Professional Documents

Culture Documents

Income Tax Sections On House Property

Uploaded by

anandprakash72Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Sections On House Property

Uploaded by

anandprakash72Copyright:

Available Formats

C.Income from house property Income from house property.

49

22. 50The annual value of property consisting of any buildings51 or lands appurtenant51 thereto of which the assessee is the owner 51, other than such portions of such property as he may occupy51 for the purposes of any business or profession carried on by him the profits of which are chargeable to income-tax, shall be chargeable to income-tax under the head "Income from house property".

52

[Annual value how determined.

23. (1) For the purposes of section 22, the annual value of any property shall be deemed to be (a) the sum for which the property might reasonably be expected to let from year to year; or (b) where the property or any part of the property is let and the actual rent received or receivable53 by the owner in respect thereof is in excess of the sum referred to in clause ( a), the amount so received or receivable; or (c) where the property or any part of the property is let and was vacant during the whole or any part of the previous year and owing to such vacancy the actual rent received or receivable by the owner in respect thereof is less than the sum referred to in clause ( a), the amount so received or receivable : Provided that the taxes levied54 by any local authority in respect of the property shall be deducted (irrespective of the previous year in which the liability to pay such taxes was incurred by the owner according to the method of accounting regularly employed by him) in determining the annual value of the property of that previous year in which such taxes are actually paid by him. Explanation.For the purposes of clause (b) or clause (c) of this sub-section, the amount of actual rent received or receivable by the owner shall not include, subject to such rules55 as may be made in this behalf, the amount of rent which the owner cannot realise. (2) Where the property consists of a house or part of a house which (a) is in the occupation of the owner for the purposes of his own residence; or (b) cannot actually be occupied by the owner by reason of the fact that owing to his employment, business or profession carried on at any other place, he has to reside at that other place in a building not belonging to him, the annual value of such house or part of the house shall be taken to be nil. (3) The provisions of sub-section (2) shall not apply if

(a) the house or part of the house is actually let during the whole or any part of the previous year; or (b) any other benefit therefrom is derived by the owner. (4) Where the property referred to in sub-section (2) consists of more than one house (a) the provisions of that sub-section shall apply only in respect of one of such houses, which the assessee may, at his option, specify in this behalf; (b) the annual value of the house or houses, other than the house in respect of which the assessee has exercised an option under clause (a), shall be determined under sub-section (1) as if such house or houses had been let.]

56

[ Deductions from income from house property.

24. Income chargeable under the head "Income from house property" shall be computed after making the following deductions, namely: (a) a sum equal to thirty per cent of the annual value; (b) where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital: Provided that in respect of property referred to in sub-section (2) of section 23, the amount of deduction shall not exceed thirty thousand rupees : Provided further that where the property referred to in the first proviso is acquired or constructed with capital borrowed on or after the 1st day of April, 1999 and such acquisition or construction is completed 57[within three years from the end of the financial year in which capital was borrowed], the amount of deduction under this clause shall not exceed one lakh fifty thousand rupees. Explanation.Where the property has been acquired or constructed with borrowed capital, the interest, if any, payable on such capital borrowed for the period prior to the previous year in which the property has been acquired or constructed, as reduced by any part thereof allowed as deduction under any other provision of this Act, shall be deducted under this clause in equal instalments for the said previous year and for each of the four immediately succeeding previous years:]

58

[Provided also that no deduction shall be made under the second proviso unless the assessee furnishes a certificate, from the person to whom any interest is payable on the capital borrowed, specifying the amount of interest payable by the assessee for the purpose

of such acquisition or construction of the property, or, conversion of the whole or any part of the capital borrowed which remains to be repaid as a new loan. Explanation.For the purposes of this proviso, the expression "new loan" means the whole or any part of a loan taken by the assessee subsequent to the capital borrowed, for the purpose of repayment of such capital.]

Amounts not deductible from income from house property. 25. Notwithstanding anything contained in section 24, any 59[***] interest chargeable under this Act which is payable outside India (not being interest on a loan issued for public subscription before the 1st day of April, 1938), on which tax has not been paid or deducted under Chapter XVII-B and in respect of which there is no person in India who may be treated as an agent under section 163 shall not be deducted in computing the income chargeable under the head "Income from house property".

60

[Special provision for cases where unrealised rent allowed as deduction is realised subsequently. 25A. Where a deduction has been made under clause (x) of sub-section (1) of section 24 61[as it stood immediately before its substitution by the Finance Act, 2001] in the assessment for any year in respect of rent from property let to a tenant which the assessee cannot realise and subsequently during any previous year the assessee has realised any amount in respect of such rent, the amount so realised shall be deemed to be income chargeable under the head "Income from house property" and accordingly charged to income-tax (without making any deduction under section 23 or section 24 62[as it stood immediately before its substitution by the Finance Act, 2001]) as the income of that previous year, whether the assessee is the owner of that property in that year or not.]

62

[Unrealised rent received subsequently to be charged to income-tax.

25AA. Where the assessee cannot realise rent from a property let to a tenant and subsequently the assessee has realised any amount in respect of such rent, the amount so realised shall be deemed to be income chargeable under the head "Income from house property" and accordingly charged to income-tax as the income of that previous year in which such rent is realised whether or not the assessee is the owner of that property in that previous year.]

63

[Special provision for arrears of rent received.

25B. Where the assessee (a) is the owner of any property consisting of any buildings or lands appurtenant thereto which has been let to a tenant; and (b) has received any amount, by way of arrears of rent from such property, not charged to income-tax for any previous year, the amount so received, after deducting 64[a sum equal to thirty per cent of such amount], shall be deemed to be the income chargeable under the head "Income from house property" and accordingly charged to income-tax as the income of that previous year in which such rent is received, whether the assessee is the owner of that property in that year or not.]

Property owned by co-owners.

65

26. 66Where property consisting of buildings or buildings and lands appurtenant thereto is owned by two or more persons and their respective shares are definite and ascertainable, such persons shall not in respect of such property be assessed as an association of persons, but the share of each such person in the income from the property as computed in accordance with sections 22 to 25 shall be included in his total income.

67

[Explanation.For the purposes of this section, in applying the provisions of sub-section (2) of section 23 for computing the share of each such person as is referred to in this section, such share shall be computed, as if each such person is individually entitled to the relief provided in that sub-section.]

"Owner of house property", "annual charge", etc., defined.

68

27. For the purposes of sections 22 to 26 (i) an individual who transfers otherwise than for adequate consideration any house property to his or her spouse, not being a transfer in connection with an agreement to live apart, or to a minor child not being a married daughter, shall be deemed to be the owner of the house property so transferred; (ii) the holder of an impartible estate shall be deemed to be the individual owner of all the properties comprised in the estate ;

69

[(iii) a member of a co-operative society, company or other association of persons to whom a building or part thereof is allotted or leased under a house building scheme of the society, company or association, as the case may be, shall be deemed to be the owner of that building or part thereof ;

(iiia) a person who is allowed to take or retain possession of any building or part thereof in part performance of a contract of the nature referred to in 70section 53A of the Transfer of Property Act, 1882 (4 of 1882), shall be deemed to be the owner of that building or part thereof ; (iiib) a person who acquires any rights (excluding any rights by way of a lease from month to month or for a period not exceeding one year) in or with respect to any building or part thereof, by virtue of any such transaction as is referred to in clause ( f) of section 269UA, shall be deemed to be the owner of that building or part thereof;] (iv) 71[***] (v) 71[***] (vi) taxes levied by a local authority in respect of any property shall be deemed to include service taxes levied by the local authority in respect of the property.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- How To Use Stripe ForeverDocument5 pagesHow To Use Stripe ForeverAdi S. Gunawan75% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Concept of Permanent Establishment in China Tax TreatyDocument14 pagesThe Concept of Permanent Establishment in China Tax Treatyanandprakash72No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- EBook3-Excel Beyond The Basics PDFDocument307 pagesEBook3-Excel Beyond The Basics PDFanandprakash72No ratings yet

- Od 123941656293759000Document1 pageOd 123941656293759000MANORANJAN BEHERANo ratings yet

- Income Tax Table - NIRCDocument6 pagesIncome Tax Table - NIRCgoateneo1bigfightNo ratings yet

- Rules For The ICC Court of ArbitrationDocument12 pagesRules For The ICC Court of Arbitrationanandprakash72No ratings yet

- Trade PolicyDocument165 pagesTrade PolicyRamesh BharathiNo ratings yet

- Cs Manual2013Document270 pagesCs Manual2013zydusNo ratings yet

- SS-1 Final PDFDocument33 pagesSS-1 Final PDFAashish K BhattNo ratings yet

- Service TaxDocument164 pagesService TaxVarsha BhatterNo ratings yet

- DirectTaxesCode2013 31032014Document343 pagesDirectTaxesCode2013 31032014Dhananjay KulkarniNo ratings yet

- Safe Harbour RuleDocument21 pagesSafe Harbour Ruleanandprakash72No ratings yet

- 7 CpaDocument4 pages7 Cpaanandprakash72No ratings yet

- Companies Act 1956 13jun2011Document332 pagesCompanies Act 1956 13jun2011Tukaram ChinchanikarNo ratings yet

- Casio 24-27 ENGDocument4 pagesCasio 24-27 ENGanandprakash72No ratings yet

- Ar TaxDocument380 pagesAr TaxamitjadonNo ratings yet

- Bir Ruling (Da-373-05)Document4 pagesBir Ruling (Da-373-05)Rester John NonatoNo ratings yet

- Tax Reform in Nepal: A Study of Nepalese VATDocument118 pagesTax Reform in Nepal: A Study of Nepalese VATMilan Shakya91% (47)

- GST Book ConstructionDocument121 pagesGST Book Constructionvijaykadam_ndaNo ratings yet

- Caf 2 QB Past PapersDocument169 pagesCaf 2 QB Past PapersWahajaaNo ratings yet

- GSTR 3B Vs GSTR 1 Tax Comparison Report 2Document14 pagesGSTR 3B Vs GSTR 1 Tax Comparison Report 2Mani SinghNo ratings yet

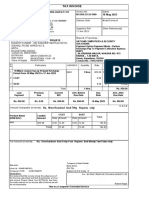

- Invoice SHADOWFAXDocument1 pageInvoice SHADOWFAXAinta GaurNo ratings yet

- (Understanding TCC) TaxAdministrationDocument2 pages(Understanding TCC) TaxAdministrationhandoutNo ratings yet

- Chap # 3 Job Order Costing All ProblemsDocument4 pagesChap # 3 Job Order Costing All ProblemsDaniyal PervezNo ratings yet

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011No ratings yet

- Mod 7Document1 pageMod 7Renz Joshua Quizon MunozNo ratings yet

- Assessments of Municipal Finances For The City of Mehasana: Finance Group Water Supply and Sanitation Lab. 07-08-2013Document24 pagesAssessments of Municipal Finances For The City of Mehasana: Finance Group Water Supply and Sanitation Lab. 07-08-2013Swapneel VaijanapurkarNo ratings yet

- Manish Payslip May 2019Document1 pageManish Payslip May 2019ManishNo ratings yet

- Cash Disbursement JournalDocument3 pagesCash Disbursement JournalRhea Mikylla ConchasNo ratings yet

- Session 11 and 12 - Accounting For DepreciationDocument57 pagesSession 11 and 12 - Accounting For DepreciationKashish Manish JariwalaNo ratings yet

- SKMK Impex PVT - LTD.: Original/Duplicate/TriplicateDocument1 pageSKMK Impex PVT - LTD.: Original/Duplicate/TriplicateabdcNo ratings yet

- GST On Real Estate - Analysis of Notifications Issued On 29.03.2019 - Taxguru - inDocument8 pagesGST On Real Estate - Analysis of Notifications Issued On 29.03.2019 - Taxguru - inAnshulNo ratings yet

- TCDN Clc63d - Peony Coffee-V1Document4 pagesTCDN Clc63d - Peony Coffee-V111219775No ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- Final Project On Service Tax 2017Document21 pagesFinal Project On Service Tax 2017ansh patelNo ratings yet

- Sample Natural Form of Statement of Comprehensive IncomeDocument1 pageSample Natural Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Form 04Document7 pagesForm 04bradleytedhouseofkingston174No ratings yet

- Selected Information From The December 31Document1 pageSelected Information From The December 31PetraNo ratings yet

- April Salary PDFDocument1 pageApril Salary PDFomkassNo ratings yet

- Quarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoDocument1 pageQuarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoAlexis TrinidadNo ratings yet

- Final Module 2 TaxationDocument20 pagesFinal Module 2 TaxationJulius Earl MarquezNo ratings yet

- Premier Support AutoRenew Eligible Store Terms Conditions v082420 091420Document2 pagesPremier Support AutoRenew Eligible Store Terms Conditions v082420 091420Stefan AmarandeiNo ratings yet

- Diwa One Plus 5Document1 pageDiwa One Plus 5kunal.nitw100% (1)