Professional Documents

Culture Documents

Benefits Tax Implications of Purchasing A House

Uploaded by

Priya GoyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefits Tax Implications of Purchasing A House

Uploaded by

Priya GoyalCopyright:

Available Formats

BENEFITS & TAX IMPLICATIONS OF PURCHASING A HOUSE

Before buying or selling a house, it would be prudent to know the tax considerations. Here, we discuss the tax implications/benefits of purchasing a house and the taxation of gains from the sale of a house.

OWNING A HOUSE

The Indian Income Tax Act, 1961 (IT Act), considers a residential house as a source of income. Under the I-T Act, the owner of a house is taxed on the income, in the form of its annual value, under the head 'Income from House Property'. The annual value of a house property is higher of the income earned or the fair rent (expected reasonable rent for properties of a similar size in the same locality). In the case of a self-occupied house, the annual value is nil. However, in the case of more than one house property, only one house property can be considered as self-occupied, and the higher of the rent earned or the fair rent would be treated as annual value for the other house(s). Municipal taxes (including property tax, water tax, etc) are deductible from the annual value (other than from the house property where the annual value is nil); 30% of such net annual value is available as standard deduction from the rental income. In the case of a housing loan, additional deduction is available for the interest paid for the loan. The deduction, however, is restricted to a maximum of Rs 1.5 lakh in the case of self-occupied property where the annual value is taken as nil. In other cases, there is no such restriction on the deduction for interest. In cases where the deduction for interest is higher than the net annual value, the excess of the interest is treated as loss. Such a loss can be set off against income from other house property or from any other income of the owner for the same year. In the absence of sufficient income, the balance loss can be carried forward to the following year and set off against 'Income from House Property'. However, such a loss cannot be carried forward for more than eight years. Additionally, under section 80C of the I-T Act, the repayment of principal amount of up to Rs 1 lakh is available as deduction from the taxable income of the owner. SELLING A HOUSE Under the I-T Act, a residential house property is treated as a capital asset. Any gain or loss on sale/transfer of such capital assets is treated as capital gains or loss. If the house property is held by the owner for three years or more, it is treated as a long-term capital asset and capital gains arising from the sale/transfer are accordingly taxable at a reduced rate of 20%. Where the holding period is less than three years, the house property is treated as short-term capital asset and the capital gains on its sale/transfer are taxable at normal rates (as applicable to the taxpayer). In order to compute the capital gains in the hands of the seller, the consideration for sale/transfer is reduced by the cost of the acquisition. In case the assessable value as determined under the Stamp Act of the state concerned (or Indian Stamp Act where applicable) is higher than the consideration, then the same is substituted for consideration while computing capital gains. In the case of sale/transfer of a house property held for a period of three years or more, the cost of acquisition is increased to compensate for the proportionate increase in the cost inflation index STAMP DUTY Typically, the stamp duty is payable on the purchase/sale of the house property. The levy and computation of duty is prescribed under the Stamp Act of each state, or in the absence of a state Act, under the Indian Stamp Act, 1899. If borne by the purchaser, the stamp duty would be added to his

cost of acquisition of the house property for the purpose of computation of any gain on subsequent sale/transfer. The stamp duty is also payable on lease/leave & licence agreements. WEALTH TAX According to the provisions of the Wealth Tax Act, 1957, any immovable property, whether residential or commercial, is considered as a taxable asset. However, specific exclusion is provided in respect of the following house properties: those used as stock-in-trade, or occupied for conducting business or profession, or given on rent for more than 300 days in a year. Wealth tax is payable at the rate of 1% on the taxable wealth exceeding Rs 30 lakh. The DTC has proposed to increase this exemption limit from Rs 30 lakh to Rs 1 crore.

A Helping hand CA CS Prakash Somani p_somani@yahoo.co.in

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1 Ca Irs 3176CDocument3 pages1 Ca Irs 3176CStephen Monaghan100% (1)

- CIR Vs Club Filipino DigestDocument2 pagesCIR Vs Club Filipino DigestJC100% (2)

- Bill 9500639426Document1 pageBill 9500639426sayys1390No ratings yet

- Bob StatementDocument18 pagesBob StatementShreya AgrawalNo ratings yet

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchDocument6 pagesCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchAkhbar-ul- AkhyarNo ratings yet

- PGL Gpi MD Uetr 2021Document13 pagesPGL Gpi MD Uetr 2021Esteban Enrique Posan BalcazarNo ratings yet

- CIR v. BCDADocument2 pagesCIR v. BCDAChariNo ratings yet

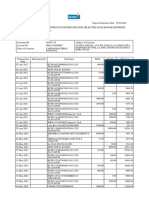

- Salary Slip - July-2013: Earnings DeductionsDocument5 pagesSalary Slip - July-2013: Earnings DeductionsPriya GoyalNo ratings yet

- Axis Seed & Crop Technology: Leave Application Form (Casual/Sick/Earn/P.L.)Document1 pageAxis Seed & Crop Technology: Leave Application Form (Casual/Sick/Earn/P.L.)Priya GoyalNo ratings yet

- Frequently Asked Questions (Faqs) : E Filing and CPCDocument22 pagesFrequently Asked Questions (Faqs) : E Filing and CPCPriya GoyalNo ratings yet

- Mihir 178 20 20Document6 pagesMihir 178 20 20Priya GoyalNo ratings yet

- 6 Single Minute Exchange of DieDocument3 pages6 Single Minute Exchange of DiePriya GoyalNo ratings yet

- Organization Chart: 1. As Suggested by Me (Bhavin Shah) As Per The Current Structure of OrganizationDocument2 pagesOrganization Chart: 1. As Suggested by Me (Bhavin Shah) As Per The Current Structure of OrganizationPriya GoyalNo ratings yet

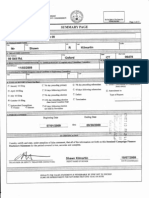

- Axis Seeds & Crop Technology: Employee's Name: Location: Designation: Department: PeriodDocument1 pageAxis Seeds & Crop Technology: Employee's Name: Location: Designation: Department: PeriodPriya GoyalNo ratings yet

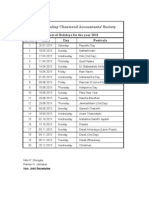

- List of Holidays 2013Document1 pageList of Holidays 2013Priya GoyalNo ratings yet

- Guidelines - Reims ProcessDocument1 pageGuidelines - Reims ProcessPriya GoyalNo ratings yet

- Saving Bank InterestDocument20 pagesSaving Bank InterestPriya GoyalNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomePriya GoyalNo ratings yet

- DATE 26/08/2013: TH THDocument1 pageDATE 26/08/2013: TH THPriya GoyalNo ratings yet

- Axis Agri Services: Particulars Credit DebitDocument1 pageAxis Agri Services: Particulars Credit DebitPriya GoyalNo ratings yet

- As DasDocument2 pagesAs DasPriya GoyalNo ratings yet

- 01010Document2 pages01010Priya GoyalNo ratings yet

- Axis Seed 2012-13 RM Opg in Out/Use Loss Closing PCKG Opg in Out/Use Loss Closing Fin Good Opg in Out ClogDocument1 pageAxis Seed 2012-13 RM Opg in Out/Use Loss Closing PCKG Opg in Out/Use Loss Closing Fin Good Opg in Out ClogPriya GoyalNo ratings yet

- Asd SDF SDF SDF SDF Asd SDFDocument1 pageAsd SDF SDF SDF SDF Asd SDFPriya GoyalNo ratings yet

- BhgssssDocument1 pageBhgssssPriya GoyalNo ratings yet

- QQQQQDocument1 pageQQQQQPriya GoyalNo ratings yet

- S F S F D DF Asd As SD F F AsDocument2 pagesS F S F D DF Asd As SD F F AsPriya GoyalNo ratings yet

- QQQQQDocument2 pagesQQQQQPriya GoyalNo ratings yet

- ColllDocument2 pagesColllPriya GoyalNo ratings yet

- Family Budget PlannerDocument4 pagesFamily Budget PlannerPriya GoyalNo ratings yet

- TahfgDocument2 pagesTahfgPriya GoyalNo ratings yet

- Vahan 4Document1 pageVahan 4Chetan SharmaNo ratings yet

- TicketsDocument1 pageTicketsYuvraj SinghNo ratings yet

- CA FInal DT SampleDocument8 pagesCA FInal DT SampleprasannaNo ratings yet

- IPR ProjectDocument32 pagesIPR ProjectHemantPrajapatiNo ratings yet

- Conso Report of Disbursements SampleDocument1 pageConso Report of Disbursements SampleWinther Earl Dano HupaNo ratings yet

- Tutorial 6: Jane Lazar and Huang (4 Edition) - Chapter 35-MFRS133Document15 pagesTutorial 6: Jane Lazar and Huang (4 Edition) - Chapter 35-MFRS133HOW BING CHENNo ratings yet

- Chapter C2 Formation of The Corporation Discussion QuestionsDocument16 pagesChapter C2 Formation of The Corporation Discussion QuestionsPennyW0% (1)

- Seec F'orm 20Document23 pagesSeec F'orm 20The Valley IndyNo ratings yet

- ITR-3 Computation of TaxDocument25 pagesITR-3 Computation of TaxsharathNo ratings yet

- Invoice 20200706Ts005: Prutech Solutions India Private Limited Bill To: Ship ToDocument2 pagesInvoice 20200706Ts005: Prutech Solutions India Private Limited Bill To: Ship Topanthula srikanthNo ratings yet

- Vyapti Infrabuild PVT - LTD.: Duvf - U QHN (Document2 pagesVyapti Infrabuild PVT - LTD.: Duvf - U QHN (M AbhiNo ratings yet

- Invoice For Portable Toilets - Nuggets ParadeDocument1 pageInvoice For Portable Toilets - Nuggets Parade9newsNo ratings yet

- Common-Size Analysis: By: Hendru Chahayo, SE. (HCO)Document25 pagesCommon-Size Analysis: By: Hendru Chahayo, SE. (HCO)AnQi LeeNo ratings yet

- Account Summary: Charles Micky Account Name Account Number 867295857 Phone Number Multiple ServicesDocument3 pagesAccount Summary: Charles Micky Account Name Account Number 867295857 Phone Number Multiple ServicesMiki CharlyNo ratings yet

- Debit NoteDocument1 pageDebit Notesbos1No ratings yet

- Moneycontrol. P&L BataDocument2 pagesMoneycontrol. P&L BataSanket BhondageNo ratings yet

- Account STMT XX9794 31122023Document16 pagesAccount STMT XX9794 31122023shubhamkasyap443No ratings yet

- Taxation Bar ExamDocument34 pagesTaxation Bar ExamDenise DianeNo ratings yet

- Business Expenses - InvestopediaDocument3 pagesBusiness Expenses - InvestopediaBob KaneNo ratings yet

- Becker CPA Review Summary of Changes Included in The V1.1 REG TextbookDocument16 pagesBecker CPA Review Summary of Changes Included in The V1.1 REG Textbookmohit2ucNo ratings yet

- Od 226072731036375000Document1 pageOd 226072731036375000Chirag ChauhanNo ratings yet

- 1Document13 pages1Anonymous Se3uRZNo ratings yet