Professional Documents

Culture Documents

Ishtq Individual

Uploaded by

safdar2020Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ishtq Individual

Uploaded by

safdar2020Copyright:

Available Formats

1

Table of contents Introduction Need to Register a company Pre-Incorporation Stage Formation of company (flow chart) Registration of corporations Memorandum of Association Articles of Association Companies Need Approval Documents required to be filed for Post Corporation Stage Conversion of companies Memorandum of understanding Retained Earnings Share capital 2 2 2 3 4 4 5 5 6 7 9 9 10 10

Introduction

Corporation is a form of business organization that is recognized under the law as a separate legal entity. A corporation has the rights and responsibilities apart from of those its owners. The assets of corporation do not belong to its owners but corporation itself. The corporation is responsible for its own debts and must pay income tax on its earnings, being a separate legal entity corporation can enter in a contract, it may sue and be sued as it were a person.

Advantages of corporation

Limited personal liability Transferability of ownership Professional management Continuity to existence

disadvantages of corporations

Double Taxation Greater Regulation Cost of formation separation of ownership and management

Types of corporation

Publicly owned corporations These are the corporations whose shares are traded through the organized stock exchanges. The shares are available for general public thats why called publicly owned corporations . Closely held corporations These are the corporations whose shares are not traded through the organized stock exchanges. These corporations have few stockholders mostly owned by individual or by the members of family.

Need to register a company?

The Companies Ordinance, 1984 strictly state that no company shall be formed for the obtaining of gain through its mode of business if it is not registered as a company under the Ordinance. So any person who shall go against of the provisions of the Ordinance shall be liable to pay fine which may extend to Rs. 5000 and he will also liable for all the liabilities of the business. To facilitate the promoters of companies and general public, Securities & Exchange of Pakistan (SECP) has established seven company registrations offices (CROs) at Islamabad, Karachi, Lahore, Peshawar, Faisalabad, Multan and Quetta. To provide services and guidance relating the registration of new companies is the main Function of CRO and other responsibility of CRO is to ensure that director of new company comply with the statutory requirements as provided under the Companies Ordinance 1984.

Pre-Incorporation Stage

The persons who under take task to form a company are called promoters. In order to register a company the promoters must prepare and file certain documents with the registrar of companies and pay fees and

3 stamp duties. Such documents are to be filed with the Registrar in the province or the part of Pakistan not forming part of a province, as the case may be, in which the registered office of the company is stated by the memorandum to be situated, under section 30 of the Companies Ordinance, 1984.

Formation of company (flow chart)

Registration of a private/public company

-a single person may form a single member company. -any one or more person may from a private company. - Three or more persons may form a public company. -4 Seven or more persons may form a listed public company

Application for availability of name

Certain categories of companies are required to obtain prior approval of the relevant minister/deptt.

Documents required for registration private company

Registration of corporations

1 Registration of a Private/Public Company 1 A single person may form a single member company. 2 Any one or more persons may form a private company. 3 Three or more persons may form a public company 4 Seven or more persons may form a listed public company 2 Application for availability of name 1 Application for the availability of the company name must be made to the Registrar it must accompany original Chillan fee payment of Rs.200 2 The name must not be unsuitable, deceptive, designed to develop or defend any religion, be matching or have a close similarity with that of an existing company name. 3 On receiving the application, the Registrar issues a certificate of availability of name within 2 days if he thinks fit. 4 The name is kept for 30 days from the getting of the certificate of the availability of name. 5 If promoters fail to get the company registered within 30 days from the receipt of such certificate, the Registrar may allot such name to any other applicant seeking the same name.

Memorandum of Association

The promoters of the company set up the memorandum of association. It has the significant importance for the company. The memorandum of association is the charter of the company it defines the powers and states the companys objectives. The compulsory contents of the memorandum of association are as follows: 8 1. The name clause The name clause must mention the following: a) The word Limited as the last word in case of a Public Limited Company. b) The words (Private) Limited as the last words in the case of a Private Limited Company. c) The words (SMC-Private) Limited as the last words of a Single Member Private Limited Company. 2. Registered Office Details This clause must state the address details of the company offices. 3. Object Clause This is the most important part of the memorandum of association and is to be worded immensely carefully. A company cannot legally start up any business that is not allowed by its object clause. The

5 object clause cannot contain any thing disparate to the provisions of the Companies Ordinance, 1984. It is generally very lengthy and the scope of the companys activities is widened by including the words and the doing of all such other things incidental or conductive of the environment of the above objects. 4. Liability Clause The liability clause must state whether the company is limited by share or guarantee. The purpose of this statement is in the event if the company is wound up, the members of the company will not be liable to give more than the amount, if any, unpaid on their shares, in case of a company limited by shares. In the case of a company limited by guarantee, the members have to contribute a specific amount to the assets of the company. 5. Share Capital Clause The share capital clause include following information, except for guarantee companies having no share capital and unlimited companies: a) The amount of share capital with which the company is formed and registered. b) The division of share capital into shares of fixed amounts. The memorandum of association must be signed by the subscribers i.e. the first members of the association.

Articles of Association

The memorandum of association, are the articles of association, which relate to the internal management of the company. a) The Articles of association include a description of the regulations and by-laws with which the company intends to perform and regulate its daily working on different issues e.g. transfer of shares, general meetings, voting, notices, etc. b) The Articles of Association must be signed by the subscribers to memorandum of association. c) These members may also adopt all or any of the regulations specified in Table A if the First Schedule of the Companies Ordinance, 1984, if they do not prepare the articles of association.

3 Certain categories of companies are required to obtain prior approval of the relevant ministry or department. Without this approval a company can not be formed.

A banking company must obtain Ministry of Finance and State bank of Pakistan A Non-banking finance company (NBFC) has to obtain approval from Securities and Exchange Commission of Pakistan (under part-viii-A and section 282 of the Companies Ordinance, 1984 8A corporate brokerage house should have Stock Exchange under section 8 of the Securities & Exchange Ordinance, 1969 A money exchange company should have approval from State Bank Of Pakistan

6 A company having objects of a security guard company has approval from Ministry of Interior An association not for profit u/s 42 of the Companies Ordinance, 1984 must have License from Securities exchange Commission Pakistan. A trade organization u/s 42 should have License from Ministry of Commerce

4 Documents required to be filed for:

a) Four copies of memorandum and articles of association, signed by each member in the presence of a witness, one copy special stamp pasted, copy of N.I.C.s of promoters b) Form-1 Declaration of compliance with the fundamentals of the formation of the company. Witnessed by 1 person and affixed with a stamp of Rs.50. c) Form-21 identifying the location of the registered office d) Form-29 Particulars of directors, secretary, accountant, etc. e) Original Chillan of registration fee.

Additional documents to be filed for a public limited company. a) Form 27 List of persons consenting to act as directors. b) Form 28 Consent to act as Director/Chief. Additional Documents to be filed for a Single Member Company a) Form S1 Nomination of nominee director. Additional Documents to be filed for a Company having objects of providing security services a) Nine additional sets of each of the documents at Nos. 1 and 2 above. It is pertinent to note that the memorandum clause should not contain any business other than related to security business. b)Bio-data of each subscribers/promoters. Ex-army personnel should clearly indicate PA and Corps number and usual residential address of each promoter must be complete and clearly identifiable. c) Four attested photographs of each subscriber. d) Financial position/bank statement of the subscribers (Aggregate wealth Should not be less than 1.5 million). E) Additional Documents to be filed for Company not for profit (U/S 42 of the Companies Ordinance, 1984) a) Memorandum and Articles of Association. b )Bio-data of each promoter. c) Declaration. (To what effect) d) Names of companies in which the promoters of the proposed association hold any office. e) Estimates of annual income and expenditure

7 f) Brief statement of work already done and to be done. (Section 42 & Rule 6) Foreign company establishing its place of business in Pakistan. The following requirements have to be fulfilled within 30 days from the date of establishing the place of business of foreign company in Pakistan: 1. Form-38(Annex.10) is to be submitted along with a certified copy of the charter, statute or Memorandum and Article of the company, duly certified by: (a) the public officer in the country where the company is incorporated to whose custody the original is committee. OR (b) A notary public of the country where the company is incorporated OR (c) An affidavit of a responsible officer of the company in the country where the company is incorporated. Provided that the signature or seal of the person certifying shall be authenticated by a Pakistani diplomatic consular or consulate officer Provided further that if the charter, required to be submitted, is in other than English language, it has to be translated into English or Urdu language certified by the persons and in the manner given above for certifying the Form-38. 2. Form-39 (Annex.11) notifying address or registered office or principle office of the company. 3. Form-40 (Annex.12) showing particulars of directors, chief executive and secretary (if any) or of any alteration therein. 4. Form-41 (Annex.13) showing particulars of principle officer of the company in Pakistan or of any alteration therein. 5. Form-42 (Annex.14) showing particulars of person(s) resident in Pakistan authorized to accept service on behalf of a foreign company, along with the certified copy of the appointment order, authority letter of board of director resolution and consent of the principle officer. 6. Form-43 (Annex.15) stating address of the principle place of business in Pakistan of the foreign company. 7. Permission letter from the Board of Investment (BOI) with a specific validity period for opening and maintenance of a branch/liaison office by a foreign company. 8. Power of attorney in the favor of principal officer/authorized person to sign the documents submitted with the registrar. The said power of attorney is to be duly notarized in the country of origin. 9. Copy of NIC of principle officer or in case of foreigner copy of passport.

POST CORPORATION STAGE

Private companies after incorporation

1. Private companies may start business from the date of incorporation. 2. The first annual general meeting is necessary to be held within eighteen months of incorporation (Section158). Accordingly Form-A (Annex.19) is to be filed with the registrar within 30 days.

8 3. Following annual general meetings are to be held once every year, within a period of six months after the close of its financial year, and not more than 15 months after the holding of the last AGM. 4. The first election for directors is to be conducted at the first annual general meeting. Subsequent election should take place every three years. (Section 176 & 178) 5. An annual return given on Form-A is required to be filed with the registrar at the end of each year. 6. In the case of increase in paid-up capital, the company is must offer new shares to its members. A circular (under section 86(3)) shall be issued to all the members of company. A copy of the circular will also be filed with the registrar concerned, and thereafter Form-3 (Annex.20) to be filed within 30 days of the allocation of shares. 7. Any meeting or change in the Directors, Chief Executive, Auditors, Chief Accountant is compulsory to be notified to the concerned registrar by filing Form-29. This is to be done within 14 working days for any meeting or change. 8. The first auditors of the company must be appointed within 60 days of the date of incorporation. Other auditors must then be appointed only at the annual general meetings. 9. Every credit or charge created by the company on its property should be registered with the concerned registrar. Any changes afterward in this should also be registered.

Public companies after incorporation

1. A public company may not start business except a Certificate of Commencement of Business is obtained from the Registrar concerned. 2. A legal meeting is required to be held within a after 3 months but not more than 6 months from the date at which it becomes permitted to start business. A legal report is must be forwarded to the members at least 21 days before this meeting.5 duly certified copies of the legal report shall be delivered to the registrar without delay after sending the report to the members. 3. The first audited accounts are must be shown in the first annual general meeting to be held within 18 months from the date of incorporation. Five duly attested copies of the accounts and an Annual Return in form A it to filed with the registrar within 30 days of the date of the AGM. 4. Following AGMs shall be held once every year in which audited accounts are presented. Every AGM must be held within six months of the closing of the financial year and not more than 15 months after the last meeting. 5. The procedure of appointing of directors is exactly the same as in private companies. 6. Any change in Directors/Chief Executives, Auditors, Secretaries, Chief Accountants, and Legal Advisors etc shall be conducted in the same manner as in private companies. 7. Again the procedure stated in increase of paid-in capital same as private companies.

Conversion of companies How to convert a single member company into multi-members Private Limited Company

The procedures to convert a single member company in to multi-member private limited company 1. The number of members is increased by passing a special resolution. 2. Shares should be transferred to new members within 7 days after passing special resolution. 3. change in the Articles of Association accordingly within thirty days. 4 Election for one or more directors, in addition to the existing single director, should held within fifteen days of passing of the special resolution.

9 5. Notify SECP of such appointment/election on Form-29, within fourteen days thereof. 6. Filing a notice in writing to this fact on Form-S-2 (Annex.16) with the Registrar within sixty days of passing of the special resolution.

Conversion of multi-members private limited company into a single member company

Requirements for conversion

1. A special resolution has to be passed for the change of status. 2. Necessary changes in companys articles has to be made. 3. Approval of the SECP for such change needs to be sought. Application for approval must be submitted in the Form S-4 (Annex.17) within thirty days of passing of the special resolution for change of status into single member company. 4. Shares should be transferred to single member within fifteen days of getting approval from the SECP 5. Notification of change in the board of directors on Form-29 within fourteen days from the date of transfer of shares. 6. Filing of a notice of the change of status in the Form S-5 (Annex.18) with the registrar along with a certified copy of the order containing the approval within fifteen days. 7. Filing of Form-S-1, to nominate at least two individual one, to act as a Nominee Director to manage the affairs of the Company in case of death of single member till the transfer of shares to legal heirs and the other individual to act as an alternative Nominee Director in case of non-availability of the Nominee Director, with the registrar within fifteen days. None of these nominees can be member or secretary of the Company.

You might also like

- Conclusion SuggestionDocument2 pagesConclusion Suggestionsafdar2020No ratings yet

- Measuring The Cost of Living: Aman 22 February 2013Document37 pagesMeasuring The Cost of Living: Aman 22 February 2013safdar2020No ratings yet

- AssssssssssDocument9 pagesAsssssssssssafdar2020No ratings yet

- NawazDocument19 pagesNawazsafdar2020No ratings yet

- 196VB 0Document4 pages196VB 0safdar2020No ratings yet

- MBA Macroeconomics Assignment - 2 PDFDocument2 pagesMBA Macroeconomics Assignment - 2 PDFsafdar2020No ratings yet

- Ishtq IndivasssDocument9 pagesIshtq Indivassssafdar2020No ratings yet

- Production and Growth: 8 March 2013Document42 pagesProduction and Growth: 8 March 2013safdar2020No ratings yet

- Female Economy (Autosaved)Document39 pagesFemale Economy (Autosaved)safdar2020No ratings yet

- Tutorial WeekI PDFDocument4 pagesTutorial WeekI PDFsafdar2020No ratings yet

- Registration of Corporation: Submitted byDocument1 pageRegistration of Corporation: Submitted bysafdar2020No ratings yet

- Money Growth and Inflation: The Meaning of MoneyDocument29 pagesMoney Growth and Inflation: The Meaning of Moneysafdar2020No ratings yet

- Measuring The Cost of LivingDocument2 pagesMeasuring The Cost of Livingsafdar2020No ratings yet

- Measuring The Cost of Living: Aman 22 February 2013Document37 pagesMeasuring The Cost of Living: Aman 22 February 2013safdar2020No ratings yet

- Measuring The Cost of Living: Assignment No 1Document1 pageMeasuring The Cost of Living: Assignment No 1safdar2020No ratings yet

- Key Concepts and Definitions in Labor Force SurveyDocument6 pagesKey Concepts and Definitions in Labor Force Surveysafdar2020No ratings yet

- The Monetary System - Tutorial PDFDocument2 pagesThe Monetary System - Tutorial PDFsafdar2020No ratings yet

- Methodology of Price Collection and Computing Price IndicesDocument11 pagesMethodology of Price Collection and Computing Price Indicessafdar2020No ratings yet

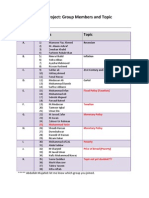

- Mini Project: Group Members and TopicDocument1 pageMini Project: Group Members and Topicsafdar2020No ratings yet

- Q&A WeekI PDFDocument1 pageQ&A WeekI PDFsafdar2020No ratings yet

- One Pager On Gold Vs CpiDocument1 pageOne Pager On Gold Vs Cpisafdar2020No ratings yet

- Natural Rate of Unemployment and Its Factors in Developing NationsDocument1 pageNatural Rate of Unemployment and Its Factors in Developing Nationssafdar2020No ratings yet

- Registration of Corporation: Submitted byDocument1 pageRegistration of Corporation: Submitted bysafdar2020No ratings yet

- Final Project For Nestle PakistanDocument35 pagesFinal Project For Nestle Pakistanshahrose93% (28)

- Natural Rate of Unemployment and Its Factors in Developing NationsDocument1 pageNatural Rate of Unemployment and Its Factors in Developing Nationssafdar2020No ratings yet

- Assignment 2Document1 pageAssignment 2safdar2020No ratings yet

- Lecture 6-Principles of ManagementDocument22 pagesLecture 6-Principles of Managementsafdar2020100% (1)

- Main PageDocument1 pageMain Pagesafdar2020No ratings yet

- Lecture 3 - Principles of ManagementDocument35 pagesLecture 3 - Principles of Managementsafdar2020No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ocugiene v. ThermaMEDx - ComplaintDocument15 pagesOcugiene v. ThermaMEDx - ComplaintSarah BursteinNo ratings yet

- Alternative Complaint Objecting To Secured Debt Til Bankruptcy-2006 - Appendix - GDocument116 pagesAlternative Complaint Objecting To Secured Debt Til Bankruptcy-2006 - Appendix - GCharlton ButlerNo ratings yet

- Post Money SAFE Valuation CapDocument6 pagesPost Money SAFE Valuation CappomegranatesoupNo ratings yet

- NEGOTIABLE INSTRUMENT Reviewer For QuizDocument7 pagesNEGOTIABLE INSTRUMENT Reviewer For Quizlicarl benitoNo ratings yet

- Property Management LawDocument11 pagesProperty Management Lawasdas asfasfasdNo ratings yet

- Dean Salao's Notes on Personal Property Security ActDocument9 pagesDean Salao's Notes on Personal Property Security ActCassie GacottNo ratings yet

- Unit 1 IprDocument37 pagesUnit 1 IprVaibhavNo ratings yet

- Unit-V Legal Framework: Ms. VibhaDocument62 pagesUnit-V Legal Framework: Ms. Vibhaarchana_anuragiNo ratings yet

- Property Management Agreement TemplateDocument2 pagesProperty Management Agreement TemplatemarcelNo ratings yet

- Pointers & Cases: Negotiable Instruments LawDocument7 pagesPointers & Cases: Negotiable Instruments LawPduys16No ratings yet

- Atty. Dionisio Calibo, Jr.,V. Court of Appeals and Dr. Pablo U. Abella G.R. No. 120528, January 29, 2001 FactsDocument2 pagesAtty. Dionisio Calibo, Jr.,V. Court of Appeals and Dr. Pablo U. Abella G.R. No. 120528, January 29, 2001 FactsFrancis Puno50% (2)

- Articles of IncorporationDocument5 pagesArticles of IncorporationFemee JisonNo ratings yet

- Submitted To Submitted By:-Mr. Amit Kumar Neha Deepak Harish Mohit KrishanDocument9 pagesSubmitted To Submitted By:-Mr. Amit Kumar Neha Deepak Harish Mohit KrishanrajatNo ratings yet

- Metropolitan Waterworks and Sewerage System vs. Hon. Reynaldo B. Daway and Maynilad Water Services, Inc.Document1 pageMetropolitan Waterworks and Sewerage System vs. Hon. Reynaldo B. Daway and Maynilad Water Services, Inc.Louie Marrero DadatNo ratings yet

- Analyze The Role of A Business Entity in Relation To Commercial LawDocument5 pagesAnalyze The Role of A Business Entity in Relation To Commercial LawHafsa RashidNo ratings yet

- Trade Marks Act, 2004 (Act 664)Document41 pagesTrade Marks Act, 2004 (Act 664)AaaaNo ratings yet

- Instant Download Understanding Management 9th Edition Daft Solutions Manual PDF Full ChapterDocument15 pagesInstant Download Understanding Management 9th Edition Daft Solutions Manual PDF Full ChapterElizabethPhillipsfztqc100% (6)

- Pro Forma Notice Non CompeteDocument2 pagesPro Forma Notice Non CompeteJoed MariceNo ratings yet

- Architect Agreement (Short Form)Document3 pagesArchitect Agreement (Short Form)Hanna MoirNo ratings yet

- Vishwesha Kumara - Ip Assignment Deed - 1FFDocument11 pagesVishwesha Kumara - Ip Assignment Deed - 1FFdcfl k sesaNo ratings yet

- Holy Trinity College liable under MOA for dance group's European tourDocument2 pagesHoly Trinity College liable under MOA for dance group's European touramareia yapNo ratings yet

- CV Summary for Insurance ProfessionalDocument2 pagesCV Summary for Insurance ProfessionalSANUSI BASHIR ADEWALENo ratings yet

- Negotiable Instruments Act 1881Document23 pagesNegotiable Instruments Act 1881Sarvar Pathan100% (1)

- Executors' Duties in Administering Insolvent EstatesDocument5 pagesExecutors' Duties in Administering Insolvent EstatesIsa MajNo ratings yet

- Updated British Horse Society Sample Loan AgreementDocument6 pagesUpdated British Horse Society Sample Loan Agreementcheryl jamesNo ratings yet

- Final Exam - GM 8 - BelsDocument2 pagesFinal Exam - GM 8 - BelsR NaritaNo ratings yet

- 2023 - Doctrines in Civil LawDocument2 pages2023 - Doctrines in Civil LawAisha FernandezNo ratings yet

- DerivativesDocument2 pagesDerivativesRanjeet MauryaNo ratings yet

- JJJ HTMLDocument12 pagesJJJ HTMLpatel jayNo ratings yet