Professional Documents

Culture Documents

Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining Industry

Uploaded by

Q.M.S Advisors LLCOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining Industry

Uploaded by

Q.M.S Advisors LLCCopyright:

Available Formats

This material does not constitute investment advice and should not be

viewed as a current or past recommendation or a solicitation of an

offer to buy or sell any securities or to adopt any investment strategy.

Fundamental Analysis &

Analyst Recommendations

QMS Gold Miners FlexIndex The QMS Advisors' Gold Miners Flexible Index tracks

companies involved in the Gold Mining Industry.

July 2013

Q M S Advisors

.

Q.M.S Advisors | Avenue de la Gare, 1 1003 Lausanne | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

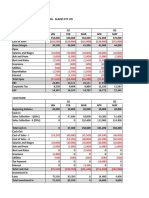

Valuation Measures I/II

Market Capitalization & Asset Liability data

Market

Total

Capitalization (in mio

Daily

Common Total Debt Preferred

Currency

USD)

Volume (M) Shares (M)

(USD)

Stock (USD)

Minority

Interest

(USD)

Total Revenue

Cash and Enterprise

Equivalents

Value

(USD)

(USD)

Tot. Rev. LFY

Est. Tot.

Rev. - Tr.

12M

EBITDA

Earnings Per Share

Est. Tot.

Est. Tot.

Est. EBITDA - Est. EBITDA - Est. EBITDA Rev. - 2013 Rev. - 2014 EBITDA - LFY Tr. 12M

2013

2014

EPS - LFY

Price/Earnings ratio

Est. EPS Tr. 12M

Est. EPS 2013

Est. EPS 2014

P/E Ratio LFY

Est. P/E

Ratio - Tr.

12M

Rev. Growth

EBITDA Growth

Est.

Est.

Est. Est.

Est. P/E

Est. P/E

Revenue

Revenue Est. EBITDA

EBITDA

Est. EBITDA

Ratio - 2013 Ratio - 2014 Growth - 1Y Growth - 5Y Growth - 1Y Growth - 5Y Margin -

S&P LT

Credit

Rating -

S&P LT Credit

Rating Date

Moody's LT

Credit

Moody's LT Credit

Rating

Rating Date

S&P 500 INDEX

USD

14827808

2000.805

1118

1118

204

220

220

102.41

110.19

110.19

15.69

15.69

14.58

14.58

18.73

Euro Stoxx 50 Pr

EUR

2548017

5339.84

4610

4610

738

771

771

205.58

300.90

300.90

21.67

17.15

14.81

14.81

20.37

NIKKEI 225

JPY

2653801

188.4611

192

192

18

22

22

5.43

7.94

7.94

0.26

0.24

0.18

0.18

0.11

FTSE 100 INDEX

GBP

2606011

11425.82

10175

10175

1424

1682

1682

592.58

812.01

812.01

24.49

21.53

17.88

17.88

21.45

SWISS MARKET INDEX

CHF

1029308

10842.85

4132

4132

868

835

835

420.45

562.22

562.22

20.54

17.05

15.36

15.36

22.32

S&P/TSX COMPOSITE INDEX

CAD

1561598

16437.06

8368

8368

1784

1983

1983

737.92

823.55

823.55

14.85

14.85

13.31

13.31

23.26

S&P/ASX 200 INDEX

AUD

1209852

5805.067

2584

2584

555

632

632

227.09

302.19

302.19

17.45

14.28

13.11

13.11

20.39

HANG SENG INDEX

HKD

1603954

3014.557

1669

1669

356

397

397

278.82

270.43

270.43

1.24

1.41

1.28

1.28

2.92

MSCI EM

USD

7107686

1301.645

969

969

188

180

180

82.42

90.56

90.56

11.41

11.60

10.38

10.38

19.23

GOLDCORP INC

USD

20080

13961

812

20.55

5435

5101

4677

5879

2798

2532

555

555

1.99

1.70

1.27

1.83

14.51

14.51

19.44

13.51

1.36

13.48

19.78

21.03

49.64

BBB+

01.06.2009

Baa2

13.03.2013

BARRICK GOLD CORP

USD

15758

31012

1001

14

30.91

14547

14340

13188

13960

7358

7071

1475

1475

3.74

3.30

2.90

2.93

4.77

4.77

5.43

5.38

2.18

13.61

-11.64

24.49

49.31

BBB

26.04.2013

Baa2

24.04.2013

NEWMONT MINING CORP

USD

14943

21350

497

23.11

9868

9362

8841

10057

4169

3731

711

711

3.71

3.34

2.41

2.93

8.97

8.97

12.42

10.22

-4.73

4.99

-19.24

19.37

39.85

BBB+

11.08.2008

Baa1

26.07.2010

RANDGOLD RESOURCES LTD-ADR

USD

5905

1871

92

5.81

1318

1331

1319

1740

699

689

4.65

4.48

4.06

6.36

14.29

14.29

15.75

10.07

16.92

27.97

20.16

53.34

51.75

YAMANA GOLD INC

USD

7155

13005

7.72

2337

2312

2353

2883

1269

1164

241

241

0.69

0.98

13.70

9.73

7.52

14.54

0.53

26.81

50.35

GOLD FIELDS LTD-SPONS ADR

USD

3884

6925

16

28916

38146

28744

31456

14243

18261

12281

12281

5.29

7.53

9.79

6.88

14.46

8.58

5.29

13.85

47.87

BB+

15.11.2012

SILVER WHEATON CORP

USD

6975

9886

850

856

854

969

701

700

148

148

1.39

1.54

14.18

12.74

16.38

43.77

13.36

43.74

81.79

ANGLOGOLD ASHANTI-SPON ADR

USD

5511

3469

30

52160

51968

61184

70391

19105

17635

20567

20567

14.10

26.22

10.01

5.38

-4.14

11.91

-17.82

86.63

33.93

BBB-

10.12.2012

CIA DE MINAS BUENAVENTUR-ADR

USD

4068

3412

4.30

1564

1492

1601

1718

569

518

199

199

2.69

2.27

2.11

1.97

6.49

6.47

7.00

7.48

0.44

14.04

-30.59

7.40

34.71

NEW GOLD INC

USD

3062

6485

3.24

791

824

921

985

390

388

95

95

0.37

0.51

17.21

12.61

13.70

39.01

13.39

63.80

47.02

BB-

27.03.2012

B2

27.03.2012

AGNICO EAGLE MINES LTD

USD

4761

3530

5.28

1918

1865

1673

1988

787

735

111

111

0.95

1.55

28.90

17.83

5.26

38.09

4.59

31.64

39.41

NR

12.03.2003

WR

05.03.2002

ELDORADO GOLD CORP

USD

4419

8458

4.63

1148

1214

1227

1338

584

631

114

114

0.38

0.45

16.18

13.76

3.97

58.56

-9.24

53.95

51.94

BB

13.11.2012

Ba3

12.11.2012

KINROSS GOLD CORP

USD

5822

20939

1140

6.63

4311

4333

3903

3963

1962

1981

338

338

0.77

0.74

0.39

0.47

6.89

6.89

13.21

10.83

12.20

27.96

1.87

40.67

45.72

BBB-

15.08.2011

Baa3

15.08.2011

ROYAL GOLD INC

USD

2709

2188

59

2.35

263

292

298

358

233

260

58

58

1.63

1.45

1.51

1.97

28.96

28.96

27.96

21.41

21.52

33.98

25.17

44.69

88.90

HARMONY GOLD MNG-SPON ADR

USD

1658

4247

15169

16353

17453

21284

4222

3140

4857

4857

3.88

4.80

9.70

7.84

30.81

9.67

79.35

16.71

19.20

IAMGOLD CORP

USD

1631

13844

1.71

1670

1571

1389

1590

710

642

127

127

0.46

0.60

9.37

7.25

-0.19

12.44

-9.54

30.21

40.84

BB-

10.09.2012

PAN AMERICAN SILVER CORP

USD

1762

4614

1.32

929

943

897

978

362

345

52

52

0.61

0.81

18.96

14.37

8.57

24.85

-18.81

25.23

36.62

FIRST MAJESTIC SILVER CORP

USD

1238

2422

1.16

247

256

320

474

135

132

0.74

1.21

14.37

8.78

0.68

59.29

-13.49

101.01

51.60

COEUR MINING INC

USD

1350

3888

1.37

895

863

849

998

378

343

78

78

0.59

0.68

0.43

1.11

19.56

19.56

31.07

11.99

-12.31

37.42

-28.81

43.35

39.75

B+

25.06.2012

B3

24.01.2013

AURICO GOLD INC

USD

1079

5960

0.98

164

285

374

52

53

20

20

0.22

0.36

19.77

12.31

94.95

15.72

2151.89

ALLIED NEVADA GOLD CORP

USD

673

11451

90

1.01

215

225

348

588

95

98

25

25

0.54

0.54

0.67

1.34

11.91

11.91

9.72

4.84

41.13

95.75

43.59

07.06.2012

B3

16.05.2012

HECLA MINING CO

USD

850

11906

285

0.71

321

306

480

665

93

74

45

45

0.07

0.12

0.10

0.28

24.83

24.83

29.50

10.53

-32.76

22.69

-63.53

10.36

24.02

04.04.2013

B2

02.04.2013

NEVSUN RESOURCES LTD

USD

587

1146

0.40

566

488

291

668

426

347

21

21

0.25

0.84

11.66

3.53

3.34

-0.64

71.21

AURIZON MINES LTD

USD

635

5181

0.48

224

210

92

78

0.06

0.19

67.51

21.32

-14.02

5.97

-26.18

14.15

37.08

SILVER STANDARD RESOURCES

USD

512

1545

0.23

241

252

55

65

-6

-6

-0.27

-0.16

63.09

38.56

25.82

SEABRIDGE GOLD INC

USD

430

767

0.41

-16

-15

-15

-0.22

-0.46

20.14

TANZANIAN ROYALTY EXPLORATIO

USD

272

701

0.27

-5

-5

-16.99

GOLDEN STAR RESOURCES LTD

USD

109

28562

259

0.16

551

552

125

117

15

15

-0.05

-0.16

-0.10

0.07

16.89

21.87

35.80

83.24

21.18

VISTA GOLD CORP

USD

79

5706

82

0.02

-36

-36

-0.54

-0.51

-0.27

-0.25

-26.58

GREAT BASIN GOLD LTD

USD

3503

0.32

170

145

18

-26

70.83

-18.00

ARGONAUT GOLD INC

CAD

806

1336

149

0.62

178

196

194

253

102

112

16

16

0.65

0.60

0.36

0.50

8.16

8.16

75.04

87.25

54.21

TOREX GOLD RESOURCES INC

CAD

767

5955

604

0.40

-57

-61

-0.13

-0.14

-0.08

-0.08

-73.37

LIONGOLD CORP LTD

SGD

804

7738

922

0.77

95

90

-12

-0.02

-0.03

17.94

6.97

-155.65

1.17

CHINA GOLD INTERNATIONAL RES

CAD

1055

641

396

1.13

316

315

PERSEUS MINING LTD

CAD

213

2455

0.19

138

SANDSTORM GOLD LTD

CAD

539

970

86

0.46

53

OCEANAGOLD CORP

CAD

363

1144

294

0.56

MEDUSA MINING LTD

AUD

273

2634

189

DUNDEE PRECIOUS METALS INC

CAD

515

867

126

RIO ALTO MINING LTD

CAD

326

942

176

AURIZON MINES LTD

USD

635

5181

ENDEAVOUR SILVER CORP

USD

342

2212

CONTINENTAL GOLD LTD

CAD

397

858

108

RUBICON MINERALS CORP

CAD

370

1239

288

SILVERCORP METALS INC

USD

482

1834

EVOLUTION MINING LTD

AUD

373

2690

CHINA PRECIOUS METAL RESOURC

HKD

724

2756

SEABRIDGE GOLD INC

USD

430

767

BEADELL RESOURCES LTD

AUD

369

6220

RESOLUTE MINING LTD

AUD

347

4561

254

90

7.99

188

446

204

459

6.00

13.67

9.83

320

521

132

141

121

121

0.17

0.17

0.14

0.15

13.82

13.82

16.86

16.32

6.43

-1.24

42.61

284

340

53

121

0.09

0.13

5.08

3.66

55

62

85

35

34

0.24

0.16

0.16

0.34

32.79

32.79

32.98

15.61

82.39

87.09

58.01

366

373

500

555

137

161

45

45

0.08

0.10

0.17

0.22

10.68

10.68

6.42

5.02

-2.44

13.24

-11.45

63.77

41.00

0.24

74

85

100

209

53

59

0.24

0.26

0.35

0.71

4.63

3.45

1.72

-41.88

86.44

-47.76

63.64

0.51

366

355

393

439

17

17

0.37

0.32

0.51

0.76

12.00

12.00

7.67

5.09

12.97

41.31

0.28

301

267

313

299

165

126

0.54

0.39

0.41

0.42

4.51

4.51

4.28

4.20

44.84

0.48

224

210

92

78

0.06

0.19

67.51

21.32

-14.02

5.97

-26.18

14.15

37.08

0.34

208

229

238

281

90

88

0.27

0.40

12.56

8.64

62.57

53.81

38.56

38.27

0.22

-11

-0.07

-0.10

-0.08

-0.09

0.23

64

-11

-11

-0.04

-0.04

-0.03

0.03

41.39

44.25

0.44

182

182

254

354

90

91

0.30

0.50

9.40

5.70

-23.68

11.35

-41.73

3.36

50.02

707

0.41

431

584

558

627

175

196

94

94

0.06

0.17

0.08

0.09

2.87

6.35

5.33

261.59

496.24

30.83

4351

1.01

210

210

233

303

144

144

144

144

0.02

0.02

0.02

1.38

1.28

1.06

5.84

26.55

4.61

8.88

0.41

-16

-15

-15

-0.22

-0.46

20.14

742

0.49

280

304

-13

135

135

-0.04

-0.05

0.12

0.15

3.57

2.87

55.37

636

0.29

529

567

605

529

233

239

0.15

0.23

0.21

0.11

2.13

2.34

4.47

27.13

26.81

120.30

96.07

38.62

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Valuation Measures I/II

Market Capitalization & Asset Liability data

Market

Total

Capitalization (in mio

Daily

Common Total Debt Preferred

Currency

USD)

Volume (M) Shares (M)

(USD)

Stock (USD)

Minority

Interest

(USD)

Total Revenue

Cash and Enterprise

Equivalents

Value

(USD)

(USD)

Tot. Rev. LFY

Est. Tot.

Rev. - Tr.

12M

EBITDA

Earnings Per Share

Est. Tot.

Est. Tot.

Est. EBITDA - Est. EBITDA - Est. EBITDA Rev. - 2013 Rev. - 2014 EBITDA - LFY Tr. 12M

2013

2014

EPS - LFY

Price/Earnings ratio

Est. EPS Tr. 12M

Est. EPS 2013

Est. EPS 2014

P/E Ratio LFY

Est. P/E

Ratio - Tr.

12M

Rev. Growth

EBITDA Growth

Est.

Est.

Est. Est.

Est. P/E

Est. P/E

Revenue

Revenue Est. EBITDA

EBITDA

Est. EBITDA

Ratio - 2013 Ratio - 2014 Growth - 1Y Growth - 5Y Growth - 1Y Growth - 5Y Margin -

S&P LT

Credit

Rating -

S&P LT Credit

Rating Date

Moody's LT

Credit

Moody's LT Credit

Rating

Rating Date

S&P 500 INDEX

USD

14827808

2000.805

1118

1118

204

220

220

102.41

110.19

110.19

15.69

15.69

14.58

14.58

18.73

Euro Stoxx 50 Pr

EUR

2548017

5339.84

4610

4610

738

771

771

205.58

300.90

300.90

21.67

17.15

14.81

14.81

20.37

NIKKEI 225

JPY

2653801

188.4611

192

192

18

22

22

5.43

7.94

7.94

0.26

0.24

0.18

0.18

0.11

FTSE 100 INDEX

GBP

2606011

11425.82

10175

10175

1424

1682

1682

592.58

812.01

812.01

24.49

21.53

17.88

17.88

21.45

SWISS MARKET INDEX

CHF

1029308

10842.85

4132

4132

868

835

835

420.45

562.22

562.22

20.54

17.05

15.36

15.36

22.32

S&P/TSX COMPOSITE INDEX

CAD

1561598

16437.06

8368

8368

1784

1983

1983

737.92

823.55

823.55

14.85

14.85

13.31

13.31

23.26

S&P/ASX 200 INDEX

AUD

1209852

5805.067

2584

2584

555

632

632

227.09

302.19

302.19

17.45

14.28

13.11

13.11

20.39

HANG SENG INDEX

HKD

1603954

3014.557

1669

1669

356

397

397

278.82

270.43

270.43

1.24

1.41

1.28

1.28

2.92

MSCI EM

USD

7107686

1301.645

969

969

188

180

180

82.42

90.56

90.56

11.41

11.60

10.38

10.38

19.23

ENDEAVOUR MINING CORP

CAD

220

5809

391

0.37

329

366

456

543

129

130

0.13

0.08

5.26

5.26

3.86

6.26

130.81

204.08

37.42

FORTUNA SILVER MINES INC

CAD

417

1074

125

0.33

153

153

163

201

67

62

0.26

0.22

0.22

0.30

13.75

13.75

13.81

10.07

44.08

45.08

42.57

64.01

38.42

MCEWEN MINING INC

USD

499

27070

296

0.45

39

22

20

-92

-67

-0.19

-0.17

-0.05

0.04

48.00

-54.81

-171.96

MAG SILVER CORP

CAD

352

183

60

0.32

-13

-13

-3

-3

-0.21

-0.23

-0.17

-0.19

-38.94

PRIMERO MINING CORP

CAD

516

618

97

0.39

174

176

191

238

74

68

29

29

0.51

0.48

0.39

0.52

8.33

8.33

10.38

7.76

16.03

6.02

36.89

KINGSGATE CONSOLIDATED LTD

AUD

186

2249

151

0.31

328

341

311

332

151

0.48

0.32

0.18

0.15

3.54

6.12

7.65

98.45

77.23

134.54

TIMMINS GOLD CORP

CAD

318

698

144

0.31

148

158

187

204

65

72

17

17

0.24

0.30

0.31

0.31

6.89

6.89

6.66

6.83

83.78

57.10

43.49

ST BARBARA LTD

AUD

208

3497

325

0.35

496

478

480

572

205

184

0.38

0.25

0.07

0.12

1.56

5.61

3.26

46.32

25.52

96.25

77.54

35.34

15.03.2013

PREMIER GOLD MINES LTD

CAD

260

2188

149

0.20

-12

-13

-0.14

-0.10

0.01

-0.07

133.80

-5.07

-1376.44

NORTHERN STAR RESOURCES LTD

AUD

247

3841

402

0.21

91

105

44

53

69

69

0.05

0.07

0.07

0.08

7.26

7.76

-12.29

4.80

46.49

TANZANIAN ROYALTY EXPLORATIO

USD

272

701

0.27

-5

-5

-16.99

REAL GOLD MINING LTD

HKD

1032

907

0.49

176

176

153

153

0.12

0.12

0.94

0.95

4.55

7.03

11.19

GOLDEN STAR RESOURCES LTD

USD

109

28562

259

0.16

551

552

125

117

15

15

-0.05

-0.16

-0.10

0.07

16.89

21.87

35.80

83.24

21.18

ROMARCO MINERALS INC

CAD

262

1412

585

0.20

-11

-11

-8

-8

-0.02

-0.02

-0.02

-0.01

21.42

BANRO CORPORATION

CAD

196

1904

202

0.34

41

72

133

326

21

-0.02

0.03

0.04

0.34

24.70

24.70

2.06

28.29

COLOSSUS MINERALS INC

CAD

145

1722

106

0.17

10

159

-31

-27

-6

-6

-0.27

-0.16

-0.12

0.27

3.92

-11.63

RAINY RIVER RESOURCES LTD

CAD

338

7315

100

0.24

-61

-61

-14

-14

-0.69

-0.59

-0.19

-0.13

-286.68

SULLIDEN GOLD CORP LTD

CAD

203

700

243

0.18

-11

-4

-0.06

-0.04

-0.04

-0.04

-34.70

ASANKO GOLD INC

CAD

182

598

76

-34

-35

-0.47

-0.25

-0.23

-0.16

6.98

BEAR CREEK MINING CORP

CAD

149

218

92

0.08

-30

-26

-0.32

-0.28

-0.20

-0.06

-5.61

PARAMOUNT GOLD AND SILVER

USD

185

1707

0.17

-18

-17

-9

-9

-0.06

-0.06

-59.56

-54.62

-27663.33

KIRKLAND LAKE GOLD INC

CAD

295

997

70

0.35

152

132

224

53

23

22

22

0.54

-0.01

0.02

0.38

51.98

59.45

105.42

16.70

GUYANA GOLDFIELDS INC

CAD

162

531

95

0.04

393

-8

-7

-0.09

-0.06

-0.07

-0.06

18.65

HIGHLAND GOLD MINING LTD

GBp

265

10

325

0.33

535

535

701

247

247

239

239

0.58

0.58

0.41

0.49

3.28

3.27

26.18

37.68

5.46

62.71

70.14

INDOPHIL RESOURCES NL

AUD

292

853

1203

0.08

-16

-16

0.00

0.00

51.60

-113.62

LYDIAN INTERNATIONAL LTD

CAD

148

418

127

0.06

-0.05

-0.06

-0.03

-0.02

SABINA GOLD & SILVER CORP

CAD

175

621

174

0.08

-11

-11

-0.08

-0.08

-0.03

-0.03

-17.79

LAKE SHORE GOLD CORP

CAD

125

3041

416

0.23

126

144

185

233

36

44

-0.21

-0.21

-0.02

0.03

11.09

95.83

396.33

29.00

BRIGUS GOLD CORP

USD

118

1129

0.19

118

136

148

160

48

63

0.12

0.12

4.18

4.36

63.78

239.92

60.49

46.39

GREAT PANTHER SILVER LTD

USD

104

546

0.08

61

60

57

68

16

12

0.02

0.04

52.96

21.47

5.74

21.76

-28.90

19.63

INTREPID MINES LTD

AUD

143

2307

555

0.12

-44

-44

-0.10

-0.12

-0.01

-0.01

-19.91

VISTA GOLD CORP

USD

79

5706

82

0.02

-36

-36

-0.54

-0.51

-0.27

-0.25

-26.58

ALEXCO RESOURCE CORP

USD

70

688

0.06

85

77

25

20

-0.21

-0.17

87.81

276.59

160.76

26.11

ATAC RESOURCES LTD

CAD

89

320

104

0.06

-1

-1

-0.08

-0.02

-0.03

-0.04

SCORPIO MINING CORP

CAD

64

642

198

0.03

44

40

13

12

0.04

0.03

0.03

0.03

10.77

10.77

-23.75

-49.20

28.55

MIDWAY GOLD CORP

USD

121

1954

128

0.10

-14

-16

-0.12

-0.12

-0.11

-0.13

21.14

PATAGONIA GOLD PLC

GBp

117

15

813

0.12

-24

-24

-0.03

-0.03

79.12

GRYPHON MINERALS LTD

AUD

50

5118

348

0.00

-7

-7

-0.01

-0.01

-0.01

45.27

DRDGOLD LTD-SPONSORED ADR

USD

209

85

1764

1959

2066

2096

380

400

460

460

6.82

7.43

27.89

7.86

62.47

13.51

20.40

RED 5 LTD

AUD

15

37

113

-3

-4

-0.01

-0.06

-0.06

0.21

39.77

-27.08

LINGBAO GOLD CO LTD-H

HKD

134

824

824

892

850

95

95

97

97

0.03

0.03

0.02

0.02

0.65

0.62

1.49

INTL TOWER HILL MINES LTD

USD

64

454

-56

-57

-0.09

-0.04

SARACEN MINERAL HOLDINGS LTD

AUD

66

4332

595

192

184

58

48

60

60

0.04

-0.02

0.05

0.06

EXETER RESOURCE CORP

USD

63

226

-26

-23

-0.29

-0.26

-0.13

-0.11

RICHMONT MINES INC

USD

60

RAMELIUS RESOURCES LTD

AUD

GOLDEN MINERALS CO

133

446

147

459

147

582

73

46

85

74

-0.04

0.10

6.00

16.10

221.11

4.64

10.42

7.86

135

818

770

0.62

0.04

0.07

169

171

88

0.01

207

40

0.02

102

100

105

134

-0.08

-0.21

0.05

0.36

35.54

42

3181

336

0.01

77

106

117

145

12

-10

22

22

0.01

-0.06

0.00

0.03

24.76

USD

59

3145

43

0.02

26

26

28

39

-35

-31

-6

-6

-1.44

-1.37

-0.45

-0.34

SAN GOLD CORP

CAD

33

4399

335

0.04

135

124

125

160

34

24

-0.04

-0.06

-0.07

-0.03

OREZONE GOLD CORP

CAD

34

306

86

0.02

-27

-29

-0.06

-0.10

-0.13

GRAN COLOMBIA GOLD CORP

CAD

27

107

15

0.19

160

155

14

10

-1.90

-1.43

-1.49

161

191

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

6.40

10.53

3.81

9.79

7.21

0.78

0.85

1.52

2.37

-1.33

0.92

-463.04

1.90

1.75

16.55

5.59

25.48

17.44

4.44

-14.20

11.05

-79.79

8.26

2.89

3.75

-39.49

160.51

-80.92

7.99

-8.33

1320.81

45.58

-120.89

23.33

132.20

178.55

17.95

-0.06

9.26

0.29

21.07

833.21

6.36

5.60

Valuation Measures II/II

Price to Book Ratio

Price to Sales Ratio

Price to Cash Flow Ratio

Enterprise Value to EBITDA Ratio

Price to Earnings Ratio

Estimated Dividend Yield

Target

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

%D to Spot

S&P 500 INDEX

2.25

2.25

2.06

1.89

2.25

1.44

1.44

1.37

1.32

1.44

10.14

10.14

9.46

9.81

10.14

9.09

9.09

8.38

7.83

9.09

14.58

14.58

13.09

11.89

14.58

2.17

2.17

2.34

2.52

2.17

1775.4

10.5%

Euro Stoxx 50 Pr

1.14

1.14

1.08

1.02

1.14

0.74

0.74

0.72

0.70

0.74

5.65

5.65

5.18

4.72

5.65

6.93

6.93

6.55

6.19

6.93

11.34

11.34

10.12

9.11

11.35

4.40

4.40

4.68

5.04

4.40

2974.5

13.7%

NIKKEI 225

1.51

1.51

1.41

1.31

1.51

0.72

0.72

0.70

0.68

0.72

8.87

8.87

8.20

7.47

8.87

8.66

8.66

8.02

7.54

8.66

17.52

17.52

15.59

14.02

17.52

1.66

1.66

1.81

1.96

1.66

14876.5

7.4%

FTSE 100 INDEX

1.66

1.66

1.55

1.45

1.66

0.94

0.94

0.91

0.93

0.94

8.24

8.25

7.48

6.85

8.24

6.79

6.79

6.40

6.01

6.79

11.75

11.75

10.70

9.86

11.75

3.98

3.98

4.28

4.66

3.98

6996.7

11.6%

SWISS MARKET INDEX

2.32

2.32

2.15

2.00

2.32

1.98

1.98

1.88

1.80

1.98

11.84

11.84

10.80

9.66

11.84

12.99

12.99

11.96

11.20

12.99

14.52

14.52

13.07

11.91

14.52

3.34

3.34

3.73

4.27

3.34

8621.0

11.8%

S&P/TSX COMPOSITE INDEX

1.61

1.61

1.50

1.40

1.61

1.38

1.38

1.42

1.47

1.38

8.15

8.15

7.35

6.12

8.15

8.29

8.29

7.33

6.76

8.29

14.00

14.00

12.35

11.27

14.00

3.32

3.32

3.47

3.64

3.32

14185.0

16.9%

S&P/ASX 200 INDEX

1.78

1.78

1.69

1.59

1.78

1.67

1.67

1.58

1.50

1.67

10.55

10.55

9.37

8.52

10.55

9.18

9.18

8.18

7.48

9.18

14.29

14.29

12.81

11.68

14.29

4.80

4.80

5.11

5.48

4.80

5209.2

10.6%

HANG SENG INDEX

1.24

1.24

1.14

1.05

1.24

1.61

1.61

1.48

1.37

1.61

7.39

7.39

7.04

6.63

7.39

7.59

7.59

6.93

6.31

7.59

9.92

9.92

9.14

8.35

9.92

3.88

3.88

4.18

4.59

3.88

24826.0

19.3%

MSCI EM

1.36

1.36

1.25

1.14

1.36

0.97

0.97

0.91

0.85

0.97

6.72

6.72

6.16

5.71

6.72

7.24

7.24

6.56

6.12

7.24

10.38

10.38

9.35

8.58

10.38

2.97

2.97

3.29

3.61

2.97

1132.2

20.4%

GOLDCORP INC

0.90

0.86

0.84

0.81

0.70

3.64

4.29

3.42

3.09

2.56

8.69

10.87

8.23

6.69

5.17

6.96

9.40

6.60

5.63

4.44

12.48

19.44

13.51

11.98

8.13

2.17

2.39

2.41

2.43

2.43

35.58

43.9%

BARRICK GOLD CORP

0.61

0.68

0.66

0.61

0.51

1.11

1.19

1.13

1.15

1.02

2.86

3.51

3.38

3.21

2.86

4.14

4.86

4.65

4.54

3.75

4.14

5.43

5.38

5.56

4.27

4.78

5.10

5.13

5.21

6.99

25.53

62.2%

NEWMONT MINING CORP

1.09

1.04

1.00

0.97

0.95

1.49

1.69

1.49

1.51

1.59

4.96

5.97

5.20

5.90

8.23

5.35

7.64

6.41

6.57

6.93

8.42

12.42

10.22

11.57

13.90

4.79

4.18

3.99

3.33

4.01

38.30

27.9%

RANDGOLD RESOURCES LTD-ADR

2.26

1.97

1.69

1.47

4.36

4.48

3.39

3.44

3.77

10.08

9.79

6.57

5.92

9.74

8.13

8.77

6.25

5.74

6.75

13.56

15.75

10.07

9.36

10.22

0.76

0.74

0.89

1.00

108.64

69.8%

YAMANA GOLD INC

0.91

0.89

0.84

0.80

3.01

3.04

2.48

2.50

2.09

6.68

7.17

5.75

5.29

4.66

5.88

6.56

4.95

4.95

3.54

10.42

13.70

9.73

9.19

7.99

2.51

2.62

2.60

2.48

16.06

68.9%

GOLD FIELDS LTD-SPONS ADR

0.64

0.74

0.68

0.63

0.78

1.33

1.22

1.21

2.36

3.60

3.65

3.36

4.57

9.79

6.88

6.05

6.87

3.27

4.06

4.75

7.70

46.7%

SILVER WHEATON CORP

2.23

2.06

1.86

1.67

8.52

8.17

7.20

6.61

10.31

10.45

9.41

8.42

11.89

14.18

12.74

11.83

1.90

2.29

2.11

2.33

34.70

76.4%

ANGLOGOLD ASHANTI-SPON ADR

1.02

0.87

0.78

0.71

0.90

0.89

0.77

0.85

3.21

2.99

2.54

3.19

5.24

10.01

5.38

7.25

2.68

1.37

2.00

1.46

25.64

79.3%

CIA DE MINAS BUENAVENTUR-ADR

1.04

0.92

0.85

0.78

2.65

2.54

2.37

2.52

9.11

12.62

10.01

5.20

7.00

7.48

8.27

4.15

3.03

3.86

3.47

24.48

65.8%

NEW GOLD INC

1.18

1.08

1.02

0.96

3.99

3.33

3.11

3.06

3.05

10.37

8.54

6.79

6.38

10.81

68.4%

AGNICO EAGLE MINES LTD

1.37

1.38

1.37

1.34

2.49

2.85

2.39

2.39

2.19

6.74

9.43

7.40

39.83

44.6%

ELDORADO GOLD CORP

0.73

0.73

0.72

0.70

3.82

3.60

3.30

2.37

1.57

9.49

9.29

11.29

82.7%

KINROSS GOLD CORP

0.44

0.60

0.59

0.58

1.35

1.49

1.47

1.56

1.40

4.06

7.58

48.7%

ROYAL GOLD INC

1.36

1.13

1.10

1.04

9.89

9.08

7.57

5.73

HARMONY GOLD MNG-SPON ADR

0.43

0.42

0.41

0.40

0.97

0.94

0.77

0.68

IAMGOLD CORP

0.43

0.43

0.42

0.42

0.99

1.17

1.03

1.01

PAN AMERICAN SILVER CORP

0.62

0.66

0.66

0.64

1.84

1.96

1.80

FIRST MAJESTIC SILVER CORP

2.00

4.70

3.87

COEUR MINING INC

0.56

0.57

0.55

0.52

0.46

1.49

AURICO GOLD INC

0.57

0.55

0.54

0.53

0.46

ALLIED NEVADA GOLD CORP

0.92

0.75

0.54

0.46

HECLA MINING CO

0.75

0.76

0.72

0.67

NEVSUN RESOURCES LTD

0.95

0.91

0.80

0.74

AURIZON MINES LTD

1.72

SILVER STANDARD RESOURCES

0.49

1.28

4.96

0.43

0.43

11.71

12.23

10.51

9.68

7.00

9.39

2.85

5.01

6.21

5.72

6.19

6.42

8.19

7.05

5.86

5.23

4.93

15.81

17.21

12.61

12.05

13.66

0.00

0.00

6.69

5.86

6.38

9.02

6.65

6.37

4.12

13.06

28.90

17.83

16.88

12.95

2.79

3.08

3.05

2.99

8.26

5.62

3.30

7.63

7.72

7.02

4.63

2.68

13.46

16.18

13.76

8.82

4.66

2.35

2.02

1.93

2.39

4.45

4.25

4.66

4.25

3.34

4.40

4.03

4.28

3.58

6.91

13.21

10.83

12.32

10.04

3.14

3.14

3.14

3.14

13.56

14.29

11.79

9.01

9.70

8.83

7.46

5.72

24.03

27.96

21.41

14.25

1.30

1.78

1.97

2.26

73.11

73.7%

3.90

3.63

3.32

3.43

5.50

9.70

7.84

11.94

3.18

1.48

2.10

1.68

6.60

73.2%

0.94

3.04

4.02

3.42

3.41

3.14

2.32

3.09

2.53

2.66

1.99

5.03

9.37

7.25

8.05

7.02

5.87

5.80

5.38

5.20

5.77

7.59

75.2%

1.84

1.52

6.52

7.92

7.38

7.91

4.95

3.34

4.79

3.96

4.41

2.21

9.27

18.96

14.37

18.96

9.51

1.52

4.28

4.27

4.28

4.30

15.21

30.6%

2.61

2.33

2.15

8.57

8.53

6.05

5.20

4.79

6.90

7.16

4.69

3.97

3.47

11.03

14.37

8.78

7.30

6.79

17.67

66.8%

1.59

1.35

1.48

1.60

4.49

5.55

4.40

4.60

5.55

3.68

4.31

3.20

3.52

4.21

12.20

31.07

11.99

12.48

18.22

18.56

39.6%

3.45

3.79

2.88

2.32

2.04

10.79

10.05

6.13

5.38

4.68

6.80

7.46

4.90

3.97

3.47

10.93

19.77

12.31

11.38

11.06

0.43

3.10

1.94

1.14

1.04

0.64

7.17

6.61

3.80

2.90

2.02

10.67

6.63

3.62

3.24

2.18

12.00

9.72

4.84

4.21

2.54

0.63

2.60

1.77

1.28

1.22

1.16

9.55

8.44

5.08

4.25

3.76

6.43

4.05

2.25

1.98

1.70

27.59

29.50

10.53

8.90

7.45

1.34

1.07

1.17

0.84

1.07

2.02

0.88

0.92

1.44

2.23

4.78

2.45

2.76

3.53

0.96

2.46

0.90

0.96

1.66

4.23

11.66

3.53

4.54

7.38

3.36

3.90

3.69

3.83

9.42

10.13

6.33

19.66

67.50

21.32

12.53

13.69

12.65

0.85

0.57

0.51

2.95

0.43

6.97

2.73

0.33

2.06

2.72

2.51

2.52

2.25

4.92

11.44

6.50

3.23

6.65

5.11

4.79

0.00

4.10

3.16

3.50

2.90

3.14

4.42

1.34

0.00

1.68

181.14

0.00

0.00

0.00

0.00

SEABRIDGE GOLD INC

6.35

45.2%

13.36

106.1%

4.50

51.0%

5.05

71.3%

4.67

21.4%

11.51

81.6%

25.08

166.0%

TANZANIAN ROYALTY EXPLORATIO

GOLDEN STAR RESOURCES LTD

0.25

VISTA GOLD CORP

0.57

0.27

0.27

0.23

0.00

0.20

GREAT BASIN GOLD LTD

0.00

ARGONAUT GOLD INC

1.35

0.91

0.84

0.75

4.34

TOREX GOLD RESOURCES INC

1.49

2.77

1.46

1.37

1841.66

0.24

0.24

0.23

0.21

0.94

1.94

1.35

1.20

0.88

1.39

2.69

1.39

10.78

0.01

LIONGOLD CORP LTD

3.03

2.69

1.98

6.41

2.37

7.83

1.91

0.77

0.69

0.62

PERSEUS MINING LTD

0.66

0.59

0.52

0.41

0.33

OCEANAGOLD CORP

0.60

0.56

0.54

0.52

0.57

MEDUSA MINING LTD

0.86

0.74

0.56

0.44

0.39

DUNDEE PRECIOUS METALS INC

0.71

0.66

0.56

0.52

RIO ALTO MINING LTD

1.50

1.11

1.01

AURIZON MINES LTD

1.72

SANDSTORM GOLD LTD

7.63

5.85

6.70

19.00

11.77

6.20

6.53

4.65

3.77

2.82

3.13

1.93

7.95

9.36

7.25

1.45

0.78

0.65

0.45

0.40

3.79

3.58

2.30

1.26

1.30

3.30

1.86

1.53

0.84

9.12

8.28

6.05

4.78

6.13

10.70

12.56

8.37

6.73

9.54

11.38

13.56

6.98

5.28

0.93

0.69

0.62

0.66

0.84

3.00

1.83

1.71

1.91

3.63

4.06

2.71

2.76

3.01

6.29

3.01

2.50

1.20

1.05

0.78

5.00

4.00

2.56

1.71

1.69

4.04

3.51

1.60

1.43

1.53

1.31

1.17

1.07

4.38

4.42

3.40

2.99

2.70

3.92

3.57

2.57

2.09

1.04

1.09

1.04

3.11

3.15

3.30

3.22

2.75

1.57

2.34

2.09

1.92

9.42

10.13

6.33

4.12

5.58

4.00

CONTINENTAL GOLD LTD

RUBICON MINERALS CORP

6.65

0.89

1.44

1.22

1.16

1.15

220.35

264.41

247.87

2.17

0.83

5.82

SILVERCORP METALS INC

EVOLUTION MINING LTD

0.37

0.36

0.33

0.30

CHINA PRECIOUS METAL RESOURC

1.43

1.03

0.91

0.75

0.31

9.76

14.38

10.34

4.41

3.14

1.66

3.85

1.33

0.00

0.74

77.0%

4.55

368.9%

7.92

8.91

39.12

35.95

0.00

0.00

0.49

0.00

0.00

0.00

0.00

0.39

0.00

0.00

10.22

79.7%

2.47

85.5%

5.51

5.91

184.17

2.95

ENDEAVOUR SILVER CORP

6.00

10.15

9.66

9.18

CHINA GOLD INTERNATIONAL RES

8.75

0.84

0.08

3.94

1.16

2.39

1.90

1.36

1.54

0.86

0.67

0.60

0.58

3.76

3.11

2.39

2.46

0.61

12.98

17.74

17.17

4.06

5.35

3.85

1.96

2.04

19.42

34.70

16.43

11.59

22.56

19.31

6.75

5.28

6.37

1.40

4.64

3.76

1.87

1.74

2.12

6.99

1.38

1.55

7.13

8.07

5.35

4.76

4.30

0.00

0.00

3.70

4.50

4.42

4.38

3.36

0.00

0.00

19.66

67.50

21.32

7.83

12.56

8.64

0.82

4.92

3.76

3.46

174.25

6.97

32.14

4.43

6.23

5.13

3.20

3.81

2.06

2.12

1.91

1.86

3.84

4.74

3.11

2.82

2.90

12.60

1.88

11.73

3.73

2.34

2.81

2.48

1.89

1.64

1.58

7.99

7.01

5.76

5.41

1.78

8.03

11.77

0.00

0.00

7.71

3.67

4.74

5.26

43.55

7.11

13.24

9.40

5.70

7.05

5.58

6.93

5.81

4.87

12.90

9.92

8.22

8.06

4.32

1.80

1.18

0.93

0.60

72.91

1.32

1.21

1.37

1.47

RESOLUTE MINING LTD

0.66

0.58

0.51

0.44

0.31

0.62

0.57

0.66

0.62

0.61

1.87

3.57

2.52

3.47

1.73

2.33

1.95

2.09

1.19

3.59

3.03

3.97

5.09

1.16

1.55

1.30

1.10

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

2.71

18.3%

1.60

226.3%

11.01

78.4%

2.09

61.1%

4.45

182.4%

10.00

132.6%

5.28

171.0%

4.67

21.4%

7.89

6.84

99.4%

8.71

9.38

184.1%

2.33

72.8%

5.30

88.1%

0.97

68.5%

3.48

5.42

0.00

1.39

2.96

3.13

2.61

0.78

SEABRIDGE GOLD INC

BEADELL RESOURCES LTD

3.31

1.66

28.4%

25.08

166.0%

3.89

3.13

4.15

3.78

0.00

0.39

1.76

1.76

3.33

0.94

84.9%

2.55

4.88

3.86

3.60

0.00

6.61

3.05

4.75

8.47

1.18

99.6%

Valuation Measures II/II

Price to Book Ratio

Price to Sales Ratio

Price to Cash Flow Ratio

Enterprise Value to EBITDA Ratio

Price to Earnings Ratio

Estimated Dividend Yield

Target

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

2014

2015

2016

2017

2013

%D to Spot

S&P 500 INDEX

2.25

2.25

2.06

1.89

2.25

1.44

1.44

1.37

1.32

1.44

10.14

10.14

9.46

9.81

10.14

9.09

9.09

8.38

7.83

9.09

14.58

14.58

13.09

11.89

14.58

2.17

2.17

2.34

2.52

2.17

1775.4

10.5%

Euro Stoxx 50 Pr

1.14

1.14

1.08

1.02

1.14

0.74

0.74

0.72

0.70

0.74

5.65

5.65

5.18

4.72

5.65

6.93

6.93

6.55

6.19

6.93

11.34

11.34

10.12

9.11

11.35

4.40

4.40

4.68

5.04

4.40

2974.5

13.7%

NIKKEI 225

1.51

1.51

1.41

1.31

1.51

0.72

0.72

0.70

0.68

0.72

8.87

8.87

8.20

7.47

8.87

8.66

8.66

8.02

7.54

8.66

17.52

17.52

15.59

14.02

17.52

1.66

1.66

1.81

1.96

1.66

14876.5

7.4%

FTSE 100 INDEX

1.66

1.66

1.55

1.45

1.66

0.94

0.94

0.91

0.93

0.94

8.24

8.25

7.48

6.85

8.24

6.79

6.79

6.40

6.01

6.79

11.75

11.75

10.70

9.86

11.75

3.98

3.98

4.28

4.66

3.98

6996.7

11.6%

SWISS MARKET INDEX

2.32

2.32

2.15

2.00

2.32

1.98

1.98

1.88

1.80

1.98

11.84

11.84

10.80

9.66

11.84

12.99

12.99

11.96

11.20

12.99

14.52

14.52

13.07

11.91

14.52

3.34

3.34

3.73

4.27

3.34

8621.0

11.8%

S&P/TSX COMPOSITE INDEX

1.61

1.61

1.50

1.40

1.61

1.38

1.38

1.42

1.47

1.38

8.15

8.15

7.35

6.12

8.15

8.29

8.29

7.33

6.76

8.29

14.00

14.00

12.35

11.27

14.00

3.32

3.32

3.47

3.64

3.32

14185.0

16.9%

S&P/ASX 200 INDEX

1.78

1.78

1.69

1.59

1.78

1.67

1.67

1.58

1.50

1.67

10.55

10.55

9.37

8.52

10.55

9.18

9.18

8.18

7.48

9.18

14.29

14.29

12.81

11.68

14.29

4.80

4.80

5.11

5.48

4.80

5209.2

10.6%

HANG SENG INDEX

1.24

1.24

1.14

1.05

1.24

1.61

1.61

1.48

1.37

1.61

7.39

7.39

7.04

6.63

7.39

7.59

7.59

6.93

6.31

7.59

9.92

9.92

9.14

8.35

9.92

3.88

3.88

4.18

4.59

3.88

24826.0

19.3%

MSCI EM

1.36

1.36

1.25

1.14

1.36

0.97

0.97

0.91

0.85

0.97

6.72

6.72

6.16

5.71

6.72

7.24

7.24

6.56

6.12

7.24

10.38

10.38

9.35

8.58

10.38

2.97

2.97

3.29

3.61

2.97

1132.2

20.4%

0.65

0.48

0.40

0.36

0.22

1.32

1.45

1.19

0.95

0.49

2.71

2.06

1.81

1.58

1.20

3.61

4.06

6.59

3.29

0.93

2.17

287.5%

2.43

1.97

1.98

2.08

6.19

7.12

6.14

5.85

6.79

4.96

5.06

3.70

3.53

4.23

12.05

14.53

10.60

9.32

11.47

4.80

37.2%

23.21

25.21

3.47

8.25

45.40

7.44

3.31

48.00

13.44

33.60

3.27

94.5%

14.25

131.7%

8.42

79.2%

2.35

76.4%

ENDEAVOUR MINING CORP

FORTUNA SILVER MINES INC

1.71

MCEWEN MINING INC

1.39

1.18

1.02

0.57

0.57

0.56

0.91

MAG SILVER CORP

2.61

2.90

3.47

4.13

PRIMERO MINING CORP

0.75

0.76

0.81

0.66

KINGSGATE CONSOLIDATED LTD

0.27

0.29

0.30

0.29

TIMMINS GOLD CORP

2.08

1.58

1.25

1.25

ST BARBARA LTD

0.28

0.24

0.21

0.20

0.25

PREMIER GOLD MINES LTD

0.64

NORTHERN STAR RESOURCES LTD

2.90

2.18

1.80

1.51

1.32

0.00

2.46

12.00

33.60

2.13

0.43

5.59

18.67

2.57

7.50

0.00

0.00

0.00

8.24

2.78

2.57

2.06

1.51

1.16

4.81

5.68

5.19

4.44

2.45

4.71

4.62

2.98

1.98

1.32

9.02

10.92

8.17

6.69

3.68

0.00

0.00

0.56

0.60

0.56

0.53

0.44

1.66

2.33

1.92

1.79

2.36

1.97

3.01

2.73

2.44

1.72

2.23

6.68

8.34

6.51

2.33

16.18

7.12

7.49

2.09

1.70

1.56

1.52

1.51

5.87

4.85

4.98

4.97

4.55

4.33

3.74

3.62

4.01

3.45

8.35

7.01

7.18

6.82

6.54

0.00

0.00

0.00

0.42

0.43

0.36

0.34

0.39

0.71

2.42

1.36

1.26

1.67

1.73

2.44

1.67

1.61

2.02

1.28

6.12

3.55

3.35

5.34

0.00

0.00

2.15

3.87

4.30

1.86

1.68

1.68

0.95

6.41

4.23

4.74

5.43

2.76

4.48

3.06

2.77

2.81

1.75

11.34

6.98

6.76

4.70

0.00

4.72

3.62

5.51

0.24

0.24

0.23

0.21

1.94

1.35

1.20

0.88

2.69

1.39

1.16

1.91

6.00

3.85

1.33

2.75

1.83

18.61

40.62

1.20

0.98

1.03

4.31

1.57

1.51

144.07

2.45

140.77

8.47

17.90

0.00

4.09

3.31

42.8%

1.02

120.4%

5.34

191.8%

0.99

56.5%

TANZANIAN ROYALTY EXPLORATIO

REAL GOLD MINING LTD

1.43

GOLDEN STAR RESOURCES LTD

0.25

0.27

0.27

0.23

ROMARCO MINERALS INC

0.27

0.46

0.30

0.21

1.34

0.81

BANRO CORPORATION

COLOSSUS MINERALS INC

4.50

0.46

1.08

1.69

0.20

4.46

6.01

1.40

0.57

0.53

0.47

13.67

0.87

0.53

0.61

355.81

355.81

RAINY RIVER RESOURCES LTD

1.48

SULLIDEN GOLD CORP LTD

0.78

17.39

1.47

0.84

2.09

0.67

ASANKO GOLD INC

0.80

BEAR CREEK MINING CORP

1.09

0.94

70.85

3.34

3.80

1.39

7.55

197.54

8.26

2.94

2.42

1.70

2.22

0.96

1.08

5.27

4.94

1.24

1.09

0.80

1.87

GUYANA GOLDFIELDS INC

0.68

0.56

0.59

0.60

0.47

HIGHLAND GOLD MINING LTD

0.34

0.31

0.29

0.26

0.23

LYDIAN INTERNATIONAL LTD

1.97

1.24

SABINA GOLD & SILVER CORP

0.56

0.33

0.56

0.58

LAKE SHORE GOLD CORP

0.14

0.20

0.18

0.77

2.00

0.69

16.94

2.17

1.79

1.90

1.28

4.13

2.04

2.00

0.00

2.12

1.31

0.93

0.69

0.41

0.82

0.75

0.57

0.56

0.57

1.48

0.96

9.40

2.64

0.00

0.00

7.70

8.98

5.79

1.97

11.39

2.51

4.91

1.89

2.56

1.75

2.81

1.38

1.85

1.57

6.63

2.75

3.95

3.96

0.69

1.32

0.00

446.73

0.00

PARAMOUNT GOLD AND SILVER

KIRKLAND LAKE GOLD INC

0.00

8.75

0.47

5.71

1.38

11.71

1.36

4.83

1.10

2.41

2.11

1.16

0.42

1.07

1.15

6.07

2.60

232.63

3.05

11.08

2.51

0.00

0.00

0.00

0.00

0.74

77.0%

1.16

146.5%

1.77

115.9%

4.09

235.4%

3.73

5.2%

1.68

112.8%

4.07

81.0%

3.47

104.1%

37.8%

0.86

1.64

4.32

2.83

8.03

81.6%

6.99

2.33

4.79

254.9%

2.75

2.91

135.65

153.5%

15.30

14.14

3.23

169.3%

3.89

297.2%

0.00

9.09

8.60

9.21

7.74

INDOPHIL RESOURCES NL

BRIGUS GOLD CORP

0.00

0.43

GREAT PANTHER SILVER LTD

INTREPID MINES LTD

0.86

VISTA GOLD CORP

0.57

1.09

1.14

1.01

0.60

0.54

0.47

0.40

3.00

2.30

1.51

1.14

0.85

7.67

3.84

2.13

1.89

1.40

0.97

0.80

0.74

0.59

0.43

2.21

1.83

1.83

1.62

1.26

3.47

2.41

2.14

1.76

1.67

1.77

1.93

1.61

5.97

15.57

7.94

4.96

4.18

4.65

10.48

4.57

4325.94

0.83

1.04

0.92

0.86

0.80

1.29

1.87

1.65

1.63

0.25

0.25

0.25

0.21

SCORPIO MINING CORP

MIDWAY GOLD CORP

0.67

4.45

0.60

1.43

1.01

1.39

0.87

0.79

0.50

0.86

3.25

5.07

2.08

1.25

0.87

0.31

11.67

4.77

3.50

0.96

205.6%

141.3%

5.20

4.18

4.36

2.76

2.43

1.23

12.22

52.95

21.47

79.43

26.48

1.15

52.2%

0.21

-25.0%

4.55

368.9%

0.00

10.78

ALEXCO RESOURCE CORP

ATAC RESOURCES LTD

0.94

12.27

4.42

3.86

2.91

2.00

0.00

0.00

0.00

0.84

1.41

0.74

5.56

3.02

58.28

3.59

29.14

21.04

3.09

8.50

21.57

8.27

25.19

2.38

0.99

0.81

0.20

0.05

19.64

10.97

10.30

3.42

1.62

99.21

15.26

3.07

1.05

1.94

72.9%

2.13

156.0%

1.57

360.8%

1.70

80.0%

0.39

190.2%

6.90

27.1%

PATAGONIA GOLD PLC

GRYPHON MINERALS LTD

0.12

21.94

19.45

29.08

1.00

0.99

6.09

2.07

0.68

0.66

0.12

0.12

0.12

0.14

DRDGOLD LTD-SPONSORED ADR

RED 5 LTD

LINGBAO GOLD CO LTD-H

0.33

0.33

INTL TOWER HILL MINES LTD

0.29

1.14

SARACEN MINERAL HOLDINGS LTD

0.40

0.24

EXETER RESOURCE CORP

0.32

0.31

OREZONE GOLD CORP

GRAN COLOMBIA GOLD CORP

7.86

0.00

7.21

0.00

0.00

5.51

4.56

0.00

0.00

0.41

0.86

6.01

6.39

5.94

6.24

3.92

6.05

6.62

7.85

6.99

5.19

4.72

3.78

0.25

0.21

0.19

0.39

0.34

0.36

0.35

0.31

1.26

1.03

0.98

1.00

1.01

1.30

1.21

1.06

0.92

1.11

2.67

2.07

1.90

1.88

1.43

0.00

0.00

0.00

0.00

0.00

1.15

0.28

0.17

0.15

0.15

GOLDEN MINERALS CO

SAN GOLD CORP

4.70

0.00

RICHMONT MINES INC

RAMELIUS RESOURCES LTD

6.14

5.60

0.15

0.16

4.12

4.12

0.60

0.60

0.47

0.49

0.36

0.29

2.35

2.10

1.50

0.25

0.27

0.21

4.12

0.33

0.27

5.71

5.24

2.24

6.14

0.99

1.50

0.16

0.13

0.35

0.26

0.21

1.53

0.91

1.54

0.66

0.41

0.13

1.57

0.08

0.70

0.26

0.15

15.23

35.53

4.44

3.65

27.00

4.09

0.40

0.81

1.37

3.40

1.97

1.64

3.33

25.26

0.99

0.39

5.21

28.27

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

6.43

4.95

2.22

58.93

5.89

3.38

0.00

0.00

0.00

3.70

7.41

1.83

36.2%

1.85

184.6%

0.19

60.0%

1.89

165.9%

3.56

134.0%

0.25

88.9%

1.07

-21.2%

0.23

117.5%

7.39

1.94

362.1%

0.86

9.25

397.3%

01.07.2013

Goldcorp Inc

Goldcorp, Inc. is engaged in the acquisition, exploration, development and

operation of precious metal properties in Canada, the United States, Mexico and

Central and South America.

Price/Volume

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (21.09.2012)

52-Week Low (26.06.2013)

Daily Volume

Current Price (7/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 31.05.2013

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

GG US EQUITY YTD Change

GG US EQUITY YTD % CHANGE

12/2012

03/yy

47.42

22.22

13'961'380.00

24.73

-47.85%

11.30%

9.96%

812.0

20'080.41

783.00

0.0

213.0

918.00

20'554.41

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

31.12.2009

31.12.2010

2'723.6

3'738.0

10.50x

9.95x

1'366.2

2'026.0

20.94x

18.36x

240.2

2'051.0

50.85x

30.36x

Profitability

20.0 M

15.0 M

10.0 M

5.0 M

.0 M

a-12

LTM-4Q

31.12.2011

5'362.0

6.61x

2'336.0

15.18x

1'187.0

22.24x

31.12.2012

5'435.0

5.50x

2'798.0

10.69x

1'749.0

18.47x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

2'798.00

2'123.00

39.06%

41.44%

5.06%

7.08%

6.69%

0.16%

44.6%

49.6%

36.6%

32.2%

2.15

1.39

2.51%

3.45%

8.61

4.47

Price/ Cash Flow

03/yy

5'357

27.45x

2'966.0

12.15x

1'709.0

23.69x

s-12

o-12

n-12

d-12

LTM

03/yy

5'101

24.55x

2'532.0

10.97x

1'579.0

19.73x

j-13

f-13 m-13

a-13 m-13

j-13

FY+1

2.24

0.71

809.06

5.26

-33.10%

-31.96%

0.711

27

4.407

11'029'279

7'844'050

7'903'566

FY+2

FQ+1

FQ+2

12/13 Y

12/14 Y

06/13 Q2 09/13 Q3

4'677

5'879

1'151

1'206

4.60x

3.69x

18.12x

17.49x

2'187.7

3'115.5

555.4

603.6

9.40x

6.60x

8.68x

8.49x

1'066.8

1'513.5

210.1

248.0

19.44x

13.51x

18.41x

16.96x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

01.06.2009

BBB+

STABLE

93.27

6.33

0.10

0.90

3.4%

3.3%

0.16

0.20

42.40

81.59

83.78

33.03

Sales/Revenue/Turnover

30.00

6'000.0

25.00

5'000.0

20.00

4'000.0

15.00

3'000.0

10.00

2'000.0

5.00

1'000.0

0.00

01.01.2010

25.0 M

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2008

2'419.6

9.42x

1'052.2

21.66x

1'475.6

57.34x

50

45

40

35

30

25

20

15

10

5

0

j-12

0.0

01.07.2010

01.01.2011

01.07.2011

01.01.2012

01.07.2012

01.01.2013

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

01.07.2013

Goldcorp Inc

Holdings By:

All

Holder Name

FMR LLC

VAN ECK ASSOCIATES C

ROYAL BANK OF CANADA

BMO FINANCIAL CORP

FIRST EAGLE INVESTME

CARMIGNAC GESTION

FRANKLIN RESOURCES

TD ASSET MANAGEMENT

CI INVESTMENTS INC

TORONTO DOMINION BAN

CIBC WORLD MARKETS I

CAISSE DE DEPOT ET P

BLACKROCK

RS INVESTMENT MANAGE

CIBC GLOBAL ASSET MA

FIERA CAPITAL CORPOR

IA CLARINGTON INVEST

GREYSTONE MANAGED IN

BANK OF AMERICA CORP

NORGES BANK

Firm Name

Deutsche Bank

Stifel

Cowen and Company

Credit Suisse

RBC Capital Markets

Salman Partners

TD Securities

GMP

EVA Dimensions

JPMorgan

Scotia Capital

Macquarie

BMO Capital Markets

Canaccord Genuity Corp

CIBC World Markets

Davenport & Co

Cormark Securities Inc.

Mackie Research Capital Corp.

Veritas Investment Research Co

Barclays

Jefferies

HSBC

Makor Capital

Morgan Stanley

Raymond James

Portfolio Name

n/a

n/a

n/a

BMO FINANCIAL CORP

FIRST EAGLE INVESTME

CARMIGNAC GESTION

n/a

TD ASSET MANAGEMENT

Multiple Portfolios

TORONTO DOMINION BAN

CIBC WORLD MARKETS I

CAISSE DE DEPOT ET P

n/a

RS INVESTMENT MANAGE

CIBC GLOBAL ASSET MA

FIERA CAPITAL CORPOR

Multiple Portfolios

GREYSTONE MANAGED IN

BANK OF AMERICA

NORGES BANK

Analyst

JORGE M BERISTAIN

GEORGE J TOPPING

ADAM P GRAF

ANITA SONI

STEPHEN D WALKER

DAVID WEST

GREG BARNES

GEORGE V ALBINO

CRAIG STERLING

JOHN BRIDGES

TANYA M JAKUSCONEK

TONY LESIAK

DAVID HAUGHTON

STEVEN BUTLER

ALEC KODATSKY

LLOYD T O'CARROLL

RICHARD GRAY

BARRY D ALLAN

PAWEL RAJSZEL

FAROOQ HAMED

PETER D WARD

PATRICK CHIDLEY

ALBERT SAPORTA

PARETOSH MISRA

BRAD HUMPHREY

Source

ULT-AGG

ULT-AGG

ULT-AGG

13F

13F

13F

ULT-AGG

13F

MF-AGG

13F

13F

13F

ULT-AGG

13F

13F

13F

MF-AGG

13F

13F

13F

Recommendation

hold

buy

market perform

neutral

outperform

top pick

buy

buy

overweight

overweight

sector outperform

outperform

outperform

buy

sector outperform

buy

buy

buy

sell

overweight

hold

overweight

buy

Equalwt/In-Line

Under Review

Amt Held

30'068'165

28'365'944

23'371'159

19'122'015

18'417'273

17'580'357

15'884'009

15'368'322

12'996'285

11'605'532

11'582'812

11'159'562

10'893'980

8'785'563

7'186'295

6'835'256

6'101'525

6'076'235

5'947'164

5'776'522

% Out

3.7

3.49

2.88

2.35

2.27

2.17

1.96

1.89

1.6

1.43

1.43

1.37

1.34

1.08

0.89

0.84

0.75

0.75

0.73

0.71

Weighting

Change

3

5

3

3

5

5

5

5

5

5

5

5

5

5

5

5

5

5

1

5

3

5

5

3

#N/A N/A

M

M

M

M

M

M

M

M

U

M

M

M

M

M

M

M

M

M

M

M

M

M

M

M

N

Latest Chg

(2'289'399)

(3'227'565)

379'529

(574'672)

7'264'832

17'580'357

5'768'962

(264'603)

(440'597)

195'729

(224'052)

3'920'300

(533'828)

4'171'254

(176'695)

1'053'271

(20'600)

(1'030'733)

1'660'114

-

Target Price

27

36

23

28

36

45

37

41

#N/A N/A

47

39

37

42

41

45

35

43

44

28

38

27

35

33

#N/A N/A

#N/A N/A

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

31.03.2013

Investment Advisor

28.06.2013

Investment Advisor

31.03.2013

Bank

31.03.2013

Investment Advisor

31.03.2013 Hedge Fund Manager

31.12.2012

Investment Advisor

31.03.2013

Investment Advisor

31.03.2013

Investment Advisor

31.12.2012

Investment Advisor

31.03.2013

Investment Advisor

31.03.2013

Investment Advisor

31.03.2013

Investment Advisor

27.06.2013

Investment Advisor

31.03.2013

Investment Advisor

31.03.2013

Investment Advisor

31.03.2013

Investment Advisor

31.12.2012

Investment Advisor

31.03.2013

Investment Advisor

31.03.2013

Investment Advisor

31.12.2012

Government

Date

12 month

Not Provided

12 month

Not Provided

12 month

12 month

12 month

Not Provided

Not Provided

6 month

12 month

12 month

Not Provided

12 month

Not Provided

Not Provided

12 month

12 month

Not Provided

Not Provided

12 month

Not Provided

Not Provided

Not Provided

Not Provided

Date

28.06.2013

28.06.2013

26.06.2013

25.06.2013

24.06.2013

19.06.2013

19.06.2013

17.06.2013

12.06.2013

06.06.2013

24.05.2013

17.05.2013

09.05.2013

09.05.2013

08.05.2013

08.05.2013

07.05.2013

03.05.2013

03.05.2013

03.05.2013

02.05.2013

28.04.2013

15.04.2013

08.01.2013

19.11.2008

01.07.2013

Barrick Gold Corp

Barrick Gold Corporation is an international gold company with operating mines

and development projects in the United States, Canada, South America, Australia,

and Africa.

Price/Volume

45

70.0 M

40

60.0 M

35

50.0 M

30

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (21.09.2012)

52-Week Low (28.06.2013)

Daily Volume

Current Price (7/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 31.05.2013

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ABX US EQUITY YTD Change

ABX US EQUITY YTD % CHANGE

12/2012