Professional Documents

Culture Documents

Working Capital Cal

Uploaded by

Muthu MarshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Cal

Uploaded by

Muthu MarshCopyright:

Available Formats

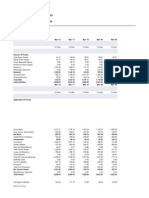

Table :4.3.

1 STATEMENT SHOWING CHANGES IN WORKING CAPITAL 2005 -2006 *2005 Particulars Current Assets Inventories Sundry Debtors Cash & Bank Balances Loan & Advances Total Current Assets (A) Current Liabilities Current Liabilities & Provisions Total Current Liabilities (B) Net Working Capital ( A-B) Decrease In Working Capital Total (Rs In Lakhs) 14541.48 15101.08 416.91 104899.9 134959.37 *2006 (Rs In Lakhs) 15749.44 16952.88 391.58 46800.61 79894.51 Increase (Rs In Lakhs) 1207.96 1851.8 25.33 58099.29 Decrease (Rs In Lakhs)

73553.95 73553.95 61405.42 61405.42

100307.42 100307.42 -20412.91 81818.33 61405.42 3059.76 81818.33 111631.56

26753.47 26753.47 84878.09 111631.56

Note : *Financial Statement is prepared for 18 months

INFERENCE: From the above table shows that Net Working Capital for the year 2005 & 2006 is Rs 61405.42 & Rs (20412.92). Thus the Working Capital Of the Concern is decreased in 2006 Compare to the Net Working Capital In 2005.

Table : 4.3.2 STATEMENT SHOWING CHANGES IN WORKING CAPITAL 2006 -2008

Particulars Current Assets Inventories Sundry Debtors Cash & Bank Balances Loans & Advances Total Current Assets (A) Less: Current Liabilities Current Liabilities & Provisions Total Current Liabilities (B) Net Working Capital (A -B) Decrease In Working Capital Total

*2008 * 2006 (Rs In Lakhs) (Rs In Lakhs) 15749.44 16952.88 391.58 46800.61 79894.51 16082.88 12001.25 19347.57 16502.53 63934.23

Increase (Rs In Lakhs) 333.44

Decrease (Rs In Lakhs)

4951.63 18955.99 30298.08

101039 101039 - 21144.49 -21144.49

86186.97 86186.97 -22252.74 1108.25 -21144.49

14852.03

34141.46 1108.25 35249.71

35249.71 35249.71

Note : *Financial Statement is prepared for 18 months INFERENCE: From the Above Table it shows that the Net Working Capital For the year 2006 & 2008 is Rs 21144.49 & Rs -22252.74. Thus it is inferred that the Net Working Capital in 2008 is decreased compare to the Net Working Capital in 2006.

Table : 4.3.3 STATEMENT SHOWING CHANGES IN WORKING CAPITAL 2008 -2009

Increase Particulars Current Assets Inventories Sundry Debtors Cash & Bank Balances Loans & Advances Total Current Assets (A) Current Liabilities & Provisions Liabilities Provisions Total Current Liabilities (B) Net Working Capital ( A - B) Increase In Working Capital Total 2008 (Rs In Lakhs) 16127.46 12001.25 19347.57 16457.95 63934.23 2009 (Rs In Lakhs) 12064.77 5275.05 28772.3 16378.75 62490.87

Decrease

(Rs In Lakhs) (Rs In Lakhs) 4062.69 6726.2 9424.73 79.2

85192.45 994.52 86186.97 -22252.74 898.92 -21353.82

82457.01 1387.68 83844.69 -21353.82 -21353.82

2735.44 393.16

12160.17 12160.17

11261.25 898.92 12160.17

INFERENCE: From the Above Table it shows that the Net Working Capital For the year 2008 & 2009 is Rs (-22252.74) & Rs (-21353.82). Thus it is inferred that the Net Working Capital in 2009 is increased compare to the Net Working Capital in 2008.

Table : 4.3.4 STATEMENT SHOWING CHANGES IN WORKING CAPITAL 2009-2010 Particulars 2009 2010

Rs (In Lakhs) Current Assets Interest Accrued on Investment Inventories Sundry Debtors Cash & Bank Bank Balances Loan & Advances Total Current Assets (A) Current Liabiities & Provisions Liabilities Provisions Total Current Liabilities (B) Net Working Capital ( A - B) Decrease In Working Capital Total

Rs (In Lakhs)

Increase (Rs In Lakhs)

Decrease (Rs In Lakhs) 0.21 1262.24

6.56 12064.77 5275.05 28772.3 16372.19 62490.87

6.35 10802.53 7171.39 18264.72 15123.27 51368.26

1896.34 10507.58 1248.92

83374.71 469.98 83844.69 -21353.82 -21353.82

78870.03 427.52 79297.55 -27929.29 6575.47 -21353.82

4504.68 42.46

6443.48 6575.47 13018.95

13018.95 13018.95

INFERENCE: From the Above Table it shows that the Net Working Capital For the year 2009 & 2010 is Rs (-21353.82) & Rs (-27929.29). Thus it is inferred that the Net Working Capital in 2008 is decreased compare to the Net Working Capital in 2006.

Table: 4.3.5 STATEMENT SHOWING CHANGES IN WORKING CAPITAL 2010 2011 2010 Rs (In Lakhs) 6.35 2011 Rs (In Lakhs) 0

Particulars Current Assets Interest Accrued On Investments

Increase

Decrease 6.35

Inventories Sundry Debtors Cash & Bank Balances Loans & Advances Total Current Assets (A) Current Liabilities Liabilities Provisions Total Current Liabilities (B) Net Working Capital ( A - B) Increase In Working Capital Total INFERENCE:

10802.53 7171.39 18264.72 15123.27 51368.26

16816.17 10926.52 9964.73 27283.06 64990.48

6013.64 3755.13 8299.99 12159.79

76138.03 427.52 76565.55 - 25197.29 5323.43 -19873.86

84393.78 470.56 84864.34 -19873.86 -19873.86 21928.56 21928.56

8255.75 43.04

16605.13 5323.43 21928.56

From the Above Table it shows that the Net Working Capital For the year 2010 & 2011 is Rs(-25197.29) & Rs (-19873.86). Thus it is inferred that the Net Working Capital in 2011 is increased compare to the Net Working Capital in 2006.

CASH FLOW STATEMENT FOR THE YEAR 2005 2006 Table : 4.4.1 Particulars A. CASH FROM OPERATING ACTIVITIES Profit /loss for the period/year Adjustment: Depreciation Loss On sale of assets Loss On sale of investments Inventories written off Dimuution in the value of investments Assets written off Miscellaneous expenditure written off Provision for doubt ful debts &advances Bad debts & advances written off *2006 (Rs In Lakhs) *2005 (Rs In Lakhs)

-38947.64 8257.01 -5.38 -18.48 481.64 443.43 513.61 351.5 1191.04 7789.75 4227.77 221.25 13.69 427.54 2384.72 -

974.42

Exchange difference interest & financial charges Net Gain on restructuring of float rate Income from investments interest income Operating Profit Before Working Capital Charges Adjustments : (increase)/Decrease in Sundry Debtors (increase)/Decrease in inventories (increase)/Decrease in loans & advances (increase)/Decrease in Liabilities & provisions Cash generated from operations Direct Taxes paid / Received Payments under voluntary retirement scheme NET CASH FROM OPERATING ACTIVITIES B. CASH FLOW FROM INVESTING ACTIVITIES Deletions /additions to fixed assets Particulars Capital Work in progress /advances Particulars Adjustments for exchange fluctuation Proceeds from sales of fixed assets Interest Income NET CASH FROM INVESTING ACTIVITIES C. CASH FROM FINANCING ACTIVITIES Repayment of borrowings Proceeds From borrowings Share Capital Advance Dividend Paid Interest & Financial Charges Paid NET CASH FLOW ( A+B+C) Cash & Cash equivalents (opening balance)

795.97 30078.62 -3040.61 -167.13

-1088.35 18227.86 21254.27 -251.35 46670.97 -164.51 7723.33

2744.35 3718.77

-3704.29 -1689.61 2032.15 21111.88 17750.13 25473.46 163.1 25636.56

3236.78 698.9 10340.06 15582.21 9177.83 12896.6 -199.09 -657.94 12039.57

-1373.46 * 2006 164.71 780.7 189.94 167.13 -70.98

-904.98 *2005 305.53 251.35 35.72 164.51 -147.87

-5608.17 -27.05 -19955.69 -25590.91 -25.33

-1057.7 4981.44 39.51 -21.06 18279.85 -14337.66 -2455.96

Cash & Cash equivalents (closing balance) Disclosure of non cash transaction write off old subsidies 36954.74 write off old advances 6494.31 Restatement of liabilities 4885.57 Conversion of loan to investment 6379.06 Investments acquired on amalgamation 1590.66 Investments made Reduction in liability on restructuring Floating Rate Exchange (loss)/gain on restatement of liability Note : *Financial Statement is prepared for 18 months INFERENCE: -

2000 21254.27 -756.85

From the above Table Net Cash from operating activities in 2005 is 12039.57 & in 2006 is 25636.56.I

2005 the Net Cash from investing activities is -147.87 & in 2006 the Net cash is -70.98.The Net cash from

financing Activities in 2005 is -14337.66 & in 2006 is -25590.91 .Thus it is understood that The above tab shows cash outflow for both the year

CASH FLOW STATEMENT FOR THE YEAR 2006 - 2008 Table : 4.4.2 Particulars A. CASH FROM OPERATING ACTIVITIES Profit /loss for the period/year Adjustment: Depreciation Loss On sale of assets Loss On sale of investments Inventories written off Dimution in the value of investments Assets written off Provision of non moving inventories Miscellaneous expenditure written off Provision for doubt ful debts &advances Bad debts & advances written off Exchange difference interest & financial charges Net Gain on restructuring of float rate *2008 (Rs In Lakhs) *2006 (Rs In Lakhs)

-56410.36 12590.48 314.22 8554.20 937.89 256.99 3777.51 217.20 2495.63 38511.47 8257.01 508.23 -18.48 481.43 443.43 351.50 1191.04 7789.75 795.97 30078.62 -

-38947.64

Income from investments interest income Operating Profit Before Working Capital Charges Adjustments : (increase)/Decrease in Sundry Debtors (increase)/Decrease in inventories (increase)/Decrease in loans & advances (increase)/Decrease in Liabilities & provisions Cash generated from operations Direct Taxes paid / Received Payments under voluntary retirement scheme NET CASH FROM OPERATING ACTIVITIES B. CASH FLOW FROM INVESTMENT Particulars Deletions /additions to fixed assets including Capital Work in progress /advances Adjustments for exchange fluctuation Proceeds from sales of fixed assets Income from investments Purchase of investments Proceeds from sale of investments Interest Income NET CASH FROM INVESTING ACTIVITIES C. CASH FROM FINANCING ACTIVITIES Long term borrowings Dividend paid Deposits Paid Interest & Financial Charges Paid C. NET CASH FROM FINANCIAL ACTIVITIES NET CASH FLOW ( A+B+C) Cash & Cash equivalents (opening balance)

-2142.54 -276.66 60245.13 3834.77 4211.69 -1271.34 29038.77 19283.67 12695.45 16530.22 -762.39 15767.83 *2008 (Rs In Lakhs)

-3040.61 -167.13 46670.97 7723.33 3704.29 1689.61 2032.15 21111.88 17750.13 25473.46 163.10 25636.56 *2006 (Rs In Lakhs)

-2175.45 436.04 842.40 -4350.40 276.66 -4970.75

1373.46 164.71 780.70 189.94 164.51 -70.98

3963.58 -15.95 -11.38 -937.18 -2999.07 -2999.07 9424.73 19347.57

15235.14 -43.98 57.56 -11968.41 3165.19 -3165.19 18955.99 391.58

Cash & Cash equivalents (closing balance) Disclosure of non cash transaction Unpaid interest 11837.13 Exchange loss/ gain on restatement of FRN Liability -3723.86 Conversion of subsidy to investment 434.90 Note : *Financial Statement is prepared for 18 months INFERENCE:

28772.30

19347.57

26543.06 1830.12 4350.40

From the above Table Net Cash from operating activities in 2005 is 12039.57 & in 2006 is 25636.56.I

2005 the Net Cash from investing activities is -147.87 & in 2006 the Net cash is -70.98.The Net cash from

financing Activities in 2005 is -14337.66 & in 2006 is -25590.91 .Thus it is understood that The above tab shows cash outflow for both the years CASH FLOW STATEMENT FOR THE YEAR 2008 - 2009 Table :4.4.3 Particulars A. CASH FROM OPERATING ACTIVITIES loss for the period before exceptional item & tax Provision for dimunition in the value of investments Loss for the year before tax & after exceptional item Adjustment: Depreciation Loss On sale of assets Assets written off Loss On sale of investments Dimunition in the value of investments Provision for non moving inventories Miscellaneous expenditure written off Provision for doubt ful debts &advances Bad debts & advances written off Exchange difference interest & financial charges Income from investments interest income Operating Profit Before Working Capital Charges Adjustments : 2009 (Rs In Lakhs) 2008 (Rs In Lakhs)

-25894.92 44773.03 (70667.95) 8245.52 589.19 434.97 -143.49 44773.03 853.22 139.97 -98.28 8.23 6924.90 12774.31 -879.80 -2070.07 71551.50 883.55 12590.48 -11.08 325.26 8554.20 937.89 256.99 3777.51 217.20 -2495.63 38511.47 -2142.54 -276.66

-47856.16 8554.20 -56410.36

60245.13 3834.77

(increase)/Decrease in Sundry Debtors (increase)/Decrease in inventories (increase)/Decrease in loans & advances (increase)/Decrease in Liabilities & provisions Cash generated from operations Direct Taxes paid / Received NET CASH FROM OPERATING ACTIVITIES B. CASH FLOW FROM INVESTMENT Particulars Deletions /additions to fixed assets including Capital Work in progress /advances Adjustments for exchange fluctuation Proceeds from sales of fixed assets Income from investments Proceeds from sale of investments Interest Income NET CASH FROM INVESTING ACTIVITIES C. CASH FROM FINANCING ACTIVITIES Long term Borrowings Dividend Paid Deposit paid Interest & Financial Charges Paid NET CASH FROM FINANCING ACTIVITIES NET CASH FLOW ( A+B+C) Cash & Cash equivalents (opening balance) Cash & Cash equivalents (closing balance) Disclosure of non cash transaction Unpaid Interest Exchange (loss)/gain on restatement of liability Conversion of subsidy to investment

6935.91 3209.48 1053.86 8214.46 2984.79 3868.34 -1068.14 2799.20

384.03 -1271.33 27973.43 -13747.36 13338.77 17173.54 -762.39 16411.15

2009 (Rs In Lakhs)

2008 (Rs In Lakhs)

-1599.35 378.50 879.80 1897.44 2070.07 3926.46 3926.46

-2175.45 436.04 842.40 276.66

-620.35

3963.58 -15.95 -11.38 -937.18 2999.07 2999.07 9424.73 9424.73 19347.57 28772.30 11837.13 -3723.86 434.90

15235.14 -43.98 -57.56 -11968.41 3165.19 3165.19 -2455.96 18955.99 391.58 19347.57 26543.06 1830.12 4350.40

INFERENCE:

From the above Table Net Cash from operating activities in 2008 is 16411.15 & in 2009 is 2799.20. I

2008 the Net Cash from investing activities is -620.35 & in 2008 the Net cash is3626.46 .The Net cash from financing Activities in 2008 is 3165.19 & in 2008 is2999.07 . Thus the Net Cash flow in 2008 & 2009 18955.99 & 9424.73 . Compare to 2008 the Net Cash flow in 2009 is is decreased.

CASH FLOW STATEMENT FOR THE YEAR 2009 2010 Table : 4.4.4 Particulars A. CASH FROM OPERATING ACTIVITIES Loss for the period/year Add: Exceptional item Provisional for dimunition in the value of investment loss on sale of fixed assets Profit on sale of investments in a joint venture & in a wholly owned subsidiary company Excess liability for interest on loans written back Provision for claims no longer required written back Loss for the year before tax & after exceptional item Adjustment: Depreciation Loss On sale of assets Assets written off Profit On sale of investments Dimunition in the value of investments Excess liability for interest on loans written back Inventories provision write back Miscellaneous Expenditure written off Miscellaneous expenditure written off Provision for doubt ful debts &advances Bad debts & advances written off Exchange difference interest & financial charges Income from investments interest income Operating Profit Before Working Capital Charges Adjustments : (increase)/Decrease in Sundry Debtors (increase)/Decrease in inventories (increase)/Decrease in loans & advances 2009 (Rs In Lakhs) -8163.21 -30609.63 -1315.50 7694.45 2010 (Rs In Lakhs) -47856.16

9667.44 1980.42 -7781.92 30616.20 -17065.40 74.22 74.34 -2871.92 1029.67 -3123.22 253.46 -3750.95 882.72 -829.72 9365.19 3091.38 -1692.89 1187.89 1083.83

12590.48 -11.04 325.26 8554.20 937.89

256.99 3777.51 217.20 -2495.63 38511.47 -2142.54 -276.66 60245.13 3834.77 384.03 -1271.33 27973.43

(increase)/Decrease in Liabilities & provisions Cash generated from operations Direct Taxes paid / Received NET CASH FROM OPERATING ACTIVITIES Particulars B. CASH FLOW FROM INVESTING ACTIVITIES Deletions /additions to fixed assets including Capital Work in progress /advances Adjustments for exchange fluctuation Proceeds from sales of fixed assets Income from investments Proceeds from sale of investments Interest Income NET CASH FROM INVESTING ACTIVITIES C. CASH FROM FINANCING ACTIVITIES Proceed from issue of preference share capital Long term Borrowings Dividend Paid Deposit paid Interest & Financial Charges Paid NET CASH FROM FINANCING ACTIV ITIES NET CASH FLOW ( A+B+C) Cash & Cash equivalents (opening balance) Cash balance regrouped from secured loans Cash & Cash equivalents (closing balance) Disclosure of non cash transaction Unpaid Interest Exchange (loss)/gain on restatement of liability Conversion of subsidy to investment INFERENCE

1691.98 2270.81 -820.57 -388.84 -1209.41 2010 (Rs In Lakhs)

13747.36 13338.77 17173.54 -762.39 2799.20 2009 (Rs In Lakhs)

-1215.84 8017.89 882.72 10872.81 829.72 19386.66 19386.66

-2175.45 436.04 842.40 276.66 -620.35 -620.35

5000.00 35999.47 -3.65 -228.41 31231.53 31231.53 -13054.28 28772.30 2546.70 18264.72 28772.30 1821.10 2048.99 -

3963.58 -15.95 -11.38 -937.18 2999.07 2999.07 -9424.73 19347.57 28772.30 19347.57 11837.13 -3723.66 434.90

From the above Table Net Cash from operating activities in 2009 is 2799.20& in 2010 is-1209.41. In 2009 the Net Cash from investing activities is 620.35& in 2010 the Net cash is 19386.66.The Net cash from financing Activities in 2009 is 2999.07 & in 2010 is 31231.53. Thus the Net Cash flow in 2009 & 2010 is -9424.73& -13054.28. Thus Compare to 2009 the cash flow in 2010 is decreased

CASH FLOW STATEMENT FOR THE YEAR 2010 2011 Table : 4.4.5 Particulars A. CASH FROM OPERATING ACTIVITIES Loss for the period/year Add: Exceptional item Provisional for dimunition in the value of investment Profit on sale of fixed assets Profit on sale of investments in a joint venture & in a wholly owned subsidiary company Excess liability for interest on loans written back Provision for claims no longer required written back Profit /Loss for the year before tax & after exceptional item Adjustment: Depreciation Loss On sale of assets Impairment of assets Loss On sale of investments Dimunition in the value of investments Excess liability for interest on loans written back Provision for non - Inventories Provision for claims no longer required written back Provision for doubt ful debts &advances Unclaimed Credit balances written back Provisions no longer required written back Bad debts & advances written off Exchange difference interest & financial charges Income from investments interest income Operating Profit Before Working Capital Charges Adjustments : (increase)/Decrease in Sundry Debtors (increase)/Decrease in inventories (increase)/Decrease in loans & advances (increase)/Decrease in Liabilities & provisions Cash generated from operations Particulars 2011 (Rs In Lakhs) -2387.40 -3463.19 14048.95 8198.36 8894.90 4714.36 920 .02 -14031.95 260.31 119.22 -165.70 -120.34 0.98 -462.51 2551.04 -323.96 -381.80 1974.57 10172.93 -3824.60 -6349.86 11275.26 9194.77 12254.95 -2082.02 2011 (Rs In Lakhs) 1692.89 1187.89 150.42 1691.98 1337.40 1753.98 2010 (Rs In Lakhs) 9667.44 1980.42 -7781.92 30616.20 -17065.40 74.34 -2871.92 1029.67 -1818.09 -1305.13 253.46 -3750.95 2049.51 -882.72 -829.72 9365.19 3091.38 2010 (Rs In Lakhs) -8163.21

-30609.63 1315.50 7694.45 17085.40 2841.92 12456.57

Direct Taxes paid / Received NET CASH FROM OPERATING ACTIVITIES

-28.07 -2110.09

-388.84 -2142.82

B. CASH FLOW FROM INVESTING ACTIVITIES Deletions /additions to fixed assets including Capital Work in progress /advances Adjustments for exchange fluctuation Proceeds from sales of fixed assets Income from investments Proceeds from sale of investments Interest Income NET CASH FROM INVESTING ACTIVITIES C. CASH FROM FINANCING ACTIVITIES Proceed from issue of preference share capital Long term Borrowings Deposit paid Interest & Financial Charges Paid NET CASH FROM FINANCING ACTIV ITIES NET CASH FLOW ( A+B+C) Cash & Cash equivalents (opening balance) Cash balance regrouped from secured loans Cash & Cash equivalents (closing balance) Disclosure of non cash transaction Unpaid Interest Exchange (loss)/gain on restatement of liability Conversion of subsidy to investment INFERENCE From the above Table Net Cash from operating activities in 2010 is -2142.82& in 2011 is2110.09. In 2010 the Net Cash from investing activities is 19386.66 & in 2011 the Net cash is 41255.17.The Net cash from financing Activities in 2010 is 31231.53& in 2011 is 46721.25. Thus the Net Cash flow in 2009 & 2010 is -13987.69& -7576.17. Thus Compare to 2010 the cash flow in 2011 is decreased.

-1314.60 9579.09 323.96 32284.91 381.81 41255.17 41255.17

-1215.64 8017.05 882.72 10872.81 829.72 19386.66 19386.66

-46555.68 -6.27 -159.30 46721.25 46721.25 -7576.17 15402.53 7826.36 2391.74 172.81 2745.00

5000 -35999.47 -3.65 -228.41 31231.53 31231.53 -13987.69 26643.52 2546.70 15402.53 1821.10 2048.99 3000.00

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Insurance Agency Business PlanDocument43 pagesInsurance Agency Business PlanJoin Riot100% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Group Case 2 - Playing The Numbers GameDocument33 pagesGroup Case 2 - Playing The Numbers GameHannahPojaFeria0% (1)

- The Ultimate Reverse Mortgage GuideDocument18 pagesThe Ultimate Reverse Mortgage GuideTerry SniderNo ratings yet

- Project For Sand StoneDocument29 pagesProject For Sand StonesudhirsenNo ratings yet

- Retail Management 4 StoreAndLocationDocument69 pagesRetail Management 4 StoreAndLocationMuthu MarshNo ratings yet

- Annual Sales Revenue 2009Document2 pagesAnnual Sales Revenue 2009Muthu MarshNo ratings yet

- A Study On Inventory Management With Reff To Kallishwari CompanyDocument52 pagesA Study On Inventory Management With Reff To Kallishwari CompanyMuthu MarshNo ratings yet

- Financial Analysis of SpicDocument72 pagesFinancial Analysis of SpicMuthu MarshNo ratings yet

- Financial Statement Analysis 2011 - 2012Document75 pagesFinancial Statement Analysis 2011 - 2012Shams SNo ratings yet

- Survey of Accounting 5th Edition Edmonds Test Bank 1Document63 pagesSurvey of Accounting 5th Edition Edmonds Test Bank 1melody100% (43)

- TS Cash FlowDocument4 pagesTS Cash FlowVansh GoelNo ratings yet

- Test Bank Chapter 16Document23 pagesTest Bank Chapter 16rolathaer1996No ratings yet

- IFRS Differences in Accounting 17Document7 pagesIFRS Differences in Accounting 17Silvia alfonsNo ratings yet

- GR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)Document7 pagesGR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)fiza alviNo ratings yet

- KPI RepositoryDocument33 pagesKPI RepositoryBONo ratings yet

- S5a FINANCIAL RATIO ANALYSIS ASSIGNMENT QUESTIONSDocument16 pagesS5a FINANCIAL RATIO ANALYSIS ASSIGNMENT QUESTIONSSYED ANEES ALINo ratings yet

- MFRS Glossary in Bahasa Malaysia - July2015Document66 pagesMFRS Glossary in Bahasa Malaysia - July2015Muhammad Yunus KamilNo ratings yet

- BT Ma 1Document2 pagesBT Ma 1fin.minhtringuyenNo ratings yet

- Analisis Keuangan - Fakhri UIDocument72 pagesAnalisis Keuangan - Fakhri UIbyfadia5No ratings yet

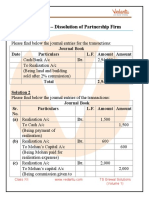

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDocument17 pagesTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (1)

- M3W4 Entreprenuership 2ND Semester Module 4 BontilaoDocument24 pagesM3W4 Entreprenuership 2ND Semester Module 4 BontilaoRoshaine Esgana TaronaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoRaymond RosalesNo ratings yet

- Adjusting Entries - Entries Made Prior To The Preparation of Financial Statements To UpdateDocument2 pagesAdjusting Entries - Entries Made Prior To The Preparation of Financial Statements To UpdateLarry IcayanNo ratings yet

- Fixed Rate Mortgage Homework ProblemsDocument2 pagesFixed Rate Mortgage Homework ProblemscjNo ratings yet

- Dissolution SolutionDocument32 pagesDissolution SolutionKomal RastogiNo ratings yet

- Cma2 Ch2 Mgmt@DuDocument16 pagesCma2 Ch2 Mgmt@DuGosaye AbebeNo ratings yet

- Markel PDFDocument331 pagesMarkel PDFvikrant_16No ratings yet

- Ias 10Document4 pagesIas 10Grishma DoshiNo ratings yet

- Corporate Finance Academic Year 2011-2012 TutorialsDocument21 pagesCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- Cash Flow StatementsDocument3 pagesCash Flow Statementsits_mubeen_4uNo ratings yet

- 9 Partnership Question 4Document7 pages9 Partnership Question 4kautiNo ratings yet

- Supplemental Guide: Module 4: Reporting & TroubleshootingDocument75 pagesSupplemental Guide: Module 4: Reporting & TroubleshootingEdward DubeNo ratings yet

- NPO - Income &expenditureDocument47 pagesNPO - Income &expenditureAhmad NawazNo ratings yet

- Financial Management Notes: Note:The Information Provided Here Is Only For Reference - It May Vary The OriginalDocument68 pagesFinancial Management Notes: Note:The Information Provided Here Is Only For Reference - It May Vary The OriginalNittala SandeepNo ratings yet