Professional Documents

Culture Documents

Consulting Fees

Uploaded by

jaga67Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consulting Fees

Uploaded by

jaga67Copyright:

Available Formats

Consulting Fees

in perspective

CEBC - APEGBC Fee Guidelines for Engineering Services

The Fee Guidelines provide a good overview of the basis for and methods of remuneration for consulting engineering services, as well as background into what is involved in providing those services. The purpose of this article is to explain the many costs incurred in providing a quality service to the client.

The Financial Requirements of a Business

Investment

Services Skills Consulting Company Fees Return to Investors Clients

The Creativity and Business of Professional Engineering

Engineers design a wide range of infrastructure to meet the needs of society (buildings, roads, railways, airports, water supply, sanitation, telecommunications, etc). Some engineers work directly for government departments and private sector business, while others work as independent consultants that provide their services to both government and private sector business. While all engineers have a proud professional interest in their work, consultants also assume business risks and financial obligations.

Margins and Multipliers

To sustain the financial requirements of business, the markups on products are commonly expressed as margins as the product passes from manufacturer to customer, while those for services are termed multipliers. While hourly rates and lump sums are often quoted for professional services, they ultimately depend on the total costs of providing the service as outlined herein. Few people understand what degree of margins and multipliers are needed to sustain and develop a product or a service. For example, with a typical consumer product passing through the manufacturer-wholesaler-retailercustomer chain, the customer usually pays three to eight times the cost of manufacture, often without realizing it. If a fair margin is not in place, the product will simply not be available, except in a bankruptcy or second-hand sale. The multipliers of a professional service business present a similar transition from manufacturer (the engineer in this case) to customer' (the client) for delivery of a finished project. A typical breakdown of costs behind such a multiplier is presented in this Commentary. The results are revealing without a reasonable multiplier there is no business opportunity nor a mechanism to deliver a quality service.

Risks in Consulting Engineering

Examples include: Cyclical nature of spending Domestic and foreign competition Government policy changes Changing technology Direct and indirect liability Changing contractual arrangements Fee pressures

The table below explains why the hourly rate charged for a consulting engineer is significantly greater than the hourly salary. The difference relates to the costs of doing business, and it will vary from one firm to another with time, specialty, and employees. The numbers are fairly typical, but could vary by 20% or more. The employee is assumed to be paid $35/hour for 37.5 hours/week (ie the monthly salary is 35 x 37.5 x 52 12 = $5,687.50).

Description of Services Basic hourly salary Direct benefits (Canada Pension Plan, UIC, Insurance, WCB, pension plan, group benefit plan, etc) = 16 - 20%

Cost to Employer $ 35.00 $ 5.00 - 7.00 $ 40.00 - 42.00

Copies of the following publications are available from CEBC Fee Guidelines for Engineering Services CEBC Directory of Member Firms and their Fields of Practice Awards for Engineering Excellence Magazine Consulting Engineering Industry Profile Guide to Selecting a Consulting Engineer Requests for Proposals Are You as Indemnified as You Think You Are? Value Engineering Design-Build in the Public Sector Geotechnical Engineering Transportation Engineering Electrical Engineering Consulting Engineers of Yukon c/o 6 - 151 Industrial Road, Whitehorse, Yukon Y1A 2V3 phone: (867) 668-3068 fax: (867) 6684349 E-Mail: cey@eba.ca Website: www.cey.ca January 1997

Vacation + statutory holidays 10% 12% (A) Payroll Cost Time not chargeable (sick time, conferences, education, marketing, overhead, proposals, travel, administration, committees, etc) = 25 30% of (A)

$ 4.00 - 5.00 $ 44.00 - 47.00

$ 11.00 - 14.00

$ 55.00 - 61.00 Non-technical and overhead staff (secretarial, business, bookkeeping etc) $ 7.00 - 15.00 $ 62.00 - 76.00 Overhead expenses (rent, general insurance, legal/accounting, travel (non-reimbursable), phone, fax, supplies, printing, utilities, office equipment depreciation and repairs, dues, computers, rentals, bank charges, etc)

$ 15.00 - 25.00

$ 77.00 - 101.00 Professional Liability Insurance $ 2.00 - 4.00 $ 79.00 - 105.00 Return on Investment, 10% (B) Charge Out Rate Payroll Multiplier (B) (A) (refer to Fee Guidelines) $ 8.00 - 11.00 $ 87.00 - 116.00 2.0 - 2.5

You might also like

- Construction Cost EstimatingDocument25 pagesConstruction Cost Estimatingabdou100% (2)

- Guidelines For Determining Architect-Engineering FeesDocument14 pagesGuidelines For Determining Architect-Engineering FeesMolly0630No ratings yet

- Consulting Proposal Template 06Document20 pagesConsulting Proposal Template 06rekcah ehtNo ratings yet

- Eee-Viii-electrical Design Estimation and Costing 10ee81 - SolutionDocument58 pagesEee-Viii-electrical Design Estimation and Costing 10ee81 - SolutionTejas88% (8)

- FeasibilityDocument26 pagesFeasibilitypravmali7No ratings yet

- Consultant FeeDocument15 pagesConsultant Feesadaqat181No ratings yet

- HvacDocument12 pagesHvacSri Hari50% (2)

- Making Sense of Your Project Cost EstimateDocument5 pagesMaking Sense of Your Project Cost Estimategeorge israelNo ratings yet

- Q4 Quantity SurveyorDocument4 pagesQ4 Quantity SurveyorBhaskar KilliNo ratings yet

- Chapter 12 Project Procurement ManagementDocument37 pagesChapter 12 Project Procurement ManagementFederico KeselmanNo ratings yet

- Construction Cost EstimatingDocument25 pagesConstruction Cost Estimatingrcallikan100% (1)

- 25r-03 AACE EStimating Lost Labor Productivity in Construction ClaimsDocument35 pages25r-03 AACE EStimating Lost Labor Productivity in Construction ClaimsThomas Vielma100% (5)

- Quantity Surveyor DutyDocument8 pagesQuantity Surveyor DutyDavid WebNo ratings yet

- Construction Auditing Risk and Cost Segregation Strategies For 2013 and BeyondDocument48 pagesConstruction Auditing Risk and Cost Segregation Strategies For 2013 and BeyondChinh Lê Đình100% (1)

- Ansi B16-104Document1 pageAnsi B16-104Monica Suarez100% (1)

- A Roadmap For The MEP EngineerDocument8 pagesA Roadmap For The MEP EngineerAlbert ArominNo ratings yet

- How Mixing Affects The Rheology of Refractory Castables - Part IIDocument25 pagesHow Mixing Affects The Rheology of Refractory Castables - Part IIVinh Do ThanhNo ratings yet

- Method of CompensationDocument23 pagesMethod of CompensationMiks NapNo ratings yet

- APC Slide ShoeDocument105 pagesAPC Slide ShoeSandbucket100% (2)

- Design Office PracticeDocument10 pagesDesign Office PracticeSandeep Varma100% (1)

- Textbook of Urgent Care Management: Chapter 4, Building Out Your Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 4, Building Out Your Urgent Care CenterNo ratings yet

- Dow DC895 3Document1 pageDow DC895 3jaga67No ratings yet

- Description of Services Cost To Employer Basic Hourly SalaryDocument1 pageDescription of Services Cost To Employer Basic Hourly Salaryjaga67No ratings yet

- Description of Services Cost To Employer Basic Hourly SalaryDocument1 pageDescription of Services Cost To Employer Basic Hourly Salaryjaga67No ratings yet

- CEBC Fee Guidelines 2012Document4 pagesCEBC Fee Guidelines 2012axf9dtjhdNo ratings yet

- Civil Service Charges..Document4 pagesCivil Service Charges..DaaZy LauZahNo ratings yet

- Aeguidelines For CostingDocument14 pagesAeguidelines For CostingJide ZubairNo ratings yet

- What Do Engineers Do?: Who Is An Engineer? What Is Engineering Work?Document4 pagesWhat Do Engineers Do?: Who Is An Engineer? What Is Engineering Work?SivabalanNo ratings yet

- Project Cost ManagementDocument28 pagesProject Cost ManagementGebeyehuNo ratings yet

- 4-Selection of Consultants Lecture 4ADocument17 pages4-Selection of Consultants Lecture 4Aesmail aliNo ratings yet

- 2023 CEA Rate Guideline FinalDocument2 pages2023 CEA Rate Guideline FinalGiovanni PratamaNo ratings yet

- Employment Posting ID:: BCH-T-0752-190316E1Document3 pagesEmployment Posting ID:: BCH-T-0752-190316E1babaNo ratings yet

- E STR 07Document20 pagesE STR 07abdullahshamimNo ratings yet

- Chapter-2 - Engineering Costs and Estimating Costs - Summary and Solution TipsDocument6 pagesChapter-2 - Engineering Costs and Estimating Costs - Summary and Solution TipsFokhruz ZamanNo ratings yet

- Automotive EngineerDocument5 pagesAutomotive EngineerNida DastgirNo ratings yet

- White Paper ESO Market TrendsDocument8 pagesWhite Paper ESO Market TrendsramptechNo ratings yet

- ITL Technical Inspection Executive SummaryDocument3 pagesITL Technical Inspection Executive SummaryhamzaywaleNo ratings yet

- Electrical Engineering Student ResumeDocument6 pagesElectrical Engineering Student Resumeafaybiikh100% (2)

- Assistant Civil Engineer ResumeDocument8 pagesAssistant Civil Engineer Resumeafiwgbuua100% (2)

- Tendering For Profitable Building WorkDocument71 pagesTendering For Profitable Building WorkabdouNo ratings yet

- Services-Marketing RiassuntiDocument152 pagesServices-Marketing RiassuntiTeam ManagerNo ratings yet

- Lec 3 Civil Engineering PracticeDocument15 pagesLec 3 Civil Engineering PracticeDark bearcat ArzadonNo ratings yet

- Case Study - Formulation of Business Cases - Jan2023Document4 pagesCase Study - Formulation of Business Cases - Jan2023Jacky MagsNo ratings yet

- Effective Financial Management of Communications and TechnologyDocument34 pagesEffective Financial Management of Communications and TechnologymoxlindeNo ratings yet

- Classification of Engineering ServicesDocument7 pagesClassification of Engineering ServicesHarvey PalabayNo ratings yet

- Emerging Trends in Computation of Consultancy Fees: February 2017Document13 pagesEmerging Trends in Computation of Consultancy Fees: February 2017TerrenceNo ratings yet

- Training For Young EngineersDocument13 pagesTraining For Young EngineersVeenoyNo ratings yet

- Barun Kumar Singh Hsmc301Document42 pagesBarun Kumar Singh Hsmc301BARUN SINGHNo ratings yet

- Appointing Consultants For Building Design and ConstructionDocument5 pagesAppointing Consultants For Building Design and ConstructionAlbertNo ratings yet

- Solution ManualDocument194 pagesSolution ManualJohn Michael Zumarraga CatayloNo ratings yet

- Project Thesis in Mechanical Engineering PDFDocument4 pagesProject Thesis in Mechanical Engineering PDFWritingPaperHelpProvo100% (2)

- Homework Doc 1 - Case StudyDocument7 pagesHomework Doc 1 - Case StudyMarwahKNo ratings yet

- Lect-04 Engineering Economics and ManagmentDocument29 pagesLect-04 Engineering Economics and ManagmentAnas SheikhNo ratings yet

- PM FAsDocument8 pagesPM FAsRamesh BabuNo ratings yet

- Blue Wolf State of Outsourcing 2013Document15 pagesBlue Wolf State of Outsourcing 2013angelgmv9492No ratings yet

- Job Market SerachDocument14 pagesJob Market SerachKirankumar ReddyNo ratings yet

- Feasibility StudyDocument3 pagesFeasibility StudyShielle Azon100% (1)

- Studies On Drying Kinetics of Solids in A Rotary DryerDocument6 pagesStudies On Drying Kinetics of Solids in A Rotary DryerVinh Do ThanhNo ratings yet

- Air-Fuel Ratio, Lambda and Engine Performance: AFR M MDocument12 pagesAir-Fuel Ratio, Lambda and Engine Performance: AFR M MVinh Do ThanhNo ratings yet

- Tỷ số air-fuel lý tưởng (14.7)Document9 pagesTỷ số air-fuel lý tưởng (14.7)Vinh Do ThanhNo ratings yet

- Dryer CalculationsDocument4 pagesDryer CalculationsVinh Do Thanh0% (1)

- Modeling and Simulation of A Co-Current Rotary Dryer Under Steady ConditionsDocument8 pagesModeling and Simulation of A Co-Current Rotary Dryer Under Steady ConditionsVinh Do ThanhNo ratings yet

- Modelling and Simulation of A Direct Contact Rotary DryerDocument16 pagesModelling and Simulation of A Direct Contact Rotary DryerVinh Do ThanhNo ratings yet

- 4244 12672 1 PB PDFDocument15 pages4244 12672 1 PB PDFVinh Do ThanhNo ratings yet

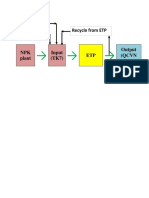

- Recycle From ETP Make Up H2O DAP, UreaDocument1 pageRecycle From ETP Make Up H2O DAP, UreaVinh Do ThanhNo ratings yet

- PEP Report 267A: Ihs ChemicalDocument8 pagesPEP Report 267A: Ihs ChemicalVinh Do ThanhNo ratings yet

- 4244 12672 1 PB PDFDocument15 pages4244 12672 1 PB PDFVinh Do ThanhNo ratings yet

- E. E.' " (75 Ion Agent of Firm Rope-Mckay & AssociatesDocument7 pagesE. E.' " (75 Ion Agent of Firm Rope-Mckay & AssociatesVinh Do ThanhNo ratings yet

- Aoac - Methods.1.1990. MoistureDocument2 pagesAoac - Methods.1.1990. MoistureVinh Do ThanhNo ratings yet

- Tinh Luong Nuoc Bay HoiDocument22 pagesTinh Luong Nuoc Bay HoiVinh Do ThanhNo ratings yet

- Estimating Evaporation From Water SurfacesDocument27 pagesEstimating Evaporation From Water SurfacesVinh Do ThanhNo ratings yet

- CRACKER A PC Based Simulator For Industr PDFDocument6 pagesCRACKER A PC Based Simulator For Industr PDFVinh Do ThanhNo ratings yet

- Metal Price IndexDocument1 pageMetal Price IndexVinh Do ThanhNo ratings yet

- Equivalent Grades of Cast IronsDocument2 pagesEquivalent Grades of Cast IronsVinh Do Thanh100% (1)

- MCCM 69 3 s192-197 KrauseDocument6 pagesMCCM 69 3 s192-197 KrauseVinh Do ThanhNo ratings yet

- DRS 279-2015 Organic Fertilizer - SpecificationDocument17 pagesDRS 279-2015 Organic Fertilizer - SpecificationVinh Do ThanhNo ratings yet

- 8D Problem Solving Worksheet: AQDEF.406Document8 pages8D Problem Solving Worksheet: AQDEF.406Vinh Do ThanhNo ratings yet

- Application of Excel in Psychrometric AnalysisDocument20 pagesApplication of Excel in Psychrometric AnalysisVinh Do ThanhNo ratings yet