Professional Documents

Culture Documents

Ipo

Uploaded by

abrarbuttOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ipo

Uploaded by

abrarbuttCopyright:

Available Formats

Wateen Telecom Limited Initial Public Offering

Vision To introduce Wateen Telecom in the European and North American markets and provide the leading telecommunications international voice services through a world-class cutting-edge network to deliver a broad range of reliable, affordable and quality customer-centric services. Mission To provide affordable communication services that meets and exceeds customers' requirements To deliver high-quality, flexible and innovative solutions that are cost effective and conducive To provide complete customer satisfaction on time, every time

Present Issue consist of 110,000,000 ordinary shares of PKR 10 each (20.85% of the enhanced paid up capital of PKR 5,274,746,200) with a Greenshoe option of up to additional 90,000,000 ordinary shares (14.58% of the enhanced paid up capital of PKR 6,174,746,200) in case of oversubscription at an Issue price of PKR 10/- per share to general public. Underwriters: National Bank of Pakistan Atlas Bank Limited Arif Habib Limited Habib Bank Limited MCB Bank Limited Bank of Khyber

Askari Bank Limited Allied Bank Limited KASB Bank Limited Pak Oman Investment Co. Limited Arif Habib Bank Limited Faysal Bank Limited Pearl Securities Limited Wincom (Pvt.) Limited

Date of Public Subscription The subscription list will open on April 20th, 2010 at the commencement of banking hours and will close on April 21st, 2010 at the close of banking hours. The Public Offer Wateen has proposed to issue additional 110,000,000 shares to institutional investors and general public at a price of PKR 10/- per share amounting to PKR 1,100 million with a Greenshoe option of 90,000,000 ordinary shares. The paid up capital of the Company will increase from PKR 4.174 billion to PKR 5.275 billion. The principal purpose of the proposed Initial Public Offering is to Repay PKR 1.469 billion to financial institutions as against the Companys financial obligations arises out of payment of LCs, Acquire 49 percent shares (397,027 shares of face value of PKR 100 per share) of Wateen Solutions (Pvt.) Limited (formerly National Engineers (Pvt.) Limited) amounting to PKR 490 million to make it a wholly owned subsidiary of Wateen Telecom Limited, Broaden the investor base through an increase in the number of shareholders, Provide the public investor an opportunity to participate in the future of the Company with sound prospects. Wateen Telecom Limited Overview

Wateen Telecom Limited was incorporated in Pakistan under the Companies Ordinance 1984, on 4 March 2005. Wateens successful four years of operations in the telecom industry of Pakistan speak for itself. Some of the businesss salient features are presented below: Largest commercial and first nationwide 3.5 GHz WiMAX network rollout in the world covering 22 cities and more than 1,100 sites (900 live). Largest operator of Satellite services in the country (c. 500+ MHz in use). Wateen has one of the largest Optic Fiber network spanning over more than 10,000 km (including Government of Pakistan USF projects) across all the four provinces of Pakistan including metro connectivity in 22 cities. This network provides the backbone for Wateens National Transmission Services. Sales growth rate has been far steeper compared to the industry average, evident from the fact that Wateen enjoys over 60 percent share of the wireless broadband market. Wateen also successfully closed one of the largest Islamic Financing deal in the same period.

You might also like

- Wateen Telecom Limited Initial Public OfferingDocument4 pagesWateen Telecom Limited Initial Public OfferingQasim AliNo ratings yet

- Green Shoe Option" Initial Public Offering: Wateen Telecom "Document21 pagesGreen Shoe Option" Initial Public Offering: Wateen Telecom "Syed Umair JavaidNo ratings yet

- About Warid TelecomDocument6 pagesAbout Warid TelecomIbrahim RafeNo ratings yet

- Wateen Telecom 19-04-10Document3 pagesWateen Telecom 19-04-10Muhammad BilalNo ratings yet

- 04.1-Telenor Pakistan - Culture and Competitive AdvantageDocument37 pages04.1-Telenor Pakistan - Culture and Competitive AdvantageshamzanNo ratings yet

- Finalized ProjectDocument35 pagesFinalized Projectnoor-us- sabaNo ratings yet

- PTCL 1Document19 pagesPTCL 1usmanaminchNo ratings yet

- Organization Diagnosis of PTCLDocument19 pagesOrganization Diagnosis of PTCLKainat Afridi100% (1)

- PTCL Internship ReportDocument32 pagesPTCL Internship Reporthiramalik33% (3)

- Financial Analysis of PTCLDocument47 pagesFinancial Analysis of PTCLIlyas Ahmad Farooqi67% (3)

- Marketing Plan of PTCL: Submitted To: Ali Shaikh Submitted By: Shah Fahad Date: 11-11-2010Document7 pagesMarketing Plan of PTCL: Submitted To: Ali Shaikh Submitted By: Shah Fahad Date: 11-11-2010exceedorNo ratings yet

- PTCL ProjectDocument28 pagesPTCL ProjectFahad RazaNo ratings yet

- Project Report On Pakistan Telecommunication Company Limited (PTCL)Document19 pagesProject Report On Pakistan Telecommunication Company Limited (PTCL)Bilal NaseerNo ratings yet

- Strategic Management Report On Wateen Telecom LTDDocument54 pagesStrategic Management Report On Wateen Telecom LTDfarhanfarhat67% (3)

- Downfall OF MobilinkDocument26 pagesDownfall OF Mobilinkfizza.azam100% (1)

- FINAL PROJECT OF BP ON PTCL For PrintingDocument27 pagesFINAL PROJECT OF BP ON PTCL For PrintingSaad AzharNo ratings yet

- Using "Beyond The Quick Fix Model" Identify The Challenges of PTCL and Suggest As OD Consultant For The Development of This OrganizationDocument17 pagesUsing "Beyond The Quick Fix Model" Identify The Challenges of PTCL and Suggest As OD Consultant For The Development of This OrganizationSamiullah SarwarNo ratings yet

- UfoneDocument32 pagesUfoneUmer ManzoorNo ratings yet

- History of PTCLDocument4 pagesHistory of PTCLswealumair86No ratings yet

- ReportDocument30 pagesReportSehar MalikNo ratings yet

- Privatization of PTCL: MissionDocument7 pagesPrivatization of PTCL: MissionpalwashaNo ratings yet

- Intternshp ReprtDocument21 pagesIntternshp ReprtAnum AsgharNo ratings yet

- Pta Ann Rep 11Document95 pagesPta Ann Rep 11sabihakhawarNo ratings yet

- PTCL CompanyDocument10 pagesPTCL Companyaliswati546No ratings yet

- Final Project Pakistan Telecommunication Company Limited (PTCL)Document21 pagesFinal Project Pakistan Telecommunication Company Limited (PTCL)Mehran MalikNo ratings yet

- Industry Background Company Snapshot: Brief SketchDocument12 pagesIndustry Background Company Snapshot: Brief SketchtajalaNo ratings yet

- U Fone HRM Full-2Document65 pagesU Fone HRM Full-2arshad zaheerNo ratings yet

- Pakistan Telecommunication Company LimitedDocument14 pagesPakistan Telecommunication Company Limitedملک حمائلNo ratings yet

- Introduction of PTCLDocument3 pagesIntroduction of PTCLliaqat mahmoodNo ratings yet

- Mission Statement of PTCL To Achieve Our Vision by HeavingDocument4 pagesMission Statement of PTCL To Achieve Our Vision by Heavingahscen0% (2)

- PTCL (Feel The Difference)Document40 pagesPTCL (Feel The Difference)ahmadzaeemNo ratings yet

- Executive Summary: RD THDocument18 pagesExecutive Summary: RD THhammadmunir1No ratings yet

- Hutchison Essar Vodafone: TitledDocument11 pagesHutchison Essar Vodafone: Titledabhishekpatidar77No ratings yet

- Final PPT of VodafoneDocument44 pagesFinal PPT of VodafoneChinmay P Kalelkar100% (1)

- Telecom SectorDocument13 pagesTelecom SectorGayathri ReddyNo ratings yet

- Telecom at A GlanceDocument20 pagesTelecom at A GlanceParas GalaNo ratings yet

- 1.1 Background of The Study:: Pakistan Telecommunication Company LTDDocument87 pages1.1 Background of The Study:: Pakistan Telecommunication Company LTDarshad_numlNo ratings yet

- WaridDocument30 pagesWaridMakkia ShaheenNo ratings yet

- 1st Quarter Report 2016Document40 pages1st Quarter Report 2016fazal hadiNo ratings yet

- Board of Directors Corporate Information Directors' Report: Pakistan Telecommunication Company LimitedDocument26 pagesBoard of Directors Corporate Information Directors' Report: Pakistan Telecommunication Company LimitedTahir ArfiNo ratings yet

- HRM ReportDocument23 pagesHRM ReportemanNo ratings yet

- Introduction of PTCL Complete ReportDocument23 pagesIntroduction of PTCL Complete Reportimranjpr964475% (4)

- Internship Report On PTCLDocument29 pagesInternship Report On PTCLAli AbbasNo ratings yet

- Telecom Cellular SectorDocument32 pagesTelecom Cellular SectorM.Zuhair Altaf100% (1)

- Corporate Governance:: Failure of Corporate Governance: Privatization of PTCL PakistanDocument4 pagesCorporate Governance:: Failure of Corporate Governance: Privatization of PTCL PakistanSaad ButtNo ratings yet

- PTCL - Pakistan Telecommunication Limited Introduction of PTCLDocument3 pagesPTCL - Pakistan Telecommunication Limited Introduction of PTCLAbdul Malik ZakirNo ratings yet

- MissionDocument30 pagesMissionudaasiNo ratings yet

- Annual Report 2010Document83 pagesAnnual Report 20101vijayvijayvijayNo ratings yet

- Emerging Strategies in Telecommunication SectorDocument11 pagesEmerging Strategies in Telecommunication SectorMaitreyee100% (1)

- Audit Mid ProjectDocument5 pagesAudit Mid ProjectCH AhmadNo ratings yet

- Ufone SMDocument5 pagesUfone SMfizukotNo ratings yet

- Report On PTCLDocument11 pagesReport On PTCLahaqsroyaNo ratings yet

- Final For PTCLDocument53 pagesFinal For PTCLmirzawaqarNo ratings yet

- Wired Telecommunications Carrier Lines World Summary: Market Values & Financials by CountryFrom EverandWired Telecommunications Carrier Lines World Summary: Market Values & Financials by CountryNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Linear and Non-Linear Video and TV Applications: Using IPv6 and IPv6 MulticastFrom EverandLinear and Non-Linear Video and TV Applications: Using IPv6 and IPv6 MulticastNo ratings yet

- Unlocking the hydrogen economy — stimulating investment across the hydrogen value chain: Investor perspectives on risks, challenges and the role of the public sectorFrom EverandUnlocking the hydrogen economy — stimulating investment across the hydrogen value chain: Investor perspectives on risks, challenges and the role of the public sectorNo ratings yet

- BTC - Autopilot - Method - MAKE - 700$-800$ - PER - WEEKDocument4 pagesBTC - Autopilot - Method - MAKE - 700$-800$ - PER - WEEKMatheus CamiloNo ratings yet

- Unit1 Communication Skils COmputerDocument8 pagesUnit1 Communication Skils COmputerkeenelgamal3No ratings yet

- Team08 Final Design Report PDFDocument221 pagesTeam08 Final Design Report PDFCraneo LocoNo ratings yet

- Eset Internet Security 9 10 Keys 2019Document2 pagesEset Internet Security 9 10 Keys 2019Bc Dušan ĎurovkinNo ratings yet

- 1.5.7 Packet Tracer - Network Representation (ANSWERED)Document2 pages1.5.7 Packet Tracer - Network Representation (ANSWERED)Lemuel DioquinoNo ratings yet

- Fusion Development Teams and Power Virtual Agents Enable Rapid COVID-19 Response at Ottawa Public HealthDocument2 pagesFusion Development Teams and Power Virtual Agents Enable Rapid COVID-19 Response at Ottawa Public Healthavarza pourbemaniNo ratings yet

- How To Install HP Printer Drivers For Your First HP Printer SetupDocument5 pagesHow To Install HP Printer Drivers For Your First HP Printer SetupDavid PalmerNo ratings yet

- 9 FB 2 ZF 8 UmzvfyjyxDocument4 pages9 FB 2 ZF 8 Umzvfyjyxsathish guptaNo ratings yet

- Forensic Analysis of Asterisk-FreePBX Based VoIP SDocument7 pagesForensic Analysis of Asterisk-FreePBX Based VoIP SherbetythiagoNo ratings yet

- Suggestion To PM of India 32 Post OfficeDocument4 pagesSuggestion To PM of India 32 Post OfficeKishor kumar BhatiaNo ratings yet

- Royal Brunei Airlines - Reservation PDFDocument4 pagesRoyal Brunei Airlines - Reservation PDFWray TanNo ratings yet

- 18 Major Vowel Harmony - Turkish Language LessonsDocument4 pages18 Major Vowel Harmony - Turkish Language LessonsAlongMXNo ratings yet

- Trail Mail EtiquetteDocument5 pagesTrail Mail EtiquettemengelhuNo ratings yet

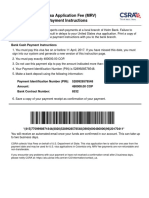

- Payment InstructionsDocument2 pagesPayment Instructionsangie_navia2077No ratings yet

- Reading Comprehension Shot 05Document4 pagesReading Comprehension Shot 05Sam AuthurNo ratings yet

- (PDF) Schedule of Rates For Civil Works Public Works DepartmentDocument407 pages(PDF) Schedule of Rates For Civil Works Public Works DepartmentRadha Vaibhav VaishNo ratings yet

- Gooogle Hacking at Your Finger TipsDocument84 pagesGooogle Hacking at Your Finger Tipsapi-27185622100% (16)

- PlantStruxure TVDA Catalog V15Document76 pagesPlantStruxure TVDA Catalog V15kyawlwinoo73No ratings yet

- Webpower Help: User'S GuideDocument272 pagesWebpower Help: User'S GuideDerek BNo ratings yet

- ZXMSG 5200 (V2.0.2) Multiplex Service Gateway Command Manual (Vol I)Document284 pagesZXMSG 5200 (V2.0.2) Multiplex Service Gateway Command Manual (Vol I)Miky CCis100% (3)

- How To Become A YoutuberDocument14 pagesHow To Become A YoutuberAlisa YapNo ratings yet

- Multipart Message Handling Using The POP3 and SMTP AdaptersDocument6 pagesMultipart Message Handling Using The POP3 and SMTP Adaptersapi-3811524100% (3)

- Using Seed: Using: Jrdseed PQL Sac Resp JplotrespDocument16 pagesUsing Seed: Using: Jrdseed PQL Sac Resp JplotrespIrwansyah Rey FarizNo ratings yet

- Endpoint Security Remote Access VPN DatasheetDocument2 pagesEndpoint Security Remote Access VPN DatasheetalexvelezNo ratings yet

- Blue Prism v6.9: HTML Source CodeDocument2 pagesBlue Prism v6.9: HTML Source CodekiranNo ratings yet

- 4it1 01r Que 20220517 PDFDocument24 pages4it1 01r Que 20220517 PDFcherryl hartonoNo ratings yet

- Apple Mobile Device Basics 20142015Document20 pagesApple Mobile Device Basics 20142015Rockstar RichNo ratings yet

- Vsat Application For Remote Mine in ZimbabweDocument17 pagesVsat Application For Remote Mine in ZimbabweBrian MoyoNo ratings yet

- Various MDX Cheat SheetDocument2 pagesVarious MDX Cheat SheettsatheeshmcaNo ratings yet

- Aruba Commands That Reset An APDocument2 pagesAruba Commands That Reset An APlsimon_ttNo ratings yet