Professional Documents

Culture Documents

Ahrpv0731f 2013-14

Uploaded by

Shiva KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ahrpv0731f 2013-14

Uploaded by

Shiva KumarCopyright:

Available Formats

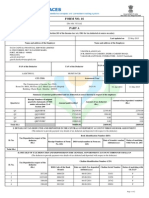

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary Certificate No. FDFMZYG Name and address of the Employer NTT DATA GLOBAL DELIVERY SERVICES LIMITED F-43, Basement, LAJPAT NAGAR II, New Delhi - 110024 Delhi +(91)11-28212877 thiyagarajan.damodaran@nttdata.com Last updated on Name and address of the Employee 17-May-

ALAGARSAMY ANNAMALAI CHITTIYAR VIJI ETHILI NO 84 SUNDARAPANDIAN STRE, BODINAYAKKANUR, THENI 625513 Tamilnadu

PAN of the Deductor

TAN of the Deductor

PAN of the Employee

Employee Reference No. provided by the Employer (If available)

AABCK7777J CIT (TDS) The Commissioner of Income Tax (TDS) Aayakar Bhawan, District Centre, 6th Floor Room no 610, Hall no. 4 , Luxmi Nagar, Delhi - 110092

DELM04995E Assessment Year

AHRPV0731F Period with the Employer From 2013-14 01-Apr-2012 To 31-Mar-2013

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee Receipt Numbers of original quarterly statements of TDS under sub-section (3) of Section 200 KNRXXCYA KNRXBSIG KNRXEARA KNRXGRHC Amount of tax deposited / remitted (Rs.)

Quarter(s)

Amount paid/credited

Amount of tax deducted (Rs.)

Q1 Q2 Q3 Q4 Total (Rs.)

60147.00 62306.00 39062.00 95489.00 257004.00

1084.00 998.00 667.00 4559.00 7308.00

1084.00 998.00 667.00 4559.00 7308.00

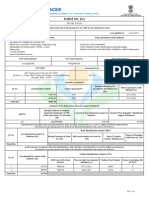

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT (The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee) Book Identification Number (BIN) Sl. No. Tax Deposited in respect of the deductee (Rs.) Receipt Numbers of Form No. 24G DDO serial number in Form no. 24G Date of transfer voucher Status of matching (dd/mm/yyyy) with Form no. 24G

Total (Rs.) II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN (The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee) Challan Identification Number (CIN) BSR Code of the Bank Branch 0510308 0510308 0510308 0510308 Date on which Tax deposited Challan Serial Number (dd/mm/yyyy) 04-05-2012 06-06-2012 05-07-2012 06-08-2012 01143 01500 00924 02208 Status of matching with OLTAS* F F F F

Sl. No.

Tax Deposited in respect of the deductee (Rs.) 423.00 330.00 331.00 332.00

1 2 3 4

Page 1 of 2

Certificate Number: FDFMZYG

TAN of Employer: DELM04995E

PAN of Employee: AHRPV0731F

Assessment Year: 2013-14

Sl. No.

Tax Deposited in respect of the deductee (Rs.) 333.00 333.00 334.00 333.00 1474.00 3085.00 7308.00

Challan Identification Number (CIN) BSR Code of the Bank Branch 0510308 0510308 0510308 0510308 0510308 0510308 Date on which Tax deposited Challan Serial Number (dd/mm/yyyy) 06-09-2012 04-10-2012 05-11-2012 05-12-2012 07-03-2013 05-04-2013 02091 01111 03828 03539 09378 01163 Status of matching with OLTAS* F F F F F F

5 6 7 8 9 10 Total (Rs.)

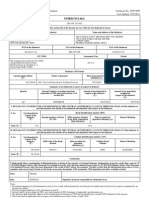

Verification

I, DAMODARAN THIYAGARAJAN, son / daughter of DAMODARAN working in the capacity of GROUP MANAGER FINANCE (designation) do hereby certify that a sum of Rs. 7308.00 [Rs. Seven Thousand Three Hundred and Eight Only (in words)] has been deducted and a sum of Rs. 7308.00 [Rs. Seven Thousand Three Hundred and Eight Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place Date

LAJPAT NAGAR 17-May-2013 (Signature of person responsible for deduction of Tax) Full Name: DAMODARAN THIYAGARAJAN

Designation: GROUP MANAGER FINANCE Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer. 2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details of tax deducted and deposited for all the quarters of the financial year. 3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee. 4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16 * Status of matching with OLTAS

Legend U P Description Unmatched Provisional Definition Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in bank match with details of deposit in TDS / TCS statement Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on verification of payment details submitted by Pay and Accounts Officer (PAO) In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government account have been verified by Pay & Accounts Officer (PAO) Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or makes new payment for excess amount claimed in the statement

Final

Overbooked

Signature Not Verified

Digitally signed by THIYAGARAJAN D Date: 2013.05.17 15:24:27 IST

Page 2 of 2

You might also like

- Form 16Document2 pagesForm 16SIVA100% (1)

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Form 16 and Salary DetailsDocument22 pagesForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryNo ratings yet

- FORM 16 TITLEDocument5 pagesFORM 16 TITLEPunitBeriNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Form 16 TDS certificate for FY 2014-15Document2 pagesForm 16 TDS certificate for FY 2014-15RamyaMeenakshiNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- TDS certificate details for employeeDocument2 pagesTDS certificate details for employeeravibhartia1978No ratings yet

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- TDS certificateDocument2 pagesTDS certificateMohammed MohieNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNo ratings yet

- Form 16 Salary CertificateDocument2 pagesForm 16 Salary CertificateGopal TrivediNo ratings yet

- Sungf9tIqDhAO64RjsPj Form16 PartADocument2 pagesSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHINo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument3 pagesFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNo ratings yet

- TdsDocument4 pagesTdsSahil SheikhNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Form 16A TDS Certificate DetailsDocument2 pagesForm 16A TDS Certificate DetailsKovidh GoyalNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Document2 pagesRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688No ratings yet

- Form No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)Document4 pagesForm No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)jay_yashwanteNo ratings yet

- MTC - 40Document14 pagesMTC - 40Anonymous eCUVunlzKaNo ratings yet

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDocument34 pagesI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- MONTHLY PERCENTAGE TAX RETURNDocument2 pagesMONTHLY PERCENTAGE TAX RETURNGeox SalasNo ratings yet

- Form 16 of ANIT SINGHDocument5 pagesForm 16 of ANIT SINGHAnit SinghNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999No ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Week-1 Mock Test Jan2012Document12 pagesWeek-1 Mock Test Jan2012Shiva KumarNo ratings yet

- Certified Sap HCM With 4+ Exp in Pa, PT, Om, PyDocument5 pagesCertified Sap HCM With 4+ Exp in Pa, PT, Om, PyShiva KumarNo ratings yet

- Introduction To HCM V2Document28 pagesIntroduction To HCM V2Shiva KumarNo ratings yet

- Unit 16 Part 2Document14 pagesUnit 16 Part 2Shiva KumarNo ratings yet

- Human Resources: Business BlueprintDocument55 pagesHuman Resources: Business BlueprintShiva KumarNo ratings yet

- 85854Document6 pages85854Shiva KumarNo ratings yet

- Week-1 Mock Test Jan2012Document12 pagesWeek-1 Mock Test Jan2012Shiva KumarNo ratings yet

- MIS Report1Document96 pagesMIS Report1Shiva KumarNo ratings yet

- Configure SAP HR: Define CompanyDocument30 pagesConfigure SAP HR: Define Companypraful12100% (1)

- Basic Guide To Models: Confidential. All Trademarks Appearing Herein Belong To Their Respective OwnersDocument20 pagesBasic Guide To Models: Confidential. All Trademarks Appearing Herein Belong To Their Respective OwnersShiva KumarNo ratings yet

- NAJRAJDocument138 pagesNAJRAJShiva KumarNo ratings yet

- Market SegmentationDocument14 pagesMarket SegmentationShiva KumarNo ratings yet

- Email Id of CompnayDocument1 pageEmail Id of CompnayShiva KumarNo ratings yet

- Cluster AnalysisDocument38 pagesCluster AnalysisShiva KumarNo ratings yet

- Introduction To SAS: Windows Display SystemDocument10 pagesIntroduction To SAS: Windows Display SystemShiva KumarNo ratings yet

- Input Datalines: / Program-1 To Find The Weight Loss Height LossDocument2 pagesInput Datalines: / Program-1 To Find The Weight Loss Height LossShiva KumarNo ratings yet

- DBMS & SQLDocument109 pagesDBMS & SQLShiva Kumar100% (1)

- SasDocument7 pagesSasMarsi BaniNo ratings yet

- Enterprise MinerDocument63 pagesEnterprise MinerShiva KumarNo ratings yet

- SsDocument5 pagesSsShiva KumarNo ratings yet

- 85854Document6 pages85854Shiva KumarNo ratings yet

- Human Resources: Business BlueprintDocument55 pagesHuman Resources: Business BlueprintShiva KumarNo ratings yet

- MB 51 Screen ShotsDocument8 pagesMB 51 Screen ShotsShiva KumarNo ratings yet

- Human Resources: Business BlueprintDocument55 pagesHuman Resources: Business BlueprintShiva KumarNo ratings yet

- Human Resources: Business BlueprintDocument55 pagesHuman Resources: Business BlueprintShiva KumarNo ratings yet

- VRV Asia Om&paDocument84 pagesVRV Asia Om&paShiva KumarNo ratings yet

- Taxation Law Review Syllabus January 10 2018 PDFDocument4 pagesTaxation Law Review Syllabus January 10 2018 PDFArs MoriendiNo ratings yet

- Five StagesDocument5 pagesFive StagessaifuddinNo ratings yet

- AIBEA - Know Your Service ConditionsDocument40 pagesAIBEA - Know Your Service ConditionsLvly AngelNo ratings yet

- PAS 41 Biological Assets GuideDocument7 pagesPAS 41 Biological Assets Guidejek vinNo ratings yet

- Anhui Expressway 2020 Interim Report HighlightsDocument102 pagesAnhui Expressway 2020 Interim Report HighlightsWinston MahNo ratings yet

- Mechanical Cash BuilderDocument29 pagesMechanical Cash BuilderMuhammad Ali100% (1)

- RA Manual 2015Document176 pagesRA Manual 2015anon_177396550No ratings yet

- SafeShop Business Plan PDFDocument16 pagesSafeShop Business Plan PDFkalchati yaminiNo ratings yet

- 3 Chapter 1Document13 pages3 Chapter 1nurzbiet8587No ratings yet

- Nolco QuizDocument5 pagesNolco QuizKendra LorinNo ratings yet

- Fra Cia 1Document13 pagesFra Cia 1RNo ratings yet

- Ace Institute of Management Bba 6 SemesterDocument93 pagesAce Institute of Management Bba 6 SemesterharshadaNo ratings yet

- Definition of PovertyDocument7 pagesDefinition of Povertyapi-259815497No ratings yet

- Ordinary V CapitalDocument26 pagesOrdinary V CapitalerwinNo ratings yet

- Ial Wac11 Oct19 MSDocument37 pagesIal Wac11 Oct19 MSsoren50% (2)

- PWC - PSAK 71 - Financial Instruments 2019Document40 pagesPWC - PSAK 71 - Financial Instruments 2019Aditya Barmen SaragihNo ratings yet

- AC 513 Expanded Syllabus (2012)Document24 pagesAC 513 Expanded Syllabus (2012)St Dalfour CebuNo ratings yet

- FinalDocument1,200 pagesFinalRahulNo ratings yet

- FS TypesDocument23 pagesFS TypesAnamika VermaNo ratings yet

- HW#9Document3 pagesHW#9Arod CaliberNo ratings yet

- Mileage Allowance Rates 2011Document2 pagesMileage Allowance Rates 2011Fuzzy_Wood_PersonNo ratings yet

- EITF Topic D-98Document18 pagesEITF Topic D-98Alycia SkousenNo ratings yet

- Deloitte Uk M and A Index q4 2015Document24 pagesDeloitte Uk M and A Index q4 2015lucindaNo ratings yet

- Delhi Metro - Research ReportDocument16 pagesDelhi Metro - Research Reportraamz89% (19)

- Financial FunctionsDocument7 pagesFinancial FunctionsRavi Kumar KamparaNo ratings yet

- Accounting and Financial Statement Analysis Notes PDFDocument58 pagesAccounting and Financial Statement Analysis Notes PDFyadgar ahmedNo ratings yet

- CSEC Study Guide - February 22, 2011Document11 pagesCSEC Study Guide - February 22, 2011ChantelleMorrisonNo ratings yet

- NAVDocument27 pagesNAVSai PrintersNo ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- CSSProfile GAA8GQL 3Document12 pagesCSSProfile GAA8GQL 3Aroush KhanNo ratings yet