Professional Documents

Culture Documents

PIN Pad Security Best Practices V2

Uploaded by

Antony IngramCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PIN Pad Security Best Practices V2

Uploaded by

Antony IngramCopyright:

Available Formats

PIN Pad Security Best Practices v2

PIN Pad Security Best Practices

Copyright, VeriFone, 2008

PIN Pad Security Best Practices v2

Introduction

The payment industry and card associations adopted PED and PCI PED requirements because of concerns that sophisticated criminal organizations may have the resources to tamper with PED terminals to install a bug and collect private card data. In Pre PED devices, security features were left to each vendor to determine. The more recently adopted Visa PED and PCI PED requirements provide standardized security features that make tampering progressively more difficult. We are seeing an increase in criminal organizations targeting the less secure pre PED terminals by installing bugs to collect private credit card and debit information. In these cases, the criminal organizations are inserting a bug into an in-place device or obtaining the same terminal model that a retailer uses, installing a bug, and then substituting the tampered device for the retailer's terminals. They then either come back to retrieve these terminals to obtain the stolen information, or in some cases, the tampered terminals send the information to another computer via wireless communications. Due to repeated targeting of pre PED PIN pads and payment terminals, VeriFone has developed the following PIN Pad Security Best Practices. These best practices first enable a retailer to determine if any existing terminals have been tampered with, and second make tampering much more difficult by implementing a comprehensive set of security controls to prevent tampering and more quickly become aware if tampering has occurred. This document details the PIN Pad Security Best Practices from a sound security perspective to minimize fraud through education, routine inspection, vendor management, and prompt action. Each of the Best Practices are organized into the following categories: 1. Administrative Activities This category covers items that include employee education on data security theft, and common prevention activities. 2. Physical Activities This category includes items involving physical inspection of payment system components. 3. Technical Activities This category addressed data encryption and serial number validation with the POS. To encourage reading of these best practices they have been condensed and categorized into a one page Quick Reference Guide VeriFone recommends all retailers implement the following PIN Pad Security Best Practices immediately. If a retailer does not enact a complete PIN pad security program, including PIN Pad Security Best Practices, then they will remain vulnerable to this kind of tampering.

Copyright, VeriFone, 2008

PIN Pad Security Best Practices v2

PIN Pad Security Best Practices

Quick Reference Guide

Prevent Detect

Prevention

Educate store employees about the techniques criminals use Update new employee training curriculum to include security awareness Instruct all employees to be vigilant in looking for suspicious activity around pumps Change default PIN Pad passwords. Monitor PIN Pad payment problems Check the accreditations / references of any service technicians. Require they show ID and sign a service log Use and retain accurate shift schedules so that a staff audit trail is available

Detection

Correction

Administrative Activities

Periodically audit the service log Check repair technician verification and service log Store PIN Pad and payment terminals in a secure location Track terminal assets as they move in and out of inventory Only purchase payment terminals from authorized sources Use only authorized repair centers Securely dispose of retired terminal inventory Develop a response plan in advance in case a breach occurs Mount PIN Pads securely to counter Visually inspect terminals weekly

Physical Activities

Focus security cameras on terminals; maintain CCTV data logs for use later Call Law Enforcement if device tampering is found

Technical Activities

Encrypt data from the PIN Pad Validate all serial numbers manually with the serial number printed on the bottom of the terminal Validate all terminal serial numbers electronically with the POS Authenticate all payment applications

Copyright, VeriFone, 2008

PIN Pad Security Best Practices v2

Administrative Activities

1. Educate your store employees and managers about the techniques criminals use to breach PIN Pads and payment terminals. Data thieves have sophisticated equipment that can be installed in minutes. Store employees should be educated as to the type of equipment data thieves install, where they typically install it, and what information they can gain once it is installed. 2. Update new employee training curriculum to include the techniques criminals use to breach PIN Pads and payment terminals. New employees should be trained to be on the lookout for suspicious activity around the PIN Pad or payment terminal, and who to call should such activity be cause for concern. 3. Change Default PIN Pad Password Make sure the password for device access is not the original default password. If it is, have it changed, as default passwords become widely known. Contact your account executive if you need help changing this password. 4. Monitor PIN Pad Payment Problems Develop a process to monitor devices that consistently do not work properly such as high magstripe read failures or debit card declines. These can be indicators of tampered terminals. Contact the security officer at the terminal manufacturer to determine the next steps. 5. Check the accreditations / references of any service technicians. Require they show a photo ID and sign a service log Social engineering is sometimes employed to commit fraud; a fraudster acts as a service technician or consultant to allow them to gain unauthorized access. All service technicians should be required to show a photo ID and sign a service log. The details of the visit should be communicated in advance to the manager or cashier by management. 6. Use and retain accurate shift schedules so that a staff audit trail is available Schedules of what staff worked when should be maintained to help with any investigations or enquiries that may arise at a future date. This will also act as a deterrent to staff to commit fraud as they are accountable for their actions. 7. Periodically audit the service log Establish and maintain a service log that records the who/what/where/when/why of a technician visit should be periodically audited by management to ensure that all servicing was approved. 8. Check Repair Technician Verification and Log Service Activities Implement a procedure to require all repair technicians who visit your stores sign in, verify their identity with photo identification, and remain accompanied by store personnel during any work on PIN pads. 9. Store PIN Pad and Payment Terminals in a Secure Location Store all spare devices under lock and key to prevent unauthorized removal. Incorporate a procedure to validate the devices inventory at every shift and have not disappeared.

Copyright, VeriFone, 2008

PIN Pad Security Best Practices v2

10. Track Terminal Assets as they move in and out of Inventory Institute a procedure to track every time a terminal is replaced within the store, whether from the in-store inventory, by a repair technician, or units shipped into the store 11. Purchase from Authorized Sources Only obtain PIN pads from a manufacturer or manufacturers authorized partner. Unauthorized resellers, such as may be found online at sites such as eBay, may potentially sell devices that are already compromised, whether intentionally or unwittingly. 12. Use Authorized Repair Centers For similar reasons, have your PIN pads repaired at the manufacturer or an authorized manufacturers repair center which has completed a TG3 Key Injection audit. 13. Securely Dispose of Retired Terminal Inventory In order to properly dispose of retired terminal inventory, only use firms that destroy the encryption keys during the retirement and recycling process. Select environmentally friendly destruction facilities that recycle all metal and plastic components, and follow proper hazardous material destruction procedures for PCB components. For PCI compliance verification, consider firms that issue an inventory disposal report that lists all terminals being retired by their serial number. 14. Develop a Response Plan in Advance! Develop methods and procedures on how to handle subsequent activities should a breach occur. Determine who in you company will be the go-to person or coordinator of all breach-related activity. How do you respond? Who do you need to call first? Can you respond internally or should a third party be involved? Who is the third party? How do you manage external communications? What internal systems are involved in the breach? Do you keep accurate records of all system change activities for all of your sites?

Physical Activities

1. Mount PIN Pads Securely to Counter Review the installation of your PIN pads. They should be mounted on the counter; unplugging cables should require more than turning the unit over; and you may want to consider installing locking stands to prevent unauthorized removal. 2. Weekly Visual Terminal Inspections Immediately have a visual inspection performed on every device to look for potential signs of tampering. These include anything that does not look normal such as lack of tamper seals, damaged or altered tamper seals, mismatched keys, missing screws, incorrect keyboard overlays, external wires, holes in the terminal or anything else unusual. Look for hidden cameras in the ceiling and inspect non-secured wiring. If anything out of the ordinary is noticed, stop using the device, disconnect it from the pos terminal or network, but do not power it down. Contact the security officer at the terminal manufacturer to determine the next steps. Continue to perform visual inspections weekly. Copyright, VeriFone, 2008

PIN Pad Security Best Practices v2

3. Focus Security Cameras on PIN Pads Ensure security cameras have a clear line of sight to the PIN Pad terminals to aid investigators in the event of a security compromise. Images of data thieves and the methods they are using is invaluable information. Front orientation cameras provide the best evidence without interfering with customers actual PIN entry on the payment devices. 4. Contact Law Enforcement if Evidence of Tampering or Device Substitution is Found Law enforcement needs to be involved if there is any suspicion of data theft crime. They will engage experts who need to respond quickly in order to apprehend the criminals.

Technical Activities

1. Encrypt Data from the PIN Pad As Terminal Physical Security Has Increased, Criminals have turned to tapping the connection between the PIN Pad and the POS Terminal, or From the POS Terminal to the Communications Equipment. All sensitive customer data should be encrypted before it leaves the PIN Pad 2. Serial Number Validation If your terminal contains an electronic serial number, have the electronic serial number compared to the serial number printed on the bottom of the terminal. If these do not match stop using the device, disconnect it from the POS terminal or network, but do not power it down. Contact the security officer at the terminal manufacturer to determine the next steps. 3. Electronic Serial Number Validation If the PIN Pad supports electronic serial numbers, implement a scheme to validate the Pin Pad serial number every time the POS. starts up to insure the device has not been replaced, and if it has, automatically send an alert. If the device supports Ethernet connectivity, consider implementing a device management solution to track all in service devices.

4. Authenticate Applications

To insure rogue applications are not installed on the PIN Pad and access to ports are controlled all applications should utilize the vendors method of authentication. Insure the default certificates are changed prior to deployment.

Reference Documents

1. POS/POI Terminal Security Best practices to application developers, system integrators, and end users, MasterCard, February 2006, Draft V02 2. Visa Fraud Prevention for merchants (http://merchants.visa.com/prevention/main.jsp) 3. Payment Card Industry (PCI) Data Security Standard (https://www.pcisecuritystandards.org) 4. Fuel Dispenser Payment Security Best Practices V1, VeriFone Inc, October 2008 5. VeriFones Retail Payment Security website, www.secureretailpayments.com. Copyright, VeriFone, 2008

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 01 OSHistoryDocument15 pages01 OSHistorySohail KhanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Crafting An Interpreter Part 2 - The Calc0 Toy Language: Congratulations! Your Download Is CompleteDocument7 pagesCrafting An Interpreter Part 2 - The Calc0 Toy Language: Congratulations! Your Download Is CompleteAntony IngramNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Crafting An Interpreter Part 3 - Parse Trees and Syntax Trees - VROSNET - CodePrDocument9 pagesCrafting An Interpreter Part 3 - Parse Trees and Syntax Trees - VROSNET - CodePrAntony IngramNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- YB1972Document664 pagesYB1972Antony IngramNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Crafting An Interpreter Part 1 - Parsing and Grammars - Martin - Holzherr - CodePrDocument12 pagesCrafting An Interpreter Part 1 - Parsing and Grammars - Martin - Holzherr - CodePrAntony IngramNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Comparison of VbScript and JavaScript: Insight On Selection and Future Enhancements (193-734-1-PB PDFDocument5 pagesA Comparison of VbScript and JavaScript: Insight On Selection and Future Enhancements (193-734-1-PB PDFAntony IngramNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Natural Langauge Understanding Assignment 1: Semantic ParsingDocument4 pagesNatural Langauge Understanding Assignment 1: Semantic ParsingAntony IngramNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Crafting An Interpreter Part 1 - Parsing and Grammars - Martin - Holzherr - CodePrDocument12 pagesCrafting An Interpreter Part 1 - Parsing and Grammars - Martin - Holzherr - CodePrAntony IngramNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Crafting An Interpreter Part 3 - Parse Trees and Syntax Trees - VROSNET - CodePrDocument9 pagesCrafting An Interpreter Part 3 - Parse Trees and Syntax Trees - VROSNET - CodePrAntony IngramNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Crafting An Interpreter Part 1 - Parsing and Grammars - Martin - Holzherr - CodePrDocument12 pagesCrafting An Interpreter Part 1 - Parsing and Grammars - Martin - Holzherr - CodePrAntony IngramNo ratings yet

- Crafting An Interpreter Part 2 - The Calc0 Toy Language: Congratulations! Your Download Is CompleteDocument7 pagesCrafting An Interpreter Part 2 - The Calc0 Toy Language: Congratulations! Your Download Is CompleteAntony IngramNo ratings yet

- SecurityPolicy-2 0Document31 pagesSecurityPolicy-2 0Antony IngramNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- (ThinkCentre Service Manual) 46r4780Document572 pages(ThinkCentre Service Manual) 46r4780Antony IngramNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Optix 740 Tech GuideDocument39 pagesOptix 740 Tech GuidemoiibdNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- P 020121117475356328606Document78 pagesP 020121117475356328606Antony IngramNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Atm Technical RequirementsDocument13 pagesAtm Technical RequirementsAntony IngramNo ratings yet

- ISE334: Using RSA Encryption in CDocument6 pagesISE334: Using RSA Encryption in CAntony IngramNo ratings yet

- Triton FT7000 ProductSheet LowresDocument2 pagesTriton FT7000 ProductSheet LowresAntony IngramNo ratings yet

- Pad Darb2Document15 pagesPad Darb2Antony IngramNo ratings yet

- T-Box User GuideDocument28 pagesT-Box User GuideAntony IngramNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MicroATMStandards V1draftDocument23 pagesMicroATMStandards V1draftchintan310No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Nokia 6720c UG enDocument91 pagesNokia 6720c UG enfxfool81No ratings yet

- HP Security HandbookDocument224 pagesHP Security HandbookAntony IngramNo ratings yet

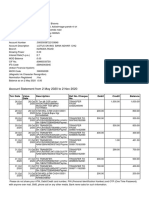

- Bank account statement details for Mr. BODA MALLESHDocument5 pagesBank account statement details for Mr. BODA MALLESHSanthosh Naik BhukyaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Public School Teachers May Lose License To Teach Over Unpaid LoansDocument2 pagesPublic School Teachers May Lose License To Teach Over Unpaid LoansSebastian GarciaNo ratings yet

- Account Terms Cards Mastercard enDocument12 pagesAccount Terms Cards Mastercard enHASSAN KocentiniNo ratings yet

- ATM Management System Project ReportDocument7 pagesATM Management System Project ReportMd.Faraz AlamNo ratings yet

- DXN E-Point User Guide v1 - EnglishDocument79 pagesDXN E-Point User Guide v1 - Englishapi-204080761No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- RTK VRS - : 262 Receiver EZ Guide 500 FM 1000Document25 pagesRTK VRS - : 262 Receiver EZ Guide 500 FM 1000RevelinoNo ratings yet

- 3 JuneDocument2 pages3 JuneAdventurous Freak100% (1)

- SSDDocument6 pagesSSDHarinniy IlanchezhianNo ratings yet

- Equitrac Embedded For Xerox EIPDocument82 pagesEquitrac Embedded For Xerox EIPAyman SolimanNo ratings yet

- Research ProposalDocument33 pagesResearch ProposalNegash LelisaNo ratings yet

- Chapter 5 NotesDocument45 pagesChapter 5 NotesAbrasaxEimi370No ratings yet

- INDOASIS-Registration-Procedure - 07 10 2020Document1 pageINDOASIS-Registration-Procedure - 07 10 2020KNRavi KiranNo ratings yet

- Customer Perception of E-Banking Services at AU Small Finance BankDocument87 pagesCustomer Perception of E-Banking Services at AU Small Finance BankPatel MehulNo ratings yet

- Computer IX CH-5,6,7Document47 pagesComputer IX CH-5,6,7sqamar68No ratings yet

- Manual Nevera BioredDocument8 pagesManual Nevera BioredPaulaOsorioNo ratings yet

- 1882 DidDocument16 pages1882 Didrohit dasNo ratings yet

- Financial Inclusion 15012019Document5 pagesFinancial Inclusion 15012019Joydeep Chatterjee100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 18CSE364T - System Administration and MaintenanceDocument5 pages18CSE364T - System Administration and MaintenanceK MAHESHWARI (RA1811031010041)No ratings yet

- Mrs. Panchal Bhavna bank account statementDocument2 pagesMrs. Panchal Bhavna bank account statementLavkush YadavNo ratings yet

- 1421 PDFDocument12 pages1421 PDFLuis F JaureguiNo ratings yet

- ATM CodeDocument3 pagesATM CodeJayyaad ArshadNo ratings yet

- Important Instructions To Examiners:: Maharashtra State Board of Technical Education (ISO/IEC - 27001 - 2013 Certified)Document34 pagesImportant Instructions To Examiners:: Maharashtra State Board of Technical Education (ISO/IEC - 27001 - 2013 Certified)Mahesh DahiwalNo ratings yet

- BASE24-eps OverviewDocument36 pagesBASE24-eps OverviewTedh Shin100% (4)

- Unit 7Document46 pagesUnit 7zoya fathimaNo ratings yet

- Frequently Asked Questions MyABL LatestDocument11 pagesFrequently Asked Questions MyABL LatestTafseer HussainNo ratings yet

- Assignment 2Document8 pagesAssignment 2NURAINA SYAKIRAH BINTI NOR AZLAN (BG)No ratings yet

- Bank Management SystemDocument16 pagesBank Management SystemDarade AkankshaNo ratings yet

- G747 User Guide: Everything You Need to KnowDocument40 pagesG747 User Guide: Everything You Need to Knowjoemonmm14No ratings yet

- Password-Less ProtectionDocument24 pagesPassword-Less ProtectionJoachim LuengasNo ratings yet

- Year 9 ICT Homework #02 - Model Answer Chapter 02 Input and Output DevicesDocument12 pagesYear 9 ICT Homework #02 - Model Answer Chapter 02 Input and Output DevicesSalma KelanyNo ratings yet

- Defensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityFrom EverandDefensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityRating: 5 out of 5 stars5/5 (1)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Chip War: The Fight for the World's Most Critical TechnologyFrom EverandChip War: The Fight for the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (82)

- CompTIA A+ Complete Review Guide: Exam Core 1 220-1001 and Exam Core 2 220-1002From EverandCompTIA A+ Complete Review Guide: Exam Core 1 220-1001 and Exam Core 2 220-1002Rating: 5 out of 5 stars5/5 (1)