Professional Documents

Culture Documents

The Monetary System - Tutorial PDF

Uploaded by

safdar2020Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Monetary System - Tutorial PDF

Uploaded by

safdar2020Copyright:

Available Formats

The Monetary System

Question 1: What are reserve requirements? Why State Bank of Pakistan use reserve requirements to control the money supply? Reserve requirements are regulations on the minimum amount of reserves that banks must hold against deposits. An increase in reserve requirements raises the reserve ratio, lowers the money multiplier, and decreases the money supply. When using reserve requirements, the central bank is not so completely in control. Question 2: What is meant by the following terms: capital adequacy ratio, liquidity ratio and cash reserve ratio? How does a decrease in the OCR affect the cash reserve ratio, and why? The capital adequacy ratio (CAR) is the ratio of a banks capital stock that is easily exchangeable to cash to its total risk weighted financial assets. The liquidity ratio (LR) the ratio of settlement cash to banks assets that can be used as collateral. The reserve ratio is the ratio of the amount of cash reserves that banks must hold against deposits. If the SBP decreases the CMR, the banks will lower their cash-to-deposit ratio, and the money multiplier will work such that the money supply will increase at any given level of interest. This is because a lower CMR decreases the opportunity cost of cash reserves and hence the banks will lower their cash-to-deposits ratio.

Question 3: National Bank (NB) holds $250 million in deposits and maintains a reserve ratio of 10%. a) Show a T-account for NB b) Now suppose that NBs largest depositor withdraws $10 million in cash from her account. If NB decides to restore its reserve ratio by reducing the amounts of loans outstanding, show its new T-account. c) Explain what effect NBs action will have on other banks. d) Why might it be difficult for NB to take the action described in part (b)? Discuss another way for NB to return to its original reserve ratio. a) Here is NB's T-account: National Bank Assets Reserves Loans $25 million $225million Deposits Liabilities $250 million

b) When NB's largest depositor withdraws $10 million in cash and NB reduces its loans outstanding to maintain the same reserve ratio, its T-account is now:

National Bank Assets Reserves Loans $24 million $216 million Deposits Liabilities $240 million

c) Since NB is cutting back on its loans, other banks will find themselves short of reserves and they may also cut back on their loans as well. d) NB may find it difficult to cut back on its loans immediately, since it cannot force people to pay off loans. Instead, it can stop making new loans. But for a time it might find itself with more loans than it wants. It could try to attract additional deposits to get additional reserves, or borrow from another bank or from the SBP.

Question 4: The State Bank buys $20 million worth of government bonds from a selected number of registered banks which are registered for such open market operations. If the optimal reserve ratio is 5%, what is the largest possible increase in the money supply for any given interest rate that could result? What is the smallest possible increase? Explain.

With a required reserve ratio of 5 per cent, the money multiplier could be as high as 1/.05 = 20, if banks hold no excess reserves and people do not keep some additional currency. So the maximum increase in the money supply from a $20 million openmarket purchase is $400 million. The smallest possible increase is $20 million if all of the money is held by banks as excess reserves.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- AssssssssssDocument9 pagesAsssssssssssafdar2020No ratings yet

- Conclusion SuggestionDocument2 pagesConclusion Suggestionsafdar2020No ratings yet

- Registration of Corporation: Submitted byDocument1 pageRegistration of Corporation: Submitted bysafdar2020No ratings yet

- Money Growth and Inflation: The Meaning of MoneyDocument29 pagesMoney Growth and Inflation: The Meaning of Moneysafdar2020No ratings yet

- Female Economy (Autosaved)Document39 pagesFemale Economy (Autosaved)safdar2020No ratings yet

- MBA Macroeconomics Assignment - 2 PDFDocument2 pagesMBA Macroeconomics Assignment - 2 PDFsafdar2020No ratings yet

- Ishtq IndivasssDocument9 pagesIshtq Indivassssafdar2020No ratings yet

- NawazDocument19 pagesNawazsafdar2020No ratings yet

- Ishtq IndividualDocument9 pagesIshtq Individualsafdar2020No ratings yet

- 196VB 0Document4 pages196VB 0safdar2020No ratings yet

- Production and Growth: 8 March 2013Document42 pagesProduction and Growth: 8 March 2013safdar2020No ratings yet

- Measuring The Cost of Living: Aman 22 February 2013Document37 pagesMeasuring The Cost of Living: Aman 22 February 2013safdar2020No ratings yet

- Tutorial WeekI PDFDocument4 pagesTutorial WeekI PDFsafdar2020No ratings yet

- Measuring The Cost of Living: Aman 22 February 2013Document37 pagesMeasuring The Cost of Living: Aman 22 February 2013safdar2020No ratings yet

- Q&A WeekI PDFDocument1 pageQ&A WeekI PDFsafdar2020No ratings yet

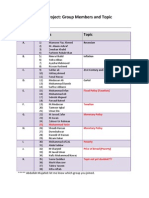

- Mini Project: Group Members and TopicDocument1 pageMini Project: Group Members and Topicsafdar2020No ratings yet

- Methodology of Price Collection and Computing Price IndicesDocument11 pagesMethodology of Price Collection and Computing Price Indicessafdar2020No ratings yet

- Measuring The Cost of Living: Assignment No 1Document1 pageMeasuring The Cost of Living: Assignment No 1safdar2020No ratings yet

- Key Concepts and Definitions in Labor Force SurveyDocument6 pagesKey Concepts and Definitions in Labor Force Surveysafdar2020No ratings yet

- Measuring The Cost of LivingDocument2 pagesMeasuring The Cost of Livingsafdar2020No ratings yet

- Final Project For Nestle PakistanDocument35 pagesFinal Project For Nestle Pakistanshahrose93% (28)

- One Pager On Gold Vs CpiDocument1 pageOne Pager On Gold Vs Cpisafdar2020No ratings yet

- Main PageDocument1 pageMain Pagesafdar2020No ratings yet

- Natural Rate of Unemployment and Its Factors in Developing NationsDocument1 pageNatural Rate of Unemployment and Its Factors in Developing Nationssafdar2020No ratings yet

- Registration of Corporation: Submitted byDocument1 pageRegistration of Corporation: Submitted bysafdar2020No ratings yet

- Lecture 3 - Principles of ManagementDocument35 pagesLecture 3 - Principles of Managementsafdar2020No ratings yet

- Natural Rate of Unemployment and Its Factors in Developing NationsDocument1 pageNatural Rate of Unemployment and Its Factors in Developing Nationssafdar2020No ratings yet

- Assignment 2Document1 pageAssignment 2safdar2020No ratings yet

- Lecture 6-Principles of ManagementDocument22 pagesLecture 6-Principles of Managementsafdar2020100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- KOTAK MahindraDocument121 pagesKOTAK MahindraRahul SoganiNo ratings yet

- 22BEDocument491 pages22BESanjay AgnihotriNo ratings yet

- FIM-Module II-Banking InstitutionsDocument11 pagesFIM-Module II-Banking InstitutionsAmarendra PattnaikNo ratings yet

- Exam 2013 With Memo PDFDocument42 pagesExam 2013 With Memo PDFTumi Mothusi100% (1)

- SALVATION THROUGH INFLATION - The Economics of Social Credit - Gary NorthDocument333 pagesSALVATION THROUGH INFLATION - The Economics of Social Credit - Gary NorthA.J. MacDonald, Jr.No ratings yet

- Compress ActivityACCBBP100 (Week 1-3) FinalDocument4 pagesCompress ActivityACCBBP100 (Week 1-3) FinalOiram Ocirol50% (2)

- (B) Increase DecreaseDocument5 pages(B) Increase Decreaseyiming peiNo ratings yet

- Introduction to Economic FluctuationsDocument11 pagesIntroduction to Economic FluctuationsClerisha DsouzaNo ratings yet

- New Central Bank ActDocument12 pagesNew Central Bank ActLouisPNo ratings yet

- Group 3 Report DEVELOPMENT POLICIES AND PROGRAMS FINALDocument85 pagesGroup 3 Report DEVELOPMENT POLICIES AND PROGRAMS FINALMicsjadeCastilloNo ratings yet

- The Behavior of Interest Rates: Cecchetti, Chapter 7Document41 pagesThe Behavior of Interest Rates: Cecchetti, Chapter 7Trúc Ly Cáp thịNo ratings yet

- Fiscal, Monetary & Supply Side Policies (4.3, 4.4 & 4.5 in Syllabus)Document17 pagesFiscal, Monetary & Supply Side Policies (4.3, 4.4 & 4.5 in Syllabus)Bianca WoanyahNo ratings yet

- Economic Conditions Analysis for BUS 530 Final AssignmentDocument12 pagesEconomic Conditions Analysis for BUS 530 Final AssignmentShoaib AhmedNo ratings yet

- ECN209 International Finance MidTerm Coursework ExamDocument7 pagesECN209 International Finance MidTerm Coursework Examhunainzia744No ratings yet

- Terra White PaperDocument16 pagesTerra White Paperkr2983No ratings yet

- Chapter 7 Conduct of Monetary Policy: Tools, Goals, and TargetsDocument10 pagesChapter 7 Conduct of Monetary Policy: Tools, Goals, and TargetskiracimaoNo ratings yet

- The Money Supply: M1, M2, M3Document4 pagesThe Money Supply: M1, M2, M3Veronica GarsteaNo ratings yet

- Untitled13 PDFDocument22 pagesUntitled13 PDFErsin TukenmezNo ratings yet

- Ap Macro 2017-2018-BurbineDocument10 pagesAp Macro 2017-2018-Burbineapi-366462466No ratings yet

- RBI Annual Report 2010-2011Document208 pagesRBI Annual Report 2010-2011Aparna PandeyNo ratings yet

- Chapter 38Document31 pagesChapter 38kesianaNo ratings yet

- Fed Money Supply ChapterDocument4 pagesFed Money Supply ChapterVanu VanujanNo ratings yet

- A Study On Impact of Apex Bank Decission On Indian BanksDocument56 pagesA Study On Impact of Apex Bank Decission On Indian BanksAnonymous yXJnZMtNo ratings yet

- Bouchena Abed AssamedDocument85 pagesBouchena Abed Assamedالتهامي التهاميNo ratings yet

- All Subject Syllabus Class 12 CBSE 2020-21Document51 pagesAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNo ratings yet

- Economic DevelopmentDocument44 pagesEconomic DevelopmentIrina NamNo ratings yet

- Hancock TheDocument52 pagesHancock Theshubhkarman_sin2056No ratings yet

- Swiss Finance Banking, FinanceDocument639 pagesSwiss Finance Banking, FinancePaulino Aguilera MalagónNo ratings yet

- Alternative Economic System Maher D KababjiDocument50 pagesAlternative Economic System Maher D KababjiChihab-abderrahmane SafiNo ratings yet

- Money Demand and SupplyDocument22 pagesMoney Demand and SupplyHarsh Shah100% (1)