Professional Documents

Culture Documents

09.04.23 Furnishedholidaylettings

Uploaded by

admin866Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09.04.23 Furnishedholidaylettings

Uploaded by

admin866Copyright:

Available Formats

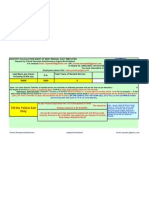

Tel: 01292 288999 | Fax: 01292 272150 | Web: www.sinclairscott.

com

Contact: Sinclair Scott.

Note: text can be used, but must be attributed to

Sinclair Scott CA

FURNISHED HOLIDAY LETTINGS

IMPACT OF BUDGET 2009 CHANGES

Background

Furnished holiday lettings have always been taxed as part of a property business.

Legislation has, however, allowed special rules to apply for furnished holiday lettings

which are detailed below.

In order to satisfy the criteria to qualify as furnished holiday lettings the holiday

accommodation must be:-

a) Available for commercial letting to the public generally as holiday

accommodation for at least 140 days in the 12 month period, and

b) Is so let be let for at least 70 such days

Tax benefits

The income is treated as if it was generated from a trade for tax purposes. This

means that the landlord is entitled to:-

a) Claim loss relief as if it was a trade – this allows any loss to be set against other

income.

b) Treat the holiday home as if it were an asset used in a trade so that those

selling the property can postpone tax and rollover the gain by investing in

another property or by benefitting from entrepreneurs relief, paying capital

gains tax on the profit at 10% rather than the normal 18%.

c) Claim that the furnished holiday letting property will qualify for Business

Property Relief and be free from inheritance tax should the deceased Estate

include such an asset.

d) Claim plant and machinery allowances on applicable capital expenditure. This

can mean that up to 100% of expenditure on items such as furniture, equipment

is tax deductible in the year of expenditure. This is not normally allowed with

other property letting.

e) Treat profits from letting of furnished holiday lets as relevant earnings for

calculating their ability to make pension contributions.

H.M. Revenue & Customs concerns

There has been a suggestion that since the current rules only apply to landlords with

income from furnished holiday accommodation in the UK that this approach is not

compliant with European law. To tackle this the Revenue have allowed those who let

furnished holiday accommodation within the European Economic Area to benefit from

the existing FHL rules up to 5 April 2010. From 5 April 2010 the rules in relation to

furnished holiday letting will be appealed and all income from furnished holiday lets

should be taxed in the same manner as other property rentals without the favourable

tax treatments detailed above.

Unfairness

• Many providers of furnished holiday accommodation carry on their business in

the same manner as those operating other accommodation such as hotels,

guest houses etc.

• Many providers of holiday accommodation have a number of employees who

actively manage and market their properties generating their only source of

income. The inability to make pension contributions based on this income will

have a long term impact on their financial position. It could be that such

individuals will be able to reclassify their business as a trade but we move into

one of H.M. Revenue & Customs grey areas and at minimum we should receive

some guidance on this.

The textbooks refer to the possibility of treating the lettings as a trade if the

landlord provided services such as cleaning, laundry and meals. It doesn’t

make any reference to the efforts managing the property, marketing the

property, attending to enquiries via e-mail, letter etc.

• Many individuals will have planned their acquisition of a property or properties

in the knowledge that they would have significant capital gains, income tax and

inheritance tax advantages. The removal of these advantages will impact

greatly on the financial planning of such individuals.

• In a time when the government should be doing more to promote and assist the

indigenous tourism industry these changes to the rules are very unwelcome.

• There was a similar challenge to the Agricultural Property Relief rules which did

not apply to any land other than those outside the UK. The Budget 2009

extended the relief to all farm land which meets the definition located within the

UK and European economic area. It seems strange therefore that the Revenue

allowed one change which encompass property within the European Economic

Area and the other which has the removal of the tax advantages of all property

within the UK and EEA.

You might also like

- File by Mail Instructions For Your Federal Amended Tax ReturnDocument14 pagesFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Property Rental PDFDocument25 pagesProperty Rental PDFlewisweiss363No ratings yet

- Rental Properties 2021: Guide For Rental Property OwnersDocument52 pagesRental Properties 2021: Guide For Rental Property Ownersuly01 cubillaNo ratings yet

- Lesson 1 Tax Planning & ManagementDocument35 pagesLesson 1 Tax Planning & ManagementkelvinNo ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- Financial Literacy (Done)Document5 pagesFinancial Literacy (Done)Joseph Paul VERDANNo ratings yet

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Common Sense Risk Management of Trees National Tree Safety GroupDocument104 pagesCommon Sense Risk Management of Trees National Tree Safety Groupadmin866No ratings yet

- UK State Pension StatementDocument7 pagesUK State Pension StatementElmer LeonardNo ratings yet

- Shipping Leasing Offers Tax Efficiencies and FlexibilityDocument6 pagesShipping Leasing Offers Tax Efficiencies and FlexibilityKofikoduah100% (1)

- HMRC - Trust and UK Estate PropertyDocument8 pagesHMRC - Trust and UK Estate PropertyRay Walsh100% (1)

- UK Residential Property GuideDocument5 pagesUK Residential Property Guidemiceguelci100% (1)

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- AP MPL Act 1965 SectionsDocument32 pagesAP MPL Act 1965 SectionsRaghu RamNo ratings yet

- New Employee Orientation ChecklistDocument4 pagesNew Employee Orientation ChecklistMary Anne BantogNo ratings yet

- CIR V Benguet Corporation DIGESTDocument3 pagesCIR V Benguet Corporation DIGESTGretchen MondragonNo ratings yet

- 9A Fetalino Vs COMELECDocument3 pages9A Fetalino Vs COMELECJulius AlcantaraNo ratings yet

- Reduxion: Qualifying Permitting IntervalsDocument2 pagesReduxion: Qualifying Permitting Intervalszonesun3No ratings yet

- Business Taxation: Rachel Griffith, Helen Miller and Martin O'Connell (IFS)Document12 pagesBusiness Taxation: Rachel Griffith, Helen Miller and Martin O'Connell (IFS)anon_241413889No ratings yet

- Maximizing Returns_ Exploring Property Income Taxation for ACCA UK-TX FA2021Document5 pagesMaximizing Returns_ Exploring Property Income Taxation for ACCA UK-TX FA2021Gaziyah BenthamNo ratings yet

- Ey Qatar Enacts New Income Tax LawDocument3 pagesEy Qatar Enacts New Income Tax Lawjenniferonyeke77No ratings yet

- UK Taxation - IntroductionDocument15 pagesUK Taxation - IntroductionPriynah ValechhaNo ratings yet

- Property Rental Toolkit: 2019-20 Self Assessment Tax Returns Published April 2020Document28 pagesProperty Rental Toolkit: 2019-20 Self Assessment Tax Returns Published April 2020jonofsNo ratings yet

- Solution Review QuestionsDocument41 pagesSolution Review Questionsying huiNo ratings yet

- IG CH 01Document27 pagesIG CH 01Basa TanyNo ratings yet

- Income From Property Frequently Asked Questions - HandoutDocument12 pagesIncome From Property Frequently Asked Questions - Handoutkwok wing kwanNo ratings yet

- Different Types of Property IncomeDocument21 pagesDifferent Types of Property IncomeYoven VeerasamyNo ratings yet

- CH 16Document38 pagesCH 16tomas PenuelaNo ratings yet

- Chapter 5Document49 pagesChapter 5shambelmekuye804No ratings yet

- Nigeria Property Tax in Federal Capital TerritoryDocument3 pagesNigeria Property Tax in Federal Capital TerritoryMark allenNo ratings yet

- Tax rules for rental properties and holiday homesDocument41 pagesTax rules for rental properties and holiday homesRoger DaltryNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 20Document32 pagesMultinational Business Finance 12th Edition Slides Chapter 20Alli Tobba100% (2)

- Lecture 11 - INTERNATIONAL TAXATIONDocument34 pagesLecture 11 - INTERNATIONAL TAXATIONStephen ArkohNo ratings yet

- The Taxperts GroupDocument2 pagesThe Taxperts GrouptaxpertsNo ratings yet

- Business Taxation Notes Income Tax NotesDocument39 pagesBusiness Taxation Notes Income Tax NotesvidhyaaravinthanNo ratings yet

- Withholding Tax On Rental Services: Guide 01Document2 pagesWithholding Tax On Rental Services: Guide 01Abdul NafiNo ratings yet

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093Document36 pagesSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093juliebeasleywjcygdaisn100% (23)

- Taxation and Fiscal Policy: First Semester 2020/2021Document33 pagesTaxation and Fiscal Policy: First Semester 2020/2021emeraldNo ratings yet

- Dwnload Full Principles of Taxation For Business and Investment Planning 16th Edition Jones Solutions Manual PDFDocument36 pagesDwnload Full Principles of Taxation For Business and Investment Planning 16th Edition Jones Solutions Manual PDFfayaliteelectary2o3oz100% (9)

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- Principles of Taxation For Business and Investment Planning 16th Edition Jones Solutions ManualDocument26 pagesPrinciples of Taxation For Business and Investment Planning 16th Edition Jones Solutions ManualAustinSmithpdnq100% (46)

- Principles of Taxation For Business and Investment Planning 14th Edition Jones Solutions ManualDocument35 pagesPrinciples of Taxation For Business and Investment Planning 14th Edition Jones Solutions Manualoutlying.pedantry.85yc100% (16)

- Principles of Taxation For Business and Investment Planning 14th Edition Jones Solutions ManualDocument25 pagesPrinciples of Taxation For Business and Investment Planning 14th Edition Jones Solutions ManualRobertBlankenshipbrwez100% (36)

- Finance-Act-2019-Summary - 0319Document10 pagesFinance-Act-2019-Summary - 0319Tufail A. KhanxadaNo ratings yet

- TAX AssignmentsDocument2 pagesTAX Assignmentsmshafkan7No ratings yet

- The Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationDocument8 pagesThe Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationBiniamNo ratings yet

- Tax Digest CompilationDocument37 pagesTax Digest CompilationVerine SagunNo ratings yet

- Taxation Direct and IndirectDocument9 pagesTaxation Direct and IndirectFlora ChauhanNo ratings yet

- Answer Public Finance & TaxationDocument12 pagesAnswer Public Finance & TaxationkiduseNo ratings yet

- P-05-968: Pay Coronavirus grants to all businesses eligible for Small Business Rate Relief same as rest of UKDocument6 pagesP-05-968: Pay Coronavirus grants to all businesses eligible for Small Business Rate Relief same as rest of UKficoNo ratings yet

- Kirklees Council Discretionary Grant Fund GuidanceDocument8 pagesKirklees Council Discretionary Grant Fund GuidancerbfaliNo ratings yet

- Tax implications of rental income and expensesDocument14 pagesTax implications of rental income and expensesMuhammad shehryar wainNo ratings yet

- IMChap 011Document24 pagesIMChap 011Aaron Hamilton100% (2)

- Sa105 NotesDocument14 pagesSa105 Notesmarijana_jovanovikNo ratings yet

- 10 Recommendations For Business Tax ReformDocument2 pages10 Recommendations For Business Tax ReformPrecious RubaNo ratings yet

- Solution Manual For Principles of Taxation For Business and Investment Planning 14th Edition Jones Catanach 0078136687 9780078136689Document36 pagesSolution Manual For Principles of Taxation For Business and Investment Planning 14th Edition Jones Catanach 0078136687 9780078136689ericakaufmanctpkanfyms100% (23)

- Contemporary Tax Issues PresentationDocument38 pagesContemporary Tax Issues PresentationSamuel DwumfourNo ratings yet

- UK Vs USA Common Law Vs Common SenceDocument7 pagesUK Vs USA Common Law Vs Common SenceShlomo Isachar Ovadiah100% (1)

- Tax Answer BankDocument13 pagesTax Answer BankShadreck VanganaNo ratings yet

- Capital Gains Tax ArticleDocument5 pagesCapital Gains Tax ArticleErnest O'BrienNo ratings yet

- Tax ConsiderationsDocument30 pagesTax ConsiderationsLubertuz WahyuNo ratings yet

- Pita Amendment January 2012Document3 pagesPita Amendment January 2012Mark allenNo ratings yet

- Grant Thornton Alert - The Finance Bill 2020Document10 pagesGrant Thornton Alert - The Finance Bill 2020elinzolaNo ratings yet

- Ch6 - Hiep Dinh ThueDocument80 pagesCh6 - Hiep Dinh ThueQUỲNH HUỲNH TRẦN TRÚCNo ratings yet

- Wales Coast Path Media Pack - EnglishDocument49 pagesWales Coast Path Media Pack - Englishadmin866No ratings yet

- FINAL Septic Tank LetterDocument2 pagesFINAL Septic Tank Letteradmin866No ratings yet

- Economic Update Nov201Document12 pagesEconomic Update Nov201admin866No ratings yet

- Fish Week 1Document1 pageFish Week 1admin866No ratings yet

- Pembrokeshire Occ Results 2011Document2 pagesPembrokeshire Occ Results 2011admin866No ratings yet

- Proxy Voting Form-01.12Document1 pageProxy Voting Form-01.12admin866No ratings yet

- Trade Survey 2011 Key Findings DocumentDocument5 pagesTrade Survey 2011 Key Findings Documentadmin866No ratings yet

- Fish Week 1Document1 pageFish Week 1admin866No ratings yet

- Nomination Form 2012Document1 pageNomination Form 2012admin866No ratings yet

- Economic Update Nov201Document12 pagesEconomic Update Nov201admin866No ratings yet

- Safety in Our Hands.: Risk Management ServicesDocument16 pagesSafety in Our Hands.: Risk Management Servicesadmin866No ratings yet

- Burch Wealth Management 30.08.11Document4 pagesBurch Wealth Management 30.08.11admin866No ratings yet

- Arts and Craft Sector Meeting - Final PDFDocument1 pageArts and Craft Sector Meeting - Final PDFadmin866No ratings yet

- Arts Marketing Essentials Booking FormDocument3 pagesArts Marketing Essentials Booking Formadmin866No ratings yet

- Burch Wealth Management LTD 01.08.11Document3 pagesBurch Wealth Management LTD 01.08.11admin866No ratings yet

- Welsh Government Tourist Signing Policy (Brown Sign) ConsultationDocument5 pagesWelsh Government Tourist Signing Policy (Brown Sign) Consultationadmin866No ratings yet

- Burch Wealth Management 05.09.11Document3 pagesBurch Wealth Management 05.09.11admin866No ratings yet

- Pembrokeshire Tourism Response To Consultation DocumentDocument7 pagesPembrokeshire Tourism Response To Consultation Documentalisonbelton4575No ratings yet

- Winter Guide Booking Form 2011-12Document2 pagesWinter Guide Booking Form 2011-12admin866No ratings yet

- Pembrokeshire News: 8. The Good Beach Guide - Because Clean Seas Mean Great Beaches!Document10 pagesPembrokeshire News: 8. The Good Beach Guide - Because Clean Seas Mean Great Beaches!admin866No ratings yet

- HalfPage SPECs - Proof 7june WGDocument1 pageHalfPage SPECs - Proof 7june WGadmin866No ratings yet

- Letter Regarding General MeetingDocument2 pagesLetter Regarding General Meetingadmin866No ratings yet

- Quarter Page SPEC - 2june WGDocument1 pageQuarter Page SPEC - 2june WGadmin866No ratings yet

- SWWRTP QuestionnaireDocument2 pagesSWWRTP Questionnaireadmin866No ratings yet

- Market Bulletin Mark BurchDocument2 pagesMarket Bulletin Mark Burchadmin866No ratings yet

- Burch Wealth Mangement 20 06 11Document2 pagesBurch Wealth Mangement 20 06 11admin866No ratings yet

- Letter Regarding General MeetingDocument2 pagesLetter Regarding General Meetingadmin866No ratings yet

- Market Bulletin Mark BurchDocument2 pagesMarket Bulletin Mark Burchadmin866No ratings yet

- Market Bulletin Mark BurchDocument2 pagesMarket Bulletin Mark Burchadmin866No ratings yet

- Abolition of AP Administrative TribunalDocument2 pagesAbolition of AP Administrative TribunalSandeepPamaratiNo ratings yet

- Retirement Gratuity Calculation For West Bengal Govt EmployeeDocument4 pagesRetirement Gratuity Calculation For West Bengal Govt EmployeePranab Banerjee100% (1)

- hrm4111 Recruitment and Selection Assignment Five Employment Contract Christina RanasinghebandaraDocument3 pageshrm4111 Recruitment and Selection Assignment Five Employment Contract Christina Ranasinghebandaraapi-3245028090% (1)

- Latest NPS Sunny Dogra - RemovedDocument1 pageLatest NPS Sunny Dogra - Removeddinesh makwanaNo ratings yet

- Jiban Bima CorporationDocument29 pagesJiban Bima CorporationBijoy Salahuddin100% (1)

- Introduction:-: WorksheetDocument24 pagesIntroduction:-: WorksheetbharatNo ratings yet

- Budget OrdinanceDocument490 pagesBudget OrdinanceDaniel StraussNo ratings yet

- Establishment ManualDocument131 pagesEstablishment ManualmanishdgNo ratings yet

- Salary Details2Document2 pagesSalary Details2Mahesh MeenaNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- IAS 19 Employee Benefits History and Key RequirementsDocument5 pagesIAS 19 Employee Benefits History and Key RequirementsCA Rekha Ashok PillaiNo ratings yet

- TAxation LAw Complete HandoutsDocument15 pagesTAxation LAw Complete HandoutsAbdullah ShahNo ratings yet

- Items and Concept of IncomeDocument48 pagesItems and Concept of Incomejeff herradaNo ratings yet

- Complete ITR12 Tax ReturnDocument24 pagesComplete ITR12 Tax Returnmalshang9039No ratings yet

- EnglishDocument50 pagesEnglishsainiks100% (18)

- Fill in The Blanks, True & False MCQs (Accounting Manuals)Document13 pagesFill in The Blanks, True & False MCQs (Accounting Manuals)Ratnesh RajanyaNo ratings yet

- Sandhar 2Document25 pagesSandhar 2NipunVashisthaNo ratings yet

- Question Bank - Tax LawDocument6 pagesQuestion Bank - Tax LawNiraj PandeyNo ratings yet

- Nomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Document2 pagesNomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Dinesh SahuNo ratings yet

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputeNo ratings yet

- Reducing Balance LoansDocument71 pagesReducing Balance LoansofishifaNo ratings yet

- IAS 19 - Employee BenefitsDocument1 pageIAS 19 - Employee BenefitsClarize R. MabiogNo ratings yet

- Tamilnadu Govt Pensioner DA Hike 10% (35% To 45%) From July 2010 GO No 375 Date 29 Sep2010Document4 pagesTamilnadu Govt Pensioner DA Hike 10% (35% To 45%) From July 2010 GO No 375 Date 29 Sep2010Mohankumar P KNo ratings yet