Professional Documents

Culture Documents

Recent UK Economy Performance

Uploaded by

Rishabh JindalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recent UK Economy Performance

Uploaded by

Rishabh JindalCopyright:

Available Formats

ECON10082

STUDENT ID: 8760535

Tutor: Serena Masino

In this essay, I will discuss some measures of economic performance of the UK to access its overall performance over the last two decades, while also comparing its performance with other countries. I will be looking at inflation, unemployment rate, and GDP growth rate to make these comparisons.

Inflation In the UK, there are many method to calculate the inflation rate, while Consumer Price Index (CPI) and Retail price index (RPI) remain the dominant ones. CPI is measured according to the EU guidelines and therefore is internationally comparable. The only problem to CPI is that it lacks the ability to measure changes in some house costs. Thus, I will be using an additional measure called CPIH along with CPI, to include housing costs for making a more inclusive assessment of UKs inflation history. CPIH is a new additional measure of consumer price inflation including a measure of owner occupiers housing costs (OOH) and it is important to include OOH in our index as these account for approximately ten per cent of total household expenditure in the UK. (Restieaux, 2013, p.1). The recent data on CPI and CPIH is shown below:

Figure 1:

1990-2013

ECON10082

STUDENT ID: 8760535

Figure 2:

1990-2013

6.0

1.5

Figure 3: CPIH and CPI 12 month change 2006-2012

5.0 12 month percentage change Difference (CPI - CPIH) 4.0 3.0 2.0 1.0 0.0 -1.0 -2.0 CPI-CPIH (right-hand axis) CPIH CPI -0.5 0.0 0.5 1.0

Jan-11

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-12

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Source: ONS The above figure 1 shows that UK has quite successfully been able to manage its target of 2 percent

inflation, if we ignore the big lumps followed by steep fall of early 1990s exchange rate crisis and the recent great depression of 2008-09. Since the great depression, because of the efforts to revive economy through interest rates, UKs economy has not been able to cop-up with its target, maybe because of a fear of another depression period, on the other hand US has managed to do it better even after a deeper recession as shown by figure 2. Figure 3 shows how house prices affect the inflation, where CPIH always being lower than or equal to CPI.

2

Jul-12

ECON10082

STUDENT ID: 8760535

The below table compares UKs average annual CPI with that of 8 other economies over past 14 years:

Figure 4: HICP - International comparisons: EU countries: 1998 to 2013 Percentage change over 12 months

6 4 2 0 -2 -4 France Ireland Netherlands Sweden EU 25 (till 2006), EU 27 (2006 onwards) Germany Italy Spain UK Source: ONS (Feb 2013) 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

It can be observed that the above EU countries follow almost the same trend over the years and the current average of most economies range between 2 to 3 percent with notable exceptions of Sweden and Italy.

Unemployment

This is one of the most influential factor to access the economic performance. It shows how an economy takes care of its labour force especially in the times of recession. I shall look at the past two decades unemployment rate and compare it with that of US, giving special attention to the post crisis performance. Take a look at the following figure which records UKs unemployment rate

ECON10082

STUDENT ID: 8760535

since 1990:

Figure 5:

It can be observed from the above figure that since the early 1990s crisis, UK was able to manage its unemployment quite successfully, enjoying an eight year long period of stability. There is a sudden increase in unemployment since the great depression, which UK has not been able to tackle since then. The below figure compares UKs performan ce in managing unemployment since the 2008 crisis with that of US and EU: Figure 6: Unemployment Rate International Comparison (Jan 2008 - Feb 2013)

14 12

Unemployment Rate (%)

10 8 6 4 2 0

Jul-09

Nov-11

Jul-08

Jul-10

Jul-11

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jul-12

Nov-08

Nov-09

Nov-10

May-08

May-09

May-10

May-11

May-12

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

UK

US

EU

Sources: ONS (UK data), Eurostat (EU data), Bureau of Labour Statistics (US data).

It can be clearly observed that US observed a greater unemployment rate than UK due to the depression, but it is showing clear signs of recovery; on the other hand, UK is still struggling to

4

Nov-12

Sep-08

Sep-09

Sep-10

Sep-11

Sep-12

Jan-13

ECON10082

STUDENT ID: 8760535

overcome the effects of the crisis with no progress at all. However both economies performed significantly better than the Eurozone, which is still worsening main reason being the Southern European countries. The difference in the unemployment rate might also be due to the different approaches to measure it. An interesting fact to note here is that in the early 2008, both inflation and unemployment were found to be increasing together right before the crisis.

GDP The gross domestic product (GDP) is the main measure to access the economic performance of an economy in the global market. Growth in GDP is considered as a growth in overall economy as it reflects the growth in the income of the residents. I will look at the UKs performance in keeping up its GDP growth rate through the following figure:

Figure 7:

One unique feature of this great depression was that it took the GDP growth rate to the minimum according to the above figure, and yet the growth rate is falling. It certainly reflects how severe this depression is. One can easily see the relatively smooth phase of GDP growth between the two depressions of 1990s and 2008-09 respectively. To access UKs relative performance in recovering from the crisis, I shall compare the post-crunch period through the following figure:

ECON10082

STUDENT ID: 8760535

Figure 8: International comparision of UK's quarterly GDP growth rate (2008 - Q1 2013)

6 4 2 0 -2 -4 -6 -8 -10 UK US EU Sources: ONS (UK data), Eurostat (EU data), Bureau of Economic Analysis (US data).

The above figure more clearly reflects the post crisis story, taking quarterly growth rate in account. It can be observed that the UK has consistently been showing a negative GDP growth with a few positives. The Euro zone shows the similar story, where it seems difficult to recover from the creditcrunchs effects. On the other hand, US, even after having a considerably larger disaster, has improved its performance with consistently positive GDP growth. While looking at the GDP performance, one must also consider that GDP is essentially an indicator of a nations production. But production may be a poor indicator of societys well-being (Sloman, 2005, p.377). Conclusion UK observed a very long period of stability with favourable performance between the two crisis of early 1990s and 2008 respectively. Since the great depression, UK, along with its neighbour economies, have been struggling to improve its performance but still being better than the Eurozone average as seen above. The signs of this depression are clear and worse in the Euro area. As the post-crunch economy shows no signs of progress even after 4 years, this certainly is a great depression, thus it is too early to measure the consequences.

[Words count: 1,000]

GDP growth rate (%)

ECON10082

STUDENT ID: 8760535

Bibliography

RESTIEAUX, A. 2013. Introducing the New CPIH Measure of Consumer Price Inflation. March 12, 2013 ed.: Office for National Statistics.

SLOMAN, J. 2005. Economics, GB, Pearson Education.

Office for National Statistics, UK , (Online), Available: http://www.ons.gov.uk/ons/datasets-andtables/index.html

Eurostat (Online), Available: http://epp.eurostat.ec.europa.eu/portal/page/portal/statistics/themes

U.S. Bureau of Labour Statistics (Online), Available : http://www.bls.gov/data/

You might also like

- A Dynamic AD-AS Analysis of The UK Economy, 2002-2010Document9 pagesA Dynamic AD-AS Analysis of The UK Economy, 2002-2010Shubham RaoNo ratings yet

- Global Lessons For Inclusive Growth: As Prepared For DeliveryDocument18 pagesGlobal Lessons For Inclusive Growth: As Prepared For DeliveryTBP_Think_TankNo ratings yet

- I: The Economic Performance of The United KingdomDocument26 pagesI: The Economic Performance of The United KingdomAmit PatelNo ratings yet

- Edexcel As Econ Unit 2 FullDocument198 pagesEdexcel As Econ Unit 2 Fullloca_sanamNo ratings yet

- Deflation Danger 130705Document8 pagesDeflation Danger 130705eliforuNo ratings yet

- Aqa Econ4 W SQP 07Document6 pagesAqa Econ4 W SQP 07James JohnNo ratings yet

- Aqa Econ4 W QP Jun11Document8 pagesAqa Econ4 W QP Jun11api-247036342No ratings yet

- 30 June COTW Commentary 2Document5 pages30 June COTW Commentary 2jitenparekhNo ratings yet

- The UKs Sustained Growth Between 1997 and 2008Document6 pagesThe UKs Sustained Growth Between 1997 and 2008tuan sonNo ratings yet

- Has Austerity Worked in Spain?Document14 pagesHas Austerity Worked in Spain?Center for Economic and Policy ResearchNo ratings yet

- US Economic Recovery After 2008 Crisis Slow But SteadyDocument7 pagesUS Economic Recovery After 2008 Crisis Slow But SteadyĐào Duy TúNo ratings yet

- Thinking About MacroeconomicsDocument30 pagesThinking About MacroeconomicsChi-Wa CWNo ratings yet

- The Forces Shaping The Economy Over 2012Document10 pagesThe Forces Shaping The Economy Over 2012economicdelusionNo ratings yet

- Economic Update Nov201Document12 pagesEconomic Update Nov201admin866No ratings yet

- Global Financial Crisis Effects on UK EconomyDocument3 pagesGlobal Financial Crisis Effects on UK EconomyTam LeNo ratings yet

- Business cycles and recessions comparedDocument8 pagesBusiness cycles and recessions comparedmadhavithakurNo ratings yet

- Effects of Global Crisis On Structural Policies and Financial Regulations: The Comparison of OECD EconomiesDocument4 pagesEffects of Global Crisis On Structural Policies and Financial Regulations: The Comparison of OECD EconomiesabdullahburhanbahceNo ratings yet

- The Impact of The Financial Crisis On The Real EconomyDocument17 pagesThe Impact of The Financial Crisis On The Real EconomyRajbir BhatiaNo ratings yet

- c1 PDFDocument11 pagesc1 PDFDanish CooperNo ratings yet

- RecentDocument8 pagesRecentRani JosephNo ratings yet

- Arithmetic Is Absolute: Euro-Area Adjustment: PolicyDocument7 pagesArithmetic Is Absolute: Euro-Area Adjustment: PolicyBruegelNo ratings yet

- 4 PDFDocument10 pages4 PDFMagofrostNo ratings yet

- Introduction To Business FluctuationsDocument68 pagesIntroduction To Business FluctuationsSuruchi SinghNo ratings yet

- Draghi Jackson HoleDocument11 pagesDraghi Jackson HoleargayuNo ratings yet

- GDP Measurement of Economic GrowthDocument7 pagesGDP Measurement of Economic GrowthAndhoXNo ratings yet

- Trading Economics: A Guide to Economic Statistics for Practitioners and StudentsFrom EverandTrading Economics: A Guide to Economic Statistics for Practitioners and StudentsNo ratings yet

- Thesis On Okuns LawDocument8 pagesThesis On Okuns Lawshannongutierrezcorpuschristi100% (2)

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- UK manufacturing policy to focus on niche high-tech industriesDocument5 pagesUK manufacturing policy to focus on niche high-tech industriesJake MorganNo ratings yet

- The UK Recession in Context - Bank of England PDFDocument15 pagesThe UK Recession in Context - Bank of England PDFQuickie SandersNo ratings yet

- Macro Mankiw CleanDocument11 pagesMacro Mankiw Cleanployphatra setthakornNo ratings yet

- Austerity in The Aftermath of The Great RecessionDocument3 pagesAusterity in The Aftermath of The Great RecessionAdrià LópezNo ratings yet

- Forum Van Ark 0Document4 pagesForum Van Ark 0Rachel RobinsonNo ratings yet

- The Crisis, Policy Reactions and Attitudes To Globalization and JobsDocument33 pagesThe Crisis, Policy Reactions and Attitudes To Globalization and JobsSehar AzharNo ratings yet

- FIN 201 - Indi AsDocument10 pagesFIN 201 - Indi AsPvtValley1No ratings yet

- Germany's Economic Recovery from the 2008 RecessionDocument12 pagesGermany's Economic Recovery from the 2008 RecessionMinh TongNo ratings yet

- The Case of Ecuador: Working PaperDocument47 pagesThe Case of Ecuador: Working PaperdidierNo ratings yet

- Eco Project UKDocument16 pagesEco Project UKPankesh SethiNo ratings yet

- As Macro Revision Trade SterlingDocument2 pagesAs Macro Revision Trade SterlingAnonymous fIL7OsuyNo ratings yet

- From Convergence to Crisis: Labor Markets and the Instability of the EuroFrom EverandFrom Convergence to Crisis: Labor Markets and the Instability of the EuroNo ratings yet

- Data Figure ReportDocument15 pagesData Figure Reportapi-667757034No ratings yet

- Paper2 2011Document11 pagesPaper2 2011nikosx73No ratings yet

- Inclusive Growth - Measures and TrendsDocument26 pagesInclusive Growth - Measures and TrendsSurvey TakerNo ratings yet

- Criticart - Young Artists in Emergency: Chapter 1: World Economic Crisis of 2007-2008Document17 pagesCriticart - Young Artists in Emergency: Chapter 1: World Economic Crisis of 2007-2008Oana AndreiNo ratings yet

- Strong U.K. Economic Recovery Remains Intact: Economics GroupDocument5 pagesStrong U.K. Economic Recovery Remains Intact: Economics Grouppathanfor786No ratings yet

- Causes and Consequences of The Spanish Economic Crisis - University of Minho Portugal EssayDocument20 pagesCauses and Consequences of The Spanish Economic Crisis - University of Minho Portugal EssayMichael KNo ratings yet

- Chapter 1 - Monitoring Macroeconomic Performance PDFDocument29 pagesChapter 1 - Monitoring Macroeconomic Performance PDFshivam jangidNo ratings yet

- Why Are European Countries Diverging in Their Unemployment Experience?Document38 pagesWhy Are European Countries Diverging in Their Unemployment Experience?danielpupiNo ratings yet

- What Is The Economic Outlook For OECD Countries?: Angel GurríaDocument22 pagesWhat Is The Economic Outlook For OECD Countries?: Angel GurríaJohn RotheNo ratings yet

- The Economic Landscape of United KindomDocument5 pagesThe Economic Landscape of United KindomJoanna Marie DucutNo ratings yet

- How Vulnerable Is ItalyDocument26 pagesHow Vulnerable Is ItalyCoolidgeLowNo ratings yet

- Sa-2019-Inflation, A Phillips Curve For The Euro Area, Nber ReviewDocument28 pagesSa-2019-Inflation, A Phillips Curve For The Euro Area, Nber ReviewAyu SrimulyaniNo ratings yet

- Bank of England speech examines supply issues impacting inflationDocument15 pagesBank of England speech examines supply issues impacting inflationplozlozNo ratings yet

- Global Economic Outlook: Unfinished BusinessDocument22 pagesGlobal Economic Outlook: Unfinished Businessapi-227433089No ratings yet

- Econs-H1-8819-2016-Cs-Que-Q1-The Impact of Rising and Falling PricesDocument3 pagesEcons-H1-8819-2016-Cs-Que-Q1-The Impact of Rising and Falling PricesAnonymous f3nxAScsGNo ratings yet

- Economics Edexcel Theme2 Workbook Answers 1Document40 pagesEconomics Edexcel Theme2 Workbook Answers 1Thais LAURENTNo ratings yet

- Macroeconomics: Theory and Applications: SpringDocument15 pagesMacroeconomics: Theory and Applications: Springmed2011GNo ratings yet

- SYZ & CO - SYZ Asset Management - 1 Month in 10 Snapshots March 2013Document4 pagesSYZ & CO - SYZ Asset Management - 1 Month in 10 Snapshots March 2013SYZBankNo ratings yet

- Essay On Economic Impacts of Euromarkets and Other Offshore Markets On Global Financial MarketDocument4 pagesEssay On Economic Impacts of Euromarkets and Other Offshore Markets On Global Financial MarketKimkhorn LongNo ratings yet

- Career PlanDocument3 pagesCareer PlanMaria Cristina HonradaNo ratings yet

- Damodaran PDFDocument79 pagesDamodaran PDFLokesh Damani0% (1)

- Zimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWDocument1 pageZimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWBen GanzwaNo ratings yet

- Hotel Industry - Portfolia AnalysisDocument26 pagesHotel Industry - Portfolia Analysisroguemba87% (15)

- Chapter 16 Planning The Firm's Financing Mix2Document88 pagesChapter 16 Planning The Firm's Financing Mix2api-19482678No ratings yet

- Germany Vs Singapore by Andrew BaeyDocument12 pagesGermany Vs Singapore by Andrew Baeyacs1234100% (2)

- Receipt Voucher: Tvs Electronics LimitedDocument1 pageReceipt Voucher: Tvs Electronics LimitedKrishna SrivathsaNo ratings yet

- Steel-A-thon Strategy & Supply Chain CaseletsDocument8 pagesSteel-A-thon Strategy & Supply Chain CaseletsAnkit SahuNo ratings yet

- Terms of TradeDocument3 pagesTerms of TradePiyushJainNo ratings yet

- 2021-09-21 Columbia City Council - Public Minutes-2238Document8 pages2021-09-21 Columbia City Council - Public Minutes-2238jazmine greeneNo ratings yet

- 10A. HDFC Jan 2021 EstatementDocument10 pages10A. HDFC Jan 2021 EstatementNanu PatelNo ratings yet

- Real Estate Project Feasibility Study ComponentsDocument2 pagesReal Estate Project Feasibility Study ComponentsSudhakar Ganjikunta100% (1)

- AGI3553 Plant ProtectionDocument241 pagesAGI3553 Plant ProtectionDK White LionNo ratings yet

- Rationale Behind The Issue of Bonus SharesDocument31 pagesRationale Behind The Issue of Bonus SharesSandeep ReddyNo ratings yet

- Understanding essay questionsDocument11 pagesUnderstanding essay questionsfirstclassNo ratings yet

- Government Sanctions 27% Interim Relief for PensionersDocument4 pagesGovernment Sanctions 27% Interim Relief for PensionersThappetla SrinivasNo ratings yet

- VhduwsDocument3 pagesVhduwsVia Samantha de AustriaNo ratings yet

- Integration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025Document587 pagesIntegration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025tdropulicNo ratings yet

- Print - Udyam Registration Certificate AnnexureDocument2 pagesPrint - Udyam Registration Certificate AnnexureTrupti GhadiNo ratings yet

- Aec 2101 Production Economics - 0Document4 pagesAec 2101 Production Economics - 0Kelvin MagiriNo ratings yet

- Addmaths FolioDocument15 pagesAddmaths Foliomuhd_mutazaNo ratings yet

- STIEBEL ELTRON Produktkatalog 2018 VMW Komplett KleinDocument276 pagesSTIEBEL ELTRON Produktkatalog 2018 VMW Komplett KleinsanitermNo ratings yet

- PLCPD Popdev Media AwardsDocument21 pagesPLCPD Popdev Media AwardsMulat Pinoy-Kabataan News NetworkNo ratings yet

- Yr1 Yr2 Yr3 Sales/year: (Expected To Continue)Document7 pagesYr1 Yr2 Yr3 Sales/year: (Expected To Continue)Samiksha MittalNo ratings yet

- YMCA 2010 Annual Report - RevisedDocument8 pagesYMCA 2010 Annual Report - Revisedkoga1No ratings yet

- AssignmentDocument1 pageAssignmentdibakar dasNo ratings yet

- Cover NoteDocument1 pageCover NoteSheera IsmawiNo ratings yet

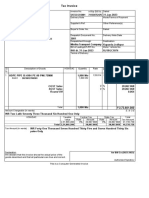

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- Basic Statistics for Local Level Development in SundargarhDocument130 pagesBasic Statistics for Local Level Development in SundargarhTarun BarveNo ratings yet

- Senior Development and Communications Officer Job DescriptionDocument3 pagesSenior Development and Communications Officer Job Descriptionapi-17006249No ratings yet