Professional Documents

Culture Documents

Indian Labour Laws - Good

Uploaded by

Rajesh RaghavanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Labour Laws - Good

Uploaded by

Rajesh RaghavanCopyright:

Available Formats

Indian Labour laws

TABLE OF CONTENTS 1. SHOPS & ESTABLISHMENTS ACT 1.1 PROCEDURE FOR ISSUING A NEW REGISTRATION CERTIFICATE 1.2 WORKING HOURS , OVERTIME & CLOSE DAY 1.3 COMPULSORY HOLIDAYS 1.4 LEAVES & WAGE DURING LEAVES 1.5 DISMISSAL & TERMINATION 1.6 RECOVERY OF ADVANCE 1.7 ACCIDENTS 1.8 RECORD 1.9 LETTER OF APPOINTMENT EMPLOYEES PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952 2.1 SCOPE 2.2 CONTRIBUTION 2.3 RETURNS 2.4 REGISTERS PAYMENT OF BONUS ACT, 1965 3.1 SCOPE 3.2 CONTRIBUTION 3.3 RETURNS 3.4 REGISTERS EMPLOYEES STATE INSURANCE ACT, 1948 4.1 SCOPE 4.2 CONTRIBUTION 4.3 RETURNS 4.4 REGISTERS PAYMENT OF GRATUITY ACT, 1972 5.1 NOMINATION 5.2 AMOUNT 5.3 PAYMENT PERIOD 5.4 DISPLAY THE EMPLOYMENT EXCHANGES (COMPULSORY NOTIFICATION OF VACANCIES) ACT, 1959 6.1 SCOPE 6.2 RETURNS THE MATERNITY BENEFIT ACT, 1961 7.1 SCOPE 7.2 LEAVES 7.3 BONUS OTHERS 8.1 PERMANENT ACCOUNT NUMBER (PAN) FROM IT DEPARTMENT 8.2 TAX DEDUCTION ACCOUNT NUMBER (TAN) FROM IT DEPARTMENT 8.3 PROFESSION TAX DEDUCTION NUMBER ( CAN GET FROM SALES TAX OFFICE)

2.

3.

4.

5.

6. 7.

8.

1. SHOPS & ESTABLISHMENTS ACT

SECTION HEADING 1.1 Procedure for issue of new Registration Certificate

PROVISION a) Application: Made in the specified format b) Processing Charges : Rs 200/- to be paid along with the application c) Documents to be enclosed:

i) Ownership documents/Proof of Possession and/or Proof of authorization/tolerated status of the structure as format Indemnity Bond on non-judicial stamp paper ii) Undertaking/Indemnity bond as per the specified formats d) Inspection: Concerned Municipal Staff will visit the premises within 10 days from the date of receipt of application e) Issuance/Rejection: The processing gets completed within 15 days from the date of receipt of application and the applicant will be issued Registration Certificate or the rejection letter as the case may be. 1.2 Working Hours , Overtime & Close Day Normal working hours(Sec. 8) 9 hours a day /48 hours a week Opening hours not before 8 AM and closing hours not after 6 PM Rest (Sec. 10) 1/2 hour each day Period of continuous work not to exceed 5 hours Spread over(Sec. 11) 10 1/2 hours including interval for rest Overtime(Sec. 8) Should not exceed 54 hours including normal working hours in a week Overtime should not exceed 150 hours a year Close Day(Sec. 16) There should be one close day every week 3 National holidays (26 Jan, 15 Aug, 2 October) Weekly close day; and PL / CL PL -Not less than 15 days after every 12 months continuous service, provided that if an employee completes a period of 4 months in continuous employment, he shall be entitled to not less than 5 days PL for every such completed period. -Can be accumulated upto 3 years (i.e. upto 3 times the period of leave to which the employee is entitled after one year. -If an employee separates before he has been allowed PL, the employer shall pay him full wages for the period of leave due to him. SL/ CL -SL or CL not less than 12 days in a year, provided that if an employee completes a period of 1 month in continuous employment, he shall be entitled to not less than 1 days CL for every month. -Need not be accumulated beyond one year.

1.3 Compulsory holidays(Sec 16) 1.4 Leaves- Sec. 22

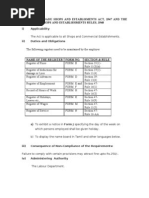

1.4 Wages during leave Sec. At a rate equivalent to daily average of his wages for the days on which he 23 actually worked during the preceding three months, excluding overtime, but including dearness allowance. 1.5 Notice of dismissal Sec. 30 1.5 Termination by or on behalf of the employer(Sec. 19-5) 1.6 Recovery of advances Sec. 20(2)(vi) 1.7 Accidents Sec. 29 In case of employee completing 3 months continuous service, minimum 1 months written notice/ payment in lieu thereof is required by either side, as the case may be. Wages to be paid before the expiry of 2nd working day after the day on which employment is terminated Deduction for recovery of advances should not exceed one-fourth of the wages earned in that month The provisions of Workmens Compensation Act 1923 shall apply if the accident occurs in the course of employment. If ESI is applicable to the employee, the employer shall cease to be liable under the Workmens Compensation Act. Close Day Notice (Form K); Hours worked, amount of leave taken, intervals allowed for rest and meals, particulars of all employment overtime; Form K to display. The following particulars should be contained in the appointment letter: The name of the employer; The name, if any, and the postal address of the establishment; The name, fathers name and the age of the employee; The hours of work; Date of appointment.

1.8 Records Sec. 33

1.9 Letters of appointments Sec. 34

2. EMPLOYEES' PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952

SECTION HEADING 2.1 Scope 2.2 Contribution

PROVISION To all establishments with 20 or more employees. Employees contribution upto a Salary (Basic + DA) less than or equal to Rs. 5000/- ; Salary (Basic + DA) <=5000 *Employer's share 8.33%-Pension; 3.67%-PF; 0.5%-EDLI. 1.10% or Rs.5, whichever is high, for administration of PF; 0.01% or Rs.2, whichever is high, for administration of EDLI; *Employee's share 12%-PF *Contribution to be deposited within 15 days through challan *Monthly- within 25 days (Form 3A) *Annual- within 30 days (Form 6A) *Return of membership, showing addition /deletion in members with details within 15 days of the close of every month (Form 9 / 5) *Eligibility Register: to record the particulars of every employee eligible to become a member of PF and the number of working days during each month *PF Register: in the form of contribution cards for each employee *PF Ledger: this ledger contains the total monthly contributions, withdrawals from the account, repayment of loans and balance at the end of each month *Inspection Book: to record the observations of an Inspector on his visit to the establishment

2.3 Returns

2.4 Registers

3. PAYMENT OF BONUS ACT, 1965

SECTION HEADING 3.1 Scope

PROVISION *Salary (Basic + DA + any payment on account of rise in the cost of living) less than or equal to Rs.3500/*Employee should have worked for at least 30 working days during that year *8.33-20% of wages, to be made within 8 months of close of Accounting Year Annual Return within 30 days after expiry of the time limit specified for payment of bonus (Form D) (Form A)register showing the computation of the allocable surplus (Form B)register showing set on and set off of the allocable surplus (Form C)register showing the details of the amount of bonus due to each employee, deductions therefrom and the amount disbursed

3.2 Contribution 3.3 Returns 3.4 Registers

4. EMPLOYEES' STATE INSURANCE ACT, 1948

SECTION HEADING 4.1 Scope

PROVISION * Salary less than or equal to Rs.6500/-, excluding any travelling allowance, and any sum paid to defray special expenses entailed by the employee by the nature of employment Employer-4.75% Employee-1.75% Bi-Annually return of contribution in quadruplicate within 30 days of the end of contribution period (Form 6) (Form 7) Covered employees

4.2 Contribution 4.3 Returns 4.4 Registers

(Form15) Accident Book, Inspection Book

5. PAYMENT OF GRATUITY ACT, 1972

SECTION HEADING 5.1 Nominations 5.2 Amount

PROVISION (Form F) Employees required to submit nominations in duplicate (Form H) Change in nominations *@15 days wages per completed year of service for employees completing 5 years or more; not to exceed Rs. 3,50,000/*Wages include all emoluments including DA, but does not include bonus, commission, HRA, overtime wages and any other allowance Payment of gratuity within 30 days of its becoming applicable *notice specifying name of the officer with designation, authorized to receive notices under the Act or rules; *an abstract of the Act and Rules in Form U

5.3 Period 5.4 Display

6. THE EMPLOYMENT EXCHANGES (COMPULSORY NOTIFICATION OF VACANCIES) ACT, 1959

SECTION HEADING 6.1 Scope 6.2 Returns

PROVISION -Notification of vacancies (where basic pay is more than or equal to Rs.1400/- PM) to employment exchange before filling up any vacancy. ER I quarterly return within 30 days for the number of employees (Male & female), and number of vacancies ER II biennial occupational return within 30 days for the number of employees under each prescribed category

7. THE MATERNITY BENEFIT ACT, 1961

SECTION HEADING 7.1 Scope 7.2 Leaves

PROVISION All Women employees who have worked for 80 days in the last 12 months, except the ones covered under the ESI Act. 12 Weeks, 6 weeks before the date of delivery and 6 weeks after the date of delivery. If a woman does not avail six weeks leave preceding the date of her delivery, she can avail of that leave following her delivery, provided the total leave period does not exceed 12 weeks. Miscarriage or medical termination of pregnancy- 6 weeks immediately following the date of her miscarriage/medical termination of pregnancy. 2 weeks immediately following her day of tubectomy operation

7.2 Leave for Miscarriage 7.2 Leave for tubectomy operation 7.3 Medical Bonus

Every women entitled to maternity benefit under the act shall also be entitled to receive a medical bonus of Rs.250/-, if no pre-natal confinement and post natal care is provided for by the employer free of charge.

You might also like

- Indian Labour Laws 136Document4 pagesIndian Labour Laws 136kritz57No ratings yet

- Labour LawsDocument5 pagesLabour LawsDinesh KumarNo ratings yet

- 14-Employment Act 1955Document46 pages14-Employment Act 1955Nor Azmi SabriNo ratings yet

- General Policies On LeavesDocument4 pagesGeneral Policies On LeavesRogelio del Rosario100% (2)

- Myanmar Employment Law OverviewDocument158 pagesMyanmar Employment Law OverviewKhineNo ratings yet

- Monetization of Leave CreditsDocument31 pagesMonetization of Leave Creditsapi-284317024100% (32)

- Applicablity of Labour Law in Service SectorDocument8 pagesApplicablity of Labour Law in Service SectorSameerNo ratings yet

- The Payment of Bonus ActDocument10 pagesThe Payment of Bonus Actshanky631No ratings yet

- Labor Law Project Covers Bonus Act and ESI ActDocument28 pagesLabor Law Project Covers Bonus Act and ESI ActbubaimaaNo ratings yet

- Statutory Compliance of All ActsDocument16 pagesStatutory Compliance of All ActsezhilarasanmpNo ratings yet

- Brief Notes Compliance Checklist Under Labour LawsDocument39 pagesBrief Notes Compliance Checklist Under Labour LawsJitendra Nagvekar100% (1)

- Pay and AllowancesDocument23 pagesPay and AllowancesRavi KumarNo ratings yet

- The Payment of Bonus Act, 1965Document36 pagesThe Payment of Bonus Act, 1965NiveditaSharmaNo ratings yet

- National and Festival Holidays: Factories Act, 1948Document5 pagesNational and Festival Holidays: Factories Act, 1948amsynergyNo ratings yet

- 15) Malaysia Employment Laws 1955Document45 pages15) Malaysia Employment Laws 1955thehrmaven2013100% (1)

- Telangana Labour Welfare Fund Rules 1988Document11 pagesTelangana Labour Welfare Fund Rules 1988Ashish MaanNo ratings yet

- Federal Government's Revised Leave Rules, 1980Document71 pagesFederal Government's Revised Leave Rules, 1980Sher Ali Khan83% (30)

- INDUSTRIAL DISPUTES ACT OVERVIEWDocument32 pagesINDUSTRIAL DISPUTES ACT OVERVIEWLatha Dona VenkatesanNo ratings yet

- Payment of Gratuity ActDocument36 pagesPayment of Gratuity ActAkhilaSridhar 21No ratings yet

- Chapter II BLC 2006: M. A. Bashar Professor Management Studies University of ChittagongDocument30 pagesChapter II BLC 2006: M. A. Bashar Professor Management Studies University of ChittagongFàrhàt HossainNo ratings yet

- Volunta RetirementDocument4 pagesVolunta RetirementC.P,1, PUZHALNo ratings yet

- Statutory Compliance - PF and GratuityDocument11 pagesStatutory Compliance - PF and GratuityHusna SadiyaNo ratings yet

- Payment of Wages Act 1936Document22 pagesPayment of Wages Act 1936Vetri Velan100% (1)

- 7 Serrano V Soeverino Santos G.R. No. 187698 August 9 2010Document2 pages7 Serrano V Soeverino Santos G.R. No. 187698 August 9 2010Mae BernadetteNo ratings yet

- The Child LabourDocument6 pagesThe Child LabourJithin KrishnanNo ratings yet

- Leave Rules As Per Factories Act 1948Document5 pagesLeave Rules As Per Factories Act 1948Dhanasekar BNo ratings yet

- Leave Rules PDFDocument6 pagesLeave Rules PDFRamu BanothNo ratings yet

- Work Hours LACE 3.28.12Document43 pagesWork Hours LACE 3.28.12bienvenido.tamondong TamondongNo ratings yet

- Balochistan Province Civil Servants Leave RulesDocument10 pagesBalochistan Province Civil Servants Leave RulesSirajMeerNo ratings yet

- FACTORY AND LABOR LAWSDocument22 pagesFACTORY AND LABOR LAWSAkhil NagpalNo ratings yet

- Andhra Pradesh Labour Welfare Fund Rules, 1988 PDFDocument5 pagesAndhra Pradesh Labour Welfare Fund Rules, 1988 PDFneohorizonsNo ratings yet

- Bonus Act eligibility and disqualification provisionsDocument12 pagesBonus Act eligibility and disqualification provisionsrashmaNo ratings yet

- The Payment of Wages Act, 1936Document19 pagesThe Payment of Wages Act, 1936H N Sahu90% (10)

- Employment Agreement Template 2020Document5 pagesEmployment Agreement Template 2020Mary gil AurelioNo ratings yet

- Portability Law (RA 7699) : Creditable Service Valdez Vs Gsis G.R. 14617 June 30, 2008Document8 pagesPortability Law (RA 7699) : Creditable Service Valdez Vs Gsis G.R. 14617 June 30, 2008Debra RuthNo ratings yet

- Abstract of Payment of Gratuity Act & Rules, 1972, Form UDocument4 pagesAbstract of Payment of Gratuity Act & Rules, 1972, Form UPankaj Mehra100% (2)

- Sr. No. Act Provisions Forms FrequencyDocument6 pagesSr. No. Act Provisions Forms FrequencyAkshay Guleria AkkiNo ratings yet

- BCEA Summary GuideDocument8 pagesBCEA Summary GuideXavier HumanNo ratings yet

- Panduan Penyediaan DLDocument6 pagesPanduan Penyediaan DLZeeshan AbbasNo ratings yet

- Chapter 5 LEAVEDocument49 pagesChapter 5 LEAVEjanyaaan100% (2)

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- Prescribed Government Working HoursDocument53 pagesPrescribed Government Working HoursLizette Sy100% (6)

- RA 7641 RETIREMENT PAY LAW GUIDELINESDocument6 pagesRA 7641 RETIREMENT PAY LAW GUIDELINESIller Anne AniscoNo ratings yet

- Lecture 4 Individual Statutory Rights Affecting The Course of Employment Lecture VersionDocument51 pagesLecture 4 Individual Statutory Rights Affecting The Course of Employment Lecture VersionNg Yih MiinNo ratings yet

- Abstract of Labour LawsDocument4 pagesAbstract of Labour LawsVishwesh KoundilyaNo ratings yet

- Statutory Check List 927Document62 pagesStatutory Check List 927Saravana KumarNo ratings yet

- Employee Provident Fund & Miscellaneous ACT 1952: Abhishek NagreDocument28 pagesEmployee Provident Fund & Miscellaneous ACT 1952: Abhishek NagreSaiPhaniNo ratings yet

- 1 Wages Boards OrdinanceDocument37 pages1 Wages Boards Ordinancesandhwani3893No ratings yet

- Annual Leave Act SummaryDocument7 pagesAnnual Leave Act SummaryNityaNo ratings yet

- Contract Employment Junior Day CareDocument8 pagesContract Employment Junior Day CareCalvinhoNo ratings yet

- Employee Sample ContractDocument2 pagesEmployee Sample ContractAnne CNo ratings yet

- Labour Laws KPTCL NotesDocument9 pagesLabour Laws KPTCL NotesSanthosh RMNo ratings yet

- Seminar 6 QDocument7 pagesSeminar 6 QAccount SpamNo ratings yet

- Pension Handbook for Family PensionersDocument77 pagesPension Handbook for Family PensionersVenugopalNo ratings yet

- Payment of Wages Act-LABOUR LAWDocument6 pagesPayment of Wages Act-LABOUR LAWArunaML100% (1)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- AIHR People Analytics Resource LibraryDocument25 pagesAIHR People Analytics Resource LibraryAlexNo ratings yet

- Sample Employee HandbookDocument38 pagesSample Employee HandbookAid BolanioNo ratings yet

- UPL Leave Policy IndiaDocument8 pagesUPL Leave Policy IndiaBrijnandan TiwariNo ratings yet

- Complete Payroll - Template - Time and Attendance PolicyDocument4 pagesComplete Payroll - Template - Time and Attendance PolicyiamgodrajeshNo ratings yet

- Synise HandbookDocument60 pagesSynise HandbookrajeshNo ratings yet

- KPI Discussion Paper 3Document22 pagesKPI Discussion Paper 3Manager HR Hijaz Hospital100% (1)

- Employee HandbookDocument28 pagesEmployee Handbookacsi1966No ratings yet

- Attendance Procedure at BSA (Final)Document4 pagesAttendance Procedure at BSA (Final)naveed ahmed100% (1)

- Adobe India Leaves and Holiday Policy 2018Document5 pagesAdobe India Leaves and Holiday Policy 2018RakeshNo ratings yet

- Synise HandbookDocument60 pagesSynise HandbookrajeshNo ratings yet

- HR PolicyDocument35 pagesHR PolicyNooral AlfaNo ratings yet

- HR Policies and Procedures F-HR6:2:007:05: 4.1 Identity Card Issuing ProcedureDocument4 pagesHR Policies and Procedures F-HR6:2:007:05: 4.1 Identity Card Issuing ProcedureiamgodrajeshNo ratings yet

- Upes Principles of Engagement: Human ResourcesDocument8 pagesUpes Principles of Engagement: Human ResourcesiamgodrajeshNo ratings yet

- ClearPoint Healthcare KPIsDocument19 pagesClearPoint Healthcare KPIsJosue PazNo ratings yet

- Interview Report: (Name Disguised To Protect Confidentiality)Document2 pagesInterview Report: (Name Disguised To Protect Confidentiality)iamgodrajeshNo ratings yet

- Attendance PolicyDocument7 pagesAttendance Policyiamgodrajesh100% (1)

- Purpose: Transfer and RelocationDocument3 pagesPurpose: Transfer and RelocationiamgodrajeshNo ratings yet

- Exit PolicyDocument9 pagesExit PolicyiamgodrajeshNo ratings yet

- Employee HandbookDocument28 pagesEmployee Handbookacsi1966No ratings yet

- Okr For Human Resource Team: Sample OkrsDocument4 pagesOkr For Human Resource Team: Sample OkrsiamgodrajeshNo ratings yet

- Contemporary Recruitment and Selection ProcessDocument16 pagesContemporary Recruitment and Selection ProcessiamgodrajeshNo ratings yet

- Biometric Attendance System: (Nodal Officer Manual)Document65 pagesBiometric Attendance System: (Nodal Officer Manual)iamgodrajeshNo ratings yet

- Shops & Establishment Act: HandbookDocument9 pagesShops & Establishment Act: HandbookiamgodrajeshNo ratings yet

- Employee Exit Policy: PurposeDocument2 pagesEmployee Exit Policy: PurposeiamgodrajeshNo ratings yet

- Punjab Labour Welfar Fund ActDocument22 pagesPunjab Labour Welfar Fund ActiamgodrajeshNo ratings yet

- Rambh: An Amd InitiativeDocument20 pagesRambh: An Amd InitiativeiamgodrajeshNo ratings yet

- Ag Au JH Office Manual Chapter 16 20200714110442Document27 pagesAg Au JH Office Manual Chapter 16 20200714110442iamgodrajeshNo ratings yet

- Tr-trf9triT cf. 36 lig 1983Document109 pagesTr-trf9triT cf. 36 lig 1983iamgodrajeshNo ratings yet

- Sample Employment Contract TemplateDocument2 pagesSample Employment Contract TemplateDestina AsiaNo ratings yet

- Vi Business Plus Plans For COCPDocument3 pagesVi Business Plus Plans For COCPiamgodrajeshNo ratings yet

- Ratio Analysis - Montex PensDocument28 pagesRatio Analysis - Montex Penss_sannit2k9No ratings yet

- Foreclosure Mill Albertelli LawDocument12 pagesForeclosure Mill Albertelli LawAlbertelli_Law100% (3)

- Chapter 17 ACCOUNTING FOR NOT FOR PROFIT ORGANIZATIONSDocument22 pagesChapter 17 ACCOUNTING FOR NOT FOR PROFIT ORGANIZATIONSJammu JammuNo ratings yet

- Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument48 pagesPartnerships - Formation, Operations, and Changes in Ownership InterestsAyu TrikatonNo ratings yet

- Mortgage Foreclosure DisputeDocument7 pagesMortgage Foreclosure DisputePea ChubNo ratings yet

- India Infrastructure Report PDFDocument159 pagesIndia Infrastructure Report PDFSirsanath Banerjee50% (2)

- PIL Challenges Implementation of GST from July 1Document33 pagesPIL Challenges Implementation of GST from July 1aditya vermaNo ratings yet

- Reaction Paper On GRP 12Document2 pagesReaction Paper On GRP 12Ayen YambaoNo ratings yet

- Salary NegotiationDocument54 pagesSalary NegotiationCaroline Eleonora100% (1)

- ACT Bill December 2019Document4 pagesACT Bill December 2019kulaiNo ratings yet

- Special Terms and Conditions For Hiring of Light VehiclesDocument4 pagesSpecial Terms and Conditions For Hiring of Light VehiclesChowkidar Dhirendra Pratap SinghNo ratings yet

- Fria QuizDocument2 pagesFria QuizdavidgollaNo ratings yet

- Chapter 15 International FinanceDocument31 pagesChapter 15 International FinanceSANANDITA DASGUPTA 1723585100% (1)

- Week 2 Titman - PPT - CH05Document45 pagesWeek 2 Titman - PPT - CH05Nuralfiyah MuisNo ratings yet

- Chila Saln 2019Document2 pagesChila Saln 2019Glorie Lyn Prevendido ZapantaNo ratings yet

- Assessing Financial Statements: Travis Remick Bond Manager Contract Surety (206) 473-3638Document9 pagesAssessing Financial Statements: Travis Remick Bond Manager Contract Surety (206) 473-3638Alice LinNo ratings yet

- Chapter 6 Managing Your Money: Personal Finance, 6e (Madura)Document22 pagesChapter 6 Managing Your Money: Personal Finance, 6e (Madura)Huỳnh Lữ Thị NhưNo ratings yet

- PT SLJ Global Tbk Consolidated Financial Statements for Q3 2017Document91 pagesPT SLJ Global Tbk Consolidated Financial Statements for Q3 2017J KNo ratings yet

- Midterm 1 WQ08 KEY financial termsDocument10 pagesMidterm 1 WQ08 KEY financial termsmidaksNo ratings yet

- What is an ADR? Guide to American Depositary ReceiptsDocument9 pagesWhat is an ADR? Guide to American Depositary ReceiptsyashpoojaraiNo ratings yet

- Republic Act No. 7918 - Amendment To E.O. No. 226 (Omnibus InvestmentsDocument3 pagesRepublic Act No. 7918 - Amendment To E.O. No. 226 (Omnibus InvestmentsMaria Celiña PerezNo ratings yet

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburNo ratings yet

- Case Digest - FRIADocument13 pagesCase Digest - FRIAAiko DalaganNo ratings yet

- LTA - FormDocument3 pagesLTA - FormpowermuruganNo ratings yet

- Audit Nightly TransactionsDocument3 pagesAudit Nightly Transactionsfiles onleh100% (1)

- UNIT IV - The Accommodation Product Notes PDFDocument16 pagesUNIT IV - The Accommodation Product Notes PDFKiran audinaNo ratings yet

- Aoc 026 PDFDocument3 pagesAoc 026 PDFchrisNo ratings yet

- Global Economic Crisis causes and impactDocument14 pagesGlobal Economic Crisis causes and impactSridip AdhikaryNo ratings yet

- Finance II - CHP 13 MCQDocument2 pagesFinance II - CHP 13 MCQjudyNo ratings yet

- NegoDocument8 pagesNegoJohn M. MoradaNo ratings yet