Professional Documents

Culture Documents

Financial Management MBA2

Uploaded by

harshaldhingraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management MBA2

Uploaded by

harshaldhingraCopyright:

Available Formats

MB00-45-FINANCIAL MANAGEMENT Q1.

Ans. What are the goals of financial management? Financial Management means maximization of economic welfare of its shareholders. Maximization of economic welfare means of wealth of its shareholders. Shareholders Wealth maximization is reflected in the market value of the firms shares. Experts believe that, the goal of financial management is attained when it maximizes the market value of shares. There are two versions of the goals of financial management of the firm profit Maximization and wealth maximization. Goals of financial management Profit maximization: - It is based on the cardinal rule of efficiency. Its goal is to maximize the returns with the best output and price levels. A firms performance is evaluated in terms of profitability. Profit maximization is the traditional and narrow approach, which aims at maximizing the profit of the concern. The concept of profit lacks clarity. What does profit mean? Is a profit after tax or before tax? Is it operating profit or net profit available to shareholders? In the sense, profit is neither defined precisely nor correctly. It creates unnecessary conflicts regarding the earning habits of the business concern. Differences in interpretation of the concept of profit thus expose the weakness of profit maximization. Profit maximization neither considers the time value of money nor the net present value of the cash inflow. It does not differentiate between profits of current year with the profits to be earned in later years. The concept of profit maximization apprehends to be either accounting profit or economic normal profit or economic supernormal profit. Wealth maximization:-The term wealth means shareholders wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Wealth maximization is based on the concept of cash flows. Cash flows are a reality and not based on any subjective interpretation. On the other hand, profit maximization is based on accounting profit and it also contains subjective elements. Wealth maximization considers time value of money. Time value of money translates cash flow occurring at different period into a comparable value at zero periods. I finally crystallize into the rate of return that will motivate investors to part with their hard earned savings. Maximizing the wealth of the shareholders means positive net present value of the decisions implemented.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- sl2018 667 PDFDocument8 pagessl2018 667 PDFGaurav MaithilNo ratings yet

- 14 15 XII Chem Organic ChaptDocument2 pages14 15 XII Chem Organic ChaptsubiNo ratings yet

- The Teacher and The Community School Culture and Organizational LeadershipDocument10 pagesThe Teacher and The Community School Culture and Organizational LeadershipChefandrew FranciaNo ratings yet

- Restructuring Egypt's Railways - Augst 05 PDFDocument28 pagesRestructuring Egypt's Railways - Augst 05 PDFMahmoud Abo-hashemNo ratings yet

- Bandung Colonial City Revisited Diversity in Housing NeighborhoodDocument6 pagesBandung Colonial City Revisited Diversity in Housing NeighborhoodJimmy IllustratorNo ratings yet

- Advantages and Disadvantages of The DronesDocument43 pagesAdvantages and Disadvantages of The DronesVysual ScapeNo ratings yet

- USA V BRACKLEY Jan6th Criminal ComplaintDocument11 pagesUSA V BRACKLEY Jan6th Criminal ComplaintFile 411No ratings yet

- Cisco CMTS Feature GuideDocument756 pagesCisco CMTS Feature GuideEzequiel Mariano DaoudNo ratings yet

- Recycle Used Motor Oil With Tongrui PurifiersDocument12 pagesRecycle Used Motor Oil With Tongrui PurifiersRégis Ongollo100% (1)

- Class Ix - Break-Up SyllabusDocument3 pagesClass Ix - Break-Up Syllabus9C Aarib IqbalNo ratings yet

- Computer Portfolio (Aashi Singh)Document18 pagesComputer Portfolio (Aashi Singh)aashisingh9315No ratings yet

- Operation Manual: Auto Lensmeter Plm-8000Document39 pagesOperation Manual: Auto Lensmeter Plm-8000Wilson CepedaNo ratings yet

- Tatoo Java Themes PDFDocument5 pagesTatoo Java Themes PDFMk DirNo ratings yet

- Post Marketing SurveillanceDocument19 pagesPost Marketing SurveillanceRamanjeet SinghNo ratings yet

- Tender Notice and Invitation To TenderDocument1 pageTender Notice and Invitation To TenderWina George MuyundaNo ratings yet

- Fiera Foods - Production SupervisorDocument1 pageFiera Foods - Production SupervisorRutul PatelNo ratings yet

- Roadmap For Digitalization in The MMO Industry - For SHARINGDocument77 pagesRoadmap For Digitalization in The MMO Industry - For SHARINGBjarte Haugland100% (1)

- Expressive Matter Vendor FaqDocument14 pagesExpressive Matter Vendor FaqRobert LedermanNo ratings yet

- Judge Vest Printable PatternDocument24 pagesJudge Vest Printable PatternMomNo ratings yet

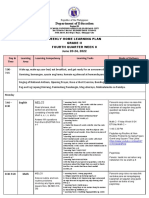

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Document8 pagesDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIONo ratings yet

- Inbound 9092675230374889652Document14 pagesInbound 9092675230374889652Sean Andrew SorianoNo ratings yet

- Philips DVD Player SpecificationsDocument2 pagesPhilips DVD Player Specificationsbhau_20No ratings yet

- Application D2 WS2023Document11 pagesApplication D2 WS2023María Camila AlvaradoNo ratings yet

- Living Nonliving DeadDocument11 pagesLiving Nonliving DeadArun AcharyaNo ratings yet

- Rheology of Polymer BlendsDocument10 pagesRheology of Polymer Blendsalireza198No ratings yet

- Driving Continuous Improvement by Developing and Leveraging Lean Key Performance IndicatorsDocument10 pagesDriving Continuous Improvement by Developing and Leveraging Lean Key Performance IndicatorskellendadNo ratings yet

- Ana White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Document20 pagesAna White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Ahmad KamilNo ratings yet

- Numerical Methods: Jeffrey R. ChasnovDocument60 pagesNumerical Methods: Jeffrey R. Chasnov2120 sanika GaikwadNo ratings yet

- TransistorDocument1 pageTransistorXhaNo ratings yet

- Kahveci: OzkanDocument2 pagesKahveci: OzkanVictor SmithNo ratings yet