Professional Documents

Culture Documents

Whitehall: Monitoring The Markets Vol. 3 Iss. 22 (June 11, 2013)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitehall: Monitoring The Markets Vol. 3 Iss. 22 (June 11, 2013)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

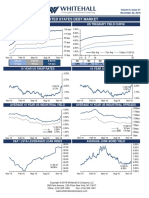

Volume 3, Issue 22 June 11, 2013

Whitehall

UNITED STATES DEBT MARKET

US Libor

6 mth 3 mth 1 mth 90 bps 80 bps 70 bps 60 bps 50 bps 40 bps 30 bps 20 bps 10 bps 0 bps 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% I I 30yr Avg 15yr Avg Today (6/11/13)

US Treasury Yield Curve

23

Libor 06/11/13 1 month 19 bps 3 month 27 bps 6 month 41 bps

I 5

I 7

I 10

2yr 3yr 5yr 7yr

I 30

UST 06/11/13

10yr

30yr

0.32% 0.58% 1.11% 1.55% 2.20% 3.36%

10 Year US Swap Rates

6/11/13 2.40% 2.50%

10 Year US Treasury

6/11/13 2.20% 2.50%

2.00%

2.00%

1.50%

1.50%

1.00%

1.00%

Average 10 Year US Industrial Yield

4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00%

Average 10 Year US Industrial Spreads

225 bps 200 bps 175 bps 150 bps 125 bps 100 bps 75 bps 50 bps 25 bps 0 bps

6/11/13 3.13% A BBB 3.89%

6/11/13 A 95 bps BBB 172 bps

S&P/LSTA Leveraged Loan Index

6/11/13 97.90% 99.00 98.00 97.00 96.00 95.00 94.00 93.00 92.00 91.00 90.00

Average Junk-Bond Yield

6/11/13 6.11 % 8.75% 8.25% 7.75% 7.25% 6.75% 6.25% 5.75% 5.25% 4.75%

Source: Bloomberg This market letter is not to be construed as a recommendation to buy, hold or sell any particular security. Copyright 2013 Whitehall & Company, LLC 7 Times Square, 46th Floor, New York, NY 10036 Office: (212) 205-1380 Fax: (212) 205-1381 www.whitehallandcompany.com

Volume 3, Issue 22 June 11, 2013

Whitehall

SELECT US PRIVATE PLACEMENTS

Type $mm

$50 $549 $160 $195

Date

6/7 6/7 6/7 6/7

Issuer

Years Spread

10 10 26/17avg 10 17.1/9.8avg 250bps 213bps N/A 190bps 200bps

Coupon

N/A N/A 5.00% 4.01% N/A

Rating

2 2 2 2

Sector

Industrial Consumer, Cyclical Industrial Energy

Country

Australia USA Denmark Denmark

Australian Capital Equity Snr Sec Pty Ltd The San Francisco Snr Sec 49er's Stadium Copenhagen Airport Snr Notes Meridian Spirit Snr Sec

Public and private market information is from sources that are deemed reliable, but information has not been confirmed.

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date

6/4

Issuer

Baxter International Inc

Type

Snr Notes

$mm

$3,500

Years Spread

1 3 5 10 30 5 7 10 30 10 10 FRN 50bps 80bps 110bps 122bps 85bps 115bps 125bps 140bps 150bps 85bps

Coupon

L+17bps 0.95% 1.85% 3.20% 4.50% 1.88% 2.65% 3.38% 4.65%

Rating

A3/A

Sector

Consumer, NonCyclical

Country

USA

6/3

EMC Corp

Snr Notes

$5,500

A1/A

Industrial

USA

6/3 6/3 6/3

Indianapolis Power & Light Co NextEra Energy Capital Holding Inc PacifiCorp

Snr Notes Snr Notes Snr Sec

$170 $250 $300

A3/BBB+

Utilities Utilities Utilities

USA USA USA

3.63% Baa1/BBB+ 2.95% A2/A

Source: Bloomberg

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date

6/7 6/7 6/6

Issuer

Jack Cooper Holdings Corp InterGen NV Approach Resources Inc

Type

Snr Sec Snr Sec Snr Notes

$mm

$225 $925 $250

Years Spread

7 8 10 8 768bps 516bps 611bps 532bps

Coupon

9.25% 7.00% 7.50% 7.00%

Rating

B2/BB1/B+ B3/B-

Sector

Industrial Utilities Energy

Country

USA USA USA

Source: Bloomberg

SELECT CLOSED SYNDICATED LOANS

Date

6/7 6/5 6/3 6/3

Issuer

US Foods Inc NRG Energy Inc Hecla Mining Co Catamaran Corp

Type

Term Term Term Revolver Term Term

$mm

$2,100 $450 $1572 $200 $200 $1,000

Months

58 60 60 36 36 60

Spread

L+350bps L+200bps L+200bps L+300bps L+300bps L+163bps

Rating

B BBB BB

Sector

Consumer, Non-Cyclical Utilities Basic Materials Consumer, Non-Cyclical

Source: Bloomberg

CONTACT WHITEHALL

Jonathan Cody Managing Director (646) 450-9750 jp.cody@ whitehallandcompany.com Timothy Page Managing Director (212) 205-1399 timothy.page@ whitehallandcompany.com Roland DaCosta Managing Director (212) 205-1394 roland.dacosta@ whitehallandcompany.com Oliver Langel Managing Director (212) 205-1386 oliver.langel@ whitehallandcompany.com Vincas Snipas Managing Director (212) 205-1385 vincas.snipas@ whitehallandcompany.com Susan Vick Managing Director (212) 205-1398 susan.vick@ whitehallandcompany.com Brian Burchfield Director (212) 205-1395 brian.burchfield@ whitehallandcompany.com

Natalia Kotlyarchuk Vice President (212) 205-1396 natalia.kotlyarchuk@ whitehallandcompany.com

Nicholas Page Associate (212) 205-1389 nicholas.page@ whitehallandcompany.com

Gabrielle Sullivan Analyst (212) 205-1383 gabrielle.sullivan@ whitehallandcompany.com

Blaine Burke Analyst (212) 205-1382 blaine.burke@ whitehallandcompany.com

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security. Copyright 2013 Whitehall & Company, LLC 7 Times Square, 46th Floor, New York, NY 10036 Office: (212) 205-1380 Fax: (212) 205-1381 www.whitehallandcompany.com

You might also like

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)Whitehall & CompanyNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 23 (June 18, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 23 (June 18, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 27 (July 23, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 27 (July 23, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 46 (December 10, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 46 (December 10, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Whitehall & CompanyNo ratings yet

- 2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Document2 pages2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 34 (September 17, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 34 (September 17, 2013)Whitehall & CompanyNo ratings yet

- 2.47 Whitehall: Monitoring The Markets Vol. 2 Iss. 47 (November 20, 2012)Document2 pages2.47 Whitehall: Monitoring The Markets Vol. 2 Iss. 47 (November 20, 2012)Whitehall & CompanyNo ratings yet

- 2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Document2 pages2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 20 (May 29, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 20 (May 29, 2013)Whitehall & CompanyNo ratings yet

- 2.42 Whitehall: Monitoring The Markets Vol. 2 Iss. 42 (October 16, 2012)Document2 pages2.42 Whitehall: Monitoring The Markets Vol. 2 Iss. 42 (October 16, 2012)Whitehall & CompanyNo ratings yet

- 2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Document2 pages2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 45 (December 3, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 45 (December 3, 2013)Whitehall & CompanyNo ratings yet

- 2.46 Whitehall: Monitoring The Markets Vol. 2 Iss. 46 (November 13, 2012)Document2 pages2.46 Whitehall: Monitoring The Markets Vol. 2 Iss. 46 (November 13, 2012)Whitehall & CompanyNo ratings yet

- 2.24 Whitehall: Monitoring The Markets Vol. 2 Iss. 24 (June 12, 2012)Document2 pages2.24 Whitehall: Monitoring The Markets Vol. 2 Iss. 24 (June 12, 2012)Whitehall & CompanyNo ratings yet

- 2.26 Whitehall: Monitoring The Markets Vol. 2 Iss. 26 (June 26, 2012)Document2 pages2.26 Whitehall: Monitoring The Markets Vol. 2 Iss. 26 (June 26, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 13 (April 8, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 13 (April 8, 2013)Whitehall & CompanyNo ratings yet

- 2.22 Whitehall: Monitoring The Markets Vol. 2 Iss. 22 (May 30, 2012)Document2 pages2.22 Whitehall: Monitoring The Markets Vol. 2 Iss. 22 (May 30, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 31 (August 20, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 31 (August 20, 2013)Whitehall & CompanyNo ratings yet

- 2.40 Whitehall: Monitoring The Markets Vol. 2 Iss. 40 (October 2, 2012)Document2 pages2.40 Whitehall: Monitoring The Markets Vol. 2 Iss. 40 (October 2, 2012)Whitehall & Company0% (1)

- MTM 239 2012-09-25Document2 pagesMTM 239 2012-09-25whitehall4883No ratings yet

- 2.45 Whitehall: Monitoring The Markets Vol. 2 Iss. 45 (November 6, 2012)Document2 pages2.45 Whitehall: Monitoring The Markets Vol. 2 Iss. 45 (November 6, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Whitehall & CompanyNo ratings yet

- 2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Document2 pages2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 26 (July 22, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 26 (July 22, 2015)Whitehall & CompanyNo ratings yet

- 2.41 Whitehall: Monitoring The Markets Vol. 2 Iss. 41 (October 9, 2012)Document2 pages2.41 Whitehall: Monitoring The Markets Vol. 2 Iss. 41 (October 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 26 (June 29, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 26 (June 29, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 17 (May 13, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 17 (May 13, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 40 (November 4, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 40 (November 4, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 49 (December 31, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 49 (December 31, 2013)Whitehall & CompanyNo ratings yet

- 2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Document2 pages2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 46 (December 8, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Whitehall & CompanyNo ratings yet

- 2.35 Whitehall: Monitoring The Markets Vol. 2 Iss. 35 (August 28, 2012)Document2 pages2.35 Whitehall: Monitoring The Markets Vol. 2 Iss. 35 (August 28, 2012)Whitehall & CompanyNo ratings yet

- 617 2016-04-29 PDFDocument2 pages617 2016-04-29 PDFWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 25 (June, 21 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 25 (June, 21 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 42 (November 10, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 3 (January 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 3 (January 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 30 (August 18, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 47 (November 22, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 47 (November 22, 2016)Whitehall & CompanyNo ratings yet

- 1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Document2 pages1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- MCQDocument6 pagesMCQkris mNo ratings yet

- Gateway Vs AppleDocument2 pagesGateway Vs Applesummiyailtaf100% (1)

- ANA Shopper Marketing PlaybookDocument28 pagesANA Shopper Marketing PlaybookDemand Metric100% (1)

- Midterm Exam in Capital Market 1Document4 pagesMidterm Exam in Capital Market 1Joel PangisbanNo ratings yet

- Intro To DerivativesDocument11 pagesIntro To DerivativescollegetradingexchangeNo ratings yet

- Additional Exercises Lecture 4 Consumer BehaviourDocument5 pagesAdditional Exercises Lecture 4 Consumer BehaviourAmgad ElshamyNo ratings yet

- Micro Economics & Macro EconomicsDocument79 pagesMicro Economics & Macro EconomicsKunnal NandaNo ratings yet

- Chapter I Pr2 Final FinalDocument10 pagesChapter I Pr2 Final FinalRem GNo ratings yet

- Chobani PPTDocument30 pagesChobani PPTtrangiabaoNo ratings yet

- Retail Management Module 1 Chapter 1Document24 pagesRetail Management Module 1 Chapter 1KhrisTinay Dee ELNo ratings yet

- Supply ChainDocument8 pagesSupply ChainashokNo ratings yet

- ADL 55 - Management of Financial Services Study MaterialDocument218 pagesADL 55 - Management of Financial Services Study MaterialSnehasis PanditNo ratings yet

- The Combined Cost Leadership and Differentiation Generic Strategies Boost Nike's Performance in The Global IndustryDocument6 pagesThe Combined Cost Leadership and Differentiation Generic Strategies Boost Nike's Performance in The Global IndustryTahira FarooqNo ratings yet

- Bba Project For MarketingDocument12 pagesBba Project For MarketingKannanEceNo ratings yet

- IMC AssignmentDocument7 pagesIMC AssignmentAmardeep RajNo ratings yet

- Pricing Strategies For Firms With Market PowerDocument33 pagesPricing Strategies For Firms With Market PowerIkrame KiyadiNo ratings yet

- Lampiran M - Booklet Applied ScienceDocument17 pagesLampiran M - Booklet Applied ScienceSarah Sabreina ZamriNo ratings yet

- Smelser Neil J., Swedberg Richard. - The Sociological Perspective On The EconomyDocument18 pagesSmelser Neil J., Swedberg Richard. - The Sociological Perspective On The EconomySociedade Sem HinoNo ratings yet

- The Principles of Marketing Week 1Document16 pagesThe Principles of Marketing Week 1Juliana Chancafe IncioNo ratings yet

- PT Pertamina Lubricant Oil: Local Market StrategyDocument14 pagesPT Pertamina Lubricant Oil: Local Market Strategywendy priana negaraNo ratings yet

- Tutorial 1 - Answers: Problem 1Document10 pagesTutorial 1 - Answers: Problem 1Phươnganh NguyễnNo ratings yet

- Supply Chain of Agora BangladeshDocument12 pagesSupply Chain of Agora BangladeshSAHR SAIFNo ratings yet

- AaliShafi AAJ TVDocument1 pageAaliShafi AAJ TVAali ShafiNo ratings yet

- Fashion CycleDocument26 pagesFashion CycleAjinder Deol100% (1)

- Eur Usd Golden Strategy 1 1Document7 pagesEur Usd Golden Strategy 1 1eslamabomostafa82No ratings yet

- POM Project ReportDocument6 pagesPOM Project ReportNida MajidNo ratings yet

- Essential Marketing Models: 24 16:9 Easy To EditDocument28 pagesEssential Marketing Models: 24 16:9 Easy To EditMaría Argomedo ReyesNo ratings yet

- Student Final Presentation TemplateDocument9 pagesStudent Final Presentation TemplateNitesh SoniNo ratings yet

- Template Simulasi Action PlanDocument18 pagesTemplate Simulasi Action PlanAinur RizkiNo ratings yet

- Credit Card Debt AssignmentDocument5 pagesCredit Card Debt Assignmentapi-581454156No ratings yet

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyFrom EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyRating: 5 out of 5 stars5/5 (2)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolFrom EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNo ratings yet

- Form Your Own Limited Liability Company: Create An LLC in Any StateFrom EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNo ratings yet

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersFrom EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNo ratings yet

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreFrom EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreRating: 3.5 out of 5 stars3.5/5 (2)

- Getting Permission: Using & Licensing Copyright-Protected Materials Online & OffFrom EverandGetting Permission: Using & Licensing Copyright-Protected Materials Online & OffRating: 4.5 out of 5 stars4.5/5 (20)

- The Trademark Guide: How You Can Protect and Profit from Trademarks (Third Edition)From EverandThe Trademark Guide: How You Can Protect and Profit from Trademarks (Third Edition)No ratings yet

- Flora and Vegetation of Bali Indonesia: An Illustrated Field GuideFrom EverandFlora and Vegetation of Bali Indonesia: An Illustrated Field GuideRating: 5 out of 5 stars5/5 (2)

- Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayFrom EverandSolve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayRating: 4 out of 5 stars4/5 (8)

- Commentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769From EverandCommentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Rating: 4 out of 5 stars4/5 (6)

- Legal Writing in Plain English, Third Edition: A Text with ExercisesFrom EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNo ratings yet

- Torts: QuickStudy Laminated Reference GuideFrom EverandTorts: QuickStudy Laminated Reference GuideRating: 5 out of 5 stars5/5 (1)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- He Had It Coming: How to Outsmart Your Husband and Win Your DivorceFrom EverandHe Had It Coming: How to Outsmart Your Husband and Win Your DivorceNo ratings yet