Professional Documents

Culture Documents

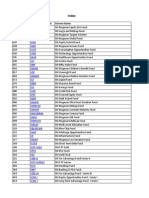

2007-2010 Banking Bar Questions

Uploaded by

Norhalisa Naga SalicCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007-2010 Banking Bar Questions

Uploaded by

Norhalisa Naga SalicCopyright:

Available Formats

1

2007-2010 BANKING LAWS BAR QUESTIONS 2007 X. (5%) Name at least five (5) predicate crimes to money laundering. Any five of the following are predicate crimes to money laundering: 1. (1) Kidnapping for ransom under Article 267 of Act No. 3815, otherwise known as the Revised Penal Code, as amended; 2. (2) Sections 3, 4, 5, 7, 8 and 9 of Article Two of Republic Act No. 6425, as amended, otherwise known as the Dangerous Drugs Act of 1972; 3. (3) Section 3 paragraphs B, C, E, G, H and I of Republic Act No. 3019, as amended, otherwise known as the Anti-Graft and Corrupt Practices Act; 4. (4) Plunder under Republic Act No. 7080, as amended; 5. (5) Robbery and extortion under Articles 294, 295, 296, 299, 300, 301 and 302 of the Revised Penal Code, as amended; 6. (6) Jueteng and Masiao punished as illegal gambling under Presidential Decree No. 1602; 7. (7) Piracy on the high seas under the Revised Penal Code, as amended and Presidential Decree No. 532; 8. (8) Qualified theft under Article 310 of the Revised Penal Code, as amended; 9. (9) Swindling under Article 315 of the Revised Penal Code, as amended; 10. (10) Smuggling under Republic Act Nos. 455 and 1937; 11. (11) Violations under Republic Act No. 8792, otherwise known as the Electronic Commerce Act of 2000; 12. (12) Hijacking and other violations under Republic Act No. 6235; destructive arson and murder, as defined under the Revised Penal Code, as amended, including those perpetrated by terrorists against non-combatant persons and similar targets; 13. (13) Fraudulent practices and other violations under Republic Act No. 8799, otherwise known as the Securities Regulation Code of 2000; 14. (14) Felonies or offenses of a similar nature that are punishable under the penal laws of other countries. 2009 True/False If the Ombudsman is convinced that there is a violation of law after investigating a complaint alleging illicit bank deposits of a public officer, the Ombudsman may order the bank concerned to allow in camera inspection of bank records and documents. False. The Bank Secrecy Law prohibits the inspection of a bank account unless the permission of the account holder is obtained, or upon lawful order of the court or when the deposit is the subject of litigation. Investigation by the Ombudsman is not considered as a pending litigation to allow the examination of the bank records and documents (Marquez v. Desierto, 359 SCRA 772, 2001) A bank under receivership can still grant new loans and accept new deposits. False. During the receivership, the assets and properties of the corporation are being gathered for conversion into cash in preparation for distribution to creditors. Granting new loans and accepting new deposits would constitute doing business for the bank in

the ordinary course of business which is contrary to the purpose and nature of a receivership proceeding. VIII. Maharlikang Pilipino Banking Corporation (MPBC) operates several branches of Maharlikang Pilipino Rural Bank in Eastern Visayas. Almost all the branch managers are close relatives of the members of the Board of Directors of the corporation. Many undeserving relatives of the branch managers were granted loans. In time, the branches could not settle their obligations to depositors and creditors. Receiving reports of these irregularities, the Supervising and Examining Department (SED) of the Monetary Board prepared a detailed report (SED Report) specifying the facts and the chronology of events relative to the problems that beset MPBC rural bank branches. The report concluded that the bank branches were unable to pay their liabilities as they fell due, and could not possibly continue in business without incurring substantial losses to its depositors and creditors. May the Monetary Board order the closure of the MPBC rural banks relying only on the SED Report, without need of an examination? Explain. (3%) Yes, Upon receipt of the report of the SED, the Monetary Board is authorized to take any of the actions enumerated under Sec. 30, RA 7653, otherwise known as the New Central Bank Act, leading to the receivership and liquidation of a bank or quasi-bank. There is no requirement that an examination be first conducted before a banking institution may be placed under receivership (Rural Bank of Buhi v. CA, 162 SCRA 288, 1988) If MPBC hires you as lawyer because the Monetary Board has forbidden it from carrying on its business due to its imminent insolvency, what action will you institute to question the Monetary Boards order? Explain. (3%) The order of the MB may be questioned on a petition for certiorari on the ground that the action taken was in excess of jurisdiction or with grave abuse of discretion amounting to lack or excess of jurisdiction. The petition of certiorari may only be filed by the stockholders of record representing the majority of the capital stock within 10 days from receipt by the board of directors of MPBC of the order directing receivership, liquidation or conservatorship (Sec. 30, par. 2, R.A. 7653) 2010 I. Briefly describe the following types of banks: (2% each) A. universal bank A universal bank is a commercial bank with two additional powers, namely: 1) the power of an investment house and 2) the power to invest in non-allied enterprises (Sec. 23, GBL of 2000) B. commercial bank A commercial bank is a bank that can: 1) accept drafts; 2) issue letters of credit; 3)discount and negotiate promissory notes, drafts, bills of exchange, and other evidence of debt; 4)accept or create demand deposits; 5) receive other types of deposits, as well as deposit substitutes; 6)buy and sell foreign exchange, as well as gold or silver bullion; 7) acquire marketable bonds and other debt securities; and 8) extend credit, subject to such rules promulgated by the Monetary Board (Sec. 29 of

GBL) C. thrift bank A thrift bank is one established as a savings and mortgage bank, a stock savings and loan association, or a private development bank, for the purpose of: 1)accumulating the savings of depositors and investing them in outlets determined by the Monetary Board as necessary in the furtherance of national economic objectives; 2)providing short term working capital, medium and long-term financing, to businesses engaged in agriculture, services, industry and housing and 3) chosen market and constituencies specially for small and medium enterprises and individuals. D. rural bank A rural bank is one established to provide credit facilities to farmers and merchants or their cooperatives and, in general, to the people of the rural communities (Sec. 3, RA 7353, The Rural Banks Act of 1992) E. cooperative bank A cooperative bank is organized under the Cooperative Code to provide financial and credit services to cooperatives. It may perform any or all the services offered by a rural bank, including the operation of a Foreign Currency Deposit Unit subject to certain conditions (Sec. 100, RA 6938, The Cooperative Code of the Philippines). II. A. How do you characterize the legal relationship between a commercial bank and its safety deposit box client? (2%) The relationship between a commercial bank and its safety deposit box client is that of a bailee and a bailor, the bailment being for hire and mutual benefit (Sia v. CA, 222 S 24 (1993); CA Agro-Industrial Development Corp v. CA, 219 SCRA 426, 1993) ALTERNATIVE ANSWER: The legal relationship of the bank and its safety deposit box client is that of lessor and lessee. B. Is a stipulation in the contract for the use of a safety deposit box relieving the bank of liability in connection with the use thereof valid? The stipulation relieving the bank of liability in connection with the use of the safety deposit box is void as it is against law and public policy (CA AgroIndustrial Development Corp. v CA supra) C. Differentiate bank deposits from deposit substitutes.(2%) Bank deposits are funds obtained by a bank from the public which are relent by such bank to its own borrowers. Deposits substitutes are alternative forms of obtaining funds from the public, other than deposits, through the issuance, endorsement, or acceptance of debt instruments for the own account of the borrower, for the purpose of relending or purchasing of receivables and other obligations. These instruments may include, but need not be limited to, bankers acceptances, promissory notes, participations, certificates of assignment and similar instruments with recourse and repurchase agreements (Sec. 95, RA No. 7653, The New Central Bank Act) D. Why are banks required to maintain reserves against their deposits and deposit substitutes? State one of three purposes for these reserves.

Any one of the following four (4) purposes for requiring banks to maintain reserves against their deposits and deposit substitutes will suffice: a. One of the purposes of the requirement to maintain bank reserves is to control the volume of money created by the credit operations of the banking system (Sec. 94 of NCBA) b. It is to enable the banks to answer any withdrawal; c. To help Government to finance its operation; d. To help the Government control money supply. XIV When OCCIDENTAL Bank folded up due to insolvency, Manuel had the following separate deposits in his name: P200,000 in savings deposit; P250,000 in time deposit; P50,000 in a current account; P1 million in a trust account; and P3 million in money market placement. Under the Philippine Deposit Insurance Corporation Act, how much could Manuel recover? Explain. Manuel can recover P500,000.00, because this is the total of his savings deposit, time deposit and current account (Sec. 4(g) of RA 3591, as amended) . The trust account and the money market placements are not included in the insured deposits (Sec. 4(f) of RA 3591). 2011 (14) Under the Anti-Money Laundering Law, a covered institution is required to maintain a system of verifying the true identity of their clients as well as persons purporting to act on behalf of (A) those doing business with such clients. (B) unknown principals. (C) the covered institution. (D) such clients. (34) A bank can be placed under receivership when, if allowed to continue in business, its depositors or creditors would incur (A) probable losses (B) inevitable losses (C) possible losses (D) a slight chance of losses (68) May a publicly listed universal bank own 100% of the voting stocks in another universal bank and in a commercial bank? (A) Yes, if with the permission of the Bangko Sentral ng Pilipinas. (B) No, since it has no power to invest in equities. (C) Yes, as there is no prohibition on it. (D) No, since under the law, the 100% ownership on voting stocks must be in either bank only.

You might also like

- Basic Finance-An Introduction To Financial Institutions Investments and Management 10th Edition Mayo Test BankDocument10 pagesBasic Finance-An Introduction To Financial Institutions Investments and Management 10th Edition Mayo Test BankRobinson MojicaNo ratings yet

- Mendoza Vs CA AmlcDocument3 pagesMendoza Vs CA AmlccyNo ratings yet

- Agra9-16compilation TanyagDocument64 pagesAgra9-16compilation TanyagMatthew Mossesgeld MortegaNo ratings yet

- Obli Con ReviewerDocument8 pagesObli Con ReviewerJohn Felix Morelos DoldolNo ratings yet

- 02 Antero Sison Jr. Vs Acting BIR Commissioner Ruben AnchetaDocument2 pages02 Antero Sison Jr. Vs Acting BIR Commissioner Ruben Anchetasunsetsailor85No ratings yet

- Heirs of Luis Bacus V CADocument7 pagesHeirs of Luis Bacus V CAElizabeth LotillaNo ratings yet

- G.R. No. L-56450 - Ganzon vs. InsertoDocument5 pagesG.R. No. L-56450 - Ganzon vs. InsertoseanNo ratings yet

- Tibajia v. CADocument2 pagesTibajia v. CALloyd David P. VicedoNo ratings yet

- Aurora Alcantara-Daus vs. Sps. HermosoDocument2 pagesAurora Alcantara-Daus vs. Sps. Hermosoamareia yapNo ratings yet

- 5 Ontimare vs. ElepDocument8 pages5 Ontimare vs. ElepChezca MargretNo ratings yet

- Distinctions Insurable Interest in Life v. PropertyDocument1 pageDistinctions Insurable Interest in Life v. Propertyjerico lopezNo ratings yet

- Psych Incap1Document3 pagesPsych Incap1Bee JusNo ratings yet

- CA upholds insurer's subrogation rights for unpaid goods destroyed in fireDocument5 pagesCA upholds insurer's subrogation rights for unpaid goods destroyed in fireKimberly SendinNo ratings yet

- Case DigestDocument3 pagesCase DigestMarc Justine BoralNo ratings yet

- Antonio Perla, Petitioner v. Mirasol Baring and Randy Perla, Respondents FactsDocument1 pageAntonio Perla, Petitioner v. Mirasol Baring and Randy Perla, Respondents FactsWhere Did Macky GallegoNo ratings yet

- DECHAVEZ - JOSEPHFERDINAND - Discipline of LawyersDocument93 pagesDECHAVEZ - JOSEPHFERDINAND - Discipline of Lawyers'Naif Sampaco PimpingNo ratings yet

- Marie-Gonzales v. Gotiong and Sanchez v. BueviajeDocument2 pagesMarie-Gonzales v. Gotiong and Sanchez v. BueviajeAna AltisoNo ratings yet

- Garcia vs Court of Appeals and Levy Hermanos vs Gervacio Case DigestDocument3 pagesGarcia vs Court of Appeals and Levy Hermanos vs Gervacio Case DigestShaira UntalanNo ratings yet

- Hermojina Estores Vs Spouses Arturo and Laura Supangan GR 175139Document17 pagesHermojina Estores Vs Spouses Arturo and Laura Supangan GR 175139chingdelrosarioNo ratings yet

- Bitanga v. Pyramid, G.R. 173526, 28 August 2008Document1 pageBitanga v. Pyramid, G.R. 173526, 28 August 2008Kim SimagalaNo ratings yet

- Bona Fides of The Vendor A Retro. It Must Appear That There Was A Belief On His PartDocument14 pagesBona Fides of The Vendor A Retro. It Must Appear That There Was A Belief On His PartKrizel BianoNo ratings yet

- Sps Bergonia V CADocument8 pagesSps Bergonia V CAyasuren2No ratings yet

- People v. NitchaDocument12 pagesPeople v. NitchaemyNo ratings yet

- Case No 3&8Document4 pagesCase No 3&8May ChanNo ratings yet

- Macasaet Vs Macasaet G.R. 154391 - 92 September 30, 2004Document3 pagesMacasaet Vs Macasaet G.R. 154391 - 92 September 30, 2004Rehina Mae MagtutoNo ratings yet

- Law Bank Secrecy Protect DepositsDocument3 pagesLaw Bank Secrecy Protect DepositsLuis CarreonNo ratings yet

- Facts:: Rule 66: Quo Warranto 1. Arquero vs. CA 2. Moro vs. Del CarmenDocument6 pagesFacts:: Rule 66: Quo Warranto 1. Arquero vs. CA 2. Moro vs. Del CarmencH3RrY1007No ratings yet

- Criminal Procedure SyllabusDocument2 pagesCriminal Procedure SyllabusAiyla AnonasNo ratings yet

- Executive Order 228 Streamlines Land Reform PaymentsDocument5 pagesExecutive Order 228 Streamlines Land Reform Paymentsgivemeasign24No ratings yet

- Joaquino Vs ReyesDocument2 pagesJoaquino Vs ReyesJoshua OuanoNo ratings yet

- Adoption and Support CasesDocument10 pagesAdoption and Support CasesMaria Cristina Falls ElizagaNo ratings yet

- Shortened Ruling For GR 169202Document1 pageShortened Ruling For GR 169202Ren PiñonNo ratings yet

- RA 7080 PlunderDocument19 pagesRA 7080 PlunderLuzenne JonesNo ratings yet

- Agustin vs. Edu, 88 SCRA 195Document1 pageAgustin vs. Edu, 88 SCRA 195k9 unit ro 1No ratings yet

- Cases 126-129Document3 pagesCases 126-129RZ ZamoraNo ratings yet

- 147315-1960-Heirs of Candelaria v. RomeroDocument3 pages147315-1960-Heirs of Candelaria v. RomeroJoshua ReyesNo ratings yet

- Domingo v. CA (G.R. No. 104818 September 17, 1993)Document12 pagesDomingo v. CA (G.R. No. 104818 September 17, 1993)Hershey Delos SantosNo ratings yet

- Employer-Employee Relationship CasesDocument190 pagesEmployer-Employee Relationship CasesEloisa Katrina MadambaNo ratings yet

- 1337840359fksu Amousp Ksa Cba 2012 FinalDocument35 pages1337840359fksu Amousp Ksa Cba 2012 FinalBojoNo ratings yet

- Practice QuestionsDocument22 pagesPractice Questionsalaynamangroo10No ratings yet

- Petitioner/s: Manila Prince Hotel (MPH) Respondent/s: Government Service Insurance System (GSIS) Manila HotelDocument6 pagesPetitioner/s: Manila Prince Hotel (MPH) Respondent/s: Government Service Insurance System (GSIS) Manila HotelMark Angelo Cabillo100% (1)

- 07 People v. GoDocument1 page07 People v. GoAnonymous bOncqbp8yiNo ratings yet

- Agra Quiz 2Document7 pagesAgra Quiz 2ashNo ratings yet

- Court of Appeals upholds private ownership over disputed landDocument3 pagesCourt of Appeals upholds private ownership over disputed landMarianne Shen Petilla100% (1)

- 2015 2016 Tax Case Digest PDFDocument114 pages2015 2016 Tax Case Digest PDFAnonymous CWcXthhZgxNo ratings yet

- COURT RULES JUDICIAL DEPOSIT INVALID WITHOUT PRIOR TENDER OF PAYMENTDocument3 pagesCOURT RULES JUDICIAL DEPOSIT INVALID WITHOUT PRIOR TENDER OF PAYMENTMac SorianoNo ratings yet

- Magellan Capital Management Corporation vs. Zosa, 355 SCRA 157 (2001)Document5 pagesMagellan Capital Management Corporation vs. Zosa, 355 SCRA 157 (2001)DNAA100% (1)

- Makati Stock Exchange vs. Campos G.R No. 138814 J April 16 J 2009Document1 pageMakati Stock Exchange vs. Campos G.R No. 138814 J April 16 J 2009Jefferson SombilloNo ratings yet

- Social Legislation TSNDocument6 pagesSocial Legislation TSNResci Angelli Rizada-NolascoNo ratings yet

- Francisco Vs Flores Case DigestDocument2 pagesFrancisco Vs Flores Case DigestEpalan Justine AngelicaNo ratings yet

- Legal Ethics of AgpaloDocument90 pagesLegal Ethics of AgpaloPatrick AmbagNo ratings yet

- Reyes V PearlbankDocument2 pagesReyes V PearlbankKrizzia GojarNo ratings yet

- Civrevdigests Midterms Dean Del CastilloDocument49 pagesCivrevdigests Midterms Dean Del CastilloPJezrael Arreza FrondozoNo ratings yet

- December Case DigestDocument12 pagesDecember Case DigestAnonymous IhmXvCHj3cNo ratings yet

- Lecture Notes On PartnershipDocument2 pagesLecture Notes On PartnershipSakuraCardCaptor100% (1)

- Venzon v. Atty. Peleo III, A.C. No. 9354, August 2019Document12 pagesVenzon v. Atty. Peleo III, A.C. No. 9354, August 2019Han SamNo ratings yet

- RA 7076 - Small Scale Mining ActDocument7 pagesRA 7076 - Small Scale Mining ActPaolo GonzalesNo ratings yet

- Osmena V PslamDocument4 pagesOsmena V PslamRose Mary G. Enano100% (1)

- Lim Tay vs. Court of AppealsDocument16 pagesLim Tay vs. Court of Appealscarl dianneNo ratings yet

- UP Law Center's 2010 Bar Exam Review in Mercantile LawDocument14 pagesUP Law Center's 2010 Bar Exam Review in Mercantile LawJaymih Santos AbasoloNo ratings yet

- Mohamed Assem Financial Managment AssignmentDocument10 pagesMohamed Assem Financial Managment AssignmenthananNo ratings yet

- Dokumen - Tips - Sap Financial Consolidation Starter Kit For Financial Sapidp012002523100003571162015eDocument75 pagesDokumen - Tips - Sap Financial Consolidation Starter Kit For Financial Sapidp012002523100003571162015eantonydonNo ratings yet

- HRC Handbook BBI 2012 - PDF - Financial Markets - BanksDocument46 pagesHRC Handbook BBI 2012 - PDF - Financial Markets - BankscewoxNo ratings yet

- GoharDocument329 pagesGoharStathis NteskosNo ratings yet

- The Relationship Between New Issue Markets and Stock ExchangeDocument10 pagesThe Relationship Between New Issue Markets and Stock Exchangeકાશ ઠક્કરNo ratings yet

- CH05Document13 pagesCH05林筱涵No ratings yet

- MULTIPLE-CHOICE QUESTIONS COVERING MONEY MARKETS AND BONDSDocument5 pagesMULTIPLE-CHOICE QUESTIONS COVERING MONEY MARKETS AND BONDSLê HiếuNo ratings yet

- Rates FO Training - Jan 21 2010Document9 pagesRates FO Training - Jan 21 2010agnihereNo ratings yet

- AC825 - 46C - Money Market - Foreign Exchage and DerivativesDocument379 pagesAC825 - 46C - Money Market - Foreign Exchage and DerivativesUmarah Furqan100% (1)

- IM Financial MarketsDocument50 pagesIM Financial MarketsJohanz Nicole SupelanaNo ratings yet

- Financial Market AnalysisDocument83 pagesFinancial Market AnalysisAlessandra ZannellaNo ratings yet

- Chapter 2Document10 pagesChapter 2Siddhartha PatraNo ratings yet

- Test 1 Maf653 Nov 2016 QnADocument10 pagesTest 1 Maf653 Nov 2016 QnAFakhrul Haziq Md FarisNo ratings yet

- CV JAMES SIBANDA BANKING FINANCE EXPERIENCEDocument5 pagesCV JAMES SIBANDA BANKING FINANCE EXPERIENCENixon Gomeya ChinkhwangwaNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument30 pagesThe Financial Market Environment: All Rights ReservedSajjad RavinNo ratings yet

- Financial SystemDocument36 pagesFinancial SystemSrikanth BalakrishnanNo ratings yet

- Certificate of DepositsDocument8 pagesCertificate of DepositsSweta SinghNo ratings yet

- Indian Financial SystemDocument75 pagesIndian Financial SystemVipul TandonNo ratings yet

- Financial Markets and ServicesDocument12 pagesFinancial Markets and Servicessrilekha thamalampudiNo ratings yet

- Debt InstrumentsDocument5 pagesDebt InstrumentsŚáńtőśh MőkáśhíNo ratings yet

- Regulatory Framework of Mutual Funds in IndiaDocument14 pagesRegulatory Framework of Mutual Funds in Indiaayushi guptaNo ratings yet

- Fin242 Chapter 1 Latest April 2021Document14 pagesFin242 Chapter 1 Latest April 2021laurenNo ratings yet

- All Schemes Monthly Portfolio - As On 31 August 2018Document759 pagesAll Schemes Monthly Portfolio - As On 31 August 2018brijsingNo ratings yet

- Call Money Market & T Bills 1Document37 pagesCall Money Market & T Bills 1Nishant MishraNo ratings yet

- Growth of Indian Mutual Funds IndustryDocument105 pagesGrowth of Indian Mutual Funds IndustryrahulprajapNo ratings yet

- Financial System of Bangladesh - An OverviewDocument11 pagesFinancial System of Bangladesh - An OverviewMD Hafizul Islam HafizNo ratings yet

- External Income Outsourcing (1) - 1Document100 pagesExternal Income Outsourcing (1) - 1kunal.gaud121103No ratings yet

- Class 02Document3 pagesClass 02Aasim Bin BakrNo ratings yet

- Group 8 - Investment Management - 704aDocument29 pagesGroup 8 - Investment Management - 704aJewelyn CioconNo ratings yet