Professional Documents

Culture Documents

Accounting For Managers Final

Uploaded by

Manal ElkhoshkhanyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Managers Final

Uploaded by

Manal ElkhoshkhanyCopyright:

Available Formats

Accounting Basics for Managers Final Exam

Problem 1: The balance sheet presents the following common stock information: Common stock, $10 par value, 7,000,000 shares authorized, 5,700,000 shares issued, 5,500,000 shares outstanding. (a.) Calculate the dollar amount that will be presented as Common stock. = 5,700,000 $10 = $57,000,000 (b.) Calculate the total amount of a cash dividend of $1.00 per share. = 5,500,000 $1 = $5,500,000 (c.) What accounts for the difference between issued shares and outstanding shares?

Treasury Stock is what accounts for the difference between issued shares and outstanding shares

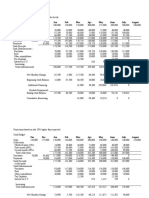

Problem 2: Presented below is the income statement for Smith Food Center for the month of July:

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 15 percent. (a.) Rearrange the above income statement to the contribution margin format.

a)

Smith Food Center Income Statement Sales Variable Expenses Contribution Margin Fixed Expenses Operating Income $1,280,000 $1,088,000 $192,000 $156,000 $36,000 100% 85% 15%

Problem 2 (continued): (b.) If sales increase by 10 percent, what will be the firm's operating income? 10% 15% Increase in Sales Increase in Contribution Margin Previous Operating Income Adjusted Operating Income $128,000 $19,200 $36,000 $55,200

(c.) Calculate the amount of revenue required for Smiths Food Center to break even.

Breakeven in Dollars (Fixed Expenses/CMR)

$1,040,000

Problem 3: The cost formula for the maintenance department of the Eifel Co. is $6,500 per month plus $3.50 per machine hour used by the production department. a. Calculate the maintenance cost that would be budgeted for the month of May in which 5,700 machine hours are planned to be used. Budgeted Cost = $6,500 + ($3.50 5,700) = $26,450 b. Prepare an appropriate performance report (contains columns for the original budget, flex budget, actual cost, variance) for the maintenance department assuming that 5,860 machine

hours were actually used in the month of May, and the total maintenance cost incurred was $28,010. Original Budget (5,700 MH) $26,450 Problem 4: Danzi, Inc., has budgeted sales for the month of July and estimated cost behavior patterns for a number of its expense items listed below. From this information prepare an operating expense budget for the month of July. Flexed Budget (5,860 MH) $27,010 Actual Cost $28,010 Variance $1,000 U

Selling Expenses: Variable Selling Expenses: Sales Commission (5% $230,000) Marketing Promotions ($0.75 4,600) Delivery Expense ($0.50 4,600) Bad Debts Expense (1% $230,000) Total Variable Selling Expenses Fixed Selling Expenses: Sales Salaries Advertising Total Fixed Selling Expenses Total Selling Expenses Administrative Expenses: Administrative Salaries Facility Expense Depreciation on Office Equipment Property Taxes on Office Total Administrative Expenses Budgeted Operating Expenses

$11,500 $3,450 $2,300 $2,300 $19,550 $6,800 $4,200 $11,000 $30,550 $9,400 $8,000 $2,500 $3,000 $22,900 $53,450

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- L Branch 8311652012 QuestionsDocument9 pagesL Branch 8311652012 QuestionsMohitNo ratings yet

- Acct 2302 Quiz 3 KeyDocument11 pagesAcct 2302 Quiz 3 KeyRachel YangNo ratings yet

- Practice Problems For Midterm - Spring 2017Document6 pagesPractice Problems For Midterm - Spring 2017Derny FleurimaNo ratings yet

- MGMT ACCT SET-2-WPS OfficeDocument3 pagesMGMT ACCT SET-2-WPS Officesaina khanamNo ratings yet

- ACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Document9 pagesACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Hannah NazirNo ratings yet

- Exam 7Document15 pagesExam 7mohit verrmaNo ratings yet

- Operating and Financial LeverageDocument3 pagesOperating and Financial LeverageperiNo ratings yet

- Exam 3 Version1Document11 pagesExam 3 Version1Minh Huy NguyenNo ratings yet

- Managerial Accounting ProjectDocument5 pagesManagerial Accounting ProjectAyaz AbroNo ratings yet

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- tổng hợp đề KTQT 2Document60 pagestổng hợp đề KTQT 2NHI HUYNH MANNo ratings yet

- Brewer Chapter 6Document8 pagesBrewer Chapter 6Sivakumar KanchirajuNo ratings yet

- BudgetDocument6 pagesBudgetshobuzfeni100% (1)

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Exercise Over Chapter 18 Name - Key - 1. List The Five Areas of Farm Business AnalysisDocument2 pagesExercise Over Chapter 18 Name - Key - 1. List The Five Areas of Farm Business AnalysisJenny VarelaNo ratings yet

- Acct116 FinalDocument7 pagesAcct116 FinalVivek BhattNo ratings yet

- Untitled DocumentDocument8 pagesUntitled DocumentbetsegawabebeaNo ratings yet

- Problems On LeverageDocument2 pagesProblems On LeverageRituparna Nath100% (2)

- Soal Akuntansi ManajemenDocument10 pagesSoal Akuntansi ManajemenIchwalsyah SyNo ratings yet

- Seminar 11answer Group 10Document75 pagesSeminar 11answer Group 10Shweta Sridhar40% (5)

- SLC ACCT5 2019S3 101 Assignment04Document8 pagesSLC ACCT5 2019S3 101 Assignment04kasad jdnfrnasNo ratings yet

- VANDERBECKCh7 - Multiple Choice (Theory and Problem)Document8 pagesVANDERBECKCh7 - Multiple Choice (Theory and Problem)Saeym SegoviaNo ratings yet

- Practice Sheet 8 - CH9 SolutionDocument5 pagesPractice Sheet 8 - CH9 SolutionMuhammadNo ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- MAS, CVP Analysis, MultichoiceDocument3 pagesMAS, CVP Analysis, MultichoiceChristopher PriceNo ratings yet

- Ch12 VarianceAnalysis QDocument11 pagesCh12 VarianceAnalysis QUmairSadiqNo ratings yet

- 8508 QuestionsDocument3 pages8508 QuestionsHassan MalikNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- 6486 Chap008 PDFDocument17 pages6486 Chap008 PDFDheaNo ratings yet

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- Contabilidad M3Document13 pagesContabilidad M3Azin RostamiNo ratings yet

- Revision Module 6Document7 pagesRevision Module 6avineshNo ratings yet

- MGRL Practice 2 ModDocument20 pagesMGRL Practice 2 ModAnn Kristine TrinidadNo ratings yet

- Solving A CVP ProblemDocument11 pagesSolving A CVP ProblemMahruf OpuNo ratings yet

- MAS Midterm Exam PDFDocument12 pagesMAS Midterm Exam PDFZyrelle DelgadoNo ratings yet

- CH 1 ProblemsDocument8 pagesCH 1 Problemsbangun7770% (1)

- Accounting Day 6Document3 pagesAccounting Day 6Benjamin0% (1)

- Budgetary Control and Responsibility Accounting CH 10 Revised March 1, 2010Document36 pagesBudgetary Control and Responsibility Accounting CH 10 Revised March 1, 2010Vipra BhatiaNo ratings yet

- 6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDocument8 pages6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDias AdhyaksaNo ratings yet

- Multiple Choice - Part 1Document39 pagesMultiple Choice - Part 1Nguyễn Vũ Linh NgọcNo ratings yet

- ACG 2071 Exam 3 Practice Test With SolutionsDocument22 pagesACG 2071 Exam 3 Practice Test With SolutionsMay RamosNo ratings yet

- Sample Questions FinalDocument11 pagesSample Questions FinaldunyaNo ratings yet

- FCES - Damanhour 3 Year - 2 Term: Management AccountingDocument11 pagesFCES - Damanhour 3 Year - 2 Term: Management Accountingahmedgalalali497No ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthMohitNo ratings yet

- Managerial Accounting Exam 2 With SolutionsDocument13 pagesManagerial Accounting Exam 2 With Solutionskwathom1No ratings yet

- Managerial Accounting - WS4 Connect Homework GradedDocument9 pagesManagerial Accounting - WS4 Connect Homework GradedJason HamiltonNo ratings yet

- Chapter03-Class ActivitiesDocument3 pagesChapter03-Class ActivitiesHungNo ratings yet

- Chapter 7 Variable CostingDocument5 pagesChapter 7 Variable CostingRidha YaminNo ratings yet

- Review ExercisesDocument5 pagesReview ExercisesThy Tran HongNo ratings yet

- MBA 620 Week 3 HW SolutionsDocument5 pagesMBA 620 Week 3 HW SolutionsphoebeNo ratings yet

- CVP Analysis QuestionsDocument5 pagesCVP Analysis Questionsqadrih8638No ratings yet

- Profit Planning Discussion ProblemsDocument5 pagesProfit Planning Discussion ProblemsVatchdemonNo ratings yet

- Leverages NotesDocument9 pagesLeverages NotesAshwani ChouhanNo ratings yet

- NAME: - : Problems #1-12. (From Chapter 4)Document8 pagesNAME: - : Problems #1-12. (From Chapter 4)Kateryna TernovaNo ratings yet

- F2 Mock Questions 201603Document12 pagesF2 Mock Questions 201603Renato WilsonNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Egypt Revolution Inc.Document4 pagesEgypt Revolution Inc.Manal ElkhoshkhanyNo ratings yet

- Hightower ServiceDocument3 pagesHightower ServiceManal Elkhoshkhany100% (2)

- Auditing SP 2008 CH 5 SolutionsDocument13 pagesAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyNo ratings yet

- Auditing SP 2008 CH 6 SolutionsDocument19 pagesAuditing SP 2008 CH 6 SolutionsManal ElkhoshkhanyNo ratings yet

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- 50 Multiple Choice, T/F, & Essay QuestionsDocument24 pages50 Multiple Choice, T/F, & Essay QuestionsManal Elkhoshkhany100% (1)

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNo ratings yet

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyNo ratings yet

- Managerial AccountingDocument5 pagesManagerial AccountingManal ElkhoshkhanyNo ratings yet

- Project A Project B Probability Net Cash Flow Probability Net Cash FlowDocument1 pageProject A Project B Probability Net Cash Flow Probability Net Cash FlowManal ElkhoshkhanyNo ratings yet

- Reed Clothier Income StatementDocument4 pagesReed Clothier Income StatementManal ElkhoshkhanyNo ratings yet

- Comprehensive Problem 2Document3 pagesComprehensive Problem 2Manal ElkhoshkhanyNo ratings yet

- Summertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Document2 pagesSummertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Manal ElkhoshkhanyNo ratings yet

- Gray HouseDocument2 pagesGray HouseManal ElkhoshkhanyNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- Fashion ShoeDocument5 pagesFashion ShoeManal ElkhoshkhanyNo ratings yet

- StatsDocument1 pageStatsManal ElkhoshkhanyNo ratings yet

- Nov Dec Jan Feb Mar Apr May June July AugustDocument9 pagesNov Dec Jan Feb Mar Apr May June July AugustManal ElkhoshkhanyNo ratings yet

- Finance QuizDocument2 pagesFinance QuizManal ElkhoshkhanyNo ratings yet

- Finance QuizDocument3 pagesFinance QuizManal ElkhoshkhanyNo ratings yet

- JanDocument1 pageJanManal ElkhoshkhanyNo ratings yet

- Lesson 2 Technical Analysis Using Japanese CandlesticksDocument5 pagesLesson 2 Technical Analysis Using Japanese Candlesticksგიორგი წოწკოლაურიNo ratings yet

- Pdfcoffee LojnkbkbjkmDocument35 pagesPdfcoffee Lojnkbkbjkmdraga pinasNo ratings yet

- Lesson 1 Profit or Loss For A Business: Let's Explore and DiscoverDocument8 pagesLesson 1 Profit or Loss For A Business: Let's Explore and DiscoverScarlet VillamorNo ratings yet

- Aldi Case StudyDocument2 pagesAldi Case StudySeemal Ali0% (1)

- BCIfactsheet Nov 10Document2 pagesBCIfactsheet Nov 10Daplet ChrisNo ratings yet

- Maf Seminar Slide SyafDocument19 pagesMaf Seminar Slide SyafNur SyafiqahNo ratings yet

- Patanjali Pricing Strategy: AdvertisementDocument4 pagesPatanjali Pricing Strategy: AdvertisementPrachi VermaNo ratings yet

- ACC 305 Week 3 Quiz 02 Chapter 18Document6 pagesACC 305 Week 3 Quiz 02 Chapter 18LereeNo ratings yet

- Econ 281 Chapter09Document71 pagesEcon 281 Chapter09Elon MuskNo ratings yet

- Interest Rate RiskDocument18 pagesInterest Rate RiskDonny RamantoNo ratings yet

- Penshoppe Swot GRP 4Document10 pagesPenshoppe Swot GRP 4Lhiamar CorpuzNo ratings yet

- Nick Stavrou Tutorial Questions 2015Document2 pagesNick Stavrou Tutorial Questions 2015Trang PhanNo ratings yet

- Starbucks Business Model CanvasDocument1 pageStarbucks Business Model CanvasTrâm Phạm Thu LàiNo ratings yet

- THE Project Report ON "Analysis of Factors Influencing The Choice of Mutual Funds in India"Document62 pagesTHE Project Report ON "Analysis of Factors Influencing The Choice of Mutual Funds in India"Temp CadNo ratings yet

- Entrepreneurship Week 3 and 4Document10 pagesEntrepreneurship Week 3 and 4hyunsuk fhebieNo ratings yet

- CRM Strategy - Case Study Analysis Section C: Group 3Document22 pagesCRM Strategy - Case Study Analysis Section C: Group 3Shruti DhirNo ratings yet

- Paper15 PDFDocument76 pagesPaper15 PDFsrinivasNo ratings yet

- Fleming, Jasmine, MKT 6953-003Document25 pagesFleming, Jasmine, MKT 6953-003Spencer KariukiNo ratings yet

- Chapter 9 Electronic CommerceDocument18 pagesChapter 9 Electronic CommerceDianna RabadonNo ratings yet

- Business Ethics Presentation On "Insider Trading"Document8 pagesBusiness Ethics Presentation On "Insider Trading"Umika SawhneyNo ratings yet

- Module 7 - Mini Marketing PlanDocument13 pagesModule 7 - Mini Marketing PlanCESTINA, KIM LIANNE, B.No ratings yet

- Competitive Strength of Pepsi in A Given Market PlaceDocument10 pagesCompetitive Strength of Pepsi in A Given Market Placesaurabh151No ratings yet

- Digital SWOT AnalysisDocument3 pagesDigital SWOT Analysisdanny lastNo ratings yet

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaNo ratings yet

- MohammadDocument2 pagesMohammadxfzm99mr8rNo ratings yet

- Sp21 ECN 202 Final AssignmentDocument2 pagesSp21 ECN 202 Final AssignmentMaher Neger AneyNo ratings yet

- Ravi Blackbook DoneDocument65 pagesRavi Blackbook DoneRavi VishwakarmaNo ratings yet

- Unit 4 World Financial EnvironmentDocument6 pagesUnit 4 World Financial EnvironmentTharun VelammalNo ratings yet

- Chapter #1Document4 pagesChapter #1Vivek KavtaNo ratings yet

- System' Company: Analisis SwotDocument11 pagesSystem' Company: Analisis SwotZzzz GamingNo ratings yet