Professional Documents

Culture Documents

IMF Facilities

Uploaded by

Amit KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMF Facilities

Uploaded by

Amit KumarCopyright:

Available Formats

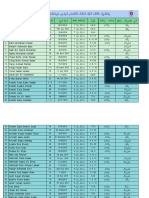

IMF Facilities Poverty Reduction and Growth Facility (PRGF) and Exogenous Shocks Facility (ESF). (0.

.5 percent interest) a. for reduction of poverty b. long term loan 5.5 to 10 years Stand-By Arrangements (SBA) (Surcharges apply ) a. Removal and correction of disequlibrem of BOP b. To address short term balance of payment problems c. Repayment normally expected within 2year 3month to 4 years Extended Fund Facility (EFF) (Surcharges apply ) a. To overcome balance of payments difficulties resulting from macroeconomic and structural problem. b. For longer period of time c. 4.5 to 7 years Supplemental Reserve Facility (SRF) (surcharge of 3-5 %) a. For short term correction of BOP on large scale b. Countries are expected to repay loans within 2- 2.5 years, but may request an extension of up to 6 month Compensatory Financing Facility (CFF) a. To assist countries experiencing either a sudden shortfall in export earnings or an increase in the cost of cereal imports caused by fluctuating world commodity price. b. Rate as same in SBA . Contingent credit lines (CCL) a. To correct the BOP problem which arises because of the disturbance of economy of some other country .(our economy is sound) b. Facilities same as SBA Emergency assistance a. to countries that have experienced a natural disaster or are emerging from conflict b. loan must be repaid within 3 1/4 to 5 years.

IMF Financial Facilities

The IMF makes its financial resources available to member countries through a variety of financial facilities. Except for the ESAF (see below), members avail themselves of the IMF's financial resources by purchasing (drawing) other members' currencies or SDRs with an equivalent amount of their own currency. The IMF levies charges on these

drawings and requires that members repurchase (repay) their own currency from the IMF over a specified time. IMF Financial Policies IMF financial policies govern the modalities for the use of its financial resources under existing IMF facilities. These include:

Reserve Tranche Policies. A member has a reserve tranche position in the IMF to the extent that its quota exceeds the IMF's holdings of its currency, excluding credits extended to it by the IMF. Subject only to balance of payments need, a member may draw up to the full amount of its reserve tranche position at any time. This drawing does not constitute a use of IMF credit, as its reserve position is considered part of the member's foreign reserves, and is not subject to an obligation to repay. Credit Tranche Policies. Credits under regular facilities are made available to members in tranches (segments) of 25 percent of quota. For first credit tranche drawings, members must demonstrate reasonable efforts to overcome their balance of payments difficulties, and no phasing applies. Upper credit tranche drawings (over 25 percent) are normally phased in relation to certain conditions or "performance criteria." Policy on Emergency Assistance. The IMF provides emergency assistance by allowing members to make drawings to meet balance of payments needs arising from sudden and unforeseeable natural disasters and in postconflict situations. Normally this takes the form of an outright purchase of up to 25 percent of quota provided that the member is cooperating with the IMF. It does not entail performance criteria or a phasing of drawings. Debt and Debt-Service Reduction Policies. Part of a credit extended to a member by the IMF under regular facilities can be set aside to finance operations involving debt principal and debt service reduction. The exact amount of the set-aside is determined on a case-by-case basis; its availability is generally tied to program performance.

Regular IMF Facilities Stand-by arrangements (SBA): designed to provide short-term balance of payments assistance for deficits of a temporary or cyclical nature, such arrangements are typically for 12 to 18 months. Drawings are phased on a quarterly basis, with their release made conditional on meeting performance criteria and the completion of periodic program reviews. Repurchases are made 3 to 5 years after each purchase. Extended Fund Facility (EFF): designed to support medium-term programs that generally run for three years, the EFF aims at overcoming balance of payments difficulties stemming from macroeconomic and structural problems. Performance

criteria are applied, similar to those in stand-by arrangements, and repurchases are made in 4 to 10 years. Concessional IMF Facility Enhanced Structural Adjustment Facility (ESAF): established in 1987, and enlarged and extended in 1994. Designed for low-income member countries with protracted balance of payments problems, ESAF drawings are loans and not purchases of other members' currencies. They are made in support of three-year programs and carry an annual interest rate of 0.5 percent, with a 5-year grace period and a 10-year maturity. Quarterly benchmarks and semiannual performance criteria apply; 80 low-income countries are currently eligible to use the ESAF. Special IMF Facilities Systemic Transformation Facility (STF): in effect from April 1993 to April 1995. The STF was designed to extend financial assistance to transition economies experiencing severe disruption in their trade and payments arrangements. Repurchases are made over 4 to 10 years. Compensatory and Contingency Financing Facility (CCFF): provides compensatory financing for members experiencing temporary export shortfalls or excesses in cereal import costs, as well as financial assistance for external contingencies in Fund arrangements. Repurchases are made over 3 to 5 years. Supplemental Reserve Facility (SRF): provides financial assistance for exceptional balance of payments difficulties due to a large short-term financing need resulting from a sudden and disruptive loss of market confidence. Repurchases are expected to be made within 1 to 1 years, but can be extended, with IMF Board approval, to 2 to 2 years.

You might also like

- Liane Chu's Artist InterviewDocument3 pagesLiane Chu's Artist InterviewEugene LeeNo ratings yet

- Foreword For 2015 SRC RulesDocument2 pagesForeword For 2015 SRC RulesRea Rosario G. MaliteNo ratings yet

- Bangko Sentral NG PilipinasDocument2 pagesBangko Sentral NG PilipinasEllechir Jeanne100% (1)

- Functions of Office Superintendent, SrTA, TADocument16 pagesFunctions of Office Superintendent, SrTA, TAshivaniNo ratings yet

- The Purposes of The Securities Regulation CodeDocument2 pagesThe Purposes of The Securities Regulation CodeagnesNo ratings yet

- IMF Financial FacilitiesDocument3 pagesIMF Financial FacilitiesDaval MalikNo ratings yet

- International Finance: Topic: Imf Lending FacilitiesDocument17 pagesInternational Finance: Topic: Imf Lending FacilitiesRiyasNo ratings yet

- Glossary of Selected Financial TermsDocument14 pagesGlossary of Selected Financial TermsElena CojocaruNo ratings yet

- IMF Lending: When Can A Country Borrow From The IMF?Document5 pagesIMF Lending: When Can A Country Borrow From The IMF?Ram KumarNo ratings yet

- International Monetary Fund: Sarath.K.S & Aneesh PDocument38 pagesInternational Monetary Fund: Sarath.K.S & Aneesh PSarath Sadasivan K SNo ratings yet

- Inrernationa Monetary FundDocument25 pagesInrernationa Monetary FundAjit Singh SainiNo ratings yet

- Imf Tranches: - Jasmine - Lavanya - Harighuan - Hariharan - RaghavanDocument11 pagesImf Tranches: - Jasmine - Lavanya - Harighuan - Hariharan - RaghavanjasmineNo ratings yet

- EEB 4.2 IMF ConditionalitiesDocument5 pagesEEB 4.2 IMF ConditionalitiessaboorakheeNo ratings yet

- IMFDocument33 pagesIMFShaheen KhanNo ratings yet

- Amity Business School: MBA 2013, 3 SemesterDocument72 pagesAmity Business School: MBA 2013, 3 SemesterShwetika GuptaNo ratings yet

- International Monetary FundDocument5 pagesInternational Monetary FundAastha sharmaNo ratings yet

- Access PolicyDocument20 pagesAccess PolicyPankaj SharmaNo ratings yet

- International Financial SystemDocument21 pagesInternational Financial SystemZawad TahmeedNo ratings yet

- IMF Con 2011Document26 pagesIMF Con 2011anashussainNo ratings yet

- IMF PakistanDocument14 pagesIMF Pakistanrameen kamranNo ratings yet

- International Monetary FundDocument32 pagesInternational Monetary FundlalitNo ratings yet

- International Monetary FundDocument32 pagesInternational Monetary FundLalit ShahNo ratings yet

- FSSP: Financial Sector Support ProjectDocument6 pagesFSSP: Financial Sector Support ProjectRaihanul KabirNo ratings yet

- Q&a On ImfDocument15 pagesQ&a On ImfFuaad DodooNo ratings yet

- International Finanacial InstitutionsDocument7 pagesInternational Finanacial InstitutionsMufāsir MusthāfƛNo ratings yet

- The Policy Coordination Instrument: Communications DepartmentDocument2 pagesThe Policy Coordination Instrument: Communications DepartmentThe Independent MagazineNo ratings yet

- The International Monetary Fund: Dr. SheetalDocument17 pagesThe International Monetary Fund: Dr. SheetalsheetalsinglaNo ratings yet

- Section - 2: Financial Norms ofDocument12 pagesSection - 2: Financial Norms ofwqsdNo ratings yet

- Imf & World Bank 1Document20 pagesImf & World Bank 1AnonymousNo ratings yet

- Name: - Adnan KaziDocument12 pagesName: - Adnan KaziadnanbmsNo ratings yet

- International Monetary Fund: Hardeepika Singh AhluwaliaDocument24 pagesInternational Monetary Fund: Hardeepika Singh AhluwaliaHardeepika AhluwaliaNo ratings yet

- Crb5100512an PDFDocument11 pagesCrb5100512an PDFanand sahuNo ratings yet

- Revised Scheme For Issue of Kisan Credit Card (KCC)Document15 pagesRevised Scheme For Issue of Kisan Credit Card (KCC)manindersingh949No ratings yet

- Treasury Management Practices 2022/23: Appendix 2Document45 pagesTreasury Management Practices 2022/23: Appendix 2markngare investmentdataNo ratings yet

- Scheme For Sustainable Structuring of Stressed AssetsDocument9 pagesScheme For Sustainable Structuring of Stressed Assetssumit pamechaNo ratings yet

- Monetary Policy and Central Banking in The PhilippinesDocument29 pagesMonetary Policy and Central Banking in The PhilippinesYogun BayonaNo ratings yet

- Draft EFSF Guideline On Precautionary ProgrammesDocument5 pagesDraft EFSF Guideline On Precautionary Programmeslevel3assetsNo ratings yet

- SBP Export Refinance SchemeDocument20 pagesSBP Export Refinance Schemesaeedkhan2288No ratings yet

- PGDBA - FIN - SEM III - International FinanceDocument21 pagesPGDBA - FIN - SEM III - International Financeapi-3762419100% (3)

- Prudential Regulations For Corporate / Commercial BankingDocument73 pagesPrudential Regulations For Corporate / Commercial BankingAsma ShoaibNo ratings yet

- PGDBA - FIN - SEM III - International FinanceDocument22 pagesPGDBA - FIN - SEM III - International FinancepoonamsrilkoNo ratings yet

- 13 Debt PolicyDocument7 pages13 Debt Policy1t4No ratings yet

- IMF, World Bank and PakistanDocument29 pagesIMF, World Bank and Pakistansaad_sheikh_1100% (1)

- Origin of IMF:: These AreDocument4 pagesOrigin of IMF:: These ArenavreenNo ratings yet

- Accounting Considerations For Lenders and Borrowers Under The State Bank of Pakistan IntroducedDocument4 pagesAccounting Considerations For Lenders and Borrowers Under The State Bank of Pakistan IntroducedRANA FAKHAR ALINo ratings yet

- September 2022Document19 pagesSeptember 2022Harshit SinghalNo ratings yet

- SidbiDocument34 pagesSidbiSri Harsha JettiNo ratings yet

- US Risk Retention RuleDocument16 pagesUS Risk Retention RuleJonathan ChingNo ratings yet

- Exposures Norms12Document8 pagesExposures Norms12Rishav SinhaNo ratings yet

- Dairy Processing and Infrastructure Development FundDocument4 pagesDairy Processing and Infrastructure Development FundSrinivasNo ratings yet

- New Liberal Economic System. (World Bank, Imf and Wtos Stabilization, Structural Adjustments and Trade Reform Programs)Document47 pagesNew Liberal Economic System. (World Bank, Imf and Wtos Stabilization, Structural Adjustments and Trade Reform Programs)Kaleemullah AsmiNo ratings yet

- Vishesh Microfinance Yojana (VMY) 1Document3 pagesVishesh Microfinance Yojana (VMY) 1Tarik A R BiswasNo ratings yet

- 181exposure Norms1Document8 pages181exposure Norms1sumit morNo ratings yet

- Xternal Ommercial Orrowings: Chinmay@sbhandari - inDocument176 pagesXternal Ommercial Orrowings: Chinmay@sbhandari - incachinmayNo ratings yet

- Condition Ali Ties by International Monetary FundDocument4 pagesCondition Ali Ties by International Monetary FundTooba MubarakNo ratings yet

- Unit 18 Rise and Fall of Bretton Woods Institutions: 18.0 ObjectivesDocument17 pagesUnit 18 Rise and Fall of Bretton Woods Institutions: 18.0 ObjectivesRakesh KumarNo ratings yet

- Prudential Regulations For Microfinance BanksDocument40 pagesPrudential Regulations For Microfinance BanksSajid Ali MaariNo ratings yet

- Approval of IMF Arrangements As The Identification of The Dependent Variable1Document2 pagesApproval of IMF Arrangements As The Identification of The Dependent Variable1AliLeeNo ratings yet

- Updates On Revised Kisan Credit Card (KCC) SchemeDocument10 pagesUpdates On Revised Kisan Credit Card (KCC) SchemeSelvaraj VillyNo ratings yet

- Non Banking Finacial Companies (NBFC)Document20 pagesNon Banking Finacial Companies (NBFC)UtkarshNo ratings yet

- Departmental AccountingDocument6 pagesDepartmental AccountingAmit KumarNo ratings yet

- Branch AccountingDocument7 pagesBranch AccountingAmit KumarNo ratings yet

- General Conclusion of A Leader: Session 5-1Document17 pagesGeneral Conclusion of A Leader: Session 5-1Amit KumarNo ratings yet

- Changing Organizations - Why Fail?: Session 1Document87 pagesChanging Organizations - Why Fail?: Session 1Amit KumarNo ratings yet

- Ifm QuestionDocument4 pagesIfm QuestionAmit KumarNo ratings yet

- Ifm QuestionDocument4 pagesIfm QuestionAmit KumarNo ratings yet

- Success and Failure Factor of E-GovernenceDocument10 pagesSuccess and Failure Factor of E-GovernenceAmit KumarNo ratings yet

- Project F I MDocument18 pagesProject F I MAmit KumarNo ratings yet

- Garrido Vs TuasonDocument1 pageGarrido Vs Tuasoncmv mendozaNo ratings yet

- Definition of Social PharmacyDocument7 pagesDefinition of Social PharmacyShraddha PharmacyNo ratings yet

- Salesforce Salesforce AssociateDocument6 pagesSalesforce Salesforce Associatemariana992011No ratings yet

- The History of Land Use and Development in BahrainDocument345 pagesThe History of Land Use and Development in BahrainSogkarimiNo ratings yet

- Trade Promotion Optimization - MarketelligentDocument12 pagesTrade Promotion Optimization - MarketelligentMarketelligentNo ratings yet

- SiswaDocument5 pagesSiswaNurkholis MajidNo ratings yet

- NIST SP 800-53ar5-1Document5 pagesNIST SP 800-53ar5-1Guillermo Valdès100% (1)

- Narendra Budiman: Professional StatementDocument1 pageNarendra Budiman: Professional StatementPratika SariputriNo ratings yet

- Disabilities AssignmentDocument8 pagesDisabilities Assignmentapi-427349170No ratings yet

- Open Quruan 2023 ListDocument6 pagesOpen Quruan 2023 ListMohamed LaamirNo ratings yet

- In-CIV-201 INSPECTION NOTIFICATION Pre-Pouring Concrete WEG Pump Area PedestalsDocument5 pagesIn-CIV-201 INSPECTION NOTIFICATION Pre-Pouring Concrete WEG Pump Area PedestalsPedro PaulinoNo ratings yet

- Shipping - Documents - Lpg01Document30 pagesShipping - Documents - Lpg01Romandon RomandonNo ratings yet

- How To Write A Driving School Business Plan: Executive SummaryDocument3 pagesHow To Write A Driving School Business Plan: Executive SummaryLucas Reigner KallyNo ratings yet

- The Call For The Unity of Religions (Wahdatul Adyaan) A False and Dangerous Call. - An Elimination of The Truth by DR - Saleh As-SalehDocument52 pagesThe Call For The Unity of Religions (Wahdatul Adyaan) A False and Dangerous Call. - An Elimination of The Truth by DR - Saleh As-SalehMountainofknowledge100% (1)

- Resume-Pam NiehoffDocument2 pagesResume-Pam Niehoffapi-253710681No ratings yet

- Design of Swimming Pool PDFDocument21 pagesDesign of Swimming Pool PDFjanithbogahawatta67% (3)

- The Key To The Magic of The Psalms by Pater Amadeus 2.0Document16 pagesThe Key To The Magic of The Psalms by Pater Amadeus 2.0evitaveigasNo ratings yet

- NZAA ChartsDocument69 pagesNZAA ChartsA340_600100% (5)

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- Sailpoint Training Understanding ReportDocument2 pagesSailpoint Training Understanding ReportKunalGuptaNo ratings yet

- Specpro.09.Salazar vs. Court of First Instance of Laguna and Rivera, 64 Phil. 785 (1937)Document12 pagesSpecpro.09.Salazar vs. Court of First Instance of Laguna and Rivera, 64 Phil. 785 (1937)John Paul VillaflorNo ratings yet

- Budo Hard Style WushuDocument29 pagesBudo Hard Style Wushusabaraceifador0% (1)

- Jurnal SejarahDocument19 pagesJurnal SejarahGrey DustNo ratings yet

- Prince Baruri Offer Letter-1Document3 pagesPrince Baruri Offer Letter-1Sukharanjan RoyNo ratings yet

- Pulse of The Profession 2013Document14 pagesPulse of The Profession 2013Andy UgohNo ratings yet

- Philippine Politics and Governance: Lesson 6: Executive DepartmentDocument24 pagesPhilippine Politics and Governance: Lesson 6: Executive DepartmentAndrea IbañezNo ratings yet

- Hunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchiveDocument21 pagesHunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchivePrince KatheweraNo ratings yet

- Surahduha MiracleDreamTafseer NoumanAliKhanDocument20 pagesSurahduha MiracleDreamTafseer NoumanAliKhanspeed2kxNo ratings yet

- Sarala Bastian ProfileDocument2 pagesSarala Bastian ProfileVinoth KumarNo ratings yet