Professional Documents

Culture Documents

Basel III - Impact On Foreign Banks in India PDF

Uploaded by

Vivek KheparOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel III - Impact On Foreign Banks in India PDF

Uploaded by

Vivek KheparCopyright:

Available Formats

www.pwc.

com

Basel III Impact on Foreign Banks in India Discussion note

May 2012

May 2012

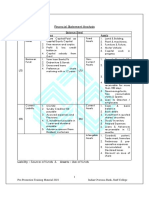

RBI guidelines on Basel III Key components

Tighter definitions for regulatory capital Capital buffer requirements Enhanced Enhanced liquidity counterparty credit standards risk controls

Leverage ratio

Redefined Core, Tier Capital conservation 1, Tier 2 capital: buffer: Banks must Qualifying asset types are maintain a buffer above restricted and tier is the minimum capital structure is rationalized requirements

Strengthened Short-term liquidity Non-risk weighted counterparty credit coverage ratio: Banks measure of exposure: risk management: must meet funding Banks must keep the ratio Banks must include obligations for 30 days of Tier 1 capital to grossStressed inputs, credit under an acute liquidity exposures, including offvaluation adjustments stress scenario balance sheet exposures, Public disclosure Countercyclical and wrong-way risk in at specific conversion requirements: Banks capital buffer: Banks Long-term net stable risk modelling and rates, above 4.5% must reconcile regulatory must maintain an funding ratio: Banks conduct robust back(current RBI guidelines) capital to audited additional capital buffer must hold adequate testing financial statements during times of excessive longer-term stable credit growth Strengthened funding sources in terms Higher levels of collateral mgmt of the liquidity profile of capital: Common equity Framework for standards: Banks must their assets requirement increased capital buffer improve collateral from 2% to 5.5%, plus a replenishment: Banks operations and apply 2.5% conservation. Tier 1 are constrained in longer margining periods capital ratio increased to distributing earnings if for derivatives exposures 8% buffers under-funded Contingent capital: Banks must hold further debt securities that can convert to equity in times of stress Incentives for central clearing of OTC Products: Centrally cleared products are given low risk weightings

As RBI guidelines on Basel III impact heavily on capital, liquidity and overall leverage, they will necessitate changes to the business and operational strategy of several banks

PwC 2

Capital Base Transitional arrangements : RBI guidelines on Basel III

Jan 1, 2013 Min Common Equity Tier 1 Capital conservation buffer Min common equity + cap conservation buffer Minimum Tier 1 Capital Minimum Total Capital * Min Total Capital + cap conservation buffer Phase in of deductions from Common Equity Tier 1 Capital instruments that no longer qualify as Tier 1 or Tier 2 4.5% Mar 31, 2014 5.0% Mar 31, 2015 5.5% 0.625% 6.125% 7.0% 9.0% 9.625% 60% Mar 31, 2016 5.5% 1.25% 6.75% 7.0% 9.0% 10.25% 80% Mar 31, 2017 5.5% 1.875% 7.375% 7.0% 9.0% 10.875% 100% Mar 31, 2018 5.5% 2.5% 8.0% 7.0% 9.0% 11.5% 100%

4.5% 6.0% 9.0% 9.0% 40%

5.0% 6.5% 9.0% 9.0% 40%

Phased out over 10 year period starting January 2013

* The difference between the minimum total capital requirement of 9% and the Tier 1 requirement can be met with Tier 2 and higher forms of capital.

PwC 3

RBI guidelines on Basel III Impact on foreign banks in India (1)

Common equity and retained earnings should be the predominant component of Tier 1 capital instead of debt-like instruments, well above the current 50% rule Gradual phase-out of hybrid Tier 1 components including many of the step-up / innovative / SPV issued Tier 1 instruments used by banks Minimum common equity Tier 1: Increased from 2% to 5.5%

Tighter definitions for regulatory capital

Plus capital conservation buffer of 2.5%

Bringing total common equity requirements to 8.0% Minimum total capital: Increased from 9.0% to 11.5% (including conservation buffer)

To be phased in from 2013 to 2018

Capital buffer requirements

Capital conservation buffer of 2.5 % in addition to minimum capital requirements Counter-cyclical capital buffer being developed which is expected to be implemented by increases to the capital conservation buffer during periods of excessive credit growth. RBI will issue further guidelines on CC, this may lead to marginally additional capital requirement

4

PwC

RBI guidelines on Basel III Impact on foreign banks in India (2)

Enhanced counterparty credit risk controls Improved counterparty risk management standards in the area of collateral management and stress-testing Encouraging use of Central Counterparties (CCPs) for standardised derivatives The liquidity coverage ratio will help ensure that banks have sufficient high-quality liquid assets to withstand a stressed funding scenario specified by RBI For liquidity coverage ratio, assets get a liquidity based weightage varying from 100% for government bonds and cash to 0%-50% for corporate bonds For net stable funding ratio, required and available funding amounts are determined using weighing factors, reflecting the stability of the funding available and the duration of the asset LCR & NSFR For net stable funding ratio, the weightage factors for assets vary from 0% and 5% for cash and government bonds, to 85% for retail loans and small business loans (remaining maturity < 1 year) and 100% for other assets

Enhanced liquidity standards

Leverage Ratio

The leverage ratio is implemented on a gross and un-weighted basis (banks total assets including both on and off-balance sheet assets) as a proportion of the banks total capital. This does not take into account the risks related to the assets. Final leverage ratio requirement would be prescribed by RBI after the parallel run taking into account the prescriptions given by the Basel Committee Banks which at present have the leverage ratio below 4.5% may endeavor to bring it above 4.5% as early as possible

PwC

Thank you

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers Private Limited, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. 2012 PricewaterhouseCoopers Private Limited. All rights reserved. In this document, PwC refers to PricewaterhouseCoopers Private Limited (a limited liability company in India), which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- KKR Private CreditDocument47 pagesKKR Private CreditBernard100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Ultimate Guide To Debt & Leveraged Finance - Wall Street PrepDocument18 pagesUltimate Guide To Debt & Leveraged Finance - Wall Street PrepPearson SunigaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tail Risk Management - PIMCO Paper 2008Document9 pagesTail Risk Management - PIMCO Paper 2008Geouz100% (1)

- Corporate FinanceDocument96 pagesCorporate FinanceRohit Kumar80% (5)

- Cosmetics Business PlanDocument21 pagesCosmetics Business PlanJinendra Sandeepa100% (4)

- Analyse Financiere IscaeDocument102 pagesAnalyse Financiere IscaeBenbrahim Mohammed100% (2)

- Financial AnalysisDocument15 pagesFinancial AnalysisSitiNorhafizahDollah100% (1)

- Chapter 9 Financial ManagementDocument18 pagesChapter 9 Financial ManagementAshish GangwalNo ratings yet

- Starting PageDocument8 pagesStarting PageVivek KheparNo ratings yet

- Hedge Fund AccountingDocument14 pagesHedge Fund AccountingVivek KheparNo ratings yet

- Hedge FundsDocument25 pagesHedge FundsVivek KheparNo ratings yet

- KK - DepositoryDocument36 pagesKK - DepositoryVivek KheparNo ratings yet

- Form QuotDocument7 pagesForm Quotsaravanan_c1No ratings yet

- Fine Tippy Golden Flowery Orange PekoeDocument2 pagesFine Tippy Golden Flowery Orange PekoeVivek KheparNo ratings yet

- Assignment of AccountsDocument26 pagesAssignment of AccountsVivek KheparNo ratings yet

- Abcd PDFDocument72 pagesAbcd PDFVivek KheparNo ratings yet

- 7-Market Risk Management PDFDocument7 pages7-Market Risk Management PDFVivek KheparNo ratings yet

- Amruta - Tamhankar - Export Import Transactions in BankDocument84 pagesAmruta - Tamhankar - Export Import Transactions in BankVivek KheparNo ratings yet

- Time Series and ForecastingDocument20 pagesTime Series and ForecastingVivek KheparNo ratings yet

- Customer EngagementDocument5 pagesCustomer EngagementVivek KheparNo ratings yet

- Export Finance - Shivali MehtaDocument91 pagesExport Finance - Shivali MehtaVivek KheparNo ratings yet

- Risk ReturnDocument2 pagesRisk ReturnVivek KheparNo ratings yet

- Social MediaDocument2 pagesSocial MediaVivek Khepar100% (1)

- Accounting For ManagementDocument2 pagesAccounting For ManagementVivek KheparNo ratings yet

- Activity Based CostingDocument2 pagesActivity Based CostingVivek KheparNo ratings yet

- 7 - 4-Managing Market Risk PDFDocument17 pages7 - 4-Managing Market Risk PDFVivek KheparNo ratings yet

- Colgate Palmolive - Re-Iterate Accumulate Mar 21 2013Document14 pagesColgate Palmolive - Re-Iterate Accumulate Mar 21 2013Vivek KheparNo ratings yet

- 7 - 1-Market Risk PDFDocument15 pages7 - 1-Market Risk PDFVivek KheparNo ratings yet

- 7 - 3-Measurement of Market Risk PDFDocument42 pages7 - 3-Measurement of Market Risk PDFVivek KheparNo ratings yet

- Summer Report FormatDocument8 pagesSummer Report FormatSahilJainNo ratings yet

- 7 - 2-Basel Committee Recomendations PDFDocument23 pages7 - 2-Basel Committee Recomendations PDFVivek KheparNo ratings yet

- Underlined) : Annex 1 and Paragraph 1.4 of Annex 2 RespectivelyDocument6 pagesUnderlined) : Annex 1 and Paragraph 1.4 of Annex 2 RespectivelyVivek KheparNo ratings yet

- ProjectDocument1 pageProjectVivek KheparNo ratings yet

- Risk MGMTDocument126 pagesRisk MGMTAndrés Vargas NavaNo ratings yet

- PROJECTDocument16 pagesPROJECTVivek KheparNo ratings yet

- Banking RiskDocument26 pagesBanking RiskmkrmadNo ratings yet

- Asset 24oct07Document9 pagesAsset 24oct07Faith RiderNo ratings yet

- ECGC Cla PDFDocument9 pagesECGC Cla PDFVivek KheparNo ratings yet

- Mankiw10e Lecture Slides Ch04Document43 pagesMankiw10e Lecture Slides Ch04Anggi YudhaNo ratings yet

- Irctc: Accounting Report On Comparative and Ratio Analysis OFDocument14 pagesIrctc: Accounting Report On Comparative and Ratio Analysis OFSoumya Sumana SendNo ratings yet

- Synopsis On Capital StructureDocument11 pagesSynopsis On Capital StructureSanjay MahadikNo ratings yet

- Corporate Reporting Answers: Foundation Level Examination 2019 Mock ExamDocument18 pagesCorporate Reporting Answers: Foundation Level Examination 2019 Mock ExamOyeleye TofunmiNo ratings yet

- Hedge Funds: Origins and Evolution: John H. MakinDocument17 pagesHedge Funds: Origins and Evolution: John H. MakinHiren ShahNo ratings yet

- Chapter 3 Analyzing Bank PerformanceDocument84 pagesChapter 3 Analyzing Bank Performancesubba raoNo ratings yet

- 202 FM MCQsDocument39 pages202 FM MCQsAK Aru ShettyNo ratings yet

- Development of Prediction Models For Horizontal and Vertical MergersDocument13 pagesDevelopment of Prediction Models For Horizontal and Vertical MergersEnaNukovićNo ratings yet

- An OverviewDocument19 pagesAn OverviewFelix HonNo ratings yet

- Literature Review On Ratio AnalysisDocument8 pagesLiterature Review On Ratio Analysisgw2wr9ss100% (1)

- Abnormal Audit Fee and Audit QualityDocument23 pagesAbnormal Audit Fee and Audit QualityYohaNnesDeSetiyanToNo ratings yet

- Capital StructureDocument58 pagesCapital Structurekedar25hNo ratings yet

- An Empirical Analysis On The Capital Structure of Chinese Listed IT CompaniesDocument6 pagesAn Empirical Analysis On The Capital Structure of Chinese Listed IT CompaniesKiều NguyễnNo ratings yet

- The Effect of Financial Leverage On Profitability and Risk of Restaurant FirmsDocument20 pagesThe Effect of Financial Leverage On Profitability and Risk of Restaurant Firmsmaine pamintuanNo ratings yet

- Value Creation Bridge 1704547119Document5 pagesValue Creation Bridge 1704547119mblue.mkNo ratings yet

- Using DuPont Analysis To Assess The Financial Perf PDFDocument16 pagesUsing DuPont Analysis To Assess The Financial Perf PDFKhusboo ChowdhuryNo ratings yet

- Report INDDocument13 pagesReport INDKacangHitamNo ratings yet

- Financial Statements and Ratio Analysis: True or FalseDocument18 pagesFinancial Statements and Ratio Analysis: True or FalseAbd El-Rahman El-syeoufyNo ratings yet

- BRMDocument69 pagesBRMpatesweetu1No ratings yet

- Financial Statement Analysis: Balance Sheet Liabilities AssetsDocument17 pagesFinancial Statement Analysis: Balance Sheet Liabilities AssetsAman MujeebNo ratings yet

- Fritz - Cherubin02@stjohns - Edu Jillian - Negron02@stjohns - Edu Jabar - Smith02@stjohns - EduDocument36 pagesFritz - Cherubin02@stjohns - Edu Jillian - Negron02@stjohns - Edu Jabar - Smith02@stjohns - EduHaidar IsmailNo ratings yet

- Unit Iv Fund Based Financial Services: Basic Concepts in LeasingDocument13 pagesUnit Iv Fund Based Financial Services: Basic Concepts in LeasingJessica TerryNo ratings yet