Professional Documents

Culture Documents

Dismissal of Undersecretary for failure to disclose spouse's business interests

Uploaded by

Minerva Vallejo AlvarezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dismissal of Undersecretary for failure to disclose spouse's business interests

Uploaded by

Minerva Vallejo AlvarezCopyright:

Available Formats

PRESIDENTIAL ANTI-GRAFT COMMISSION (PAGC) and THE OFFICE OF THE PRESIDENT vs. SALVADOR A. PLEYTO, G.R. No.

176058, March 23, 2011

This case is about the dismissal of a department undersecretary for failure to declare in his Sworn Statement of Assets, Liabilities, and Net Worth (SALN) his wifes business interests and financial connections. On July 10, 2003 PAGC found Pleyto guilty as charged and recommended to the OP his dismissal with forfeiture of all government financial benefits and disqualification to re-enter government service. On January 29, 2004 the OP approved the recommendation. Pleyto filed a motion for reconsideration which was denied. He elevated the case to the Appelate Court which granted his petition. Hence, this petition for certiorari filed by PAGC and The Office of the President.

ISSUE: 1. Whether or not the CA erred in not finding Pleytos failure to indicate his spouses business interests in his SALNs a violation of Section 8 of R.A. 6713. 2. Whether or not the CA erred in finding that under the Review and Compliance Procedure, Pleyto should have first been allowed to correct the error in his SALNs before being charged for violation of R.A. 6713.

RULING: 1. Yes, Assuring the truth and accuracy of the answers in the SALN is the function of the filers oath that to the best of his knowledge and information, the data he provides in it constitutes the true statements of his assets, liabilities, net worth, business interests, and financial connections, including those of his spouse and unmarried children below 18 years of age. Any falsity in the SALN makes him liable for falsification of public documents under Article 172 of the Revised Penal Code. 2. The law will not require the impossible, namely, that the Committee must ascertain the truth of all the information that the public officer or employee stated or failed to state in his SALNs and remind him of it. The DPWH affirms this fact in its certification The purpose of R.A. 6713 is to promote a high standard of ethics in public service. Public officials and employees shall at all times be accountable to the people and shall discharge their duties with utmost responsibility, integrity, competence, and loyalty, act with patriotism and justice, lead modest lives, and uphold public interest over personal interest.[31] The law expects public officials to be accountable to the people in the matter of their integrity and competence. Thus, the Court cannot interpret the Review and Compliance Procedure as transferring such accountability to the Committee.

FERDINAND R. MARCOS, JR. vs. REPUBLIC rep. by the PCGG, G.R. No. 189434, April 25, 2012 IMELDA ROMUALDEZ-MARCOS vs. REPUBLIC, G.R. No. 189505

FACTS: These two consolidated Petitions filed under Rule 45 of the 1997 Rules of Civil Procedure pray for the reversal of the 2 April 2009 Decision of the Sandiganbayan in Civil Case No. 0141. The anti-graft court granted the Motion for Partial Summary Judgment filed by respondent Republic of the Philippines (Republic) and declared all assets and properties of Arelma, S.A., an entity created by the late Ferdinand E. Marcos, forfeited in favor of the government. On 17 December 1991, the Republic, through the PCGG, filed a Petition for Forfeiture before the Sandiganbayan pursuant to the forfeiture law, Republic Act No. 1379 (R.A. 1379) in relation to Executive Order Nos. 1, 2 and 14. Respondent Republic, through the PCGG and OSG, sought the declaration of Swiss bank accounts totaling USD 356 million (now USD 658 million), and two treasury notes worth USD 25 million and USD 5 million, as ill-gotten wealth. The Swiss accounts, previously held by five groups of foreign foundations, were deposited in escrow with the PNB, while the treasury notes were frozen by the BSP. ISSUE: Whether petitioner Republic complied with Section 3, subparagraphs c, d, and e of R.A. 1375; RULING: The court finds the claim that petitioners comply with subparagraphs c, d, and e above, because the latter allegedly never took into account the years when Ferdinand Marcos served as a war veteran with back pay, a practicing lawyer, a trader and investor, a congressman and senator to be a haphazard rehash of what has already been conclusively determined by the Sandiganbayan and the Supreme Court in the Swiss Deposits Decision. The alleged receivables from prior years were without basis, because Marcos never had a known law office nor any known clients, and neither did he file any withholding tax certificate that would prove the existence of a supposedly profitable law practice before he became President. R.A. 1379 provides that whenever any public officer or employee has acquired during his incumbency an amount of property manifestly out of proportion to his salary as such public officer and to his other lawful income, said property shall be presumed prima facie to have been unlawfully acquired. The elements that must concur for thisprima facie presumption to apply are the following: (1) the offender is a public officer or employee; (2) he must have acquired a considerable amount of money or property during his incumbency; and (3) said amount is manifestly out of proportion to his salary as such public officer or employee and to his other lawful income and income from legitimately acquired property. Thus, in determining whether the presumption of ill-gotten wealth should be applied, the relevant period is incumbency, or the period in which the public officer served in that position. The amount of the public officers salary and lawful income is compared against any property or amount acquired for that same period. In the Swiss Deposits Decision, the Court ruled that petitioner Republic was able to establish the prima facie presumption that the assets and properties acquired by the Marcoses were manifestly and patently disproportionate to their aggregate salaries as public officials.

You might also like

- Fundamentals of Income Taxation: Focus Notes On TaxationDocument38 pagesFundamentals of Income Taxation: Focus Notes On TaxationamiNo ratings yet

- Palting V San Jose PetroleumDocument14 pagesPalting V San Jose PetroleumMp CasNo ratings yet

- Republic of The Philippines Manila: Gutierrez v. Collector G.R. Nos. L-9738 and L-9771Document7 pagesRepublic of The Philippines Manila: Gutierrez v. Collector G.R. Nos. L-9738 and L-9771Jopan SJ100% (1)

- ABS-CBN Broadcasting Corp. vs. CADocument18 pagesABS-CBN Broadcasting Corp. vs. CAw8ndblidNo ratings yet

- Conflict of Law Jurisdictions: Daniel Lising MD LLMDocument49 pagesConflict of Law Jurisdictions: Daniel Lising MD LLMFelip MatNo ratings yet

- 2 Secuya V de SelmaDocument3 pages2 Secuya V de SelmaAndrew GallardoNo ratings yet

- Caltex V CADocument19 pagesCaltex V CAcmdelrioNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument6 pagesFinancial Rehabilitation and Insolvency ActEliyah JhonsonNo ratings yet

- 127 Scra 9 (GR 119761) Commisioner vs. CADocument23 pages127 Scra 9 (GR 119761) Commisioner vs. CARuel FernandezNo ratings yet

- Renato Diaz & Aurora Tumbol vs. Secretary of Finance DOCTRINE: The Law Imposes Value Added Tax (VAT) On "All Kinds of Services"Document21 pagesRenato Diaz & Aurora Tumbol vs. Secretary of Finance DOCTRINE: The Law Imposes Value Added Tax (VAT) On "All Kinds of Services"Vicente Del Castillo IVNo ratings yet

- Insurance law bar exam questionsDocument5 pagesInsurance law bar exam questionsMayroseTAquinoNo ratings yet

- PaleDocument18 pagesPalejeppiner4No ratings yet

- Lanzaderas vs. AmethystDocument2 pagesLanzaderas vs. AmethystrebellefleurmeNo ratings yet

- Sansio V MogolDocument2 pagesSansio V Mogolkpaglicawan_1No ratings yet

- Gsis Vs ManaloDocument1 pageGsis Vs ManaloKarl Marxcuz Reyes100% (1)

- 6.expert Travel & Tours v. CADocument24 pages6.expert Travel & Tours v. CARocelle LaquiNo ratings yet

- Commercial Law Case Digest: List of CasesDocument57 pagesCommercial Law Case Digest: List of CasesJean Mary AutoNo ratings yet

- Revalida - 4. Cha Vs CADocument2 pagesRevalida - 4. Cha Vs CADonna Joyce de BelenNo ratings yet

- Coleongco Vs ClaparolsDocument2 pagesColeongco Vs ClaparolsMichael C. PayumoNo ratings yet

- Realty Exchange Venture Co. vs. Sendino, 233 SCRA 665 (1994)Document5 pagesRealty Exchange Venture Co. vs. Sendino, 233 SCRA 665 (1994)Christiaan CastilloNo ratings yet

- Ramnani v. CIRDocument14 pagesRamnani v. CIRJun SapnuNo ratings yet

- Pay Vs PalancaDocument2 pagesPay Vs PalancaGeorge AlmedaNo ratings yet

- CIR v. P&G Philippine tax credit deniedDocument2 pagesCIR v. P&G Philippine tax credit deniedNaomi QuimpoNo ratings yet

- Marcos v. CADocument2 pagesMarcos v. CANikki MalferrariNo ratings yet

- Manila Banking V TeodoroDocument2 pagesManila Banking V Teodoroluiz ManieboNo ratings yet

- Bonifacio Cruz MemoDocument7 pagesBonifacio Cruz MemoErgel Mae Encarnacion RosalNo ratings yet

- CASES - DigestDocument11 pagesCASES - DigestChameNo ratings yet

- Conflicts Case DigestsDocument8 pagesConflicts Case Digestsjeandpmd100% (1)

- Philippines Pre-Need Code establishes regulationDocument23 pagesPhilippines Pre-Need Code establishes regulationAicing Namingit-VelascoNo ratings yet

- Case 23 - Basco Vs PagcorDocument1 pageCase 23 - Basco Vs PagcorMadame VeeNo ratings yet

- 03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990Document4 pages03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990kram.erri2012No ratings yet

- San Beda College of Law Memory Aid in Commercial LawDocument5 pagesSan Beda College of Law Memory Aid in Commercial LawTwinkleNo ratings yet

- 1, Petition To COMELECDocument47 pages1, Petition To COMELECMCamelloNo ratings yet

- Local Government Taxation (Bangcal, Eleccion)Document25 pagesLocal Government Taxation (Bangcal, Eleccion)Filiusdei100% (1)

- Surety Liable Despite Absence of Written Principal ContractDocument2 pagesSurety Liable Despite Absence of Written Principal ContractJana Felice Paler GonzalezNo ratings yet

- Tax 3rd SetDocument33 pagesTax 3rd SetAnthea Louise RosinoNo ratings yet

- IV. INSURANCE CODE (Republic Act No. 10607, As Amended) : A. Concept of InsuranceDocument5 pagesIV. INSURANCE CODE (Republic Act No. 10607, As Amended) : A. Concept of InsuranceTrinca DiplomaNo ratings yet

- PHIVIDEC v. Court of Appeals, 181 SCRA 669 (1990)Document11 pagesPHIVIDEC v. Court of Appeals, 181 SCRA 669 (1990)inno KalNo ratings yet

- National Telecommunication CommissionDocument1 pageNational Telecommunication CommissionClaire BarnesNo ratings yet

- Labor Law Mock Bar Exam AnswersDocument3 pagesLabor Law Mock Bar Exam AnswersMark MartinezNo ratings yet

- G.R. No. 166859 Entitled Republic of The Philippines vs. Sandiganbayan (E-SCRA)Document267 pagesG.R. No. 166859 Entitled Republic of The Philippines vs. Sandiganbayan (E-SCRA)Rhei BarbaNo ratings yet

- G.R. No. L-26306 Ventura Vs VenturaDocument5 pagesG.R. No. L-26306 Ventura Vs Venturajoebell.gpNo ratings yet

- People v. Johnson (348 SCRA 526)Document9 pagesPeople v. Johnson (348 SCRA 526)Jomarc MalicdemNo ratings yet

- CIR v. Avelino - Assessment Deemed Prima Facie CorrectDocument26 pagesCIR v. Avelino - Assessment Deemed Prima Facie CorrectronasoldeNo ratings yet

- Ramos Vs PeraltaDocument5 pagesRamos Vs PeraltaKarla Marie TumulakNo ratings yet

- GRP-MILF Peace Agreements ChallengedDocument50 pagesGRP-MILF Peace Agreements ChallengedRyan ChristianNo ratings yet

- Deutsche Bank vs. CirDocument1 pageDeutsche Bank vs. CirDee WhyNo ratings yet

- Bank Not Liable for Non-Compliance with Letter of Credit TermsDocument4 pagesBank Not Liable for Non-Compliance with Letter of Credit TermsCleinJonTiuNo ratings yet

- 20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931Document7 pages20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931joyeduardoNo ratings yet

- RCBCDocument2 pagesRCBCfradz08No ratings yet

- Different Kinds of Obligations: ©2016 Atty. Raphael James Dizon Photo byDocument24 pagesDifferent Kinds of Obligations: ©2016 Atty. Raphael James Dizon Photo byJimmy Boy DiazNo ratings yet

- Insurance Corp vs Lighterage Carrier on Notice of Claim DeadlineDocument2 pagesInsurance Corp vs Lighterage Carrier on Notice of Claim Deadlinekmand_lustregNo ratings yet

- Articles of Incorporation for House of Gentle FluffDocument5 pagesArticles of Incorporation for House of Gentle FluffAprilNo ratings yet

- Prisma V MenchavezDocument3 pagesPrisma V MenchavezKate Bernadette MadayagNo ratings yet

- Bañez v. CA - Art. 1337-Undue InfluenceDocument2 pagesBañez v. CA - Art. 1337-Undue InfluenceMaria Francheska GarciaNo ratings yet

- Fajardo v. CorralDocument6 pagesFajardo v. CorralAnthony Rey BayhonNo ratings yet

- Lumanlan Vs CuraDocument3 pagesLumanlan Vs CuraaceamulongNo ratings yet

- Supreme Court Rules on SALN Non-Disclosure CaseDocument9 pagesSupreme Court Rules on SALN Non-Disclosure Caseacheron_pNo ratings yet

- R.A. No. 3019 Anti-Graft and Corrupt PracticesDocument6 pagesR.A. No. 3019 Anti-Graft and Corrupt Practiceskaleidoscope worldNo ratings yet

- Saln 2 Dof VS OmbDocument7 pagesSaln 2 Dof VS Ombzge.singsonNo ratings yet

- MOA Certification - ACEF-GIAHEPDocument1 pageMOA Certification - ACEF-GIAHEPMinerva Vallejo AlvarezNo ratings yet

- Department of Agrarian Reform: CertificationDocument1 pageDepartment of Agrarian Reform: CertificationMinerva Vallejo AlvarezNo ratings yet

- MOA Certification - Lab ServicesDocument1 pageMOA Certification - Lab ServicesMinerva Vallejo AlvarezNo ratings yet

- MOA Certification - ACEF-GIAHEPDocument1 pageMOA Certification - ACEF-GIAHEPMinerva Vallejo AlvarezNo ratings yet

- Department of Agrarian Reform: CertificationDocument1 pageDepartment of Agrarian Reform: CertificationMinerva Vallejo AlvarezNo ratings yet

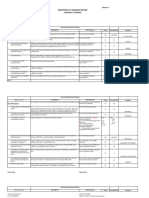

- Annex A of Engineer DEC 2022Document6 pagesAnnex A of Engineer DEC 2022Minerva Vallejo AlvarezNo ratings yet

- Revised Agrarian Reform ContractDocument12 pagesRevised Agrarian Reform ContractMinerva Vallejo AlvarezNo ratings yet

- MOA Certification - DMMMSUDocument1 pageMOA Certification - DMMMSUMinerva Vallejo AlvarezNo ratings yet

- Annex A ESS SUPPORT August 2022Document8 pagesAnnex A ESS SUPPORT August 2022Minerva Vallejo AlvarezNo ratings yet

- Affidavit of Total Aggregate Landholding - FRANCISCA A. YUNSONDocument1 pageAffidavit of Total Aggregate Landholding - FRANCISCA A. YUNSONMinerva Vallejo AlvarezNo ratings yet

- Annex A of Legal Office DEC2022Document6 pagesAnnex A of Legal Office DEC2022Minerva Vallejo AlvarezNo ratings yet

- Department of Agrarian Reform: CertificationDocument1 pageDepartment of Agrarian Reform: CertificationMinerva Vallejo AlvarezNo ratings yet

- DAR Accomplishment Report of FVT1 EngineerDocument2 pagesDAR Accomplishment Report of FVT1 EngineerMinerva Vallejo AlvarezNo ratings yet

- Annex-A-DOCUMENTOR-DEC 2022Document5 pagesAnnex-A-DOCUMENTOR-DEC 2022Minerva Vallejo AlvarezNo ratings yet

- RSS - T-413Document1 pageRSS - T-413Minerva Vallejo AlvarezNo ratings yet

- Department of Agrarian Reform: CertificationDocument1 pageDepartment of Agrarian Reform: CertificationMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 3A - Individual ARB Environmental & Social Performance (IA-ESP) AssessmentDocument10 pagesTEST ESMF 3A - Individual ARB Environmental & Social Performance (IA-ESP) AssessmentMinerva Vallejo AlvarezNo ratings yet

- Department of Agrarian Reform: CertificationDocument1 pageDepartment of Agrarian Reform: CertificationMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 3B - Individual Actual Occupant Environmental & Social Performance (IO-ESP) AssessmentDocument11 pagesTEST ESMF 3B - Individual Actual Occupant Environmental & Social Performance (IO-ESP) AssessmentMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 2 - Collective CLOA Environmental & Social Performance (CC-ESP) AssessmentDocument6 pagesTEST ESMF 2 - Collective CLOA Environmental & Social Performance (CC-ESP) AssessmentMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 3A - Individual ARB Environmental & Social Performance (IA-ESP) AssessmentDocument10 pagesTEST ESMF 3A - Individual ARB Environmental & Social Performance (IA-ESP) AssessmentMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 1 - Rapid Environmental and Social Screening Form For CCLOADocument8 pagesTEST ESMF 1 - Rapid Environmental and Social Screening Form For CCLOAMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 2 - Collective CLOA Environmental & Social Performance (CC-ESP) AssessmentDocument6 pagesTEST ESMF 2 - Collective CLOA Environmental & Social Performance (CC-ESP) AssessmentMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 1 - Rapid Environmental and Social Screening Form For CCLOADocument8 pagesTEST ESMF 1 - Rapid Environmental and Social Screening Form For CCLOAMinerva Vallejo AlvarezNo ratings yet

- Deed of Sale of FirearmDocument2 pagesDeed of Sale of FirearmMinerva Vallejo AlvarezNo ratings yet

- TEST ESMF 3B - Individual Actual Occupant Environmental & Social Performance (IO-ESP) AssessmentDocument11 pagesTEST ESMF 3B - Individual Actual Occupant Environmental & Social Performance (IO-ESP) AssessmentMinerva Vallejo AlvarezNo ratings yet

- Sample Memo Pre-Planning MeetingDocument1 pageSample Memo Pre-Planning MeetingMinerva Vallejo AlvarezNo ratings yet

- Memo SUBMIT WRITTEN EXPLANATIONDocument1 pageMemo SUBMIT WRITTEN EXPLANATIONMinerva Vallejo AlvarezNo ratings yet

- Sample Memo Pre-Planning MeetingDocument1 pageSample Memo Pre-Planning MeetingMinerva Vallejo AlvarezNo ratings yet

- Ds 160 Step by Step GuideDocument26 pagesDs 160 Step by Step GuideSutan Chandra Dosma Sitohang100% (1)

- Lifespan ApproachDocument2 pagesLifespan ApproachJP OcampoNo ratings yet

- Sikolohiyang PilipinoDocument9 pagesSikolohiyang PilipinoMargielane AcalNo ratings yet

- Pharmally Pharmaceuticals Corporate Governance and Ethics AnalysisDocument3 pagesPharmally Pharmaceuticals Corporate Governance and Ethics AnalysisAndreaaAAaa TagleNo ratings yet

- 1-Gregorio Araneta Inc V TuazonDocument19 pages1-Gregorio Araneta Inc V TuazonRen A EleponioNo ratings yet

- Jurisprudence and Legal Theory in Nigeria by IsochukwuDocument17 pagesJurisprudence and Legal Theory in Nigeria by IsochukwuVite Researchers100% (3)

- Cambridge IGCSE™: Global Perspectives 0457/13 May/June 2020Document15 pagesCambridge IGCSE™: Global Perspectives 0457/13 May/June 2020vanjatirnanicNo ratings yet

- Gender ManualDocument16 pagesGender ManualAlmina ŠatrovićNo ratings yet

- Uniform Civil Code and Gender JusticeDocument13 pagesUniform Civil Code and Gender JusticeS.P. SINGHNo ratings yet

- Principles of TQMDocument2 pagesPrinciples of TQMmacNo ratings yet

- Saemaul Undong Global Training for 45 CountriesDocument4 pagesSaemaul Undong Global Training for 45 CountriesCarlos RiveraNo ratings yet

- Managing Groups & Teams EffectivelyDocument23 pagesManaging Groups & Teams EffectivelyjaffnaNo ratings yet

- Most Effective Lesson Plan Edn4100 2018Document4 pagesMost Effective Lesson Plan Edn4100 2018api-263226444No ratings yet

- Althusser-Essays in Self CriticismDocument141 pagesAlthusser-Essays in Self CriticismLiza RNo ratings yet

- Growing Green (Group 7)Document14 pagesGrowing Green (Group 7)Rohith NairNo ratings yet

- Solomon MotivationDocument36 pagesSolomon MotivationJR JRovaneshwaranNo ratings yet

- Drugs ActivityDocument1 pageDrugs ActivityISTJ hohohoNo ratings yet

- Leadership The Effective Use of PowerDocument7 pagesLeadership The Effective Use of PowerMỹ DuyênNo ratings yet

- By Deepak Mangal Harkesh Gurjar Sanjay GuptaDocument22 pagesBy Deepak Mangal Harkesh Gurjar Sanjay GuptaagyeyaNo ratings yet

- 38.hoa Pham - Story Mr. Know AllDocument7 pages38.hoa Pham - Story Mr. Know AllThuỳ Vy ĐàoNo ratings yet

- 02 McGuigan CH 01Document14 pages02 McGuigan CH 01Zoran BosevskiNo ratings yet

- Neuromarketing and Consumer Neuroscience PDFDocument26 pagesNeuromarketing and Consumer Neuroscience PDFsamadaaliNo ratings yet

- Anti & Alter GlobalizationDocument11 pagesAnti & Alter GlobalizationJahedHossainNo ratings yet

- Probation Law of 1976Document3 pagesProbation Law of 1976Roland MarananNo ratings yet

- Montejo vs. Commission On Audit DigestDocument2 pagesMontejo vs. Commission On Audit DigestEmir MendozaNo ratings yet

- Bruford 1975 German Self Cultivation GoetheDocument16 pagesBruford 1975 German Self Cultivation GoetheMiec NecuticNo ratings yet

- JUTA's StatementDocument1 pageJUTA's StatementThe WireNo ratings yet

- Lopez Sugar Corp V Secretary DigestDocument2 pagesLopez Sugar Corp V Secretary DigestChristian SorraNo ratings yet

- Revoking Agreements by Cameron DayDocument2 pagesRevoking Agreements by Cameron Daygrobi6986% (7)

- Poetic Devices and Themes AnalysisDocument7 pagesPoetic Devices and Themes AnalysisJohn Carlo MendozaNo ratings yet

- 9 Moral Dilemmas That Will Break Your BrainDocument11 pages9 Moral Dilemmas That Will Break Your BrainMary Charlene ValmonteNo ratings yet

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Export & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesFrom EverandExport & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesRating: 5 out of 5 stars5/5 (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceFrom EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo ratings yet

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Richardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesFrom EverandRichardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- The HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsFrom EverandThe HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsRating: 3.5 out of 5 stars3.5/5 (3)