Professional Documents

Culture Documents

SP Saratoga Springs NY Report

Uploaded by

lmccarty2656Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SP Saratoga Springs NY Report

Uploaded by

lmccarty2656Copyright:

Available Formats

Summary:

Saratoga Springs, New York; General Obligation

Primary Credit Analyst: Timothy J Daley, Boston 617-530-8121; timothy.daley@standardandpoors.com Secondary Contact: Linda Yip, New York 212-438-2036; linda.yip@standardandpoors.com

Table Of Contents

Rationale Outlook Related Criteria And Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JUNE 5, 2013 1

1141432 | 301668693

Summary:

Saratoga Springs, New York; General Obligation

Credit Profile

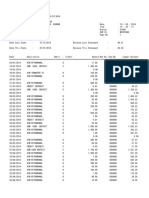

US$4.278 mil GO pub imp (serial) bnds ser 2013 dtd 06/15/2013 due 06/15/2033 Long Term Rating Saratoga Springs GO Long Term Rating AA+/Stable Affirmed AA+/Stable New

Rationale

Standard & Poor's Ratings Services assigned its 'AA+' rating and stable outlook to Saratoga Springs, N.Y.'s series 2013 general obligation (GO) bonds. In addition, Standard & Poor's affirmed its 'AA+' rating on the city's GO bonds outstanding. The outlook is stable. The rating reflects our view of Saratoga Springs': Participation in the diverse regional employment base of the Albany-Schenectady-Troy metropolitan statistical area; Strong wealth and income; Healthy operations that have contributed to what we consider strong finances; and Low debt, with limited capital and debt needs.

The city's full faith and credit pledge secures the bonds. We understand that officials intend to use bond proceeds to fund various capital projects. Saratoga Springs, with a 2012 population estimate of 26,761, is in eastern upstate New York State in Saratoga County, approximately 30 miles north of Albany. The city is a commercial and industrial center for the surrounding areas; however, it is best known for the Saratoga Race Track and its performing arts center, as well as Skidmore College, which is one of the city's leading local employers. We continue to view the economy as a key determinant of credit quality across the U.S. public finance sector in 2013 and 2014. Management indicates Saratoga Springs has benefited economically from continued development at the Luther Forest Technology Campus, a 1,414-acre technology park designed for nanotechnology manufacturing and research and development. GLOBALFOUNDRIES Inc., the anchor tenant, has completed its chip fabrication plant, which began construction in 2009. At full build-out, the company expects to generate about 1,600 new jobs for the area. In addition, the Saratoga Casino and Raceway recently announced it will invest $30 million and build a 120-room hotel in Saratoga Springs in a bid to become a full-scale casino. The management team expects to hire 260 workers, increasing total employment at the Racino to 900 workers. Construction is expected to commence in 2014 with the expansion opening in 2015. According to management, Saratoga Springs expects to continue to see steady commercial and residential development in the near term. In addition to local employment, residents find other employment opportunities in Albany, Troy, and Schenectady.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JUNE 5, 2013 2

1141432 | 301668693

Summary: Saratoga Springs, New York; General Obligation

The city's strong economy and participation in nearby Albany's government sector has provided it with favorable economic trends and indicators. We expect professional and business services to contribute to employment growth in the region. Unemployment, at 6.3% as of March 2013, continues to decline below state (8.3%) and national rates (7.6%). Median household effective buying income is what we consider a strong 124% of the national level. Regional home price declines were fairly modest relative to other parts of the country, and there are signs the real estate market is improving. As a result, our current forecast reflects a modest rise in home prices and a jump in housing starts in 2013, with the housing recovery gaining steam in 2014. The city's median home price in 2012 was 60% higher than the national average. Assessed value (AV) has increased less than 1% annually, on average, in the past four fiscal years to $3.1 billion in fiscal 2013. Full valuation is $3.7 billion, or $139,700 per capita, a level we consider extremely strong. Management expects the modest trend of AV growth to continue in the near term. Little taxpayer base concentration exists with the 10 leading taxpayers accounting for what we consider a very diverse 7.9% of AV. Saratoga Springs has consistently maintained what we regard as, strong finances in the past three fiscal years. Unaudited fiscal 2012 figures, ended Dec. 31, 2012, indicate a $1.8 million (5% of budget) operating surplus. Management attributes the positive operating performance to steady growth in revenues relative to budget, as well as the city taking over ambulance services from a private provider. As a result, the year closed with a general fund balance of $12.7 million. Management considers $8.3 million (assigned and unassigned), or what we view as a very strong 22.8% of budgeted expenditures, to be available; this is in accordance with the city's reserve policy. Liquidity was also good, in our opinion, with cash and equivalents of $5.3 million, or about 53 days' operating liquidity. The city's fiscal 2013 adopted budget totals $39.1 million, a 5.6% increase over the adopted 2012 budget. The 2013 city tax rate remained flat and the tax levy decreased about 5.2%. Consequently, management can carry over 1.5% of the unused levy to fiscal 2014, providing additional flexibility in the next budget year if needed. Management indicates that there have been no major variances to the budget to date. Property taxes are Saratoga Spring's leading revenue source, accounting for 44% of general fund revenue in fiscal 2013, followed by another 32% from nonproperty taxes. In addition, six of the city's seven union contracts remain unsettled; in our view, this could put some downward pressure on Saratoga Springs' finances in the next few years. Management, however, indicates it has built contingencies into the budget to cover the likely negotiated outcomes. Standard & Poor's still considers its assessment of Saratoga Spring's financial management practices "good" under its Financial Management Assessment (FMA). An FMA of good indicates financial practices exist in most areas but that governance officials might not formalize or regularly monitor all of them. The city implemented and formalized a reserve and liquidity policy, as well as a debt management policy in fiscal 2011. Its reserve policy requires the city to maintain an unassigned general fund balance between 10.0% and 12.5% of the budget. With city council approval, management can use amounts in excess of the 12.5% to fund one-time expenses. If the balance declines below 10%, management will prepare and submit a plan to the council to restore the fund balance back to the minimum target by either the next budget year or another appropriate period. The city's debt policy adheres to state statutes, and the city council will review the policy annually. Saratoga Springs continues to project major costs and revenue well in advance of its budget formulation, and it monitors budget variances monthly with the council. Investment management follows state guidelines.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JUNE 5, 2013 3

1141432 | 301668693

Summary: Saratoga Springs, New York; General Obligation

After this issue, the city will have overall net debt, including overlapping entities, of $59.6 million. In our opinion, overall debt is a moderate $2,229 per capita, or a low 1.6% of market value. Debt service carrying charges remained a low, in our view, 7.9% of expenditures in fiscal 2011. We consider debt amortization slower than average with officials planning to retire 41% of principal over 10 years and 83% in 20 years. The city's future debt plans are guided by management's five-year capital improvement plan, which has about $20 million in future projects. Saratoga Springs participates in the state's pension systems and provides other postemployment benefits (OPEB) through a single-employer, defined-benefit health care plan. The city has consistently funded 100% of its pension contributions over the past three fiscal years. Contributions were $4.7 million, or 12.7% of general fund expenditures, in 2012. It continues to fund OPEB contributions through pay-as-you-go financing, which was $2.2 million, or about 27.8% of the annual OPEB cost, in fiscal 2012. As of Dec. 31, 2012, the OPEB unfunded actuarial accrued liability (UAAL) was $122.8 million. When this UAAL is added to the city's debt, overall net debt increases to what we view as a high $6,819 per capita, or a moderate 4.8% of market value.

Outlook

The stable outlook reflects what Standard & Poor's considers Saratoga Springs' strong finances and access to a stable and diverse regional economy. We believe management will continue to make the necessary budget adjustments to maintain balanced operations, as well as continue to adhere to its reserve and debt management policies. However, if reserves deteriorate materially due to ongoing labor negotiations or (while unlikely) the city's pension and OPEB costs increase, we could lower the rating.

Related Criteria And Research

U.S. State And Local Government Credit Conditions Forecast, April 4, 2013 USPF Criteria: Key General Obligation Ratio Credit Ranges Analysis Vs. Reality, April 2, 2008 USPF Criteria: GO Debt, Oct. 12, 2006 USPF Criteria: Financial Management Assessment, June 27, 2006

Complete ratings information is available to subscribers of RatingsDirect at www.globalcreditportal.com. All ratings affected by this rating action can be found on Standard & Poor's public Web site at www.standardandpoors.com. Use the Ratings search box located in the left column.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JUNE 5, 2013 4

1141432 | 301668693

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JUNE 5, 2013 5

1141432 | 301668693

You might also like

- UPDATE Foot Pursuit Aug 31Document3 pagesUPDATE Foot Pursuit Aug 31Dennis YuskoNo ratings yet

- NYCLU Letter To Saratoga Springs City CouncilDocument1 pageNYCLU Letter To Saratoga Springs City Councillmccarty2656No ratings yet

- Surveillance Camera ReportDocument51 pagesSurveillance Camera Reportlmccarty2656100% (2)

- Saratoga Springs City Employee SalariesDocument1 pageSaratoga Springs City Employee Salarieslmccarty2656No ratings yet

- The 2006 Comprehensive Plan UpdateDocument82 pagesThe 2006 Comprehensive Plan Updatelmccarty2656No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Delta PresentationDocument36 pagesDelta Presentationarch_ianNo ratings yet

- Prevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaDocument10 pagesPrevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaNo ratings yet

- Pro Tools ShortcutsDocument5 pagesPro Tools ShortcutsSteveJones100% (1)

- Manuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Document46 pagesManuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Franzis Jayke BatallantesNo ratings yet

- Tracker Pro Otm600 1.5Document19 pagesTracker Pro Otm600 1.5Camilo Restrepo CroNo ratings yet

- Communication On The Telephone InfoDocument30 pagesCommunication On The Telephone Infomelese100% (1)

- Power For All - Myth or RealityDocument11 pagesPower For All - Myth or RealityAshutosh BhaktaNo ratings yet

- Drill String DesignDocument118 pagesDrill String DesignMohamed Ahmed AlyNo ratings yet

- Descriptive Statistics - SPSS Annotated OutputDocument13 pagesDescriptive Statistics - SPSS Annotated OutputLAM NGUYEN VO PHINo ratings yet

- QCM Part 145 en Rev17 310818 PDFDocument164 pagesQCM Part 145 en Rev17 310818 PDFsotiris100% (1)

- E Nose IoTDocument8 pagesE Nose IoTarun rajaNo ratings yet

- Service Manual: Model: R410, RB410, RV410, RD410 SeriesDocument116 pagesService Manual: Model: R410, RB410, RV410, RD410 SeriesJorge Eustaquio da SilvaNo ratings yet

- Digital Documentation Class 10 NotesDocument8 pagesDigital Documentation Class 10 NotesRuby Khatoon86% (7)

- HandbookDocument194 pagesHandbookSofia AgonalNo ratings yet

- Rs 422Document1 pageRs 422rezakaihaniNo ratings yet

- CavinKare Karthika ShampooDocument2 pagesCavinKare Karthika Shampoo20BCO602 ABINAYA MNo ratings yet

- EASY DMS ConfigurationDocument6 pagesEASY DMS ConfigurationRahul KumarNo ratings yet

- Stock Prediction SynopsisDocument3 pagesStock Prediction SynopsisPiyushPurohitNo ratings yet

- Life Cycle Cost Analysis of Hvac System in Office ProjectsDocument3 pagesLife Cycle Cost Analysis of Hvac System in Office ProjectsVashuka GhritlahreNo ratings yet

- Amazon Case StudyDocument22 pagesAmazon Case StudySaad Memon50% (6)

- Entrep Q4 - Module 7Document5 pagesEntrep Q4 - Module 7Paula DT PelitoNo ratings yet

- Question Paper: Hygiene, Health and SafetyDocument2 pagesQuestion Paper: Hygiene, Health and Safetywf4sr4rNo ratings yet

- Marley Product Catalogue Brochure Grease TrapsDocument1 pageMarley Product Catalogue Brochure Grease TrapsKushalKallychurnNo ratings yet

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanDocument4 pagesLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarNo ratings yet

- Quantum Hopfield NetworksDocument83 pagesQuantum Hopfield NetworksSiddharth SharmaNo ratings yet

- Ssasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Document167 pagesSsasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Sunil Singh100% (1)

- Sciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithDocument10 pagesSciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithTushar singhNo ratings yet

- Service ManualDocument30 pagesService ManualYoni CativaNo ratings yet

- WHO Partograph Study Lancet 1994Document6 pagesWHO Partograph Study Lancet 1994Dewi PradnyaNo ratings yet