Professional Documents

Culture Documents

Yesterday Is Gone: Think of Tomorrow

Uploaded by

Gilford SecuritiesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yesterday Is Gone: Think of Tomorrow

Uploaded by

Gilford SecuritiesCopyright:

Available Formats

May 17, 2013

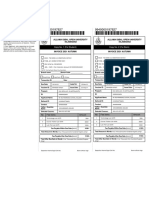

SOSNICK ON RETAILERS

J.C. Penney

Yesterday Is Gone: Think of Tomorrow

BUY

JCP-NYSE 52-Week Range Market Cap. Shares Outstdg. Book Value/Sh. Debt/Total Cap. Divd. Yield Avg. Daily Vol.

$18.30 $33.-$14 $4.1bn 220mn $13.00 60% Nil 5.6mm

Investment Opinion: JCP is moving from danger to a more secure foundation to build upon. CEO Ullman has improved finances. Next should come operating results, and that might not take long. A rally to $20-$25 seems likely. More might follow. Eighteen months of mismanagement by Ron Johnson et al are over. But the past is not entirely behind us because the Board of Directors, culpable for this misadventure, is still in place. Men and women worthy of respect, would come to the annual meeting with resignation in hand, especially William Ackman who pressured for damaging changes that undermined the company and investment portfolios. The carnage under Johnson was on display again with the report of 1Q/13 operating resultshuge loss and cash burn to the point of requiring large loans to carry on. The Board permitted Johnson to plunge ahead with big capital expenditures to redo home departments, leaving $325mm of bills to be paid in 2Q/13. Mike Ullman took responsibility for the company five weeks ago and has quickly shown that he can stabilize it, bringing in needed cash and setting a sober course for correction of errors. Penney is in a deep hole, but in our opinion, it is not a bottomless pit: There is daylight, as evidence by what apparently was a strong positive response by customers to Penneys marketing on Mothers Day. We anticipate more news in that vein now that the worst of Johnsons decisionsabsence of promotionshas been reversed.

2015E 2014E 2013E 2012 2011 2010

EPS: 1.40 0.71 (1.95) (4.49) 0.68 1.59

P/E 13.1x 25.7x NM NM

Bernard Sosnick 631-964-8716

bernard.sosnick@gilfordsecurities.com

JCPs earnings release cited the thought of look forward, not back. We agree entirely. We doubt that another loss of sales and profits as large as the first quarters will occur in the foreseeable future. The upside potential for EPS is not determinable yet might surprise on the upside, along with stock price appreciation.

Please refer to Page 3 of this document for important disclosures

Page 1

Gilford Securities Incorporated

J.C. Penney

For a full text version of this report, which includes the model and other details of note, please contact the analyst.

Risks

Penney faces the macro-economic risks normal to retailers but its greatest risks are internal. Financial risk will be the primary risk for shareholders, although that should be eased by the receipt of $1.75bn from a new loan agreement. We believe CEO Ullmans first actions are encouraging but that does not assure a favorable outcome for the company. We believe Penney is better positioned to rebuild sales than seems to be the prevailing opinion, but our premise remains to be tested. We cannot reliably estimate earnings at this point or be confident that JCP will become profitable. We believe changes in the Board of Directors are required, but cannot be certain this will happen. JCP remains a risky situation. Investors should be able to accept abnormal risk and be willing speculate that a turn for the better is occurring.

Page 2

Gilford Securities Incorporated

J.C. Penney

ANALYST CERTIFICATION I, Bernard Sosnick, certify that all the views expressed in this research report accurately reflect my personal views of the subject company (ies). I also certify that I have not and will not receive compensation with respect to the issuance of this report. REQUIRED DISCLOSURES In the normal course of business, Gilford Securities seeks to perform investment banking and other services for various companies and to receive compensation in connection with such services. As such, Gilford Securities intends to seek compensation for investment banking services from the subject companies in the next 3 months. The analysts responsible for preparing research reports are compensated on commissions from non-investment banking activities such as transactional trading and research fees. POTENTIAL RISKS Economic conditions in the US represent the foremost risks to Penneys sales and earnings, in our opinion. The company also faces challenges from formidable competitors that might block the company from achieving its business plan for 2010-2014. Gilford Securities, Inc. has prepared the information and opinions in this report based on our analysis of public information. Gilford Securities, Inc. makes every effort to use reliable, comprehensive information, but we make no representation that the information is accurate or complete. Recipients should consider this report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments. ANALYST STOCK RATINGS Buy Sell The stock should outperform its industry or peer group by 20% or greater within a 12-18 month time frame. The stock is expected to under-perform its industry or peer group by 20% or greater within a 12-18 month time frame, or where fundamentals of a company have deteriorated significantly and the stock is expected to materially depreciate.

Neutral Performance in-line relative to broad market indexes and/or a representative peer-group return over 12-18 months; a potential source of funds.

Distribution of Gilford Ratings (As of 05-09-13)

IB Services* Category Coverage Buy 58% 5% Neutral 39% 23% Sell 3% 0% * Percentage of companies within this category for whom Gilford has provided investment banking (IB) Services within the last 12 months.

Date May20,2010 July21,2010 January28,2011 February14,2011 February25,2011 March7,2011 October7,2011 November14,2011 November14,2011 February1,2012 March1,2012 March22,2012 May8,2012 June 19,2012 July24,2012 July30,2012 August15,2012 September25,2012 November13,2013 January29,2013 February5,2013 February14,2013 February28,2013 March1,2013 March5,2013 March7,2013 March19,2013 April 4,2013 April 9,2013 April 22,2013 April 29,2013 May1,2013 May8,2013 May10,2013 May17,2013 Rating Hold Hold Buy Buy Buy Buy Buy Buy Buy Buy Hold Hold Hold Hold Hold Hold Hold Hold Hold Hold Hold Sell Sell Sell Sell Sell Sell Neutral Neutral Buy Buy Buy Buy Buy Buy Price $26.25 $23.63 $32.90 $36.30 $34.61 $34.11 $28.80 $33.00 $33.00 $41.00 $39.00 $36.75 $33.35 $21.95 $21.12 $22.00 $23.36 $24.82 $17.75 $20.35 $19.90 $19.80 $21.15 $17.57 $15.60 $14.43 $16.44 $14.83 $14.20 $15.25 $17.00 $16.00 $17.70 $17.50 $18.30

Bernard Sosnick 631-964-8716

bernard.sosnick@gilfordsecurities.com

ADDITIONAL INFORMATION AVAILABLE UPON REQUEST

Page 3

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Faks Borang Pemindahan Baki: Langkah 1Document1 pageFaks Borang Pemindahan Baki: Langkah 1Mazlan AmingNo ratings yet

- Page 1of 19Document19 pagesPage 1of 19Ricardo PaduaNo ratings yet

- General JournalDocument2 pagesGeneral JournalJacob SnyderNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- ATA Contract Virtual OfficeDocument6 pagesATA Contract Virtual OfficeGuo YanmingNo ratings yet

- GFGC - K. R. Pet - Preliminary Exam For Business Quiz - 2019Document2 pagesGFGC - K. R. Pet - Preliminary Exam For Business Quiz - 2019Kiran A SNo ratings yet

- Equity Research (Titan Biotech Limited)Document9 pagesEquity Research (Titan Biotech Limited)Dhruv ThakkarNo ratings yet

- Banking Maths ProjectDocument7 pagesBanking Maths ProjectSarthak Chauhan58% (62)

- Zoya ProjectDocument60 pagesZoya Projectanas khanNo ratings yet

- HLB CC Sutera Plat TNCDocument3 pagesHLB CC Sutera Plat TNCAnonymous gMgeQl1SndNo ratings yet

- Corporate Finance Current Papers of Final Term PDFDocument35 pagesCorporate Finance Current Papers of Final Term PDFZahid UsmanNo ratings yet

- AAOIFI Footprint Layout Final Report 1Document226 pagesAAOIFI Footprint Layout Final Report 1bilal12941No ratings yet

- SITXFIN004 - Prepare and Monitor BudgetDocument5 pagesSITXFIN004 - Prepare and Monitor BudgetAnaya Ranta50% (4)

- IIPC Report Morocco Luetjens Scheck FinalDocument58 pagesIIPC Report Morocco Luetjens Scheck Finalhubba180No ratings yet

- Commercial BankCommercial Bank Address - Bank Sentral Republik Indonesia Address - Bank Sentral Republik IndonesiaDocument5 pagesCommercial BankCommercial Bank Address - Bank Sentral Republik Indonesia Address - Bank Sentral Republik IndonesiaAndang We SNo ratings yet

- David WintersDocument8 pagesDavid WintersRui BárbaraNo ratings yet

- 5 6332319680358777015Document6 pages5 6332319680358777015Hitin100% (1)

- Maybank List ReportDocument3 pagesMaybank List ReportpalmkodokNo ratings yet

- MRTP ActDocument29 pagesMRTP ActawasarevinayakNo ratings yet

- Bar Review Material No. 3 PDFDocument2 pagesBar Review Material No. 3 PDFScri Bid100% (1)

- Strategic Management: Implementing Strategies: Marketing IssuesDocument37 pagesStrategic Management: Implementing Strategies: Marketing IssuesAli ShanNo ratings yet

- Bankers Blanket Bond Proposal FormDocument34 pagesBankers Blanket Bond Proposal FormTeodora KotevskaNo ratings yet

- E - Portfolio Assignment MacroDocument8 pagesE - Portfolio Assignment Macroapi-316969642No ratings yet

- Board Resolution FormatDocument3 pagesBoard Resolution Formatjayanthi_kondaNo ratings yet

- Dissertation Topics in Financial EconomicsDocument5 pagesDissertation Topics in Financial EconomicsOrderAPaperOnlineUK100% (1)

- Template For Loan AgreementDocument3 pagesTemplate For Loan AgreementlegallyhungryblueNo ratings yet

- Obligations and Contracts Interest Interest RatesDocument9 pagesObligations and Contracts Interest Interest Ratesdwight yuNo ratings yet

- Coursepack Basic AccountingDocument61 pagesCoursepack Basic Accountingdeepak singhalNo ratings yet

- Hedging With Futures PDFDocument35 pagesHedging With Futures PDFmichielx1No ratings yet

- Project Manager Inc. Real Estate DevelopmentDocument13 pagesProject Manager Inc. Real Estate DevelopmentinventionjournalsNo ratings yet