Professional Documents

Culture Documents

Victorias Milling Vs Municipality of Victorias

Uploaded by

Ziazel ThereseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Victorias Milling Vs Municipality of Victorias

Uploaded by

Ziazel ThereseCopyright:

Available Formats

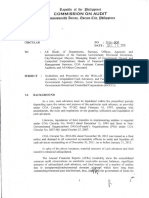

No. L-21183. September 27, 1968. VICTORIAS MILLING CO., INC., plaintiff-appellant, vs.

THE MUNICIPALITY OF VICTORIAS, PROVINCE OF NEGROS OCCIDENTAL, defendant-appellant. Municipal law; Taxation; Licenses; Authority to impose licenses; Kinds.Under the provisions of Section 1 of Commonwealth Act 472 and pertinent jurisprudence, a municipality is authorized to impose three kinds of licenses: (1) license for regulation of useful occupations or enterprises; (2) license for restriction or regulation of non-usef ul occupations or enterprises; and (3) license for revenue (Cf. Cu Unjieng v. Patstone, 42 Phil. 818). The first two easily fall within the broad police power granted under the general welfare clause (Sec, 2238, Rev. Adm. Code). The third class, however, is for revenue purposes. It is not a license fee, properly speaking, and yet it is generally so termed. It rests on the taxing power. That taxing power must be expressly conferred by statute upon the municipality (Sec. 2287, Rev. Adm. Code; Cu Unjieng v. Patstone, supra; People v. Felisarta, L-15346, June 29, 1962, etc.). Same; Concept of municipal license tax; Designation given does not decide whether the imposition is a license tax or a license fee; Determining factors.The use of the term "municipal license tax" does not necessarily connote the idea that the tax is imposed as a revenue measure in the guise of a license tax. For really, this runs counter to the declared purpose to make money. Besides, the term "license tax" has not acquired a fixed meaning. It is often "used indiscriminately to designate impositions exacted for the exercise of various privileges. In many instances, it refers to "revenue-raising exactions on privileges or activities". On the other hand, license fees are commonly called taxes. But legally speaking, the latter are "'for the purpose of raising revenues", in contrast to the f ormer which are imposed "in the exercise of the police power for purposes of regulation". (Compaia General de Tabacos de Filipinas v. City of Manila, L-16619, June 29, 1963.) Same; Percentage taxation; Doctrine of preemption; When not applicable.What can be said at most is that the national government has preempted the f ield of percentage taxation. Section 1 of C. A. 472, while granting municipalities power to levy taxes, expressly removes from them the power to exact "percentage taxes". It is correct to say that preemption in the matter of taxation simply refers to an instance where the national government elects to tax a particular area, impliedly withholding from the local government the delegated power to tax the same field. This doctrine primarily rests upon the intention of Congress. Conversely, should Congress allow municipal corporations to cover fields of taxation it already occupies, then the doctrine of preemption will not apply. In the case at bar, Section 4 (1) of C. A. 472 clearly and specifically allows municipal councils to tax persons engaged in "the same businesses or occupation" on which "fixed internal revenue privilege taxes" are "regularly imposed by the Government". Same; Ordinance No. 1, Series of 1956, held valid; Case at bar.In the case at bar, Ordinance No. 1 was approved by the municipality of Victorias on September 22, 1956 by way of an amendment to two municipal ordinances separately imposing license taxes on operators of sugar centrals and sugar ref ineries. The changes were: with respect to sugar centrals, by increasing the rates of license taxes; and so to sugar refineries, by increasing the rates of license taxes as well as the range of graduated schedule of annual output capacity. In the absence of sufficient proof that license taxes are unreasonable, the presumption of validity subsists. A cash sur-plus alone cannot stop a municipality from enacting a revenue ordinance increasing license taxes in anticipation of municipal needs. Discretion to determine the amount of revenue required for the needs of the municipality is lodged with the municipal authorities. Judicial intervention steps in only when there is a flagrant, oppressive and excessive abuse of power by said municipal authorities. Said Ordinance No. 1, series of 1956, is not discriminatory. The ordinance does not single out Victorias as the only object of the ordinance. Said ordinance is made to apply to any sugar central or

sugar refinery which may happen to operate in the municipality. So it is, that the fact that plaintiff is actually the sole operator of a sugar central and a sugar refinery does not make the ordinance discriminatory (Cf. also Shell Co. of P.I. v. Vao, 94 Phil. 389 and Ormoc Sugar Co., Inc. v. Mun. Board of Ormoc City, L-24322, July 21, 1967) We, accordingly, rule that Ordinance No. 1, series of 1956, of the Municipality of Victorias, was promulgated not in the exercise of the municipality's regulatory power but as a revenue measuretax on occupation or business. The authority to impose such tax is backed by the express grant of power in Section 1 of C.A. No. 472. Same; Double taxation; Description; Existence; Definition; Where no double taxation exists; Case at bar.Double taxation has been otherwise described as "direct duplicate taxation". For double taxation to exist, the same property must be taxed twice, when it should be taxed but once. Double taxation has been also def ined as taxing the same person twice by the same jurisdiction for the same thing (Cf. Manila Motor Co., Inc. v. Ciudad de Manila, 72 Phil. 336). In the case at bar, plaintiff's argument on double taxation does not inspire assent. First. The two taxes cover two different objects. Section 1 of the ordinance taxes a person operating sugar centrals or engaged in the manufacture of centrifugal sugar. While under Section 2, those taxed are the operators of sugar refinery mills. One occupation or business is different from the other. Second. The disputed taxes are imposed on occupation or business. Both taxes are not on sugar. The amount thereof depends on the annual output capacity of the mills concerned, regardless of the actual sugar milled. Plaintiff's argument perhaps could make out a point if the object of taxation here were the sugar it produces, not the business of producing it. APPEAL from a judgment of the Court of First Instance of Negros Occidental. De la Cruz, J. The facts are stated in the opinion of the Court. Hilado & Hilado for plaintiff-appellant. The Provincial Fiscal of Negros Occidental for defendant-appellant. SANCHEZ, J.: This case calls into question the validity of Ordinance No. 1, series of 1956, of the Municipality of Victorias, Negros Occidental. The disputed ordinance was approved by the municipal council of Victorias on September 22, 1956 by way of an amendment to two municipal ordinances separately imposing license taxes on operators of sugar centrals1 and sugar refineries.2 The changes were: with respect to sugar centrals, by increasing the rates of license taxes; and as to sugar refineries, by increasing the rates of license taxes as well as the range of graduated schedule of annual output capacity. Ordinance No. 13 is labeled "An Ordinance Amending Ordinance No. 25, Series of 1953 and Ordinance No. 18, Series of 1947 on Sugar Central by Increasing the Rates on Sugar Ref inery Mill by Increasing the Range of Graduated Schedule on Capacity Annual Output Respectively". It was, as the ordinance itself states, enacted pursuant to the taxing power conf erred by Commonwealth Act 472. By Section 1 of the Ordinance: "Any person, corporation or other forms of companies, operating sugar central or engage[d] in the manufacture of centrifugal sugar shall be required to pay the f ollowing annual municipal license tax, payable quarterly, to wit: x x x". Section 1 referred to prescribes a wide range of schedule. It starts with a sugar central with mill having an annual output capacity of not less than 50,000 piculs of centrifugal sugar, in which case an annual municipal license tax of P1,000.00 is provided. Depending upon the annual output capacity the schedule of taxes continues with P2,000.00 progressively upward in twelve other grades until an output capacity of 1,500,001 piculs or more shall have been reached. For this, the annual tax is P40,000.00. The tax on sugar ref ineries is likewise calibrated with similar rates. It also starts with P1,000.00 for a refinery with mill having an annual output capacity of not less than 25,000 bags of 100 Ibs. of refined sugar. Then, it continues with the second bracket of from 25,001 bags to 75,000 bags of 100 Ibs. Here, the municipal license tax is

P1,500.00. Then follow the other rates in the graduated scale with the ceiling placed at a capacity of 1,750,001 bags or more. The annual municipal license tax f or the last mentioned output capacity is P40,000.00. Of importance are the provisions of Section 1(m) relating to sugar centrals and Section 2(m) covering sugar refineries with specific reference to the maximum annual license tax, viz: "SECTION No. 1Any person, corporation or other forms of Companies, operating Sugar Central or engage[d] in the manufacture of centrifugal sugar shall be required to pay the following annual municipal license tax, payable quarterly, to wit: x x x (m) Sugar Central with mill having a capacity of producing an annual output of from 1,500,001 piculs or more shall be required to pay an annual municipal license tax off 40,000.00. "SECTION No. 2Any person, corporation or other forms of Companies shall be required to pay an annual municipal license tax for the operation of Sugar Refinery Mill at the following rates: x x x (m) Sugar Refinery with mill having a capacity of producing an annual output of from 1,750,001 bags of 100 Ibs. or more shall be required to pay an annual municipal license tax ofP40,000.00", For, the production of plaintiff Victorias Milling Co., Inc. in both its sugar central and its sugar refinery located in the Municipality of Victorias comes within these items in the schedule. Plaintiff filed suit below4 to ask for judgment declaring Ordinance No. 1, series of 1956, null and void; ordering the ref und of all license taxes paid and to be paid under protest; directing the officials of Victorias and the Province of Negros Occidental to observe, during the pendency of the action, the provisions of section 357 of the Revised Manual of Instructions to Treasurers of Provinces, Cities and Municipalities, 1954 edition,5 regarding the treatment of license taxes paid under protest by virtue of a disputed ordinance; and other reliefs.6 The reasons put forth by plaintiff are that: (a) the ordinance exceeds the amounts fixed in Provincial Circular 12-A issued by the Finance Department on February 27, 1940; (b) it is discriminatory since it singles out plaintiff which is the only operator of a sugar central and a sugar refinery within the jurisdiction of defendant municipality; (c) it constitutes double taxation; and (d) the national government has preempted the field of taxation with respect to sugar centrals or refineries. Upon the complaint as supplemented and amended, and the answer thereto, and following hearing on the merits, the trial court rendered its judgment. After declaring that "[t]here is no doubt that" the ordinance in question "refers to license taxes or fees", and that "[i]t is settled that a license tax should be limited to the cost of licensing, regulating and surveillance",7 the trial court ruled that said license taxes in dispute are unreasonable,8 and held that: "If the defendant has the power to tax the plaintiff for purposes of revenue, it may do so by proper municipal legislation, but not in the guise of a license tax".9 The court added: "The Court is not, however, prepared to order the refund of all the license taxes paid by the plaintiff under protest and amounting, up to the second quarter of 1960, to P280,000.00, considering that the plaintiff appears to have agreed to the payment of the license taxes at the rates fixed prior to Ordinance No. 1, series of 1956; that the defendant had evidently not complied with the provisions of Section 357 of the Revised Manual of Instructions to Treasurers of Provinces, Cities and Municipalities, 1954 Edition, as the plaintiff herein seeks an order enjoining the defendant and its appropriate officials to carry out said provisions; that the financial position of the defendant would surely be disrupted if ordered to refund, while the plaintiff may perhaps easily forego or forget what it had already parted with".10 It disposes of the suit in the following manner: "WHEREFORE, judgment is rendered (a) declaring that Ordinance No. 1, series of 1956, of the municipality of Victorias, Negros Occidental, is invalid; (b) ordering all officials of the defendant to observe the provisions of Section 357 of the Revised Manual of Instructions to Treasurers of Provinces, Cities and Municipalities, 1954 Edition, with particular reference to any license taxes paid by the plaintiff under said Ordinance No. 1, series of 1956, after notice of this decision; and (c) ordering the

defendant to refund to the plaintiff any and all such license taxes paid under protest after notice of this decision".11 Both plaintiff and defendant appealed direct to this Court. Plaintiff questions that portion of the decision denying the refund of the license taxes paid under protest in the amount of P280,000 covering the period from the first quarter of 1957 to the second quarter of 1960; and balked at the court's order limiting refund to "any and all such license taxes paid under protest after notice of this decision". Defendant, upon the other hand, challenges the correctness of the court's decision invalidating Ordinance No. 1, series of 1956. The questions raised in the appeals will be discussed in their proper sequence. 1. We first grapple with the threshold question: Was Ordinance No. 1, series of 1956, passed by defendant's municipal council as a regulatory enactment or as a revenue measure? The trial court says, and plaintiff seconds, that the amounts set forth in the ordinance in question did exceed the cost of licensing, regulating and surveillance, and that defendant cannot impose a taxfor revenuein the guise of a police or a regulatory measure. Our finding, however, is the other way. The ordinance itself recites that its source of taxing power emanates from Commonwealth Act 472, Section 1 of which reads: "SECTION 1. A municipal council or municipal district council shall have authority to impose municipal license taxes upon persons engaged in any occupation or business, or exercising privileges in the municipality or municipal district, by requiring them to secure licenses at rates f ixed by the municipal council, or municipal district council, and to collect fees and charges for services rendered by the municipality or municipal district and shall otherwise have power to levy for public local purposes, and for school purposes, including teachers' salaries, just and uniform taxes other than percentage taxes and taxes on specified articles". Under the statute just quoted and pertinent jurisprudence, a municipality is authorized to impose three kinds of licenses: (1) license for regulation of useful occupations or enterprises; (2) license for restriction or regulation of non-useful occupations or enterprises; and (3) license for revenue.12 The first two easily fall within the broad police power granted under the general welfare clause.13 The third class, however, is for revenue purposes. It is not a license fee, properly speaking, and yet it is generally so termed. It rests on the taxing power. That taxing power must be expressly conferred by statute upon the municipality,14 It is so granted under Commonwealth Act 472. To be recalled at this point is that Ordinance No. 1, series of 1956, is but an amendment of Ordinance No. 18, series of 1947, in reference to refineries, and Ordinance No. 25, series of 1953, covering sugar centrals. Ordinance No. 18 imposes "municipal taxes on persons, firms or corporations operating refinery mills in this municipality".15 Ordinance No. 25 speaks of municipal taxes "relative to the output of the sugar centrals".16 What are these taxes for? Resolution No. 60 of the municipal council of Victorias,17 adopted also on September 22, 1956 in conjunction with Ordinance No. 1, series of 1956, furnishes a ready answer. It reads in part: "WHEREAS, the Municipal Treasurer informed the Municipal Council of the revenue of the Municipality and the heavy obligations which confront it because of the implementation of Minimum Wage Law on the salaries and wages it pays to its municipal employees and laborers thus greatly draining the Municipal Treasury; WHEREAS, this local administration is committed to the plan of ameliorating the deplorable situation existing in the barrios, sitios and rural areas by giving them essential and necessary facilities calculated to improve conditions thereat thru improvements of roads and feeder roads; WHEREAS. one of the causes of the municipality's financial difficulty is low rates of municipal taxes imposed by some of the ordinances enacted by the local legislative body; WHEREAS, [in] x x x the ordinances known as Ordinance No. 25, Series of 1953, dealing on the operation of Sugar Central, and Ordinance No. 18, Series of 1947, which exclusively deals with the

operation of Sugar Refinery Mill, the rates so given are rates suggested and determined by the Provincial Circular No. 12-A, dated February 27, 1940 issued by the Department of Finance as regards to Sugar Centrals; WHEREAS, the Municipal Council has come to the conclusion that the rates provided for in such ordinances are no longer adequate if made in keeping with the present high cost of living; WHEREAS, the Municipal Council has also taken cognizance of the fact that the price of sugar per picul today is more than twice its pre-war average price; x x x".18 Given the purposes just mentioned, we find no warrant in logic to give our assent to the view that the ordinance in question is solely for regulatory purpose. Plain is the meaning conveyed. The ordinance is for raising money. To say otherwise is to misread the purpose of the ordinance. We should not hang so heavy a meaning on the use of the term "municipal license tax". This does not necessarily connote the idea that the tax is imposedas the lower court would want itto mean a revenue measure in the guise of a license tax. For really, this runs counter to the declared purpose to make money. Besides, the term "license tax" has not acquired a fixed meaning. It is often "used indiscriminately to designate impositions exacted for the exercise of various privileges".19 It does not refer solely to a license for regulation. In many instances, it refers to "revenue-raising exactions on privileges or activities".20 On the other hand, license fees are commonly called taxes. But, legally speaking, the latter are "for the purpose of raising revenues", in contrast to the former which are imposed "in the exercise of police power for purposes of regulation".21 We accordingly say that the designation given by the municipal authorities does not decide whether the imposition is properly a license tax or a license fee. The determining factors are the purpose and effect of the imposition as may be apparent from the provisions of the ordinance.22 Thus, "[w]hen no police inspection, supervision, or regulation is provided, nor any standard set for the applicant23 to establish, or that he agrees to attain or maintain, but any and all persons engaged in the business designated, without qualif fication or hindrance, may come, and a license on payment of the, stipulated sum will issue, to do business, subject to no prescribed rule of conduct and under no guardian eye, but according to the unrestrained judgment or fancy of the applicant and licensee, the presumption is strong that the power of taxation, and not the police power, is being exercised."24 Precisely because of these considerations the present imposition must be treated as a levy for revenue purposes. A quick glance at the big amount of maximum annual tax set forth in the ordinance, P40,000.00 for sugar centrals, and P40,000.00 for sugar refineries, will readily convince one that the tax is really a revenue tax. And then, we read in the ordinance nothing which would as much as indicate that the tax imposed is merely for police inspection, supervision or regulation. Our view that the tax imposed by the ordinance is for revenue purposes finds support in judicial pronouncements which have gained foothold in this jurisdiction. In Standard Vacuum vs. Antigua,25 this Court had occasion to pass upon a similar ordinance. In categorical terms, we there stated: "We are satisfied that the graduated license tax imposed by the ordinance in question is an occupation tax, imposed not under the police or regulatory power of the municipality but by virtue of its taxing power for purposes of revenue, and is in accordance with the last part of Section 1 of Commonwealth Act No. 472. It is, therefore, valid".26 The present case is not to be analogized with Panaligan vs. City of Tacloban cited in the decision below.27 For there, the inspection fee sought to be collectedupon every head of specified animals to be transported out of the City of Tacloban (P2.00 per hog, P10.00 per cow and P20.00 per carabao) was in reality an export tax specifically withheld from municipal taxing power under Section 2287 of the Revised Administrative Code. So also do we say that the cases of Pacific Commercial Co. vs. Romualdez,28 Lacson vs. City of Bacolod,29 and Santos vs. Municipal Government of Caloocan,30 used by plaintiff as references, are entirely inopposite. In Pacific Commercial, the tax involvedon frozen meatwas nullified because

tax measures on cold stores were not then within the legislative grant to the City of Manila. In Lacson, the City of Bacolod taxed every admission ticket sold in the moviehouses. And justification for this imposition was moored to the general welfare clause of the city charter, This Court held the ordinance ultra vires for the reason that the authority to tax cannot be derived from the general welfare clause. In Santos, the taxes in controversy were internal organs f ees, meat inspection f ees and corral f ees, separate f rom the slaughter or slaughterhouse fees. In annulling the taxes there questioned, this Court declared: "[W]hen the Council ordained the payment of internal organs fees, meat inspection fees and corral f ees, aside f rom the slaughter or slaughterhouse f ees, it overstepped the limits of its statutory grant [Sec. 1, C.A. 655]. Only one fee was allowed by that law to be charged and that was slaughter or slaughterhouse fees". In the cases cited then, the tax ordinances did not find plain and clear statutory prop. Such infirmity is not present here. We, accordingly, rule that Ordinance No. 1, series of 1956, of the Municipality of Victorias, was promulgated not in the exercise of the municipality's regulatory power but as a revenue measurea tax on occupation or business. The authority to impose such tax is backed by the express grant of power in Section 1 of Commonwealth Act 472. 2. Not that the disputed ordinance lacks the imprimatur of the Secretary of Finance required in paragraph 2, Section 4, of Commonwealth Act 472. This legal provision necessitates such approval "whenever the rate of fixed municipal license taxes on businesses not excepted in this Act or otherwise covered by the preceding paragraph and subject to the fixed annual tax imposed in section one hundred eighty-two of the National Internal Revenue Law, is in excess of fifty pesos per annum; x x x". The ordinance here challenged was recommended by the Provincial Board of Negros Occidental in its resolution (No. 1864) of October 26, 1956.31 And, the Undersecretary of Finance in his letter to the municipal council of Victorias on December 18, 1956 approved said ordinance. But considering that it is amendatory in nature, that approval was coupled with the mandate that the ordinance "should take effect at the beginning of the ensuing calendar year [1957] pursuant to Section 2309 of the Revised Administrative Code."32 3. Plaintiff argues that the municipality is bereft of authority to enact the ordinance in question because the national government "had preempted it from entering the field of taxation of sugar centrals and sugar refineries".33 Plaintiff seeks refuge in Section 189 of the National Internal Revenue Code which subjects proprietors or operators of sugar centrals or sugar refineries to percentage tax. The implausibility of this position is at once apparent, We are not dealing here with percentage tax. Rather, we are concerned with a tax specif ically f or operators of sugar centrals and sugar refineries. The rates imposed are based on the maximum annual output capacity. Which is not a percentage. Because it is not a share. Nor is it a tax based on the amount of the proceeds realized out of the sale of sugar, centrifugal or refined.34 What can be said at most is that the national government has preempted the field of percentage taxation. Section 1 of Commonwealth Act 472, while granting municipalities power to levy taxes, expressly removes from them the power to exact "percentage taxes". It is correct to say that preemption in the matter of taxation simply refers to an instance where the national government elects to tax a particular area, impliedly withholding from the local government the delegated power to tax the same field. This doctrine primarily rests upon the intention of Congress.35 Conversely, should Congress allow municipal corporations to cover fields of taxation it already occupies, then the doctrine of preemption will not apply. In the case at bar, Section 4(1) of Commonwealth Act 472 clearly and specifically allows municipal councils to tax persons engaged in "the same businesses or occupation" on which "f ixed internal revenue privilege taxes" are "regularly imposed by the National Government". With certain exceptions specified in Section 3 of the same statute. Our case does not fall within the exceptions. It would therefore be futile to argue that Congress exclusively reserved to the national government the right to

impose the disputed taxes. We rule that there is no preemption. 4. Petitioner advances the theory that the ordinance is excessive. An ordinance carries with it the presumption of validity. The question of reasonableness though is open to judicial inquiry. Much should be left thus to the discretion of municipal authorities. Courts will go slow in writing off an ordinance as unreasonable unless the amount is so excessive as to be prohibitive, arbitrary, unreasonable, oppressive, or conf iscatory.36 A rule which has gained acceptance is that factors relevant to such an inquiry are the municipal conditions as a whole and the nature of the business made subject to imposition.37 Plaintif f has however not suf f iciently proven that, taking these factors together, the license taxes are unreasonable. The presumption of validity subsists. For, plaintiff has limited itself to insisting that the amounts levied exceed the cost of regulation and that the municipality has adequate funds for the alleged purposes as evidenced by the municipality's cash surplus for the fiscal year ending 1956. The cost of regulation cannot be taken as a gauge, if the municipality really intended to enact a revenue ordinance. For, "if the charge exceeds the expense of issuance of a license and costs of regulation, it is a tax".38 And if it is, and it is validly imposed, as in this case, "the rule that license fees for regulation must bear a reasonable relation to the expense of the regulation has no application".39 And then, a cash surplus alone cannot stop a municipality from enacting a revenue ordinance increasing license taxes in anticipation of municipal needs. Discretion to determine the amount of revenue required for the needs of the municipality is lodged with the municipal authorities. Again, judicial intervention steps in only when there is a flagrant, oppressive and excessive abuse of power by said municipal authorities.40 Not that defendant municipality was without reason. On February 27, 1940, the Secretary of Finance, later President, Manuel A. Roxas, issued Provincial Circular 12-A. In that circular, the then Finance Secretary stated that his "Department has reached the conclusion that a tax on the basis of one centavo f or every picul of annual output capacity of sugar centrals x x x would be just and reasonable". At that time, the price of sugar was around P6.00 per picul. Sixteen years later1956when Ordinance No. 1 was approved, the market quotation for export sugar ranged from P12.000 to P15.00 per picul.41 And yet, since then the rate per output capacity of a sugar central in Ordinance No. 1 was merely from one centavo to two centavos. There is a statement in the municipality's brief ,42 that thereafter the price of sugar had never gone below P16.00 per picul; instead it had gone up. The reasonableness of the ordinance may not be disputed. It is not confiscatory. There was misapprehension in the decision below in its statement that the increase of rates for refineries was 2,000%. We should not overlook the fact that the original maximum rate covering refineries in Ordinance No. 18, series of 1947, was P2,000.00; but that was only for a refinery with an output capacity of 90,000 or more sacks. Under Section 2(c) of Ordinance No. 1, series of 1956, where the refineries have an output capacity of from 75,-001 bags to 100,000 bags, the tax remains at P2,000.00. From here on, the ordinance provides for ten more scales for the graduation of the tax depending upon the output capacity (P3,000.00, P4,000.00, P5,000.00, P10,000.00, P15,000.00, P20,000.00, P25,000.00, P30,000.00, P35,000.00 and P40,000.00). But it is only where a refinery has an output capacity of 1,750,001 or more bags that the present ordinance imposes a tax of P40,000.00. The happenstance that plaintiff's refinery is in the last bracket calling upon it to pay P40,000.00 per annum does not make the ordinance in question unreasonable. Neither may we tag the ordinance with excessiveness if we consider the capital invested by plaintiff in both its sugar central and sugar refinery and its annual income from both. Plaintiff's capital investment in the sugar central and sugar refinery is more or less P26,000,000.00.43 And here are its annual net income: for the year 1956P3,852,910; for the year 1957P3,854,520; for the year 1958 P7,230,493; for the year 1959f 5,951,187; and for the year 1960P7,809,250.44 If these figures mean anything at all, they show that the ordinance in question is neither confiscatory nor unjust and

unreasonable. 5. Upon the averment that in the Municipality of Victorias plaintiff is the only operator of a sugar central and sugar refinery, plaintiff now presses its argument that Ordinance No. 1, series of 1956, is discriminatory. The ordinance does not single out Victorias as the only object of the ordinance. Said ordinance is made to apply to any sugar central or sugar refinery which may happen to operate in the municipality. So it is, that the fact that plaintiff is actually the sole operator of a sugar central and a sugar ref inery does not make the ordinance discriminatory. Argument along the same lines was rejected in Shell Co. of P.I., Ltd. vs. Vao,45 this Court holding that the circumstance "that there is no other person in the locality who exercises" the occupation designated as installation manager "does not make the ordinance discriminatory and hostile, inasmuch as it is and will be applicable to any person or f irm who exercises such calling or occupation", And in Ormoc Sugar Company, Inc. vs. Municipal Board of Ormoc City,46 declaratory relief was sought to test the validity of a municipal ordinance which provides a city tax of twenty centavos per picul of centrifugal sugar and one per centum on the gross sale of its derivatives and by-products "produced by the Ormoc Sugar Company, Incorporated, or by any other sugar mill in Ormoc City". Mr. Justice Enrique Fernando, delivering the opinion of this Court, declared that the ordinance did not suffer "from a constitutional or statutory infirmity". And yet, in Ormoc, it is to be observed that Section 1 of the ordinance spelled out Ormoc Sugar Company, Incorporated specifically by name.. Not even the name of plaintiff herein was ever mentioned in the ordinance now disputed. No discrimination exists. 6. As infirm is plaintiff's stand that its business is not confined to the Municipality of Victorias. It suffices that plantiff engages in a business or occupation subject to an exaction by the municipality within the territorial boundaries of that municipality. Plaintiff's sugar central and sugar refinery are located within the Municipality of Victorias. In this central and refinery, plaintiff manufactures centrifugal sugar and refined sugar, respectively. But plaintiff insists that plaintiff's sugar milling and refining operations are not wholly performed within the territorial limits of Victorias. According to plaintiff, transportation of canes from plantation to the mill site, operation and maintenance of telephone system, inspection of crop progress and other related activities, are conducted not only in defendant's municipality but also in the municipalities of Cadiz, Manapla, Sagay and Saravia as well.47 We fail to see the relevance of these facts. Because, if we follow plaintiff's ratiocination, neither Victorias nor any of the municipalities just adverted to would be able to impose the tax. One thing certain, of course, is that the tax is imposed upon the business of operating a sugar central and a sugar refinery. And the situs of that business is precisely the Municipality of Victorias. 7. Plaintiff finally impleads double taxation, Its reason is that in computing the amount of taxes to be paid by the sugar refinery the cost of the raw sugar coming from the sugar central is not deducted; ergo, plaintiff is taxed twice on the raw sugar. Double taxation has been otherwise described as "direct duplicate taxation".48 For double taxation to exist, "the same property must be taxed twice, when it should be taxed but once".49 Double taxation has also been "defined as taxing the same person twice by the same jurisdiction for the same thing".50 As stated in Manila Motor Company, Inc. vs. Ciudad de Manila,51 there is double taxation "cuando la misma propiedad se sujeta a dos impuestos por la misma entidad o Gobierno, para el mismo fin y durante el mismo periodo de tiempo". With the foregoing precepts in mind, we find no difficulty in saying that plaintiff s argument on double taxation does not inspire assent. First. The two taxes cover two different objects. Section 1 of the ordinance taxes a person operating sugar centrals or engaged in the manufacture of centrifugal sugar. While under Section 2, those taxed are the operators of sugar refinery mills. One occupation or business is different from the other. Second. The disputed taxes are imposed on occupation or business. Both taxes are not on sugar. The amount thereof depends on the annual output capacity of the mills

concerned, regardless of the actual sugar milled. Plaintiff's argument perhaps could make out a point if the object of taxation here were the sugar it produces, not the business of producing it. There is no double taxation. For the reasons given The judgment under review is hereby reversed; and Judgment is hereby rendered: (a) declaring valid and subsisting Ordinance No. 1, series of 1956, of the Municipality of Victorias, Province of Negros Occidental; and (b) dismissing plaintiff's complaint as supplemented and amended. Costs against plaintiff. So ordered. Concepcion, C.J., Reyes, J.B.L., Dizon, Makalintal, Zaldivar, Castro, Angeles, Fernando and Capistrano, JJ., concur. Judgment reversed. Note.See the annotation on "Validity of Municipal License Fees Imposed Pursuant to Municipal Power," 2 SCRA 313-319. See also Pepsi-Cola Bottling Company of the Philippines, Inc. vs. City of Butuan, L-22814, Aug. 28, 1968, 24 SCRA 789-797, and the notes thereunder; American Mail Line vs. City of Basilan, L-12647, May 31, 1961, 2 SCRA 309; Ormoc Sugar Company, Inc. vs. Treasurer of Ormoc City, L-23794, Feb. 17, 1968, 22 SCRA 603, and the notes thereunder; Ormoc Sugarcane Planters Association, Inc. vs. Municipal Board of Ormoc City, L-23793, Feb. 23, 1968, 22 SCRA 736.

You might also like

- 16 Ormoc Sugar Vs ConejosDocument4 pages16 Ormoc Sugar Vs ConejosEMNo ratings yet

- Remedial Law) Notes of Bautista) Made 2002) by SU (Daki) ) 57 PgaesDocument57 pagesRemedial Law) Notes of Bautista) Made 2002) by SU (Daki) ) 57 PgaesbubblingbrookNo ratings yet

- SSS V City of BacolodDocument2 pagesSSS V City of BacolodChery Sheil ValenzuelaNo ratings yet

- Petitioners Vs Vs Respondents Augusto P. Jimenez, Jr. Fred Henry V. MarallagDocument5 pagesPetitioners Vs Vs Respondents Augusto P. Jimenez, Jr. Fred Henry V. MarallagPoPo MillanNo ratings yet

- Erectors, Inc. v. NLRC (GR 71177)Document3 pagesErectors, Inc. v. NLRC (GR 71177)minesmdvlNo ratings yet

- Mighty Corp. Vs E. & J. Gallo Winery - FullDocument15 pagesMighty Corp. Vs E. & J. Gallo Winery - FullVhin ChentNo ratings yet

- ANTIFENCING - People Vs de GuzmanDocument4 pagesANTIFENCING - People Vs de GuzmanKathlyn DacudaoNo ratings yet

- Smith Bell Co. Ltd. v. NatividadDocument13 pagesSmith Bell Co. Ltd. v. Natividadsensya na pogi langNo ratings yet

- Republic v. Marcos Sandiganbayan Civil Case No 0141 (No Footnotes)Document28 pagesRepublic v. Marcos Sandiganbayan Civil Case No 0141 (No Footnotes)Fortunato MadambaNo ratings yet

- 143147-1968-Ormoc Sugar Co. Inc. v. Treasurer of Ormoc PDFDocument4 pages143147-1968-Ormoc Sugar Co. Inc. v. Treasurer of Ormoc PDFCedrick Contado Susi BocoNo ratings yet

- VAT Digest PDFDocument31 pagesVAT Digest PDFangelicaNo ratings yet

- Local Government ReviewerDocument182 pagesLocal Government ReviewerClaire Balacdao Dales100% (1)

- Article 34 LaborDocument7 pagesArticle 34 LaborVev'z Dangpason BalawanNo ratings yet

- Fort Bonifacio Development Corporation vs. CIR, 583 SCRA 168, G.R. No. 158885 April 2, 2009Document64 pagesFort Bonifacio Development Corporation vs. CIR, 583 SCRA 168, G.R. No. 158885 April 2, 2009Alfred GarciaNo ratings yet

- Pangasinan vs. Disonglo-Almazora G.R. No. 200558. July 1, 2015.Document17 pagesPangasinan vs. Disonglo-Almazora G.R. No. 200558. July 1, 2015.VKNo ratings yet

- Lara v. Del Rosario, G.R. No. L-6339 April 20, 1954Document4 pagesLara v. Del Rosario, G.R. No. L-6339 April 20, 1954Tin SagmonNo ratings yet

- Perez Vs Rosal PDFDocument5 pagesPerez Vs Rosal PDFjeandpmdNo ratings yet

- Lee V Court of Appeals G.R. NO. 117913. February 1, 2002Document12 pagesLee V Court of Appeals G.R. NO. 117913. February 1, 2002Zarah JeanineNo ratings yet

- 01-White Gold Marine Services vs. Pioneer Insurance, Et Al. (GR No. 154514, 28 July 2005) - EscraDocument10 pages01-White Gold Marine Services vs. Pioneer Insurance, Et Al. (GR No. 154514, 28 July 2005) - EscraJ100% (1)

- Cases For VatDocument18 pagesCases For VatAya AntonioNo ratings yet

- DeRacho Vs Municipality of IliganDocument1 pageDeRacho Vs Municipality of IliganJay AnnNo ratings yet

- 408 Supreme Court Reports Annotated: Salcedo vs. Court of AppealsDocument10 pages408 Supreme Court Reports Annotated: Salcedo vs. Court of AppealsMirzi Olga Breech SilangNo ratings yet

- Taxation Law: Answers To Bar Examination QuestionsDocument125 pagesTaxation Law: Answers To Bar Examination QuestionsAnonymous bioCvBieYNo ratings yet

- Fernando U. Juan, Petitioner, V. Roberto U. Juan (Substituted by His Son Jeffrey C. Juan) and Laundromatic Corporation, Respondents. FactsDocument12 pagesFernando U. Juan, Petitioner, V. Roberto U. Juan (Substituted by His Son Jeffrey C. Juan) and Laundromatic Corporation, Respondents. FactsJohn Carlo DizonNo ratings yet

- 10 - The Shell Co Vs Municipality of Sipocot PDFDocument2 pages10 - The Shell Co Vs Municipality of Sipocot PDFtamakiusui18No ratings yet

- Place of Incorporation Test PDFDocument6 pagesPlace of Incorporation Test PDFNarciso Reyes Jr.No ratings yet

- Revalida - Fria - 2. Viva Shipping Lines Vs Keppel PhilippinesDocument4 pagesRevalida - Fria - 2. Viva Shipping Lines Vs Keppel PhilippinesACNo ratings yet

- Tax2 - Midterms DigestsDocument95 pagesTax2 - Midterms DigestsValerie TioNo ratings yet

- Sps. Cruz vs. Sun Holidays, Inc., G.R. No. 186312, June 29, 2010Document1 pageSps. Cruz vs. Sun Holidays, Inc., G.R. No. 186312, June 29, 2010MellyNo ratings yet

- Dimasacat and Robles V CADocument2 pagesDimasacat and Robles V CABreth1979No ratings yet

- Goodyear Tire & Rubber Co. of The Phils., Ltd. vs. Reyes, Sr. 123 SCRA 273, July 02, 1983Document6 pagesGoodyear Tire & Rubber Co. of The Phils., Ltd. vs. Reyes, Sr. 123 SCRA 273, July 02, 1983mary elenor adagioNo ratings yet

- John Hay Peoples Alternative Coalition v. Victor LimDocument1 pageJohn Hay Peoples Alternative Coalition v. Victor LimcynaracaballesNo ratings yet

- Hacbang v. AloDocument8 pagesHacbang v. AloBeau MasiglatNo ratings yet

- Commodatum Mutuum Deposit (Articles 1962 - 2009) Guaranty (Articles 2047 - 2084) SuretyDocument9 pagesCommodatum Mutuum Deposit (Articles 1962 - 2009) Guaranty (Articles 2047 - 2084) SuretyGnairah Agua AmoraNo ratings yet

- 031 - Miranda v. AguirreDocument3 pages031 - Miranda v. Aguirrergtan3No ratings yet

- Cir V PinedaDocument1 pageCir V PinedaHoreb FelixNo ratings yet

- Chart - PFRDocument12 pagesChart - PFRLei TacangNo ratings yet

- Arigo Et Al v. Scott H. SwiftDocument2 pagesArigo Et Al v. Scott H. SwiftGabriel Angelou SilangNo ratings yet

- New Tax Rates (TRAIN LAW) PDFDocument1 pageNew Tax Rates (TRAIN LAW) PDFphoebemariealhambra1475No ratings yet

- Cases On Forgery (Negotiable Instruments)Document4 pagesCases On Forgery (Negotiable Instruments)Gwen AligaNo ratings yet

- 269-Republic v. Patanao G.R. No. L-22356 July 21, 1967Document3 pages269-Republic v. Patanao G.R. No. L-22356 July 21, 1967Jopan SJNo ratings yet

- Rosario Oñas V Consolacion Javillo: ST NDDocument1 pageRosario Oñas V Consolacion Javillo: ST NDAli BastiNo ratings yet

- Alcan Packaging Starpack Corp. v. The Treasurer of The City of ManilaDocument2 pagesAlcan Packaging Starpack Corp. v. The Treasurer of The City of ManilaCharles Roger RayaNo ratings yet

- Flour Mill V CIRDocument2 pagesFlour Mill V CIRJefferson NunezaNo ratings yet

- Petitioners vs. VS.: en BancDocument45 pagesPetitioners vs. VS.: en BancDuffy DuffyNo ratings yet

- 15 ABS CBN vs. CTA 108 SCRA 142Document6 pages15 ABS CBN vs. CTA 108 SCRA 142Rogelio CartinNo ratings yet

- Banco Nacional de Cuba FULL TextDocument37 pagesBanco Nacional de Cuba FULL TextJJ CoolNo ratings yet

- Petitioner: Jai-Alai Corporation of The Philippines Respondent: Bank of The Philippine Island Session: 2 TopicDocument2 pagesPetitioner: Jai-Alai Corporation of The Philippines Respondent: Bank of The Philippine Island Session: 2 TopicRona TumaganNo ratings yet

- BSP Circular No. 1105 Series of 2020Document8 pagesBSP Circular No. 1105 Series of 2020justinelim03No ratings yet

- Gillaco v. Manila RailroadDocument4 pagesGillaco v. Manila RailroadHaniyyah FtmNo ratings yet

- San Beda College of Law: Insurance CodeDocument24 pagesSan Beda College of Law: Insurance CodeMary Jean C. BorjaNo ratings yet

- Donation IntervivosDocument1 pageDonation IntervivosbobbyrickyNo ratings yet

- Case: Miguel Beluso vs. The Municipality of Panay (Capiz), G.R. No. 153974 August 7, 2006Document3 pagesCase: Miguel Beluso vs. The Municipality of Panay (Capiz), G.R. No. 153974 August 7, 2006PRINCESS MAGPATOCNo ratings yet

- Cordillera v. COADocument2 pagesCordillera v. COAVince MontealtoNo ratings yet

- 9.villafuerte Vs RobredoDocument9 pages9.villafuerte Vs RobredoLord AumarNo ratings yet

- Laher v. LopezDocument7 pagesLaher v. LopezHayden Richard AllauiganNo ratings yet

- Phil. Veterans Bank V CADocument8 pagesPhil. Veterans Bank V CAApril DiolataNo ratings yet

- Panganiban, J.:: (G.R. No. 148267. August 8, 2002)Document6 pagesPanganiban, J.:: (G.R. No. 148267. August 8, 2002)Mary Denzyll BunalNo ratings yet

- Victorias Milling Co., Inc. vs. Mun. of Victorias, Negros Occidental, 25 SCRA 192, September 27, 1968Document21 pagesVictorias Milling Co., Inc. vs. Mun. of Victorias, Negros Occidental, 25 SCRA 192, September 27, 1968Daniela SandraNo ratings yet

- Victorias Milling v. Municipality of VictoriaDocument12 pagesVictorias Milling v. Municipality of Victoriagemao.jb1986No ratings yet

- Insurance HistoryDocument7 pagesInsurance HistoryZiazel ThereseNo ratings yet

- 03-PPC2016 Executive SummaryDocument8 pages03-PPC2016 Executive SummaryZiazel ThereseNo ratings yet

- Balance Sheet Accounts Assets: Account Code Account TitleDocument17 pagesBalance Sheet Accounts Assets: Account Code Account TitleZiazel ThereseNo ratings yet

- Coa C2016-005Document11 pagesCoa C2016-005aliahNo ratings yet

- Rana Digest - PropertyDocument6 pagesRana Digest - PropertyZiazel ThereseNo ratings yet

- Commission On Audit Circular No 96-011 - Delayed Submission of Banc ReconDocument3 pagesCommission On Audit Circular No 96-011 - Delayed Submission of Banc ReconAr LineNo ratings yet

- Lung Center Vs QCDocument11 pagesLung Center Vs QCZiazel ThereseNo ratings yet

- Institutions Shall Include The Study of The Constitution As Part of The Curricula."Document7 pagesInstitutions Shall Include The Study of The Constitution As Part of The Curricula."Ziazel ThereseNo ratings yet

- PDAF Case DigestDocument11 pagesPDAF Case DigestZiazel ThereseNo ratings yet

- Institutions Shall Include The Study of The Constitution As Part of The Curricula."Document7 pagesInstitutions Shall Include The Study of The Constitution As Part of The Curricula."Ziazel ThereseNo ratings yet

- The Court of Last ResortDocument6 pagesThe Court of Last ResortZiazel ThereseNo ratings yet

- Rule On Mandatory Legal Aid ServiceDocument6 pagesRule On Mandatory Legal Aid ServiceZiazel ThereseNo ratings yet

- Ziakoy's NotesDocument17 pagesZiakoy's NotesZiazel ThereseNo ratings yet

- CIR vs. Hantex - DigestDocument2 pagesCIR vs. Hantex - DigestZiazel Therese67% (3)

- Group 5 ReportDocument40 pagesGroup 5 ReportZiazel ThereseNo ratings yet

- Chavez Vs ComelecDocument4 pagesChavez Vs ComelecZiazel ThereseNo ratings yet

- Guaio Vs ComelecDocument20 pagesGuaio Vs ComelecZiazel ThereseNo ratings yet

- Civpro Case DigestsDocument21 pagesCivpro Case DigestsZiazel ThereseNo ratings yet

- Castromayor Vs COMELECDocument3 pagesCastromayor Vs COMELECZiazel ThereseNo ratings yet

- Court of Last ResortDocument20 pagesCourt of Last ResortZiazel ThereseNo ratings yet

- Community-Based Forest ManagementDocument7 pagesCommunity-Based Forest ManagementZiazel ThereseNo ratings yet

- Irr Ra 6713Document18 pagesIrr Ra 6713icebaguilatNo ratings yet

- Claim: You Should Use A Hearing AidDocument4 pagesClaim: You Should Use A Hearing AidZiazel ThereseNo ratings yet

- Case Digest - Hyatt Industrial Manufacturing Corp. Vs Ley ConstructionDocument3 pagesCase Digest - Hyatt Industrial Manufacturing Corp. Vs Ley ConstructionZiazel ThereseNo ratings yet

- Ynot Vs IACDocument42 pagesYnot Vs IACMichael Matnao100% (1)

- Lto V City of ButuanDocument1 pageLto V City of ButuanPrincess Ayoma0% (1)

- Iloilo City Regulation Ordinance 2005-195Document3 pagesIloilo City Regulation Ordinance 2005-195Iloilo City CouncilNo ratings yet

- Municipality of Parañaque V. V.M. Realty Corporation G.R. NO. 127820 (July 20, 1998) Panganiban, JDocument1 pageMunicipality of Parañaque V. V.M. Realty Corporation G.R. NO. 127820 (July 20, 1998) Panganiban, JLA RicanorNo ratings yet

- MMDA Memo Circular Billboards and AdvertisementsDocument10 pagesMMDA Memo Circular Billboards and Advertisementslovekimsohyun89No ratings yet

- CARLOS BALACUIT, LAMBERTO TAN and SERGIO YU CARCEL Vs COURT OF FIRST INSTANCE OF AGUSAN DEL NORTE AND BUTUAN CITYDocument2 pagesCARLOS BALACUIT, LAMBERTO TAN and SERGIO YU CARCEL Vs COURT OF FIRST INSTANCE OF AGUSAN DEL NORTE AND BUTUAN CITYKenJoNo ratings yet

- Committee Report 1624 Moa Dilg PCFDocument4 pagesCommittee Report 1624 Moa Dilg PCFbubblingbrookNo ratings yet

- An Ordinance Banning The Use of Firecrackers in The Municipality of Banaybanay, Davao OrientalDocument2 pagesAn Ordinance Banning The Use of Firecrackers in The Municipality of Banaybanay, Davao OrientalEden Celestino Sarabia CachoNo ratings yet

- White Light Corporation Vs City of ManilaDocument1 pageWhite Light Corporation Vs City of ManilaSaraAiJenneNo ratings yet

- Case Digests in HR LawDocument14 pagesCase Digests in HR LawJhoanna Marie Manuel-Abel100% (1)

- Solicitor General V Metropolitan Manila AuthorityDocument2 pagesSolicitor General V Metropolitan Manila AuthorityJessie Albert CatapangNo ratings yet

- RA 8487 - Charter of Taguig CityDocument60 pagesRA 8487 - Charter of Taguig CitybongricoNo ratings yet

- City Govt. of Quezon City vs. Ericta - DIGESTDocument2 pagesCity Govt. of Quezon City vs. Ericta - DIGESTblessaraynes100% (1)

- Baguio Zoning AdminDocument12 pagesBaguio Zoning AdminsophiegenesisNo ratings yet

- Local Gov Tax Case DigestDocument14 pagesLocal Gov Tax Case Digestpraning125No ratings yet

- People v. RelovaDocument3 pagesPeople v. RelovaDianne SantiagoNo ratings yet

- Presidential Decree No. 1605, S. 1978Document3 pagesPresidential Decree No. 1605, S. 1978Jhecy RodriguezNo ratings yet

- Qualifications and Disqualifications of Public OfficersDocument7 pagesQualifications and Disqualifications of Public OfficersAnonymous OVr4N9MsNo ratings yet

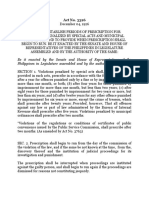

- Act No. 3326 (As Amended by Act No. 3763)Document3 pagesAct No. 3326 (As Amended by Act No. 3763)JustGentleNo ratings yet

- Peralta V Director of PrisonsDocument6 pagesPeralta V Director of PrisonsChow Momville EstimoNo ratings yet

- Legaspi vs. City of Cebu 711 SCRA 771, December 10, 2013, G.R. No. 159110, G.R. No. 159692Document2 pagesLegaspi vs. City of Cebu 711 SCRA 771, December 10, 2013, G.R. No. 159110, G.R. No. 159692Almer TinapayNo ratings yet

- UNITED STATES v. JOSE TAMPARONG, ET AL. G.R. No. 9527 August 23, 1915 PDFDocument9 pagesUNITED STATES v. JOSE TAMPARONG, ET AL. G.R. No. 9527 August 23, 1915 PDFIvan Angelo ApostolNo ratings yet

- IRR Ordinance No. 483, S-2011Document8 pagesIRR Ordinance No. 483, S-2011Michelle Ricaza-Acosta0% (1)

- Mlupa ParkingOrdDocument2 pagesMlupa ParkingOrdMapulang Lupa Valenzuela City100% (1)

- Budget Authorization - MMLDocument52 pagesBudget Authorization - MMLLhan Fabrigas100% (1)

- Planning Law Sri Lanka PDFDocument17 pagesPlanning Law Sri Lanka PDFIshan RanganathNo ratings yet

- Drilon Vs LimDocument2 pagesDrilon Vs LimhowieboiNo ratings yet

- Ordinance 2018-01 S. 2018 - Barangay Official Seal OrdinanceDocument5 pagesOrdinance 2018-01 S. 2018 - Barangay Official Seal OrdinanceRobe Jan Ivan Pagulong100% (3)

- Magtajas V PycerDocument2 pagesMagtajas V PycerJoan PabloNo ratings yet

- Magsalin Consti 2 CompilationDocument257 pagesMagsalin Consti 2 CompilationHark ReynaldoNo ratings yet

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Money Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasFrom EverandMoney Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasRating: 3 out of 5 stars3/5 (1)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Summary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamFrom EverandSummary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamRating: 5 out of 5 stars5/5 (1)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestFrom EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestRating: 5 out of 5 stars5/5 (1)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeFrom EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyFrom EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyRating: 4 out of 5 stars4/5 (4)

- 109 Personal Finance Tips: Things you Should Have Learned in High SchoolFrom Everand109 Personal Finance Tips: Things you Should Have Learned in High SchoolNo ratings yet