Professional Documents

Culture Documents

Roland Berger E Mobility in CEE 20111021

Uploaded by

ioanitescumihaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Roland Berger E Mobility in CEE 20111021

Uploaded by

ioanitescumihaiCopyright:

Available Formats

ROLAND BERGER STRATEGY CONSULTANTS

E-mobility E mobility in Central and Eastern Europe

OCTOBER 2011

Maturity and potential of electric vehicle markets in CEE

ROLAND BERGER STRATEGY CONSULTANTS

C CONTE ENTS

A. FOREWORD B. KEY LEARNINGS C. STUDY OBJECTIVES, , SCOPE AND FRAMEWORK D. STUDY RESULTS 1. E-mobility framework elements 2. Definition of e-mobility clusters E. OUTLOOK F. BACKUP: COUNTRIES SUMMARY G. AUTHORS

3 4 8 10 10 16 17 20 22

CEE E-MOBILITY STUDY

A. FOREWORD

E-mobility is one of tomorrow's major business opportunities. By the year 2025, electric or partially electric vehicles will account for up to 50% of new vehicle registrations in Europe. Although e-mobility is certainly not part of our everyday lives yet, it is definitely picking up speed. The European Union is setting the pace of change: it has decreed that CO2 emissions must be reduced by 20% between now and 2020. But who are the major players, and what are the most important drivers? Utility companies, for instance, want to become greener and boost sales in the process. At the same time, they hope that electricity storage and grid balancing become easier. Automakers, on the other hand, must develop new technological knowhow to gain the edge over their competitors and fulfill EU emissions targets. Governments hope to use e-mobility to reduce dependence on oil, improve the quality of life and promote their local economies. E-mobility is here to stay. This is clearly illustrated by the fact that Mr. Obama's stated goal is to have one million electric vehicles on the road in four years' time, while China is running 25 pilot projects and has pledged to invest more than EUR 10 billion in vehicle electrification. While some Western European economies, especially France and Germany, are known as highly developed e-mobility countries, our study is the first to look into the situation in Central and Eastern Europe we set out to take a closer look at eight countries in this region. Who is the regional leader? What can the followers learn from the leaders? What are the regional best practices? Why should one get involved already now? What challenges can be expected along the way? To find out, we scrutinized publicly available information and complemented it g e-mobility y know-how and experience. p The general g structure of with Roland Berger our analysis is based on the four key elements of the industry: market supply and demand, the regulatory environment and the general operating environment (such as the number of big cities, per capita GDP, number of cars, etc.). To clearly assess these elements using a comparable methodology we have created an e-mobility maturity index. Our general goal is to show how mature the selected e-mobility markets are and make recommendations for the stakeholders involved.

ROLAND BERGER STRATEGY CONSULTANTS

B. KEY LEARNINGS

Although the golden age for e-mobility is still a long way off, the e-mobility concept is making rapid advances, especially thanks to a number of pilot projects. Despite the high uncertainty of the future development of e-mobility, the question is no longer "whether" it will come, but rather "how fast and where first", and "what can we do to accelerate it". We measured the e-mobility readiness of specific CEE countries by constructing the "maturity index", which combines four key elements: demand, supply, operating environment and regulatory environment. The results show that CEE countries are relatively strongly differentiated in terms of the maturity of their e-mobility markets. In a nutshell, while there is no best-practice example in the region (from the European perspective), there is a clear regional leader (Austria), followed by two fast followers (Czech Republic and Poland). Other countries achieved a rather low score and were classified as followers (Romania, Hungary, Slovenia and Slovakia) or laggards (Croatia). FIGURE 1: COUNTRY POSITIONING: MATURITY CURVE

Maturity index 5 4 3 2 1

> Croatia

> > > >

Laggard gg

Romania Hungary Slovenia Slovakia Follower

> Czech Republic > Poland Fast follower

> Austria

Time

Leader

practice Best p

CEE E-MOBILITY STUDY

A number of countries in Europe have paved the way in particular areas and thus serve as best-practice examples. Germany supports eight model regions with well advanced pilot projects and shows high infrastructure readiness. French national automakers number among the most advanced, with seven market-ready electric vehicles (EV) models as of 2012. Denmark is boosting e-mobility through intense government support (purchase subsidy and tax reliefs up to approximately EUR 31,000, or more than 30% of the 2010 EV price), and the City of London has developed a scheme of operational benefits (e.g. free parking and free entrance into the city center) and is building a dense infrastructure network (1,300 public charging points by 2013). Based on international best practices and the analysis of stakeholders across CEE, we have summarized the regional best practices (figure 2) and have used these characteristics as a benchmark to assess the maturity of the e-mobility elements in all other countries. Austria's regional e-mobility leadership is fueled by its high public interest and regular EV events, which translate into growing demand. The number of registered EVs reached a total of approximately 600 (midpilot p projects), j ) almost double the 2010 figure. g 2011, out of that 370 in p Simultaneously, major Austrian utilities are involved in a number of pilot projects in five model regions (which translates into strong supply), and there is clear support from the government and municipalities (key drivers). Also the fast followers the Czech Republic and Poland show relatively high public awareness and regular e-mobility events, although there are pilot p projects j in place p resulting g in generally g y lower supply pp y (1 ( city y smaller p in CZ with around 65 EVs, 5 cities in Poland with up to around 50 EVs, compared with about 370 EVs across 5 model regions in Austria). However, the major differentiating factor is the limited government support. This leads to a lack of incentives and no clear nationwide strategy, especially as all three countries have similar e-mobility potential (demonstrated by the operating environment score). Whereas the Austrian government aims to have 250,000 EVs on the streets by 2020 with a committed budget of more than EUR 40 million to date and 2020, established subsidies for EV buyers (up to EUR 5,000 per car), there are no initiatives of such scale in either the Czech Republic or Poland.

FIGURE 2: CHARACTERISTICS OF E-MOBILITY LEADER

DEMAND > High awareness and activities by a number of consumer groups > Regular nationwide events, meetings and competitions > Publication of dedicated magazines SUPPLY > Utilities with clear long-term e-mobility strategy > Numerous regional pilots with a large number of EVs and an extensive charging station network > Many e-mobility activities by OEMs and specialized EV producers > Availability of charging station providers REGULATORY ENVIRONMENT > Clear Cl long-term l t e-mobility bilit strategy t t at t government and municipal level > Favorable legislation > Subsidies for stakeholders > Strong incentive programs for consumers OPERATING ENVIRONMENT > Very high GDP per capita > High number of vehicles per capita > High share of urban population in cities of >100,000 inhabitants > High R&D spending

ROLAND BERGER STRATEGY CONSULTANTS

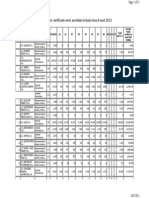

FIGURE 3: COUNTRY POSITIONING: SCORE IN INDIVIDUAL CATEGORIES

Categories Weight

10%

1 2 3 4 5

1 2 3 4

Demand

HR SK RO HU

SL

PL

CZ

AT

Supply

40%

Regulatory environment

40%

Operating environment

10% HR SK SL HU RO 1.3 1.51.7 1.71.8 PL CZ 2.52.5 AT 3.3

Overall weighted index

Note: 1: low, 5: high

Behind the Czech Republic and Poland is a relatively homogeneous group (in terms of overall ranking) of followers: Romania, Hungary, Slovenia and Slovakia. These countries are characterized by low customer awareness (demand) and almost non-existent supply. The differentiating factors are the regulatory and operating environment. Government/municipal support is low in Slovakia and medium in Hungary, with Slovenia and Romania reaching the level of Poland and the Czech Republic. Two of the followers (Romania and Hungary) score high in the operating environment category compared with the other followers. The least-developed CEE country examined is Croatia (laggard), with very low public interest in e-mobility, limited events and low interest on the part of the authorities. The overall promising assessment of the operating environment the most highly ranked element for all countries (except Slovenia) implies a positive outlook for the future. In other words, the CEE countries have not yet tapped their e-mobility potential. The good news is that it isn't too late to start, and today's laggards can (still) become tomorrow's leaders. In figure 4, we have summarized key learnings for major stakeholders if they want to become e-mobility champions based on the best practices we found.

CEE E-MOBILITY STUDY

Governments/municipalities need to set up a dedicated e-mobility team (ideally cross-functional), develop a clear, target-based strategy (to clearly signal its goals) and adopt measures in line with the strategy to put it into practice. Authorities should also boost awareness among the public and get involved in pilot projects and infrastructure development to keep close contact with the industry and gain access to state-of-theart information. Clear government support is especially crucial in the early stages (i.e. now), as it can help significantly increase awareness and "kick off" e-mobility through subsidies and incentives. Limited contribution from authorities doesn't mean that e-mobility "won't fly", j t that just th t it won't 't fly fl as soon as it could ld or as high as it does d in i countries ti with high government involvement. Utilities and automakers must follow their e-mobility strategy and get involved in pilot projects. These can also serve as PR, but the primary focus must be on real data and know-how generation through extensive infrastructure and business models/technology testing. This information will be needed in order to readjust the strategy and business models before the large-scale business starts. Making the right decisions on products and value chain coverage, target customers and sales channels, pricing and billing, and the infrastructure approach is key for real future (profitable) business development. FIGURE 4: KEY LEARNINGS FOR E-MOBILITY STAKEHOLDERS IN CEE

GOVERNMENT/MUNICIPALITIES > Develop your goal and strategy > Decide what measures you will use to reach your goal1) > Form an e-mobility task force > Educate your citizens > Support pp demand and build infrastructure > Develop partnerships and get involved in pilot project(s) > Learn from the most advanced cities and replicate > Enable easy permitting UTILITIES AND AUTOMAKERS > Define your goal and strategy > Set up a dedicated e-mobility team > Develop partnerships and get involved in pilot project(s) > Determine your value chain positioning > Formulate target g product/offering p / g > Select target customers, sales channels and promotion > Determine your pricing and billing > Set your approach to infrastructure

Key tasks

1) Several types of monetary incentives can be applied: support for manufacturing and research, grants and loans for building charging infrastructure, incentives for buying electric vehicles or disincentives in the form of a carbon tax, which should be balanced with non-monetary incentives such as preferential parking and driving lane access

ROLAND BERGER STRATEGY CONSULTANTS

C. STUDY OBJECTIVES, SCOPE AND FRAMEWORK

FIGURE 5: STRUCTURE OF THE STUDY

1 MARKET MATURITY ASSESSMENT > Characterizing the overall e-mobility framework in CEE > Highlighting the role of individual e-mobility stakeholders > Assessing each country's maturity and potential based on a comprehensive set of criteria > Mapping each country's maturity and potential on the e-mobility d l development t curve 2 MARKET COMPARISON AND CLUSTERING > Building maturity clusters On country level: identifying the countries that are the leaders, fast followers, followers and laggards On e-mobility y element level: assessing supply, demand, regulatory environment and operating environment > Defining best practices 3 RECOMMENDATIONS FOR NEXT STEPS > Providing recommendations on next steps for key stakeholders (government/municipalities, utilities, and automakers)

The aim of the study is to evaluate the overall maturity/development of the e-mobility market in Central and Eastern Europe by comparing individual CEE countries and suggesting next steps for key stakeholders. Eight CEE countries were selected for the purpose of the study: Austria, C hR Czech Republic, bli Slovakia, Sl ki P Poland, l d H Hungary, R Romania, i Sl Slovenia i and d Croatia. These countries are leaders in the region and represent the majority of the population (53%) and GDP (80%) of the region (Russia not considered). The study was conducted outside-in that is, it was based on publicly available information regarding the development in specific countries. This information was complemented by Roland Berger e-mobility industry know-how and experience. The study was structured within the basic e-mobility framework, which consists of four key elements: market demand and supply, regulatory environment and operating environment (see figure 6 for details). Demand is the main driver of e-mobility success it is customers and users who will decide where (and when) EVs will become a viable transportation mode. The key long-term demand enablers are the price of EVs, their driving range, market availability of EVs and environmental awareness. However, as the market is not sufficiently developed in any of the analyzed countries, other categories had to be selected to assess the current state of demand. In the early stages of e-mobility markets, it is crucial to build general awareness so elements such as the current number of EVs in the country and e-mobility events were assessed. There are three basic groups of stakeholders that must satisfy the demand from customers/users: utilities, automakers and infrastructure providers. To evaluate the level of supply, elements such as the number of players active in e-mobility, their vision, strategy and pilot project coverage were defined. Governments and municipalities also play a crucial role, as they set the play". y Vision/strategy / gy and level of overall scene and define the "rules of p legislation/subsidies were thus selected as the most appropriate categories.

CEE E-MOBILITY STUDY

The final element, the operating environment, is shaped by the overall economic and technological status of the country. Generally speaking, the operating environment enables practical application of EVs and is thus a key indicator of the future potential for EVs in the country. The operating environment was assessed using a number of macroeconomic/statistical indicators, such as per capita GDP, number of cars in operation, number of cars per capita and number of cities with 100,000 or more inhabitants. All the categories were ranked and weighted to form the e-mobility index, an aggregated indicator of e-mobility market maturity/development in a given gi country. t FIGURE 6 METHODOLOGY: E-MOBILITY INDEX OVERVIEW

1

DEMAND

SUPPLY

GOAL: Evaluation of supply level Key criteria used > Number of utilities, automakers and other stakeholders active in e-mobility > Vision, strategy, penetration target > Coverage of pilot projects > Partnership with relevant stakeholders GOAL: Evaluation of the general operating conditions Key criteria used > Number of cities with > 100,000 100 000 inhabitants > Real GDP per capita > R&D expenditure > CO2 production and target > Vehicle fleet (size and density)

GOAL: Evaluation of customer/user acceptance and awareness Key criteria used > Number of EVs in the country currently > E-mobility associations > E-mobility events

GOAL: Evaluation of regulatory environment created by government and municipalities Key criteria used > Vision, strategy, penetration target > Legislation, incentives, subsidies and education > Direct demand and supply creation > Involvement in pilot projects 3

E-mobility Index

REGULATORY ENVIRONMENT

OPERATING ENVIRONMENT

Based on the e-mobility e mobility index score, score the specific countries were split into maturity clusters (i.e. leaders, fast followers, followers and laggards). Similarly, the key stakeholders were clustered according to their e-mobility index result. As the EV markets are very dynamic, and as our analysis was conducted outside-in and based on number of subjective categories, we understand that our findings must be considered to be indicative. Nevertheless, we h hope th that t the th study t d will ill provide id a useful f l reading di on where h certain t i countries stand today and what needs to be done to potentially become an e-mobility champion.

ROLAND BERGER STRATEGY CONSULTANTS

D. STUDY RESULTS

Each stakeholder contributes a certain input to the e-mobility market and pursues its own set of goals that must be understood to comprehensively assess its e-mobility readiness. FIGURE 7: STAKEHOLDERS THEIR PRIMARY GOALS AND THEIR ROLES IN E-MOBILITY STAKEHOLDERS, E MOBILITY

ELEMENT

Demand Supply

STAKEHOLDER

Customers/users Utilities

GOAL

> Meet mobility needs > > > > Image improvement (short-term goal) Sales increase (long-term goal)1) Tighter customer relationship Grid balancing, energy storage

ROLE/INPUT

> Generate demand > > > > > Electricity Grid Billing know-how Customer contacts Possible e-mobility y p provision2)

Automakers

> EV technology testing (short-term goal) > Higher sales (long-term goal) > Compliance with CO2 regulations > Sales generation

> Electric vehicles > Maintenance and repair infrastructure > Possible e-mobility provision2) > Provision of charging infrastructure > Sale of EVs > Possible e-mobility provision2) > Regulation > Incentives on the supply and demand sides

Other stakeholders (infrastructure providers, car dealers) Regulatory environment Government/ municipality

> > > >

Reduction in energy dependency Reduction in CO2 emissions Improvement p in q quality y of life ( (air q quality, y, noise reduction) ) Boost for the economy

1) Through e-mobility provision, increased electricity sales , enhanced customer retention or new customer acquisition 2) E-mobility provider supplies electricity, infrastructure access, billing and add-on services

D.1 E-MOBILITY FRAMEWORK ELEMENTS

We assessed the maturity of the key elements (supply, demand, regulatory and operating environment) based on the readiness of individual stakeholders (summary in figure 9). The assessment of individual stakeholders in the analyzed countries highlights which of them are the e-mobility drivers. Whereas, in the case of Austria, supply is driven mainly by utilities (leader) and other stakeholders (fast follower), the Czech Republic is the only country that also shows a contribution from automakers. automakers

CEE E-MOBILITY STUDY 11

FIGURE 8: COUNTRY POSITIONING: STAKEHOLDERS' SCORES

Austria DEMAND SUPPLY > Utilities > Automakers > Other stakeholders REGULATORY ENVIRONMENT > Government > Municipalities OPERATING ENVIRONMENT

Laggard Follower Fast follower Leader Best practice

Czech Republic

Poland

Hungary

Slovakia

Slovenia

Romania

Croatia

The success or failure of e-mobility depends on the DEMAND generated by consumers/users. Early deployment of e-mobility is typically started by groups of enthusiasts who care about the environment and/or who are fascinated by electric propulsion. These enthusiasts form EV associations (e.g. Electromobiles Civic Society [CZ], Association of Electric Vehicle Users [PL] and Association for the Promotion of Electric Vehicles [RO]), launch web-based magazines (e.g. futureage.eu, elektromobily.sk, hybrid.cz and stromfahren.at) and organize EV events (such as e-mobility days [CZ] and e-mobility power Groglockner [AT]). As far as the penetration of EVs is concerned, in the first stage, the enthusiast groups convert regular cars into EVs for their own use/testing. Later, the converted EVs are sold to other customers, and in the final stage, customers start buying original EVs.

FIGURE 9: MATURITY OF KEY ELEMENTS

Demand Supply

Regulatory environment

Operating environment

Mass penetration of EVs (i.e. to B2C customers) is also aided by the initial focus of e-mobility providers on B2B customers. For them, e-mobility is a convenient tool to promote their green image or comply with corporate emissions standards, despite potentially higher costs. pave the way y for ramping p g up p Penetration of EVs into the B2B world will p production capacities. This, in turn, will reduce EV production costs and also generate first positive experiences that will be decisive for penetration into the B2C segment.

Laggard Follower Fast follower

Leader Best practice

ROLAND BERGER STRATEGY CONSULTANTS

In most of the countries analyzed, there were already early signs of e-mobility acceptance, such as a wide variety of different EV associations and events. events However, However there are as yet only a few registered EVs and, and as expected, a significant number of them were converted from regular cars. Original EVs were only recently launched on the focus markets. The regional best-in-class example of customer demand is Austria, where the highest number of EVs (almost 600 in mid-2011) in the region can be found (driven mostly by the Vlotte project). Austria also shows high public awareness, boosted by numerous events and a wide range of available EVs (generally all EVs commercially available in Europe). Europe) FIGURE 10: DEMAND CEE BEST-IN-CLASS EXAMPLE: AUSTRIA

NUMBER OF EVs1)

591 353 131 146 223

MAJOR EV BRANDS

MAJOR EV EVENTS

> E-Mobility Power Groglockner > Euro EV Race 2010 > Information events by fleet operators (e.g. Vlotte, Salzburg AG) > EV infrastructure demonstration at European Forum Alpbach > E-mobility expo 2011

2007

2008

2009

2010

20112)

1) Pure EVs only, additional 4,800 hybrids/PHEVs in 2010 2) By April 2011, driven by the Vlotte project with 250 operational EVs by mid-2011 (300 acquired), at the end of 2010 only 77 EVs operational

On the SUPPLY side, utilities play a crucial role. They can be either the true driving force (e.g. CEZ in the Czech Republic) or merely an active player. p y In the latter case, , the driving g force behind e-mobility y is then typically the government and/or the municipalities (e.g. Austria). There are several types of automakers that are active in e-mobility: traditional OEMs, specialized EV producers and retrofit manufacturers that convert traditional cars to EVs. Of these players, traditional OEMs clearly have much greater market power, and their involvement in e-mobility is an important indicator of the country's e-mobility readiness.

CEE E-MOBILITY STUDY 13

FIGURE 11: SUPPLY UTILITY AS E-MOBILITY DRIVER EXAMPLE: CZECH REPUBLIC

Utilities/automakers involved in e-mobility

Utilities > > > > CEZ RWE E.ON PRE All major utilities in the Czech Republic

CEZ e-mobility vision/strategy

Vision > CEZ is committed to tackling climate change in CEE and is actively looking for opportunities to reduce pollution in any given sector by offering new solutions such as e-mobility Strategy

CEZ e-mobility pilot project

> Location: City of Prague, Vrchlab region > Timing: 2010-2013 > No. of EVs: >65 > Number of charging stations: >150 > Locations ocat o s of o charging c a g g stations: stat o s At home, at work, retail parking lots, public places > Automaker partners: PSA (Peugeot Citroen) > Budget: EUR 20 m for FuturEmotion program altogether (e-mobility not specified)

Automakers > SKODA > AVIA > SOR Considerable involvement of local automakers in the region

> Leverage first mover position > Test and develop long-term business model > Gather know-how and develop infrastructure

The traditional automotive industry y is very y strong g in some of the CEE countries, such as Slovakia and the Czech Republic. However, OEMs are not yet the driving force behind e-mobility in any of the countries studied. The traditional OEMs in CEE who made the greatest progress are found in the Czech Republic: Skoda released its EV Octavia Green E Line in 2010 (only testing stage), AVIA plans to sell e-trucks in cooperation with Smith Electric Vehicles (AVIA focuses on cabins and chassis sub-deliveries, some units already sold on the US market, launch on Czech market planned by 2012) and SOR produces electric electric-powered powered buses (marketed since late 2010). In several CEE countries, one can find specialized EV producers new companies or companies that did not previously produce cars. Specialized EV producers can be found even in countries with a rather weak automotive industry, such as Croatia (DOK-ING). There are also a number of retrofit manufacturers, manufacturers which convert conventional ICE cars to electric vehicles, such as the EVC Group based in the Czech Republic. Access to the charging infrastructure is ensured by an infrastructure provider, which may be a specialized company or any other e-mobility stakeholder. In the focus countries, the role of infrastructure provider is frequently played by a utility company, e.g. CEZ in the Czech Republic. It is rare for a non-utility company to announce its intention to build a charging infrastructure (as happened in the case of Telekom Austria and Elektromobil in Slovakia). As far as the infrastructure itself is concerned, there is no nationwide network in any of the focus countries. Infrastructure is just now being built in conjunction with pilot projects.

ROLAND BERGER STRATEGY CONSULTANTS

Governments and municipalities are the key stakeholders that define the REGULATORY ENVIRONMENT. Government involvement in e-mobility in the analyzed countries ranges from being the driving force to practical inactivity. FIGURE 12: REGULATORY ENVIRONMENT CEE BEST-IN-CLASS EXAMPLE: AUSTRIA

OVERALL SETUP

Vision > EVs should form a significant proportion of new vehicles Penetration target of 250,000 in 2020 (i.e. 3-5% of the vehicle fleet)

LEGISLATION & & SUPPORT SUPPORT LEGISLATION

Government Government Public knowledge knowledge sharing sharing via via > Public "e-connected.at" "e-connected.at" PR work work through through the the ministries ministriesinvolved involvedand and > PR the Climate Climate and and Energy Energy Fund Fund the Ministries develop develop specific specific measures measures needed needed > Ministries to promote promote e-mobility e-mobility(ready (ready by by end end of of2011) 2011) to 1) PPP research research program program A3PS A3PS1) Collaboration Collaboration > PPP platform for for domestic domestic industry industry players players and and platform universities universities

Municipalities Municipalities > Plans Plans to to push push building buildingsocieties societiesand and developers developers into into integrating integrating charging chargingpoints points into into new new apartment apartment complexes, complexes, garages, garages,etc. etc. > Substantial Substantial PR PR work work in in all all of of the the model model regions regions to to promote promote e-mobility e-mobility(e.g. (e.g. Kitzbhel) Kitzbhel)

SUBSIDIES SUBSIDIES

Government Government > Project Projectfinancing financingCommitted Committedbudget budgetof ofEUR EUR > >40m mto todate date >40 > Ministry Ministryof ofEnvironmental EnvironmentalAffairs Affairsco-financed co-financed > theinstallation installationof of1,000 1,000EV EVcharging chargingstations stations the acrossthe thecountry country across > Purchase Purchaseincentives incentivesof ofup upto toEUR EUR5,000 5,000per per > EV(companies (companiesonly) only) EV > Exemption Exemptionof ofEVs EVsfrom fromfuel fuelconsumption consumptiontax tax > 2) 2)and (up (upto toEUR EUR500) 500) andvehicle vehicletax tax

Municipalities Municipalities > > Various Varioussubsidy subsidyprograms programsfor fore-mobility e-mobility Different Differentsubsidy subsidyamounts amountsfor forbuyers buyersof ofnew new EVs EVs(cars, (cars,scooters, scooters,e-bikes) e-bikes) > >A Auniversal, universal,time-limited time-limitedsubsidy subsidyof ofEUR EUR300 300 has hasled ledto toa asmall smallboom boomin ine-bikes e-bikesin inVienna; Vienna; the thesubsidies subsidiesinitiated initiatedorders ordersand andspecial special offers offersby byretailers retailersthat thatpreviously previouslydid didnot not carry carrye-bikes e-bikes

Coverage > > > > > State of Vorarlberg (2008) City of Salzburg (2009) City of Vienna (2010) City of Graz (2010) City of Eisenstadt (2010)

1) Austrian Agency for Alternative Propulsion Systems

2) Until Until mid-2012 mid 2012 mid-2012

The most advanced status was reached in Austria. Its government published a strategy and goals, including a penetration target of 250,000 EVs in 2020 (which would mean 3-5% of the vehicle fleet). Austria also defined five so-called model regions, one of them being among the three largest pilot projects in Europe (Vlotte, with around q by y mid-2011). ) 300 EVs acquired Moreover, Austria has committed a budget worth more than EUR 40 million to date to support the model regions and various research programs, with EUR 35 million still open (aimed at supporting new energy systems). The government also conducts PR work via a dedicated website (e-connected.at). The Polish g government provided p some EUR 5 million to the Mielec Regional Development Agency for the project "Building the electric vehicle market and charging point infrastructure as the basis for energy security". This body coordinates pilot projects in five major cities. Among other things, it aims to build the infrastructure of 330 charging points, deliver 20 test electric vehicles, build a monitoring station and gather information about users' habits.

CEE E-MOBILITY STUDY 15

The Slovenian government targets 23% of EVs in Slovenia by 2030. So far, however, it has introduced only indirect support through a CO2-based tax system. system The Romanian government has introduced direct subsidies to EV buyers within the scrappage scheme (20% subsidy capped at EUR 3,700), and Romanian electric vehicles are also exempt from CO2 tax. The involvement of the Czech and Hungarian governments is limited to tax advantages. Slovakia does not yet offer any specific subsidies or incentives. Due to the fact that the OPERATING ENVIRONMENT is tightly linked with a country's ' socio-economic i i development, d l it i is i diffi difficult l to i influence fl i it i in the short term. However, it has an important impact on e-mobility development. There are great differences in the countries studied as far as the operating environment is concerned. The number of inhabitants ranges from 2 million in Slovenia to about 38 million in Poland. Real GDP per capita is as high as nearly EUR 30,000 in Austria and as low as about EUR 3,000 in Romania. R&D expenditures vary between 0.5% of GDP in Slovakia and 2.7% of GDP in Austria. The number of vehicles in the country ranges from about 19 million in Poland to slightly over 1 million in Slovenia. Nevertheless, there are four markets that score high in the operating environment category. Poland and Romania, for their overall market size (demonstrated by number of cities with more than 100,000 inhabitants), and Austria and Czech Republic, as the most developed countries (assessed by per capita GDP) in the region (and still relatively large markets, unlike Slovenia). Poland's high score in operating environment is also the reason why even non-domestic utilities launched e-mobility projects here (e.g. RWE), to benefit from the first-mover position in this promising market.

FIGURE 13: OPERATING ENVIRONMENT SELECTED CRITERIA

CITIES >100,000 INHABITANTS [#] PL RO HU CZ AT HR SK SL 3 2 2 6 5 9 24 40

REAL GDP PER CAPITA, 2009 [EUR '000] AT SL CZ HR PL SK HU RO 3 8 8 7 6 6 14 28

ROLAND BERGER STRATEGY CONSULTANTS

D.2 DEFINITION OF E-MOBILITY CLUSTERS

Clear cluster characteristics were identified based on the countries analyzed. These clusters also present the basic "ladder" that the particular stakeholders have to climb to become e-mobility champions. FIGURE 14: CHARACTERISTICS OF MATURITY CLUSTERS

Category DEMAND Laggard

> No consumer groups > Minimal public interest

Follower

> Presence of EV hobby groups > Rare events > Occasional press coverage

Fast follower

> Presence of several EV consumer organizations > Occasional local/national events and meetings > Regular online and offline press coverage

Leader

> High awareness and activities by number of consumer groups > Regular nationwide events, meetings and competitions > Publication of dedicated magazines > Utilities with clear long-term e-mobility strategy > Numerous regional pilots with a large number of EVs and an extensive charging station network > Many e-mobility activities by OEMs and specialized EV producers > Availability of charging station providers > Clear long-term e-mobility strategy at government and municipal level > Favorable legislation > Subsidies for stakeholders > Strong incentive programs for consumers > Very high GDP per capita > High number of vehicles per capita > High share of urban population in cities of >100,000 inhabitants > High R&D spending

SUPPLY

> Low e-mobility activity by utilities > No pilot programs > No EV manufacturing, only conversions by individual enthusiasts

> Utilities use e-mobility for PR > Utilities show serious interest in purposes, initial signs of long-term e-mobility and have long-term view on e-mobility view > Initial discussions among > At least one pilot project is stakeholders about pilot project launched with medium test fleet partnerships size and medium charging network > Companies offering custom > Some boutique EV manufacturing conversions of ICEs to EVs

REGULATORY ENVIRONMENT

> Government and municipalities have no interest in e-mobility

> Government and municipalities show interest in e-mobility, but no action taken

> Initial e-mobility initiatives from the government and municipalities > Limited support to stakeholders > Symbolic incentives for consumers (e.g. free parking) > Above average GDP per capita > Above average number of vehicles per capita > High share of urban population in cities of >100,000 inhabitants > Above average R&D spending

OPERATING ENVIRONMENT

> Below average GDP per capita > Low number of vehicles per capita > Low share of urban population in cities of >100,000 inhabitants > Low R&D spending

> Average GDP per capita > Average number of vehicles per capita > Medium share of urban population in cities of >100,000 inhabitants > Average R&D spending

While "laggards" laggards are countries with limited e e-mobility mobility development on both the demand and the supply side, and no interest on the part of their governments, e-mobility "leaders", in contrast, must show high public awareness driven by nationwide events and promoted by dedicated consumer groups, and strong supply demonstrated by numerous pilot projects with clear strategies and visions and supported by both utilities and automakers. Simultaneously, Sim ltaneo sl to become a leader, leader the government go ernment m must st de develop elop a clear nationwide strategy that covers both early-stage development incentives and overall e-mobility legislation.

CEE E-MOBILITY STUDY 17

E. OUTLOOK

E-mobility will play a crucial role in future transportation systems. By 2025, up to 50% of newly registered vehicles in Europe are expected to be fueled by some kind of electric propulsion, and almost every fourth car sold in CEE markets in 2025 is likely to be EV or PHEV1). However, there H h is i not expected d to b be any genuine i rise i i in e-mobility bili b before f 2015. Then, it will initially be driven by B2B customers, and the main boom will come after 2020, when B2C customers join in. The share of B2C customers is estimated to reach 30% in 2015, and increase to 70% in 2020. Over the next 15 years, we expect e-mobility to develop in three major stages, closely linked to the ramp-up of EVs sold (figure 15). In the initial stage (i.e. now), the number of EVs is driven mostly by pilot projects, and there is virtually no standalone market, neither in the B2B nor in the B2C segment. The primary task of the key stakeholders involved is thus to generate sufficient know-how to fine-tune their strategies and business models before the next phase commences. Mass production of a number of EV models is expected as early as at the end of this phase, in line with increasing overall awareness among the public. Starting in 2015, the number of EV users is likely to grow, with the B2B segment initially playing a key role. The main demand drivers of this segment are the need for companies to enhance green image, ambitions to meet corporate emissions targets and fleet purchases by state-owned companies. Nevertheless, this will be possible only with simultaneous infrastructure development, which, based on the chicken-and-egg paradox, will be both the main driver and the main inhibitor of developgrowing g number of p players y will lead to a ment in certain countries. The g rise in competition, thus increasing the need to differentiate and to build a unique selling proposition (USP) in order to attract customers. The growing EV penetration will further push the unification of technological standards and the specification of a legal framework (e.g. safety rules).

1) PHEV Plug-in-Hybrid electric vehicle

ROLAND BERGER STRATEGY CONSULTANTS

In the third phase, the focus will be on capturing market share, especially in the B2C segment, which will become fully addressable (focus on B2C segment already at the end of phase II). II) A clear USP (already shaped in the earlier phase) will be the key success factor, as the competition will be intense. Penetration into the B2C segment will be enabled particularly by technological progress and a corresponding drop in production costs. Earlier Roland Berger studies revealed that consumers are ready to pay extra for EVs in order to benefit from cheaper operational costs later, but they are not willing to pay more than EUR 4,500. While the cost difference between EVs and conventional cars will still be around EUR 10 000 -15,000 10,000 15 000 i in 2015 2015, it i is expected t dt to f fall ll b below l th the break-even b k limit of EUR 4,500 by 2020. Uncertainty regarding the ramp-up of electric-powered vehicles is extremely high, fueled by unpredictable oil price development, the speed of necessary technological improvements and the level of governments' involvement. As we have already noted, the question is no longer "whether" but rather "when" the above-mentioned factors will speed up (or slow down) EV market growth rather than influence its magnitude as such. Thus, we consider it of crucial importance for all stakeholders to keep pace with e-mobility developments in other words, to work hard on being ready for the next phase, when "full scale" e-mobility kicks off. There are number of reasons to start "getting ready" now. The demand ramp-up could turn out to be faster than expected, and only the players with turnkey solutions in place (business model, offering, billing and pricing, profitability and investment expectations, etc.) will be able to benefit from it. This is all the more valid as the e-mobility industry shows rather high entry barriers caused by R&D and infrastructure development costs it will be costly to win market shares over established players at later stages, once the "die has been cast". Early involvement will also secure the first-mover advantage, which is significant especially with regard to infrastructure. To cover all critical places and provide peace of mind, the infrastructure must be wise, rather than dense. Studies showed that customers with access to public infrastructure used EVs much more intensively, as their "range anxiety" was eliminated. As infrastructure development costs are high, the player who manages to cover the key spots first will gain an advantage over the followers. g g, as models and Also the cost burden can be lower at the beginning, technologies can be tested through joint data collection on the costsharing principle. Joint development will become less likely as the market matures, since by that time, the early players will have developed significant know-how that they will not be willing to share.

CEE E-MOBILITY STUDY 19

Early players will not only benefit from mutual learning through partner networks, but they will also be able to shape the overall e-mobility framework i framework, i.e. e technology standards, standards legislation framework, framework comcom patibility, etc. And last but not least, it is not easy for any organization to embrace such a change as e-mobility (new business model, new product, new technology, new partners and relationships). Developing the e-mobility concept, generating know-how, educating staff and turning the concept into a practical reality will take several years, and many as yet unforeseen hurdles will emerge on the way way. Early involvement will ensure sufficient time to master all these challenges and thus provide a valuable advantage. FIGURE 15: EV/PHEV DEVELOPMENT IN CEE ['000 UNITS]

Share of total cars sold [%]1) 800 600 400 200 0 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 2030 ~2% ~13% ~23%

Phase I: Get ready > Gather know-how in pilot projects > Define future strategies and business models (based on pilot project results) > Start mass production of variety of EV models > Attract first EV users > Build awareness among the public

Phase II: Develop a competitive advantage > Roll out infrastructure > Build mass customer base (initially B2B, later also ) B2C focus) > Develop systems and processes > Differentiate and develop USPs > Standardize technology > Build stakeholder relationships (roaming, billing) > Legislate and develop safety standards

Phase III: Gain market share Phase IV: Run a profitable business > Fully fledged business > Gaining mass customer base (B2C focus) g market share > Gaining > New generation of EVs > Product customization > Business as usual turn into profit generator > Continuous optimization

Know-how and publicity focus

1) Only private cars and LCV (light commercial vehicles) considered

Profit focus

figures_final.pptx

ROLAND BERGER STRATEGY CONSULTANTS

F. BACKUP: COUNTRIES SUMMARY

AUSTRIA

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

> High level of public interest, currently more than 590 EVs > Regular EV events (e.g E-Mobility Power Groglockner, Euro EV Race), various web platforms > Five utility providers active in e-mobility with large-scale pilot projects > Many R&D and production activities by OEMs and specialized manufacturers in the field of electric propulsion > High number of dealerships selling a wide range of EVs > Strong support from the Federal Ministry for Transportation, Innovation and Technology > Considerable public interest, currently more than 100 EVs > Regular EV events (exhibitions, reunions of owners of EVs, competitions, conferences), several EV associations and online platforms > Main utility provider CEZ developed a long term e-mobility strategy and launched pilot project > Above-average R&D intensity and EV manufacturing activity (e.g. Skoda, AVIA) > Limited government support, with few incentives to buy > Medium public interest in EVs > Three major EV associations, associations some occasional events > Three utility providers active in e-mobility, several large scale pilot projects in place > R&D activity is low, OEMs do not participate in development, some smaller specialized manufacturers are involved in e-mobility > Special governmental workgroup is studying the possibility of supporting e-mobility, but has no strategy so far Some tax based incentives are already in place > Moderate public interest in EVs > One formal interest group recently established, some online communities, events are rare > One utility provider showed signs of e-mobility involvement, however the project has still a PR nature, rather than actual testing > R&D intensity is average, OEM involvement limited to one bus manufacturer, however activity of specialized manufacturers is very high > Government has announced interest in e-mobility, however has not taken any steps in actual support, some taxation incentives are in place

Laggard Follower Fast follower Leader Best practice

CZECH REPUBLIC

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

POLAND

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

HUNGARY

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

CEE E-MOBILITY STUDY 21

> > > >

Little public interest in EVs No events, no formal associations, only some online platforms Limited utility involvement in e-mobility, no full scale pilot projects Very low R&D intensity, no OEM or specialized manufacturer involvement, long-term production plans only > Government is contemplating e-mobility support possibilities but has not taken any specific actions yet > Bratislava and Vienna work on cross border project

SLOVAKIA

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

> Interest in EVs is fairly low > There is only one major formal association and one online platform > No e-mobility involvement of Slovenian utility companies has been reported > No OEM involvement and very low activity of specialized producers > Government announced a long term penetration target and took initial measures for e-mobility development (CO2 based taxation)

SLOVENIA

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

> Interest in EVs is currently fairly low, with only one association > Several players are interested in e e-mobility mobility involvement (partnership was recently set up between Renault, Electrica, Siemens and Schneider Electric); no projects yet > Low R&D intensity; Renault involved in promoting e-mobility > Government set up a special working group for developing the e-mobility strategy in Romania, subsidies for EV purchase recently introduced (up to EUR 3,700)

ROMANIA

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

> Very little public interest > Virtually no regular events, one formal association > Local utility provider HEP is preparing to roll out a pilot project to test charging infrastructure > R&D intensity is average, no OEM activity and only one specialized producer > City of Zagreb is preparing an infrastructure development project, no specific details known > Government has so far indicated no interest in supporting e-mobility

CROATIA

DEMAND SUPPLY REGULATORY ENVIRONMENT OPERATING ENVIRONMENT

Laggard

Follower

Fast follower

Leader

Best practice

ROLAND BERGER STRATEGY CONSULTANTS

G. AUTHORS

Roland Berger Strategy Consultants Na Porici 24 Praha 110 00 Czech Republic www.rolandberger.cz www.rolandberger.com

ROLAND ZSILINSZKY

Head of the Automotive Competence Center in CEE

+420 210 219 524 Roland_Zsilinszky@cz.rolandberger.com

ALEXANDER KAINER

Head of the Energy Competence Center in CEE

+43 1 536 02 139 Alexander_Kainer@at.rolandberger.com

JAN SKLENAR

Senior consultant in the Automotive Competence Center in CEE

+420 210 219 531 Jan_Sklenar@cz.rolandberger.com

ALEKSZEJ BORSCS

Senior consultant in the Automotive Competence Center in CEE

+36 1 301 70 70 Alekszej_Borscs@ru.rolandberger.com

You might also like

- User Manual For Inquisit's Attentional Network TaskDocument5 pagesUser Manual For Inquisit's Attentional Network TaskPiyush ParimooNo ratings yet

- CE Delft - Impact of Electric VehiclesDocument87 pagesCE Delft - Impact of Electric VehiclesbhushanrautNo ratings yet

- Driving Electrification: White PaperDocument40 pagesDriving Electrification: White PaperFederico MarzulloNo ratings yet

- EVUE BejaCaseStudy 01Document78 pagesEVUE BejaCaseStudy 01aquel1983No ratings yet

- Eprs Bri (2024) 762287 enDocument12 pagesEprs Bri (2024) 762287 enLuciaNo ratings yet

- Final Capstone Report ArupDocument70 pagesFinal Capstone Report ArupChristopher Y. WangNo ratings yet

- Project Results Online PDFDocument27 pagesProject Results Online PDFAndreea StefanaNo ratings yet

- E Government Benchmark 2016 Insight ReportDocument80 pagesE Government Benchmark 2016 Insight ReportTeona TurashviliNo ratings yet

- EaP CSF RecommendationsDocument3 pagesEaP CSF RecommendationsEaP CSFNo ratings yet

- Dutch EV PlanDocument24 pagesDutch EV Planrkapoor584199No ratings yet

- L A P O K: Ocal Ction LAN F AtowiceDocument19 pagesL A P O K: Ocal Ction LAN F AtowiceRadu StefanaNo ratings yet

- Electric Vehicle Charging Network in Europe 2021Document18 pagesElectric Vehicle Charging Network in Europe 2021Maria Merano100% (1)

- Local Government and Utilities Perspectives On Europes E-Mobility Charging InfrastructureDocument8 pagesLocal Government and Utilities Perspectives On Europes E-Mobility Charging InfrastructureAlejandro GuerreroNo ratings yet

- Executive Radar 2011: European Rail IndustryDocument30 pagesExecutive Radar 2011: European Rail IndustryBrazil offshore jobsNo ratings yet

- National Action Plan On Intelligent Transport Systems (ITS) : April 2013Document56 pagesNational Action Plan On Intelligent Transport Systems (ITS) : April 2013Eka KrisdayantiNo ratings yet

- Sustainability 06 08056 PDFDocument23 pagesSustainability 06 08056 PDFEric HuangNo ratings yet

- Brussels Group ProjectDocument10 pagesBrussels Group ProjectSaraNo ratings yet

- Europeran Commission - Smart Mobility and Services - Expert Group ReportDocument20 pagesEuroperan Commission - Smart Mobility and Services - Expert Group Reportandrikfca100% (1)

- Smart Sustainable: MobilityDocument78 pagesSmart Sustainable: MobilityMiaNo ratings yet

- EGovernment Benchmark Insight ReportpdfDocument42 pagesEGovernment Benchmark Insight ReportpdfAvocat Ion Gabriel AnghelusNo ratings yet

- SWD (2016) 226Document55 pagesSWD (2016) 226Maksym LukianenkoNo ratings yet

- AT End of Year 2012.2013 Report Agenda Item 10iDocument6 pagesAT End of Year 2012.2013 Report Agenda Item 10iBen RossNo ratings yet

- Global Electric Vehicles (EV) Market Analysis and Forecast (2013 - 2018)Document13 pagesGlobal Electric Vehicles (EV) Market Analysis and Forecast (2013 - 2018)Sanjay MatthewsNo ratings yet

- Deas2009 16wpDocument20 pagesDeas2009 16wpNiculet NicoletaNo ratings yet

- Stakeholder Consultation On The Mid-Term Review of The 2011 White Paper On TransportDocument2 pagesStakeholder Consultation On The Mid-Term Review of The 2011 White Paper On TransportMaksym LukianenkoNo ratings yet

- Tco LCV EVDocument28 pagesTco LCV EVMadanagopal ManiNo ratings yet

- "E MOBILITY"-End of Pollution ???????Document55 pages"E MOBILITY"-End of Pollution ???????Sudipto PaulNo ratings yet

- 6 EuDocument9 pages6 EuMinh VũNo ratings yet

- Technology Roadmap For EVs and HEVsDocument52 pagesTechnology Roadmap For EVs and HEVskollanegeen100% (2)

- Local Action Plan For Electric Mobility in Lisbon: Final VersionDocument20 pagesLocal Action Plan For Electric Mobility in Lisbon: Final Versionaquel1983No ratings yet

- Action Plan en Act Part1 v2Document19 pagesAction Plan en Act Part1 v2Alfonso GruesoNo ratings yet

- Electric Vehicle Report EN - AS FINALDocument60 pagesElectric Vehicle Report EN - AS FINALCREAFUTURNo ratings yet

- The Future of Energy and MobilityDocument17 pagesThe Future of Energy and MobilityRounak DuttaNo ratings yet

- The State of Play in Electric Vehicle Charging ServicesDocument15 pagesThe State of Play in Electric Vehicle Charging ServicesShayan AhmedNo ratings yet

- GIZ Newsletter 2-2014 enDocument2 pagesGIZ Newsletter 2-2014 enAlexandru PaliiNo ratings yet

- Gymnasio Palouriotissas 1Document4 pagesGymnasio Palouriotissas 1Skoogle Learning WorldsNo ratings yet

- Paris 2020Document13 pagesParis 2020chopinaNo ratings yet

- Call For Evidence: Transport Investment and Economic PerformanceDocument8 pagesCall For Evidence: Transport Investment and Economic Performancepathanfor786No ratings yet

- The Contribution of Competition Policy To Growth and The EU 2020 Strategy PDFDocument118 pagesThe Contribution of Competition Policy To Growth and The EU 2020 Strategy PDFmarandan85No ratings yet

- PESTLE AnalysisDocument30 pagesPESTLE Analysispriti_chitiNo ratings yet

- The Making of A Smart City - Policy RecommendationsDocument24 pagesThe Making of A Smart City - Policy RecommendationsBhupendra JhaNo ratings yet

- The Future of Urban TransportDocument27 pagesThe Future of Urban TransportGustavo LeivasNo ratings yet

- Broadband 2011Document119 pagesBroadband 2011amedinagomez3857No ratings yet

- Plug in Vehicle Infrastructure StrategyDocument51 pagesPlug in Vehicle Infrastructure StrategyRishi KeshNo ratings yet

- IATSS Research: Francesca Romana Medda, Gianni Carbonaro, Susan L. DavisDocument5 pagesIATSS Research: Francesca Romana Medda, Gianni Carbonaro, Susan L. DavisZulfadly UrufiNo ratings yet

- Sustainability - Different Scenarios of Electric MobilityDocument51 pagesSustainability - Different Scenarios of Electric Mobilitycontiniandrea97No ratings yet

- TAB Arbeitsbericht Ab153 - ZDocument16 pagesTAB Arbeitsbericht Ab153 - ZEli BaalaaNo ratings yet

- Road User TaxationDocument83 pagesRoad User TaxationDonny Dwi SaputroNo ratings yet

- Safe, Smart, and Green: Boosting European Passenger Rail's Modal ShareDocument10 pagesSafe, Smart, and Green: Boosting European Passenger Rail's Modal ShareAntónio AlmeidaNo ratings yet

- Cycling Infrastructure Is An Economic Asset For Society As A WholeDocument9 pagesCycling Infrastructure Is An Economic Asset For Society As A WholeDaijo Private LimitedNo ratings yet

- Fuel Economy of Road VehiclesDocument50 pagesFuel Economy of Road VehiclesdressfeetNo ratings yet

- Mobility of The Future BrochureDocument20 pagesMobility of The Future BrochureRahul SachdevaNo ratings yet

- CPB Background Document Social Cost Benefit Analysis Road Pricing NetherlandsDocument16 pagesCPB Background Document Social Cost Benefit Analysis Road Pricing NetherlandsChNo ratings yet

- Informal Notes "PPP Info-Day": Brussels, 13 July 2009Document17 pagesInformal Notes "PPP Info-Day": Brussels, 13 July 2009Sachindra KumarNo ratings yet

- Elost Policy IctafDocument69 pagesElost Policy IctafYoel RabanNo ratings yet

- 2022 New Mobility Patterns in European Cities Task B Executive SummaryDocument17 pages2022 New Mobility Patterns in European Cities Task B Executive SummaryEscoroxNo ratings yet

- UE Urban Mobility Plans 2007Document20 pagesUE Urban Mobility Plans 2007Laura AlboiuNo ratings yet

- Non-Revenue Funding of Railways in EuropeDocument16 pagesNon-Revenue Funding of Railways in EuropeADBI EventsNo ratings yet

- Electric Vehicles 89176bc1 1aee 4c6e 829f Bd426beaf5d3Document7 pagesElectric Vehicles 89176bc1 1aee 4c6e 829f Bd426beaf5d3Sun77789No ratings yet

- Strategy and Action Plan for the Greater Mekong Subregion East-West Economic CorridorFrom EverandStrategy and Action Plan for the Greater Mekong Subregion East-West Economic CorridorNo ratings yet

- CH 07Document51 pagesCH 07ioanitescumihaiNo ratings yet

- Global Smart Homes Market (2013 - 2018)Document14 pagesGlobal Smart Homes Market (2013 - 2018)Sanjay MatthewsNo ratings yet

- EY The Big Data Dilemma PDFDocument4 pagesEY The Big Data Dilemma PDFioanitescumihaiNo ratings yet

- Certina Product Sheet DS PH200M C036.407.11.050.01Document1 pageCertina Product Sheet DS PH200M C036.407.11.050.01ioanitescumihaiNo ratings yet

- Euroncap Ford Mondeo 2014 5stars PDFDocument5 pagesEuroncap Ford Mondeo 2014 5stars PDFcarbasemyNo ratings yet

- GSM ThermostaatDocument10 pagesGSM ThermostaatioanitescumihaiNo ratings yet

- PPM Resource Demand PlanningDocument2 pagesPPM Resource Demand PlanningioanitescumihaiNo ratings yet

- Product Development ManagerDocument1 pageProduct Development ManagerioanitescumihaiNo ratings yet

- ABB Solutions For Photovoltaics: Protection and Other Modular DevicesDocument20 pagesABB Solutions For Photovoltaics: Protection and Other Modular Deviceskiller klausNo ratings yet

- EY The Big Data Dilemma PDFDocument4 pagesEY The Big Data Dilemma PDFioanitescumihaiNo ratings yet

- Coal in Europe 2011: Lignite Production, Hard Coal Production and Imports (In MT)Document1 pageCoal in Europe 2011: Lignite Production, Hard Coal Production and Imports (In MT)ioanitescumihaiNo ratings yet

- Opcom: JANUARY 2013 Monthly Market ReportDocument4 pagesOpcom: JANUARY 2013 Monthly Market ReportioanitescumihaiNo ratings yet

- Solar Energy PrimerDocument16 pagesSolar Energy PrimerFforward1605No ratings yet

- LT ENTSO-E Concerning PV Issue Annex 1 Assessment of The System Security With Respect To Disconnection Rules of PV Panels 120425Document12 pagesLT ENTSO-E Concerning PV Issue Annex 1 Assessment of The System Security With Respect To Disconnection Rules of PV Panels 120425ioanitescumihaiNo ratings yet

- 2.5 - Conclusions of The 2nd High-Level Loop-Flow Conference PDFDocument1 page2.5 - Conclusions of The 2nd High-Level Loop-Flow Conference PDFioanitescumihaiNo ratings yet

- The Potential of Securitization in PV FinanceDocument37 pagesThe Potential of Securitization in PV FinanceioanitescumihaiNo ratings yet

- EDFFacts and Figures - 2012Document221 pagesEDFFacts and Figures - 2012ioanitescumihaiNo ratings yet

- Opcom: February 2013 Monthly Market ReportDocument4 pagesOpcom: February 2013 Monthly Market ReportioanitescumihaiNo ratings yet

- Annual Report - 2011 - EN PDFDocument8 pagesAnnual Report - 2011 - EN PDFioanitescumihaiNo ratings yet

- Carbon Capture J13webDocument28 pagesCarbon Capture J13webioanitescumihaiNo ratings yet

- Grid Integration of Renewable Electricity Trading and Transmission Roundtable: Summary and HighlightsDocument14 pagesGrid Integration of Renewable Electricity Trading and Transmission Roundtable: Summary and HighlightsioanitescumihaiNo ratings yet

- Emise Lunar 2013 Emise Lunar 2013Document43 pagesEmise Lunar 2013 Emise Lunar 2013afddymyltnNo ratings yet

- Brochure Electricity Costs BFDocument44 pagesBrochure Electricity Costs BFioanitescumihaiNo ratings yet

- Power in EuropeDocument31 pagesPower in EuropeioanitescumihaiNo ratings yet

- Silent KillersDocument56 pagesSilent KillersioanitescumihaiNo ratings yet

- Brazil LowcarbonStudyDocument286 pagesBrazil LowcarbonStudyMondragon EdithNo ratings yet

- Presentation of Draft FGEBDocument24 pagesPresentation of Draft FGEBioanitescumihaiNo ratings yet

- Regulation (Ec) No 219 2009Document46 pagesRegulation (Ec) No 219 2009ioanitescumihaiNo ratings yet

- Directive 8 2004 Cosolidated 2009Document20 pagesDirective 8 2004 Cosolidated 2009ioanitescumihaiNo ratings yet

- Chemistry InvestigatoryDocument16 pagesChemistry InvestigatoryVedant LadheNo ratings yet

- CRM Final22222222222Document26 pagesCRM Final22222222222Manraj SinghNo ratings yet

- A - Persuasive TextDocument15 pagesA - Persuasive TextMA. MERCELITA LABUYONo ratings yet

- 5f Time of Legends Joan of Arc RulebookDocument36 pages5f Time of Legends Joan of Arc Rulebookpierre borget100% (1)

- Designing HPE Server Solutions: Supporting ResourcesDocument3 pagesDesigning HPE Server Solutions: Supporting ResourcesKARTHIK KARTHIKNo ratings yet

- Food NutritionDocument21 pagesFood NutritionLaine AcainNo ratings yet

- Rid and Clean Safety DataDocument1 pageRid and Clean Safety DataElizabeth GraceNo ratings yet

- Assignment 2 Malaysian StudiesDocument4 pagesAssignment 2 Malaysian StudiesPenny PunNo ratings yet

- Hanumaan Bajrang Baan by JDocument104 pagesHanumaan Bajrang Baan by JAnonymous R8qkzgNo ratings yet

- Java Magazine JanuaryFebruary 2013Document93 pagesJava Magazine JanuaryFebruary 2013rubensaNo ratings yet

- Internal Rules of Procedure Sangguniang BarangayDocument37 pagesInternal Rules of Procedure Sangguniang Barangayhearty sianenNo ratings yet

- Frbiblio PDFDocument16 pagesFrbiblio PDFreolox100% (1)

- Health and Hatha Yoga by Swami Sivananda CompressDocument356 pagesHealth and Hatha Yoga by Swami Sivananda CompressLama Fera with Yachna JainNo ratings yet

- Reflection On An American ElegyDocument2 pagesReflection On An American ElegyacmyslNo ratings yet

- Prof. Monzer KahfDocument15 pagesProf. Monzer KahfAbdulNo ratings yet

- Dragon Ball AbrigedDocument8 pagesDragon Ball AbrigedAlexander SusmanNo ratings yet

- Circular No 02 2014 TA DA 010115 PDFDocument10 pagesCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Karak Rules - EN - Print PDFDocument8 pagesKarak Rules - EN - Print PDFWesley TeixeiraNo ratings yet

- 5g-core-guide-building-a-new-world Переход от лте к 5г английскийDocument13 pages5g-core-guide-building-a-new-world Переход от лте к 5г английскийmashaNo ratings yet

- A List of Run Commands For Wind - Sem AutorDocument6 pagesA List of Run Commands For Wind - Sem AutorJoão José SantosNo ratings yet

- The Rise of Political Fact CheckingDocument17 pagesThe Rise of Political Fact CheckingGlennKesslerWPNo ratings yet

- Kolehiyo NG Lungsod NG Lipa: College of Teacher EducationDocument3 pagesKolehiyo NG Lungsod NG Lipa: College of Teacher EducationPrincess LopezNo ratings yet

- Spice Processing UnitDocument3 pagesSpice Processing UnitKSHETRIMAYUM MONIKA DEVINo ratings yet

- PUERPERAL SEPSIS CoverDocument9 pagesPUERPERAL SEPSIS CoverKerpersky LogNo ratings yet

- Death and The King's Horseman AnalysisDocument2 pagesDeath and The King's Horseman AnalysisCelinaNo ratings yet

- Ict - chs9 Lesson 5 - Operating System (Os) ErrorsDocument8 pagesIct - chs9 Lesson 5 - Operating System (Os) ErrorsOmengMagcalasNo ratings yet

- Journal Entry EnrepDocument37 pagesJournal Entry Enreptherese lamelaNo ratings yet

- National Rural Employment Guarantee Act, 2005Document17 pagesNational Rural Employment Guarantee Act, 2005praharshithaNo ratings yet

- Unit 3 RequirementsDocument4 pagesUnit 3 Requirementsravioli kimNo ratings yet