Professional Documents

Culture Documents

Social Control Over Finance Federal Corporate Law After The Meltdown

Uploaded by

kumarpallav20063929Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Social Control Over Finance Federal Corporate Law After The Meltdown

Uploaded by

kumarpallav20063929Copyright:

Available Formats

Comment by: Kumar Pallav Corporate law: Policy Analysis

Comment on Social Control over Finance: Federal Corporate Law after the Meltdown

Author: Robert B. Thompson New York Alumni Chancellors Chair in Law and Professor of Management

Market collapse reaction in U.S. financial sector leads to significant change in the structure of corporate law. The present paper makes a first step towards providing as how federal and state governments have settled into federalism equilibrium by contrasting approaches to corporate law with a distinct and opposite approach to law-making. This paper investigates the fundamental legal reforms that followed the Great Depression. In this comment I intend to focus on the paper written by Robert B. Thompson and how the author could explain that Delaware, while declining to take on the federal regulation directly, has developed a more effective way of delivering integrated regulation using both federal and state law. The goal of this comment will be to support and contrast the views of Robert B. Thompson, specifically in the issue of shared function of the state and federal governments in which the states have the primary role and federal law takes a supporting function. The author analyzed the new governance challenges and tried to track the answer to the primary policy questionis this issue best resolved by private ordering (which means leaving it to state law) or does it require some form of government regulation (which means putting it within the federal realm of corporate law)? In order to give the answer of this question, author has given the evidence of federal intrusions into the internal governance of corporations that follows in the line of the earlier reforms. These reforms include provisions of insider trading of the Securities Exchange Act of 1934, banning entity loans to insiders, certification requirement of firms financial statement on CEO and CFO and the minimum qualifications of directors via the Sarbanes-Oxley Act of 2002 (Sarbox) .

Comment by: Kumar Pallav Corporate law: Policy Analysis

On the other hand author analyzed the role of Delaware. It has declined to take on the federal regulation directly and has developed a more effective way of delivering integrated regulation using both federal and state law. Delaware has laid down a marker based on the necessity of linking disclosure to shareholders with protection of the space given shareholders to make a decision. However, It is notable that look of federal state regulation in corporate governance will depend on whether the trend in these Delaware cases effectively linking disclosure and substantive protection of shareholder space spreads to related areas. Paper reveals a surprising result that Delaware courts during the last decade have shown how state courts can use the federal disclosure system to regulate corporate transactions in a more integrated way than is done in federal law. Law-making at the federal level occurs more regularly by SEC rule-making to fill gaps delegated to the agency in the Congressional statutes. The SEC, like any administrative agency is subject to capture by the host of regulated industries who have great incentives to seek to influence its regulation and the positive incentives of the agency dont seem as great as those of Delaware. This supports the fact that state law should govern the internal affairs of the corporation. At the other end of the spectrum, the analysis explore that in an economy where so few transactions are off the grid of an interconnected global market, state law less often seems the appropriate level for government response. Additionally, the need for domestic companies to meet numerous and sometimes conflicting standards of multiple states do not support state law in corporation law for future. Author supports that this argument against federalism has less power in corporate governance. Author suggests that the state of incorporation determines things like governance and the relationship between managers and shareholders. This undercuts the multistate inefficiency argument for federalism in corporate governance. The analysis explores the fact that The SEC has reworked its rules on disclosure of compensation twice in recent years. But the pay of chief executives has grown to a multiple of the average worker that is greatly higher than a generation ago. This fact leave a scope of further

Comment by: Kumar Pallav Corporate law: Policy Analysis

analyses of impact of SECs regulation on executive compensation .The author did not explain these issues which may certainly put some light on the reasons behind the failure of federal and state laws to completely control this core issue of internal corporate affairs . I admire finding in this paper which bring to light the shared function of the state and federal governments in which the states have the primary role and federal law takes a supporting function. This paper addresses the central issue of this bipolar federalism that corporate transactions remain subject to two sets of rules reflecting different philosophies to regulation. This paper gives a message that how state courts can use the federal disclosure system to regulate corporate transactions in a more integrated way than is done in federal law.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Legal - Kumar Pallav 2019Document2 pagesLegal - Kumar Pallav 2019kumarpallav20063929No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Operation Management - "Segment Your Suppliers To Reduce Risk"Document6 pagesOperation Management - "Segment Your Suppliers To Reduce Risk"kumarpallav20063929No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

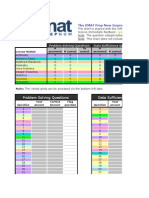

- GMAT Prep Now Improvement Chart For OG13Document67 pagesGMAT Prep Now Improvement Chart For OG13kumarpallav20063929No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- New York PracticeDocument34 pagesNew York Practicekumarpallav20063929100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Questioins - Ch1 - GovrDocument4 pagesQuestioins - Ch1 - GovrMohamed HegazyNo ratings yet

- Ifrs Insurance Contracts Standard Visual Guide June 2017Document1 pageIfrs Insurance Contracts Standard Visual Guide June 2017YoanNo ratings yet

- CertIFR Session 03-Module 01Document18 pagesCertIFR Session 03-Module 01Samer AfanehNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- CompassGroup Annual Report2019Document252 pagesCompassGroup Annual Report2019Jerry StephenNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sony Company OverviewDocument31 pagesSony Company OverviewAnshulMittal100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ey Europe Long Term Value and Corporate Governance Survey 2023Document32 pagesEy Europe Long Term Value and Corporate Governance Survey 2023ComunicarSe-ArchivoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- BA201 PresentationDocument87 pagesBA201 PresentationRF PopeXianNo ratings yet

- Course Syllabus MGT 104 Corp GovernanceDocument5 pagesCourse Syllabus MGT 104 Corp GovernanceKristelle Anne Mae Gayamat100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- END2007 Loss Development TrianglesDocument91 pagesEND2007 Loss Development TrianglesRaoul TurnierNo ratings yet

- Citic Pacific Case StudyDocument5 pagesCitic Pacific Case StudykeeriofazlerabiNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Financial Derivative AssignmentDocument14 pagesFinancial Derivative AssignmentSriSaraswathyNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Mr. Carl Newman A.A.E. CEO of Jackson Municipal Airport Authority Elected Chair of AAAEDocument2 pagesMr. Carl Newman A.A.E. CEO of Jackson Municipal Airport Authority Elected Chair of AAAEthe kingfishNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 4 Advanced Financial Accounting PDFDocument39 pagesChapter 4 Advanced Financial Accounting PDFAddis FikruNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- 09 - Chapter 3 PDFDocument24 pages09 - Chapter 3 PDFShamshuddin nadafNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- InfosysDocument71 pagesInfosysyoursabhishekNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Effect of Stakeholder Pressure and Corporate Governance On The Quality of Sustainability ReportDocument19 pagesThe Effect of Stakeholder Pressure and Corporate Governance On The Quality of Sustainability ReportDannyPutraPratamaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- رسالة ماجستير أعمال الإصلاح المحاسبي في الجزائر وآفاق تبني وتطبيق النظام المحاسبي المالي بوعلام صالحي PDFDocument257 pagesرسالة ماجستير أعمال الإصلاح المحاسبي في الجزائر وآفاق تبني وتطبيق النظام المحاسبي المالي بوعلام صالحي PDFSo FìaneNo ratings yet

- The Importance of Corporate Governance in Public Sector: January 2012Document8 pagesThe Importance of Corporate Governance in Public Sector: January 2012Yuvin YaNnNo ratings yet

- 2020 Corportate Sustainability ReportDocument22 pages2020 Corportate Sustainability ReportMohamed KannouNo ratings yet

- Numerical AssignmentDocument2 pagesNumerical AssignmentPS FITNESSNo ratings yet

- BodyDocument263 pagesBodyTiyas KurniaNo ratings yet

- The Role of Managerial FinanceDocument42 pagesThe Role of Managerial Financemild incNo ratings yet

- (Book - Securities Markets Series) Sunil K. ParameswaraDocument68 pages(Book - Securities Markets Series) Sunil K. Parameswarachemical_alltimeNo ratings yet

- Acc111 - PPT - Corporate Governance and AuditsDocument28 pagesAcc111 - PPT - Corporate Governance and AuditsMAE ANNE SILAGANNo ratings yet

- 7 MsDocument3 pages7 MsAiza Bermejo100% (4)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Basic of Reinsurance 03 June 21 Munch ReDocument24 pagesBasic of Reinsurance 03 June 21 Munch ReFernand DagoudoNo ratings yet

- Pos Malaysia 2018 PDFDocument231 pagesPos Malaysia 2018 PDFGaya GemilangNo ratings yet

- Board Characteristics, State Ownership and FirmDocument20 pagesBoard Characteristics, State Ownership and FirmIsmanidarNo ratings yet

- Bokaro or Electrosteel Annual Report of 2017Document126 pagesBokaro or Electrosteel Annual Report of 2017Sachidananda SubudhyNo ratings yet

- Sterling Bank PLC 2010 Annual Report & AccountsDocument125 pagesSterling Bank PLC 2010 Annual Report & AccountsSterling Bank PLC100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)