Professional Documents

Culture Documents

3017 Tutorial 3 Solutions

Uploaded by

Nguyễn HảiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3017 Tutorial 3 Solutions

Uploaded by

Nguyễn HảiCopyright:

Available Formats

FINC3017 Investments and Portfolio Management Tutorial 3 Optimal Portfolios

1.

Refer to the spreadsheet from Tutorial 1. Use the Solver optimisation tool in Excel to calculate the weights in the minimum-variance portfolio, for the three-security portfolio (excl the index). How does it compare to the equal-weighted portfolio from Tutorial 1?

2.

What are the minimum variance weightings for a two-asset portfolio where both assets have the same variance?

3.

In estimating the opportunity set, does the assumption that the expected returns, variances and covariances are known with certainty matter?

The expected returns may be estimated with error and the error may not be consistent across securities. For example the level of information varies across securities and so the precision of the estimates will also vary across securities. If estimates are prone to error the opportunity set may concentrate on those securities with greatest error rather than those companies which best meet the needs of the investor. This result is often termed error maximisation and can result in a portfolio that concentrates on a fairly small subset of the available securities. These are the securities with greatest expected returns and/or least variance and covariance effect, often the most likely to suffer from data entry errors and errors in analysis. The key point to note is the importance of accurate measures of expected return, variance and covariance and the possibility that a number of approximately optimal portfolios may exist in practice.

4.

The ABC company wants to invest in two risky assets over the next 12 months. Analysts predict that the expected return on asset A is 5% per annum and on asset B it is 7% per annum. The standard deviation of the returns for asset A is 8% and for asset B it is 9%. The correlation between the two assets in 0.4 and the risk-free rate is 5.5% per annum. What combination of the two assets will give returns that exceed the riskfree rate?

The question requires an estimate of the weights in the risky assets that produces a portfolio return that exceeds the return on the risk-free asset. We can solve as follows: wa E(Ra) + (1wa) E(Rb) > 5.5% wa 5 + (1wa)7 > 5.5% 5 wa + 7 7 wa > 5.5% 2 wa > 1.5 wa < 0.75 Therefore, all portfolios that have a weight of less than 75% in asset A will have a return that exceeds the risk-free rate. Note that the standard deviation and correlation do not affect the weights.

5.

The correlation coefficients between pairs of stocks are as follows: Corr(A,B) = 0.85, Corr(A,C) = 0.60, Corr(A,D) = 0.45. Each stock has an expected return of 8% and a standard deviation of 20%. If your entire portfolio is now composed of stock A and you can add some of only one stock to your portfolio, would you choose: a) B b) C c) D d) Need more data.

The correct choice is c. Intuitively, we note that since all stocks have the same expected rate of return and standard deviation, we choose the stock that will result in lowest risk. This is the stock that has the lowest correlation with Stock A. More formally, we note that when all stocks have the same expected rate of return, the optimal portfolio for any risk-averse investor is the global minimum variance portfolio (G). When the portfolio is restricted to Stock A and one additional stock, the objective is to find G for any pair that includes Stock A, and then select the combination with the lowest variance. With two stocks, I and J, the formula for the weights in G is:

w Min (I)

2 J Cov( rI , rJ ) 2 I 2 J 2Cov( rI , rJ )

w Min (J) 1 w Min (I)

Since all standard deviations are equal to 20%:

Cov(rI , rJ ) I J 400 and wMin ( I ) wMin ( J ) 0.5

This intuitive result is an implication of a property of any efficient frontier, namely, that the covariances of the global minimum variance portfolio with all other assets on the frontier are identical and equal to its own variance. (Otherwise, additional diversification would further reduce the variance.) In this case, the standard deviation of G(I, J) reduces to:

Min (G ) [200 (1 IJ )]1/ 2

This leads to the intuitive result that the desired addition would be the stock with the lowest correlation with Stock A, which is Stock D. The optimal portfolio is equally invested in Stock A

and Stock D, and the standard deviation is 17.03%.

You might also like

- MIM Corporate Finance BerlinDocument7 pagesMIM Corporate Finance Berlinismael.benamaraNo ratings yet

- Comsats Institute of Information Technology Islamabad: Page - 1Document12 pagesComsats Institute of Information Technology Islamabad: Page - 1Talha Abdul RaufNo ratings yet

- Portfolio Risk & ReturnDocument54 pagesPortfolio Risk & ReturnalibuxjatoiNo ratings yet

- CH 07Document33 pagesCH 07Nguyen Thanh Tung (K15 HL)No ratings yet

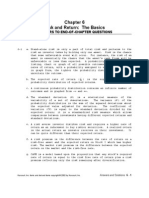

- Risk and Return: Before You Go On Questions and AnswersDocument33 pagesRisk and Return: Before You Go On Questions and AnswersAmandaNo ratings yet

- Theory of Finance AnswersDocument11 pagesTheory of Finance Answersroberto piccinottiNo ratings yet

- Solutions To Pq2Document4 pagesSolutions To Pq2amalNo ratings yet

- NPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudDocument8 pagesNPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudAnkit ChawlaNo ratings yet

- Assignment 2Document3 pagesAssignment 2François VoisardNo ratings yet

- 03.risk and Return IIIDocument6 pages03.risk and Return IIIMaithri Vidana KariyakaranageNo ratings yet

- An Introduction To Portfolio ManagementDocument32 pagesAn Introduction To Portfolio Managementch_arfan2002No ratings yet

- Ch06 Solations Brigham 10th EDocument32 pagesCh06 Solations Brigham 10th ERafay HussainNo ratings yet

- Chương 7 - QLDMĐTDocument8 pagesChương 7 - QLDMĐTNguyễn Thanh PhongNo ratings yet

- High Liquidity AssetsDocument7 pagesHigh Liquidity AssetsKrisshna Kumar ChandrasekaranNo ratings yet

- Integrated Case Merril Finch IncDocument10 pagesIntegrated Case Merril Finch IncEmman DtrtNo ratings yet

- BKM CH 07 Answers W CFADocument14 pagesBKM CH 07 Answers W CFAGhulam Hassan100% (5)

- Corporate Finance CHDocument26 pagesCorporate Finance CHSK (아얀)No ratings yet

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- 1.risk Return-Portfolio Theory 26-1-20Document23 pages1.risk Return-Portfolio Theory 26-1-20Aiman IqbalNo ratings yet

- 6 & 7Document13 pages6 & 7Awais ChNo ratings yet

- Corporate Finance Ross 10th Edition Solutions ManualDocument26 pagesCorporate Finance Ross 10th Edition Solutions ManualAntonioCohensirt100% (40)

- An Introduction To Asset Pricing Models: Questions To Be AnsweredDocument45 pagesAn Introduction To Asset Pricing Models: Questions To Be AnsweredEka Maisa YudistiraNo ratings yet

- Managerial Finance Chapter 8 - Risk and Return by Endah RiwayatunDocument43 pagesManagerial Finance Chapter 8 - Risk and Return by Endah RiwayatunEndah Riwayatun100% (2)

- Optimal Risky PortfolioDocument25 pagesOptimal Risky PortfolioAlexandra HsiajsnaksNo ratings yet

- Ch11 Solutions 6thedDocument26 pagesCh11 Solutions 6thedMrinmay kunduNo ratings yet

- Assignment: Submitted Towards The Partial Fulfillment ofDocument16 pagesAssignment: Submitted Towards The Partial Fulfillment ofHarsh Agarwal100% (2)

- 1 19Document8 pages1 19Yilei RenNo ratings yet

- The Mathematics of DiversificationDocument8 pagesThe Mathematics of DiversificationRyanNo ratings yet

- Portfolio Markowitz ModelDocument43 pagesPortfolio Markowitz Modelbcips100% (1)

- Corporate Finance HW 10Document4 pagesCorporate Finance HW 10RachelNo ratings yet

- Corporate Finance HW 10Document4 pagesCorporate Finance HW 10RachelNo ratings yet

- Chapter 11Document27 pagesChapter 11Sufyan KhanNo ratings yet

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Week 3 Tutorials - PDF PDFDocument9 pagesWeek 3 Tutorials - PDF PDFDaniel NgoNo ratings yet

- Chapter 6: Modern Portfolio Theory: PDF Created With Pdffactory Trial VersionDocument15 pagesChapter 6: Modern Portfolio Theory: PDF Created With Pdffactory Trial Versionworld4meNo ratings yet

- CAPMDocument77 pagesCAPMaon aliNo ratings yet

- Portfolio Risk and ReturnDocument21 pagesPortfolio Risk and ReturnSamuel DwumfourNo ratings yet

- CH 08Document77 pagesCH 08SaMi QuReSHiNo ratings yet

- ps3 2010Document6 pagesps3 2010Ives LeeNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument65 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNo ratings yet

- CML Vs SMLDocument9 pagesCML Vs SMLJoanna JacksonNo ratings yet

- Arbitage Pricing ModelDocument54 pagesArbitage Pricing Modelsouvik.icfai0% (1)

- Aide Memoire: FTX3044F - TEST 2 (Chapters 5 - 12)Document18 pagesAide Memoire: FTX3044F - TEST 2 (Chapters 5 - 12)Callum Thain BlackNo ratings yet

- Risk and Return S1 2018Document9 pagesRisk and Return S1 2018Quentin SchwartzNo ratings yet

- An Introduction To Portfolio ManagementDocument11 pagesAn Introduction To Portfolio ManagementHogo DewenNo ratings yet

- CH 05Document48 pagesCH 05Ali SyedNo ratings yet

- Week 4 Lecture PDFDocument69 pagesWeek 4 Lecture PDFAkshat TiwariNo ratings yet

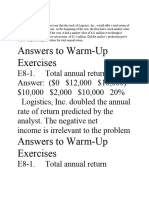

- Warm Up Chapter 8Document5 pagesWarm Up Chapter 8abdulraufdghaybeejNo ratings yet

- FM Unit 3 Lecture Notes - Risk and ReturnDocument6 pagesFM Unit 3 Lecture Notes - Risk and ReturnDebbie DebzNo ratings yet

- Solution ProblemSet3 TPDocument7 pagesSolution ProblemSet3 TPMustafa ChatilaNo ratings yet

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- In FinanceDocument8 pagesIn FinanceSsahil KhanNo ratings yet

- Beta (Finance) : From Wikipedia, The Free EncyclopediaDocument11 pagesBeta (Finance) : From Wikipedia, The Free Encyclopediashruthid894No ratings yet

- Bond Portfolio Construction: Chapter SummaryDocument31 pagesBond Portfolio Construction: Chapter Summarys yanNo ratings yet

- Chapter 7Document17 pagesChapter 7Moti BekeleNo ratings yet

- Investments Chapter 5Document11 pagesInvestments Chapter 5b00812473No ratings yet

- Chapter 7 Portfolio Theory & Risk DiversificationDocument13 pagesChapter 7 Portfolio Theory & Risk Diversificationtame kibruNo ratings yet

- Chapter 11Document28 pagesChapter 11Khoa LêNo ratings yet

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- 3017 Tutorial 9 SolutionsDocument4 pages3017 Tutorial 9 SolutionsNguyễn Hải100% (1)

- 3017 Tutorial 7 SolutionsDocument3 pages3017 Tutorial 7 SolutionsNguyễn HảiNo ratings yet

- 3017 Tutorial 6 SolutionsDocument3 pages3017 Tutorial 6 SolutionsNguyễn HảiNo ratings yet

- 3017 Tutorial 4 SolutionsDocument3 pages3017 Tutorial 4 SolutionsNguyễn HảiNo ratings yet

- 3017 Tutorial 5 SolutionsDocument3 pages3017 Tutorial 5 SolutionsNguyễn HảiNo ratings yet

- 3017 Tutorial 2 SolutionsDocument2 pages3017 Tutorial 2 SolutionsNguyễn Hải100% (1)

- 3017 Tutorial 1 SolutionsDocument2 pages3017 Tutorial 1 SolutionsNguyễn HảiNo ratings yet

- India Internet Goldman SachsDocument86 pagesIndia Internet Goldman SachsTaranjeet SinghNo ratings yet

- The Christian Life ProgramDocument28 pagesThe Christian Life ProgramRalph Christer MaderazoNo ratings yet

- SKZ TrackDocument6 pagesSKZ TrackOliviaNo ratings yet

- Rath'S Lectures: Longevity Related Notes On Vimsottari DasaDocument5 pagesRath'S Lectures: Longevity Related Notes On Vimsottari DasasudhinnnNo ratings yet

- Adobe Voice Assessment Tool-FinalDocument1 pageAdobe Voice Assessment Tool-Finalapi-268484302No ratings yet

- Examination of Conscience Ten Commandments PDFDocument2 pagesExamination of Conscience Ten Commandments PDFAntonioNo ratings yet

- Letter Writing - Task1Document5 pagesLetter Writing - Task1gutha babuNo ratings yet

- Another Monster - Chapter 5 - Kinderheim 511Document7 pagesAnother Monster - Chapter 5 - Kinderheim 511Jaime MontoyaNo ratings yet

- Case Digest: Pedro Elcano and Patricia Elcano Vs - Reginald Hill and Marvin HillDocument5 pagesCase Digest: Pedro Elcano and Patricia Elcano Vs - Reginald Hill and Marvin Hillshirlyn cuyongNo ratings yet

- De Villa vs. Court of AppealsDocument1 pageDe Villa vs. Court of AppealsValerie Aileen AnceroNo ratings yet

- Isolasi Dan Karakterisasi Runutan Senyawa Metabolit Sekunder Fraksi Etil Asetat Dari Umbi Binahong Cord F L A Steen S)Document12 pagesIsolasi Dan Karakterisasi Runutan Senyawa Metabolit Sekunder Fraksi Etil Asetat Dari Umbi Binahong Cord F L A Steen S)Fajar ManikNo ratings yet

- Sample Opposition To Motion To Alter or Amend Judgment in United States District CourtDocument3 pagesSample Opposition To Motion To Alter or Amend Judgment in United States District CourtStan BurmanNo ratings yet

- Nurse Implemented Goal Directed Strategy To.97972Document7 pagesNurse Implemented Goal Directed Strategy To.97972haslinaNo ratings yet

- Operations Management and Operations PerformanceDocument59 pagesOperations Management and Operations PerformancePauline LagtoNo ratings yet

- Anglicanism QuestionsDocument36 pagesAnglicanism QuestionsspringsdanielconceptNo ratings yet

- Canine HyperlipidaemiaDocument11 pagesCanine Hyperlipidaemiaheidy acostaNo ratings yet

- (These Are Taken From The Hics Infectious Disease Incident Response Guide Available atDocument2 pages(These Are Taken From The Hics Infectious Disease Incident Response Guide Available atDavid MitchellNo ratings yet

- Fsi GreekBasicCourse Volume1 StudentTextDocument344 pagesFsi GreekBasicCourse Volume1 StudentTextbudapest1No ratings yet

- He Didnt Die in Vain - Take No GloryDocument2 pagesHe Didnt Die in Vain - Take No GloryDagaerag Law OfficeNo ratings yet

- English Preparation Guide DAF 202306Document12 pagesEnglish Preparation Guide DAF 202306TIexamesNo ratings yet

- 0606 - s03 - 2 - 0 - QP PENTING KE 2Document8 pages0606 - s03 - 2 - 0 - QP PENTING KE 2Titin ChayankNo ratings yet

- WLAS - CSS 12 - w3Document11 pagesWLAS - CSS 12 - w3Rusty Ugay LumbresNo ratings yet

- 5909 East Kaviland AvenueDocument1 page5909 East Kaviland Avenueapi-309853346No ratings yet

- Sample Marketing Plan HondaDocument14 pagesSample Marketing Plan HondaSaqib AliNo ratings yet

- Doloran Auxilliary PrayersDocument4 pagesDoloran Auxilliary PrayersJosh A.No ratings yet

- Natural Language Processing Projects: Build Next-Generation NLP Applications Using AI TechniquesDocument327 pagesNatural Language Processing Projects: Build Next-Generation NLP Applications Using AI TechniquesAnna BananaNo ratings yet

- Procedures: Step 1 Freeze or Restrain The Suspect/sDocument5 pagesProcedures: Step 1 Freeze or Restrain The Suspect/sRgenieDictadoNo ratings yet

- Mark Scheme (Results) Summer 2019: Pearson Edexcel International GCSE in English Language (4EB1) Paper 01RDocument19 pagesMark Scheme (Results) Summer 2019: Pearson Edexcel International GCSE in English Language (4EB1) Paper 01RNairit100% (1)

- The Concise 48 Laws of Power PDFDocument203 pagesThe Concise 48 Laws of Power PDFkaran kamath100% (1)

- Couples Recovery From Sex AddictionDocument2 pagesCouples Recovery From Sex AddictionarisplaNo ratings yet