Professional Documents

Culture Documents

Us Tax Techs

Uploaded by

srimkbCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Us Tax Techs

Uploaded by

srimkbCopyright:

Available Formats

1. 2. 3. 4. 5.

My Home > ERP Human Capital Management > Tax > Tax Wage Types

Tools

Tax Wage Types

Attachments:1 Added by S Karthik, last edited by Gabriel Bellina on Apr 05, 2012 (view change)

Purpose

This document provides basic information about WT configuration for tax calculation and output technical wage types.

Overview

US payroll will perform tax calculation (payroll function USTAX) accordingly to the configuration of each wage type assigned to each employee. The tax calculation process outputs are used to fill technical wage types and, later, the cluster tables.

A. User-defined tax wage types

Tax wage types are defined by Processing Class 68, 69, and 71: PRCL 68 - determines the tax method PRCL 69 - defines if it is an earning or deduction PRCL 71 - indicates the tax class (customer-defined)

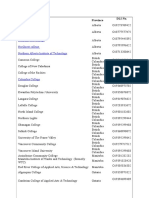

Fig. 1 Screenshot of tcode SM30 view V_512W_O: wage type M003 processing class configuration

Taxable earnings PRCL 68 must be set to one of the following 6 values: * 1 - regular * 2 - supplemental * 3 - cumulative * 4 - vacation * 5 - gross-up regular * 6 - gross-up supplemental (BSI only allows for these types of taxable earnings) PRCL 69 must be set to: * 1 - taxable earning PRCL 71 must be set to: * one tax class based on the tax model

B. SAP technical tax wage types

Most commonly used: /3xx - total gross earnings (w/o deductions) /4xx - tax amount (returned from BSI) /6xx - gross earnings (w/ deductions) /7xx - taxed earnings (returned from BSI) Other technical wage types: /Qxx - taxable not taxed /Nxx - tax not taken /Ixx - deductions not applied /3xx - Gross earnings: Total gross earnings not including any pre-tax deduction. Example: Salary : $1,000 401K pre-tax deduction : $ 200 /3xx : $ 1,000 /4xx Tax amount Tax calculated and returned by BSI /6xx Taxable earnings: Gross earnings less pre-tax deduction amount. Amount passed to BSI for tax calculation. Example: Salary : $1,000 401K pre-tax deduction : $ 200 /6xx : $ 800 /7xx Taxes earnings Taxed earnings returned by BSI. Reportable earnings amount. Example: /603 EE FICA : $10,000 YTD /603 : $80,000 FICA ceiling : $87,000 /703 : $7,000

/Qxx Taxable but not taxed Any reportable amount from which no taxes are withheld. PRCL 69 = 3 Usually used for assessments of non-cash benefits. Example: Use of company car : $500 (assessed value) /4xx : $0 /Qxx : $500 /Nxx Tax note taken Tax calculated but not able to be taken (not enough cash). These wage types are built in payroll function UTPRI and depend upon settings in table T5US0 and T51P1. /Ixx Pre-tax deductions not taken Result of pre-tax deductions exceeding taxable earnings. /Ixx stores the amount that would have been reduced if taxable earnings existed to be reduced. Example: Vacation Payout : $1,000.00 Medical deduction : $100.00 Fed: 01 (FIT) : 1000 - 100 = 900 03 (EE FICA) : 1000 - 100 = 900 CA: 01 (SIT) : 1000 - 100 = 900 41 (SDI) : 0 - 100 = -100 moved into /I41 $100 /Ixx holds a taxable deduction that has not been used for the EE's benefit.

URL FOR MORE INFORMATIONS http://help.sap.com/saphelp_45b/helpdata/en/89/6d4d12728f11d280dd00c04fadbff 1/frameset.htm

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Private Investigator Security Guard Training Manual January 2008Document573 pagesPrivate Investigator Security Guard Training Manual January 2008righttrack186% (7)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- PSISA Practice Test1 PDFDocument31 pagesPSISA Practice Test1 PDFsrimkbNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cognitive Psychology: Kendra Cherry A Board-Certified PhysicianDocument3 pagesCognitive Psychology: Kendra Cherry A Board-Certified PhysiciansrimkbNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Retail DomainDocument108 pagesRetail DomainsrimkbNo ratings yet

- ServiceNow Sample Resume 2Document6 pagesServiceNow Sample Resume 2srimkb67% (3)

- PMP FormulaDocument3 pagesPMP FormulaCarmen SalazarNo ratings yet

- DataStage ArchitectureDocument10 pagesDataStage ArchitecturesrimkbNo ratings yet

- Estimate Story Points in AgileDocument3 pagesEstimate Story Points in AgilesrimkbNo ratings yet

- Essential ScrumMasterDocument3 pagesEssential ScrumMastersrimkbNo ratings yet

- Scrum Master Interview QuestionsDocument1 pageScrum Master Interview QuestionssrimkbNo ratings yet

- Principles of Scrum MethodologyDocument2 pagesPrinciples of Scrum MethodologysrimkbNo ratings yet

- JavaScript Built-In FunctionsDocument7 pagesJavaScript Built-In FunctionssrimkbNo ratings yet

- Contents of Service-Now Training-1Document9 pagesContents of Service-Now Training-1srimkbNo ratings yet

- SOW Implementation MethodologyDocument3 pagesSOW Implementation MethodologysrimkbNo ratings yet

- Situational ScrumDocument15 pagesSituational ScrumsrimkbNo ratings yet

- An Overview of Social Psychology: Kendra Cherry A Board-Certified PhysicianDocument3 pagesAn Overview of Social Psychology: Kendra Cherry A Board-Certified PhysiciansrimkbNo ratings yet

- Agile Development Cheat SheetDocument3 pagesAgile Development Cheat SheetsrimkbNo ratings yet

- RPA Interview QuestionsDocument2 pagesRPA Interview Questionssrimkb100% (1)

- Scrum in A Nutshell PDFDocument2 pagesScrum in A Nutshell PDFsrimkbNo ratings yet

- Scrum ArtifactsDocument1 pageScrum ArtifactssrimkbNo ratings yet

- Bow Valley College Lakeland College Medicine Hat College Norquest College Northern Alberta Institute of TechnologyDocument2 pagesBow Valley College Lakeland College Medicine Hat College Norquest College Northern Alberta Institute of TechnologysrimkbNo ratings yet

- Ibm Unica Campiagn Overview PDFDocument4 pagesIbm Unica Campiagn Overview PDFsrimkbNo ratings yet

- QuestionsDocument95 pagesQuestionssrimkbNo ratings yet

- Employment by IndustryDocument21 pagesEmployment by IndustrysrimkbNo ratings yet

- GFT Factsheet Regulatory Change Management Service enDocument2 pagesGFT Factsheet Regulatory Change Management Service ensrimkbNo ratings yet

- Invoice TemplateDocument1 pageInvoice TemplatesrimkbNo ratings yet

- Fujitsu ServiceNowDocument30 pagesFujitsu ServiceNowsrimkbNo ratings yet