Professional Documents

Culture Documents

Donors Tax

Uploaded by

tmaderazoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Donors Tax

Uploaded by

tmaderazoCopyright:

Available Formats

Contents

Tax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked Questions

Tax Rates Effective January 1, 1998 to present

Net Gift Over

But not Over

The Tax Shall be exempt 0 P 2,000.00 14,000.00 44,000.00 204,000.00 404,000.00 1,004,000.00

Plus

Of the Excess Over

100,000.00 100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 10,000,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 10,000,000.00 and over

2% 4% 6% 8% 10% 12% 15%

100,000.00 200,000.00 500,000.00 1,000,000.00 3,000,000.00 5,000,000.00 10,000,000.00

Notes: 1. Rate applicable shall be based on the law prevailing at the time of donation. 2. When the gifts are made during the same calendar year but on different dates, the donor's tax computed on the total net gifts during the year.

Donation made to a stranger is subject to 30% of the net gift. A stranger is a person who is not a: brother, sister (whether by whole or half blood), spouse, ancestor and lineal descendants; or

. relative by consanguinity in the collateral line within the fourth degree of relationship (up to first cousin).

Description Donors Tax is a tax on a donation or gift, and is imposed on the gratuitous transfer of property between two or more persons who are living at the time of the transfer. It shall apply whether the transfer is in trust or otherwise, whether the gift is direct or indirect and whether the property is real or personal, tangible or intangible. Tax Form BIR Form 1800 Donors Tax Return Documentary Requirements The following requirements must be submitted upon field or office audit of the tax case before the Tax Clearance Certificate/Certificate Authorizing Registration can be released: 1. 2. 3. 4. 5. 6. 7. Deed of Donation Sworn Statement of the relationship of the donor to the donee Proof of tax credit, if applicable Certified true copy(ies) of the Original/Transfer/Condominium Certificate of Title (front and back ) of lot and/or improvement donated, if applicable Certified true copy(ies) of the latest Tax Declaration (front and back pages) of lot and/or improvement, if applicable Certificate of No Improvement issued by the Assessors office where the properties have no declared improvement, if applicable Proof of valuation of shares of stocks at the time of donation, if applicable 8. 9. 10. For listed stocks - newspaper clippings or certification issued by the Stock Exchange as to the par value per share For unlisted stocks - latest audited Financial Statements of the issuing corporation with computation of the book value per share

Proof of valuation of other types of personal properties, if applicable Proof of claimed deductions, if applicable Copy of Tax Debit Memo used as payment, if applicable

Additional requirements may be requested for presentation during audit of the tax case depending upon existing audit procedures. Procedures File the return in triplicate (two copies for the BIR and one copy for the taxpayer) with any Authorized Agent Bank (AAB) of the RDO having jurisdiction over the place of the domicile of the donor at the time of the transfer. In places where there are no AAB, the return will be filed directly with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer where the donor was domiciled at the time of the transfer, or if there is no legal residence in the Philippines, with Revenue District No. 39 - South Quezon City. In the case of gifts made by a non-resident alien, the return may be filed with Revenue District No. 39 South Quezon City, or with the Philippine Embassy or Consulate in the country where donor is domiciled at the time of the transfer. Submit all documentary requirements and proof of payment to the Revenue District Office having jurisdiction over the place of residence of the donor. Deadlines

Within thirty days (30) after the date the gift (donation) is made. A separate return will be filed for each gift (donation) made on the different dates during the year reflecting therein any previous net gifts made during the same calendar year. If the gift (donation) involves conjugal/community/property, each spouse will file separate returns corresponding to his/ her respective share in the conjugal/community property. This rule will also apply in the case of co-ownership over the property. Related Revenue Issuances RR No. 2-2003 and RMO No. 1-98 Codal Reference Sec. 98 to Sec. 104 of the National Internal Revenue Code Frequently Asked Questions 1. Who are required to file the Donors Tax Return? Every person, whether natural or juridical, resident or non-resident, who transfers or causes to transfer property by gift, whether in trust or otherwise, whether the gift is direct or indirect and whether the property is real or personal, tangible or intangible. 2. What are the procedures in filing the Donors Tax return? File the return in triplicate (two copies for the BIR and one copy for the taxpayer) with any Authorized Agent Bank (AAB) of the RDO having jurisdiction over the place of the domicile of the donor at the time of the transfer. In places where there are no AAB, the return will be filed directly with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer where the donor was domiciled at the time of the transfer, or if there is no legal residence in the Philippines, with Revenue District No. 39 - South Quezon City. In the case of gifts made by a non-resident alien, the return may be filed with Revenue District No. 39 South Quezon City, or with the Philippine Embassy or Consulate in the country where donor is domiciled at the time of the transfer. Submit all documentary requirements and proof of payment to the Revenue District Office having jurisdiction over the place of residence of the donor. 3. What donations are tax exempt? Dowries or donations made on account of marriage before its celebration or within one year thereafter, by parents to each of their legitimate, recognized natural, or adopted children to the extent of the first P10,000 Gifts made to or for the use of the National Government or any entity created by any of its agencies which is not conducted for profit, or to any political subdivision of the said Government Gifts in favor of an educational and/or charitable, religious, cultural or social welfare corporation, institution, accredited non-government organization, trust or philantrophic organization or research institution or organization, provided not more than 30% of said gifts will be used by such donee for administration purposes Encumbrances on the property donated if assumed by the donee in the deed of donation Donations made to the following entities as exempted under special laws: Aquaculture Department of the Southeast Asian Fisheries Development Center of the Philippines Development Academy of the Philippines

Integrated Bar of the Philippines International Rice Research Institute National Social Action Council Ramon Magsaysay Foundation Philippine Inventors Commission Philippine American Cultural Foundation Task Force on Human Settlement on the donation of equipment, materials and services

4. What are the bases in the valuation of property? If the gift is made in property, the fair market value at that time will be considered the amount of gift In case of real property, the taxable base is the fair market value as determined by the Commissioner of Internal Revenue (Zonal Value) or fair market value as shown in the latest schedule of values of the provincial and city assessor (MV per Tax Declaration), whichever is higher If there is no zonal value, the taxable base is the fair market value that appears in the latest tax declaration If there is an improvement, the value of improvement is the construction cost per building permit and or occupancy permit plus 10% per year after year of construction, or the market value per latest tax declaration.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Civil Action Prior To The Criminal Action.: Ne W RuleDocument3 pagesCivil Action Prior To The Criminal Action.: Ne W RuletmaderazoNo ratings yet

- Kelan Mag Ka Order For Distribution of ResidueDocument2 pagesKelan Mag Ka Order For Distribution of ResiduetmaderazoNo ratings yet

- PP Vs Uyboco. Crim ProDocument33 pagesPP Vs Uyboco. Crim ProtmaderazoNo ratings yet

- Samplex Admin Law. TimDocument21 pagesSamplex Admin Law. TimtmaderazoNo ratings yet

- PP Vs Udtojan. Crim ProDocument2 pagesPP Vs Udtojan. Crim ProtmaderazoNo ratings yet

- Demurrer To Evidence, Does It Apply To Guardianship?Document2 pagesDemurrer To Evidence, Does It Apply To Guardianship?tmaderazoNo ratings yet

- Republic vs. City of ParanaqueDocument13 pagesRepublic vs. City of ParanaquejhonadheljacabanNo ratings yet

- Judge Cornejo 2 NotesDocument9 pagesJudge Cornejo 2 NotestmaderazoNo ratings yet

- Necesito V Paras, 104 Phil 75 (1958)Document6 pagesNecesito V Paras, 104 Phil 75 (1958)karl_baqNo ratings yet

- F H Stevens Vs NordeutscherDocument3 pagesF H Stevens Vs NordeutschertmaderazoNo ratings yet

- Succession Notes 2. AlbanoDocument4 pagesSuccession Notes 2. AlbanotmaderazoNo ratings yet

- Manila Steamship Vs AbdulhamanDocument5 pagesManila Steamship Vs AbdulhamantmaderazoNo ratings yet

- Q and A Remedial Law Crim Pro 25 JuneDocument1 pageQ and A Remedial Law Crim Pro 25 JunetmaderazoNo ratings yet

- Twa Vs CaDocument5 pagesTwa Vs CatmaderazoNo ratings yet

- Up Agency Partnership and Trust Syllabus 2012Document3 pagesUp Agency Partnership and Trust Syllabus 2012tmaderazo100% (1)

- Alitalia Airways Vs IacDocument8 pagesAlitalia Airways Vs IactmaderazoNo ratings yet

- Pan Am Vs IacDocument26 pagesPan Am Vs IactmaderazoNo ratings yet

- Ang Vs American Steamship Agencies, 19 Scra 631Document3 pagesAng Vs American Steamship Agencies, 19 Scra 631Dennis YuNo ratings yet

- Notes in Riano. Civil ProcedureDocument14 pagesNotes in Riano. Civil ProceduretmaderazoNo ratings yet

- Luna Vs CaDocument7 pagesLuna Vs CatmaderazoNo ratings yet

- Tan Vs NorthwestDocument3 pagesTan Vs NorthwesttmaderazoNo ratings yet

- LTD SyllabusDocument5 pagesLTD SyllabustmaderazoNo ratings yet

- Republic of The Philippines Manila en Banc: Supreme CourtDocument11 pagesRepublic of The Philippines Manila en Banc: Supreme Courtlen_dy010487No ratings yet

- Per Shing Queto Vs CA. Oral DonationDocument2 pagesPer Shing Queto Vs CA. Oral DonationtmaderazoNo ratings yet

- Nothing Follows 2Document2 pagesNothing Follows 2tmaderazoNo ratings yet

- BPLAC KYC CDD Frequently Asked Questions PDFDocument3 pagesBPLAC KYC CDD Frequently Asked Questions PDFtmaderazoNo ratings yet

- Credit. 28 Jan 2015Document3 pagesCredit. 28 Jan 2015tmaderazoNo ratings yet

- Samplex Admin Law. TimDocument21 pagesSamplex Admin Law. TimtmaderazoNo ratings yet

- Nothing FollowsDocument5 pagesNothing FollowstmaderazoNo ratings yet

- Odyssey Guidelines PDFDocument12 pagesOdyssey Guidelines PDFtmaderazoNo ratings yet

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation TemplatePaola Morales100% (1)

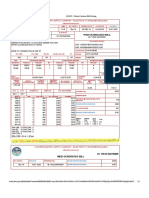

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- PMF 2017 02 MadzivanyikaDocument12 pagesPMF 2017 02 MadzivanyikaTatenda MakurumidzeNo ratings yet

- CIR V General FoodsDocument2 pagesCIR V General FoodsNelsonPolinarLaurdenNo ratings yet

- EconomicsDocument32 pagesEconomicsSahil BansalNo ratings yet

- LESCO - Online Customer Bill Printing PDFDocument1 pageLESCO - Online Customer Bill Printing PDFGulshion Malik100% (1)

- TAXATION LAW Survival Kit by 4CDocument75 pagesTAXATION LAW Survival Kit by 4CMara Corteza San Pedro100% (2)

- Invoices 22feb2022Document21 pagesInvoices 22feb2022Merliza JusayanNo ratings yet

- Tax Issues in Demarger & AmalgamationDocument25 pagesTax Issues in Demarger & AmalgamationMohit MishuNo ratings yet

- 002 EntrepDocument2 pages002 EntrepKristine RodriguezNo ratings yet

- Od 329974507178165100Document1 pageOd 329974507178165100aadarshishita2407No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument4 pagesCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingYudia0% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ananya singhNo ratings yet

- Universityof Lucknow Faculty of Law: SESSION 2020-21 Assignment of Taxation Law Topic-Gst CouncilDocument6 pagesUniversityof Lucknow Faculty of Law: SESSION 2020-21 Assignment of Taxation Law Topic-Gst CouncilGoldi SinghNo ratings yet

- Cash Flow ProjectionsDocument36 pagesCash Flow ProjectionsJoy FaruzNo ratings yet

- Swiggy BillDocument1 pageSwiggy BillAnil PallikondaNo ratings yet

- Current Transformer, Potential Transformer, CTS, PTS, Resin Cast CT, Resin Cast PT, Metering Panel, SMC Box, Deep Drawn Box, LT Distribution Box, Structures, Metering UnitDocument2 pagesCurrent Transformer, Potential Transformer, CTS, PTS, Resin Cast CT, Resin Cast PT, Metering Panel, SMC Box, Deep Drawn Box, LT Distribution Box, Structures, Metering UnitSharafatNo ratings yet

- Invoice Number: (73931) : Bill To: Bill FromDocument1 pageInvoice Number: (73931) : Bill To: Bill FromSohiniNo ratings yet

- Corporate Taxes - Life Skills 2016 1Document16 pagesCorporate Taxes - Life Skills 2016 1api-337655281No ratings yet

- Solved Peter Jones Has Owned All 100 Shares of Trenton CorporationDocument1 pageSolved Peter Jones Has Owned All 100 Shares of Trenton CorporationAnbu jaromia0% (1)

- Tax - Income Tax Individuals (Easy)Document28 pagesTax - Income Tax Individuals (Easy)Kristine Lirose BordeosNo ratings yet

- InvoiceDocument1 pageInvoiceGanesh EnterprisesNo ratings yet

- Life Always Begins With One Step Outside of Your Comfort Zone.Document21 pagesLife Always Begins With One Step Outside of Your Comfort Zone.Czarina PanganibanNo ratings yet

- Hundaol ProposalDocument22 pagesHundaol ProposalletahundaolkasaNo ratings yet

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Form App Clearance OutwardDocument1 pageForm App Clearance OutwardNuwani PreethikaNo ratings yet

- 12 V671 - Cadila Pharmaceutic Aar-Bn-511381 GSTDocument12 pages12 V671 - Cadila Pharmaceutic Aar-Bn-511381 GSTVivek SharmaNo ratings yet

- Taxation - Concept MapDocument15 pagesTaxation - Concept MapRena Rose MalunesNo ratings yet

- eFPS Home - Efiling and Payment System AprilDocument2 pageseFPS Home - Efiling and Payment System AprilRenalynNo ratings yet

- 2.6 Commissioner V PhilAmLifeDocument5 pages2.6 Commissioner V PhilAmLifeJayNo ratings yet