Professional Documents

Culture Documents

Jagu NPA

Uploaded by

imran6786Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jagu NPA

Uploaded by

imran6786Copyright:

Available Formats

DEFINITION OF NPAS A NPA is a loan or an advance where; Interest and/ or installment of principal remain overdue for a period of more

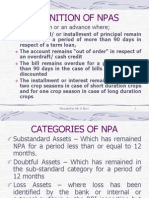

than 90 days in respect of a term loan, The account remains out of order in respect of an overdraft/ cash credit The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted The installment or interest remains overdue for two crop seasons in case of short duration crops and for one crop season in case of long duration crops CATEGORIES OF NPA Substandard Assets Which has remained NPA for a period less than or equal to 12 months. Doubtful Assets Which has remained in the sub-standard category for a period of 12 months Loss Assets where loss has been identified by the bank or internal or external auditors or the RBI inspection but the amount has not been written off wholly. PROVISIONING NORMS Standard Assets general provision of a minimum of 0.25% Substandard Assets 10% on total outstanding balance, 10 % on unsecured exposures identified as sub-standard & 100% for unsecured doubtful assets. Doubtful Assets 100% to the extent advance not covered by realizable value of security. In case of secured portion, provision may be made in the range of 20% to 100% depending on the period of asset remaining sub-standard Loss Assets 100% of the outstanding

FACTORS CONTRIBUTING TO NPAS Poor Credit discipline Inadequate Credit & Risk Management Diversion of funds by promoters Funding of non-viable projects In the early 1990s PSBs started suffering from acute capital inadequacy and lower/ negative profitability. The parameters set for their functioning did not project the paramount need for these corporate goals. The banks had little freedom to price products, cater products to chosen segments or invest funds in their best interest

CURRENT STATUS OF NPAS All SCBs average Net NPA Ratio for 2005-06 is 1.22 (As per RBIs Statistics) The banks have been able to report lower NPA percentage mostly by providing

against or writing off NPAs. The provision to certain extent was facilitated by higher profits on account of treasury management The better Net NPA ratio was also facilitated by higher credit off take resulting in larger asset portfolio/ book size. NPA MANAGEMENT PREVENTIVE MEASURES Formation of the Credit Information Bureau (India) Limited (CIBIL) Release of Wilful Defaulters List. RBI also releases a list of borrowers with aggregate outstanding of Rs.1 crore and above against whom banks have filed suits for recovery of their funds Reporting of Frauds to RBI Norms of Lenders Liability framing of Fair Practices Code with regard to lenders liability to be followed by banks, which indirectly prevents accounts turning into NPAs on account of banks own failure Corporate Debt Restructuring The objective of CDR is to ensure a timely and transparent mechanism for restructuring of the debts of viable corporate entities affected by internal and external factors, outside the purview of BIFR, DRT or other legal proceedings The legal basis for the mechanism is provided by the Inter-Creditor Agreement (ICA). All participants in the CDR mechanism must enter the ICA with necessary enforcement and penal clauses. The scheme applies to accounts having multiple banking/ syndication/ consortium accounts with outstanding exposure of Rs.10 crores and above. The CDR system is applicable to standard and sub-standard accounts with potential cases of NPAs getting a priority. Packages given to borrowers are modified time & again Drawback of CDR Reaching of consensus amongst the creditors delays the process

You might also like

- Approved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressFrom EverandApproved: How to Get Your Business Loan Funded Faster, Cheaper, & with Less StressRating: 5 out of 5 stars5/5 (1)

- Non Performing Assets: Shrawanthi Amruthwar-3 Arun Aggarwal-13 Aniket Kurup-22 Shruti Pai-35Document17 pagesNon Performing Assets: Shrawanthi Amruthwar-3 Arun Aggarwal-13 Aniket Kurup-22 Shruti Pai-35Arun HariharanNo ratings yet

- Prudential NormsDocument42 pagesPrudential NormsraajendrachNo ratings yet

- PPT On NpaDocument20 pagesPPT On NpaNoor Preet KaurNo ratings yet

- Non Performing AssetsDocument8 pagesNon Performing AssetsManoj YadavNo ratings yet

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument3 pagesInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingSNo ratings yet

- Definition of Npas: A NPA Is A Loan or An Advance WhereDocument58 pagesDefinition of Npas: A NPA Is A Loan or An Advance WhereAnnu BallanNo ratings yet

- Non Performing Assets (Npa)Document16 pagesNon Performing Assets (Npa)Avin P RNo ratings yet

- A Study On Non Performing Assets of Sbi and Canara BankDocument75 pagesA Study On Non Performing Assets of Sbi and Canara BankeshuNo ratings yet

- Prudential NormsDocument7 pagesPrudential NormsArani KarthikNo ratings yet

- Irac NormsDocument9 pagesIrac NormsAtul ThakurNo ratings yet

- BF III - Prudential NormsDocument33 pagesBF III - Prudential NormsMd Ajmal malikNo ratings yet

- India and Non-Performing Assets: BanksDocument83 pagesIndia and Non-Performing Assets: BanksprashantgoswamiNo ratings yet

- Understanding NPA, SMA and NPA ProvisioningDocument8 pagesUnderstanding NPA, SMA and NPA ProvisioningabhinavNo ratings yet

- Debt RestructuringDocument5 pagesDebt RestructuringVinay TripathiNo ratings yet

- Chapter1: Introduction: Nonperforming Asset in BankDocument35 pagesChapter1: Introduction: Nonperforming Asset in BankMaridasrajanNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaSuryaNo ratings yet

- NpaDocument19 pagesNpasayantanpatra100% (1)

- Definition of Npas: A NPA Is A Loan or An Advance WhereDocument30 pagesDefinition of Npas: A NPA Is A Loan or An Advance WheremulchandranaNo ratings yet

- Management of Non-Performing Assets: Presentation by Mr. S. RaviDocument29 pagesManagement of Non-Performing Assets: Presentation by Mr. S. RaviRajesh MaddiNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaMohamed Tousif81% (21)

- Final ReportDocument39 pagesFinal ReportBhupendra KushwahaNo ratings yet

- Non Performing AssetsDocument24 pagesNon Performing AssetsAmarjeet DhobiNo ratings yet

- Babinpa 131210023706 Phpapp01Document32 pagesBabinpa 131210023706 Phpapp01KETANNo ratings yet

- Final EditDocument24 pagesFinal EditSapla IngiNo ratings yet

- What Is NPADocument4 pagesWhat Is NPAAmishaNo ratings yet

- Npa 119610079679343 5Document46 pagesNpa 119610079679343 5Teju AshuNo ratings yet

- NPA & Income RecognitionDocument56 pagesNPA & Income RecognitionDrashti Raichura100% (1)

- Asset Quality, Credit Delivery and Management FinalDocument21 pagesAsset Quality, Credit Delivery and Management FinalDebanjan DasNo ratings yet

- Recovery of LoansDocument50 pagesRecovery of LoansRajul AgrawalNo ratings yet

- Non-Performing Assets (NPA) : Asset Classification, Income Recognition and Provisioning NormsDocument52 pagesNon-Performing Assets (NPA) : Asset Classification, Income Recognition and Provisioning Normspriyankaarora9010No ratings yet

- NPA NotesDocument33 pagesNPA NotesAdv Sheetal SaylekarNo ratings yet

- Term Paper Banking and InsuranceDocument27 pagesTerm Paper Banking and InsuranceneenajoshiNo ratings yet

- Management of Stressed AssetsDocument17 pagesManagement of Stressed AssetsRamakrishnan AnantapadmanabhanNo ratings yet

- BRM Session 3Document38 pagesBRM Session 3Saksham BavejaNo ratings yet

- Impact of Non-Performing Assets On Banking Industry: The Indian PerspectiveDocument8 pagesImpact of Non-Performing Assets On Banking Industry: The Indian Perspectiveshubham kumarNo ratings yet

- Non Performing Assets (Npa) : K.ShaliniDocument50 pagesNon Performing Assets (Npa) : K.ShalinipavvvvvviNo ratings yet

- Problem FormulationDocument35 pagesProblem FormulationJewel Binoy100% (1)

- (Non Performing Assets) : Commercial Banks Assets Are of Various Types Such AsDocument15 pages(Non Performing Assets) : Commercial Banks Assets Are of Various Types Such AsChaarvi ShridherNo ratings yet

- NPA AnalysisDocument61 pagesNPA AnalysisSabyasachi PandaNo ratings yet

- Institute - Usb Department - BbaDocument20 pagesInstitute - Usb Department - BbaAmanNo ratings yet

- A Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaDocument9 pagesA Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaSunil Kumar PalikelaNo ratings yet

- Management of Non-Performing Assets: K K Jindal Managing Director Global Management Services New DelhiDocument34 pagesManagement of Non-Performing Assets: K K Jindal Managing Director Global Management Services New DelhiNoor Preet KaurNo ratings yet

- Prudential NormsDocument24 pagesPrudential NormsProf. Amit kashyapNo ratings yet

- Mob NpaDocument44 pagesMob NpaParthNo ratings yet

- Recovery Policy - 2012Document23 pagesRecovery Policy - 2012Dhawan SandeepNo ratings yet

- Literature ReviewDocument21 pagesLiterature ReviewGaurav JaiswalNo ratings yet

- Liquidity ManagementDocument35 pagesLiquidity ManagementJadMadiNo ratings yet

- Chapter - I: Non-Performing AssetDocument46 pagesChapter - I: Non-Performing AssetVigneshwaran BbaNo ratings yet

- Npa in SbiDocument96 pagesNpa in SbiApoorva M V100% (2)

- Simer Project On Non Performing Assets..Document61 pagesSimer Project On Non Performing Assets..Simer KaurNo ratings yet

- NPAkjhhkjhkjhjhjDocument54 pagesNPAkjhhkjhkjhjhjRintu AbrahamNo ratings yet

- NPA Management by Indian Banks-LATEST: Dr. Deepak Tandon IMI New DelhiDocument40 pagesNPA Management by Indian Banks-LATEST: Dr. Deepak Tandon IMI New Delhidev mhaispurkarNo ratings yet

- Sayali ProjectDocument63 pagesSayali ProjecthemangiNo ratings yet

- Introduction of The TopicDocument8 pagesIntroduction of The TopicPooja AgarwalNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- Business Topics 1Document40 pagesBusiness Topics 1MCL EnglishNo ratings yet

- Contents of Project ProposalDocument2 pagesContents of Project ProposalFatima Razzaq100% (1)

- Issues and Challenges in Service MarketingDocument10 pagesIssues and Challenges in Service MarketingDivya GirishNo ratings yet

- CRISIL Mutual Fund Ranking Methodology Dec 2015Document5 pagesCRISIL Mutual Fund Ranking Methodology Dec 2015krajeshkumarxNo ratings yet

- BACOSTMX - Module 5 Part 2 - Lecture - Joint and by Product PDFDocument55 pagesBACOSTMX - Module 5 Part 2 - Lecture - Joint and by Product PDFDiane Cris DuqueNo ratings yet

- Introduction To Agricultural AccountingDocument54 pagesIntroduction To Agricultural AccountingManal ElkhoshkhanyNo ratings yet

- RoseDocument4 pagesRosePriyanka GirdariNo ratings yet

- Cambridge O Level: Accounting 7707/21 May/June 2020Document18 pagesCambridge O Level: Accounting 7707/21 May/June 2020Jack KowmanNo ratings yet

- Capgemini SpeakUpPolicy EnglishDocument13 pagesCapgemini SpeakUpPolicy EnglishGokul ChidambaramNo ratings yet

- FSCM Configuration Document - 1Document72 pagesFSCM Configuration Document - 1sachin nagpureNo ratings yet

- HDFC Bank DDPI - Resident Ver 2 - 17102022Document4 pagesHDFC Bank DDPI - Resident Ver 2 - 17102022riddhi SalviNo ratings yet

- Social Media Marketing and Digital Marketing ProjectDocument67 pagesSocial Media Marketing and Digital Marketing ProjectDivye Sharma50% (2)

- 201 - MM - Unit-3,4,5 MCQsDocument19 pages201 - MM - Unit-3,4,5 MCQsDilip PawarNo ratings yet

- Marketing Plan THYDocument17 pagesMarketing Plan THYnik_singerstr83% (6)

- Ecommerce ProjectDocument20 pagesEcommerce ProjectKumar BasnetNo ratings yet

- Performance Evaluation and CompensationDocument34 pagesPerformance Evaluation and CompensationarunprasadvrNo ratings yet

- CONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEDocument11 pagesCONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEBABANo ratings yet

- Vending Services Business PlanDocument40 pagesVending Services Business PlanLiudmyla ShersheniukNo ratings yet

- (TSJ) Bde Mv50kmt 190214 (Bony)Document2 pages(TSJ) Bde Mv50kmt 190214 (Bony)TMJNo ratings yet

- Process Costing Study GuideDocument14 pagesProcess Costing Study GuideTekaling NegashNo ratings yet

- Bmy S4CLD2111 BPD en FRDocument45 pagesBmy S4CLD2111 BPD en FRjihanemkaNo ratings yet

- Stock DividendsDocument7 pagesStock DividendsShaan HashmiNo ratings yet

- Industrial Visit)Document10 pagesIndustrial Visit)ZISHAN ALI-RM 21RM966No ratings yet

- Insur XDocument15 pagesInsur XJuan CumbradoNo ratings yet

- Circular 02 2020Document154 pagesCircular 02 2020jonnydeep1970virgilio.itNo ratings yet

- Sarah Chey's ResumeDocument1 pageSarah Chey's Resumeca8sarah15No ratings yet

- Production and Operation ManagementDocument19 pagesProduction and Operation Managementjuliobueno8974No ratings yet

- Sponsor and Commercial Partner - Stadium Naming Rights: BackgroundDocument1 pageSponsor and Commercial Partner - Stadium Naming Rights: BackgroundRiza El HakimNo ratings yet

- Aprds Safety ValveDocument2 pagesAprds Safety ValveMandeep SinghNo ratings yet

- Chapter 2 ExerciseDocument5 pagesChapter 2 Exercisegirlyn abadillaNo ratings yet