to support employment, by setting aside an additional 1.7 billion to help savers and families with children, to support pensioners, and to help people manage their finances. It also aims to implement guaranteed job trainings or work placements for all 18-24 year olds who have been unemployed for 12 months, to ensure no young people are left behind due to long-term unemployment. As part of this, the Government will allocate funding to provide 100,000 new jobs in socially useful activity and a further 50,000 jobs in areas of dense unemployment across the country. The guarantee will also offer new training courses, and Community Work placements. For this Budget, the Government is delivering fiscal support worth 4% of GDP in 2009-2010, and the operation of the automatic stabilisers. The Bank of England has cut Bank Rate to half a per cent and announced a 75 billion programme of asset purchases. With substantial macroeconomic stimulus already in place, this Budget focuses on further targeted support for those most affected by the downturn, and on ensuring a sustained and sustainable recovery, including support for employment and investment. In the UK, government borrowing is forecast to peak at 12.4% of GDP in 2009-2010, before falling as the economy recovers and the Government takes further action to ensure sustainability. The Budget also sets some tax and spending measures to reduce borrowing by 26.5 billion by 2013-14. Source: Adapted from the UK Budget 2009 Extract 5: Protectionism during recession The year 2008 has been defined by the worsening global economic climate, with the UK GDP contracting by 1.5 per cent in the last quarter of 2008 and with unemployment hitting 1.97 million, the focus for the government is definitely on tackling the recession. It's not just Britain that has to deal with a downturn; the rest of the world is struggling with the global recession and as this happens there could be a temptation to focus attention inwards rather than worrying about the constraints of a free market leading to protectionism.

Hwa Chong Institution. All Rights Reserved. Students Copy

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Supporters of protectionism believe that it will save local jobs and help aid declining industries, while those opposed believe it will cause what Professor Iain Begg from the European Institute at the London School of Economics and Political Science calls "a major spiral" where ultimately nobody wins from it. A strong advocate of free trade, Professor Begg also believes that a sufficient condition for getting rid of protectionist measures is that all countries act together in trying to deal with the causes of the recession and impose the appropriate macroeconomic policies. "Protectionism will only impede economic recovery and breed retaliation amongst trading countries," he says. Source: Adapted from www.politics.co.uk, 1 March 2009

Extract 6: Singapores Monetary Policy The Monetary Authority of Singapore (MAS) tightened the monetary policy stance in October 2007, by allowing a slightly steeper appreciation of the S$ nominal effective exchange rate (S$NEER) policy band. This was followed by an upward movement of the band to the prevailing level of the S$NEER in April 2008. Both external and domestic price pressures had strengthened as a result of rapid increases in global commodity prices and a build-up in domestic cost pressures. In October 2008, MAS shifted to a zero per cent appreciation of the S$NEER policy band, eliminating the crawl which had been in place since April 2004. The decision reflected the moderation of inflation from its peak in mid-2008, and also the higher risk of a further deterioration in the external outlook after September 2008, following the escalation of turbulence in global financial markets. Singapores monetary policy has also been complemented by its fiscal policy. In the latest Budget 2009, a $20.5 billion Resilience Package was unveiled. This expansionary Budget, which featured the Jobs Credit Scheme, aimed to save jobs, enhance the cash flow and competitiveness of firms, support families, and strengthen the economys long-term capabilities through the Skills Programme for Upgrading and Resilience (SPUR). At the same time, there was a reduction of corporate income tax rate from 18% to 17%. The coherent and complementary nature of these macroeconomic policies, together with the numerous Free Trade Agreements signed over the past few years, will not only provide a buffer against the present downturn, but also help to achieve economic stability and the main macroeconomic objective of sustained growth for Singapore. Source: Adapted from MAS Annual Report 2008/09

Hwa Chong Institution. All Rights Reserved. Students Copy

10

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Table 1: The Singapore Economy: Selected Economic Indicators 2005-2009 2005 GDP, at current market price (S$ bn) GDP, at 2000 market prices (% change) Inflation (% change) Unemployment rate (%) Productivity Growth (% change) Current account balance (% of GDP) Capital and Financial Account Balance (S$ bn) *forecast as at 2Q 2009 201.3 7.3 0.5 3.1 2.8 23.8 29.7 2006 221.1 8.4 1.0 2.7 1.6 26.4 35.1 2007 251.6 7.8 2.1 2.1 0.8 25.2 33.9 2008 257.4 1.1 6.5 2.2 7.8 15.2 16.2 2009* 240.9 8.8 0.1 3.6 8.7 15.5 35.8

Source: various

Table 2: The UK Economy: Selected Economic Indicators 2005-2009 2005 GDP at current market price ( bn) GDP at 2000 market prices (% change) Inflation (% change) Unemployment rate (%) Productivity Growth (% change) Current Account Balance (% of GDP) Capital and Financial Account Balance (bn) *forecast as at 2Q 2009 1,252.51 2.1 2.1 4.8 0.8 2.6 687.3 2006 1,321.86 2.8 2.8 5.4 2.4 3.4 571.9 2007 1,400.53 3.0 2.0 5.4 2.3 2.9 995.7 2008 1,442.92 0.7 3.9 5.6 0.5 1.7 655.2 2009* 1,413.79 -4.1 0.8 7.4 2.4 2.0 na

Source: various

Hwa Chong Institution. All Rights Reserved. Students Copy

11

(a)

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Summarise and account for the changes in the S$NEER since October 2007.

[5]

(b)

(i)

With the aid of a diagram, explain how tariffs on imports can save local jobs in the UK economy.

[3]

(ii)

Discuss the view that ultimately nobody wins from protectionism.

[6]

(c)

Consider whether the data would lead you to expect a further deterioration in the balance of payments of Singapore in 2009.

[4]

(d)

Discuss and compare the choice of growth policies adopted by Singapore and the UK in response to the current global downturn.

[12]

Hwa Chong Institution. All Rights Reserved. Students Copy

12

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Session 3 (14 May 2013)

HCI BT2 2011 Q2

International Trade in a Globalised World

Figure 3: World Trade Statistics

Source: The Economist, 18 December 2009

Extract 5: Globalisation changing the Composition of World Merchandise Trade In the last few decades, globalisation has contributed strongly to a surge in trade and Foreign Direct Investment (FDI) flows prior to the financial crisis. It has also seen the flow of technological know-how and people across regions. As a result of globalisation, a long-term shift in the composition of world merchandise trade has occurred. Firstly, the share of manufactured goods has been rising dramatically, against a decline in agricultural products and non-fuel minerals. Furthermore, the domination of developed countries in world exports of manufactures has been greatly diluted, first in labour-intensive goods (such as textiles and clothing) and subsequently in electronic products and capital-intensive goods (such as automotive parts). The industrial countries accounted for 85 per cent of world exports of manufactured goods in 1955 but their share declined to about two-thirds in 2008. A highly diverse group of developing economies now account for more than two-thirds of world clothing exports and more than one-half of world exports of textiles and office and telecom equipment. For all manufactured goods, the developing countries share is slightly more than a third, double their share 25 years ago. Source: Adapted from WTO: World Trade Report 2009

Hwa Chong Institution. All Rights Reserved. Students Copy

13

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Extract 6: Mixed Reaction by ASEAN leaders as Recession Batters Regional Economy Southeast Asian leaders pledged to cut trade barriers and open more service industries as the bloc struggles to overcome a global recession that has eroded export demand and boosted protectionist sentiment. The leaders reaffirmed their determination to ensure free flow of goods, services and investment and agreed to stand firm against protectionism and to refrain from introducing and raising new barriers. However, there are ASEAN leaders who warned that measures are necessary to shield domestic industries and goods from overseas competition as the worldwide economic downturn threatens jobs and hurts manufacturing. It is a normal reaction for countries to resort to protectionist tariffs in a slowdown, Malaysian Prime Minister Najib told the Bangkok Post in an interview. If we are not supportive of our own industries, and do not buy our own products and services we will have a serious problem, Najib said. As it is, we are told that countries which have been importing our products before are not going to be importing the same amount anymore. We have to protect our people, our jobs Indonesias Trade Ministry issued a decree ordering statutory boards to use local products, Jakarta Globe reported, citing Trade Minister Mari Pangestu. The decree is aimed at boosting domestic demand and helping local industries including food, beverages, footwear, clothing and music, the report said. Adapted from Bloomberg News 1 March 2010

Extract 7: Globalisation or Deglobalisation For the past two decades, globalisation has been touted as an ideal concept that would bring about prosperity for the whole world. The idea is that countries can trade goods and services without many barriers in the international markets, and enjoy the free flow of crossborder capital investments. Also, globalisation will allow cross-border migration of workers and hasten the speed of technology and knowledge transfer. So, many countries have rushed towards financial and trade liberalisation to open up their economies and reap the benefits of globalisation. And for the past 10 years, international trade has grown at breakneck speed while crossborder investments have risen rapidly. Skilled workers and professionals have moved easily to other countries for employment. The developing countries, particularly those in Asia, benefited most from this process. Their economies have grown faster than those of the developed nations.

Hwa Chong Institution. All Rights Reserved. Students Copy

14

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

But today, since the world-wide financial crisis, the worlds economies are certainly slowing fast and globalisation is now in trouble. World trade has plunged. The downturn has been sharpest in countries that opened up most to world trade, especially East Asias tigers. Singapores exports are 186% of GDP; its economy shrank at an annual rate of 17% in the last three months of 2008. Taiwans exports are over 60% of GDP; and its economy may fall as much as 11% this year. On average, says the IMF, rich countries will contract 2% this year. As a result, some believe that this economic turmoil has given rise to a new phenomenon called deglobalisation. The move to deglobalise, economists explain, is motivated by a countrys desire to minimise its dependence on trade, and to a certain extent, delink itself from the beleaguered global financial system. As the global crisis accelerates, many countries have begun to turn to their own resources to grow their economies. Protectionist barriers are rising and governments are turning inwards. For instance, the Philippines has its own Buy Filipino campaign, while the US has a Buy American clause in President Barack Obamas recently approved economic stimulus package. But economists say although the processes of globalisation have slowed, it is still too early to conclude whether globalisation has shifted into reverse gear. The biggest emerging markets which have benefitted much from globalisation with doubledigit growth are doing less badly so far. In India, where exports are around 15% of GDP, the government recently said growth in the year to April 2009 would be 7.1%. China was still growing by 6.8% in the year to the fourth quarter. All these countries have large domestic markets and relatively stable banking systems, which have not been liberalised. The economists believe this could just be a cyclical phenomenon that will fade away in time. And despite the downturn, the nations of the world have not shunned globalisation. Source: Adapted from The Economist, 19 February 2009 and The Star Online, 14 March 2009

Hwa Chong Institution. All Rights Reserved. Students Copy

15

Questions

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

(a)

With reference to Figure 3, between the period 1990 to 2008, (i) summarise the change in the volume of world trade. [2]

(ii)

explain two possible reasons for the change in the volume of world trade.

[4]

(b)

According to Extract 5, globalisation has brought about a long-term shift in the [6] composition of world merchandise trade. Using the theory of comparative advantage, explain how globalisation has facilitated the change in the pattern of world trade.

(c)

Evaluate the measures adopted by the governments of Malaysia and Indonesia in [8] view of the threats from free trade and global competition.

(d)

In light of the data provided, assess whether the view globalisation is now in trouble [10] is well-founded.

Hwa Chong Institution. All Rights Reserved. Students Copy

16

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Session 4 (16 May 2013)

HCI BT2 2012 Q2 Financial Crisis in Europe The Financial Crisis sweeping across Europe is threatening to break up the European Union (EU). The crisis is due to a combination of factors, with one theory being the ease of credit conditions that facilitated high-risk lending and borrowing practices. Many of the economies in the EU are now drowning in an ocean of unsustainable fiscal debt and is hurting investors confidence. Germany and a few other "healthy" members of the EU are trying to contain the situation through a series of bailout packages. Figure 1: Value of Euro (average rate per US$)

1 0.9 0.8 0.7 0.6 2006 2007 2008 2009 2010

Source : European Central Bank

Extract 5: An economy crumbles Greece is one of those economies that borrowed heavily in the financial market during the era of low interest. The government spent massively on the public sector in the form of extremely generous pay and pension benefits. Following the tightening of credit conditions, Greece find itself facing the risk of defaulting on its massive debt. The EU rallied to lend Greece money. In return, Greece needs to reduce its debt to GDP ratio from the current 160% to 120.5% by 2020. It must agree to continue with tight austerity measures. Few investors or businesses are brave enough to make long-term bets on the Greek economy in these conditions. Greeces economic problems are too big to be fixed quickly. In addition, The Euro has come under pressure as investors wonder if Greeces fiscal crisis will spread to other heavily indebted economies within the EU. The Euro in the past six months has fallen by about 17% against the US dollar as investors rushed to ditch the currency. Source: various

Hwa Chong Institution. All Rights Reserved. Students Copy

17

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package Table 3: Selected Economic Indicators for Greece, 2006 2011 2006 2007 3 53,444 155,827 2008 0.2 51,568 169,124 2009 3.3 44,141 168,169 2010 3.5 37,770 167,363 2011 6.9 30,012 162,320

Annual rate of growth in real GDP (%) Gross Fixed Capital formation (Million EUR) Final consumption expenditure of households (Million EUR) Current account for Greece (Million EUR) Inflation rate (%) Unemployment Rate (%) Life Expectancy Infant Mortality Rate (per 1000 birth) Inward FDI from rest of the world (% of GDP) *na: not available

5.5 49,508 145,362

23,759 3.3 8.9 78.8 3.7 2

32,602 3 8.3 78.7 3.5 0.7

34,798 4.2 7.7 79.2 2.7 1.3

25,814 1.3 9.5 79.5 3.1 0.8

22,971 4.7 12.6 79.9 3.8 0.1

21,093 3.1 17.1 na* na* na*

Source: Eurostat

Table 4: Selected Economic Indicators for Germany, 2006 2011 2006 Annual rate of growth in real GDP (%) Gross Fixed Capital formation (Million EUR) Final consumption expenditure of households (Million EUR) Current account for Germany (Million EUR) Inflation rate (%) Unemployment Rate (%) Life Expectancy Infant Mortality Rate (per 1000 birth) 3.7 417,820 1,339,540 2007 3.3 447,,880 1,356,730 2008 1.1 460,740 1,387,700 2009 - 5.1 409,260 1,387,430 2010 3.7 433,580 1,423,020 2011 3 467,690 1,474,420

144,739 1.8 5.4 79.2 3.8

180,912 2.3 5.3 79.4 3.9

153,634 2.8 5.6 79.5 3.5

140,559 0.2 7.6 79.6 3.5

150,668 1.2 7.8 79.8 3.4

147,656 2.5 8.1 na* na*

Source: Eurostat

Hwa Chong Institution. All Rights Reserved. Students Copy

18

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Extract 6: The Contagion of Austerity Austerity is the new contagion, spreading across Europe beginning with Ireland, then Greece, Spain, Portugal and today it enveloped Italy. Some of these austerity measures include: cutting government spending by pay freeze for most public sector workers, government ministries to reduce expenses and cutting ministers' salaries; and some higher earners will also face higher taxes. New powers now give the European Commission the right to levy fines on countries that fail to comply with austerity measures to bring budget deficits to within the European Unions 3 per cent target1. Some economists such as Paul Krugman however felt that slashing spending while the economy is still deeply depressed is both an extremely costly and quite ineffective way to reduce future debt. Costly, because it depresses the economy further; ineffective, because by depressing the economy, fiscal contraction now reduces tax receipts. For him, the right thing, overwhelmingly, reduce spending after the economy has recovered. As a result of the harsh austerity measures, growth in EU is expected to be 0.2% this year. In the short term, Europe is being forced to demonstrate to investors it can manage its deficits to bring back confidence in the region. But in the longer-term, it will have to show a political will to increase productivity. That will mean tearing up some of the labour laws that make hiring and firing difficult. Source: Adapted from BBC News, 25th May 2010 (a) (i) (ii) How does the value of the Euro in 2010 compare to its value in 2008? With the use of an appropriate diagram, account for this change in the value of the Euro. Describe the trend of Greeces inward FDI from rest of the world from 2008 to 2010 in Table 3. In light of the data presented, comment on the likely impact of the change in the value of the Euro described in (ai) on Greeces Balance of Payments. Compare the unemployment rate for Greece and Germany over the period 2006 to 2011. Assess whether the data provided will lead one to conclude that the current and future standard of living for Germany is higher than Greece. [1] [3]

(b)

(i)

[1]

(ii)

[5]

(c)

(i)

[2]

(ii)

[8]

(d)

Discuss how the austerity measures will help alleviate the recession in EU.

[10]

In 1992, the Treaty of Masstricht set the fiscal criteria to be met in order to join European Union (EU): the limits of government budget deficit must be kept at 3 percent of GDP and the debt to GDP ratio at 60%.

Hwa Chong Institution. All Rights Reserved. Students Copy

19

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Session 5 (23 May 2013)

HCI BT2 2011 Q1

The Global Pharmaceutical Industry Extract 1: Research & Development (R&D) Woes for Pharmaceutical Giants In the pharmaceutical industry, patent protection is an essential stimulant to research. The worlds biggest company Pfizer, has an annual R&D budget of over $7 billion. R&D costs constitute substantial part of the cost of putting a product on the market. In general, the results of that R&D can be very easily copied because synthesis and manufacturing processes are comparatively simple. This means research costs become sunk costs which could not be recovered in the face of competition from imitators who have not had to incur the costs. Protection of intellectual property rights (IPRs) through patents or other means is, therefore essential if companies are to invest in research to develop new products. However, when the patent on a particular drug expires, usually twenty years after the date at which it is granted, smaller generics companies are able to step in and exploit the lapse of the patent on the original drug to make their own special generics. Generics are different drugs containing the same active ingredients. For instance, the patent for Ventolin, an antiasthmatic drug made by Glaxo has now expired and the active ingredient, salbutomal, is now being used by other smaller generics companies to make anti-asthma drugs. Successful development of new drugs is becoming increasingly difficult. R & D is taking a growing proportion of companies revenues and yet spending more money on developing compounds is no guarantee of success. In addition, the market share of these pharmaceutical giants has been challenged by cheaper generic rivals. Over the next five years, a record $70 billion worth of drugs will face competition in America alone as their patents expire. Source: various Figure 1: Market Share of Pharmaceutical Manufacturers in the United States, 2006

Others 23.48% Johnson and Johnson 18.98%

Amgen 5.08%

Pfizer 17.21%

Eli Lilly and Co. 5.58%

HwaSquibb Chong Bristol-Myers 6.38%

Institution. All Rights Reserved. Students Copy Merck & Co.

8.06% Wyeth 7.24% Abbott Laboratories 8.00%

20

Source: Wikipedia

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Extract 2: Prescription for Change

On 26th Jan 2009, Pfizer announced that it is bidding for Wyeth, a large fellow American rival. Taking over Wyeth would cement Pfizers position as the worlds leading drugmaker. Pfizer clearly reckons that greater scale is an answer not only to the slower growth in the industry but also from competition by generic drug companies. In the next couple of years the threat will intensify as billions of dollars worth of branded drugs are set to lose patent protection. The problem is acute for Pfizer. Lipitor, a blockbusting cholesterol drug that provides $12 billion in annual revenues, is set to go off patent in 2011. Getting hold of Wyeth would provide some protection: costs could be cut by bringing together research budgets and by reducing vast overlapping marketing operations of the two firms. Six weeks after Pfizer's $68bn acquisition of Wyeth, on 9 Mar 2009, a second high-profile merger was announced in the pharmaceutical industry. American company Merck announced a $41.1bn (29.8bn) takeover of rival American drug firm Schering-Plough. Merck said the deal would mean savings of $3.5bn a year from 2011. Analysts expect the moves to put further pressure on other firms to do likewise. There have already been thousands of job cuts across the pharmaceutical industry over the past year in an effort to lower costs, and the combined Merck and Schering-Plough, both based in New Jersey, expect to lose a further 16,000 people. The combined company will benefit from a formidable research and development pipeline, a significantly broader portfolio of medicines and an expanded presence in key international markets, particularly high-growth emerging markets," said Merck chairman and chief executive Richard Clark, who will lead the combined company. Source: Adapted from The Economist, 26 Jan 2009 and Guardian, 9 Mar 2009

Extract 3: Big Pharmaceutical Companies Caught 'Delaying' Cheaper Drugs European patients, taxpayers and national treasuries are being fleeced of billions of euros because of the big pharmaceutical companies' elaborate campaigns to delay the marketing of cheaper generic drugs, the European commission said. Neelie Kroes, the competition commissioner, unveiling the findings of an 18-month inquiry into the pharmaceuticals sector, said "Makers of original medicines are actively trying to delay the entry of generic medicines on to their markets." Investigations showed that major firms had struck at least 200 settlements with generics manufacturers, costing 200m (173m) and mainly aimed at restricting the marketing of generic drugs. Another key tactic was for the major firms to sue generics companies and then stall the cases in court for several years, prompting calls for a new Europe-wide patent and a unified system of litigation to save time and money.

Hwa Chong Institution. All Rights Reserved. Students Copy

21

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Millions of euros are spent on promotional activities to create brand loyalty, in legal disputes and settlement agreements instead of in the development of new medicines. This delays or prevents the entry of more affordable and innovative medicines into the market. It is estimated that generic drugs are on average 40% cheaper than their branded equivalents within two years of coming on the market. Source: Adapted from Guardian, 8 July 2009 Extract 4: Spike in US Prices for Brand-name Drugs calls for New Measures U.S. prices for brand-name drugs of big pharmaceutical companies are rising faster than ever as patents expire on top-selling medicines and the pharmaceutical industry nervously eyes the future of healthcare reform. Two thirds of the drugs saw double-digit price hikes, well above inflation of 1.6 percent in 2010 measured using the consumer price index. The analysis indicates drug makers are scrambling to make as much money as possible from blockbuster drugs before their patents expire, while taking advantage of the fact that last year's healthcare reform bill did not cap drug prices. Consumer groups are calling for price controls on individual pharmaceutical companies. Drug makers argue they need the revenue to pay for developing new medicines. Winning regulatory approval for a drug takes, on average, 15 years and $1 billion, but we only have 20 years of patents to make a return on our investments in R&D" said Karl Uhlendorf, deputy vice president of the Pharmaceutical Research and Manufacturers of America. If the number of years of patents could be extended, prices could be lower, he added. Drug companies have a responsibility to their shareholders to maximize profits and that drives them to charge as much as they can for their drugs. It is their R & D investments that lead to pioneering advances that improve patient care. However, the cost of developing drugs is also skyrocketing and without higher prices, such investments may dry up. Drug companies suggest that if the government could subsidise their R & D cost so as to speed up the development of new and better drugs. Source: Adapted from Reuters, 23 Mar 2011

Hwa Chong Institution. All Rights Reserved. Students Copy

22

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Figure 2: Profitability** Among Pharmaceutical Manufacturers Compared to Other Industries, 1995-2009

*Data for Fortune 500 firms are not available for 2007-2009 **Profitability percent refers to median percent net profit after taxes as a percent of firm revenues for all firms in the industry.

Source: Kaiser Family Foundation

(a)

(i)

Explain why the pharmaceutical industry in the United States is an oligopoly.

[4]

(ii)

With the use of a diagram, explain the impact of the expiry of patents on the profit level of big pharmaceutical companies.

[4]

(iii) Explain how big pharmaceutical companies and manufacturers of generic drugs might compete against each other.

[4]

(b)

Discuss whether the trend towards mergers in the pharmaceutical industry is beneficial to pharmaceutical firms and consumers.

[8]

(c)

With reference to Extract 4, evaluate the effectiveness of the three measures a [10] government could adopt to protect the interests of consumers.

Hwa Chong Institution. All Rights Reserved. Students Copy

23

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Session 6 (30 May 2013)

HCI BT2 2012 Q1 Luxury Goods Retail Market Extract 1: Retailers in the Age of the Internet People seem to enjoy shopping on the internet, if high customer-satisfaction scores are any guide. Websites are doing more and cleverer things to serve and entertain their customers, and seem set to take a much bigger share of people's overall spending in the future. One of the biggest commercial advantages of the internet is a lowering of transaction costs and as long as the internet continues to deliver price and product information quickly and securely, e-commerce will continue to grow. With shoppers migration to the internet, retailers may have little choice but to create strong internet operations of their own. The biggest winners will be consumers as they can look forward not only to ever-greater convenience thanks to the internet but also find physical stores competing with online stores to make the shopping experience a pleasure. In China, however, online shoppers are finding causes for complaint as consumers can only see product images and do not meet the actual sellers. Unlike malls, websites cannot give customers the chance to try goods before buying. Many of the complaints could, however, have been avoided if stricter government regulations and supervision had been established. Adapted from Economist.com, China Daily, 2012

Table 1: Year on Year Change in Retail Sales & GDP Growth in the US, 2004-2010 Year % Change in e-commerce sales % Change in retail sales* % Real GDP Growth 2004 27.5 6.5 3.5 2005 25.1 6.2 3.1 2006 23.8 5.0 2.7 2007 20.2 3.2 1.9 2008 3.0 -1.3 -0.3 2009 1.7 -7.5 -3.5 2010 15.2 6.8 3.0

* Retail sales figure is not inclusive of e-commerce sales Source: US Department of Commerce

Hwa Chong Institution. All Rights Reserved. Students Copy

24

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Extract 2: Luxury Goods Enjoy Bumper Years Despite Rising Costs Companies are concerned about high raw material and production costs. However, in the luxury space, high-end brands have little to fear from rising raw material costs that have added to the pressures on other sectors of the economy. Luxury is about quality detail and authenticity. The high raw material prices will also have a smaller impact than other non-luxury goods companies because they represent a smaller percentage of their cost base which also includes cost outlay on advertising and celebrity endorsements. Comfortable profit margins of 55-75 percent, production mainly located in Europe where wages do not explode as in China, and strong pricing power offer luxury goods groups some shelter from cost pressures. Luxury brands have all enjoyed bumper years. China is on pace to top Japan as the world's largest market for luxury goods with sales estimated to surge 18% annually. Chinese consumption of luxury goods have surged despite hefty consumption taxes being imposed on luxury items in China to lessen the income gap. Well-heeled Chinese shoppers have longed swarmed to Hong Kong and Europe for products such as Rolex watches to avoid the hefty tariffs. Adapted from cna.com, cnn.com, 2012 Table 2: Income Distribution in China Year Gini Coefficient 2004 0.457 2005 0.457 2006 0.462 2007 0.473 2008 NA 2009 0.480

Adapted from various sources

Extract 3: Misleading Advertisement by Luxury Brand Banned The Advertising Standards Authority2 (ASA) has banned a series of print advertisements for luxury fashion brand Louis Vuitton, ruling that they misled the public by suggesting its expensive leather bags were hand-made. Louis Vuitton, part of the LVMH group, ran advertisements showing workers using a needle and thread and other artisanal techniques. Wording emphasized the individual attention to detail lavished on each product. While acknowledging the company's use of hand crafting, the ASA ruled that Louis Vuitton could not justify the message because it also used sewing machines and would not reveal how much work was done by hand. The ruling is a setback for the 156-year-old French firm, which markets its monogrammed bags as elegant examples of workmanship in an age of mass production. Adapted from www.independent.co.uk, 2010 2 ASA is the UK's independent regulator of advertising across all media. They work to ensure ads are

legal, decent, and truthful by applying the Advertising Code written by the advertising industry.

Hwa Chong Institution. All Rights Reserved. Students Copy

25

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Extract 4: Survival Strategies for Luxury Goods Value has become an important consideration for consumers of luxury goods. With the rising popularity of online discount luxury good sellers that carry time-limited offers of off-season luxury items at high discounts, the need to avoid undercutting by competitors is high. Several lower-end luxury brands are responding to the pressures of increased competition and price-conscious shoppers by aggressively investing in the expansion of discount outlets. Manufacturers such as Coach and Polo Ralph Lauren have a legacy of using discount outlets and online promotions to clear off-season goods without diluting the brand name. High-end luxury retailers that have built brands on image and lifestyle can withstand greater competitive pricing differences. Although promotions and discounting can boost the financial performance of high-end luxury retailers in the short term, shrinking profit margins and loss of prestige among more traditional luxury shoppers are a real concern in the long run. Brick-and-mortar channels will remain important, as they appeal more to the traditional prestigehunting luxury consumers. However, given that new, younger luxury shoppers prefer to shop online, establishing a powerful online presence is a key step for luxury goods manufacturers and retailers. Online shopping also provides a more private experience especially during the financial crisis when flaunting newly bought goods can be considered to be insensitive. While luxury brands experienced mixed fortunes in the financial crisis, not all premium labels have had to tighten their handcrafted belts. At Louis Vuitton (LV), sales remained robust throughout the economic turmoil. The brand never discounts or has a sale, translating to a good investment for customers as the brand holds its value. It also benefits from consistency in its marketing and production strategies as majority of its products are still made in France while its shoe production facilities are in Italy. French rival Herms moved fast as markets changed, opening and renovating 32 stores worldwide and forging into new territories in Brazil, Panama, and Turkey. Common factors keep customers coming back to luxury brands or help them to attract new buyers. It's all about a sense of belonging, ensuring the right celebrity is attached to the brand, maintaining exclusivity by never having a sale, being highly selective about where new stores are opened and providing a premium service. Adapted from: Accenture.com, http://knowledge.asb.unsw.edu, 2011

Hwa Chong Institution. All Rights Reserved. Students Copy

26

Questions (a) (i)

HWA CHONG INSTITUTION Year Two H2 Economics 2013 (TERM 2) Pre-Prelim Preparation (P-cube) Revision Package

Compare the trend of total retail sales and e-commerce sales in the US from 2004-2010.

[2]

(ii)

Explain one reason for the above difference.

[2]

(b)

Explain how the increasing presence of retailers online has benefited consumers.

[2]

(c)

With reference to Extract 2, (i) distinguish the types of costs faced by firms in the luxury goods industry. [2]

(ii)

with the aid of a diagram, explain how the profits of luxury goods makers are likely to change with rising costs. [4]

(d)

Assess whether government intervention in the luxury goods market is justified.

[8]

(e)

Discuss how firms in the luxury goods market might compete with each other.

[10]

Hwa Chong Institution. All Rights Reserved. Students Copy

27

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SWOT Analysis Microtel by WyndhamDocument10 pagesSWOT Analysis Microtel by WyndhamAllyza Krizchelle Rosales BukidNo ratings yet

- Manual MIB 303S-13/33Document58 pagesManual MIB 303S-13/33Daniel Machado100% (1)

- Computer Graphics Mini ProjectDocument25 pagesComputer Graphics Mini ProjectGautam Singh78% (81)

- (Rajagopal) Brand Management Strategy, Measuremen (BookFi) PDFDocument317 pages(Rajagopal) Brand Management Strategy, Measuremen (BookFi) PDFSneha SinghNo ratings yet

- 1.reasons For VariationsDocument2 pages1.reasons For Variationsscribd99190No ratings yet

- East St. Louis, Illinois - Wikipedia, The Free EncyclopediaDocument9 pagesEast St. Louis, Illinois - Wikipedia, The Free Encyclopediadavid rockNo ratings yet

- RA 9184 & RA 3019 NotesDocument5 pagesRA 9184 & RA 3019 Notesleng_evenNo ratings yet

- A Case Study From The: PhilippinesDocument2 pagesA Case Study From The: PhilippinesNimNo ratings yet

- KL1508 KL1516: 8/16-Port Cat 5 High-Density Dual Rail LCD KVM SwitchDocument5 pagesKL1508 KL1516: 8/16-Port Cat 5 High-Density Dual Rail LCD KVM SwitchnisarahmedgfecNo ratings yet

- An Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentDocument14 pagesAn Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentRamneet kaur (Rizzy)No ratings yet

- CRM Module 1Document58 pagesCRM Module 1Dhrupal TripathiNo ratings yet

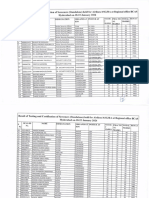

- West Bengal Joint Entrance Examinations Board: Provisional Admission LetterDocument2 pagesWest Bengal Joint Entrance Examinations Board: Provisional Admission Lettertapas chakrabortyNo ratings yet

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDocument14 pagesEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNo ratings yet

- HyderabadDocument3 pagesHyderabadChristoNo ratings yet

- ANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)Document3 pagesANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)ryujinxxcastorNo ratings yet

- IMO Special Areas Under MARPOLDocument2 pagesIMO Special Areas Under MARPOLRavi Viknesh100% (1)

- Resume (Suyash Garg)Document1 pageResume (Suyash Garg)Suyash GargNo ratings yet

- BSDC CCOE DRAWING FOR 2x6 KL R-1Document1 pageBSDC CCOE DRAWING FOR 2x6 KL R-1best viedosNo ratings yet

- BBI2002 SCL 7 WEEK 8 AdamDocument3 pagesBBI2002 SCL 7 WEEK 8 AdamAMIRUL RIDZLAN BIN RUSIHAN / UPMNo ratings yet

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerNo ratings yet

- Bemts-I (A) : Air Uni IsbDocument11 pagesBemts-I (A) : Air Uni IsbUmair AzizNo ratings yet

- Inductive Grammar Chart (Unit 2, Page 16)Document2 pagesInductive Grammar Chart (Unit 2, Page 16)Michael ZavalaNo ratings yet

- Guglielmo 2000 DiapirosDocument14 pagesGuglielmo 2000 DiapirosJuan Carlos Caicedo AndradeNo ratings yet

- B&G 3DX LiteratureDocument2 pagesB&G 3DX LiteratureAnonymous 7xHNgoKE6eNo ratings yet

- Student Application Form BCIS - 2077Document2 pagesStudent Application Form BCIS - 2077Raaz Key Run ChhatkuliNo ratings yet

- SHPXXX 20 IS XX 13Document240 pagesSHPXXX 20 IS XX 13Geyciane PinheiroNo ratings yet

- Formula Retail and Large Controls Planning Department ReportDocument235 pagesFormula Retail and Large Controls Planning Department ReportMissionLocalNo ratings yet

- Helsingborg EngDocument8 pagesHelsingborg EngMassaCoNo ratings yet

- Sahara International Petrochemical Company (SIPCHEM)Document2 pagesSahara International Petrochemical Company (SIPCHEM)shahbaz1979No ratings yet

- Farmers' Satisfaction With The Paddy Procurement Practices of The National Food Authority in The Province of Palawan, PhilippinesDocument13 pagesFarmers' Satisfaction With The Paddy Procurement Practices of The National Food Authority in The Province of Palawan, PhilippinesPsychology and Education: A Multidisciplinary JournalNo ratings yet