Professional Documents

Culture Documents

Citibank

Uploaded by

meenakshi56Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Citibank

Uploaded by

meenakshi56Copyright:

Available Formats

Citibank, N.A.

On June 16, 1812, with $2 million of capital, City Bank of New York (now Citibank) opened for business in New York City. Through many different leaders and economic environments over the course of its rich history, Citibank continues to grow and prosper. In 1968, First National City Corporation (later renamed Citicorp), a bank holding company, became the parent of Citibank. In 1998, all Citicorp divisions merged with all divisions of Travelers Group to form Citigroup Inc. Citibank continues as a strong brand under the Citigroup umbrella.

1 812 1856 1 865 1897 1 902 1914 1 915 1928 1 929 1939 1 940 1955 1 959 1965 1 966 1970 1 974 1981 1 982 1989 1

1812

June 16: New York State charters City Bank of New York with authorized capital of $2 million and paidin capital of $800,000. September 14: City Bank opens for business to serve a group of New York merchants. Samuel Osgood is elected president (18121813).

1813

First dividend is paid.

1822

Farmers' Fire Insurance and Loan Company is founded, the first incorporated trust company in the U.S. Its name becomes Farmers' Loan and Trust Company in 1835, and it merges with National City Bank in 1929.

1827

Isaac Wright is elected president (18271832).

1856

Moses Taylor is elected president (18561882).

992 1998

citigroup.com

Connect With Us:

Terms of Use Privacy Careers Contact Us Site Map Our Blog

Citigroup.com is the global source of information about and access point to financial services provided by the Citi family of companies.

India

Committed to India for over 106 years, Citi prides itself in being a premier locally-embedded financial institution backed by its global network across 100 countries. With over 10,000 employees and US$3.1 billion capital invested, Citi is the single largest foreign direct investor in the financial services industry in India. Citi is a dominant provider of banking and financial services in India and offers a comprehensive suite of products and services to over 1,500 large corporates and multinationals, over 2,500 small and medium enterprises and over 7 million retail customers. Citi India's operations encompass corporate and investment banking, consumer banking, private banking, and banking services to the international Indian community. The breadth of Citi's activities in India include: Institutional Clients Group A leading corporate bank with a 106-year history of serving Indian corporate sector and financial institutions Enjoys a dominant market share in key products like cash management, FX and Custodial Services

Has a fast growing SME franchise with a dominant share of market in many key verticals

Investment Banking & Capital Markets - Citi Dominant Investment Bank across both fund raising and advisory services Leading advisor on Equity and Equity-linked transactions Top-notch local currency debt house Pioneers in Securitisation Leading issuer of G3 bonds A top-notch Research team providing top quality research & international expertise to trading oriented investors through comprehensive coverage of the Indian markets across sectors Leading equity trading house

Alternate Investments - Citi Venture Capital International A leading private equity player over the last decade Investments in multiple sectors in the country in sectors including auto components, financial services, ITES and real estate.

Consumer Banking & Global Cards Citibank Pioneered consumer banking and was the first to introduce credit cards and consumer finance. Significant investments in technology have enabled Citi to maintain its edge through alternative distribution channels ATM, online banking, phone banking, mobile banking Retail network includes 40 branches in 28 cities and over 450 ATMs

CitiFinancial Citi Wealth Advisors

Consumer finance services for Personal Loans, Home Loans, and third-party insurance Over 350 branches across 180 geographic locations

Financial planning and investment advisory based on a retail brokerage platform to serve wealth management needs of retail investors

Global Wealth Management Citi Private Bank A holistic approach to wealth management for both individuals and businesses throughout the wealth creation cycle Provides the full range of finance, banking, investment, trust and advisory services for wealth creators Trusted advisors for designing insightful solutions customized to individual client needs, with an emphasis on personalized, confidential service

Outsourcing India is a key outsourcing hub for Citi: Provides software development for over 50 countries Offers knowledge outsourcing services to Citi's Investment Bank and Research teams across the globe

Citibank Swot Analysis

Situation Analysis Citibank is looking to expand their reach within the banking world. They had an opportunity to acquire Confia a Mexican bank. Many Mexican banks are having problems due to the lack of money and resources the Mexican people have to invest in the banks. Citibank does much research while deciding whether to follow through with the deal. At the very end of the purchasing process an undiscovered threat is exposed to Citibank that Confia may have. This brings more difficulties within the purchasing process.

Firm Strengths

Citibank's many strengths start within their 194 year old rich history. Citibank has more than 100 years of experience in the international lending field. They are also the worlds largest credit lender and have been since the 1970's. They have also taken the title of the world's largest bank in 1981. In 1994 Citibank decided to break their company up into two sectors. One division being the Global Consumer Division and the other the Global Finance Division. This is strength for Citibank because this allows for more focus on their separate segments of the market. Citibank also holds advantages and strengths within the Mexican banking market. After the Tequila Crisis most U.S. banks took their business out of Mexico, Citibank did not. They also found strength in the fact that their portfolio was not as large as other banks in Mexico, this allowing them to have fewer complications. Confia also had some strengths. Begging with their 300 branches they had in 1992. Confia also has a great reputation. They are known for their great customer service, quality and efficiency. Confia is also a Mexican bank. This provides them with local and governmental support, that foreign banks may not get. If Citibank acquired Confia some strengths that may come about are possible high returns. Again the accusation will allow Citibank to have a better local image. This may also lead to other...

itibank, N.A. - Strategic SWOT Analysis Review Summary Citibank N.A. (Citibank) is a consumer bank and wholly owned subsidiary of Citigroup, Inc. The bank offers a range of banking products and services such as commercial banking, retail banking, consumer finance, mortgage lending, investment banking, cash management, e-commerce, trade finance, and private banking. It provides deposit accounts, credit cards and loans to consumers and small businesses, and utilizes its parent's breadth of financial services by also offering insurance and investment products. It manages 200 million customer accounts across six continents in more than 100 countries. The bank principally operates in Europe, Americas, Middle East, Asia and Africa including the US, China, Hong Kong, India, Japan, the Philippines and Singapore. Citibank is headquartered in Las Vegas, Nevada, US. Citibank, N.A. Key Recent Developments Dec 21, 2010: TAQA Secures $3 Billion Revolving Credit Facility Sep 23, 2010: Maersk Secures $6.75 Billion Revolving Credit Facility Jun 25, 2010: SATORP Completes $8.5 Billion Project Financing For Jubail Refinery In Saudi Arabia Apr 12, 2010: Citibank Introduces Same-day Card Issuance Service In Hong Kong Mar 24, 2010: Gas Natural Signs EUR4 Billion Syndicated Loan Facility With 18 Banks GlobalDatas Citibank, N.A. - Strategic SWOT Analysis Review provides a comprehensive insight into the companys history, corporate strategy, business structure and operations. The report contains a detailed SWOT analysis, information on the companys key employees, key competitors and major products and services. This up-to-the-minute company report will help you to formulate strategies to drive your business by enabling you to understand your partners, customers and competitors better.

Scope - Business description A detailed description of the companys operations and business divisions. - Corporate strategy GlobalDatas summarization of the companys business strategy. - SWOT analysis A detailed analysis of the companys strengths, weakness, opportunities and threats. - Company history Progression of key events associated with the company. - Major products and services A list of major products, services and brands of the company. - Key competitors A list of key competitors to the company. - Key employees A list of the key executives of the company. - Executive biographies A brief summary of the executives employment history. - Key operational heads A list of personnel heading key departments/functions. - Important locations and subsidiaries A list of key locations and subsidiaries of the company, including contact details. Note: Some sections may be missing if data is unavailable for the company. Reasons to Buy - Gain key insights into the company for academic or business research purposes. Key elements such as SWOT analysis and corporate strategy are incorporated in the profile to assist your academic or business research needs. - Identify potential customers and suppliers with this reports analysis of the companys business structure, operations, major products and services and business strategy. - Understand and respond to your competitors business structure and strategies with GlobalDatas detailed SWOT analysis. In this, the companys core strengths, weaknesses, opportunities and threats are analyzed, providing you with an up to date objective view of the company. - Examine potential investment and acquisition targets with this reports detailed insight into the companys strategic, business and operational performance.

Reasons to buy

Gain key insights into the company for academic or business research purposes. Key elements such as SWOT analysis, corporate strategy and financial ratios and charts are incorporated in the profile to assist your academic or business research needs. Identify potential customers and suppliers with this reports analysis of the companys business structure, operations, major products and services and business strategy. Understand and respond to your competitors business structure and strategies with GlobalDatas detailed SWOT analysis. In this, the companys core strengths, weaknesses, opportunities and threats are analyzed, providing you with an up to date objectiveview of the company. Examine potential investment and acquisition targets with this reports detailed insight into the companys strategic, financial and operational performance. Financial ratios presented for major public companies in the report include revenue trends, profitability, growth, margins and returns, liquidity and leverage, financial position and efficiency ratios.

HSBC Group

Strengths

events.

The bank is well capitalised and this has enabled it to perform relatively well against other banks in recent economic

The level of capitalisation means that, going forward, the bank is unlikely to need to borrow from the UK government: this will enable it to retain more autonomy.

The bank has a strong presence in emerging markets, putting it in a good position to take advantage of future growth in those economies. The banks global presence in Europe, Asia and South America helps to spread risk and offers significant economies of scale.

Despite rebranding relatively recently (1999), the HSBC brand has become well-established and is considered particularly valuable within the industry.

Weaknesses

HSBC associates itself strongly with investment in the small business sector, but the current economic situation has led to increased risks, potentially compromising the activity levels in this area of the operation. The bank was involved with sub-prime markets in the US and has had to write off large figures lent to high-risk borrowers.

Despite falls in the UK interest rate, HSBC has increased its mortgage rates. This may be perceived negatively by borrowers and potential borrowers, adds pressure to an already depressed housing market and could ultimately lead to more defaulting as borrowers struggle with higher repayments.

loyalty.

A redundancy programme announced recently may affect morale among staff, leading to decreased production and

HSBCs branding emphasises its global presence, and this may be seen negatively by some customers in its implication of homogenisation and lack of personalisation.

Opportunities

HSBCs high level of capitalisation places it in a strong position to acquire assets Banks finding trading conditions particularly difficult at present may be available at low cost HSBC also has adequate capital to purchase stronger banks such as Bank Ekonomi in Indonesia, in which it has purchased a stake to continue its Asian expansion despite challenging economic times.

Threats

HSBCs generally strong position presents the opportunity to outperform competitors during the economic downturn and to build a reputation for being one of the safer banks for depositors, helping to increase resources for lending. Negative press coverage of competitors such as HBOS may encourage customers to choose HSBC instead.

Trust in banks has decreased due to financial losses suffered by investors, who may be more inclined to invest elsewhere. Financial losses affecting banks and investors on a global scale have resulted in less credit being available to customers. In the UK this is coupled with increases in living costs resulting in less money being saved.

default.

The falling property market has created a rise in numbers of homeowners with negative equity. If a property is worth less than was borrowed to finance its purchase, there is little likelihood that the bank will recoup all its losses if owners

Claims have been made that HSBC has understated losses resulting from US sub-prime markets, and this could undermine confidence in the bank.

You might also like

- Michigan's New Driver's License Design and Security FeaturesDocument2 pagesMichigan's New Driver's License Design and Security FeaturesIgor EftimofNo ratings yet

- The Left, The Right, and The State (Read in "Fullscreen")Document570 pagesThe Left, The Right, and The State (Read in "Fullscreen")Ludwig von Mises Institute100% (68)

- Canada Post - Customs Data Collection - PrintDocument1 pageCanada Post - Customs Data Collection - PrintAnonymous EvHYcfNo ratings yet

- CA Enrollment FormDocument7 pagesCA Enrollment FormCarolineXiaNo ratings yet

- We're Reviewing Your Money Transfer.: ReceiptDocument4 pagesWe're Reviewing Your Money Transfer.: ReceiptSwiperNoSwipin0% (1)

- Instructions 1 PDFDocument2 pagesInstructions 1 PDFMhyla CunananNo ratings yet

- CRA's Intention To Revoke Letter To ISNA, Islamic Services of CanadaDocument61 pagesCRA's Intention To Revoke Letter To ISNA, Islamic Services of CanadasdbcraigNo ratings yet

- Required Docs for NC Driver's LicenseDocument3 pagesRequired Docs for NC Driver's Licensefelicia tayNo ratings yet

- Interested Party: The Standard On West Dallas: ConfirmationDocument1 pageInterested Party: The Standard On West Dallas: ConfirmationDaniel Lee Eisenberg JacobsNo ratings yet

- Your Koodo Bill: Account SummaryDocument6 pagesYour Koodo Bill: Account SummaryJuan Lorenzo García nuñezNo ratings yet

- Insurance ID Card and Important Information: Aravind Reddy Patlolla 399 Graphic BLVD New Milford, NJ 07646Document1 pageInsurance ID Card and Important Information: Aravind Reddy Patlolla 399 Graphic BLVD New Milford, NJ 07646Aravind ReddyNo ratings yet

- Between The World and MeDocument2 pagesBetween The World and Meapi-3886294240% (1)

- How K P Pinpoint Events Prasna PDFDocument129 pagesHow K P Pinpoint Events Prasna PDFRavindra ChandelNo ratings yet

- 8 Margauxs Way #8, Norfolk, MA 02056 - MLS# 71652630 - RedfinDocument7 pages8 Margauxs Way #8, Norfolk, MA 02056 - MLS# 71652630 - Redfinashes_xNo ratings yet

- Digitally signed Reliance Private Car Package Policy documentDocument11 pagesDigitally signed Reliance Private Car Package Policy documentNaseeb SinghNo ratings yet

- Member Benefits Costco Services 7 - 13 PDFDocument10 pagesMember Benefits Costco Services 7 - 13 PDFbhungi5693No ratings yet

- UTILITY BILL SUMMARYDocument2 pagesUTILITY BILL SUMMARYKaranbir SinghNo ratings yet

- Please Confirm To ContinueDocument4 pagesPlease Confirm To ContinueMahakaal Digital PointNo ratings yet

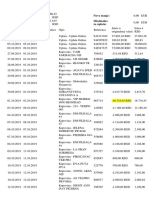

- Date Transaction Description Amount (In RS.) : Card No: 0036 1135 XXXX 3831 AAN: 0001015340002833839Document2 pagesDate Transaction Description Amount (In RS.) : Card No: 0036 1135 XXXX 3831 AAN: 0001015340002833839Satish RengarajanNo ratings yet

- American Express ProcessDocument6 pagesAmerican Express ProcessIsak VNo ratings yet

- Metocean Design and Operating ConsiderationsDocument7 pagesMetocean Design and Operating ConsiderationsNat Thana AnanNo ratings yet

- Lloyds of London Reinsurance Market GuideDocument4 pagesLloyds of London Reinsurance Market GuideVinayak NarichaniaNo ratings yet

- Ref - No. 16183558-19191991-3: Pramod Kumar S RDocument3 pagesRef - No. 16183558-19191991-3: Pramod Kumar S RS R PramodNo ratings yet

- Ngo Burca Vs RP DigestDocument1 pageNgo Burca Vs RP DigestIvy Paz100% (1)

- Kyc PDFDocument9 pagesKyc PDFOnn InternationalNo ratings yet

- Westpac Loan ApplicationDocument5 pagesWestpac Loan Applicationpatrick wafulaNo ratings yet

- Export Negotiation Collection Schedule-2015Document1 pageExport Negotiation Collection Schedule-2015kongbengNo ratings yet

- StatementsDocument5 pagesStatementsAdeelNo ratings yet

- Payment Step-By-Step: PT. Bit Coin IndonesiaDocument1 pagePayment Step-By-Step: PT. Bit Coin IndonesiaMad RajaNo ratings yet

- Payment Advices Detail ReportDocument1 pagePayment Advices Detail Reportrowena dela cruzNo ratings yet

- Bank of CyprusDocument7 pagesBank of CyprusLoizos LoizouNo ratings yet

- Bank@Campus Account - ICICI Bank LTDDocument1 pageBank@Campus Account - ICICI Bank LTDKumar RanjanNo ratings yet

- Ontario Inc.Document6 pagesOntario Inc.Metro English CanadaNo ratings yet

- BOC Account Opening FormDocument2 pagesBOC Account Opening FormCyberpoint Internet Cafe and Computer ShopNo ratings yet

- OpTransactionHistory07 10 2022Document2 pagesOpTransactionHistory07 10 2022Rg RrgNo ratings yet

- Credit Reports Scores 2Document4 pagesCredit Reports Scores 2Priya DasNo ratings yet

- KARUNANITHI SRINIVASAN1647319871895-credit-reportDocument26 pagesKARUNANITHI SRINIVASAN1647319871895-credit-reportHaritUchilNo ratings yet

- Small Business Bureau Registration Form OfficialDocument4 pagesSmall Business Bureau Registration Form OfficialNisherrie HoopsNo ratings yet

- Cimas Medical Aid Society StatementDocument2 pagesCimas Medical Aid Society Statementbertha kiaraNo ratings yet

- 2021 ArDocument142 pages2021 ArMark BöttnerNo ratings yet

- Incorporate and Grow Rich CompressDocument12 pagesIncorporate and Grow Rich CompressVictor DominguezNo ratings yet

- Deposit Bank - Google SearchDocument3 pagesDeposit Bank - Google SearchA.G. AshishNo ratings yet

- MR - Ramesh Rao DDocument2 pagesMR - Ramesh Rao DrameshraodNo ratings yet

- Digit Private Car Liability Only Policy ScheduleDocument2 pagesDigit Private Car Liability Only Policy ScheduleVishvkumar patelNo ratings yet

- Application For A Social Insurance Number Information Guide For ApplicantsDocument7 pagesApplication For A Social Insurance Number Information Guide For ApplicantsTHEBOSS09480No ratings yet

- ZYDUSLIFE 30052022203428 DLOFCoverLetterExchangesdt30052022Document81 pagesZYDUSLIFE 30052022203428 DLOFCoverLetterExchangesdt30052022Swarup JadhavNo ratings yet

- Experian Data Breach: Frequently Asked Questions For Individual ClientsDocument3 pagesExperian Data Breach: Frequently Asked Questions For Individual ClientsYusheel RamruthenNo ratings yet

- OneCard Statement Summary (20 Nov - 19 DecDocument4 pagesOneCard Statement Summary (20 Nov - 19 Decsouvik panNo ratings yet

- Bank Account Application FormDocument3 pagesBank Account Application Formeliastc76No ratings yet

- Merchant Banking in India: A GuideDocument65 pagesMerchant Banking in India: A Guideprathamesh kaduNo ratings yet

- Payment Application Form: Applicant'S ParticularsDocument2 pagesPayment Application Form: Applicant'S ParticularsVijay PuramNo ratings yet

- Money Matters FinalDocument3 pagesMoney Matters Finalapi-336224582No ratings yet

- Msi Employment Package Part1 CleanDocument11 pagesMsi Employment Package Part1 Cleanapi-474990711No ratings yet

- Borang CIMB Jan 2023Document15 pagesBorang CIMB Jan 2023anuaraqNo ratings yet

- MOTADI SAI PRASANNA statementDocument4 pagesMOTADI SAI PRASANNA statementNagarjuna SOCNo ratings yet

- Free Credit Score and Report - Free Monthly Credit CheckDocument3 pagesFree Credit Score and Report - Free Monthly Credit CheckSagar Chandra KhatuaNo ratings yet

- Mobile QR-Code For Smart Checkout System Using SETM AlgorithmDocument73 pagesMobile QR-Code For Smart Checkout System Using SETM AlgorithmVictor OkonkwoNo ratings yet

- Land and Property Taxation Systems Around the WorldDocument50 pagesLand and Property Taxation Systems Around the Worldaini nabillahNo ratings yet

- Account Opening FormDocument26 pagesAccount Opening Formshort vids sidNo ratings yet

- Novo Stanje: Novo Stanje: Minimalno Za Uplatu: Minimalno Za UplatuDocument8 pagesNovo Stanje: Novo Stanje: Minimalno Za Uplatu: Minimalno Za UplatuTemeljkovski DraganNo ratings yet

- Pay 2,000 GBP to Flywire for University FeesDocument3 pagesPay 2,000 GBP to Flywire for University FeesMuhammad Aqeel Anwar ButtNo ratings yet

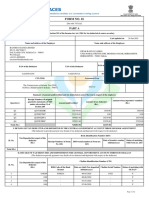

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMirza Aftab BaigNo ratings yet

- Remote Driver's Licence ApplicationDocument1 pageRemote Driver's Licence ApplicationFloyd McDermott100% (1)

- Cibil ScoreDocument2 pagesCibil ScoreAjay BaranwalNo ratings yet

- Corporate Rishi LeadershipDocument10 pagesCorporate Rishi Leadershipmeenakshi56No ratings yet

- MeenakshiDocument9 pagesMeenakshimeenakshi56No ratings yet

- A Report On "Balance of Payments": Concept QuestionsDocument28 pagesA Report On "Balance of Payments": Concept Questionsmeenakshi56No ratings yet

- Analysis Chapter5Document8 pagesAnalysis Chapter5meenakshi56No ratings yet

- Micro Finance Institutions Problems FVFFFFFFFFFFFFFFFFFFFFFFFFFFFFDocument1 pageMicro Finance Institutions Problems FVFFFFFFFFFFFFFFFFFFFFFFFFFFFFmeenakshi56No ratings yet

- Indian Depository ReceiptsDocument11 pagesIndian Depository Receiptsmeenakshi56100% (1)

- The role of corporate governance in productivity, social welfare and accountabilityDocument4 pagesThe role of corporate governance in productivity, social welfare and accountabilitymeenakshi56No ratings yet

- Slide 1Document5 pagesSlide 1meenakshi56No ratings yet

- Socialization Process IGDocument11 pagesSocialization Process IGmeenakshi56No ratings yet

- Saini Sir WordDocument10 pagesSaini Sir Wordmeenakshi56No ratings yet

- FILE008Document14 pagesFILE008meenakshi56No ratings yet

- External SeminarDocument7 pagesExternal Seminarmeenakshi56No ratings yet

- AmericaDocument8 pagesAmericameenakshi56No ratings yet

- The role of corporate governance in productivity, social welfare and accountabilityDocument4 pagesThe role of corporate governance in productivity, social welfare and accountabilitymeenakshi56No ratings yet

- Non Financial InformationDocument4 pagesNon Financial Informationmeenakshi56No ratings yet

- HimaniDocument10 pagesHimanimeenakshi56No ratings yet

- Review of LiteratureDocument7 pagesReview of Literaturemeenakshi56No ratings yet

- Micro Finance Institutions Problems FVFFFFFFFFFFFFFFFFFFFFFFFFFFFFDocument1 pageMicro Finance Institutions Problems FVFFFFFFFFFFFFFFFFFFFFFFFFFFFFmeenakshi56No ratings yet

- Thoreau's Walden Pond Experiment in Self-Reliance and SimplicityDocument10 pagesThoreau's Walden Pond Experiment in Self-Reliance and Simplicitymeenakshi56No ratings yet

- REFERENCEDocument1 pageREFERENCEmeenakshi56No ratings yet

- ENTERPDocument5 pagesENTERPmeenakshi56No ratings yet

- AdvantagesDocument6 pagesAdvantagesmeenakshi56No ratings yet

- Objective of The StudyDocument1 pageObjective of The Studymeenakshi56No ratings yet

- ConciliationDocument7 pagesConciliationmeenakshi56No ratings yet

- TVS Motors Mahindra & Mahindra Honda Motors: Bajaj AutoDocument5 pagesTVS Motors Mahindra & Mahindra Honda Motors: Bajaj Automeenakshi56No ratings yet

- Indian Banking Industry History and Current LandscapeDocument2 pagesIndian Banking Industry History and Current Landscapemeenakshi56No ratings yet

- Definition of ImportantDocument8 pagesDefinition of Importantmeenakshi56No ratings yet

- Indian Railways Online WebsiteDocument1 pageIndian Railways Online Websitemeenakshi56No ratings yet

- PNB DEPOSIT OR TERM DEPOSIT INTEREST RATES ACCORDING TO 3 AugustDocument2 pagesPNB DEPOSIT OR TERM DEPOSIT INTEREST RATES ACCORDING TO 3 Augustmeenakshi56No ratings yet

- Meaning of Internet F.RDocument3 pagesMeaning of Internet F.Rmeenakshi56No ratings yet

- Retail investment: Addressing timing and pricing issues through SIPsDocument52 pagesRetail investment: Addressing timing and pricing issues through SIPsMauryanNo ratings yet

- TARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFDocument25 pagesTARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFWilliam WulffNo ratings yet

- Answers and Equations for Investment Quotient Test ChaptersDocument3 pagesAnswers and Equations for Investment Quotient Test ChaptersJudeNo ratings yet

- ERP in Apparel IndustryDocument17 pagesERP in Apparel IndustrySuman KumarNo ratings yet

- Bautista CL MODULEDocument2 pagesBautista CL MODULETrisha Anne Aranzaso BautistaNo ratings yet

- Personal Values: Definitions & TypesDocument1 pagePersonal Values: Definitions & TypesGermaeGonzalesNo ratings yet

- Northern Nigeria Media History OverviewDocument7 pagesNorthern Nigeria Media History OverviewAdetutu AnnieNo ratings yet

- Annamalai University: B.A. SociologyDocument84 pagesAnnamalai University: B.A. SociologyJoseph John100% (1)

- Some People Think We Should Abolish All Examinations in School. What Is Your Opinion?Document7 pagesSome People Think We Should Abolish All Examinations in School. What Is Your Opinion?Bach Hua Hua100% (1)

- JNMF Scholarship Application Form-1Document7 pagesJNMF Scholarship Application Form-1arudhayNo ratings yet

- Ricoh MP 4001 Users Manual 121110Document6 pagesRicoh MP 4001 Users Manual 121110liliana vargas alvarezNo ratings yet

- High-Performance Work Practices: Labor UnionDocument2 pagesHigh-Performance Work Practices: Labor UnionGabriella LomanorekNo ratings yet

- Class Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseDocument17 pagesClass Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseNidhi ShahNo ratings yet

- Edsml Assignment SCM 2 - Velux GroupDocument20 pagesEdsml Assignment SCM 2 - Velux GroupSwapnil BhagatNo ratings yet

- GLORIADocument97 pagesGLORIAGovel EzraNo ratings yet

- F1 English PT3 Formatted Exam PaperDocument10 pagesF1 English PT3 Formatted Exam PaperCmot Qkf Sia-zNo ratings yet

- Student-Led School Hazard MappingDocument35 pagesStudent-Led School Hazard MappingjuliamarkNo ratings yet

- Fil 01 Modyul 7Document30 pagesFil 01 Modyul 7Jamie ann duquezNo ratings yet

- How Zagreb's Socialist Experiment Finally Matured Long After Socialism - Failed ArchitectureDocument12 pagesHow Zagreb's Socialist Experiment Finally Matured Long After Socialism - Failed ArchitectureAneta Mudronja PletenacNo ratings yet

- Winny Chepwogen CVDocument16 pagesWinny Chepwogen CVjeff liwaliNo ratings yet

- Chap1 HRM581 Oct Feb 2023Document20 pagesChap1 HRM581 Oct Feb 2023liana bahaNo ratings yet

- Hackers Speaking Test ReviewDocument21 pagesHackers Speaking Test ReviewMark Danniel SaludNo ratings yet

- Demonetisation IndiaDocument71 pagesDemonetisation IndiaVinay GuptaNo ratings yet

- 50 Simple Interest Problems With SolutionsDocument46 pages50 Simple Interest Problems With SolutionsArnel MedinaNo ratings yet

- A Practical Guide To The 1999 Red & Yellow Books, Clause8-Commencement, Delays & SuspensionDocument4 pagesA Practical Guide To The 1999 Red & Yellow Books, Clause8-Commencement, Delays & Suspensiontab77zNo ratings yet