Professional Documents

Culture Documents

Keybanc CM - Chemicals Update

Uploaded by

giorgiogarrido6Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Keybanc CM - Chemicals Update

Uploaded by

giorgiogarrido6Copyright:

Available Formats

Specialty Chemicals Monthly

February 2013

SPECIALTY CHEMICALS REVIEW

Market Commentary Fine Chemicals: Active Pharmaceutical Industry The active pharmaceutical ingredient (API) industry is expected to experience near-term growth of 2 3% in value terms and 4 5% in volume terms. The expected growth will be driven by an increase in demand for contractmanufacturing, specifically in late-phase clinical development and commercialization. Due to the expected increase for demand, several API manufacturers are looking to secure Western-based assets to meet the needs of emerging biopharmaceutical and large pharmaceutical clients in the U.S. and Europe. As a result, manufacturers have recently expanded or are in the process of expanding capacity. These manufacturers include Cambridge Major Laboratories, Albemarle and American Pacific. Additionally, Lonza recently established a joint venture in China to develop and manufacture generic pharmaceuticals and is planning to establish a joint venture in South America to produce APIs. Ethylene Market Update Ethane-based ethylene margins, based on contract prices, reached 31.22 cents/lb., as tracked by ICIS, which represents the highest level since 2000. The margin increase was primarily due to a nearly 50% decline in average U.S. ethane prices during 2012. Ethane prices continue to fall as newly abundant supplies of natural gas from share formations become available. According to the U.S. National Intelligence Council (NIC), U.S. production of ethane has increased by nearly 50% per year between 2007 and 2011. Ethylene profitability is expected to be similar in 2013 as cheap liquid natural gas feedstock prices are expected to remain low. U.S. based ethylene producers are currently enjoying a major cost advantage over other regions, specifically Europe and Asia, where ethylene production is predominately based on naphtha, which has experienced rising costs. Mergers & Acquisitions and Capital Markets Update (see pg. 3-7) On February 13, PolyOne completed a $600 million, 10-year senior unsecured notes offering at a 5.250% coupon to fund a portion of its acquisition of Spartech, make a $50 million pension contribution and repay its senior secured term loan KeyBanc Capital Markets acted as a Co-Manager on the offering On February 12, Milacron agreed to acquire Mold-Masters, the Canadian-based manufacturer of advanced hot runner systems, temperature controllers and auxiliary equipment for the plastic industry, for $967 million (3.6x 2012 sales) On January 21, OM Group announced the sale of its cobalt refinery assets in Kokkola, Finland to a joint venture to be held by Freeport-McMoRan Copper & Gold, Lundin Mining Corporation, and La Generale des Carrieres et des Mines for $325 million, plus the potential for $110 million in additional payments over three years, based on an earn out Source: Company Filings, Press Releases, IHS Chemical Week, ICIS, Equity Research Markets Update (see pg. 10) The KeyBanc Capital Markets (KBCM) Specialty Chemicals Index has traded up year to date for the period ended February 20th, increasing 5.8% in the period, compared to a 6.0% increase in the S&P 500. The Chemical Index is up 15.6% over the last three months vs. a 8.7% increase for the S&P 500

Disclosure: KeyBanc Capital Markets is a trade name under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC, and KeyBank National Association (KeyBank N.A.), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives, who may also be employees of KeyBank N.A. Banking products and services are offered by KeyBank N.A. This report was not issued by our research department. The information contained in this report has been obtained from sources deemed to be reliable but is not represented to be complete, and it should not be relied upon as such. This report does not purport to be a complete analysis of any security, issuer, or industry and is not an offer or a solicitation of an offer to buy or sell any securities. This report is prepared for general information purposes only and does not consider the specific investment objectives, financial situation and particular needs of any individual person or entity.

Specialty Chemicals Monthly

February 2013

RAW MATERIAL PRICE TRENDS (Through February 20, 2012) Natural Resources

EN ER GY C rude O il N a t ura l G a s N A T . R E S O UR C E S End o f M o nth P rice M o M % Change Yo Y % Change P a lm O il $ 865 4.8% (23.1 %) N a t . R ubbe r $1 .43 (7.6%) (22.2%)

End o f M o nth P rice

M o M % Change Yo Y % Change

$ 94.46

(1 .2%) (8.5%)

$ 3.35

(5.1 %) 25.5%

$16 0 $14 0

US$ / bbl

$4.0 $3.5

US$ / MMBtu

$1,400 $1,200

$3.5 $3.0

US$ / bbl

$12 0 $10 0 $80 $60 $40 Feb-12 May-12 Aug -12 Nov-12

$3.0 $2.5 $2.0 $1.5 $1.0 Feb-13

US$ / lb

$1,000 $80 0 $60 0 $40 0 Feb-12

$2.5 $2.0 $1.5 $1.0 Feb-13

May-12

Aug -12

Nov-12

Crude Oil (WTI)

Nat. Gas ( Hen ry Hub)

Palm Oil (Rotterd am)

Nat. Ru bber (Sin gapore )

Petrochemicals (Gulf Coast)

O LE F IN S End o f M o nth P rice M o M % Change Yo Y % Change E t hyle ne $ 0.62 (3.1 %) (7.5%) P ro pyle ne $ 0.74 1 7.6% 8.9% B ut a die ne $ 0.83 1 7.0% (36.0%) A R O M A T IC S End o f M o nth P rice M o M % Change Yo Y % Change B e nze ne $ 4.71 (2.1 %) 1 3.2% T o lue ne $ 4.46 5.9% 1 2.6% S t yre ne $ 0.79 5.4% 1 9.8%

$2.0 $1.5

$5.5 $5.0 US$ / gal

$0.9 $0.8 $0.7 $0.6 $0.5 $0.4 $0.3 Feb-13 Styr ene US$ / lb

US$ / lb

$4.5 $4.0 $3.5 $3.0

$1.0 $0.5 $0.0 Feb-12

May-12

Aug -12 Butadie ne

Nov-12

Feb-13 Pro pyle ne

$2.5 Feb-12

May-12 Ben zen e

Aug -12

Nov-12

Ethylene

Toluen e

Plastics[1]

P LA S T IC S End o f M o nth P rice M o M % Change Yo Y % Change PP $ 0.79 1 1 .7% 1 4.5% PS $1 .04 2.5% 4.8% P VC $1 .39 0.0% 69.5% P LA S T IC S End o f M o nth P rice M o M % Change Yo Y % Change HDP E $ 0.64 5.8% (3.1 %) LD P E $ 0.73 3.2% 0.7%

$1.6 $1.4 US$ / bbl

US$ / bbl

$1.0 $0.9 $0.8 $0.7 $0.6 $0.5 $0.4 Jan-12 Apr -12 Jul-12 Oct-12 Jan-13

$1.2 $1.0 $0.8 $0.6 $0.4 Jan-12 Apr -12 Jul-12 Oct-12 Jan-13 PVC

PP (HoPP )

PS (HIP S)

HDP E (Inj. Mo ld Grade)

LDPE (Film)

Source: Bloomberg [1] PVC pricing is for general purpose resins; Plastics pricing is through January 1, 2012

Specialty Chemicals Monthly

February 2013

SELECT RECENT TRANSACTION ACTIVITY

Closed (Announced)

Pending (2/14/2013)

Acquirer (Parent)

Rockwood Holdings, Inc.

Target (Seller)

Sachtleben Chemie GmbH (Kemira Oyj)

Highlights

Rockwood agreed to acquire Kemiras remaining 39% stake in Sachtleben Chemie, the Germain-based producer of specialty titanium dioxide pigments for the synthetic fiber, packaging inks, cosmetics and food industries, for $131 million As previously stated by Rockwood, the titanium dioxide is non-core and the transaction allows Rockwood to explore and execute the best strategic option for the business The divestment represents Kemiras focus on implementing its water strategy and also supports Kemiras restructuring measures One Rock Capital Partners (One Rock) agreed to acquire SummitReheis, the Huguenot, NY-based manufacturer of antiperspirant and deodorant active ingredients Prior to the completion of the transaction, MVC Capital agreed to purchase Summit Custom Spray Dying (SCSD), a provider of custom spray dying products to the food, pharmaceutical, and flavor and fragrance industries, from SummitReheis SCSD will operate as a stand-alone business following the closing of the SummitReheis sale Milacron agreed to acquire Mold-Masters, the Canadian-based designer and manufacturer of advanced hot runner systems, temperature controllers and auxiliary equipment for the plastic industry, for $967 million (3.6x 2012 sales) The acquisition provides Milacron with expertise in the high-growth hot-runner market as well as expanded scale, technological leadership, international presence and competitive positioning Mold-Masters generated sales of approximately $268 million in 2012 Jabil Circuit agreed to acquire Nypro, the Clinton, MA-based leader of manufactured precision plastic consumables and disposables for the healthcare market, for $665 million (0.55x 2012 sales) The transaction extends Jabils materials manufacturing capabilities into the healthcare and consumer packaging markets as well as adds depth to Jabils consumer electronics business Nypro generated sales of approximately $1.2 billion in 2012 Eurecat, a JV between Albemarle and IFP Investments, acquired Tricat Industries The transaction enhances Eurecats processing capabilities for catalyst regeneration, rejuvenation, pre-reclaim burn off, sulfiding, pre-activation and catalyst or additives toll manufacturing with the addition of two industrial sites located McAlester, Olka. and Bitterfeld, Germany Eurecats market capabilities for specialty zeolites and additives will also be strengthened with the Tricat acquisition TonenGeneral Sekiyu acquired Union Carbides 50% stake in Nippon Unicar (NUC), the Japan-based polyethylene JV The transaction will improve NUCs business capability, enabling NUC to respond quickly to market needs with integrated operations The JV generated sales of $367 million in 2011

Pending (2/13/2013)

One Rock Capital Partners LLC

SummitReheis, Inc. (MVC Capital, Inc.)

Pending (2/12/2013)

Milacron LLC

Mold-Masters Limited (3i Group plc)

Pending (2/4/2013)

Jabil Circuit Inc.

Nypro, Inc.

1/31/2013 (1/31/2013)

Eurecat Joint Venture (Albemarle, IFP Investments)

Tricat Industries

1/31/2013 (1/31/2013)

TonenGeneral Sekiyu

Nippon Unicar JV (Union Carbides 50% stake)

Source: Company Filings, Press Releases, ChemWeek, Capital IQ, Bloomberg

Specialty Chemicals Monthly

February 2013

SELECT RECENT TRANSACTION ACTIVITY

Closed (Announced)

Pending (1/22/2013)

Acquirer (Parent)

International Forest Products Ltd.

Target (Seller)

Wood Products Business (Rayonier Inc.)

Highlights

International Forest Products (IFP) agreed to acquire the assets of Rayoniers Wood Products business, which consists of three lumber mills located in Baxley, Swainsboro, and Eatonton, GA, for $80 million The transaction supports Rayoniers strategy to fully position its manufacturing operations in the specialty chemicals sector and represents IFPs first purchase outside the Northwest U.S. and Canada The three mills generated operating income of approximately $10 million in 2012 OM Group announced the sale of its cobalt refinery assets in Kokkola, Finland to a joint venture to be held by Freeport-McMoRan Copper & Gold, Lundin Mining Corporation, and La Generale des Carrieres et des Mines for total consideration of $435 million, of which $325 million is in cash and the remaining $110 million is based on the business achieving certain financial objectives over the next three years The divestiture of the cobalt business is OM Groups final step in exiting its legacy commodity business and is consistent with its strategy to move up the value chain into technology-based businesses with attractive growth prospects Subsequent to close, OM Group expects to have total cash on hand of over $500 million, which it expects to deploy to repay a substantial portion of its debt, repurchase up to $50 million of its shares, and support its strategy of profitable organic and strategic growth The Edgewater Funds (Edgewater) acquired Kenzoid Company and Eldon Water (collectively Klenzoid), Toronto, Canada-based water treatment chemicals supplier and services company The acquisition is complementary to Edgewaters purchase of Nashville Chemical in 2011, which will allow both companies to service a broader geographic base of customers while leveraging scale, procurement, and best practices Edgewater is pursuing additional acquisitions in the following water industry sectors: water treatment products, chemicals, services and pipeline infrastructure products and services Amtech acquired Arrowhead Composites and Thermoplastics (ACT), the Elmore, Alabama-based fiber-reinforced plastic components manufacturing facility serving the transportation, recreation, and utility industries Arrowhead positions Amtech to meet the demand of Amtechs regional production commitments and provide a new territory for growth Amtech plans to continue growing its business in the Pacific Northwest and is seeking growth opportunities in the Midwest Pilot Chemical Company acquired Mason Chemical Company, the Arlington Heights, Illinois-based leader in the development, registration and sale of quaternary ammonium compounds and related chemistries The acquisition enhances Pilot Chemicals household, industrial and institutional, personal care and oil and gas product portfolio, strengthening its offering by adding registered and non-registered biocidal quats and tertiary amine derivatives

Pending (1/21/2013)

FreeportMcMoRan Copper & Gold Inc.; Lundin Mining Corporation; La Generale des Carrieres et des Mines

Cobalt Chemical Refinery (OM Group, Inc.)

1/17/2013 (1/17/2013)

The Edgewater Funds

Kenzoid Company Ltd. and Eldon Water Inc.

1/10/2013 (1/10/2013)

Amtech, LLC (Blackford Capital)

Arrowhead Composites and Thermoplastics, Inc. (Arrowhead Plastic Engineering, Inc.)

1/9/2013 (1/9/2013)

Pilot Chemical Company

Mason Chemical Company

Source: Company Filings, Press Releases, ChemWeek, Capital IQ, Bloomberg

Specialty Chemicals Monthly

February 2013

SELECT RECENT TRANSACTION ACTIVITY

Closed (Announced)

1/7/2013 (1/7/2013)

Acquirer (Parent)

Innospec Inc.

Target (Seller)

Strata Control Services, Inc.

Highlights

Innospec acquired Strata Control Services, the Crowley, Louisiana-based supplier of mud and fluid loss solutions to oil and gas drilling operations (~6.0x 2012 EBITDA) The transaction provides Innospec an increased presence in the expanding oilfield specialties business Strata Control Services generated sales of approximately $20 million in 2012 SK Capital Partners acquired the Textile Chemicals, Paper Specialties, and Emulsions businesses of Clariant Chemicals for approximately $500 million The acquisition is consistent with SK Capitals strategy of acquiring niche market leaders with strong brands, technologies and underlying growth trends as well as fits with SK Capitals prior experience in the textile, fiber and nylon chemicals sectors The purchased businesses generate annual sales of approximately $1.3 billion and operate from 25 facilities around the world MidOcean Partners acquired Agilex Flavors & Fragrances, the Piscataway, New Jersey-based provider of fragrance compounds and delivery systems sold primarily to manufactures of air care, personal care, industrial and institutional and household prodcuts Agilex maintains production facilities in Georgia, New Jersey, and China along with a fragrance laboratory located in Hong Kong

Pending (12/27/2012)

SK Capital Partners

Textile Chemicals, Paper Specialties and Emulsions Businesses (Clariant Chemicals Ltd.)

12/19/2012 (11/27/2012)

MidOcean Partners

Agilex Flavors & Fragrances Inc. (Nautic Partners, LLC)

Source: Company Filings, Press Releases, ChemWeek, Capital IQ, Bloomberg

Specialty Chemicals Monthly

February 2013

SELECT RECENT CAPITAL MARKETS ACTIVITY

Closed Company Gross Offering Size

$2.3 billion Senior Notes

Highlights

2/21/2013

Ashland Inc.

Ashland, the Covington, KY-based specialty chemicals provider, completed a $2.3 billion, fourpart offering The first part consisted of a $600 million, 3-year senior notes offering at a 3.000% coupon The second part consisted of a $700 million, 5-year senior notes offering at a 3.875% coupon The third part consisted of a $650 million, 9-year senior notes offering at a 4.750% coupon The fourth part consisted of a $350 million, 30-year senior notes offering at a 6.875% coupon The proceeds, along with $200 million of revolver borrowings and cash, will be used to pay down the issuers existing term loans PolyOne, the Avon Lake, OH-based provider of specialized polymer materials, services and solutions, completed a $600 million, 10-year senior unsecured notes offering at a 5.250% coupon The proceeds will be used to fund a portion of its acquisition of Spartech, to make a $50 million pension contribution and to repay its senior secured term loan KeyBanc Capital Markets acted as a Co-Manager on the offering Praxair, the Danbury, CT-based distributor of process gases, completed a $900 million, two-part offering The first part consisted of a $400 million, 3-year senior notes offering at a 0.750% coupon The second part consisted of a $500 million, 10-year senior notes offering at a 2.700% coupon The proceeds will be used for general corporate purposes, including acquisitions and share repurchases Dupont, the Wilmington, DE-based science and technology based company, completed a $2 billion, two-part offering The first part consisted of a $1.25 billion, 10-year senior notes offering at a 2.800% coupon The second part consisted of a $750 million, 30-year senior notes offering at a 4.150% coupon The proceeds, in addition to proceeds from the divestiture of its coatings business, will be used to pay down the Companys outstanding commercial paper balances Airgas, the Radnor, PA-based distributer of industrial, medical, and specialty gases, completed a $600 million, two-part offering The first part consisted of a $325 million, 5-year senior notes offering at a 1.650% coupon The second part consisted of a $275 million, 7-year senior notes offering at a 2.375% coupon The proceeds will be used for general corporate purposes including acquisitions and share repurchases Air Products , the Allentown, PA provider of industrial gases, completed a $400 million, 10-year senior notes offering at a 2.750% coupon The proceeds will be used for general corporate purposes Orion Engineered Carbons, the German-based manufacturer of carbon black products for the tire and rubber industry, completed a $425 million, 6-year PIK notes offering at a 9.250% coupon at a price of 99, yielding 9.460% The proceeds will be used to fund a shareholder distribution, with excess capital via the upsizing simply bolstering the payment

2/13/2013

PolyOne Corp.

$600 Senior Unsecured Notes

2/13/2013

Praxair Inc.

$900 million Senior Notes

2/12/2013

Dupont

$2 billion Senior Notes

2/11/2013

Airgas, Inc.

$600 million Senior Notes

1/30/2013

Air Products & Chemicals Inc.

$400 million Senior Notes

1/29/2013

Orion Engineered Carbons GmbH

$425 million PIK Notes

Source: Company Filings, Press Releases, ChemWeek, Capital IQ, Bloomberg

Specialty Chemicals Monthly

February 2013

SELECT RECENT CAPITAL MARKETS ACTIVITY

Closed Company Gross Offering Size

$1.325 billion Senior Secured Notes

Highlights

1/24/2013

Trinseo SA

Trinseo, the Berwyn, PA-based manufacturer of specialty and customized emulsion polymers and plastics, completed a $1.325 billion, 6-year notes offering at a 8.75% coupon The proceeds will be used to pay down existing term debt The Georgia Gulf / PPG Industries combined entity completed a $688 million, 8-year notes offering at a 4.625% coupon The proceeds are expected to be used to finance the merger of Georgia Gulf and PPGs Commodity Chemicals business Georgia Gulf, the Atlanta, Georgia-based manufacturer of chemicals and building products, completed a $450 million, 10-year notes offering at a 4.875% coupon The proceeds, along with cash on hand or revolving borrowings, are expected to be used to fund a tender offer for the companys 9% secured notes due 2017 DuPont Performance Coatings, the German-based manufacturer of surface coating products, completed a $750 million, two-part offering The first part consisted of a $750 million, 8-year senior notes offering at a 7.375% coupon The second part consisted of a $322 million, 8-year senior secured notes offering at a 5.750% coupon The proceeds will be used to support Carlyle Groups $4.9 billion cash purchase of DuPonts Performance Coatings business TPC Group, the Houston, Texas-based producer of value-added products derived from petrochemical raw materials, complete a $100 million, 7-year senior secured notes offering at a 8.750% coupon The proceeds will be used for general corporate purposes, including strategic capital projects Momentive Specialty Chemicals, the Columbus, OH-based manufacturer of specialty chemicals and materials, completed a $1.1 billion, 7-year senior secured notes offering at a 6.625% coupon at a price of 100.75, yielding 6.450% The proceeds will be used to pay down the $913 million outstanding in term debt, fund a tender offer for the $120 million outstanding 2006 second-lien notes due 2014

1/17/2013

Axiall Corp.

$688 million Senior Notes

1/17/2013

Georgia Gulf Corp

$450 million Senior Unsecured Notes

1/16/2013

DuPont Performance Coatings

$750 million Senior Notes

1/16/2013

TPC Group Inc.

$100 million Senior Secured Notes

1/16/2013

Momentive Specialty Chemicals

$1.1 billion Senior Secured Notes

Source: Company Filings, Press Releases, ChemWeek, Capital IQ, Bloomberg

Specialty Chemicals Monthly

February 2013

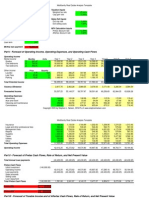

SPECIALTY CHEMICALS PUBLIC TRADING STATISTICS (Through February 20, 2013)

$ in millions, except per share data Stock Company Adhesives, Sealants & Coatings H.B. Fuller Company PPG Industries, Inc. RPM International Inc. Sherwin-Williams Company Valspar Corporation Average Median A. Schulman, Inc. Albemarle Corporation Cytec Industries Inc. Ferro Corporation Hexcel Corporation Innospec Inc. Kraton Performance Polymers, Inc. Minerals Technologies Inc. NewMarket Corporation PolyOne Corporation Spartech Corporation Stepan Company W.R. Grace & Co. Average Median American Vanguard Corp. Ashland Inc. Cabot Corporation Celanese Corporation Chemtura Corporation Eastman Chemical Co. FMC Corp. Huntsman Corporation Innophos Holdings Inc. Koppers Holdings Inc. Olin Corp. OM Group, Inc. OMNOVA Solutions Inc. Quaker Chemical Corporation Rockwood Holdings, Inc. Westlake Chemical Corporation Zep Inc. Average Median Fine Chemicals Balchem Corp. International Flavors & Fragrances Inc. Sensient Technologies Corp. Sigma-Aldrich Corporation Average Median Overall Average Overall Median S&P 500 1,511.95 BCPC IFF SXT SIAL $37.43 $72.44 $36.80 $76.38 $1,099 $5,909 $1,831 $9,200 $952 $6,615 $2,150 $9,132 $69 $565 $240 $809 AVD ASH CBT CE CHMT EMN FMC HUN IPHS KOP OLN OMG OMN KWR ROC WLK ZEP $32.02 $77.60 $37.61 $47.50 $22.75 $70.22 $58.23 $16.83 $46.73 $41.09 $22.66 $26.20 $8.08 $56.83 $58.99 $87.05 $14.59 $898 $6,129 $2,399 $7,583 $2,223 $10,769 $8,017 $4,037 $1,015 $846 $1,817 $848 $379 $743 $4,629 $5,806 $327 $929 $9,251 $3,939 $9,692 $2,797 $15,517 $8,905 $7,479 $1,164 $1,093 $2,441 $1,126 $688 $761 $6,360 $5,655 $575 $68 $1,359 $488 $1,209 $382 $1,663 $823 $1,362 $152 $158 $378 $143 $104 $76 $764 $760 $58 SHLM ALB CYT FOE HXL IOSP KRA MTX NEU POL SEH SCL GRA $30.79 $64.06 $72.01 $5.31 $27.20 $40.23 $26.00 $40.77 $246.65 $22.05 $9.56 $62.29 $71.00 $903 $5,691 $3,283 $460 $2,730 $939 $839 $1,443 $3,310 $1,974 $298 $1,295 $5,365 $1,026 $6,011 $2,666 $783 $2,954 $941 $1,085 $1,090 $3,686 $2,473 $432 $1,369 $5,134 $126 $609 $270 $90 $292 $115 $94 $160 $408 $285 $56 $179 $609 Ticker FUL PPG RPM SHW VAL Price $40.47 $131.51 $29.96 $159.33 $60.73 Market Cap. $2,010 $20,266 $3,965 $16,428 $5,462 Enterprise Value LTM EV / LTM Stock Performance (% Change) 1 month 2.4% (7.9%) (6.3%) (2.9%) (9.4%) (4.8%) (6.3%) (3.2%) (0.6%) (2.3%) 15.7% (2.3%) 1.0% (0.9%) (1.3%) (12.9%) (1.8%) (1.3%) 8.3% (0.2%) (0.1%) (1.3%) 1.2% (8.7%) (11.6%) 0.6% (5.4%) (1.4%) (3.9%) (4.2%) (9.2%) 1.0% (0.6%) 13.0% 6.0% (3.4%) 10.2% 0.5% 0.2% (0.9%) (0.6%) 0.3% 2.7% (3.2%) (0.7%) (0.2%) (0.2%) (1.1%) (1.3%) 1.7% 1 year 31.1% 42.8% 18.0% 58.8% 31.7% 36.5% 31.7% 15.1% (3.3%) 25.0% (24.9%) 5.6% 33.2% (11.7%) 22.4% 31.1% 49.0% 49.1% 44.3% 26.7% 20.1% 25.0% 92.1% 19.8% (8.3%) (8.5%) 55.7% 28.6% 20.5% 22.0% (6.5%) 7.0% 6.1% (15.1%) 47.2% 30.8% 7.5% 43.9% (11.7%) 19.5% 19.8% 3.5% 27.9% (4.4%) 6.1% 8.3% 4.8% 20.7% 22.0% 11.1% YTD 16.2% (2.8%) 2.0% 3.6% (2.7%) 3.3% 2.0% 6.4% 3.1% 4.6% 27.0% 0.9% 16.6% 8.2% 2.1% (5.9%) 8.0% 5.4% 12.2% 5.6% 7.3% 5.6% 3.1% (3.5%) (5.5%) 6.7% 7.0% 3.2% (0.5%) 5.8% 0.5% 7.7% 5.0% 18.0% 15.3% 5.5% 19.3% 9.8% 1.0% 5.8% 5.5% 2.7% 8.9% 3.5% 3.8% 4.7% 3.6% 5.8% 5.0% 6.0% $1.48 $4.39 $2.67 $4.16 $1.95 $4.83 $2.99 $4.46 $1.23 $7.76 $3.55 $4.31 $1.47 $6.42 $3.94 $1.72 $3.67 $3.67 $2.12 $1.31 $0.69 $3.33 $3.85 $6.33 $1.24 $1.62 $9.03 NA $5.02 $1.81 $7.14 $4.53 $2.29 $4.36 $4.21 $2.20 $2.00 $0.95 $3.73 $4.86 $6.93 $1.51 $2.23 $5.07 $4.85 $0.07 $1.76 $3.57 $2.48 $2.27 $18.59 $1.34 $0.31 $4.46 $4.52 $2.58 $5.72 $5.76 $0.27 $2.00 $3.88 $2.55 $2.51 $19.94 $1.80 $0.62 $4.79 $5.05 Consensus EPS 2013E $2.63 $7.82 $1.95 $7.87 $3.84 2014E $3.13 $8.95 $2.19 $9.35 $4.48 Stock Price / EPS 2013E 15.4x 16.8x 15.4x 20.2x 15.8x 16.7x 15.8x 13.8x 12.6x 14.9x NM 15.5x 11.3x 10.5x 18.0x 13.3x 16.4x 30.8x 14.0x 15.7x 15.6x 14.4x 25.9x 10.0x 10.6x 11.0x 15.5x 10.9x 14.8x 9.8x 12.7x 11.2x 10.7x 20.0x 11.7x 17.1x 15.3x 13.7x 11.8x 13.7x 11.8x 25.2x 16.5x 13.8x 18.4x 18.5x 17.4x 15.2x 14.8x 2014E 12.9x 14.7x 13.7x 17.0x 13.6x 14.4x 13.7x 11.9x 11.2x 12.5x 19.4x 13.6x 10.4x 10.2x 16.2x 12.4x 12.3x 15.4x 13.0x 14.1x 13.3x 12.5x 19.8x 8.6x NA 9.5x 12.6x 9.8x 12.9x 7.4x 10.7x 9.8x 10.3x 13.1x 8.5x 15.2x 12.1x 12.6x 9.7x 11.4x 10.5x 19.2x 15.0x 12.3x 17.1x 15.9x 16.1x 12.9x 12.6x

EBITDA EBITDA 10.6x 9.6x 11.1x 14.5x 10.7x 11.3x 10.7x 8.1x 9.9x 9.9x 8.7x 10.1x 8.2x 11.5x 6.8x 9.0x 8.7x 7.7x 7.6x 8.4x 8.8x 8.7x 13.6x 6.8x 8.1x 8.0x 7.3x 9.3x 10.8x 5.5x 7.6x 6.9x 6.5x 7.8x 6.6x 10.0x 8.3x 7.4x 9.9x 8.3x 7.8x 13.7x 11.7x 9.0x 11.3x 11.4x 11.5x 9.2x 8.7x

$2,334 $220 $22,527 $2,340 $5,158 $464 $17,342 $1,199 $6,483 $605

Source: Capital IQ, Reuters, SEC Filings

Diversified

Advanced Materials, Polymers & Additives

Specialty Chemicals Monthly

February 2013

SPECIALTY CHEMICALS PUBLIC TRADING STATISTICS (Through February 20, 2013)

$ in millions Total Company Adhesives, Sealants & Coatings H.B. Fuller Company PPG Industries, Inc. RPM International Inc. Sherwin-Williams Company Valspar Corporation Average Median A. Schulman, Inc. Albemarle Corporation Cytec Industries Inc. Ferro Corporation Hexcel Corporation Innospec Inc. Kraton Performance Polymers, Inc. Minerals Technologies Inc. NewMarket Corporation PolyOne Corporation Spartech Corporation Stepan Company W.R. Grace & Co. Average Median American Vanguard Corp. Ashland Inc. Cabot Corporation Celanese Corporation Chemtura Corporation Eastman Chemical Co. FMC Corp. Huntsman Corporation Innophos Holdings Inc. Koppers Holdings Inc. Olin Corp. OM Group, Inc. OMNOVA Solutions Inc. Quaker Chemical Corporation Rockwood Holdings, Inc. Westlake Chemical Corporation Zep Inc. Average Median Fine Chemicals Balchem Corp. International Flavors & Fragrances Inc. Sensient Technologies Corp. Sigma-Aldrich Corporation Average Median Overall Average Overall Median BCPC IFF SXT SIAL $0 $1,031 $334 $683 ($145) $707 $319 ($68) $69 $565 $240 $809 AVD ASH CBT CE CHMT EMN FMC HUN IPHS KOP OLN OMG OMN KWR ROC WLK ZEP $54 $3,610 $1,501 $3,121 $754 $4,985 $965 $3,706 $176 $296 $714 $467 $452 $39 $2,752 $764 $253 $30 $3,122 $1,409 $2,109 $567 $4,748 $888 $3,319 $149 $229 $549 $240 $309 $8 $1,478 ($151) $249 $68 $1,359 $488 $1,209 $382 $1,663 $823 $1,362 $152 $158 $378 $143 $104 $76 $764 $760 $58 SHLM ALB CYT FOE HXL IOSP KRA MTX NEU POL SEH SCL GRA $223 $699 $707 $337 $257 $30 $448 $93 $465 $707 $135 $150 $1,096 $116 $222 $527 $312 $224 $3 $246 ($376) $376 $497 $134 $73 ($241) $126 $609 $270 $90 $292 $115 $94 $160 $408 $285 $56 $179 $609 Ticker FUL PPG RPM SHW VAL Debt $520 $4,001 $1,426 $969 $1,270 Net Debt $320 $1,990 $1,043 $914 $1,021 LTM EBITDA $220 $2,340 $464 $1,199 $605 Total Debt / LTM EBITDA 2.4x 1.7x 3.1x 0.8x 2.1x 2.0x 2.1x 1.8x 1.1x 2.6x 3.8x 0.9x 0.3x 4.8x 0.6x 1.1x 2.5x 2.4x 0.8x 1.8x 1.9x 1.8x 0.8x 2.7x 3.1x 2.6x 2.0x 3.0x 1.2x 2.7x 1.2x 1.9x 1.9x 3.3x 4.3x 0.5x 3.6x 1.0x 4.4x 2.4x 2.6x NM 1.8x 1.4x 0.8x 1.4x 1.4x 2.1x 1.9x Net Debt / LTM EBITDA 1.5x 0.9x 2.2x 0.8x 1.7x 1.4x 1.5x 0.9x 0.4x 2.0x 3.5x 0.8x NM 2.6x NM 0.9x 1.7x 2.4x 0.4x NM 1.6x 1.3x 0.4x 2.3x 2.9x 1.7x 1.5x 2.9x 1.1x 2.4x 1.0x 1.5x 1.4x 1.7x 3.0x 0.1x 1.9x NM 4.3x 1.9x 1.7x NM 1.3x 1.3x NM 1.3x 1.3x 1.7x 1.5x Total Debt / Capital 39.9% 49.2% 50.6% 35.3% 51.3% 45.3% 49.2% 29.9% 26.6% 28.1% 55.2% 20.5% 8.6% 45.7% 10.2% 53.6% 52.8% 42.8% 23.7% 77.5% 36.6% 29.9% 20.1% 46.5% 43.3% 64.3% 39.9% 62.4% 38.3% 66.2% 28.4% 63.8% 41.7% 27.3% 77.6% 11.9% 59.0% 29.0% 59.5% 45.8% 43.3% 0.0% 45.2% 22.4% 21.2% 22.2% 21.8% 40.2% 41.7% LTM EBITDA / Interest 11.1x 11.1x 6.2x 28.0x 8.9x 13.1x 11.1x 15.7x 18.6x 9.0x 3.2x 29.2x NM 3.4x NM 25.2x 5.5x 4.7x 18.7x 13.1x 13.3x 13.1x 25.1x 6.6x 9.4x 6.5x 6.2x 11.6x 18.2x 6.0x 25.5x 5.6x 14.3x 2.7x 2.9x 17.1x 8.8x 17.7x 9.2x 11.4x 9.2x NM 13.5x 14.2x NM 13.9x 13.9x 12.4x 11.1x BBB NR A+ BB BBB+ BBBBB ABB BBBB BBB BBBBBB+ BBB B+ BB+ NR BBBB+ BBNR LT S&P Rating BBB BBB+ BBBA BBB

Source: Capital IQ, Standard & Poors, SEC Filings

Diversified

Advanced Materials, Polymers & Additives

Specialty Chemicals Monthly

February 2013

SPECIALTY CHEMICALS VALUATIONS (Through February 20, 2013) 5-Year Index Performance

KBCMs Specialty Chemicals Index traded down (1.1%) for the month ended February 20th, versus a 1.7% increase in the S&P 500

120% 100%

Last 12 Months KBCM Specialty Chem icals Index 20.7% 15.6% (1.1%) S&P 500 11.1% 8.7% 1.7%

88.7%

80% 60% 40% 20% 0% (20%) (40%) (60%) (80%) Feb-08

Last 3 Months Last 1 Month

11.2%

Aug-08

Feb-09

Aug-09

Feb-10

Aug-10

Feb-11

Aug-11

Feb-12

Aug-12

Feb-13

5-Year Enterprise Value / LTM EBITDA Valuations

KBCM Specialty Chemicals Index valuations increased to 9.0x EV / LTM EBITDA as of February 20th

10.0x 9.0x 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x Feb-08

Average: 7.4X

Aug-08

Feb-09

Aug-09

Feb-10

Aug-10

Feb-11

Aug-11

Feb-12

Aug-12

Feb-13

Source: Capital IQ, SEC Filings Note: KBCM Specialty Chemicals Index includes: ALB, ASH, AVD, BCPC, CBT, CE, CHMT, CYT, EMN, FMC, FOE, FUL, HUN, HXL, IFF, IOSP, IPHS, KOP, KRA, KWR, MTX, NEU, OLN, OMG, OMN, POL, PPG, ROC, RPM, SCL, SEH, SHLM, SHW, SIAL, SXT, VAL, WLK, ZEP

10

Specialty Chemicals Monthly

February 2013

SELECT KEYBANC CAPITAL MARKETS TRANSACTION EXPERIENCE

Client

PolyOne Corp. DuBois Chemicals (Aurora Capital) DuBois Chemicals (Aurora Capital) NewMarket Corp. Sherwin-Williams GEO Specialty Chemicals American Pacific Sherwin-Williams RPM International DuBois Chemicals (The Riverside Company) Citadel Plastics Holding (Wind Point Partners) Citadel Plastics Holding (Huntsman Gay Global Capital) Arizona Chemical Company (American Securities) PolyOne Corp. Stepan Company Quaker Chemical Corporation Kraton Performance Polymers (CCMP & TPG) GenTek Inc. (American Securities) Cornerstone Chemical Company (H.I.G. Capital) Flow Polymers Inc. OMNOVA Solutions, Inc. Ferro Corp. Arch Chemicals, Inc.

Business Description

Specialized polymer materials, services, and solutions Manufactures metalworking fluids, cleaners, and paper chemicals Manufactures metalworking fluids, cleaners, and paper chemicals Manufactures petroleum additives Paints, coatings and related products Manufactures paints, coating products, and polyester diols Manufactures fine and specialty chemicals Paints, coatings and related products Industrial and consumer specialty chemical products Manufactures metalworking fluids, cleaners, and paper chemicals Global compounder of thermoplastic and thermoset resins Global compounder of thermoplastic and thermoset resins Manufactures naturally derived specialty resins and pine-based chemicals Specialized polymer materials, services, and solutions Producer of specialty and intermediate chemicals Global developer and provider of high performance specialty chemical products Styrenic block copolymers for use in industrial and consumer applications Manufactures industrial components and performance chemicals Manufactures key intermediate chemical criticals Manufactures rubber processing chemicals for a variety of applications Emulsion polymers, specialty chemicals, and functional surfaces Electronic and performance materials, porcelain enamel, and polymer additives Biocides and specialty chemicals manufacturer and supplier

Deal Value ($ mm)

$600 $150 ND $350 $1,000 $120 $85 C$75 $600 $114 ND $185 $610 $300 $65 $45 $377 $425 $120 ND $250 $250 ND

Type

Co-Manager Senior Notes Joint Lead Arranger, Joint Bookrunner & Documentation Agent Senior Credit Facility Co-Buy-Side Advisor Co-Manager Senior Notes Co-Manager Senior Notes Syndication Agent Senior Credit Facility Joint Lead Arranger, Sole Bookrunner & Administrative Agent Senior Secured Credit Facility Joint Lead Arranger, Sole Bookrunner & Administrative Agent Senior Secured Credit Facility Joint Lead Arranger, Joint Bookrunner & CoSyndication Agent Senior Unsecured Credit Facility Sole Lead Arranger, Sole Bookrunner & Administrative Agent Senior Secured Credit Facility Sell-Side Advisor Joint Lead Arranger, Joint Bookrunner & Syndication Agent Senior Secured Credit Facility Co-Agent Documentation Agent Revolving Credit Facility Sole Lead Placement Agent Co-Manager Follow-on Offering Co-Manager Follow-on Offering Syndication Agent Senior Credit Facility Joint Lead Arranger Senior Secured Credit Facility Sell-Side Advisor Lead Manager Senior Notes Co-Manager Senior Notes Sell-Side Advisor Sayerlack Industrial Wood Coatings

Closed

Feb-13 Dec-12 Dec-12 Dec-12 Dec-12 Nov-12 Oct-12 June-12 June-12 Apr-12 Feb-12 Feb-12 Dec-11 Dec-11 Nov-11 May-11 Mar-11 Mar-11 Mar-11 Dec-10 Oct-10 Aug-10 Mar-10

Select Transactions

SPECIALTY CHEMICALS TEAM CONTACTS

For additional information on KeyBanc Capital Markets Specialty Chemicals Practice, please contact any of the individuals listed below

Mario Toukan 216.689.4663 mtoukan@key.com

Key Tower, Floor 6 127 Public Square

Ben Whiting 216.689.4120 bwhiting@key.com

Cleveland, OH 44114

11

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- MRO 2017 Aeroturbine and AJW PG 52Document170 pagesMRO 2017 Aeroturbine and AJW PG 52giorgiogarrido6No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Survival Rates of Service Business - StudyDocument14 pagesSurvival Rates of Service Business - Studygiorgiogarrido6No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Arisaig Quarterly: The Great Disconnect I: Stocks and Economic ActivityDocument13 pagesArisaig Quarterly: The Great Disconnect I: Stocks and Economic Activitygiorgiogarrido6No ratings yet

- Value Investors Club - Post Holdings Inc (Post)Document11 pagesValue Investors Club - Post Holdings Inc (Post)giorgiogarrido6No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Rail RenaissanceDocument27 pagesRail RenaissanceEvan TindellNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDocument26 pagesLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Wp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101Document2 pagesWp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101giorgiogarrido6No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- A Valuation of ABB Comparison of Organic and M A Growth StrategiesDocument113 pagesA Valuation of ABB Comparison of Organic and M A Growth Strategiesgiorgiogarrido6No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Platform EconomicsDocument459 pagesPlatform Economicsgiorgiogarrido6100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Navigating Planet Ad Tech: A Guide For MarketersDocument10 pagesNavigating Planet Ad Tech: A Guide For Marketersgiorgiogarrido6No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 2013 06 Greenwald Earnings Power Value EPV Lecture SlidesDocument43 pages2013 06 Greenwald Earnings Power Value EPV Lecture Slidesgiorgiogarrido6No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The State of The LandscapeDocument5 pagesThe State of The Landscapegiorgiogarrido6No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- How To Model Reversion To The Mean - Determining How Fast, and To What Mean, Results RevertDocument26 pagesHow To Model Reversion To The Mean - Determining How Fast, and To What Mean, Results Revertpjs15No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Real Estate ModelDocument13 pagesReal Estate Modelgiorgiogarrido667% (3)

- Tourism DevelopmentDocument9 pagesTourism DevelopmentPhil JayveNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Working Capital ManagementDocument14 pagesWorking Capital ManagementRujuta ShahNo ratings yet

- Somendra Kumar MeenaDocument98 pagesSomendra Kumar MeenaSomendra Kumar MeenaNo ratings yet

- Money Making StrategiesDocument57 pagesMoney Making StrategiesJanus100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- FGV Acquisition Plan: Financial Analysis On IOI and KLKDocument48 pagesFGV Acquisition Plan: Financial Analysis On IOI and KLKAlexis ChooNo ratings yet

- The Business, Tax, and Financial EnvironmentsDocument38 pagesThe Business, Tax, and Financial EnvironmentsNaveed AhmadNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Advanced Finance, Banking and Insurance SamenvattingDocument50 pagesAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNo ratings yet

- Types of Portfolio ManagementDocument3 pagesTypes of Portfolio ManagementaartiNo ratings yet

- The Correct Answers Are in Bold TextDocument3 pagesThe Correct Answers Are in Bold TextMichael WilsonNo ratings yet

- Iron and Steel Industry: Economics AssignmentDocument10 pagesIron and Steel Industry: Economics Assignmentsamikshya choudhuryNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CIFE Study Notes: Certified Islamic Finance Executive ProgramDocument0 pagesCIFE Study Notes: Certified Islamic Finance Executive ProgramBabarKalamNo ratings yet

- Modeling and Agency ContractDocument3 pagesModeling and Agency ContractMysweethearts40% (5)

- Financial Ratio Calculator: Income StatementDocument18 pagesFinancial Ratio Calculator: Income StatementPriyal ShahNo ratings yet

- Tax Reform For Acceleration and Inclusion ActDocument6 pagesTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Oracle Financials Functional Modules Online TrainingDocument10 pagesOracle Financials Functional Modules Online TrainingEbs FinancialsNo ratings yet

- Data InterpretationDocument44 pagesData InterpretationSwati Choudhary100% (2)

- Insurance Broking BusinessDocument70 pagesInsurance Broking BusinessNevinJoy100% (3)

- Senior CapstoneDocument47 pagesSenior CapstonePa'oneakaiLee-Namakaeha0% (2)

- Circular Flow ModelDocument7 pagesCircular Flow ModelshaheenNo ratings yet

- MBA Accounting Project, A STUDY ON FINANCIAL PERFORMANCE OF SARAVANA STORES FOODS PRIVATE LIMITED., CHENNAI.Document52 pagesMBA Accounting Project, A STUDY ON FINANCIAL PERFORMANCE OF SARAVANA STORES FOODS PRIVATE LIMITED., CHENNAI.AbishRaghulGaneshRL100% (2)

- Comparative Analysis On Non Performing Assets ofDocument21 pagesComparative Analysis On Non Performing Assets ofanindya_kundu100% (1)

- Off Grid Industry Yearbook 2018Document310 pagesOff Grid Industry Yearbook 2018birlainNo ratings yet

- ICICI Project ReportDocument18 pagesICICI Project ReportTamanna RanaNo ratings yet

- Additional Case-Lets For Practice-April 17-RaoDocument13 pagesAdditional Case-Lets For Practice-April 17-RaoSankalp BhagatNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Cemex WayDocument10 pagesThe Cemex WayMfalme MugabunielaNo ratings yet

- Prospect EN, 0 PDFDocument586 pagesProspect EN, 0 PDFDragan BogdanNo ratings yet

- Risk Management Framework at DCB BankDocument10 pagesRisk Management Framework at DCB BankRavi KumarNo ratings yet

- PakistanDocument4 pagesPakistanAsif AliNo ratings yet

- Msci Indonesia Esg Leaders Index Usd GrossDocument3 pagesMsci Indonesia Esg Leaders Index Usd GrossputraNo ratings yet

- Empresas Familiares en PerúDocument38 pagesEmpresas Familiares en PerúSuperlucidoNo ratings yet

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)