Professional Documents

Culture Documents

QT Notes BONY Securitzation Case

Uploaded by

Paul RobertsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QT Notes BONY Securitzation Case

Uploaded by

Paul RobertsonCopyright:

Available Formats

May 3, 2013 THE MOST IMPORTANT THING TO REMEMBER IS DENY AND DISCOVER.

You must deny that the client ever received a loan from Option One, Mortgage IT or the current servicer and there is no assignments of record to show the validity of any claim on the property. Some basics on quiet title... If someone accidentally (or on purpose) records a lien against your property and they refuse to retract it, then you are forced to file an action with the Court that says I own the property and my title is clouded by documents that were recorded as liens against my title. Those liens are not lawful, and they should be declared null and void or at a minimum the court should issue a declaratory statement based upon facts of the case that sets forth the stakeholders in the property and the nature of their claim. In order to claim the latter, you would need to state that while the lien is unlawful, the party named on the lien, or the party claiming to hold the right to the lien, refuses to cooperate with clearing title or to explain the nature of their claim. Thus the homeowner is left with a lien which is unlawful and a claimant who insists that it is lawful. The homeowner is in doubt as to his rights and therefore asks the Court to quiet title or declare the rights of the parties. In filing quiet title claims the mistake most often made is that it is being used defensively instead of offensively. THE COMPLAINT THAT FAILS, MERELY ATTACKS THE RIGHT OF SOME LENDER TO FORECLOSE. That is not a quiet title action. That is a denial of the debt, note, mortgage, default, notice etc. The Courts regularly and correctly dismiss such claims as quiet title claims. You can't quiet title because someone does not have a right to foreclose. You can only quiet title if you can assert and prove to the Court that the items on record do not apply and therefore should be removed. You can't get through a motion to dismiss a declaratory action if you don't state that you are in doubt and give cogent reasons why you are in doubt. If you state that the other side has no right to do anything and end it there, you are using quiet title defensively rather than offensively in a declaratory action. Stating that the lender has no right to foreclose is not grounds for a declaratory action either. If you make a short plain statement of FACTS (not conclusions of law) upon which the relief sought could be granted you survive a motion to dismiss. If you only state the conclusions of law, you lose the motion to dismiss based on rule 12(b)6. In such a declaratory action you must state that you have doubts because the lender has taken the position and issued statements, letters or demands indicating they are the owner of the lien but you have evidence from expert analyses from title and securitization experts that they are not the owner of the line and they never were. In securitized transactions you need to name the original named payee on the note and the secured party(ies) and state that they never should have recorded the lien because they did not perform as required by the agreement (i.e., they didn't loan any money) and/or because they received loss mitigation payments in excess of the amount due. If you want to get more elaborate, you can say that they now claim to have nothing to do with the loan and refuse to apply loss mitigation payments to the loan even though they were received.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

This quiet title claim against U.S. Bank and BONY (collectively, "Defendants") is based on the assertion that Defendants have no interest in the Plaintiffs' mortgage loan, yet have nonetheless sought to foreclose on the subject property. Currently before the court is Defendants' Motion for Summary Judgment, arguing that Plaintiffs' quiet title claim fails because there is no genuine issue of material fact that Plaintiffs' loan was sold into a public security managed by BONY, and Plaintiffs cannot tender the loan proceeds. Based on the following, the court finds that because Defendants have not established that the mortgage loans were sold into a public security involving Defendants, the court DENIES Defendants' Motion for Summary Judgment. Quiet title claims should not be dismissed. They should be heard and decided based upon the facts admitted into evidence. Presumptions are not to be used in lieu of evidence where the opposing party has denied the underlying facts and the conclusion expressed in the presumption. In other words, a presumption cannot be used to lead to a result that is contrary to the facts. Being a "holder" is a conclusion of law created by certain presumptions. It is not a plain statement of ultimate facts. If a party wishes to assert holder or holder in due course status they must plead and prove the facts supporting that legal conclusion. A sale of the note does not occur without proof under simple contract doctrine. There must be an offer, acceptance and consideration. Without the consideration there is no sale and any presumption arising out of the allegation that a party is a holder or that the loan was sold fails on its face. Self-serving letters announcing authority to represent investors are insufficient in establishing a foundation for testimony or other proof that the actor was indeed authorized. A competent witness must provide the factual testimony to provide a foundation for introduction of a binding legal document showing authority and even then the opposing party may challenge the execution or creation of such instruments. [Tactical conclusion: opposing motion for summary judgment should be filed with an affidavit alleging the necessary facts when the alleged lender files its motion for summary judgment. If the pretender's affidavit is struck down and/or their motion for summary judgment is denied, they have probably created a procedural void where the Judge has no choice but to grant summary judgment to homeowner.] "When considering the evidence on a motion for summary judgment, the court must draw all reasonable inferences on behalf of the nonmoving party. Matsushita Elec. Indus. Co., 475 U.S. at 587." See case below "a plaintiff asserting a quiet title claim must establish his superior title by showing the strength of his title as opposed to merely attacking the title of the defendant." {Tactical: by admitting the note,

mortgage. debt and default, and then attacking the title chain of the foreclosing party you have NOT established the elements for quiet title. DENY and DISCOVER: Most Lawyers think they know what is going on. This doesn't mean they do. Advice given under the presumption that the debt is genuine when that is in fact a mistake of the homeowner which Lawyers compound with their advice. Why assume the debt, note, mortgage and default are genuine when you really don't know? Why would you admit that? It is both wise and necessary to deny the debt, note, mortgage, and default as to the party attempting to foreclose. Don't try to prove your case in your pleading. Each additional "explanatory" allegation paints you into a corner. Pleading requires a short plain statement of ultimate facts upon which relief could be legally granted. A denial of signature on a document that is indisputably signed will be considered frivolous. However an allegation that the document is not an original and/or that the signature was procured by fraud or mistake is not frivolous. Coupled with allegation that the named lender did not loan the money at all and that in fact the homeowner never received any money from the lender named on the note, you establish that the deal was, sign the note and we'll give you money. The homeowner signed the note, but hey didn't give them the money. Therefore those documents may not be used against the homeowner. Here is a case that just came down on May 3, 2013, which is a really good example: MELVIN KEAKAKU AMINA and DONNA MAE AMINA, Husband and Wife, Plaintiffs, THE BANK OF NEW YORK MELLON, FKA THE BANK OF NEW YORK; U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE FOR J.P. MORGAN MORTGAGE ACQUISITION TRUST 2006-WMC2, ASSET BACKED PASS-THROUGH CERTIFICATES, SERIES 2006-WMC2 Defendants. Civil No. 11-00714 JMS/BMK. United States District Court, D. Hawaii. ORDER DENYING DEFENDANTS THE BANK OF NEW YORK MELLON, FKA THE BANK OF NEW YORK AND U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE FOR J.P. MORGAN MORTGAGE ACQUISITION TRUST 2006-WMC2, ASSET BACKED PASS-THROUGH CERTIFICATES, SERIES 2006-WMC2'S MOTION FOR SUMMARY JUDGMENT

J. MICHAEL SEABRIGHT, District Judge.

I. INTRODUCTION This is Plaintiffs Melvin Keakaku Amina and Donna Mae Amina's ("Plaintiffs") second action filed in this court concerning a mortgage transaction and alleged subsequent threatened foreclosure of real property located at 2304 Metcalf Street #2, Honolulu, Hawaii 96822 (the "subject property"). Late in Plaintiffs' first action, Amina et al. v. WMC Mortgage Corp. et al., Civ. No. 10-00165 JMS-KSC ("Plaintiffs' First Action"), Plaintiffs sought to substitute The Bank of New York Mellon, FKA the Bank of New York ("BONY") on the basis that one of the defendants' counsel asserted that BONY owned the mortgage loans. After the court denied Plaintiffs' motion to substitute, Plaintiffs brought this action alleging a single claim to quiet title against BONY. Plaintiffs have since filed a Verified Second Amended Complaint

("SAC"), adding as a Defendant U.S. Bank National Association, as Trustee for J.P. Morgan Mortgage Acquisition Trust 2006-WMC2, Asset Backed Pass-through Certificates, Series 2006-WMC2 ("U.S. Bank"). This quiet title claim against U.S. Bank and BONY (collectively, "Defendants") is based on the assertion that Defendants have no interest in the Plaintiffs' mortgage loan, yet have nonetheless sought to foreclose on the subject property. Currently before the court is Defendants' Motion for Summary Judgment, arguing that Plaintiffs' quiet title claim fails because there is no genuine issue of material fact that Plaintiffs' loan was sold into a public security managed by BONY, and Plaintiffs cannot tender the loan proceeds. Based on the following, the court finds that because Defendants have not established that the mortgage loans were sold into a public security involving Defendants, the court DENIES Defendants' Motion for Summary Judgment. II. BACKGROUND A. Factual Background Plaintiffs own the subject property. See Doc. No. 60, SAC 17. On February 24, 2006, Plaintiffs obtained two mortgage loans from WMC Mortgage Corp. ("WMC") one for $880,000, and another for $220,000, both secured by the subject property.See Doc. Nos. 68-6-68-8, Defs.' Exs. E-G.[1] In Plaintiffs' First Action, it was undisputed that WMC no longer held the mortgage loans. Defendants assert that the mortgage loans were sold into a public security managed by BONY, and that Chase is the servicer of the loan and is authorized by the security to handle any concerns on BONY's behalf. See Doc. No. 68, Defs.' Concise Statement of Facts ("CSF") 7. Defendants further assert that the Pooling and Service Agreement ("PSA") dated June 1, 2006 (of which Plaintiffs' mortgage loan is allegedly a part) grants Chase the authority to institute foreclosure proceedings. Id. 8. In a February 3, 2010 letter, Chase informed Plaintiffs that they are in default on their mortgage and that failure to cure default will result in Chase commencing foreclosure proceedings. Doc. No. 68-13, Defs.' Ex. L. Plaintiffs also received a March 2, 2011 letter from Chase stating that the mortgage loan "was sold to a public security managed by [BONY] and may include a number of investors. As the servicer of your loan, Chase is authorized by the security to handle any related concerns on their behalf." Doc. No. 68-11, Defs.' Ex. J. On October 19, 2012, Derek Wong of RCO Hawaii, L.L.L.C., attorney for U.S. Bank, submitted a proof of claim in case number 12-00079 in the U.S. Bankruptcy Court, District of Hawaii, involving Melvin Amina. Doc. No. 68-14, Defs.' Ex. M. Plaintiffs stopped making payments on the mortgage loans in late 2008 or 2009, have not paid off the loans, and cannot tender all of the amounts due under the mortgage loans. See Doc. No. 68-5, Defs.' Ex. D at 48, 49, 55-60; Doc. No. 68-6, Defs.' Ex. E at 29-32. >B. Procedural Background >Plaintiffs filed this action against BONY on November 28, 2011, filed their First Amended Complaint on June 5, 2012, and filed their SAC adding U.S. Bank as a Defendant on October 19, 2012. On December 13, 2012, Defendants filed their Motion for Summary Judgment. Plaintiffs filed an Opposition on February 28, 2013, and Defendants filed a Reply on March 4, 2013. A hearing was held on March 4, 2013. At the March 4, 2013 hearing, the court raised the fact that Defendants failed to present any evidence establishing ownership of the mortgage loan. Upon Defendants' request, the court granted Defendants additional time to file a supplemental brief.[2] On April 1, 2013, Defendants filed their supplemental

brief, stating that they were unable to gather evidence establishing ownership of the mortgage loan within the time allotted. Doc. No. 93. III. STANDARD OF REVIEW Summary judgment is proper where there is no genuine issue of material fact and the moving party is entitled to judgment as a matter of law. Fed. R. Civ. P. 56(c). The burden initially lies with the moving party to show that there is no genuine issue of material fact. See Soremekun v. Thrifty Payless, Inc., 509 F.3d 978, 984 (9th Cir. 2007) (citing Celotex, 477 U.S. at 323). If the moving party carries its burden, the nonmoving party "must do more than simply show that there is some metaphysical doubt as to the material facts [and] come forwards with specific facts showing that there is a genuine issue for trial." Matsushita Elec. Indus. Co. v. Zenith Radio, 475 U.S. 574, 586-87 (1986) (citation and internal quotation signals omitted). An issue is `genuine' only if there is a sufficient evidentiary basis on which a reasonable fact finder could find for the nonmoving party, and a dispute is `material' only if it could affect the outcome of the suit under the governing law." In re Barboza,545 F.3d 702, 707 (9th Cir. 2008) (citing Anderson v. Liberty Lobby, Inc., 477 U.S. 242, 248 (1986)). When considering the evidence on a motion for summary judgment, the court must draw all reasonable inferences on behalf of the nonmoving party. Matsushita Elec. Indus. Co., 475 U.S. at 587. IV. DISCUSSION As the court previously explained in its August 9, 2012 Order Denying BONY's Motion to Dismiss Verified Amended Complaint, see Amina v. Bank of New York Mellon,2012 WL 3283513 (D. Haw. Aug. 9, 2012), a plaintiff asserting a quiet title claim must establish his superior title by showing the strength of his title as opposed to merely attacking the title of the defendant. This axiom applies in the numerous cases in which this court has dismissed quiet title claims that are based on allegations that a mortgagee cannot foreclose where it has not established that it holds the note, or because securitization of the mortgage loan was defective. In such cases, this court has held that to maintain a quiet title claim against a mortgagee, a borrower must establish his superior title by alleging an ability to tender the loan proceeds.[3] This action differs from these other quiet title actions brought by mortgagors seeking to stave off foreclosure by the mortgagee. As alleged in Plaintiffs' pleadings, this is not a case where Plaintiffs assert that Defendants' mortgagee status is invalid (for example, because the mortgage loan was securitized, Defendants do not hold the note, or MERS lacked authority to assign the mortgage loans). See id. at *5. Rather, Plaintiffs assert that Defendants are not mortgagees whatsoever and that

there is no record evidence of any assignment of the mortgage loan to Defendants.[4] See Doc. No. 58, SAC 1-4, 6, 13-1 13-3.

In support of their Motion for Summary Judgment, Defendants assert that Plaintiffs' mortgage loan was sold into a public security which is managed by BONY and which U.S. Bank is the trustee. To establish this fact, Defendants cite to the March 2, 2011 letter from Chase to Plaintiffs asserting that "[y]our loan was sold to a public security managed by The Bank of New York and may include a number of investors. As the servicer of your loan, Chase is authorized to handle any related concerns on their behalf." See Doc. No. 68-11, Defs.' Ex. J. Defendants also present the PSA naming U.S. Bank as trustee. See Doc. No. 68-12, Defs.' Ex. J. Contrary to Defendants' argument, the letter does not establish that Plaintiffs' mortgage loan was sold into a public security, much less a public security managed by BONY and for which U.S. Bank is the trustee. Nor does the PSA establish that it governs Plaintiffs' mortgage loans. As a result, Defendants have failed to carry their initial burden on summary judgment of showing that there is no genuine issue of material fact that Defendants may foreclose on the subject property.

Indeed, Defendants admit as much in their Supplemental Brief they concede that they were unable to present evidence that Defendants have an interest in the mortgage loans by the supplemental briefing deadline. See Doc. No. 93. Defendants also argue that Plaintiffs' claim fails as to BONY because BONY never claimed an interest in the subject property on its own behalf. Rather, the March 2, 2011 letter provides that BONY is only managing the security. See Doc. No. 67-1, Defs.' Mot. at 21. At this time, the court rejects this argument the March 2, 2011 letter does not identify who owns the public security into which the mortgage loan was allegedly sold, and BONY is the only entity identified as responsible for the public security. As a result, Plaintiffs' quiet title claim against BONY is not unsubstantiated. V. CONCLUSION Based on the above, the court DENIES Defendants' Motion for Summary Judgment. IT IS SO ORDERED. [1] In their Opposition, Plaintiffs object to Defendants' exhibits on the basis that the sponsoring declarant lacks and/or fails to establish the basis of personal knowledge of the exhibits. See Doc. No. 80, Pls.' Opp'n at 3-4. Because Defendants have failed to carry their burden on summary judgment regardless of the admissibility of their exhibits, the court need not resolve these objections. Plaintiffs also apparently dispute whether they signed the mortgage loans. See Doc. No. 80, Pls.' Opp'n at 7-8. This objection appears to be wholly frivolous Plaintiffs have previously admitted that they took out the mortgage loans. The court need not, however, engage Plaintiffs' new assertions to determine the Motion for Summary Judgment. [2] On March 22, 2013, Plaintiffs filed an "Objection to [87] Order Allowing Defendants to File Supplemental Brief for their Motion for Summary Judgment." Doc. No. 90. In light of Defendants' Supplemental Brief stating that they were unable to provide evidence at this time and this Order, the court DEEMS MOOT this Objection. [3] See, e.g., Fed Nat'l Mortg. Ass'n v. Kamakau, 2012 WL 622169, at *9 (D. Haw. Feb. 23, 2012);Lindsey v. Meridias Cap., Inc., 2012 WL 488282, at *9 (D. Haw. Feb. 14, 2012); Menashe v. Bank of N.Y., ___ F. Supp. 2d ___, 2012 WL 397437, at *19 (D. Haw. Feb. 6, 2012); Teaupa v. U.S. Nat'l Bank N.A., 836 F. Supp. 2d 1083, 1103 (D. Haw. 2011); Abubo v. Bank of N.Y. Mellon, 2011 WL 6011787, at *5 (D. Haw. Nov. 30, 2011); Long v. Deutsche Bank Nat'l Tr. Co., 2011 WL 5079586, at *11 (D. Haw. Oct. 24, 2011). [4] Although the SAC also includes some allegations asserting that the mortgage loan could not be part of the PSA given its closing date, Doc. No. 60, SAC 13-4, and that MERS could not legally assign the mortgage loans, id. 13-9, the overall thrust of Plaintiffs' claims appears to be that

Defendants are not the mortgagees (as opposed to that Defendants' mortgagee status is defective). Indeed, Plaintiffs agreed with the court's characterization of their claim that they are

asserting that Defendants "have no more interest in this mortgage than some guy off the street does." See Doc. No. 88, Tr. at 9-10. Because Defendants fail to establish a basis for their right to foreclose, the court does not address the viability of Plaintiffs' claims if and when Defendants establish mortgagee status.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Quiet Title Codes (revised Feb 22, 2013)

760.010. As used in this chapter: (a) "Claim" includes a legal or equitable right, title, estate, lien, or interest in property or cloud upon title. (b) "Property" includes real property, and to the extent applicable, personal property. 760.020. (a) An action may be brought under this chapter to establish title against adverse claims to real or personal property or any interest therein. 760.030. (a) The remedy provided in this chapter is cumulative and not exclusive of any other remedy, form or right of action, or proceeding provided by law for establishing or quieting title to property. (b) In an action or proceeding in which establishing or quieting title to property is in issue the court in its discretion may, upon motion of any party, require that the issue be resolved pursuant to the provisions of this chapter to the extent practicable. 760.040. (a) The superior court has jurisdiction of actions under this chapter. (b) The court has complete jurisdiction over the parties to the action and the property described in the complaint and is deemed to have obtained possession and control of the property for the purposes of the action with complete jurisdiction to render the judgment provided for in this chapter. (c) Nothing in this chapter limits any authority the court may have to grant such equitable relief as may be proper under the circumstances of the case. 760.060. The statutes and rules governing practice in civil actions generally apply to actions under this chapter except where they are inconsistent with the provisions of this chapter. 761.010. (a) An action under this chapter is commenced by filing a complaint with the court. (b) Immediately upon commencement of the action, the plaintiff shall file a notice of the pendency of the action in the office of the county recorder of each county in which any real property described in the complaint is located.

761.020. The complaint shall be verified and shall include all of the following: (a) A description of the property that is the subject of the action. In the case of tangible personal property, the description shall include its usual location. In the case of real property, the description shall include both its legal description and its street address or common designation, if any. (b) The title of the plaintiff as to which a determination under this chapter is sought and the basis of the title. If the title is based upon adverse possession, the complaint shall allege the specific facts constituting the adverse possession. (c) The adverse claims to the title of the plaintiff against which a determination is sought. (d) The date as of which the determination is sought. If the determination is sought as of a date other than the date the complaint is filed, the complaint shall include a statement of the reasons why a determination as of that date is sought. (e) A prayer for the determination of the title of the plaintiff against the adverse claims.

761.030. (a) The answer shall be verified and shall set forth: (1) Any claim the defendant has. (2) Any facts tending to controvert such material allegations of the complaint as the defendant does not wish to be taken as true. (3) A statement of any new matter constituting a defense. (b) If the defendant disclaims in the answer any claim, or suffers judgment to be taken without answer, the plaintiff shall not recover costs.

762.010. The plaintiff shall name as defendants in the action the persons having adverse claims to the title of the plaintiff against which a determination is sought.

762.020. (a) If the name of a person required to be named as a defendant is not known to the plaintiff, the plaintiff shall so state in the complaint and shall name as parties all persons unknown in the manner provided in Section 762.060. (b) If the claim or the share or quantity of the claim of a person required to be named as a defendant is unknown, uncertain, or contingent, the plaintiff shall so state in the complaint. If the lack of knowledge, uncertainty, or contingency is caused by a transfer to an unborn or unascertained person or class member, or by a transfer in the form of a contingent remainder, vested remainder subject to defeasance, executory interest, or similar disposition, the plaintiff shall also state in the complaint, so far as is known to the plaintiff, the name, age, and legal disability (if any) of the person in being who would be entitled to the claim had the contingency upon which the claim depends occurred prior to the commencement of the action. 762.030. (a) If a person required to be named as a defendant is

dead and the plaintiff knows of a personal representative, the plaintiff shall join the personal representative as a defendant. (b) If a person required to be named as a defendant is dead, or is believed by the plaintiff to be dead, and the plaintiff knows of no personal representative: (1) The plaintiff shall state these facts in an affidavit filed with the complaint. (2) Where it is stated in the affidvit that such person is dead, the plaintiff may join as defendants "the testate and intestate successors of ____ (naming the deceased person), deceased, and all persons claiming by, through, or under such decedent," naming them in that manner. (3) Where it is stated in the affidavit that such person is believed to be dead, the plaintiff may join the person as a defendant, and may also join "the testate and intestate successors of ____ (naming the person) believed to be deceased, and all persons claiming by, through, or under such person," naming them in that manner. 762.040. The court upon its own motion may, and upon motion of any party shall, make such orders as appear appropriate: (a) For joinder of such additional parties as are necessary or proper. (b) Requiring the plaintiff to procure a title report and designate a place where it shall be kept for inspection, use, and copying by the parties. 762.050. Any person who has a claim to the property described in the complaint may appear in the proceeding. Whether or not the person is named as a defendant in the complaint, the person shall appear as a defendant. 762.060. (a) In addition to the persons required to be named as defendants in the action, the plaintiff may name as defendants "all persons unknown, claiming any legal or equitable right, title, estate, lien, or interest in the property described in the complaint adverse to plaintiff's title, or any cloud upon plaintiff's title thereto," naming them in that manner. (b) In an action under this section, the plaintiff shall name as defendants the persons having adverse claims that are of record or known to the plaintiff or reasonably apparent from an inspection of the property. (c) If the plaintiff admits the validity of any adverse claim, the complaint shall so state.

762.070. A person named and served as an unknown defendant has the same rights as are provided by law in cases of all other defendants named and served, and the action shall proceed against unknown defendants in the same manner as against other defendants named and served, and with the same effect. 762.080. The court upon its own motion may, and upon motion of any party shall, make such orders for appointment of guardians ad litem as appear necessary to protect the interest of any party. 762.090. (a) The state may be joined as a party to an action under this chapter.

(b) This section does not constitute a change in, but is declaratory of, existing law. 764.010. The court shall examine into and determine the plaintiff's title against the claims of all the defendants. The court shall not enter judgment by default but shall in all cases require evidence of plaintiff's title and hear such evidence as may be offered respecting the claims of any of the defendants, other than claims the validity of which is admitted by the plaintiff in the complaint. The court shall render judgment in accordance with the evidence and the law.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 000 Audit NotesDocument1 page000 Audit NotesPaul RobertsonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- In Re Weisband Opinion Loan List Left Blank in Psa 2010Document5 pagesIn Re Weisband Opinion Loan List Left Blank in Psa 2010Paul RobertsonNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- HSBC BANK V MILLER 5 PAGES OPINION Failed To Show Ownership of The Note Before ForeclosureDocument5 pagesHSBC BANK V MILLER 5 PAGES OPINION Failed To Show Ownership of The Note Before ForeclosurePaul RobertsonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Brian Davies Debtor's ObjectionsToLiftOfStay Wins Twice Against OneWestDocument10 pagesBrian Davies Debtor's ObjectionsToLiftOfStay Wins Twice Against OneWesttraderash1020No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Brian Davies Debtor's ObjectionsToLiftOfStay Wins Twice Against OneWestDocument10 pagesBrian Davies Debtor's ObjectionsToLiftOfStay Wins Twice Against OneWesttraderash1020No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- KMBA Opinion Letter Securitization For Lilia Gutierrez 9-25-12Document3 pagesKMBA Opinion Letter Securitization For Lilia Gutierrez 9-25-12Paul RobertsonNo ratings yet

- T Sevillano Robo Signer InfoDocument4 pagesT Sevillano Robo Signer InfoPaul Robertson100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

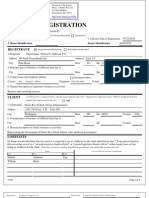

- Registration by Stanton D. Anderson, P.C. To Lobby For Puerto Rico Federal Affairs Administration (300304667)Document2 pagesRegistration by Stanton D. Anderson, P.C. To Lobby For Puerto Rico Federal Affairs Administration (300304667)Sunlight FoundationNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- CRITIQUE ON SMT. SELVI V. STATE OF KARNATAKA - A CASE ON SELF - INCRIMINATION' by Pramod TiwariDocument2 pagesCRITIQUE ON SMT. SELVI V. STATE OF KARNATAKA - A CASE ON SELF - INCRIMINATION' by Pramod TiwariDr. P.K. PandeyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- G Ramegowda and Ors Vs Special Land AcquisitionDocument5 pagesG Ramegowda and Ors Vs Special Land Acquisitionabhinandan khanduriNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Perubahan Konstitusi Dan Reformasi Ketatanegaraan IndonesiaDocument8 pagesPerubahan Konstitusi Dan Reformasi Ketatanegaraan IndonesiaEndah RyaniNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- IRS Rule 508 Section F. Religious Exemption Extended DiscussionDocument22 pagesIRS Rule 508 Section F. Religious Exemption Extended DiscussionRyan Gallagher100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Magallanes vs. AuguisDocument8 pagesMagallanes vs. AuguisRhona MarasiganNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Garcia vs. Court of Appeals (G.R. No. 83929, June 11, 1992)Document3 pagesGarcia vs. Court of Appeals (G.R. No. 83929, June 11, 1992)mshenilynNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- ComTrust v. Republic Armored Car ESCRADocument6 pagesComTrust v. Republic Armored Car ESCRAmheritzlynNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 1 RosalDocument5 pages1 RosalElma MalagionaNo ratings yet

- Libnus v. State of MaharashtraDocument9 pagesLibnus v. State of MaharashtraShreya SinhaNo ratings yet

- 2 Municipal Circuit Trial Court of Malungon-Alabel: Pre-Trial Brief For DefendantsDocument3 pages2 Municipal Circuit Trial Court of Malungon-Alabel: Pre-Trial Brief For DefendantsHan NahNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Bartolome v. IACDocument3 pagesBartolome v. IACMark Evan GarciaNo ratings yet

- 2 Ortega V CA - DigestDocument1 page2 Ortega V CA - DigestLorelieNo ratings yet

- Supreme Court Rules on Literal InterpretationDocument19 pagesSupreme Court Rules on Literal Interpretationdiksha singhNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 10 Social Security Commission Vs Rizal PoultyDocument10 pages10 Social Security Commission Vs Rizal Poultygenel marquezNo ratings yet

- Chapter 4Document11 pagesChapter 4Arhann Anthony Almachar AdriaticoNo ratings yet

- GR No 158694-96 PantaleonDocument19 pagesGR No 158694-96 PantaleonVinz G. VizNo ratings yet

- 8 Angeles Vda de Lat Vs Public Service CommissionDocument2 pages8 Angeles Vda de Lat Vs Public Service Commissionmei atienzaNo ratings yet

- 014 Hipos Vs BayDocument1 page014 Hipos Vs BayCj CarlighNo ratings yet

- 4th Amendment Ruling in Hidden Camera SearchDocument25 pages4th Amendment Ruling in Hidden Camera SearchPatrick JohnsonNo ratings yet

- G.R. No. 158540Document71 pagesG.R. No. 158540Klein CarloNo ratings yet

- BJMP Official WebsiteDocument1 pageBJMP Official WebsiteJustin CoymeNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Bernal v. JV HouseDocument1 pageBernal v. JV HouseKalliah Cassandra CruzNo ratings yet

- Dela Llana V BiongDocument3 pagesDela Llana V BiongJenny DagunNo ratings yet

- Count 1: Animal - Dangerous Animal Causing Serious InjuryDocument3 pagesCount 1: Animal - Dangerous Animal Causing Serious InjuryWXMINo ratings yet

- Republic Act No. 10515Document2 pagesRepublic Act No. 10515nido12No ratings yet

- US vs Apego: Self-defense limits in homicide caseDocument2 pagesUS vs Apego: Self-defense limits in homicide caseJoyleen HebronNo ratings yet

- Jesika and CainDocument12 pagesJesika and CainfelixmuyoveNo ratings yet

- Section 274, 275, 276 and 284Document19 pagesSection 274, 275, 276 and 284Priyanka Roy ChowdhuryNo ratings yet

- Digest Philippine Blooming Mills Employees Organization vs. Philippine Blooming MillsDocument3 pagesDigest Philippine Blooming Mills Employees Organization vs. Philippine Blooming MillsJet AviNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)