Professional Documents

Culture Documents

Risked Reserves

Uploaded by

LEO_GONZALEZOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risked Reserves

Uploaded by

LEO_GONZALEZCopyright:

Available Formats

Distributed by permission of Hart's E & P and James Murtha

Risk Analysis: Table of Contents

Biography

im Murtha, a registered petroleum engineer, presents seminars and training courses and advises clients in building probabilistic models in risk analysis and decision making. He was elected to Distinguished Membership in SPE in 1999, received the 1998 SPE Award in Economics and Evaluation, and was 1996-97 SPE Distinguished Lecturer in Risk and Decision Analysis. Since 1992, more than 2,500 professionals have taken his classes. He has published Decisions

v v v

Involving Uncertainty - An @RISK Tutorial for the Petroleum Industry. In 25 years of academic experience, he chaired a math department, taught petroleum engineering, served as academic dean, and co-authored two texts in mathematics and statistics. Jim has a Ph.D. in mathematics from the University of Wisconsin, an MS in petroleum and natural gas engineering from Penn State and a BS in mathematics from Marietta College. x

Acknowledgements

hen I was a struggling assistant professor of mathematics, I yearned for more ideas, for we were expected to write technical papers and suggest wonderful projects to graduate students. Now I have no students and no one is counting my publications. But, the ideas have been coming. Indeed, I find myself, like anyone who teaches classes to professionals, constantly stumbling on notions worth exploring. The articles herein were generated during a few years and written mostly in about 6 months. A couple of related papers found their way into SPE meetings this year. I thank the hundreds of people who listened and challenged and suggested during classes.

I owe a lot to Susan Peterson, John Trahan and Red White, friends with whom I argue and bounce ideas around from time to time. Most of all, these articles benefited by the careful reading of one person,Wilton Adams, who has often assisted Susan and me in risk analysis classes. During the past year, he has been especially helpful in reviewing every word of the papers I wrote for SPE and for this publication.Among his talents are a well tuned ear and high standards for clarity. I wish to thank him for his generosity. He also plays a mean keyboard, sings a good song and is a collaborator in a certain periodic culinary activity. You should be so lucky. x

Table of Contents

A Guide To Risk Analysis . . . . . . . . . . . . . . . . . . . . . . . . . 3 Central Limit Theorem Polls and Holes . . . . . . . . . . . 5 Estimating Pay Thickness From Seismic Data . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Bayes Theorem Pitfalls . . . . . . . . . . . . . . . . . . . . . . . . 12 Decision Trees vs. Monte Carlo Simulation . . . . . . . . 14 When Does Correlation Matter? . . . . . . . . . . . . . . . . . 20 Beware of Risked Reserves . . . . . . . . . . . . . . . . . . . . 24 Decisioneering Company Profile . . . . . . . . . . . . . . . . 26 Landmark Company Profile . . . . . . . . . . . . . . . . . . . 28 Palisade Company Profile . . . . . . . . . . . . . . . . . . . . . . 30

Risk Analysis

Risk Analysis: Risked Reserves

Beware of

Risked Reserves

Risked reserves is a phrase we hear a lot these days.

It can have at least three meanings: 1. risked reserves might be the product of the probability of success, P(S), and the mean value of reserves in case of a discovery. In this case, risked reserves is a single value; 2. risked reserves might be the probability distribution obtained by scaling down all the values by a factor of P(S); or 3. risked reserves might be a distribution with a spike at 0 having probability P(S) and a reduced probability distribution of the success case. Take as an example Exploration Prospect A. It has a 30% chance of success. If successful, then its reserves can be characterized as in Figure 1, a lognormal distribution with a mean of 200,000 STB (stock tank barrels) and a standard deviation of 40,000 STB. Then: definition 1 yields the single number 0.3*200,000 = 60,000 STB; definition 2 yields a lognormal definition with a mean of 60,000 and a standard deviation of 12,000 (See Figure 2); and definition 3 is the hybrid distribution shown in Figure 3. By contrast, suppose another prospect, B, has a 15% chance of success and a reserves distribution with a mean of 400,000 STB and a standard deviation of 200,000 STB.Then under definition 1,B would yield the same risk reserves as A, 0.15*400,000 = 60,000 STB. However, consider Figure 2, which shows how B would be scaled compared with A,with the same mean but larger standard deviation.And Figure 4 shows how the original distributions compare. Assigning these two prospects the same number for the purpose of any sort of ranking could be misleading. Prospect B is much riskier, both in the sense that it has only half the probability of success than does A, and also because even if it is a success, the range of possible outcomes is much broader. In fact, the P10, where P=Percentile, of Prospect B equals the P50 of Prospect A.Thus, if you drilled several Prospect A types,for fully half of your successes (on average),the reserves would be less than the 10th percentile of one prospect B. The only thing equal about Prospects A and B is that, in the long run, several prospects similar to Prospect A would yield the same average reserves as several other prospects like B. Even this is deceptive, because the range of possible outcomes for several prospects like A is much different from the range of

Risk Analysis

Figure 1.Lognormal distribution for Prospect A reserves

Figure 2.Comparing the original distributions for A and B

24

Risk Analysis: Risked Reserves

possible outcomes of B-types. For instance, if we consider a program of five wells similar to A, there is a 51% chance of at least one success, and a 9% chance of success on two or more. However, with five prospects like B, the corresponding chances are 26% and 2% assuming they are geologically independent.

Running economics

What kind of economics these two prospects would generate is another story. Prospects like A would provide smaller discoveries more consistent in size. They would require different development plans and have different economies of scale than would prospects like B. So, does that mean we should run economics? Well, yes, of course, but the question is with what values of reserves do we run economics? Certainly not with risked reserves according to definition 1,which is not reality at all.We would never have a discovery with 60,000 STB. Our discoveries for A would range from about 120,000 STB to 310,000 STB and for B from about 180,000 STB to 780,000 STB (we are using the P5 and P95 values of the distributions). So, surely, we must run economics for very different cases.We could take a few typical discovery sizes for A (or B), figure a production schedule, assign some capital for wells and facilities, sprinkle in some operating expenses and calculate net present value (NPV) at 10% and IRR (internal rate of return). My preference is not to run a few typical economics cases and then average them. Even if you have the percentiles correct for reserves, why should you think those carry over to the same percentiles for NPV or IRR? Rather, I prefer to run probabilistic economics. That is, build a cashflow model containing the reserves component as well as appropriate development plans. On each iteration, the field size and perhaps the sampled area might determine a suitable development plan, which would generate capital (facilities and drilling schedule), operating expense and production schedule the ingredients, along with prices, for cashflow. The outputs would include distributions for NPV and IRR. Comparing the outputs for A and B would allow us to answer questions like: what is the chance of making money with A or B? What is the probability that NPV>0? and what is the chance of exceeding our hurdle rate for IRR? The answers to these questions together with the comparison of the reserves distributions would give us much more information for decision-making or

Risk Analysis

Figure 3.Hybrid distribution for A showing spike at 0 for failure case

Figure 4. Original distributions for A and B

ranking prospects. Moreover, the process would indicate the drivers of NPV and of reserves, leading to questions of management of risks.

Summary

The phrase risked reserves is ambiguous. Clarifying its meaning will help avoid miscommunication. Especially when comparing two prospects, one must recognize the range of possibilities inherent in any multiple-prospect program. Development plans must be designed for real cases not for field sizes scaled down by chance of success. Full-scale probabilistic economics requires the various components of the model be connected properly to avoid creating inappropriate realizations.The benefits of probabilistic cashflow models, however, are significant, allowing us to make informed decisions about the likelihood of attaining specific goals. x

25

You might also like

- Phrasal VerbsDocument2 pagesPhrasal VerbsLEO_GONZALEZNo ratings yet

- 2008 Pigging PowerPointDocument59 pages2008 Pigging PowerPointLEO_GONZALEZ100% (1)

- LineMasterTraining FlyerDocument5 pagesLineMasterTraining FlyerLEO_GONZALEZNo ratings yet

- 2012 Karakehayov - Data Acquisition ApplicationsDocument351 pages2012 Karakehayov - Data Acquisition ApplicationsLEO_GONZALEZNo ratings yet

- Electrical Submersible PumpDocument24 pagesElectrical Submersible PumpJorge Mártires100% (3)

- TDW CapabilititiesDocument1 pageTDW CapabilititiesLEO_GONZALEZNo ratings yet

- Guide Risk Analysis For Oil IndustryDocument4 pagesGuide Risk Analysis For Oil IndustryLEO_GONZALEZNo ratings yet

- Decisions Involving UncertaintyDocument76 pagesDecisions Involving UncertaintyLEO_GONZALEZNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

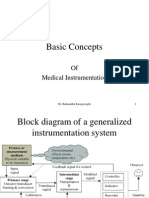

- Basic Concepts: of Medical InstrumentationDocument37 pagesBasic Concepts: of Medical InstrumentationIrahlevrikAkhelNo ratings yet

- Aerospace Engineering Sample Report PDFDocument4 pagesAerospace Engineering Sample Report PDFDuncan LeeNo ratings yet

- New Microsoft Office Word Document PDFDocument5 pagesNew Microsoft Office Word Document PDFSubhash KNo ratings yet

- Abdullah Abid - Worksheet - FractionsDocument3 pagesAbdullah Abid - Worksheet - FractionsAbdullahNo ratings yet

- TrusssDocument11 pagesTrusssfaizy216No ratings yet

- Understanding Hooke's Law and Modulus of ElasticityDocument18 pagesUnderstanding Hooke's Law and Modulus of ElasticityIznifaiznur Faiznur0% (1)

- Problem 1 SolutionDocument24 pagesProblem 1 Solutionnitte5768No ratings yet

- Arihant 40 Days Crash Course For JEE Main Mathematics Crackjee Xyz 457 460Document4 pagesArihant 40 Days Crash Course For JEE Main Mathematics Crackjee Xyz 457 460shantanu99hazra5No ratings yet

- Amc 14 QsDocument6 pagesAmc 14 Qsjoebloggs_comNo ratings yet

- Designof14speedgearbox 170425062133Document8 pagesDesignof14speedgearbox 170425062133Muket AgmasNo ratings yet

- CE214Document2 pagesCE214Mujammil ChoudhariNo ratings yet

- MIT AVL User Primer guideDocument43 pagesMIT AVL User Primer guideTinashe ErwinNo ratings yet

- FIFA Video Game - Players ClassificationDocument26 pagesFIFA Video Game - Players Classificationimmi1989No ratings yet

- Snap Fit CalculationsDocument6 pagesSnap Fit CalculationsSathish Kumar ChelladuraiNo ratings yet

- JavaScript: The Programming Language of the WebDocument15 pagesJavaScript: The Programming Language of the WebMary EcargNo ratings yet

- CCS 1501-Engineering Mathematics Unit 1 Introductory Theory of SetsDocument26 pagesCCS 1501-Engineering Mathematics Unit 1 Introductory Theory of SetsMapalo zimbaNo ratings yet

- Linear Correlation AnalysisDocument8 pagesLinear Correlation AnalysisMarga NiveaNo ratings yet

- B.tech Syllabus 3rd Semester For CSE IPUDocument8 pagesB.tech Syllabus 3rd Semester For CSE IPUykr007No ratings yet

- Pert CPMDocument42 pagesPert CPMNaveed Iqbal Salman86% (7)

- Geometry m5 Topic A Lesson 1 TeacherDocument12 pagesGeometry m5 Topic A Lesson 1 TeacherGina CasinilloNo ratings yet

- Directional Drilling - Target Approach CalculationsDocument34 pagesDirectional Drilling - Target Approach CalculationswalidNo ratings yet

- Wks Mar09 Zscore ProblemsDocument1 pageWks Mar09 Zscore ProblemsKennyNo ratings yet

- Release Notes Sap 2000 V 2020Document6 pagesRelease Notes Sap 2000 V 2020Uzair Maqbool KhanNo ratings yet

- ProbabilityDocument6 pagesProbabilitySondos Magdy22No ratings yet

- Notes For Class 11 Maths Chapter 8 Binomial Theorem Download PDFDocument9 pagesNotes For Class 11 Maths Chapter 8 Binomial Theorem Download PDFRahul ChauhanNo ratings yet

- Wolfe - Cellular ThermodynamicsDocument13 pagesWolfe - Cellular Thermodynamicsandres_old_condeNo ratings yet

- Absolute and Comparative AdvantageDocument9 pagesAbsolute and Comparative AdvantageRara AlonzoNo ratings yet

- Mat Chapter 18Document29 pagesMat Chapter 18hemant_durgawaleNo ratings yet

- PhysicsSE 10 Ch02 PowerPointsDocument104 pagesPhysicsSE 10 Ch02 PowerPointsmkdatosNo ratings yet

- I.Condition For The Equilibrium of A Particle: Stiffness KDocument5 pagesI.Condition For The Equilibrium of A Particle: Stiffness KJirah LacbayNo ratings yet