Professional Documents

Culture Documents

Oyster Bay Press Release - 25 July 2013

Uploaded by

NewsdayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oyster Bay Press Release - 25 July 2013

Uploaded by

NewsdayCopyright:

Available Formats

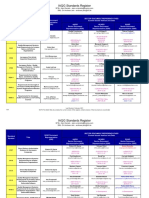

Rating On Oyster Bay, NY's GO Bonds Put On CreditWatch Negative On Uncertain Financial Position

Primary Credit Analyst: Lindsay Wilhelm, New York (1) 212-438-2301; lindsay.wilhelm@standardandpoors.com Secondary Contact: Timothy W Barrett, New York (1) 212-438-6327; timothy.barrett@standardandpoors.com

NEW YORK (Standard & Poor's) July 25, 2013--Standard & Poor's Ratings Services has placed its 'A' rating on Oyster Bay, N.Y.'s general obligation (GO) bonds on CreditWatch with negative implications. "The CreditWatch reflects our view that if a voter referendum for a property sale fails to pass on Aug. 20, 2013, or the sale does not otherwise proceed as planned, the town could have difficulty meeting its financial obligations if it further fails to receive state approval to issue deficit bonds on a timely basis," said Standard & Poor's credit analyst Lindsay Wilhelm. However, if the referendum is successful and Oyster Bay is able to close on the sale quickly, we believe that the proceeds should help stabilize the town's deficit reserve position. At the same time, Standard & Poor's assigned its 'SP-1' short-term rating to Oyster Bay's series 2013 bond anticipation notes (BANs). The 'SP-1' rating reflects our assessment of Oyster Bay's general creditworthiness, coupled with a low market risk profile. That profile reflects Oyster Bay's strong legal authority to issue long-term debt to take out the notes, as well as its position as a frequent debt issuer that regularly provides ongoing disclosure to market participants. The 'A' GO rating further reflects our opinion of the town's: Financial deterioration due to general fund deficits in each of the past seven fiscal years, as well as deficit balances in nearly all of the

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JULY 25, 2013 1

1167215 | 301932398

Rating On Oyster Bay, NY's GO Bonds Put On CreditWatch Negative On Uncertain Financial Position

town's major operating funds at the close of 2012; Significant fixed costs, including pension and other postemployment benefit (OPEB) payments coupled with a large unfunded OPEB liability. We believe these rating weaknesses are somewhat offset by the town's: Diverse economy with easy access to New York City; and Very strong wealth and incomes and a large, diverse property tax base. The town's faith and credit GO pledge secures the BANs. Officials plan to use proceeds to redeem approximately $158 million of BANs outstanding and provide approximately $42 million in new money for capital projects. Officials expect to begin converting the BANs to long-term debt within the next 12-18 months. We understand that a portion of the proceeds will be used for Superstorm Sandy-related park and highway capital costs and that the town is applying for Federal Emergency Management Agency (FEMA) reimbursement, which it will use to pay off that portion of the BANs. Within the next 90 days, we expect to have clarity on the town's ability to finance its current year budget with proceeds from either the land sale or the state-approved deficit bonds. If Oyster Bay receives proceeds on schedule and adopts a reasonable and structurally balanced operating budget for fiscal 2014, we could revise the outlook to stable. Failure to adopt a budget that will put the town on a fiscally sustainable path could lead to a negative rating action of one or more notches. Conversely, we could take significant negative rating action if the town is unable to execute on either the land sale or the bonds, unless viable alternatives are quickly identified to meet its debt and financial obligations. RELATED CRITERIA AND RESEARCH USPF Criteria: GO Debt, Oct. 12, 2006 USPF Criteria: Bond Anticipation Note Rating Methodology, Aug. 31, 2011

Complete ratings information is available to subscribers of RatingsDirect at www.globalcreditportal.com and at www.spcapitaliq.com. All ratings affected by this rating action can be found on Standard & Poor's public Web site at www.standardandpoors.com. Use the Ratings search box located in the left column.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JULY 25, 2013 2

1167215 | 301932398

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

JULY 25, 2013 3

1167215 | 301932398

You might also like

- Santos IndictmentDocument20 pagesSantos IndictmentNewsdayNo ratings yet

- Newsday/Siena Survey ResultsDocument8 pagesNewsday/Siena Survey ResultsNewsdayNo ratings yet

- From The Archives: Alicia Patterson Will Fly Airlift For Europe SurveyDocument1 pageFrom The Archives: Alicia Patterson Will Fly Airlift For Europe SurveyNewsdayNo ratings yet

- Nassau County Coliseum LeaseDocument502 pagesNassau County Coliseum LeaseNewsdayNo ratings yet

- Read The Affidavit On The Mar-A-Lago WarrantDocument38 pagesRead The Affidavit On The Mar-A-Lago WarrantNewsdayNo ratings yet

- Babylon DocumentsDocument20 pagesBabylon DocumentsNewsdayNo ratings yet

- Sigismondi LetterDocument1 pageSigismondi LetterNewsdayNo ratings yet

- Bench Trial Decision and OrderDocument20 pagesBench Trial Decision and OrderNewsdayNo ratings yet

- nextLI Blue Economy ResearchDocument73 pagesnextLI Blue Economy ResearchNewsday100% (1)

- Resume of George SantosDocument2 pagesResume of George SantosNewsdayNo ratings yet

- Donald J. Trump SOFDocument13 pagesDonald J. Trump SOFNewsdayNo ratings yet

- Statement by Donald J. Trump, 45th President of The United States of AmericaDocument2 pagesStatement by Donald J. Trump, 45th President of The United States of AmericaNewsdayNo ratings yet

- Trump Court TranscriptDocument32 pagesTrump Court TranscriptNewsday50% (2)

- Documents From Babylon FOILDocument20 pagesDocuments From Babylon FOILNewsdayNo ratings yet

- South Shore Sea Gate Study - NOVEMBER 16 2022 PresentationDocument33 pagesSouth Shore Sea Gate Study - NOVEMBER 16 2022 PresentationNewsdayNo ratings yet

- DiNotoEugenePleaAgreement CourtfiledDocument16 pagesDiNotoEugenePleaAgreement CourtfiledNewsdayNo ratings yet

- SEO: What You Need To Know: (Some Slides From Kyle Sutton, Sr. Project Manager, SEO at Gannett/USA TODAY Network)Document46 pagesSEO: What You Need To Know: (Some Slides From Kyle Sutton, Sr. Project Manager, SEO at Gannett/USA TODAY Network)NewsdayNo ratings yet

- DiNotoRobertPleaAgreement CourtfiledDocument12 pagesDiNotoRobertPleaAgreement CourtfiledNewsdayNo ratings yet

- Data Incident Report - RedactedDocument3 pagesData Incident Report - RedactedNewsdayNo ratings yet

- Genova Matter Opinion and OrderDocument6 pagesGenova Matter Opinion and OrderNewsdayNo ratings yet

- Go by LIRR? I Think I Can, I Think I CanDocument3 pagesGo by LIRR? I Think I Can, I Think I CanNewsdayNo ratings yet

- Statement by Donald J. Trump, 45th President of The United States of AmericaDocument2 pagesStatement by Donald J. Trump, 45th President of The United States of AmericaNewsdayNo ratings yet

- Signed Complaint JakubonisDocument6 pagesSigned Complaint JakubonisNewsdayNo ratings yet

- Brian Laundrie LettersDocument9 pagesBrian Laundrie LettersNewsdayNo ratings yet

- United States v. Frank James - ComplaintDocument10 pagesUnited States v. Frank James - ComplaintNewsdayNo ratings yet

- Read The Full Decision From The Supreme CourtDocument213 pagesRead The Full Decision From The Supreme CourtNewsdayNo ratings yet

- Brian Benjamin IndictmentDocument23 pagesBrian Benjamin IndictmentNewsdayNo ratings yet

- USA Vs Oyster Bay Doc. 130Document17 pagesUSA Vs Oyster Bay Doc. 130Newsday100% (1)

- United States Attorney Eastern District of New York: U.S. Department of JusticeDocument25 pagesUnited States Attorney Eastern District of New York: U.S. Department of JusticeNewsdayNo ratings yet

- East Hampton FAA Airport LetterDocument4 pagesEast Hampton FAA Airport LetterNewsdayNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Order in Respect of Application Filed by Munjal M Jaykrishna Family Trust Under Regulation 11 of Takeover Regulations, 2011 For Acquisition of Shares in AksharChem (India) LimitedDocument10 pagesOrder in Respect of Application Filed by Munjal M Jaykrishna Family Trust Under Regulation 11 of Takeover Regulations, 2011 For Acquisition of Shares in AksharChem (India) LimitedShyam SunderNo ratings yet

- What Causes Small Businesses To FailDocument11 pagesWhat Causes Small Businesses To Failmounirs719883No ratings yet

- Average Due Date and Account CurrentDocument80 pagesAverage Due Date and Account CurrentShynaNo ratings yet

- Factors That Shape The Company's Strategy: (I) Internal Environment FactorsDocument6 pagesFactors That Shape The Company's Strategy: (I) Internal Environment Factorsmba departmentNo ratings yet

- Accounting Crossword Puzzle Answer KeyDocument1 pageAccounting Crossword Puzzle Answer KeyFru RyNo ratings yet

- Memorandum of Contract For Sale and Purchase of Property PDFDocument2 pagesMemorandum of Contract For Sale and Purchase of Property PDFLee LenynnNo ratings yet

- Fundamental Analysis On Stock MarketDocument6 pagesFundamental Analysis On Stock Marketapi-3755813No ratings yet

- 60MT TraderDocument71 pages60MT TradersriNo ratings yet

- A Review of Journal/Article Title: Introducing The Hoshin Kanri Strategic Management System in Manufacturing Sme'SDocument2 pagesA Review of Journal/Article Title: Introducing The Hoshin Kanri Strategic Management System in Manufacturing Sme'SAlmas Pratama IndrastiNo ratings yet

- The New Leader's 100-Day Action PlanDocument15 pagesThe New Leader's 100-Day Action Planramjet1No ratings yet

- Export Manager or Latin America Sales ManagerDocument3 pagesExport Manager or Latin America Sales Managerapi-77675289No ratings yet

- Chanakya Neeti on ManagementDocument19 pagesChanakya Neeti on ManagementShivamNo ratings yet

- Policy On Prohibition of Child LaborDocument2 pagesPolicy On Prohibition of Child LaborkkyuvarajNo ratings yet

- Scanner for CA Foundation covers key conceptsDocument34 pagesScanner for CA Foundation covers key conceptsMadhaan Aadhvick100% (2)

- Customer Service ExcellenceDocument19 pagesCustomer Service ExcellenceAnh ThưNo ratings yet

- Prelim Quiz 2 Strategic ManagementDocument4 pagesPrelim Quiz 2 Strategic ManagementRoseNo ratings yet

- The Challenges of Funding Banks in 2012: AB+F Mortgage Innovation Forum 14 March 2012, SydneyDocument13 pagesThe Challenges of Funding Banks in 2012: AB+F Mortgage Innovation Forum 14 March 2012, Sydneyapi-128364016No ratings yet

- Planning & Strategic ManagementDocument135 pagesPlanning & Strategic ManagementSurajit GoswamiNo ratings yet

- Air BNB Business AnalysisDocument40 pagesAir BNB Business AnalysisAdolf NAibaho100% (1)

- Ril JioDocument6 pagesRil JioBizvin OpsNo ratings yet

- Urban DesignDocument22 pagesUrban DesignAbegail CaisedoNo ratings yet

- 444 Advanced AccountingDocument3 pages444 Advanced AccountingTahir Naeem Jatt0% (1)

- LC Draft Raw Cashew NutDocument5 pagesLC Draft Raw Cashew NutUDAYNo ratings yet

- Crs Report For Congress: Worldcom: The Accounting ScandalDocument6 pagesCrs Report For Congress: Worldcom: The Accounting ScandalMarc Eric RedondoNo ratings yet

- Risk Report: Marriott HotelDocument19 pagesRisk Report: Marriott HotelBao Thy Pho100% (1)

- Managing With Agile - Peer-Review Rubric (Coursera)Document8 pagesManaging With Agile - Peer-Review Rubric (Coursera)awasNo ratings yet

- Centum Rakon India CSR Report FY 2020-21Document14 pagesCentum Rakon India CSR Report FY 2020-21Prashant YadavNo ratings yet

- Presentacion Evolucion Excelencia Operacional - Paul Brackett - ABBDocument40 pagesPresentacion Evolucion Excelencia Operacional - Paul Brackett - ABBHERMAN JR.No ratings yet

- IAQG Standards Register Tracking Matrix February 01 2021Document4 pagesIAQG Standards Register Tracking Matrix February 01 2021sudar1477No ratings yet

- City Gas Distribution Projects: 8 Petro IndiaDocument22 pagesCity Gas Distribution Projects: 8 Petro Indiavijay240483No ratings yet