Professional Documents

Culture Documents

Tire City Spreadsheet Solution

Uploaded by

almasy99Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tire City Spreadsheet Solution

Uploaded by

almasy99Copyright:

Available Formats

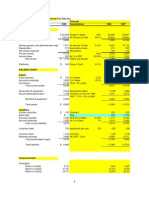

Exhibit 1

Financial Statements for Tire City, Inc. 1993 1994 1995

For years ending 12/31 INCOME STATEMENT Net sales Cost of sales Gross Profit

$ 16,230 9,430 6,800

$ 20,355 11,898 8,457 6,352 180 106 1,819 822 $ 997 $ 200

$ 23,505 13,612 9,893 7,471 213 94 2,115 925 $ 1,190 $ 240

Proportion of COGS to Sales 58.10% 58.45% Proportion of SGA to Sales 32.01% 31.21%

Selling, general, and administrative expenses5,195 Depreciation 160 Net interest expense 119 Pre-tax income 1,326 Income taxes 546 Net income $ 780 Dividends BALANCE SHEET Assets Cash balances Accounts receivable Inventories Total current assets Gross plant & equipment Accumulated depreciation Net plant & equipment Total assets Liabilities Current maturities Accounts payable Accrued expenses Total current liabilities Long-term debt Common stock Retained earnings Total shareholders' equity Total liabilities $ 155

Proportion of Income Taxes to Pre Tax Income 41.18% 45.19% Proportion of PAT paid as Dividends 19.87% 20.06%

508 2,545 1,630 4,683 3,232 1,335 1,897

609 3,095 1,838 5,542 3,795 1,515 2,280

706 3,652 2,190 6,548 4,163 1,728 2,435

Proportion of Cash to Sales 3.13% 2.99% Proportion of Account Receivables to Sales 15.68% 15.21%

$ 6,580

$ 7,822

$ 8,983

125 1,042 1,145 2,312 1,000 1,135 2,133 3,268

125 1,325 1,432 2,882 875 1,135 2,930 4,065

125 1,440 1,653 3,218 750 1,135 3,880 5,015

$ 6,580

$ 7,822

$ 8,983

Proportion of COGS to Sales 57.91% Proportion of SGA to Sales 31.78%

Average 58.16% Average 31.67%

Proportion of Income Taxes to Pre Tax Income Average 43.74% 43.37% Proportion of PAT paid as Dividends 20.17% Average 20.03%

Proportion of Cash to Sales 3.00%

Average 3.04%

Proportion of Account Receivables to Sales Average 15.54% 15.47%

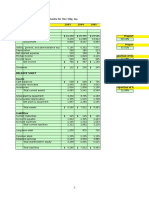

1993 Profitability Return on Sales Return on Capital Return on Equity Liquidity Current Ratio Quick Ratio Leverage Assets / Equity Debt / Total Capital Interest Coverage Activity Ratios Sales / Assets Days Receivable Days Inventory Days Payable Purchases 4.81% 18.28% 23.87%

1994 4.90% 20.18% 24.53%

1995 5.06% 20.64% 23.73%

2.03 1.32

1.92 1.29

2.03 1.35

2.01 26.36% 12.14

1.92 20.24% 18.16

1.79 15.18% 23.50

2.47 57.24 63.09 NA Data NA

2.60 55.50 56.39 39.95 12,106

2.62 56.71 58.72 37.64 13,964

In Thousands of Dollars INCOME STATEMENT Net Sales Cost of Sales Gross Profit Selling, General & Administrative Expenses Depreciation Net Interest Expense Pre Tax Income Income Taxes Net Income Dividends BALANCE SHEET ASSETS Cash Balances Accounts Receivables Inventories Total Current Assets ASSUMPTIONS 20% Growth Per Annum 58.2% of Sales 1996 28,206 16,416 11,790 1997 33,847 19,699 14,148

31.7% of Sales Assumption Given in the Case Reconciled

8,941 213 129 2,507 1,088 1,419 284 1996

10,730 Average Relationship with Sales 333 116 2,970 1,289 Average Tax Rate 1,681 336 Average Dividends Payout Ratio 1997 1,015 Average of Relationship with Sales 5,246 Average Realtionship with Sales 3,146 9,408 6,563 Increase in Dep 333

43.4% of PBT

20% of PAT

3% of Sales 15.5% of Sales Assumptions Given

846 4,372 1,625 6,843 6,163

Gross Plant & Equipment Assumptions Given Accumulated Depreciation 1996, Increase of $213 1997, Increase of $213 plus 5% of $2,400 Net Plant & Equipment Total Assets LIABILITIES Current Maturities Bank Debt Accounts Payable Accrued Expenses Total Current Liabilities Long Term Debt

1,941 4,222 11,065

2,274 4,289 13,697

Constant Balancing Figure 7% of Sales 7% of Sales

125 414 1,777 1,974 4,290 625

125 1,077 2,132 2,369 5,704 500 1,135 6,360 7,495 13,698

Decreases by $125

Common Stock Constant 1,135 Retained Earnings Beginning RE + PAT + Dividends 5,015 Total Shareholders Equity 6,150 Total Liabilities & Equity 11,065

nship with Sales

nds Payout Ratio

tionship with Sales nship with Sales

Total Depreciation for 1997 2,274

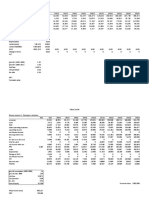

1996 Profitability Return on Sales Return on Capital Return on Equity Liquidity Current Ratio Quick Ratio Leverage Assets / Equity Debt / Total Capital Interest Coverage Activity Ratios Sales / Assets Days Receivable Days Inventory Days Payable Purchases 5.03% 22.85% 23.07%

1997 4.97% 22.47% 22.43%

1.59 1.22

1.65 1.10

1.80 11.07% 20.43

1.83 7.82% 26.60

2.55 56.58 36.13 40.92 15,851

2.47 56.58 58.29 34.07 22,845

You might also like

- Tire CityDocument5 pagesTire CitySudip BrahmacharyNo ratings yet

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdeNo ratings yet

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaNo ratings yet

- Tire City SolutionDocument2 pagesTire City Solutionadityaintouch60% (5)

- Tire City Spreadsheet SolutionDocument8 pagesTire City Spreadsheet SolutionsuwimolJNo ratings yet

- Tire City - WorksheetDocument3 pagesTire City - WorksheetBach CaoNo ratings yet

- Tire City AssignmentDocument6 pagesTire City AssignmentderronsNo ratings yet

- Tire City AssignmentDocument6 pagesTire City AssignmentXRiloXNo ratings yet

- Debt Policy at UST Inc.Document47 pagesDebt Policy at UST Inc.karthikk1990100% (2)

- Tire City IncDocument12 pagesTire City IncMahesh Kumar Meena100% (1)

- Tire City AssignmentDocument7 pagesTire City AssignmentShivam Kanojia100% (1)

- Tire City Inc. Case StudyDocument8 pagesTire City Inc. Case StudyKyeli TanNo ratings yet

- Tire City CaseDocument12 pagesTire City CaseAngela ThorntonNo ratings yet

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- 93-Tire-City 22 22Document26 pages93-Tire-City 22 22Daniel InfanteNo ratings yet

- Tire CityDocument3 pagesTire Cityrahulchohan2108No ratings yet

- Tire City CaseDocument14 pagesTire City CaseXRiloXNo ratings yet

- Tire City, Inc - Examen FinalDocument3 pagesTire City, Inc - Examen Finalmacro_jNo ratings yet

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Tire City SolutionDocument4 pagesTire City SolutionUmeshKumarNo ratings yet

- Tire City Case SolutionDocument6 pagesTire City Case SolutionShivam Bhasin60% (10)

- Tire City AnalysisDocument1 pageTire City AnalysisNikhil Kangutkar80% (10)

- NetScape ValuationDocument2 pagesNetScape Valuationmc1012No ratings yet

- Clarkson Lumber CompanyDocument6 pagesClarkson Lumber Companymehreen samiNo ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Case Analysis Toy WorldDocument11 pagesCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Group 3 - Clarkson Write UpDocument7 pagesGroup 3 - Clarkson Write UpCarlos Eduardo Ventura GonçalvesNo ratings yet

- Netscape CaseDocument6 pagesNetscape CaseVikram RathiNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionCharleneNo ratings yet

- Clarkson Lumber CompanyDocument6 pagesClarkson Lumber Companymalishka1025No ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNo ratings yet

- HBS Mercury CaseDocument4 pagesHBS Mercury CaseDavid Petru100% (1)

- Lady M CaseDocument8 pagesLady M CaseEvelyn MonzonNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Toy World, Inc. Case SolutionDocument23 pagesToy World, Inc. Case SolutionArjun Jayaprakash Thirukonda80% (5)

- Polar SportDocument4 pagesPolar SportKinnary Kinnu0% (2)

- Toy World CaseDocument9 pagesToy World Casedwchief100% (1)

- NetscapeDocument3 pagesNetscapeulix1985No ratings yet

- Pressco, IncDocument6 pagesPressco, Incrasmitamisra0% (1)

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersenkay12100% (3)

- Tire City Inc.Document6 pagesTire City Inc.Samta Singh YadavNo ratings yet

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293No ratings yet

- Butler Lumber - Pro Forma - Balance and Income StatementDocument4 pagesButler Lumber - Pro Forma - Balance and Income StatementJack Benjamin83% (6)

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandNo ratings yet

- Tire City Case Study SolutionDocument2 pagesTire City Case Study SolutionPrathap Sankar0% (1)

- ClarksonDocument2 pagesClarksonYang Pu100% (3)

- Lecture 6 Clarkson LumberDocument8 pagesLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- Sears Vs Wal-Mart Case ExhibitsDocument8 pagesSears Vs Wal-Mart Case ExhibitscharlietoneyNo ratings yet

- Tire RatiosDocument7 pagesTire Ratiospp pp100% (1)

- Sears Vs Walmart - v01Document37 pagesSears Vs Walmart - v01chansjoy100% (1)

- Woolworths Analyst Presentation Feb 2005Document45 pagesWoolworths Analyst Presentation Feb 2005rushabNo ratings yet

- Dell Working CapitalDocument12 pagesDell Working Capitalsankul50% (1)

- Swan-Davis Inc. (1) FinalDocument12 pagesSwan-Davis Inc. (1) FinalRomina Isa Losser100% (1)

- Rosario Acero S.A - LarryDocument12 pagesRosario Acero S.A - LarryStevano Rafael RobothNo ratings yet

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279No ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- Merrill Lynch - Assessing Cost of Capital and Performance 2015Document16 pagesMerrill Lynch - Assessing Cost of Capital and Performance 2015CommodityNo ratings yet

- ISE III December 2011Document16 pagesISE III December 2011sumio15No ratings yet

- ISE III Sample Paper 1 (With Answers)Document13 pagesISE III Sample Paper 1 (With Answers)BeaLorenzoNo ratings yet

- 2009 Valuation Handbook A UBS GuideDocument112 pages2009 Valuation Handbook A UBS Guidealmasy99100% (4)

- Example Marked Candidate Responses - IsE IIIDocument12 pagesExample Marked Candidate Responses - IsE IIIJuan Pedreno BernalNo ratings yet

- Vault-Finance Practice GuideDocument126 pagesVault-Finance Practice Guidealmasy99No ratings yet

- First Certificate Practice Tests Plus1 BookDocument212 pagesFirst Certificate Practice Tests Plus1 Bookalmasy9982% (11)

- 4.marketing Strategies To Increase Service QualityDocument15 pages4.marketing Strategies To Increase Service Qualityalmasy99No ratings yet

- 15.product Development ProcessDocument35 pages15.product Development Processalmasy99No ratings yet

- Anding StrategiesDocument14 pagesAnding Strategiesalmasy99100% (1)

- 8.deciding Which Markets To EnterDocument29 pages8.deciding Which Markets To Enteralmasy99100% (2)

- 13.categories That Effect The Consumer Buying Decision ProcessDocument20 pages13.categories That Effect The Consumer Buying Decision Processalmasy990% (1)

- 18.marketing ChannelsDocument42 pages18.marketing Channelsalmasy99No ratings yet

- 12.marketing ResearchDocument5 pages12.marketing Researchalmasy99No ratings yet

- 12.marketing ResearchDocument5 pages12.marketing Researchalmasy99No ratings yet

- Designing and Managing Integrated Marketing CommunicationsDocument26 pagesDesigning and Managing Integrated Marketing Communicationsalmasy99No ratings yet

- Product and Services StrategyDocument20 pagesProduct and Services Strategyalmasy99No ratings yet

- Valuing Biotech CompaniesDocument15 pagesValuing Biotech Companiesraja89No ratings yet

- 3.marketing PP 1st ClassDocument54 pages3.marketing PP 1st Classalmasy99No ratings yet

- 15.product Development ProcessDocument35 pages15.product Development Processalmasy99No ratings yet

- 18.marketing ChannelsDocument42 pages18.marketing Channelsalmasy99No ratings yet

- KH Growth Equity Fund - 2 PagerDocument2 pagesKH Growth Equity Fund - 2 Pageralmasy99No ratings yet

- Walmart ValuationDocument6 pagesWalmart Valuationalmasy99No ratings yet

- Walmart ValuationDocument6 pagesWalmart Valuationalmasy99No ratings yet

- The Impact of E-Commerce On Supply Chain RelationsDocument21 pagesThe Impact of E-Commerce On Supply Chain Relationsalmasy99No ratings yet

- Rewriting SentencesDocument7 pagesRewriting Sentencesalmasy990% (1)

- Competitive Strength Assessment For AppleDocument1 pageCompetitive Strength Assessment For Applealmasy99No ratings yet

- C6-Intercompany Inventory Transactions PDFDocument43 pagesC6-Intercompany Inventory Transactions PDFVico JulendiNo ratings yet

- Full Download Fundamentals of Corporate Finance Australian 3rd Edition Berk Solutions ManualDocument36 pagesFull Download Fundamentals of Corporate Finance Australian 3rd Edition Berk Solutions Manualhone.kyanize.gnjijj100% (37)

- ExercisestoPractice Chapters34Document2 pagesExercisestoPractice Chapters34JOSEPH MICHAEL MCGUINNESSNo ratings yet

- Irfan Rafiq 2476: Portfolio ManagementDocument87 pagesIrfan Rafiq 2476: Portfolio Managementirfan rafiq100% (2)

- Autopista Case Grupo 1Document32 pagesAutopista Case Grupo 1Amigos Al CougarNo ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Evaluating, Structuring and Restructuring A Private Equity InvestmentDocument44 pagesEvaluating, Structuring and Restructuring A Private Equity InvestmentMiguel Revilla100% (2)

- Acc Assignment 2 Hasan Ahmed 321600 Bese10ADocument9 pagesAcc Assignment 2 Hasan Ahmed 321600 Bese10AHasan AhmedNo ratings yet

- Working Capital Management: A Case Study of Hero Motocorp Pvt. LTDDocument7 pagesWorking Capital Management: A Case Study of Hero Motocorp Pvt. LTDaloksingh420aloksigh420No ratings yet

- Intermediate Accounting 3 Midterm Exam Answer KeyDocument9 pagesIntermediate Accounting 3 Midterm Exam Answer Keyshadowlord468No ratings yet

- Audit ProgramDocument16 pagesAudit Programanon_806011137100% (4)

- Case Study of Pakistan TelecommunicatioDocument45 pagesCase Study of Pakistan TelecommunicatioArshadal iqbalNo ratings yet

- Balance Sheet: As at March 31, 2022Document32 pagesBalance Sheet: As at March 31, 2022Ahire Ganesh Ravindra bs20b004No ratings yet

- SST Versus Solvency II - Comparison AnalysisDocument7 pagesSST Versus Solvency II - Comparison AnalysisXena WarriorNo ratings yet

- UST SpreadsheetDocument21 pagesUST SpreadsheetTUNo ratings yet

- Dwnload Full Marketing 14th Edition Kerin Test Bank PDFDocument14 pagesDwnload Full Marketing 14th Edition Kerin Test Bank PDFdalikifukiauj100% (9)

- Tolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFDocument1 pageTolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFAnbu jaromiaNo ratings yet

- FABM 1-Answer Sheet-Q1 - Summative TestDocument2 pagesFABM 1-Answer Sheet-Q1 - Summative TestFlorante De Leon100% (2)

- Activiity 2 Investment in AssociateDocument3 pagesActiviity 2 Investment in AssociateAldrin Cabangbang67% (3)

- Corporate Expansion and Accounting For Business Combination: Mcgraw-Hill/ IrwinDocument36 pagesCorporate Expansion and Accounting For Business Combination: Mcgraw-Hill/ IrwinYudhi SutanaNo ratings yet

- SEABANKDocument11 pagesSEABANKwidyasNo ratings yet

- MBA104 - Almario - Parco - Online Problem Solving 3 Online Quiz Exam 2Document13 pagesMBA104 - Almario - Parco - Online Problem Solving 3 Online Quiz Exam 2nicolaus copernicusNo ratings yet

- Chapter One 1.1 Background of The StudyDocument34 pagesChapter One 1.1 Background of The Studymubarek oumerNo ratings yet

- Financial Statement Analysis (Tenth Edition) Solution For CH - 07 PDFDocument50 pagesFinancial Statement Analysis (Tenth Edition) Solution For CH - 07 PDFPrince Angel75% (20)

- ReviewerDocument14 pagesReviewerLenard TaberdoNo ratings yet

- AAEL - PDD - Ver 05.5 - 2014 - 05 - 06 - TC - CleanDocument39 pagesAAEL - PDD - Ver 05.5 - 2014 - 05 - 06 - TC - CleanAnirudh AgarwallaNo ratings yet

- Lesson Title: Most Essential Learning Competencies (Melcs)Document9 pagesLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda TumbagaNo ratings yet

- Purefoods Financial Statements 2018-2021Document8 pagesPurefoods Financial Statements 2018-2021Kyle Denise Castillo VelascoNo ratings yet

- Financial Analysis of TATA STEELDocument105 pagesFinancial Analysis of TATA STEELRuta Vyas73% (11)

- Research Methods 2021Document44 pagesResearch Methods 2021DallendysheNo ratings yet