Professional Documents

Culture Documents

Telecom

Uploaded by

Saravanan RasayaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Telecom

Uploaded by

Saravanan RasayaCopyright:

Available Formats

1. Q1 2013 www.businessmonitor.comMALAYSIATELECOMMUNICATIONS REPORTINCLUDES 5-YEAR FORECASTS TO 2017ISSN 17484677Published by:Business Monitor International 2.

Malaysia Telecommunications Report Q1 2013 INCLUDES 5-YEAR FORECASTS TO 2017Part of BMIs Industry Report & Forecasts SeriesPublished by: Business Monitor InternationalCopy deadline: January 2013Business Monitor International 2013 Business Monitor InternationalSenator House All rights reserved.85 Queen Victoria StreetLondon All information contained in this publication isEC4V 4AB copyrighted in the name of Business MonitorUnited Kingdom International, and as such no part of thisTel: +44 (0) 20 7248 0468 publication may be reproduced, repackaged,Fax: +44 (0) 20 7248 0467 redistributed, resold in whole or in any part, or usedEmail: subs@businessmonitor.com in any form or by any means graphic, electronic orWeb: http://www.businessmonitor.com mechanical, including photocopying, recording, taping, or by information storage or retrieval, or by any other means, without the express written consent of the publisher.DISCLAIMERAll information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time ofpublishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Business MonitorInternational accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of thepublication. All information is provided without warranty, and Business Monitor International makes no representation of warranty of any kind asto the accuracy or completeness of any information hereto contained. 3. Malaysia Telecommunications Report Q1 2013CONTENTSBMI Industry View ............................................................................................................... 7 BMI Industry View .......................................................................................................................... ........... 7SWOT Analysis ..................................................................................................................... 9 Mobile SWOT ....................................................................................................................... .................... 9 Wireline SWOT ....................................................................................................................... ................ 10Industry Forecast .............................................................................................................. 11 Mobile ....................................................................................................................... ............................ 11 Table: Telecoms Sector - Mobile - Historical Data And Forecasts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 ARPU ........................................................................................................................ ............................ 13 Table: Telecoms Sector - Mobile ARPU - Historical Data & Forecasts (MYR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 FixedLine ........................................................................................................................... ................... 15 Table: Telecoms Sector - Fixed Line - Historical Data And

Forecasts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Broadband ................................................................................................................. ............................ 16 Table: Telecoms Sector - Internet - Historical Data And Forecasts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16Industry Business Environment Overview ...................................................................... 18 Industry Business Environment Overview ..................................................................................................... 18 Table: Asia Pacific Telecoms Risk/Reward Ratings Q113 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 Malaysia .................................................................................................................... ............................ 23Market Overview ............................................................................................................... 25 Mobile ....................................................................................................................... ............................ 25 Table: Malaysian Mobile Market Regional Comparisons, 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 Key Developments ........................................................................................................... ....................... 26 Mobile Growth ...................................................................................................................... ................ 26 Table: Malaysia Wireless Market, Q212 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 Market Shares ........................................................................................................................ ............... 28 Usage (MOU/ARPU) ........................................................................................................... ................... 31 3G/4G ........................................................................................................................ .......................... 33 MVNOs ..................................................................................................................... ........................... 37 Mobile Content/Value-Added Services ........................................................................................................ 37 Table: Malaysia Mobile Non-Voice Service Revenue Indicators . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 Mobile Broadband ................................................................................................................. ................ 39 Table: Mobile Market Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 Table: Maxis Communications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. . . . . . . . . . . . . . . 41 Table: Celcom . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.................................................................. . . . . . . . . . . . . . . 42 Table: DiGi . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. . . . . . . . . . . . . . . 43 Mobile Regional Content ...................................................................................................................... .... 46 Table: Selected NFC Developments, 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. . . . . . . . . . . . . . . . . . 48 FixedLine ........................................................................................................................... ................... 53 Business Monitor International Page 4 4. Malaysia Telecommunications Report Q1 2013 Broadband ................................................................................................................. ............................ 54 National High-Speed Broadband (HSBB) Project ......................................................................................... 57 IPTV .......................................................................................................................... .......................... 59 WiMAX .................................................................................................................... ............................ 61 LTE ........................................................................................................................... .......................... 64 Table: Wireline Developments, 20102012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65Industry Trends & Developments .................................................................................... 67 Industry Trends & Developments ........................................................................................................... ..... 67 Mobile Consolidation Imminent? .............................................................................................................. 67 TIME Invests In Regional Data Centre ....................................................................................................... 69 Entrants To Spur IPTV Growth ................................................................................................................. 70 Maxis And Astro Choose Collaboration Over Competition ............................................................................. 71 Fiberail Gets Active ........................................................................................................................ ........ 71Regulatory Development .................................................................................................. 73 Regulatory Development ............................................................................................................. .............. 73 Table: Malaysia: Regulatory Bodies And Their Responsibilities . . . . . .................................................................. . . . . . . . . . . . . . . . 74 Regulatory Developments ........................................................................................................... ............ 75Competitive Landscape .................................................................................................... 77 Competitive

Landscape ................................................................................................................. ............ 77 Table: Key Players - Malaysia Telecoms Sector . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 Table: Selected Operators - Financial Indicators, 2005-2011 (US$mn) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77Company Profiles .............................................................................................................. 78 Telekom Malaysia .................................................................................................................... ................ 78 Maxis Communications ....................................................................................................... ...................... 82 Celcom ...................................................................................................................... ............................ 86 DiGi Telecommunications ................................................................................................. ........................ 90Regional Overview ............................................................................................................ 94 Nokia Siemens Networks ................................................................................................................... ........ 94 Financial Performance .............................................................................................................. ............. 94 Table: Vendor Revenues (US$mn) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94 Restructuring Efforts ....................................................................................................................... ....... 95 Geographical Breakdown ................................................................................................................ ........ 95 Table: Net Sales By Geography (EURmn) . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. . . . . . . . . . . . . . . . . . . . 95 Asia Pacific Is The Place To Be ................................................................................................................ 96 Table: NSN Selected Asia Activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .......................................................... 97Demographic Forecast ................................................................................................... 100 Demographic Forecast ..................................................................................................................... ...... 100 Table: Malaysias Population By Age Group, 1990-2020 (000) . . . . . . . . . .................................................................. . . . . . . . . . . . 101 Table: Malaysias Population By Age Group, 1990-2020 (% of total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101 Table: Malaysias Key Population Ratios, 19902020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102 Table: Malaysias Rural And Urban Population, 1990-2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103 Business Monitor International Page 5 5. Malaysia Telecommunications Report Q1 2013Glossary ............................................................................................................ ............... 104 Glossary .................................................................................................................... .......................... 104 Table: Glossary Of Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. ............................... 104Methodology ....................................................................................................... ............. 106 Methodology ............................................................................................................. ............................ 106 Table: Key Indicators For Telecommunications Industry Forecasts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106 Telecoms Business Environment Ratings ................................................................................................... 107 Table: Ratings Indicators . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. . . . . . . . . . 108 Table: Weighting Of Indicators . . . . . . . . . . . . . . . . . . . . . . . . . . . . .................................................................. . . . . . . . . . . . . . . . . . . . . . . . . . . 109 Business Monitor International Page 6 6. Malaysia Telecommunications Report Q1 2013BMI Industry ViewBMI Industry View BMI View: Although the Malaysian mobile market still offers opportunities for organic growth - new MVNOs continue to enter the market, as reported in this quarters update - network operators face considerable challenges as voice usage declines and customers prove reluctant to upgrade to postpaid services. Subscriber numbers growth and mobile broadband usage were weaker than expected as operators tried to encourage greater voice consumption. In the background, although, non-voice service revenues are still growing, which is encouraging for those operators starting to build 4G LTE networks. That said, low- value SMS services remain a large part of non-voice revenue, so operators need to contain costs wherever possible. Key Data Our telecoms forecasts have been extended to 2017. We envisage 41.9mn mobile subscribers, 3.6mn fixed-line subscribers and 7.2mn broadband subscribers. Mobile subscriber growth rebounded in Q212 (latest available data for analysis), although the momentum could taper in Q312 after weaker figures from DiGi. ARPUs have exhibited stability, although we believe that the trend of long-term decline remains due to strong competition and price promotions. Key Trends & Developments Astro and Maxis have signed an agreement to jointly develop and market unique telecoms product bundles, including pay-TV, mobile and fixed broadband services. Maxis has been open about its intention to venture into the pay-TV market through the IPTV route. In Q212, the firm signed strategic partnerships with 14 content providers, with the aim of launching commercial IPTV services in Q312. A solo venture into the IPTV market would have pitted Maxis against experienced

players and industry leaders Telekom Malaysia, Astro, Vassetti Datatech and REDtone. DiGi and WhatsApp have teamed up to offer unlimited access to WhatsApp messenger services. The collaboration demonstrates that mobile network operators and over-the-top (OTT) content providers are able to coexist and develop a revenue-sharing business model. While a threat, OTT providers could also lead to consumers upgrading their services with telecoms operators. Business Monitor International Page 7 7. Malaysia Telecommunications Report Q1 2013 Malaysia had a Telecoms Rating score of 59.1 in BMIs latest Asia Pacific Telecoms Risk/Reward Ratings. Recent data continue to indicate that the Malaysian economy is in the midst of rebalancing. Deteriorating global economic conditions have become a major drag on manufacturing exports. Meanwhile, increased public spending has helped to boost domestic demand. However, we see limited room for additional fiscal stimulus by the government going forward, and this suggests that economic growth is poised to remain relatively subdued at 3.8% for 2012 before witnessing a mild pickup towards 4.6% in 2013. Business Monitor International Page 8 8. Malaysia Telecommunications Report Q1 2013SWOT AnalysisMobile SWOT SWOT AnalysisStrengths Three well-established mobile operators and five additional operators licensed to provide 3/4G services. Sophisticated consumer profile eager to use mobile data and value-added services (VAS). Strong regulator supportive of competition in the mobile sector, creating a mature market with penetration in excess of 100%.Weaknesses Little room for further growth in an overly competitive and increasingly saturated mobile market. ARPU rates continue to decline, despite operators witnessing the beginnings of prepaid to postpaid migration. Despite WiMAX licences being awarded in 2005, little progress has been made.Opportunities 3G services providing numerous business opportunities for content providers and a new market for handset vendors. Launch of mobile number portability (MNP) has helped to bolster competition. Upgraded networks have led to strong demand for mobile broadband services, which could help close the digital divide gap emerging between urban and rural markets.Threats Maturity of market could lead to a saturated domestic market, as in Singapore. Possibility that Malaysia could be displaced as a regional foreign direct investment (FDI) hub by China, with vendors opting to locate/relocate to neighbouring countries. Lack of key strategic regional investors, aside from Telenor and SingTel. Business Monitor International Page 9 9. Malaysia Telecommunications Report Q1 2013Wireline SWOT SWOT AnalysisStrengths Several operators (mobile and WiMAX) are licensed to offer broadband services, helping to create greater broadband access. Government initiative to improve state of high-speed internet infrastructure.Weaknesses Telekom Malaysia continues to exercise effective monopoly of domestic telephony and domestic/international leased line markets. Continued decline of fixed-line sector at hands of mobile, digital subscriber line (DSL) and voice over internet protocol (VoIP) substitution. Broadband tariffs remain high, as do wholesale broadband costs, which are being passed on to the endcustomer.Opportunities WiMAX licensing helping rapid growth of wireless

broadband technologies. Broadband market set to experience growth, with BMI forecasting more than 7.2mn subscribers by the end of 2017, up from 6.1mn in 2012.Threats Award of governments high-speed broadband (HSBB) project to Telekom Malaysia has compounded the operators dominance of the fixed broadband market. Only P1 has made any substantial developments with regard to WiMAX; the other three licence holders face the loss of their licences. Business Monitor International Page 10 10. Malaysia Telecommunications Report Q1 2013Industry ForecastMobile Table: Telecoms Sector - Mobile - Historical Data And Forecasts 2010 2011 2012f 2013f 2014f 2015f 2016f 2017fNo. of mobile phone subscribers (000) 33,859 36,661 38,677 40,108 40,991 41,442 41,732 41,857No. of mobile phone subscribers/100 inhabitants 119 127 132 135 135 135 134 132No. of mobile phone subscribers/100 fixed-linesubscribers 769 896 1,000 1,070 1,112 1,141 1,161 1,170No. of 3G phone subscribers (000) 9,202 10,335 13,952 16,882 19,415 21,162 22,326 22,7723G market as % of entire mobile market 27.2 28.2 36.1 42.1 47.4 51.1 53.5 54.4f = BMI forecast. Source: BMI, MCMC, operators According to the latest figures published by Industry Trends - Mobile Sector Malaysias three mobile operators, there were 2010-2017 34.956mn mobile subscribers in total at the end of June 2012, up by 3.5% y-o-y. However, Maxis Communications changed its definition regarding active subscribers in Q111, reducing its reported customer base by around 1.4mn. That said, the operator has provided its subscriber base under the old definition. Using this figure, there would have been 36.060mn mobile subscribers in Malaysia at the end of June 2012. The figures used for our forecasts come from the national regulatory authority, the Malaysian f = BMI forecast. Source: BMI, MCMC, operators Communications and Multimedia Commission (MCMC), which offers a more complete assessment as it draws in customer numbers from 3G operator/2G reseller U Mobile as well as MVNOs. The MCMC has recently restated its yearend 2010 mobile subscriber figure, down to 33.859mn. It has not provided previous year data for comparison, so it is unclear whether the 2009 figure presented here is totally accurate. Business Monitor International Page 11 11. Malaysia Telecommunications Report Q1 2013 At the end of June 2012, the MCMC reported 38.446mn mobile subscribers in the country, up from 35.301mn in June 2011. We expect prepaid subscribers and the growing number of MVNOs should continue to help fuel growth in Malaysias mobile sector, and should also help Maxis recover some of its lost subscriber base. After reporting a net loss of 129,000 prepaid subscribers in Q311, Maxis has since recovered 175,000 in the subsequent three quarters. However, we also believe that the operators will maintain efforts to increase the number of postpaid subscribers and will focus on migrating low-value prepaid subscribers to the more expensive contract price plans. Data from the MCMC showed that there were 12.022mn 3G subscribers in Malaysia at the end of June 2012, up by 23.2% from 9.756mn in June 2011. The strong growth trajectory is due to the increasing affordability of smartphones and data services. Like the broader mobile market, the prepaid segment is largely responsible for the momentum. We continue to see 3G growth gaining traction given that data service accounts for only about 31% of the total mobile market,

along with consumers relatively strong purchasing power and the availability of low-cost devices. e expect to see 22.772mn 3G subscribers by 2017, representing 54.4% of a total mobile market of 41.857mn, up from 13.952mn in 2012. Meanwhile, Malaysian operators continue to push for the launch of next generation LTE services, having gained the requisite spectrum and operating licences in Q411. While LTE is likely to become commercially available in Malaysia in 2013, operators have already started trialling the technology and are in the midst of forming network sharing agreements to reduce capital expenditure and accelerate service roll-out times. However, the five newcomers will struggle to finance their network roll-outs as the existing mobile operators will win most of the new customers attracted to LTE. We expect consolidation among those players and - possibly - U Mobile in 2012. Business Monitor International Page 12 12. Malaysia Telecommunications Report Q1 2013ARPU Table: Telecoms Sector - Mobile ARPU - Historical Data & Forecasts (MYR) 2010 2011 2012f 2013f 2014f 2015f 2016f 2017fCelcom 50.0 51.0 48.6 46.4 44.5 43.1 42.0 41.0Maxis 49.0 54.0 51.7 49.4 47.8 46.8 45.6 44.1DiGi 52.0 50.0 47.9 45.7 44.3 43.3 42.2 40.8Market Average 50.1 52.0 49.7 47.4 45.8 44.7 43.5 42.2f = BMI forecast. Market average adjusted based on operators markets shares. Source: BMI, operators At the time of writing, only DiGi had reported Industry Trends - Mobile ARPU ARPU data for Q312. Celcom Axiata and Maxis (MYR) had offered up data through to the end of Q212 only, 2010-2017 while 3G-only U Mobile had not disclosed any data at all. Although there were continued slow improvements in subscriber mixes and increased usage of premium non-voice services, these were not enough to offset declining voice service revenues and promotions to counter strong competition. Consequently, the market average ARPU fell slightly in Q212. In general, we expect to see Malaysian blended mobile ARPUs continue to fall as operators continue to engage in price promotions, for both the prepaid f = BMI forecast. Source: BMI, operators and postpaid segments, to attract subscribers. The expansion in rural regions to boost market shares also applies further downward pressure on ARPU. The operators continued reliance on prepaid services does not bode well for continued ARPU growth in the years ahead. That said, the rate of decline would be faster still were it not for the mitigating effects of Business Monitor International Page 13 13. Malaysia Telecommunications Report Q1 2013 mobile broadband as such services become increasingly popular and help to keep prepaid ARPU rates buoyant. We forecast Malaysias market average blended ARPU will decline to MYR49.7 in 2012 before declining to MYR42.2 in 2017. With the three operators reporting flat ARPU from the previous quarter, we have retained our forecasts. However, we continue to note that there are upside risks to our forecasts given the increasing number of 3G subscribers in the country and the impending launch of LTE services in the next few years. Business Monitor International Page 14 14. Malaysia Telecommunications Report Q1 2013Fixed-Line Table: Telecoms Sector - Fixed Line - Historical Data And Forecasts 2010 2011 2012f 2013f 2014f 2015f 2016f 2017fNo. of main telephone lines in service (000) 4,404 4,091 3,866 3,750 3,686 3,631 3,595 3,577No. of main telephone lines/100 inhabitants 15.5

14.2 13.2 12.6 12.2 11.8 11.5 11.3f = BMI forecast. Source: BMI, MCMC, operators The Malaysia Communications and Multimedia Industry Trends Fixed-Line Commission reports that there were 3.958mn fixed Sector lines at the end of June 2012, down from 4.268mn in 2010-2017 June 2011. Fluctuations in the market have made predicting the fixed-line market difficult. The market experienced a gradual contraction between Q105 and Q309 before witnessing a resurgence from Q409 to Q410, resulting in a peak of 4.404mn subscribers. However, more recent data indicate another period of decline and we believe that this will be the trend given the growing demand for mobile services. We believe that the recent uptrend was largely due to a telecoms service bundling strategy by Malaysian operators in order to encourage consumers to sign up f = BMI forecast. Source: BMI, MCMC, operators for fixed-line service even though they might not use it. This is a common tactic adopted by multi-play operators in other countries, and have been relatively successful in mitigating the decline in demand for fixedline services. For example, fixed-line incumbent Telekom Malaysia bundles a traditional fixed-line service in its fibre broadband package, and the growing adoption of fibre broadband will benefit the fixed- line market. While this could help the number of fixed lines in Malaysia to grow, in our opinion, the sector is one of decline, and this is borne out by the latest data from the MCMC. The government-backed High Speed Broadband project is a double-edged sword as it could apply further downward pressure on Malaysias fixed-line industry if operators offer VoIP services via the fibre optic Business Monitor International Page 15 15. Malaysia Telecommunications Report Q1 2013 network. We foresee the fixed-to-mobile migration to gain traction based on the increasing number of 3G subscribers in Malaysia. Consequently, we expect the number of fixed lines in Malaysia to fall to 3.577mn in 2017, down from 3.866mn in 2012.Broadband Table: Telecoms Sector - Internet - Historical Data And Forecasts 2010 2011 2012f 2013f 2014f 2015f 2016f 2017fNo. of internet users (000) 15,994 17,610 17,962 18,231 18,414 18,506 18,598 18,691No. of internet users/100 inhabitants 56.3 61.0 61.3 61.2 60.9 60.3 59.7 59.1No. of broadband internet subscribers (000) 4,722 5,687 6,142 6,541 6,803 6,986 7,126 7,219No. of broadband internet subscribers/100inhabitants 16.6 19.7 20.9 22.0 22.5 22.7 22.9 22.8f = BMI forecast. Source: BMI, ITU, MCMC, operators According to the International Telecommunication Industry Trends - Internet Sector Union, there were 17.610mn internet users in 2010-2017 Malaysia at the end of 2011, up from 15.994mn in 2010. We expect the number of internet users in Malaysia to increase gradually over the next few years, reaching 18.691mn by the close of our forecast period in 2017.. Meanwhile, there were 5.840mn broadband subscribers in the country at the end of June 2012, according to the MCMC. This represented a y-o-y increase of 8.2% from 5.397mn. The growth momentum in the sector is clearly declining. The Malaysian broadband market grew by 17.1% y-o-y f = BMI forecast. Source: BMI, ITU, MCMC, operators in Q112, 20.4% in Q411, 30.5% in Q311 and 66.9% in Q211. The regulators data include both fixed and mobile technologies with the latter (not inclusive of the 1Malaysia netbook programme) accounting for the majority at 59.1%. Business Monitor International Page 16

16. Malaysia Telecommunications Report Q1 2013 The slowing momentum is a combination of higher base effects and the market approaching saturation. Additionally, fixed broadband services tend to be shared among several users, while we believe that demand for mobile broadband would slow, too, given the increasing adoption of smartphones. Tethering could eliminate the need for consumers to subscribe to an additional dedicated mobile broadband solution. BMI forecasts the number of broadband subscribers in Malaysia to reach 7.219mn by 2017, up from 6.142mn in 2012. At the end of 2017, the broadband penetration rate will increase to 22.8% from 20.9% in 2012. Meanwhile, other developments aimed at developing the spread of broadband relate to the governments national High Speed Broadband (HSBB) network project. According to Telekom Malaysia, responsible for deploying the HSBB together with the government, the network will boost GDP by 0.6% and create 100,000 jobs by 2017. Telekom Malaysia is on track to meet its network coverage target of 1.3mn premises by 2012, and has signed up operators such as Packet One Networks, Maxis and Celcom Axiata as retail and wholesale providers to boost the number of highspeed broadband subscribers in the country. Furthermore, operators are gearing towards for the commercial launch of LTE services. Business Monitor International Page 17 17. Malaysia Telecommunications Report Q1 2013Industry Business Environment OverviewIndustry Business Environment Overview This quarter BMI has adjusted the methodology for our proprietary Risk/Reward Ratings. While the fundamental principles are unchanged, we have expanded the data used to assess the potential and challenges of investing in telecoms markets. As subscriber growth is no longer the key driving force behind market value growth, the majority of markets are now looking at encouraging existing subscribers to increase their spending on services, making factors such as the economic outlook an increasingly important determinant in ranking market opportunities. Future spending ability and our long-term economic views are therefore integral to our adjusted ratings. We have also introduced a more nuanced assessment of market dynamics as one contributing score for the industry rewards. Asia Pacifics telecoms industry registered a Varying Opportunities telecoms rating score of 56.2, up from 55.6 the Asia Pacific Telecoms Risk/Reward Ratings previous quarter. The improvement was driven by a broad base increase in the various reward and risk scores. However, we highlight that past ratings are not perfectly comparable as we have tweaked our methodology. The countries rankings have also changed in light of the fine-tuning. Japan remained the most attractive market in Asia Pacific with a telecoms rating score of 74.9 on a risk/ reward basis. While mature, operators have already turned their focus to extracting greater value from their existing subscriber bases via upgraded and add- on services. The country was one of the first in the Source: BMI region to launch commercial LTE services, and operators have seen positive responses from consumers. However, the outlook for Japan is looking increasingly vulnerable. Besides an ageing population, which bodes poorly for long-term spending on new telecoms products and services, businesses have become increasingly bearish towards current and future business conditions, based on the September 2012 Tankan survey by the

Bank of Japan. This could eventually filter down to consumers, leading to reduced discretionary spending. Business Monitor International Page 18 18. Malaysia Telecommunications Report Q1 2013 Australia was ranked second with a telecoms rating score of 73.1. The countrys significant land mass means that achieving complete telecoms coverage is a daunting task, although this presents an opportunity for companies to fill in the gaps. At present, the National Broadband Network, which in part aims to bridge the digital divide, is still progressing well. However, the opposition Coalition party has announced that it would revamp the entire project to reduce immediate cost. The trade-off comes in the form of businesses and consumers receiving slower connectivity that requires another upgrade in the future. The effective and forward-looking Singaporean regulator ensures that the country has a long-term plan and that various stakeholders collaborate on vital developments. Consequently, Singapore has the highest industry risks score in the region. While the countrys comparatively small population size places a limit on its industry rewards score, Singapores strong macroeconomic position has helped it to rank third in Asia Pacific. However, we highlight that, as with many countries in the region, continued global economic weakness would have a negative effect on export-dependent Singapore. Hong Kong is similar to Singapore in many ways, which include its industry rewards and industry risks scores. Data from the regulator have shown that mobile data consumption remains on a strong growth trajectory, which bodes well for the mobile content industry. The territory was ranked fourth due to weaker country rewards and country risks. Although Hong Kong is also vulnerable to external shocks and we are adopting a cautious take on consumer spending going forward, we expect private consumption to remain the main outperformer, among other growth components. BMI previously highlighted that South Korea could overtake Hong Kong in our ratings table, although this view has yet to play out. South Koreas nascent LTE market is one of the most vibrant in the region as all three mobile operators have launched nationwide commercial services. The country also has the support of device manufacturers such as Samsung Electronics and LG Electronics. Among the top five countries in the region, South Korea has the lowest country rewards score, and we see room for further downside. The government has so far been able to put off fiscal stimulus to boost a faltering economy. However, this abstinence may not last for long as economic growth continues to slide on the back of slower private consumption growth and a deteriorating trade picture. Business Monitor International Page 19 19. Malaysia Telecommunications Report Q1 2013 China is the highest-ranking emerging market in the Asias Big Three Asia Pacific region due to its sheer growth potential, Asia Pacific Telecoms Risk/Reward Ratings which is reflected in the countrys industry rewards score of 68.8. Chinas economic imbalances have grown consistently over the past decade, to a point where we now believe they have reached a peak. The coming years should see rebalancing take place, with the current economic structure giving way to a more sustainable and consumerdriven economy, particularly consumer services. However, the telecoms market is dominated by state-owned firms and there is no indication from the government that it is looking to liberalise the industry. Taiwan was ranked joint sixth with a

telecoms rating Source: BMI score of 61.8. The competitive landscape is slightly skewed, although the regulator has been evaluating ways to level the playing field. While the governments bet on WiMAX is increasingly unlikely to generate a significant return on investment, the industry has started to transition to TDLTE technology. Malaysia came in eighth position after registering a telecoms rating score of 59.1. The country remains one of the most attractive emerging markets in the region, partially due to a more developed economy. Further, the government has the Economic Transformation Programme (ETP), which aims to turn Malaysia into a high-income nation by 2020. The ETP has identified 12 key economic areas, which include the telecoms industry. Initiatives such as launching e-government, e-healthcare and ubiquitous broadband connectivity are expected to play key roles. Indonesia is the third most populous country in the world, although its fragmented geography has placed a dampener on the growth potential. As expanding network coverage is a challenging task, operators tend to focus on the more lucrative urban cities instead of pursuing low-value opportunities in rural regions. Meanwhile, the private consumption outlook for Indonesia was robust in H112, supported by strong income growth and increasing access to credit. However, we believe that the Indonesian consumer has hit its cyclical peak, and now see growth in the space slowing modestly in 2013 to 5.5% from 5.7% in 2012. Business Monitor International Page 20 20. Malaysia Telecommunications Report Q1 2013 Although the merger between the Philippine Long Distance Telephone Company and Digital Telecommunications Philippines has been completed, the telecoms market is still in a transitional phase. The National Telecommunications Commission is looking to award a 3G licence in the near future and this could herald the introduction of a new player. Bangladesh had a telecoms rating score of 50.4 with its country rewards component holding the country back. The allocation of 3G services is expected to take place in the near future, which would provide a much-needed revenue stream for mobile operators. Further, a recent slew of export data suggests that growth is looking set to embark on a sustained recovery. The country registered record export earnings of US$2.4bn in August 2012, having recorded two straight months of positive y-o-y growth in July and August 2012. Like Bangladesh, Thailand is about to issue 3G licences. This process has been in the making for a number of years but failed to materialise previously due to a myriad of factors. However, the new regulator, the National Broadcasting and Telecommunications Commission, has been so far performing well. A successful 3G auction and prolonged stability in the telecoms industry should see Thailands telecoms scores improve in the medium term. Not too long ago, Indias telecoms industry was experiencing robust growth, but the market is now struggling with a host of issues. Although its market potential is comparable to that of China, the competitive landscape is overcrowded and operators had resorted to an aggressive price war to sustain subscriber growth. Additionally, legal and regulatory uncertainties continue to plague the sector, which have significantly hampered companies ability to make long-term investment decisions. Given the convoluted situation, which involves a multitude of stakeholders ranging from the government to foreign companies, we do not expect a resolution in the near

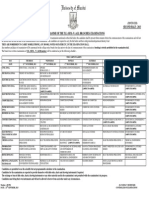

future. At present, Pakistan could still be looking to auction 3G licences before end-2012, although, like Thailand, the process has been repeatedly delayed. A pre-bid conference of prospective 3G consultancy firms was held on September 20 2012, but the regulator has not disclose a firm timeline for the actual auction. Further delays would leave Pakistan trailing behind its regional peers as consumers and businesses would not have access to mobile broadband connectivity. Business Monitor International Page 21 21. Malaysia Telecommunications Report Q1 2013 After tweaking our methodology, Sri Lanka has The Laggards moved up the ratings table to 15th position. The Asia Pacific Telecoms Risk/Reward Ratings market is gradually expanding following the end of the civil war, with the public and private sectors engaging in network expansions and new product launches. However, recovery is a long-term process and this is reflected in Sri Lankas country rewards score of 26.7, the lowest in the region. Sri Lankas export growth came in at a new multiyear low of -17.4% y-o-y in July 2012. There are a number of factors that have resulted in Vietnam ranking near the bottom of our Risk/ Reward Ratings. In addition to market saturation in Source: BMI the mobile industry in light of aggressive price competition by operators, the largest determinant is the dominance of state-owned companies. Foreign operators from countries such as South Korea and Russia have left the market due to a lack of meaningful growth opportunities. Further, there is no independent regulator with the Ministry of Information and Communications responsible for regulating the industry. Cambodias overcrowded telecoms industry remains a concern, especially when the government continues to adopt a liberal approach in the issuance of licences. The creation of an independent telecoms regulator, the Telecommunication Regulator of Cambodia, should bring stability into the market by ensuring that policies are free from government influence and agenda, although we caution that it would take a few years before we see significant improvements. The Laotian telecoms market has exhibited some signs of stability after all the operators agreed to adhere to a minimum tariff rate of LAK800. However, we believe that depressed ARPU rates will persist in the near term, partially due to an agreement to offer lower tariff rates on certain days such as holidays and continued lack of access to credit by smaller businesses and the purported lack of the flow-on effects from investments to the local community. The country is also one of the smallest in our Risk/Reward Ratings, which limits its growth potential. However, the Ministry of Planning and Investment Office has announced the approval of Business Monitor International Page 22 22. Malaysia Telecommunications Report Q1 2013 funds to enhance the countrys IT infrastructure, as part of a plan to modernise the countrys investment management system, and provide for more efficiency within the business environment. Table: Asia Pacific Telecoms Risk/Reward Ratings Q113 Rewards Risks Industry Country Industry Country Telecoms PreviousCountry Rewards Rewards Risks Risks Rating Rank RankJapan 80.0 66.7 80.0 67.9 74.9 1 1Australia 68.8 80.0 80.0 68.4 73.1 2 3Singapore 55.0 83.3 90.0 86.5 71.9 3 2Hong Kong 55.0 76.7 90.0 65.0 67.1 4 4South Korea 62.5 57.0 80.0 69.7 64.9 5 5China 68.8 31.7 70.0 81.8 61.8 =6 8Taiwan 52.5 60.0 80.0 75.0 61.8 =6

6Malaysia 52.5 57.0 70.0 71.4 59.1 8 7Indonesia 57.5 45.0 60.0 64.8 55.9 9 9Philippines 50.0 46.7 60.0 60.1 52.2 10 13Bangladesh 52.5 36.7 60.0 56.9 50.4 11 12Thailand 52.3 32.7 60.0 61.9 50.1 12 14India 52.5 32.1 60.0 61.2 49.9 13 10Pakistan 45.0 42.0 60.0 50.5 47.3 14 11Sri Lanka 45.0 26.7 60.0 57.0 44.6 15 18Vietnam 44.0 33.3 40.0 64.0 43.8 16 16Cambodia 40.0 38.3 50.0 45.3 41.9 17 15Laos 37.5 39.0 40.0 53.2 40.6 18 17Average 54.0 49.2 66.1 64.5 56.2Scores are weighted as follows: Rewards: 70%, of which industry rewards 65% and country rewards 35%; Risks: 30%,of which industry risks 40% and Country Risks 60%. The Rewards rating evaluates the size and growth potential of atelecoms market in any given state, and countrys broader economic/socio-demographic characteristics that impact theindustrys development; the Risks rating evaluates industry-specific dangers and those emanating from the statespolitical/economic profile, based on BMIs proprietary Country Risk Ratings that could affect the realisation of anticipatedreturns. Source: BMIMalaysia In our newly revised Asia Pacific Telecoms Risk/Reward Ratings, Malaysia was ranked eighth with a Telecoms Ratings score 59.1. Given the changes, we highlight that past scores and rankings are not Business Monitor International Page 23 23. Malaysia Telecommunications Report Q1 2013 comparable. Malaysia was the second-highest ranked emerging country in the region behind China. Malaysia stood out largely due to its stronger macroeconomic position. The country had an industry rewards score of 52.5, which was slightly lower than the regional average of 54.0. The country has a relatively mature telecoms market, and we forecast the entire industry (comprising mobile, fixed line and broadband) to grow by an average of 3.1% in the next five years. Unlike emerging peers such as Vietnam and Cambodia, Malaysia has a comparatively stable market with a growing proportion of postpaid subscribers. Mobile 3G services are also on the rise, which would help to support ARPU levels. Assuming the government is able to finalise the allocation of LTE licences, we expect the next generation technology to be well received in the country, which has a sizeable portion of consumers that are tech-savvy and willing to pay for the latest products and services. The Malaysian telecoms market is regulated by the Ministry of Communications and Multimedia Commission (MCMC). The country received an industry risks score of 70.0, which could be downgraded in the future if the regulator continues to muddle through the LTE licence issuance process. It was reported in September 2010 that the MCMC would award nine licences, and this was confirmed by local media in December 2011. However, some licensees have claimed that the government has yet to finalise the allocation, even though the companies are ready to offer commercial services. Malaysias real GDP grew by a better-than-expected 5.4% yo-y in Q212, beating consensus estimates of around 4.6% by a significant margin. Real GDP growth in Q112 was also revised upwards to 4.9% from 4.7% previously. The latest reading is expected to trigger a wave of analyst upgrades over the coming months, which is likely to push consensus estimates for growth towards the upper range of Bank Negara Malaysias target of 4.0-5.0%. We expect private consumption to grow at a relatively resilient pace of 4.8% in 2012 before accelerating towards 5.5% in 2013, mainly due to the positive effects of cash handouts and increased welfare spending by the government. However, we note

that the risk of a sustained collapse in exports over the coming months could potentially lead to widespread job losses in export-driven sectors. Uncertainties over the outlook for employment could, in turn, prompt households to cut back on spending. Despite the Pakatan Rakyat (PR) coalitions growing popularity in recent years, partly due to its multi-racial and pro-democracy platform, we believe that this will nonetheless be insufficient to unseat the ruling Barisan Nasional at the upcoming general election. We believe that the announcement of a generous election budget for 2013 by Prime Minister Najib Razak will help to boost voter support for the BN coalition and should be sufficient to give the BN a marginal edge at the next general election. Business Monitor International Page 24 24. Malaysia Telecommunications Report Q1 2013Market OverviewMobile Regional Perspective Malaysia is one of the more developed Asian mobile markets, with a vibrant and fast-growing 3G sector and robust growth noted in non-voice service usage. Uptake of mobile broadband services has slowed in recent quarters, however, suggesting that there are still limits to consumers willingness to invest in pure data services and content. A slowdown in the fixed mobile market has also conspired to hamper the governments plan to serve 50% of the population with affordable broadband services. However, mobile operators continue to encourage the usage of more lucrative non-voice services, with smartphones and mobile computers increasingly being used to lure customers onto their networks. A degree of mobile broadband fatigue notwithstanding, we still see room for growth in the mobile market, though not enough to justify the licensing of nine 4G LTE operators. Malaysia Mobile Market Regional Comparison 2011 Data from 18 countries where available. f = BMI forecast. Source: BMI, regulators, operators Business Monitor International Page 25 25. Malaysia Telecommunications Report Q1 2013 Table: Malaysian Mobile Market Regional Comparisons, 2011 Malaysia Asia PacificPostpaid As % Of Market 20.8 32.2Mobile Penetration (%) 127.0 109.3Blended ARPU (US$) 17.1 16.33G As % Of Entire Mobile Market 28.2 30.0Data ARPU (US$) 21.4 24.35year CAGR (%) 2.6 15.1Data from 18 countries where available. Source: BMI, regulators, operatorsKey Developments DiGi and mobile content provider WhatsApp have teamed up in October 2012 to offer unlimited access to WhatsApp Messenger services. The exclusive package on DiGi Easy Prepaid is effective from October 22 2012 and is available until March 31 2013. The unlimited access will be for five days at a cost of MYR5 (US$1.64) with 100MB of data for free. The package will allow customers to connect with family and friends through messaging, location-based functions and sharing photos, videos, sound files and contact lists. In October 2012, Telekom Malaysia (TM) was believed to be seeking the finance ministrys approval to bid for Green Packets mobile broadband unit, Packet One, reported the Business Times. The bid was reported to be worth MYR1.8bn. However, TM has denied any such move, calling it misleading as it is based on speculation (The Star). The operator added that it has not expressed interest in any bid nor has it sought approval to do so. In August 2012, Maxis launched an array of Islamic content and services in line with its Salam Ikhlas 2012 campaign. The operators subscribers will be able to access more than 30 Islamic products and services across all devices through

SMS, MMS, apps, video, audio, ebooks, iPads, Android devices and PCs. The services are inclusive of imsak and buka puasa times, where subscribers are offered free alerts annually. The alerts enable the subscriber to know exact times during the month of Ramadan. Meanwhile, Android and BlackBerry users can obtain a 5GB storage space by signing up for a free personal cloud account. DiGi added 10 new roaming outlets to its portfolio of networks in August 2012. The operator added Macau, Pakistan, Bangladesh, New Zealand, Poland, Slovakia, Hungary, Serbia, Spain and Brazil to its current list of networks. The operators TravelSure Unlimited Roaming service will allow subscribers to access services with internet roaming rates in more than 40 countries. The subscribers overseas data charges would be capped at a fixed rate of as little as MYR36 a day, according to the companys chief marketing officer, Albern Murty.Mobile Growth There were approximately 38.446mn mobile subscribers in Malaysia at the end of June 2012, according to the latest data from the Malaysian Communications and Multimedia Commission (MCMC). This represented a q-o-q increase of 3.8% and a y-o-y increase of 8.9% and resulted in a penetration rate of 133.3%, the agency said. Between them, the three leading operators - Celcom Axiata, Maxis Business Monitor International Page 26 26. Malaysia Telecommunications Report Q1 2013 Communications and DiGi served 34.956mn subscribers at the end of March 2012 (36.060mn if Maxis old definition of active subscribers is applied). 3G-only operator U Mobile - which does not regularly disclose customer numbers - would have accounted for just 2.386mn subscribers in June 2012 using Maxis old subscriber-counting definition or 3.490mn if we assume the regulator is now making its assessments using Maxis new definition. Either way, this is a very poor achievement considering U Mobile has been active since early 2009. In May 2012, U Mobile announced that it now had over 2mn subscribers, though it did not specify when that milestone had been reached. It remains difficult to properly gauge Maxis performance while it continues to report two sets of total customer numbers. Using the old methodology, Maxis appears to be growing rapidly, buoyed by strong demand for its data and mobile broadband packages and the lure of premium devices and integrated services such as the Apple iPhone and BlackBerry handsets. Using its new definition of active subscriber numbers, Maxis notes that it is enjoying strong sales of smartphones and data plans despite a falling user base. We therefore assume that many customers are upgrading their existing packages rather than joining as new customers. Also, it would appear that the number of new customers joining the Maxis network is being offset by continued deactivation of inactive accounts, mostly in the prepaid arena For the quarter ended June 2012, Maxis and Celcom recovered from the net losses in the previous quarter - Maxis gained 51,000 subscribers while Celcom added 79,000 (according to its new active subscriber calculations). DiGi reported the strongest net addition among the three mobile operators with 293,000 in the quarter ended June 2012, although the momentum tapered to 75,000 in the subsequent quarter. Table: Malaysia Wireless Market, Q212Operator No. of Subscribers (mn) Market Share (%)Maxis Communications* 12.696 36.3Celcom 12.031 34.4DiGi 10.304 29.3Total 34.956

100.0* Figures are per new subscriber definition. Source: BMI, operators Business Monitor International Page 27 27. Malaysia Telecommunications Report Q1 2013Market Shares Malaysia Prepaid Mobile Omitting U Mobile due to a lack of verifiable data, Subscriptions Maxis 12.696mn active subscribers meant that it 2009-2012 accounted for 36.3% of the market, down by 0.3 percentage points (pps) q-o-q. The operator gained 51,000 subscribers in the quarter, although this was not enough to offset the 90,000 lost in Q112. Maxis postpaid subscriber base continued to decline while subscriber growth came from the prepaid segment as the company has launched a number of prepaid-focused promotions, which helped it win back old customers. Celcoms market share fell to 34.4% even though it recovered from the net subscriber loss of 28,000 in Source: MCMC, operators Q112. The company noted that its postpaid segment is regaining momentum post high rotational churn. Postpaid net additions in Q212 reached 56,000, up from 48,000 in Q112, 43,000 in Q411 and 26,000 in Q311. With rival Maxis focusing on the prepaid market, we could see Celcom capture the postpaid market leadership in the next two years, assuming that existing trends maintain. Third-ranked DiGi could be in a position to overtake them both as the company continues to outperform in terms of customer additions and accounted for 29.3% of the market in Q212, up by 0.5pps from Q112. Unlike its rivals, DiGis Q312results were available for analysis and these showed a 75,000 subscriber net increase in the quarter, up from 293,000 in the previous quarter. The consistently strong performances underscore our view that DiGi could draw level with its rivals in the near future. That said, it is worth noting that the operator occasionally suffers from high rotational churn in the prepaid segment, potentially leaving it vulnerable to changes in market dynamics. In June 2010, DiGi and Celcom Axiata signed an MoU to collaborate on network and infrastructure projects for the long term. Under the terms of the MoU, the operators are focusing on three key areas: operations and maintenance, transmission and site sharing, and radio access network elements. The network infrastructure sharing scheme targets the removal of surplus base station sites and optimising base station deployment, slashing expenditure on infrastructure rental fees, reducing spending on services such as power Business Monitor International Page 28 28. Malaysia Telecommunications Report Q1 2013 and rationalising the costs of operating transmission systems. A definitive agreement was signed in January 2011 under a three-year term. The companies have been recording sluggish growth in service revenues and profits for some time as market maturity, and an over-reliance on low-cost prepaid services, has dampened consumer appetites for their services, despite the increasing use of higher value premium services. By proactively addressing operating and capital costs through collaboration, the companies can at least make substantial savings in their outgoings, leaving resources free to innovate in the development of new services and applications and to more aggressively target low-income and rural subscribers with affordable services and devices. The maturity of the mobile sector has been Malaysia Postpaid Mobile supported by growth in the prepaid sector. However, Subscriptions operators are keen to see the postpaid sector emerge 2009-2012 to

become the market driver as customers swap from prepaid to postpaid. The growth in postpaid is the result of low-cost services and competitively priced core services, and the introduction of attractive handsets and smartphones, leading to mobile broadband services growing in popularity. That said, despite improvements in the postpaid arena, the prepaid market continues to dominate. At the end of June 2012, the three principal operators reported serving 27.334mn prepaid subscribers, up by 3.8% y-o-y. This would represent Source: MCMC, operators 78.2% of the total number of customers they served. The regulator, however, believes there were 31.214mn prepaid subscribers as of Q212, representing an annual increase of 9.7% and 81.2% of the total market of 31.214mn. However, the 1.304mn increase in the number of prepaid subscribers from Q112 could be attributed to the inclusion of data from MVNOs. According to the MCMC, MVNO data, which were excluded in prior results, were included in Q212. Meanwhile, the number of postpaid subscribers in the country reached 7.232mn at the end of June 2012, according to data from the regulator. The three leading operators, however, said that they served 7.622mn postpaid subscribers at that time, representing annual increase 2.6%. Again, a difference in active subscriber Business Monitor International Page 29 29. Malaysia Telecommunications Report Q1 2013 definitions accounts for this discrepancy. Postpaid subscribers accounted for 18.8% of the market at that time, according to the regulator. Maxis was serving 9.559mn prepaid subscribers at the end of Q212, up by 0.5% y-o-y. We continue to believe that gross prepaid additions are higher than these figures suggest, but that most of the gains are being offset by further eliminations of accounts now deemed to be inactive. BMI thinks it likely that Maxis will report muted growth in 2012 (Q312 data were not available for analysis at the time of writing). Prepaid subscribers accounted for 75.3% of Maxis total active subscriber base in Q212, versus 74.6% in the preceding year. In terms of Maxis postpaid base, the operator had 3.137mn such subscribers (new definition) as of Q212, down by 40,000 q-o-q even though the operator has said that it is focusing on subscriber retention through smartphone offers and roaming plans. Celcom served 9.195mn prepaid subscribers in Q212 (latest data), representing a 1.4% y-o-y increase. Celcom lost 316,000 prepaid subscribers in Q311, undermining its success in adding 343,000 such customers in Q211 and 117,000 in Q111. Again, this was due to the companys efforts in dealing with excessive multi-SIM prepaid accounts. However, 498,000 new prepaid customers were added in Q411, typically a strong period of the year for the company. Nevertheless, in Q112, there were 76,000 net prepaid subscriber losses at the company, which was attributed to increased interest in its postpaid and mobile broadband offerings. Celcom added 57,000 new postpaid subscribers in Q212, bringing the total to 2.837mn. This was a continued improvement from the 48,000 and 43,000 additions recorded in Q112 and Q411 respectively, but was still a little short of the 58,000 additions recorded in Q211. Postpaid customers accounted for 23.6% of the operators total subscriber base in Q212, versus 22.7% in Q211. Celcom believes that strong demand for its mobile broadband services has been driving growth in the prepaid arena. With new devices continually being added to its range of packages, Celcom has begun reporting an improvement in its

subscriber composition and is again narrowing the gap with Maxis for the title of postpaid market leader. As for DiGi, the third-ranked operator was serving 8.647mn prepaid subscribers in Q312, representing 83.9% of the operators total subscriber base. Comparisons with its rivals were not possible as neither Celcom nor Maxis had announced Q312 results at the time of writing. In Q212, DiGi reported 8.580mn prepaid subscribers. Like Celcom, DiGi has also adopted a market segmentation approach, launching its Hit 1 prepaid plan for heavy using youth subscribers, charging MYR1 per day for SMS and Business Monitor International Page 30 30. Malaysia Telecommunications Report Q1 2013 MYR0.12 per minute for calls to any network, a rate three times lower the normal rate of MYR0.36 per minute. In terms of the postpaid market, DiGi had 1.649mn subscribers in Q212, representing an increase of 8.3% y- o-y. The rate of growth remained robust largely due to competitively priced tariffs offered for postpaid thanks to the market segmentation approach of the operator, together with attractive postpaid services and a greater range of smartphone models, as operators focus more on 3G. The operators postpaid subscriber base increased to 1.657mn in Q312, representing a y-o-y increase of 6.0%. The other operators had not reported their Q312 results at the time of writing.Usage (MOU/ARPU) Postpaid Mobile ARPU (MYR) Maxis, Celcom and DiGi all supply data covering 2009-2012 blended, prepaid and postpaid ARPU, though data for Maxis only go as far back as September 2008, a consequence of its recent listing and improved reporting of key indicators. Responsible for the recent decline in ARPUs (postpaid and prepaid) was the aggressive pricing of postpaid and prepaid services in the market, as well as the economic recession. In Q111, Maxis Communications readjusted its ARPU in line with its new definitions for prepaid and postpaid subscribers. Despite this blended Source: operators ARPUs remained flat at MYR49 in Q111 for the third consecutive quarter. Then, in Q211, blended ARPU rose to MYR51 and reached MYR54 in Q311 and Q411. The second quarter of 2012 saw Maxis blended ARPU remained stable at MYR52. This was connected to Initiatives to enhance paid usage minutes and stimulate overall MOUs. Blended voice minutes of use fell by 5.9% y-o-y to 175 minutes. It had earlier reached a high of 186 minutes, in Q211. Prepaid ARPU similarly remained flat at MYR34 during the Q410-Q111 period before rising in Q211 to MYR36, a 5.9% q-o-q increase, and then to MYR38 in Q311, a q-o-q rise of 5.6%. There was no change in Q411, but it had slipped to MYR37 by Q112 as prepaid voice minutes fell faster than the operator could Business Monitor International Page 31 31. Malaysia Telecommunications Report Q1 2013 grow its prepaid user base. Maxis Q212 prepaid ARPU remained stable at MYR37. Prepaid users spent an average of 130 minutes on their phones in Q212, down from 142 minutes one year earlier. Meanwhile, Maxis postpaid ARPU rose to MYR108, under new definitions, in Q211, from MYR105 in Q111. In Q311 it reached MYR110; again, there was no change in Q411 while Q112 saw a small contraction to MYR107. The contraction continued in Q212 with ARPU reaching MYR106. Besides seasonal factors and declining voice usage, ARPUs are not falling as fast as they might as customers continue to adopt the operators iPhone and BlackBerry data

packages and make better usage of mobile broadband services as the company progresses with its ambitious network improvements. Celcom, by contrast, experienced a degree of stability in Q212 as only its postpaid ARPU saw a slight decline from MYR96 to MYR95 over the course of the quarter. Blended ARPU remained at MYR51, while prepaid ARPU remained at MYR37. This appears to be linked to steady non-voice service usage, as well as marked increases in voice usage in general. Blended voice minutes rose to 263 minutes in Q212, the highest rate of usage we have on record. DiGi reported modest reductions in its blended, Prepaid Mobile ARPU (MYR) prepaid and postpaid ARPUs in Q212, reflecting the 2009-2012 falling usage of voice services, particularly in the postpaid segment. Its blended ARPU fell from MYR49 to MYR48 over the course of Q212, as blended minutes of use (MOU) remained unchanged at 270 minutes (the decline in postpaid minutes offset the increase in prepaid minutes). Similarly, prepaid ARPUs remained stable at MYR41 over the quarter. In Q212, prepaid ARPU remained unchanged at MYR41. The companys postpaid ARPU also did not Source: operators experience any changes in Q212, remaining stable at MYR85. However, this declined in MYR82 in Q212. Postpaid MOU shrank quite noticeably, from 431 minutes to 419 minutes in Q112, before declining to 396 minutes in Q212. Business Monitor International Page 32 32. Malaysia Telecommunications Report Q1 20133G/4G Malaysia has four holders of 3G licences: Maxis, Celcom, MiTV (U Mobile) and DiGi. Malaysia issued its first two 3G licences in 2002, to Celcom and Maxis. U Mobile and TIME dotCom won their licences in March 2006, ahead of DiGi. TIME dotCom subsequently sold its 3G licence to DiGi, which is now sharing 2G/3G facilities with U Mobile. Although none of the operators discloses 3G-specific subscriber numbers and network usage data, top-line market data from the regulator and details regarding mobile broadband user figures reported by Celcom, Maxis and DiGi give a fairly comprehensive insight into 3G adoption in Malaysia. The MCMC claims that there were 12.022mn 3G subscribers in Malaysia as of June 2012 (latest date for which data were available at the time of writing), of which 7.880mn were prepaid. The total 3G subscriber base represented a y-o-y increase of 23.2% from 9.756mn at the end of Q211. Market leaders Maxis and Celcom launched services in May 2005, with Maxis collecting around 7,000 subscribers in its first few weeks of operations (by the end of Q205) and Celcom picking up some 5,000 users. By the end of the year (2005), Celcom was understood to have overtaken Maxis in a market comprising about 70,000 subscribers. DiGi joined the fray in late 2007 when it acquired TIME dotComs 3G business. Newcomer U Mobile joined the market in 2009. The operators have been reluctant to disclose more recent subscriber figures, though aggregate numbers are reported quarterly by the regulator. Meanwhile, in April 2010, the MCMC announced it was gearing up to auction three blocks of 2.6GHz spectrum in 2011, marking the regulators first formal move to bring fourth generation (4G) LTE technology into commercial play. The MCMCs aim is to rationalise spectrum holdings in order to make the most efficient use of these scarce resources and to boost use of mobile broadband services. However, in mid-October 2010 the regulator said it had awarded spectrum in the 2.6GHz band to nine telecoms operators. The winning

operators will be able to launch high-speed mobile broadband services using LTE technology by January 1 2013. Mobile operators Celcom Axiata, Maxis Broadband, DiGi Telecommunications and U Mobile, as well as WiMAX operators Asiaspace, Packet One Networks (P1), REDtone Marketing and YTL Communications plus newcomer Puncak Semangat secured the licences. All, bar Asiaspace and Puncak Semangat, were allocated 20MHz of spectrum; Asiaspace received only 10MHz of spectrum, possibly because it already owns considerable spectrum for other purposes. Meanwhile, the newcomer was granted 30MHz of spectrum, in recognition of its lack of pre-existing infrastructure. Business Monitor International Page 33 33. Malaysia Telecommunications Report Q1 2013 By mid-February 2012, however, it was clear that nine LTE networks were not economically viable and it was being reported that YTL had approached Asiaspace and P1 with a view to pooling their resources or pursuing a formal business combination. Nothing further had been reported at the time of writing, but BMI believes many of the new entrants will have little choice but to consolidate in order to protect their investments. Maxis Communications As part of its plan to achieve 80% 3G coverage by 2014, Maxis signed a network expansion agreement with Ericsson in September 2005. Maxis pledged to invest over MYR1bn over the following three years on its 3G provision in the Klang Valley. This network agreement with Ericsson was in addition to Maxis earlier contract with Siemens in August 2005 for the delivery of 3G/W-CDMA equipment in the Klang Valley and northern Malaysia. In December 2005, Maxis expanded its 3G network so that it reached Penang, an important area for tourism and business travellers. In November 2006, Maxis expanded its high-speed downlink packet access (HSDPA) network so that it reached Penang as well as the Klang Valley, where it had launched its 3.5G network in September. An investment of MYR5mn was enough to deploy such services in Penang as well, reaching some 20,000 households. The operator reported 1.3mn active 3G subscribers as of March 2008, compared with 350,000 in March 2007. This indicates growth of 271%. Despite missing its target of 2mn 3G subscribers by April 2008, the rate of take-up was extremely encouraging. This, it is believed, was due to a fall in 3G handset prices. By the end of 2009, Maxis expected to have invested about MYR2bn in the expansion of its 3G network. Further investments in its next generation network were made in December 2009, when Maxis launched its HSPA+ platform. The technology is being rolled out alongside Maxis existing 3G infrastructure in certain areas of the country. The company claimed that services were initially available only to select customers on a trial basis, but began offering a commercial service in 2010. As of Q411, the company said that HSPA+ coverage had been expanded to more than 5,100 sites in total, covering 81% of the population. At the same time, the company is offering 3G services at 900MHz in order to improve indoor coverage and increase data transfer speeds; approximately 1,000 sites were being used in this way at the end of Q411. With HSPA+, Maxis wireless broadband network can support theoretical peak network rates of up to 21Mbps, although Maxis is keen to point out that, in areas with good coverage, typical access rates of 1015Mbps are most likely. Nevertheless, these rates are around double those

currently offered by the companys HSDPA network in certain areas of the country. Maxis claims it will deploy HSPA+ on a Business Monitor International Page 34 34. Malaysia Telecommunications Report Q1 2013 strategic basis across Malaysia. HSPA+ also provides a useful stepping stone to 4G technologies, such as LTE, which could be introduced within the next few years. In October 2011, Maxis and U Mobile entered into a multibillion ringgit agreement to share Maxis 3G radio access networks (RANs) for a period of 10 years. The companies said this was Malaysias first active 3G RAN sharing arrangement. The deal also encompasses LTE sharing, in recognition of the regulators decision to award 2.6GHz spectrum to these and seven other companies in Q411. Through the collaboration, Maxis will receive a significant new source of revenue and will enhance utilisation of its network in areas currently underutilised. Maxis has considerable experience of network sharing, as more than 54% of its base station sites were shared with other operators at the end of Q311. As for U Mobile, the company believes the agreement will enable it to accelerate the deployment of its 3G network by four to five times and deliver significant cost savings. The shared locations will exclude urban market centres such as Klang Valley, Penang, Johor Bahru and Ipoh, where U Mobile is committed to continue providing mobile broadband services over its own facilities. The deal will help U Mobile extend its 3G footprint to more than 4,000 3G sites by early 2013. In May 2011, Maxis and WiMAX provider Asiaspace were said to be considering sharing network infrastructure as they prepare for the rollout of next generation LTE services. Reportedly, Maxis would be in charge of building and running the LTE network while Asiaspace would provide additional spectrum in order to increase network coverage and capacity. Consequently, Asiaspace would act as a mobile virtual network operator and leverage Maxis network infrastructure to offer LTE services. Nothing further had been reported at the time of writing. DiGi Despite losing out on an earlier chance to win a 3G licence, DiGi later received approval from the MCMC for the transfer of TIME dotComs licence. In November 2007, TIME dotCom agreed to sell its 3G concession and frequencies for 27.5mn new DiGi shares, equivalent to a 3.5% stake in the operator. As part of the agreement, TIME dotCom was also invited to take part in the placement of 76.5mn DiGi shares (necessary for Telenor to lower its stake in the company to 49%) in compliance with foreign ownership regulations. Furthermore, DiGi agreed to review its international and domestic infrastructure agreements with TIME dotCom so that it would spend MYR10-15bn a year over a three-year period. The operators agreed to look into sharing telecoms base stations for the purpose of TIME dotComs proposed broadband WiMAX network. Business Monitor International Page 35 35. Malaysia Telecommunications Report Q1 2013 For each of the three years to late 2010, DiGi was to invest MYR400mn (US$118mn) in extending its Turbo 3G service to about 70% of the population. The company said that it saw mobile internet usage as being its primary growth driver for at least the first two years of operations, and that the low 3G tariffs it introduced would sustain that growth. By the end of 2010, the DiGi Turbo 3G network covered 50% of the population of