Professional Documents

Culture Documents

(A) Fixed Assets

Uploaded by

Priya GoyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(A) Fixed Assets

Uploaded by

Priya GoyalCopyright:

Available Formats

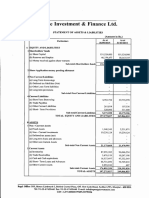

XYZ LTD. BALANCE SHEET AS AT 31ST MARCH, 2012 NOTES CURRENT YEAR NO. 31.03.

2012

PARTICULARS

PREVIOUS YEAR 31.03.2011

I. EQUITY AND LIABILITIES (1) Shareholder's Funds (a) Share Capital (b) Reserves and Surplus (c) Money received against share warrants (2) Share application money pending allotment (3) Non-Current Liabilities (a) Long Term Borrowings (b) Deferred Tax Liabilities (Net) (c) Other Long Term Liabilities (d) Long Term Provisions (4) Current Liabilities (a) Short Term Borrowings (b) Trade Payables (c) Other Current Liabilities (d) Short Term Provisions Total II.Assets (1) Non-current assets (a) Fixed Assets (i) Tangible Assets (ii) Intangible Assets (iii) Capital work-in-progress (iv) Intangible assets under development (b) Non-current Investments (c) Deferred Tax Assets (net) (d) Long Term Loans and Advances (e) Other Non-current Assets (2) Current Assets (a) Current Investments (b) Inventories (c) Trade Receivables (d) Cash and Cash Equivalents (e) Short-term Loans and Advances (f) Other Current Assets

1 2

7,480,000.00 #REF! -

7,480,000.00 30,225,470.76 -

3 4

#REF! #REF! -

45,903,033.00 428,039.00 -

5 6 7 8

47,501,574.55 #REF! #REF! #REF! #REF!

30,177,336.62 23,018,441.45 20,125,262.00 2,076,536.00 159,434,118.83

9 #REF! 514,418.85 #REF! #REF! 53,419,793.96 225,130.21 2,750,000.00 519,284.00

10 11 12

#REF! #REF! #REF! #REF! 79,910.16 Total #REF! #REF! Notes 1 to 26 form an integral part of the Balance Sheet and Statement of Profit & Loss Account 13 14 15 16 17

40,049,175.50 28,647,868.00 6,041,519.00 27,775,385.16 5,963.00 159,434,118.83 0.00

DIRECTOR

DIRECTOR As per our report of even date annexed for XYZ Chartered Accountants

DATE: PLACE ;

Page 1

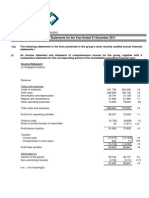

XYZ LTD. STATEMENT OF PROFIT AND LOSS FOR THE YEAR ENDED 31ST MARCH 2012 PARTICULARS Revenue from operations Less: Excise Duty \ Cess Duty Other Income Total Revenue Expenses: Cost of materials consumed Purchase of Stock-in-Trade Excise Duty on Finished Goods Changes in inventories of FG, WIP and Stock-in-Trade Employee benefit expense Financial costs Depreciation and amortization expense Other expenses Total Expenses Profit before exceptional and extraordinary items and tax Exceptional Items Profit before extraordinary items and tax Extraordinary Items Profit before tax Tax Expenses (1) Current tax (2) Deferred tax Profit(Loss) from the perid from continuing operations Profit/(Loss) from discontinuing operations Tax expense of discounting operations Profit/(Loss) from Discontinuing operations Profit/(Loss) for the period Earning per equity share (Basic & Diluted) #REF! #REF! 20 NOTES NO. 18 CURRENT YEAR 31.03.2012 548,869,509.00 49,910,230.00 498,959,279.00 240,478.00 499,199,757.00 #REF! #REF! 21 22 23 24 25 #REF! 1,970,570.00 12,014,186.00 #REF! #REF! #REF! #REF! #REF! #REF! PREVIOUS YEAR 31.03.2011 356,498,512.00 32,264,143.00 324,234,369.00 115,963.00 324,350,332.00 240,579,663.79 1,712,767.00 (5,638,300.50) 1,562,316.00 7,514,658.45 2,650,103.00 74,748,635.98 323,129,843.72 1,220,488.28 1,220,488.28 1,220,488.28

19

#REF! #REF! #REF! -

226,279.00 377,130.00 617,079.28 617,079.28 0.82

Notes 1 to 26 form an integral part of the Balance Sheet and Statement of Profit & Loss Account

DIRECTOR

DIRECTOR As per our report of even date annexed

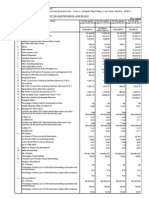

XYZ LTD. NOTES ANNEXED TO AND FORMING PART OF BALANCE SHEET AS AT 31ST MARCH 2012 STATEMENT OF PROFIT & LOSS FOR THE YEAR ENDED ON THAT DATE NOTES NO. 1 Particulars SHARE CAPITAL Authorised Share Capital 10,00,000 Equity Shares of Rs. 10/- each. Issued, Subscribed & Paid Up Share Capital 7,48,000 Equity Shares( Previous Year 7,48,000) of Rs. 10/- each, Fully Paid up Total (Rs.) Current Year 31.03.2012 Previous Year 31.03.2011

10,000,000.00 10,000,000.00 7,480,000.00 7,480,000.00

10,000,000.00 10,000,000.00 7,480,000.00 7,480,000.00

The company has only one class of equity shares having a par value of Rs.10.00 per share. Each shareholder is eligible for one vote per share. In the event of liquidation of the company, the holders of shares shall be entitled to receive any of the remaining assets of the company, after distribution of all prefrential amounts. The amount distributed will be in proportion to the number of equity shares held by the shareholders. RECONCILATION OF SHARE CAPITAL Particulars Number Shares Outstanding at the beginning of the year Shares issued during the year Shares bought back during the year Shares Outstanding at the end of the year NAME OF SHARE HOLDERS HOLDING SHARES MORE THAN 5% Current Year 31.03.2012 No. of Shares % of Holding held 73000 9.76% 59000 7.89% 163000 21.79% 227000 30.35% 522000 Previous Year 31.03.2011 No. of Shares % of Holding held 73000 9.76% 59000 7.89% 163000 21.79% 227000 30.35% 522000 748000 0 0 748000 Equity Shares Amount (Rs.) 7,480,000.00 7,480,000.00

Name of Shareholders

RESERVE & SURPLUS Securities Premium ReserveAccount Opening Balance Add : Addition during the F.Y. Surplus (Profit & Loss Account) Opening Balance Add : Addition during the F.Y. Total (Rs.)

29,520,000.00 29,520,000.00 705,470.76 #REF! #REF! #REF!

29,520,000.00 29,520,000.00 88,391.48 617,079.28 705,470.76 30,225,470.76

LONG TERM BORROWINGS Secured Borrowings Term Loan from Banks Car Loan from Bank (I) Car Loan from Bank (II) Unsecured Borrowings Inter Corporate Deposits From Directors , Shareholders & Their Relatives Total (Rs.)

#REF! #REF! #REF!

19,840,161.00 395,810.00 875,743.00

#REF! #REF! #REF!

14,000,000.00 10,791,319.00 45,903,033.00

Term Loan from ______________________________is secured by the first charges on all fixed assets and movable assets of the Company (both Present & future) and also personal guarantee by all Directors of the company. 1 From Punjab National Bank (for term loan of Rs. 325 Lacs) At the rate of 15.50 % (Previous year 15.50 % p.a.). Repayble in 84 monthly installment of Rs. 435000.00 each starting from ______ . 2 From Punjab National Bank (for Car loan of Rs. 6.50 Lacs) At the rate of 11.00% (Previous year 11.00 % p.a.). Repayble in 85 monthly installment (EMI) of Rs. 11130.00 each starting from _______ . 3 From Punjab National Bank (for Car loan of Rs. 10.00 Lacs) At the rate of 12.00 % (Previous year 12.00 % p.a.). Repayble in 84 monthly installment (EMI) of Rs. 17789.00 each starting from _______ . The scheduled maturity of the Long-term borrowings is summarised as under: Term Loans Current Maturities of long-term debt Term Loan from Banks Car Loan from Bank (I) Car Loan from Bank (II) Total (Rs.) Long term borrowings Term Loan from Banks Car Loan from Bank (I) Car Loan from Bank (II) Total (Rs.) 4 DEFERRED TAX LIABIALITY (NET) Opening Balance Add : Current year Provisions Total (Rs.) SHORT TERM BORROWINGS Secured Borrowings Working Capital Limit From Bank Total (Rs.) #REF! #REF! #REF! #REF! 19,840,161.00 395,810.00 875,743.00 21,111,714.00 #REF! #REF! #REF! #REF! 5,263,282.00 146,896.00 118,095.00 5,528,273.00 Term Loans

428,039.00 #REF! #REF!

50,909.00 377,130.00 428,039.00

47,501,574.55 47,501,574.55

30,177,336.62 30,177,336.62

Working Capital Limit from Punjab National Bank, Industrial Area, Muzaffarnagar is secured against Hypothication of Raw Material, WIP, Finished Goods, Stores & Spares and Trade Receivables of the Company and personal guarantee of all the Directors. 6 TRADES PAYABLES Trade Payable for Supplies Total (Rs.)

#REF! #REF!

23,018,441.45 23,018,441.45

OTHER CURRENT LIABILITIES Current Maturities of Long Term Debt Expenses Payable Sundry Creditors for Capital Goods Advances From Customers Cheque issued but not presented Total (Rs.) SHORT TERM PROVISIONS Provision From Employees Benefit Salary & Wages Payable Director's Salary Payable Provident Fund Payable Others Excise Duty Provision for Taxation For Current Year Total (Rs.) NON CURRENT INVESTMENTS Gold Coins Total (Rs.) LONG TERM LOANS & ADVANCES Unsecured but Considered Good Security Deposited with Govt. Departments Advances for Capital Goods Total (Rs.) OTHER NON-CURRENT ASSETS Unsecured but Considered Good Others Preliminary Expenses Opening Balance Add : Incurred during the year Less : Written off during the year Total (Rs.)

#REF! #REF! #REF! 8,667,206.00 #REF!

5,528,273.00 799,174.00 415,987.00 5,713,174.00 7,668,654.00 20,125,262.00

86,627.00 48,000.00 9,900.00 #REF! #REF! #REF!

100,198.00 28,000.00 9,292.00 1,712,767.00 226,279.00 2,076,536.00

10

514,418.85 514,418.85

225,130.21 225,130.21

11

#REF! #REF! #REF!

2,750,000.00 2,750,000.00

12

#REF! 113,820.00 113,820.00 37,940.00 151,760.00 151,760.00 37,940.00

405,464.00

75,880.00 #REF!

113,820.00 519,284.00

13

INVENTORIES Raw Material Silico Magnese Ramming Mass Refractories Stores & Spares CI Moulds Rejected Moulds Finished Goods Total (Rs.) #REF!

#REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF!

19,163,237.00 2,038,424.00 145,030.00 32,850.00 10,000.00 1,338,276.00 692,550.00 16,628,808.50 40,049,175.50

14

TRADE RECEIVABLES Unsecured, considered Good Trade Receivalbes outstanding for more than six months from the date they became due for payment Others Total (Rs.)

#REF! #REF! #REF!

2,066,840.00 26,581,028.00 28,647,868.00

15

CASH & CASH EQUIVALENTS Cash-in-Hand Cheque in Hand Balance with Banks In FDR Accounts (Margin Money Against LC) In FDR Accounts (Others) In Current Accounts Total (Rs.)

175,640.00 406,641.80

771,707.00 1,218,894.00

#REF! #REF! 1,505,987.00 #REF!

41,500.00 4,009,418.00 6,041,519.00

Rs. 41500.00 in FDR is having maturity of more than 12 months (Previous year Rs. 41500.00) 16 SHORT TERM LOANS & ADVANCES Unsecured but Considered Good Advances to Suppliers Prepaid Expenses Others Total (Rs.) OTHER CURRENT ASSETS Unsecured but Considered Good Accured Interest on FDR Income Tax Refundable Total (Rs.) REVENUE FROM OPERATION Sales of Manufacturing Products Less: Excise Duty \ Cess Duty Total (Rs.) Details of Sale Products MS INGOT Total (Rs.) 19 OTHER INCOME Interest Received Total (Rs.) 20 RAW MATERIAL CONSUMED Opening Stock Add: Purchases Add: Transfer From Rejected Moulds Total Less: Closing Stock Raw Material Consumed CHANGE IN INVENTORIES Opening Stock - Finished Goods - Stock in Process Less: Closing Stock - Finished Goods - Stock in Process Total (Rs.)

#REF! 76,597.00 #REF! #REF!

25,805,364.00 41,236.00 1,928,785.16 27,775,385.16

17

73,737.00 6,173.16 79,910.16

5,963.00 5,963.00

18

548,869,509.00 49,910,230.00 498,959,279.00

356,498,512.00 32,264,143.00 324,234,369.00

548,869,509.00 548,869,509.00

356,498,512.00 356,498,512.00

240,478.00 240,478.00

115,963.00 115,963.00

#REF! #REF! #REF! #REF! #REF! #REF!

25,940,447.00 233,802,453.79 259,742,900.79 19,163,237.00 240,579,663.79

21

16,628,808.50 16,628,808.50 #REF! #REF! #REF!

10,990,508.00 10,990,508.00 16,628,808.50 16,628,808.50 (5,638,300.50)

22

EMPLOYMENT BENEFIT EXPENSES Salary & Wages Directors Salary Contribution to P.F. Leave Encashment Total (Rs.) FINANCE COST Interest on Term Loan Interest on Working Capital Interest on Car Loan Interest Others Bank Charges Total (Rs.)

1,281,919.00 600,000.00 61,751.00 26,900.00 1,970,570.00

1,155,223.00 360,000.00 47,093.00 1,562,316.00

23

3,469,700.00 5,296,462.00 175,009.00 2,665,179.00 407,836.00 12,014,186.00

3,738,257.00 2,399,922.25 76,661.00 1,184,356.00 115,462.20 7,514,658.45

24

DEPRECIATION AND AMORTIZATION EXPENSES Depreciation Amortization of Expenses Total (Rs.) OTHER EXPENSES Manufacturing Expenses Silico Magnese Consumed Ramming Mass Consumed Refractories Consumed Stores & Spares Consumed C.I. Moulds Consumed Power Expenses D. G. Set Running Expenses Repair & Maintenance (Plant & Machinery)

#REF! 37,940.00 #REF!

2,612,163.00 37,940.00 2,650,103.00

25

#REF! #REF! #REF! #REF! #REF! 78,697,251.00 124,658.00 11,030.00 #REF!

5,605,851.00 603,934.00 965,650.00 323,524.00 265,802.00 66,013,496.00 165,529.00 188,374.00 74,132,160.00

Administrative Expenses Printing & Stationery Postage & Telegram Auditors Remuneration Advertisment Expenses Donation Filing Fees Travelling & Conveyance Vehicle Running & Maintenance Building Repair & Maintenance Misc. Balance W/off Rates & Taxes Insurance Charges Legal & Professional Charges Subscription & Membership Fees Excise Duty paid Vat Paid on Capital Goods Income Tax Paid Selling Expenses Freight on Sales Service Tax on Freight Outward Total (Rs.)

8,068.00 2,765.00 20,000.00 102,072.00 3,000.00 2,000.00 42,280.00 450.87 31,000.00 117,007.00 50,836.00 2,500.00 3,400.00 1,418.00 386,796.87 1,180,522.00 30,691.00 1,211,213.00 #REF!

4,928.00 1,985.00 20,000.00 10,600.00 2,100.00 4,000.00 15,118.00 42,391.00 5,165.00 55.02 81,560.00 91,445.00 30,500.00 10,000.00 119,813.00 5,551.00 445,100.98 171,375.00 171,375.00 74,748,635.98

26

SIGNIFICANT ACCOUNTING POLICIES:-

(a) Basis of Preparation of Financial Statements: The Financial Statement has been prepared in accordance with the applicable Accounting Standards issued by the institute of Chartered Accountants of India and the generally accepted accounting principles and the provisions of the Companies Act, 1956. (b) Valuation of Inventories: Inventory of Raw Material is valued at lower of cost or net realizable value in compliance with the requirement of Accounting Standards 2 (AS-2) issued by The Institute of Chartered Accountants of India. Cost is determined by using FIFO Method. Further, inventory of stores & spares is valued on estimated value method. Consumption of Raw Material, Consumable Stores, etc. is accounted for after reckoning the Closing Stock of respective as curtained by the Company's experts at the end of the year from the total of opening stock and purchases.

(c) Excise Duty: Excise Duty is accounted for at the time of removal of goods, while closing stock are inclusive of excise duty. (d) VAT Credit: VAT Credit is available to the company on purchase of capital goods, purchases of raw materials and other eligible inputs, which is to be adjusted against the Commercial Tax payable on clearance of finished goods. (e) Sales: Sales are inclusive of Excise Duty and net of sales return. (f) Purchases: Purchases are inclusive of freight inward and net of VAT credit available on inputs. (g) Fixed Assets and Depreciation: (1) Fixed Assets have been stated at actual cost. Actual cost is inclusive of freight, installation cost, taxes, other incidental expenses and expenses capitalized, incurred to bring the fixed assets to its present location. (2) Depreciaiton on fixed assets has been charged on the basis of Straight Line Method mehtod as per rates prescribed in Schedule XIV of the Companies Act, 1956 on monthly pro-rata basis. (h) Amortization of Expenses: Preliminary Expenses has been amortized over a period of 5 years as per provisions of section 35D of I. Tax Act, 1961 (i) Revenue Recognition: All the Income and Expenditure items having material bearing on the financial statements are recognized on accrual basis.

(j) Borrowing Cost: According to Accounting Standard 16 (AS-16) issued by the Institute of Chartered Accountants of India, Borrowing Cost that is attributable to the acqusition or construction of qualifying assets is capitalized as part of the cost of such assets. A qualifying assets is one that necessarily takes substantial period of time to get ready for intended use. All other borrowing costs are charged to revenue. (k) Segment Reporting: Since the Company operates in a single segment i.e. "MS INGOT", Accounting Standard (AS) 17- "Segment Reporting" issued by the Institute of Chartered Accountants of India is not applicable.

(l) Related Party Disclosure: Key Management Personnel

Related Party Transaction: Particulars Remuneration Personnal Loan Given Personnal to to Key Key Management Management

Current Year 31.03.2012 Value of Balance at the Transaction end of the year

Previous Year Year 31.03.2011 Value of Balance at the Transaction end of the year

(m) Earning per Share: According to Accouning Standard 20 (AS-20) issued by the Institute of Chartered Accountants of India, earning considered in ascertaining basis EPS of the company comprises the net profit after tax. The number of shares used in computing basis EPS is the weighted average of shares outstading. Particulars Profit attributable to the Shareholders (Rs.in lacs) Basic/Weighted average number of Equity Shares outstanding during the year Nominal value of Equity Shares (Rs.) Basic/Diluted Earning per Shares (Rs.) Current Year 31.03.2012 #REF! 748,000.00 10.00 #REF! Previous Year 31.03.2011 617,079.28 748,000.00 10.00 0.82

(n) Taxes on Income: (1) Provision for Current Tax is being made after taking into consideration benefits admissible to the Company under the provisions of the Income Tax Act, 1961. (2) Deferred Tax Liability, if any is computed as per in accordance with Accounting Standard (AS-22). Deffered Tax Assets and Deffered Tax Liability are computed by applying rates and tax laws that have been enacted upto the Balance Sheet date. Particulars Deferred Tax Liability (Net) Deferred Tax Liability Related to fixed assets Deferred Tax Assets Unabsorbed Losses Total (Rs) Current Year 31.03.2012 Previous Year 31.03.2011

#REF! #REF! #REF!

1,169,174.00 792,044.00 377,130.00

(n) Provision and Contingencies: A provisions is recognized when the Company has a present obligation as a result of past events and it is probable that anoutflow of resources will be required to settle the obligation in respect of which a reliable estimate can be made. The provisions are determined based on the best estimate required to settle the obligation at the Balance Sheet date.

(o) Contingent Liability & Commitments (to the extent not provided for) Current Year 31.03.2012 NIL NIL NIL NIL Previous Year 31.03.2011 NIL NIL NIL NIL

Coningent Liabilities Commitments Estimated amount of contracts remaining to be executed on capital account and not provided for Total (Rs.) (p) Auditors' Remuneration: Auditor's remuneration includes: (i) Audit Fees (ii) Tax Audit Fees (iii) Company Law Matters Total (Rs.)

15,000.00 5,000.00 20,000.00

15,000.00 5,000.00 20,000.00

(q) Other Notes (i) Balances of Sundry Debtors, Creditors and Advances as at 31st March, 2012 are subject to confirmation. (ii) In the absence of information from creditors of their status, the amount due to small and micro enterprises is not ascertainable.

(iii) In the opinion of Board of Directors, the current assets and loans & advances have a value on realization in the ordinary course of business, not less than the amount, at which they are stated in the Balance Sheet as at 31st March 2012. (iv) In view of insufficient information from the suppliers regarding their status as SSI unit, amount over due to small-scale industrial undertaking as on 31.03.2012 can not be ascertained. (v) The financial statements for the year ended 31st March 2011 had been prepared as per then applicable, pre-revised Schedule VI of the Companies Act, 1956. Consequent to the notification under the Companies Act, 1956, the financial statements for the year ended 31st March 2012 are prepared under revised Schedule VI. Accordingly, the previous year figures have also been reclassified to confirm to this year's classification.

(r) Value of Imported Raw Material, Stores & Spares Consumed and %age thereof Particulars Current Year 31.03.2012 Value (Rs.) Percentage Raw Material Imported Indigenous Total (Rs.) Chemicals Imported Indigenous Total (Rs.) Sotres & Spares Imported Indigenous Total (Rs.) #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! Previous Year 31.03.2011 Value (Rs.) Percentage 5,898,895.00 234,680,768.79 240,579,663.79 5,605,851.00 5,605,851.00 1,893,108.00 1,893,108.00 2.45% 97.55% 100.00% 0.00% 100.00% 100.00% 0.00% 100.00% 100.00%

Current Year 31.03.2012 (s) CIF Value of Imports Raw Materials Capital Goods Chemical Stores & Spare Parts (t) Expenditure in Foreign Currency (u) Remittence in Foreign Currency (v) Earning in Foreign Currency Notes 1 to 26 form an integral part of the Balance Sheet and Statement of Profit & Loss Account

Previous Year 31.03.2011 NIL NIL NIL NIL NIL NIL NIL

NIL NIL NIL NIL NIL NIL

DIRECTOR

DIRECTOR

Date : Place :

As per our report of even date annexed

XYZ LTD. F.Y.2011-2012 Calculation of Cost of Production Raw Material Manufacturing Expenses Employees Cost Depreciation other than Furn. Computer & Vehicles Administrative Expenses (25%) #REF! #REF! 1,970,570.00 #REF! 96,699.22 #REF! 16567.215 M.T. #REF!

Production Cost per ton Valuation of Closing Stock (At Cost) Closing Stock (MS Ingot & Runner Riser) Cost of Production per ton Total Cost Add : Excise Duty, Ed. Cess & H.Ed. Cess

#REF! #REF! #REF! #REF! #REF!

M.T.

Valuation of Closing Stock Closing Stock - M S Ingot Selling Price Value - Runner Riser Selling Price Value Total Value Add : Excise Duty & Ed. Cess

At Market Price (based on last sales bill) #REF! 32200.00 #REF! #REF! 28000.00 #REF! #REF! #REF! #REF! XYZ LTD. M.T.

M.T.

CALCULATIONS OF VARIOUS RATIO CURRENT ASSETS (a) Current investments (b) Inventories (c) Trade receivables (d) Cash and cash equivalents (e) Short-term loans and advances (f) Other current assets

F.Y.2011-2012

#REF! #REF! #REF! #REF! 79,910.16 #REF!

CURRENT LIABILITIES (a) Short-term borrowings (b) Trade payables (c) Other current liabilities (d) Short-term provisions

47,501,574.55 #REF! #REF! #REF! #REF! #REF! 548,869,509.00 #REF! #REF! #REF! #REF!

CURRENT RATIO SALES GROSS PROFIT NET PROFIT GROSS PROFIT/SALES NET PROFIT/SALES

TOTAL OUTSTANDING LIABILITIES Non Current Liabilities Current Liabilities

#REF! #REF! #REF!

TOTAL NET WORTH Share Capital Reserve & Surplus Deferred Tax Liabilities Less: Preliminary Expenses

7,480,000.00 #REF! #REF! #REF! 75880.00 #REF! #REF!

TOL/TNW DEBTS Term Loan from Banks Unsecured Loans

#REF! #REF! #REF!

EQUITY Share Capital Reserve & Surplus Deferred Tax Liabilities Less: Preliminary Expenses

7,480,000.00 #REF! #REF! #REF! 75880.00 #REF! #REF!

DEBT/EQUITY RATIO

XYZ LTD. CALCULATION OF MAXIMUM PERMISSIBLE BANK FINANCE (AS PER NAYAK COMMITTEE) (a) SALES (b) '25% OF SALES (c) '5% OF SALES (d) NWC (e) b-c (f) b-d (h) Permissible Bank Finance (e) or (f), which ever is lower (I) Bank Borrowings Current Assets (a) Current investments (b) Inventories (c) Trade receivables (d) Cash and cash equivalents (e) Short-term loans and advances (f) Other current assets Other Current Liabilities (a) Trade Payables (b Other Current Liabilities (c) Short Term Provisions Working Capital Less : Bank Borrowings NWC 548,869,509.00 137,217,377.25 27,443,475.45 #REF! 109,773,901.80 #REF! #REF! 47,501,574.55

#REF! #REF! #REF! #REF! 79,910.16 #REF! #REF! #REF! #REF! #REF! #REF! 47,501,574.55 #REF!

CALCULATION OF MAXIMUM PERMISSIBLE BANK FINANCE (AS PER TRADITIONAL METHOD)

(a) Current Assets Less : Current Liabilities excuding bank borrowings (b) Working Capital Gap (c) 25% of Total Current Assets (d) NWC (e) b-c (f) b-d (h) Permissible Bank Finance (e) or (f), which ever is lower (I) Bank Borrowings

#REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! 47,501,574.55

XYZ LTD. FUND FLOW STATEMENT Long Term Funds Share Capital Share Application Money Pending Allotment Reserve & Surplus Long-term borrowings Deferred tax liabilities (Net) Other Long term liabilities Long term provisions

7,480,000.00 #REF! #REF! #REF! #REF!

Long Term Uses Fixed Assets Non-current investments Deferred tax assets (net) Long term loans and advances Other non-current assets Long Term Surplus Short Term Funds Short-term borrowings Trade payables Other current liabilities Short-term provisions Short Term Uses (a) Current investments (b) Inventories (c) Trade receivables (d) Cash and cash equivalents (e) Short-term loans and advances (f) Other current assets Short Term Uses Difference

#REF! 514,418.85 #REF! #REF! #REF! #REF! 47,501,574.55 #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! 79,910.16 #REF! #REF! #REF!

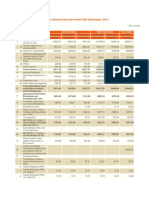

NOTES NO.9: FIXED ASSETS: Gross Block Addition Deduction during during the the year year 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1422965.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Depreciaton Deduction For the during the year year 0.00 #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! 0.00 0.00 0.00 0.00 0.00 0.00 #REF! 2612163.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Net Block Value as on 31.03.2012 0.00 #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! 0.00 0.00 0.00 0.00 0.00 0.00 #REF! 3692178.00 WDV as on 31.03.2012 3346005.00 #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! 0.00 0.00 0.00 0.00 0.00 0.00 #REF! 53419793.96 WDV as on 31.03.2011 3346005.00 10250829.45 28841943.51 372495.00 7831447.00 658483.00 52517.00 36514.00 2029560.00 53419793.96 0.00 0.00 0.00 0.00 0.00 0.00 53419793.96 54608991.96

Sr. No I 1 2 3 4 5 6 7 8 9

Particulars Tangible Assets Land Factory Building Plant and Machinery D.G. Set Electric Installation Weigh Bridge Furniture & Fixtures Computer Vehicles SUB TOTAL (A)

Rate %

Value as on 01.04.2011 3346005.00 10759954.45 31169606.51 402610.00 8463067.00 711720.00 57691.00 43850.00 2157468.00 57111971.96 0.00 0.00 0.00 0.00 0.00 0.00 57111971.96 55689006.96

Value as on 31.03.2012 3346005.00 10759954.45 31169606.51 402610.00 8463067.00 711720.00 57691.00 43850.00 2157468.00 57111971.96 0.00 0.00 0.00 0.00 0.00 0.00 57111971.96 57111971.96

Value as on 01.04.2011 0.00 509125.00 2327663.00 30115.00 631620.00 53237.00 5174.00 7336.00 127908.00 3692178.00 0.00 0.00 0.00 0.00 0.00 0.00 3692178.00 1080015.00

3.34 5.28 5.28 5.28 5.28 6.33 16.21 9.50

II

Intangible Assets SUB TOTAL (B)

III Capital Work-in-progress SUB TOTAL (C) IV Intangible Assets Under Development SUB TOTAL (D) Total [A + B + C + D] (Current Year) (Previous Year)

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- 8 Session 20 Pillar 02 Finance Management Part 1Document13 pages8 Session 20 Pillar 02 Finance Management Part 1Azfah AliNo ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- 2011 Consolidated All SamsungDocument43 pages2011 Consolidated All SamsungGurpreet Singh SainiNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Comprehensive CasesDocument80 pagesComprehensive CasesAyush PurohitNo ratings yet

- Business Analytics End Term Project: Submitted by Submitted ToDocument15 pagesBusiness Analytics End Term Project: Submitted by Submitted ToVinayak ChaturvediNo ratings yet

- Unaudited Financial Results Q2 2014Document4 pagesUnaudited Financial Results Q2 2014Dhruba DebnathNo ratings yet

- India Bulls Securities LTDDocument13 pagesIndia Bulls Securities LTDTiny TwixNo ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- UGBS Compiled Past Questions 4 PDFDocument327 pagesUGBS Compiled Past Questions 4 PDFEbunNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PTCL Accounts 2009 (Parent)Document48 pagesPTCL Accounts 2009 (Parent)Najam U SaharNo ratings yet

- 3 JBCMLDocument42 pages3 JBCMLArman Hossain WarsiNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Unaudited Financial Statements for Year Ended 31 Dec 2011Document18 pagesUnaudited Financial Statements for Year Ended 31 Dec 2011Jennifer JohnsonNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- LXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFDocument5 pagesLXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFNezer Byl P. VergaraNo ratings yet

- ITC Report and Accounts 2010 Key Financial Statements and SchedulesDocument40 pagesITC Report and Accounts 2010 Key Financial Statements and SchedulesSandeep GunjanNo ratings yet

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333No ratings yet

- Financial Reporting & Analysis Session Provides InsightsDocument41 pagesFinancial Reporting & Analysis Session Provides InsightspremoshinNo ratings yet

- Fina 004Document4 pagesFina 004Mike RajasNo ratings yet

- Balance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Document22 pagesBalance Sheet of Maruti Suzuki INDIA (In Rs. CR.) MAR 21 MAR 20 MAR 19 MAR 18Santhiya ArivazhaganNo ratings yet

- Services & Offers and Financial ProjectionDocument13 pagesServices & Offers and Financial ProjectionMark Leonil FunaNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- Financial Management - I (Practical Problems)Document9 pagesFinancial Management - I (Practical Problems)sameer_kini100% (1)

- Gat Prin & Pract of Fin Acct Nov 2006Document10 pagesGat Prin & Pract of Fin Acct Nov 2006samuel_dwumfourNo ratings yet

- Pyrogenesis Canada Inc.: Financial StatementsDocument43 pagesPyrogenesis Canada Inc.: Financial StatementsJing SunNo ratings yet

- 362 End Term FRA SecDDocument5 pages362 End Term FRA SecDkhushali goharNo ratings yet

- Arid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDocument3 pagesArid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDeadPool Pool100% (1)

- Management Team and Personnel PlanDocument13 pagesManagement Team and Personnel PlanVICTORIA MUNISINo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingSimran MittalNo ratings yet

- Capital Expenditures BudgetDocument4 pagesCapital Expenditures BudgetDawit AmahaNo ratings yet

- 1.accounts 2012 AcnabinDocument66 pages1.accounts 2012 AcnabinArman Hossain WarsiNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- S7 WEEK8 REI Corporate Finance 15 16Document6 pagesS7 WEEK8 REI Corporate Finance 15 16StefanAndreiNo ratings yet

- Auditors Report Financial StatementsDocument57 pagesAuditors Report Financial StatementsSaif Muhammad FahadNo ratings yet

- MitchellsDocument22 pagesMitchellsSHAHZADI AQSANo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Assignment: Topic: Financial Statement Analysis of National Bank of PakistanDocument28 pagesAssignment: Topic: Financial Statement Analysis of National Bank of PakistanSadaf AliNo ratings yet

- MMS 2022-24 QP Financial AccountingDocument6 pagesMMS 2022-24 QP Financial AccountingnimeshnarnaNo ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriessampadaNo ratings yet

- MMDZ Audited Results For FY Ended 31 Dec 13Document1 pageMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Cash Flow Statement PracticeDocument6 pagesCash Flow Statement PracticeVinod Gandhi100% (3)

- Bank of Tokyo Mitshubhishi LTD 2009Document46 pagesBank of Tokyo Mitshubhishi LTD 2009Mahmood KhanNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- WCL Annual Report 2011 - 12Document92 pagesWCL Annual Report 2011 - 12shah1703No ratings yet

- CBDT Circular 10 2A Firms PartnersDocument2 pagesCBDT Circular 10 2A Firms PartnersPriya GoyalNo ratings yet

- Top 50 Key Highlights - Company Bill 2013Document4 pagesTop 50 Key Highlights - Company Bill 2013Priya GoyalNo ratings yet

- Axis Seed 2012-13 RM Opg in Out/Use Loss Closing PCKG Opg in Out/Use Loss Closing Fin Good Opg in Out ClogDocument1 pageAxis Seed 2012-13 RM Opg in Out/Use Loss Closing PCKG Opg in Out/Use Loss Closing Fin Good Opg in Out ClogPriya GoyalNo ratings yet

- Axis Seed & Crop Technology: Leave Application Form (Casual/Sick/Earn/P.L.)Document1 pageAxis Seed & Crop Technology: Leave Application Form (Casual/Sick/Earn/P.L.)Priya GoyalNo ratings yet

- LIC Jeevan Tarang plan details for Mihir ShahDocument6 pagesLIC Jeevan Tarang plan details for Mihir ShahPriya GoyalNo ratings yet

- Daily HR Report - ModelDocument1 pageDaily HR Report - ModelsheetalgujarathiNo ratings yet

- Stores ManDocument20 pagesStores ManomanfastsolutionNo ratings yet

- Apply Benford's Law in ExcelDocument12 pagesApply Benford's Law in ExcelHermaz WibisonoNo ratings yet

- Gerald Appel - MACD TutorialDocument7 pagesGerald Appel - MACD Tutorialraininseattle100% (2)

- Essential of TradingDocument48 pagesEssential of TradingPriya GoyalNo ratings yet

- Salary Slip - July-2013: Earnings DeductionsDocument5 pagesSalary Slip - July-2013: Earnings DeductionsPriya GoyalNo ratings yet

- Frequently Asked Questions (Faqs) : E Filing and CPCDocument22 pagesFrequently Asked Questions (Faqs) : E Filing and CPCPriya GoyalNo ratings yet

- To Whomsoever It May Concern: Date: 30/10/2012Document1 pageTo Whomsoever It May Concern: Date: 30/10/2012Priya GoyalNo ratings yet

- 6 Single Minute Exchange of DieDocument3 pages6 Single Minute Exchange of DiePriya GoyalNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomePriya GoyalNo ratings yet

- Saving Bank InterestDocument20 pagesSaving Bank InterestPriya GoyalNo ratings yet

- Axis Seeds & Crop Technology: Employee's Name: Location: Designation: Department: PeriodDocument1 pageAxis Seeds & Crop Technology: Employee's Name: Location: Designation: Department: PeriodPriya GoyalNo ratings yet

- Organization Chart: 1. As Suggested by Me (Bhavin Shah) As Per The Current Structure of OrganizationDocument2 pagesOrganization Chart: 1. As Suggested by Me (Bhavin Shah) As Per The Current Structure of OrganizationPriya GoyalNo ratings yet

- Guidelines - Reims ProcessDocument1 pageGuidelines - Reims ProcessPriya GoyalNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomePriya GoyalNo ratings yet

- Axis Agri Services: Particulars Credit DebitDocument1 pageAxis Agri Services: Particulars Credit DebitPriya GoyalNo ratings yet

- LedgerDocument22 pagesLedgerPriya GoyalNo ratings yet

- Axis Seed 2012-13 RM Opg in Out/Use Loss Closing PCKG Opg in Out/Use Loss Closing Fin Good Opg in Out ClogDocument1 pageAxis Seed 2012-13 RM Opg in Out/Use Loss Closing PCKG Opg in Out/Use Loss Closing Fin Good Opg in Out ClogPriya GoyalNo ratings yet

- Bombay Chartered Accountants' Society 2013 Holiday ListDocument1 pageBombay Chartered Accountants' Society 2013 Holiday ListPriya GoyalNo ratings yet

- No Objection Certificate for Operation Manager ResignationDocument1 pageNo Objection Certificate for Operation Manager ResignationPriya GoyalNo ratings yet

- Asd SDF SDF SDF SDF Asd SDFDocument1 pageAsd SDF SDF SDF SDF Asd SDFPriya GoyalNo ratings yet

- CTMDocument13 pagesCTMPriya GoyalNo ratings yet

- XXX 123456Document1 pageXXX 123456Priya GoyalNo ratings yet

- AsdasfdasfasfasfDocument2 pagesAsdasfdasfasfasfPriya GoyalNo ratings yet

- QQQQQDocument1 pageQQQQQPriya GoyalNo ratings yet

- Illovo Malawi - Annual Report 2010Document54 pagesIllovo Malawi - Annual Report 2010Kristi DuranNo ratings yet

- GRI Reports List 2013 2014 EjercicioDocument3,269 pagesGRI Reports List 2013 2014 EjercicioIrina Michelle AlvaradoNo ratings yet

- The Buffett Essays Symposium - Annotated 20th Anniversary TranscriptDocument3 pagesThe Buffett Essays Symposium - Annotated 20th Anniversary Transcriptusermj9111No ratings yet

- Advertisement in RecessionDocument5 pagesAdvertisement in RecessionqamarulislamNo ratings yet

- Strategic ManagementDocument46 pagesStrategic ManagementAmrita Gharti100% (1)

- Sol. Man. - Chapter 8 - Adjusting EntriesDocument11 pagesSol. Man. - Chapter 8 - Adjusting EntriesPerdito John Vin100% (3)

- Swift Messaging Factsheet Corporateactions56104Document4 pagesSwift Messaging Factsheet Corporateactions56104kartikb60No ratings yet

- Compound Annual Growth Rate (CAGR) Calculators - Version 2Document4 pagesCompound Annual Growth Rate (CAGR) Calculators - Version 2James WarrenNo ratings yet

- SAP FICO Online Training and Placement - Online Training in SAPDocument18 pagesSAP FICO Online Training and Placement - Online Training in SAPOnline Training in SAPNo ratings yet

- FDFDFGDocument44 pagesFDFDFGmatriiixxxNo ratings yet

- Britannia Analysis 2018-19Document32 pagesBritannia Analysis 2018-19Hilal MohammedNo ratings yet

- IPM 3.11.2016 Financial Portfolio ManagementDocument9 pagesIPM 3.11.2016 Financial Portfolio Managementavinash rNo ratings yet

- DISSERTATION RE NikhilDocument37 pagesDISSERTATION RE NikhilNikhil Ranjan50% (2)

- NH PDFDocument47 pagesNH PDFDpm BalasuriyaNo ratings yet

- Final Paper 14Document960 pagesFinal Paper 14nikhil14u2No ratings yet

- Synopsis of WORKING CAPITAL ANALYSIS of Bajaj Allianz Life InsuranceDocument3 pagesSynopsis of WORKING CAPITAL ANALYSIS of Bajaj Allianz Life InsuranceHemchandra KhoisnamNo ratings yet

- Cash Payment Instructions for US Visa Application FeeDocument2 pagesCash Payment Instructions for US Visa Application FeeJOE567No ratings yet

- East Coast Yachts Financial Ratio AnalysisDocument3 pagesEast Coast Yachts Financial Ratio Analysisbrentk112100% (1)

- Real Estate Investment Portfolio and Real Estate Investment Climate in Batangas ProvinceDocument9 pagesReal Estate Investment Portfolio and Real Estate Investment Climate in Batangas ProvinceIJARP PublicationsNo ratings yet

- Orchard Projections (Imperial Units)Document11 pagesOrchard Projections (Imperial Units)Chandler OrchardsNo ratings yet

- Investment Management: Chapter 5 - Performance EvaluationDocument25 pagesInvestment Management: Chapter 5 - Performance EvaluationyebegashetNo ratings yet

- FM Questions RevisedDocument15 pagesFM Questions RevisedRajarshi DaharwalNo ratings yet

- Case Study Crown CorkDocument19 pagesCase Study Crown CorkRafael AlemanNo ratings yet

- 2009 Mid-Term SolutionDocument15 pages2009 Mid-Term SolutionJohnny HarveyNo ratings yet

- State Bank of India (SBI) : SynopsisDocument18 pagesState Bank of India (SBI) : SynopsisAshish KumarNo ratings yet

- Ratio Analysis of BSRM Steels and GPH IspatDocument41 pagesRatio Analysis of BSRM Steels and GPH IspatRabib AhmedNo ratings yet

- Multiple Bank Accounts Registration FormDocument2 pagesMultiple Bank Accounts Registration FormMamina DubeNo ratings yet

- Quiz Questions: Banking and Financial ServicesDocument41 pagesQuiz Questions: Banking and Financial Servicesgeetainderhanda4430No ratings yet

- FAR - Earnings Per ShareDocument7 pagesFAR - Earnings Per ShareJohn Mahatma Agripa100% (2)

- Darden Resumes BookDocument48 pagesDarden Resumes BookSaurabh KhatriNo ratings yet