Professional Documents

Culture Documents

Carter LBO

Uploaded by

Eddie KruleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carter LBO

Uploaded by

Eddie KruleCopyright:

Available Formats

3. Most, if not all of the value of this deal is coming from the RHS.

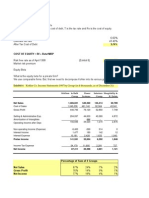

Typically, strategic buyers look to create value on the LHS, but in the case of Carters management had done a very good job at increasing revenues and EBITDA, lowering cost structure, expanding into discount channels and pursuing offshore manufacturing. These measures effectively decreased many of the potential synergies a strategic buyer may have been able to generate lowering the attractiveness of Carters as a target. Additionally, the current market environment, high growth and bullish market, could result in temporarily inflated prices for strategic buyers who might view this investment as too expensive. On the other hand many of these attributes are exactly the thing that financial sponsors are looking for in LBO targets. 8. Managements projections are optimistic, especially regarding sale growth, profit margin and SG&A margins. With regards to profit and SG&A margins this is particularly true since the company has already undertaken significant efficiency improvements so it is unclear where this performance increases are coming from over the next five years. With regards to sales growth, managements 2000-2005 growth assumptions rely heavily on new untested business ventures, including Target and full-priced retail stores. As it is, they are already 4-5% higher than historical performance. Exhibit X lays out several sensitivity analysis based on these variables, projected CAGR, new business CAGR, gross margins and SG&A margins. We find that based on historical assumptions vs. management forecasts, 2005 EBITDA would be 55-65% lower than projected. 9. There are a few reasons why a private equity firms hurdle rate would be higher than cost of capital calculated using CAPM. Specifically, the principle-agent problem and the opportunity cost of any investment. In the PE industry, hurdle rates stand for minimum rates of return for external investors that have to be met before the management of the PE firm receives carried interest. This misalignment of incentives causes firms to have hurdle rates higher than CAPM. Because a PE firm must commit a significant amount of capital to an investment, the firms required rate of return must reflect the total risk of the investment, the correlation of that risk with the risk of other investment opportunities, and achievable diversification. PE firms are typically less diversified and the investments are illiquid and therefore want to be rewarded for holding idiosyncratic risk. Additionally, PE firms uses high hurdle rates to discount only a success scenario projection for the investment. The firm does not explicitly value scenarios other than success and by biasing the discount rate upward; the investor implicitly addresses prospects for failure and for less-than-envisioned performance.

Corporate Restructuring: Jos Liberti

You might also like

- Carter's LBO ModelDocument1 pageCarter's LBO ModelNoah100% (1)

- Carter's LBO CaseDocument3 pagesCarter's LBO CaseNoah57% (7)

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- Hertz LBODocument5 pagesHertz LBOhichambentouhami100% (1)

- Rockboro Machine Tools Corporation Case QuestionsDocument1 pageRockboro Machine Tools Corporation Case QuestionsMasumiNo ratings yet

- 551 KohlerDocument3 pages551 KohlerwesiytgiuweNo ratings yet

- Case Submission - Stone Container Corporation (A) ' Group VIIIDocument5 pagesCase Submission - Stone Container Corporation (A) ' Group VIIIGURNEET KAURNo ratings yet

- Seagate LBO AnalysisDocument58 pagesSeagate LBO Analysisthetesterofthings100% (2)

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Group 6 M&A MellonBNY Case PDFDocument8 pagesGroup 6 M&A MellonBNY Case PDFPrachi Khaitan67% (3)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerNo ratings yet

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- CRBV Kohler Case - Group 6Document14 pagesCRBV Kohler Case - Group 6amitsuchi100% (4)

- BerkshireDocument30 pagesBerkshireNimra Masood100% (3)

- Southland Case StudyDocument7 pagesSouthland Case StudyRama Renspandy100% (2)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- Midland Energy Resources FinalDocument5 pagesMidland Energy Resources FinalpradeepNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Questions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Document5 pagesQuestions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Cuong NguyenNo ratings yet

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Burton SensorsDocument4 pagesBurton SensorsAbhishek BaratamNo ratings yet

- Mars - Wrigley Case Study - SolutionDocument8 pagesMars - Wrigley Case Study - SolutionSidhartha ModiNo ratings yet

- Burton Sensors Case Study 1Document10 pagesBurton Sensors Case Study 1anish mahtoNo ratings yet

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocument11 pagesSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNo ratings yet

- Hansson Private LabelDocument4 pagesHansson Private Labelsd717No ratings yet

- BCE: INC Case AnalysisDocument6 pagesBCE: INC Case AnalysisShuja Ur RahmanNo ratings yet

- Kohler DCF Control Prem and DiscDocument6 pagesKohler DCF Control Prem and Discapi-239586293No ratings yet

- Berkshire PartnersDocument2 pagesBerkshire PartnersAlex TovNo ratings yet

- KohlerDocument10 pagesKohleragarhemant100% (1)

- Case Study Hertz Corporation 130430125238 Phpapp01Document23 pagesCase Study Hertz Corporation 130430125238 Phpapp01rbhatter007100% (1)

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- Harvard Case: Sterling Household CompanyDocument10 pagesHarvard Case: Sterling Household Companymadeleine ReaNo ratings yet

- Case 26 Assignment AnalysisDocument1 pageCase 26 Assignment AnalysisNiyanthesh Reddy50% (2)

- Bidding On The Yell Group - Prasann S - 2015PGP334Document3 pagesBidding On The Yell Group - Prasann S - 2015PGP334Prasann ShahNo ratings yet

- Kohler Case Leo Final DraftDocument16 pagesKohler Case Leo Final DraftLeo Ng Shee Zher67% (3)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Multiple Choice: Performance Measurement, Compensation, and Multinational ConsiderationsDocument13 pagesMultiple Choice: Performance Measurement, Compensation, and Multinational ConsiderationsJEP WalwalNo ratings yet

- Fsa Practical Record ProblemsDocument12 pagesFsa Practical Record ProblemsPriyanka GuptaNo ratings yet

- RMC 46-99Document7 pagesRMC 46-99mnyng100% (1)

- Berkshire - IntroDocument2 pagesBerkshire - IntroRohith ThatchanNo ratings yet

- Kohler Group 5Document6 pagesKohler Group 5Prateek PatraNo ratings yet

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoNo ratings yet

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyNo ratings yet

- Stanley Black & Decker IncDocument6 pagesStanley Black & Decker IncNitesh RajNo ratings yet

- Seagate Veritas Summary 021501Document4 pagesSeagate Veritas Summary 021501satheesh21090% (1)

- Yell PresentationDocument27 pagesYell PresentationSounak DuttaNo ratings yet

- RestructuringDocument6 pagesRestructuringswati_0211No ratings yet

- CongoleumDocument16 pagesCongoleumMilind Sarambale0% (1)

- Lessons From 200 LBO DefaultsDocument10 pagesLessons From 200 LBO DefaultsforbesadminNo ratings yet

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- CasoDocument20 pagesCasoasmaNo ratings yet

- Sampa Video Case SolutionDocument6 pagesSampa Video Case SolutionRahul SinhaNo ratings yet

- RJR Case StudyDocument5 pagesRJR Case StudyFelipe Kasai MarcosNo ratings yet

- M&A - Group 3 - AirThread ValuationDocument6 pagesM&A - Group 3 - AirThread ValuationPradeep Reddy BaddamNo ratings yet

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDocument11 pagesMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Balance Sheet of Grasim Industries LimitedDocument5 pagesBalance Sheet of Grasim Industries LimitedDaniel Mathew VibyNo ratings yet

- Vault GuidebookDocument9 pagesVault GuidebookBillyNo ratings yet

- Final Company ProfileDocument28 pagesFinal Company ProfileVinod Manoj SaldanhaNo ratings yet

- Reverse Book BuildingDocument10 pagesReverse Book BuildingGaurav KatyalNo ratings yet

- Nestle Ratio AnalysisDocument10 pagesNestle Ratio AnalysisSaadMehmoodNo ratings yet

- Financial Management:: Getting Started - Principles of FinanceDocument41 pagesFinancial Management:: Getting Started - Principles of FinanceiqbalNo ratings yet

- Collateralized Mortgage Obligations (CMO)Document3 pagesCollateralized Mortgage Obligations (CMO)maria_tigasNo ratings yet

- 20 Reasons Startups Fail by CB InsightsDocument12 pages20 Reasons Startups Fail by CB Insightskrishnalohia9No ratings yet

- General Power of Attorney Final (NEW)Document4 pagesGeneral Power of Attorney Final (NEW)udNo ratings yet

- Debt and Equity MarketDocument2 pagesDebt and Equity MarketprahladtripathiNo ratings yet

- 2.4 Ishares Product List PDFDocument12 pages2.4 Ishares Product List PDFVijay YadavNo ratings yet

- As 17 - Segment ReportingDocument11 pagesAs 17 - Segment Reportinglegendstillalive4826No ratings yet

- Business Analysis Worksheet 1 3Document3 pagesBusiness Analysis Worksheet 1 3api-311946790No ratings yet

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocument80 pagesGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNo ratings yet

- PhiladelphiaBusinessJournal Feb. 16, 2018Document28 pagesPhiladelphiaBusinessJournal Feb. 16, 2018Craig EyNo ratings yet

- Financial Accounting and Reporting PartDocument6 pagesFinancial Accounting and Reporting PartLalaine De JesusNo ratings yet

- Financial Accounting Part 1: Cash & Cash EquivalentDocument7 pagesFinancial Accounting Part 1: Cash & Cash EquivalentHillary Grace VeronaNo ratings yet

- 2010 Britam Annual ReportDocument92 pages2010 Britam Annual ReportPetey K. NdichuNo ratings yet

- 10.chapter 1 (Introduction To Investments) PDFDocument41 pages10.chapter 1 (Introduction To Investments) PDFEswari Devi100% (1)

- How To Draft Articles of IncorporationDocument7 pagesHow To Draft Articles of Incorporationgilbertmalcolm100% (1)

- How To Buy and Sell StockDocument9 pagesHow To Buy and Sell StockwaelNo ratings yet

- A Report On Deviations in Ethics and FinanceDocument37 pagesA Report On Deviations in Ethics and FinanceNemil100% (2)

- What Is Portfolio ManagementDocument4 pagesWhat Is Portfolio Managementsakpal_smitaNo ratings yet

- 1 About Implementation Partner: CSR Proposal TemplateDocument7 pages1 About Implementation Partner: CSR Proposal TemplatePersafe CorpNo ratings yet

- Annual Report Accounts 2002Document156 pagesAnnual Report Accounts 2002AlezNgNo ratings yet