Professional Documents

Culture Documents

Employees Entitled to Overtime Pay and 13th Month Pay

Uploaded by

John Mark ParacadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employees Entitled to Overtime Pay and 13th Month Pay

Uploaded by

John Mark ParacadCopyright:

Available Formats

Who are covered?

All employees in all establishments and undertakings whether for profit or not are entitled to overtime pay for work rendered beyond eight (8) hours. But this does not apply to managerial employees, field personnel, members of the family of the employer who are dependent on him for support, domestic helpers, persons in the personal service of another, and workers who are paid by results. Employees in the government are also entitled to overtime pay but they are governed by Civil Service laws and rules. Only employees in the private sector are covered by the Labor Code. Special rules for health personnel For health personnel in (1)cities and municipalities with a population of at least one million (1,000,000) or in (2)hospitals and clinics with a bed capacity of at least one hundred (100), their normal hours of work are eight (8) hours a day, for five (5) days a week, exclusive of time for meals. (Article 83, LCP) Health personnel includes resident physicians, nurses, nutritionists, dietitians, pharmacists, social workers, laboratory technicians, paramedical technicians, psychologists, midwives, attendants and all other hospital or clinic personnel. Overtime work by health personnel included in the two abovementioned instances is, as a rule, not allowed since it involves strenuous physical work considering the number of patients or clients they must attend to. However, they may be compelled to work beyond such hours where the exigencies of the service require that they work for six (6) days or forty-eight (48) hours. But the employer is required to pay an additional compensation of at least thirty percent (30%) of their regular wage for work on the sixth day. Can an employee be compelled to render overtime? When an employee spends additional time for work, he puts in more physical and mental effort. It is but proper that he be compensated for that. He is also delayed in going home and cannot spend time with family and enjoy the comforts of his home. As such, the law discourages employers to require employees to work overtime. Generally, he cannot compel the employee to render overtime, except in certain instances (Sec 10, Rule I, Bk. III, IRR) to wit: 1) When the country is at war or when any other national or local emergency has been declared by the National Assembly or the Chief Executive; 2) When overtime work is necessary to prevent loss of life or property, or in case of imminent danger to public safety due to actual or impending emergency in the locality caused by serious accident, fire, floods, typhoons, earthquake, epidemic or other disaster or calamities; 3) When there is urgent work to be performed on machineries, installations, or equipment, in order to avoid serious loss or damage to the employer or some other causes of similar nature; 4) When the work is necessary to prevent loss or damage to perishable goods; 5) When the completion or continuation of work started before the 8th hour is necessary to prevent serious obstruction or prejudice to the business or operations of the employer; 6) When overtime work is necessary to avail of favorable weather or environmental conditions where performance or quality of work is dependent thereon. Can an employee insist on working overtime? The employee cannot compel his employer to allow him to work overtime when the circumstances does not require him to do so as when there is actually no work to be performed. Under time cannot be offset by overtime Under time work on any particular day shall not be offset by overtime work on any other day (Article 88, LCP). The reason behind this is fairness. If the employee works for less than eight hours, he will be paid only for the corresponding number of hours he had actually worked. If on another day he works beyond the maximum hours, he should be given additional compensation.

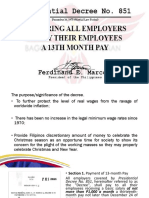

Non-payment of overtime pay is not only illegal but also contrary to public policy. The employer cannot use the overtime to offset the under time because payment of overtime pay is mandatory. However, he may either deduct the under time from the wage of the employee, or through other approaches. Although these methods are not provided by law, these may be found in company policies or established by company practices. Computation of wages The computation of overtime pay, pay for work done on holidays, premium on nightshift and 13th month pay are set out by the following rules: Computing Overtime: On Ordinary Days Number of hours in excess of 8 hours (125% x hourly rate) On a rest day, special day or regular holiday Number of hours in excess of 8 hours (130% x hourly rate) Computing pay for work done on: A special day (130% x basic pay) A special day, which is also a scheduled rest day (150% x basic pay) A regular holiday (200% x basic pay) A regular holiday, which is also a scheduled rest day (260% x basic pay) Computing Night Shift Premium Where Night Shift is a Regular Work: On Ordinary day (110% x basic hourly rate) On a rest day, special day, regular holiday (110% of regular hourly rate for a rest day, special day, regular holiday) Computing Overtime on Night Shift: On ordinary day (110%) x overtime hourly rate) On rest day, special day or regular holiday (110% x overtime hourly rate for rest days, special days, regular holidays) Computing 13th Month Pay: Total basic salary earned for the year exclusive of overtime, holiday, and night shift differential pay divided by 12 = 13th month pay. Presidential Decree No. 851 (otherwise known as Thirteenth Month Pay Law), as amended by Memorandum Order No. 28, requires all employers to pay their employees a 13th month pay not later than December 24 of every year. Historical Backdrop. Originally, when PD 851, issued by Pres. Marcos, took effect on December 16, 1975, only employees receiving a basic salary of not more than P1,000 a month were entitled to 13th pay. On August 13, 1986, Pres. Aquino, through Memorandum Order No. 28, removed the salary ceiling of P1,000. With the removal of the salary ceiling, all rank and file employees become entitled to a 13th month pay regardless of the amount of their monthly basic salary (unless their employers are exempted from the application of PD 851). Employees Covered by 13th Month Pay Law.

All rank-and-file employees, regardless of their designation or employment status, and irrespective of the method by which their wages are paid, who have worked at least one month during the calendar year are entitled to 13th month pay. Rank and File Employees Meaning. As stated above, only rank-and-file employees are entitled to 13th month pay. Managerial employees are excluded from the coverage of the law. The Labor Code distinguishes a rank-and-file employee from a managerial employee. It provides that a managerial employee is one who is vested with powers of prerogatives to lay down and execute management policies and/or to hire, transfer, suspend, lay-off, recall discharge, assign or discipline employees, or to effectively recommend such managerial actions. All employees not falling within this definition are considered rank-and-file employees. Amount of 13th Month Pay. The 13th month pay shall be in the amount not less than 1/12 of the total basic salary earned by the employee within the calendar year. Computation Only basic salary is included in the computation of 13th month pay. Allowances and monetary benefits which are not considered or integrated as part of the regular or basic salary, such as the cash equivalent of unused vacation and sick leave credits, overtime, premium, night differential and holiday pay, and cost-of-living allowances, shall be excluded from the computation. However, these salary-related benefits should be included as part of the basic salary in the computation of the 13th month pay if by individual or collective agreement, company practice or policy, the same are treated as part of the basic salary of the employees. Time of Payment of 13th Month Pay. The required 13th month pay shall be paid not later than December 24 of each year. An employer, however, may give to his employees one half of the required 13th month pay before the opening of the regular school year and the other half on before the 24th of December of every year. The frequency of payment of this monetary benefit may be the subject of agreement between the employer and the recognized/collective bargaining agent of the employees. Employees excluded from coverage of 13th month pay law. Managerial employees; Those covered under the civil service law; Those already receiving 13th month pay or its equivalent. Christmas bonus, mid-year bonus, cash bonuses and other payments amounting to not less than 1/12 of the basic salary are treated as equivalent of 13th month pay; Household helpers and persons in the personal service of another; and Those paid on purely commission, boundary, or task basis, and those who are paid fixed amount for performing specific work except those paid on a piece-rate basis. 13th Month Pay of Certain Types of Employees Employees paid on commission basis. Employees paid on a purely commission basis are not entitled to 13th month pay. They are expressly excluded from the coverage of PD 851. However, employees paid on partly commission basis, i.e., those guaranteed with a fixed wage aside from the commission, are entitled to 13th month pay. Computation. In the computation of the basic salary of employees paid partly on commission basis, we must distinguish between the two types of commission: 1. Commission as an incentives or encouragement to ensure productivity, i.e., productivity bonus; and 2. Commission as a direct remuneration for service rendered. Commission that take the form of an incentives or encouragement to ensure productivity, e.g., productivity bonus, does not form part of the basic salary. As such, it may be excluded from the computation of 13th month pay. Only the fixed or guaranteed wage is required to be included in the computation (see Boie Takeka case, 1993.) Basic salary = Fixed wage (commission is excluded)

1. 2. 3. 4. 5.

On the other hand, commission that takes the form of a direct remuneration for services rendered should be included in the computation of the basic salary. That is, it should be added to the guaranteed wage of the employee in computing his basic salary (see Philippine Duplicators v. NLRC, 1993.) Basic salary = Fixed wage + Commission 13th Month Pay of Employees with Multiple Employers. Employees with multiple employers are entitled to 13th month pay from all their private employers. Thus, if an employee works in two or more private firms, he is entitled to the pay from both or all of them. If he is a government employee, but works part time in a private enterprise, he is entitled to 13th month pay from the private enterprise. 13th Month Pay of Private School Teachers. Private school teachers are entitled to 13th month pay regardless of the numbers of months they work in a year, provided it is at least one month. Payment of 13th Month Pay to Resigned or Separated Employees. Employees who resigned or were separated during the calendar year shall be entitled to 13th month pay in proportion to the length of time he worked during the year, provided it is at least one month. The payment may be demanded by the employee upon the cessation of employment. Example 1. Assuming an employee earning a basic salary of P12,000.00 per month had worked for at least 9 months at the time of his separation, how much is his 13th month pay? Answer: P9,000.00. Computation: (P12,000.00 x 9 months) 12 = P9,000.00 Cases 1. For 2 to 3 years, Sevilla Trading, allegedly by mistake, added the night premium, maternity leavepay, etc., in the computation 13th month pay. The court ruled that the inclusion may no longer be withdrawn if it has already ripened into a company practice. Nota bene: There is no specific rule as to how many years are necessary to constitute company practice. (Sevilla Trading v. AVA Tomas, GR No. 152456.) 2. Employees paid according to boundary system are not entitled to 13th mo pay. Boundary system is where the employees do not receive fixed wages, but retain only those sums in excess of the boundary or fee they pay to the owners or operators of their vehicles. They are akin to employees paid on purely commission basis. (R&E Transport v. Latag, G.R. No. 155214.) 3. Drivers who are paid on commission basis, but with guaranteed minimum wage in case their commission be less than their basic minimum, are entitled to 13th month pay. (PACIWU v. NLRC, GR No 107994.) References 1. Presidential Decree No. 851, effective December 16, 1975. 2. Revised Rules and Regulations Implementing Presidential Decree No. 851 Last Edited: Sunday, December 18, 2011 Caveat: Subsequent court and administrative rulings, or changes to, or repeal of, laws, rules and regulations may have rendered the whole or part of this article inaccurate or obsolete. Premium Pay Meaning Premium pay refers to the additional compensation required by law to be paid to employees for work performed on nonworking days, such as rest days and special days. No Work, No Pay Rule During rest and special days, the principle of no work, no pay applies. Workers who were not required or permitted to work on those days are not by law entitled to any compensation. This is consistent with the definition above that premium pay is to be paid for work performed. Performance of work is necessary for entitlement to premium pay.

Premium Pay For Rest Days As a general rule, where an employee is made or permitted to work on his scheduled rest day, whether it is a regular day or a holiday, he shall be paid an additional compensation of at least 30% of his regular wage for that day. The rule is different for work performed on a rest day which is also a special day, in which case, 50% of the regulary daily rate is added, instead of 30% of the daily rate for special day. In sum, the premium pay rates for rest days are as follows: 1. For work performed on rest days, an additional 30% of the daily rate or a total of 130%; 2. For work performed on a rest day which is also a special day, an additional of 50% of the daily rate or a total of 150%; and 3. For work performed on a regular holiday which is also the employees rest day, an additional 30% of the regular holiday rate of 200% or a total of 260%. Computation For work performed on rest day, using P250.00 as Basic pay, the rate may be determined as follows: Rate on Rest day = Basic pay + Premium pay Where, Premium pay = 30% of Basic pay = 30% of P250.00 = 0.3 x P250.00 = P75.00 Thus, Rate on Rest day = Basic pay + Premium pay = P250.00 + P75.00 = P325.00 For work performed on a regular holiday which is also the employees rest day, the rate may be determined as follows: Rate = Daily rate on holiday + Premium pay Where, Premium pay = 30% of Daily rate on holiday, and Daily rate on holiday = 200% of Basic pay = P500.00 Thus, Premium pay = 0.3 x Daily rate on holiday = 0.3 x P500.00 = P150.00 Thus, the rate on rest day falling on a holiday is: Rate = Daily rate on holiday + Premium pay = P500.00 + P150.00 = P650.00 Or, Rate = 260% of Basic pay = 2.6 x P250.00 = P650.00 Premium pay for Special Days There are two national special days observed in the Philippines: 1. All Saints Day (November 1); and 2. The last day of the year (December 31). Work performed on special days merits additional compensation of not less than 30% on top of the basic pay or a total of 130%.

Computation Using P250.00 as daily rate (Basic pay), the Rate on special day may be determined as follows: Rate on special day = Basic pay + Premium Where, Premium = 30% of Basic pay = 30% of P250.00 = P75.00 Thus, Rate on special day = Basic pay + Premium = P250.00 + P75.00 = P325.00 Or, Rate on special day = 130% of Basic pay = Basic pay x 1.3 = P250.00 x 1.3 = P325.00 Premium Pay For Special Day falling on Rest Day. If the special day falls on employees scheduled rest day, he is entitled to at least 50% over and above the basic pay or a total of 150%. Computation Rate for work on special days which is also the employees rest day entitles him to an additional 50% of the daily rate (Basic pay). Rate = Basic pay + Premium pay Where, Premium pay = 50% of Basic pay = P250.00 x 0.5 = P125.00 Thus, Rate = Basic pay + Premium pay = P250.00 + P125.00 = P375.00 Or, Rate = 150% of Basic pay = Basic pay x 1.5 = P250.00 x 1.5 = P375.00 If no regular workdays and no scheduled regular rest days Where the nature of the work of the employee is such that he has no regular workdays and no regular rest days can be scheduled, he shall be paid an additional compensation of at least 30% of his regular wage for work performed on Sundays and holidays. Premium Pay and Holiday Pay Comparison Using the definition of premium pay above, holiday pay is not a premium pay because it does not requireperformance of work by the employee. In case of holiday pay, the employee is entitled payment even if he does not work. The same cannot be said of premium pay. Thus, unlike in premium pay, the principle no work, no pay does not similarly apply to holiday pay. Last Edited: Friday, August 19, 2011

Caveat: Subsequent court and administrative rulings, or changes to, or repeal of, laws, rules and regulations may have rendered the whole or part of this article inaccurate or obsolete. Basis. All employees required to work beyond eight hours in one workday is entitled to overtime pay. The basis of overtime pay is found in Article 87 of the Labor Code. Article 87. Overtime work. Work may be performed beyond eight hours a day provided that theemployee is paid for the overtime work an additional compensation equivalent to his regular wage plus at least twenty-five percent thereof. Work performed beyond eight hours on a holiday or rest day shall be paid an additional compensation equivalent to the rate for the first eight hours on a holiday or rest day plus at least 30 percent thereof. Terminology. Overtime Pay. Overtime pay is the additional compensation payable to employee for services or work rendered beyond the normal eight hours of work. It is computed by multiplying the overtime rate with the number of hours in excess of the regular eight hours of work. Overtime Work. Any work performed beyond the normal 8 hours of work in one workday is considered as overtime work. Workday. A workday is the consecutive 24-hour period which commences from the time the employee starts to work and ends at the same time the following day. To illustrate, if the employee regularly works from 8AM to 4PM, his regular workday is the 24-hour period from 8AM to 8AM of the following day. Workdays do not necessarily corresponds to calendar days. Overtime Pay Rates. Overtime pay rates depend upon the day the work is performed, whether it is ordinary working day, special day, holiday or rest day. For ordinary working day, an additional compensation equivalent to his regular hourly rate plus at least 25% thereof. For holiday, special day and rest day, an additional compensation equivalent to the rate for the first eight hours on a holiday or rest day plus at least 30% thereof. Computation of Overtime Pay Assuming that the mininum wage rate is P250, how much is the overtime rate per hour? On ordinary day On an ordinary day, the overtime rate per hour is determined as follows: First, compute the hourly rate of the employee: Regular hourly rate = Minumum wage rate 8 hours = P250 8 hours = P31.25 per hour Now to determine overtime rate per hour: Overtime rate = Regular hourly rate + 25% of Regular hourly rate Overtime rate = P31.25 + (25% of P31.25) = P31.25 x 1.25 = P39.06 per hour On rest day and special day Compute the hour rate of the employee on a rest day or special day: Hourly rate = 130% of Regular hourly rate = P31.25 x 1.30

= P40.625 per hour (Note: The hourly rate on rest day and special day is 130% of the regular rate.) To determine overtime rate per hour: Overtime rate = Hourly rate on rest day + 30% Hourly rate on rest day = P40.625 + (30% of P40.625) = P40.625 x 1.30 = P52.81 per hour On rest day which falls on a special day Compute the hourly rate of the employee on a rest day which falls on a special day: Hourly rate = 150% of Regular hourly rate = P31.25 x 1.50 = P46.875 per hour To determine overtime rate per hour: Overtime rate = Hourly rate + 30% of Hourly rate = P46.875 + (30% of P46.875) = P46.875 x 1.30 = P60.94 per hour On a regular holiday Compute the hourly rate on regular holiday: Hourly rate = 200% of Regular hourly rate = P31.25 x 2 = P62.5 per hour To determine overtime rate per hour: Overtime rate = Hourly rate + 30% of Hourly rate = P62.50 + (30% of P62.50) = P62.50 x 1.30 = P81.25 per hour On a rest day which falls on a regular holiday Compute the hourly rate: Hourly rate = 260% of Regular hourly rate = P31.25 x 2.60 = P81.25 per hour To determine overtime rate per hour: Overtime rate = Hourly rate + 30% of Hourly rate = P81.25 + (30% of P81.25) = P81.25 x 1.30 = P105.625 per hour Work need not be Continuous. Work performed by the employee need not be continuous as long as it falls within the same work day. For example, an employee who works in two shifts, one from 8AM to 12AM (four hours), and another from 4PM to 8PM of the same work day (another four hours), suffers a total of 8 hours of work. If he is required to work for another hour within the same work day (from 8AM to 8AM of the following day), then such work is subject to overtime pay. Undertime cannot be Offset by Overtime.

Some employers has the practice of offsetting undertime and overtime. For example, if an employee work for only 7 hours on any given day (one hour undertime), he will be required to make up for his undertime by requiring him to render additional one hour work on another day. This practice is prohibited under Article 87 of the Labor Code, viz: Article 87. Undertime not offset by overtime. Undertime work on any particular day shall not be offset by overtime work on any other day. x x x The rationale for provision is quite obvious. Offsetting undertime against overtime is improper because the employee would be deprived of the additional compensation for the overtime work he has rendered. Note that undertime is covered only by the regular hourly rate whereas overtime is subject to additional overtime rate. If the two are to be offset, the employee loses overtime pay to which he is entitled. Emergency Overtime Work. As a general rule, employees may not be compelled to work in excess of eight hours or to render overtime work on any given day against his will. The exception to this rule is found in Artile 89 of the Labor Code. Under the said article, employees may be compelled to perform overtime work in any of the following cases: 1. 2. 3. 4. 5. 6. When the country is at war or under any national or local emergency; When overtime work is necessary to prevent loss of life or property, or in case of imminent danger to public safety; When there is urgent work to be performed on machines, etc., in order to avoid serious loss or damage to the employer; When the work is necessary to prevent loss or damage to perishable goods; When the completion or continuation of work is necessary to prevent serious obstruction or prejudice to the business; or When overtime work is necessary to avail of favorable weather or environmental conditions. Managerial Employees not Entitled to Overtime Pay. Article 82 of the Labor Code states that the provisions of the Labor Code on working conditions and rest periods shall not apply to managerial employees. This includes overtime pay for overtime work. Thus managerial employees are not entitled to overtime pay for services rendered in excess of eight hours a day. Cases 1. Supervisory employees are considered as officers or members of the managerial staff, and hence are not entitled to overtime, rest day and holiday pay. (Natl Sugar Refineries Corp. vs. NLRC, G.R. No. 101761. March 24, 1993) Last Edited: Friday, August 19, 2011 Caveat: Subsequent court and administrative rulings, or changes to, or repeal of, laws, rules and regulations may have rendered the whole or part of this article inaccurate or obsolete. Normal Hours of Work The normal hours of work under the Labor Code is 8 hours in one work day. Work day is understood to mean one 24-hour cycle which starts from the time the employee is engaged to work and ends on the same time the following day. For example, if the employee is engaged to work from 8:00am to 5:00pm, his work day is the 24-hour cycle that starts from 8:00am and ends at 8:00am of the following day. The employer is free to adopt what time in a day the work shall start as long as the total number of hours worked will not exceed 8 hours. If the number of hours worked exceed 8 hours, the employee must be paidovertime pay for the excess. How to compute overtime pay? Hours worked definition Hours worked refers to all compensable period of work. Hours work includes: 1. All the time during which an employee is required to be on duty or to be at a prescribed workplace; and 2. All the time during which an employee is suffered or permitted to work. Meal periods The employer must give his employees not less than 60 minutes or one hour time-off for their meals. This period in noncompensable, which means that it is not to be included in the computation of hours worked. For example, if an employees work is from 8:00am to 5:00 with one hour meal break from 12:00nn to 1:00pm, the total compensable hours

of the employee is 8 hours, i.e., from 8:00am 12:00nn and 1:00pm 5:pm. The period from 12:00nn to 1:00pm is noncompensable. Shortened meal periods Under exceptional circumstances, the employer may give the employee a meal period of not less than 20 minutes, provided that such shorter meal period is credited as compensable hours worked of the employee. Shortened meal period may be allowed under the following cases: 1. Where the work is non-manual work in nature or does not involve strenuous physical exertion; 2. Where the establishment regularly operates not less than 16 hours a day; 3. In case of actual or impending emergencies or there is urgent work to be performed on machineries, equipment or installations to avoid serious loss; and 4. Where the work is necessary to prevent serious loss of perishable goods. Rest periods The employer may give their employees rest periods or coffee breaks during working hours in order to beef them up or to make them more productive. Unlike meal periods, rest periods running from 5 to 20 minutes is compensable as hours worked. Rest period running for more that 20 minutes may or may not be compensable depending on the situation. See letter (b) under Principles in determining hours worked. The giving of rest period, however, is not required under the Labor Code, and is largely a management prerogative. Principles in determining hours worked The following general principles may be used to determine whether the time spent by an employee is considered hours worked or not: 1. All hours are hours worked which the employee is required to give his employer, regardless of whether or not such hours are spent in productive labor or involve physical or mental exertion. 2. An employee need not leave the premises of the work place in order that his rest period shall not be counted, it being enough that he stops working, may rest completely and may leave his work place, to go elsewhere, whether within or outside the premises of his work place. 3. If the work performed was necessary, or it benefited the employer, or the employee could not abandon his work at the end of his normal working hours because he had no replacement, all time spent for such work shall be considered as hours worked, if the work was with the knowledge of his employer or immediate supervisor. 4. The time during which an employee is inactive by reason of interruptions in his work beyond his control shall be considered working time either if the imminence of the resumption of work requires the employees presence at the place of work or if the interval is too brief to be utilized effectively and gainfully in the employees own interest. Waiting time Waiting time spent by an employee shall be considered as working time if waiting is an integral part of his work or the employee is required or engaged by the employer to wait. On call duty An employee who is required to remain on call in the employers premises or so close thereto that he cannot use the time effectively and gainfully for his own purpose shall be considered as working while on call. The employee must be required to leave a word where he may be reached. An employee who is not required to leave word at his home or with company officials where he may be reached is not working while on call. Lectures, meetings, training programs Attendance at lectures, meetings, training programs, and other similar activities shall not be counted as working time if all of the following conditions are met: 1. Attendance is outside of the employees regular working hours; 2. Attendance is in fact voluntary; and 3. The employee does not perform any productive work during such attendance. References 1. Chapter 1, Title I, Book Three, Labor Code of the Philippines (Article 82 to 85)

2. Rule I, Book Three, Omnibus Rules Implementing the Labor Code. Last Edited: Friday, August 19, 2011 Caveat: Subsequent court and administrative rulings, or changes to, or repeal of, laws, rules and regulations may have rendered the whole or part of this article inaccurate or obsolete. Concept The principle of non-diminution of benefits states that: any benefit and supplement being enjoyed by employees cannot be reduced, diminished, discontinued or eliminated by the employer.[1] This principle is founded on the Constitutional mandate to protect the rights of workers and promote their welfare, and to afford labor full protection. Said mandate in turn is the basis of Article 4 of the Labor Code which states that all doubts in the implementation and interpretation of this Code, including its implementing rules and regulations shall be rendered in favor of labor.[2] Benefit and supplement definition Employee benefits are compensations given to employees in addition to regular salaries or wages.[3] Some benefits are legally required, e.g., social security benefits, medicare, retirement benefits, maternity benefits,service incentive leave, etc. Other benefits are offered by the employer as an incentive to attract and retain employees as well as increase employee morale and improve job performance.[4] Supplements include those benefits or privileges granted to an employee for the convenience of the employer, e.g., board and lodging within the company premises. Common application In employment setting, the principle of non-diminution of benefits finds application when a change initiated by the employer to existing company policies, specially matters concerning employee benefits, results in reduction, diminution or withdrawal of some or all of the the benefits already enjoyed by the employees. For example, if the employees of a certain company is traditionally granted 14th month pay, and the employer subsequently withdrew such benefit, or reduced its amount, the reduction or withdrawal is objectionable on the ground that it would result to diminution of benefits. Requirements The application of the principle presupposes that a company practice, policy and tradition favorable to the employees has been clearly established; and that the payments made by the company pursuant to it have ripened into benefits enjoyed by them.[5] To ripen into benefits, the following requisites must concur: 1. It should have been practiced over a long period of time; and 2. It must be shown to have been consistent and deliberate.[6] With regard to the length of time the company practice should have been exercised to constitute voluntary employer practice which cannot be unilaterally withdrawn by the employer, the Court has not laid down any rule requiring a specific minimum number of years.[7] 1. In the case of Davao Fruits Corporation vs Associated Labor Unions (G.R. No. 85073, August 24, 1993), the company practice lasted for six years. 2. In Davao Integrated Port Stevedoring Services vs. Abarquez (G.R. No. 102132, March 19, 1993), the employer, for three years and nine months, approved the commutation to cash of the unenjoyed portion of the sick leave with pay benefits of its Intermittent workers. 3. In Tiangco vs Leogardo, Jr. (G.R. No. L-57636, May 16, 1983), the employer carried on the practice of giving a fixed monthly emergency allowance from November 1976 to February 1980, or three years and four months. 4. In the case of Sevilla Trading Company vs Semana, ibid., the employer kept the practice of including non-basic benefits such as paid leaves for unused sick leave and vacation in the computation of their 13th-month pay for at least two (2) years. In all these cases, the grant of benefits has been held to have ripened into company practice or policy which cannot be peremptorily withdrawn.

You might also like

- Strategic Financial Management 1 70Document70 pagesStrategic Financial Management 1 70Tija NaNo ratings yet

- TSN Presentation of Judaf Ex Parte Plaintiff N.D. SGADocument2 pagesTSN Presentation of Judaf Ex Parte Plaintiff N.D. SGASarita Alvarado92% (37)

- Customizing WHT Accumulation For CBT Ref. Nota 916003Document18 pagesCustomizing WHT Accumulation For CBT Ref. Nota 916003evandroscNo ratings yet

- Solo Parents' Welfare ActDocument31 pagesSolo Parents' Welfare ActRic VinceNo ratings yet

- Motion For Reconsideration BIDDocument5 pagesMotion For Reconsideration BIDJohn Mark Paracad100% (1)

- Academic Freedom ReportDocument9 pagesAcademic Freedom ReportJohn Mark ParacadNo ratings yet

- Academic Freedom ReportDocument9 pagesAcademic Freedom ReportJohn Mark ParacadNo ratings yet

- Porcini Analysis CaaDocument9 pagesPorcini Analysis Caaapi-36667301667% (3)

- Code of ConductDocument8 pagesCode of ConductAce LimpinNo ratings yet

- TQM Multiple Choice QuestionsDocument14 pagesTQM Multiple Choice Questionskandasamykumar67% (3)

- Harley DavidsonDocument5 pagesHarley DavidsonpagalinsanNo ratings yet

- 51960revised Code of Conduct For BIR Officials and Employees 4-22-10 PDFDocument58 pages51960revised Code of Conduct For BIR Officials and Employees 4-22-10 PDFGab Naparato100% (1)

- ReinstatementDocument4 pagesReinstatementJesse Myl MarciaNo ratings yet

- Financial AccountingDocument104 pagesFinancial AccountingRuban ThomasNo ratings yet

- 10 Commandments of Front DeskDocument14 pages10 Commandments of Front DeskSurat SomboonthanaNo ratings yet

- 000.100.8100 Baseline Centric Execution - Deliver To The Baseline WorkflowDocument1 page000.100.8100 Baseline Centric Execution - Deliver To The Baseline WorkflowmiltonNo ratings yet

- Management Prerogative (Grant of Bonus and AllowancesDocument9 pagesManagement Prerogative (Grant of Bonus and AllowancesJireh AgustinNo ratings yet

- Notes Ra 6971Document4 pagesNotes Ra 6971Howard ChanNo ratings yet

- RPC Book 1Document84 pagesRPC Book 1John Mark Paracad0% (1)

- Goodyear Philippines Inc. vs. AngusDocument1 pageGoodyear Philippines Inc. vs. AngusAnn MarieNo ratings yet

- Petition For Reconstitution of TitleDocument4 pagesPetition For Reconstitution of TitleGerard Nelson Manalo75% (4)

- Summary & Extrajudicial Killings in The PhilippinesDocument10 pagesSummary & Extrajudicial Killings in The PhilippinesMayeth Maceda75% (4)

- CCV NOTES FOR THE 2019 Labor Relations: Ia. Employer-Employee RelationshipDocument200 pagesCCV NOTES FOR THE 2019 Labor Relations: Ia. Employer-Employee RelationshipJay Mark Albis SantosNo ratings yet

- Technical AnalysisDocument19 pagesTechnical AnalysisManas Maheshwari100% (1)

- Polytechnic University of The PhilippinesDocument32 pagesPolytechnic University of The PhilippinesJustin Miguel Apostol SaludezNo ratings yet

- The Difference Between Daily Rate and Monthly Rate EmployeesDocument9 pagesThe Difference Between Daily Rate and Monthly Rate EmployeesJun AspacioNo ratings yet

- Holiday Inn Manila v. NLRCDocument2 pagesHoliday Inn Manila v. NLRCMekiNo ratings yet

- Philippines Payroll Benefits GuideDocument4 pagesPhilippines Payroll Benefits GuideRossele B. CabeNo ratings yet

- Philippines Overview - Working Hours, Overtime, and Coverage of Other Mandatory Labor RightsDocument7 pagesPhilippines Overview - Working Hours, Overtime, and Coverage of Other Mandatory Labor RightsDenver TiukengNo ratings yet

- Labor Law 1997Document9 pagesLabor Law 1997Jc GalamgamNo ratings yet

- Labor 1 - Module 1 - Introduction, General Principles and Concepts PDFDocument49 pagesLabor 1 - Module 1 - Introduction, General Principles and Concepts PDFKatharina CantaNo ratings yet

- Affidavit and documents for OWWA claimsDocument4 pagesAffidavit and documents for OWWA claimsJohn Mark ParacadNo ratings yet

- 35090rmc No. 39-2007Document6 pages35090rmc No. 39-2007Printet08No ratings yet

- The New Rules of Procedure of The National Labor Relations CommissionDocument27 pagesThe New Rules of Procedure of The National Labor Relations Commissionlian12chen1112No ratings yet

- Letter For BIR ClosureDocument1 pageLetter For BIR ClosureJhoey Castillo BuenoNo ratings yet

- Outline RA 8762Document2 pagesOutline RA 8762Tamara Bianca Chingcuangco Ernacio-TabiosNo ratings yet

- TOA Quizzer With AnswersDocument55 pagesTOA Quizzer With AnswersRussel100% (1)

- RPC 2 QuestionnaireDocument14 pagesRPC 2 QuestionnaireJohn Mark ParacadNo ratings yet

- Kinds of Employees Bar Q and ADocument2 pagesKinds of Employees Bar Q and ACherlene TanNo ratings yet

- Jurisdiction and Responsibilities of NLRCDocument3 pagesJurisdiction and Responsibilities of NLRCdjamsky100% (4)

- 13th Month Pay LawDocument45 pages13th Month Pay LawDanah RamosNo ratings yet

- Dole PrinciplesDocument17 pagesDole PrinciplescristiepearlNo ratings yet

- Special Leave Benefit GuidelinesDocument5 pagesSpecial Leave Benefit GuidelinesMellie MorcozoNo ratings yet

- Joint AffidavitDocument1 pageJoint AffidavitJohn Mark ParacadNo ratings yet

- Types of EmploymentDocument2 pagesTypes of EmploymentMarvi Blaise CochingNo ratings yet

- RPC 2 Questionnaire With AnswersDocument17 pagesRPC 2 Questionnaire With AnswersJohn Mark Paracad75% (4)

- Bar Exam Questions Income TaxationDocument11 pagesBar Exam Questions Income TaxationG.B. SevillaNo ratings yet

- Compensation Structure in The PhilippinesDocument12 pagesCompensation Structure in The PhilippinesLeavic MaghanoyNo ratings yet

- Security of TenureDocument2 pagesSecurity of TenureAyme SoNo ratings yet

- Espinosa - Lasare - Lasallian Journey RoadmapDocument2 pagesEspinosa - Lasare - Lasallian Journey RoadmapLiandra Elise EspinosaNo ratings yet

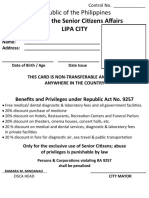

- Senior Citizen ID Card BenefitsDocument3 pagesSenior Citizen ID Card BenefitsArenz Rubi Tolentino IglesiasNo ratings yet

- REPUBLIC ACT 8972 (Solo Parents' Welfare Act of 2000)Document5 pagesREPUBLIC ACT 8972 (Solo Parents' Welfare Act of 2000)Wilchie Dane OlayresNo ratings yet

- ParentalConsentForm KYCUpgrade PDFDocument1 pageParentalConsentForm KYCUpgrade PDFFrance Bitare100% (1)

- Gsis BenefitsDocument1 pageGsis BenefitsALIAHDAYNE POLIDARIO100% (1)

- Article 221 of The Labor Code Is ClearDocument9 pagesArticle 221 of The Labor Code Is ClearAnonymous 7zVUsDhQNo ratings yet

- Annex (A1)Document1 pageAnnex (A1)Jana Jonathan0% (1)

- 13th Month Pay and 14th Month PayDocument7 pages13th Month Pay and 14th Month PayInquiry PVM100% (1)

- Quezon'S Most Outstanding SK Project 2019 Guidelines: Sangguniang Kabataan Provincial FederationDocument3 pagesQuezon'S Most Outstanding SK Project 2019 Guidelines: Sangguniang Kabataan Provincial Federationlance martinsNo ratings yet

- Slu CeeDocument3 pagesSlu CeeRaymond Dulay0% (1)

- ART. 255. (245) Ineligibility of Managerial Employees To Join Any Labor Organization Right of Supervisory EmployeesDocument1 pageART. 255. (245) Ineligibility of Managerial Employees To Join Any Labor Organization Right of Supervisory EmployeesIra AgtingNo ratings yet

- Small Claims PamphletDocument66 pagesSmall Claims PamphletZeniNo ratings yet

- Cultural Information On Conversation Topic Is PhilippinesDocument5 pagesCultural Information On Conversation Topic Is PhilippinesJoanna Felisa GoNo ratings yet

- 22 Sterling Paper Products Ent. Inc. v. KMM-Katipunan, GR No. 221493, VILLAMORA 2ADocument2 pages22 Sterling Paper Products Ent. Inc. v. KMM-Katipunan, GR No. 221493, VILLAMORA 2AMichelle VillamoraNo ratings yet

- Vicmar Development Corp. v. Elarcosa DoctrineDocument3 pagesVicmar Development Corp. v. Elarcosa DoctrineAnjela ChingNo ratings yet

- RA 7641 RETIREMENT PAY LAW GUIDELINESDocument6 pagesRA 7641 RETIREMENT PAY LAW GUIDELINESIller Anne AniscoNo ratings yet

- Article XIIDocument18 pagesArticle XIIerah maggayNo ratings yet

- (A. Nate Casket v. Arango)Document3 pages(A. Nate Casket v. Arango)Irish AlonzoNo ratings yet

- Part II - On Strikes and Lock OutsDocument53 pagesPart II - On Strikes and Lock OutsJenifer PaglinawanNo ratings yet

- Article Iii The Sangguniang Panlalawigan Section 467. CompositionDocument6 pagesArticle Iii The Sangguniang Panlalawigan Section 467. CompositionPcl Nueva VizcayaNo ratings yet

- Is Retirement Pay TaxableDocument2 pagesIs Retirement Pay TaxableChe AlsimNo ratings yet

- Wage law requirements and exemptionsDocument5 pagesWage law requirements and exemptionsGian Paula MonghitNo ratings yet

- Republic Act No. 8187Document4 pagesRepublic Act No. 8187mitsune21100% (1)

- Modal Propositions and The Multiple Types of CategoricalDocument17 pagesModal Propositions and The Multiple Types of CategoricalKristina Yu Chu50% (2)

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- GSIS Benefits & PrivilegesDocument37 pagesGSIS Benefits & PrivilegesJerald LunaNo ratings yet

- Background: Barangay IbayoDocument5 pagesBackground: Barangay Ibayozoey zaraNo ratings yet

- Basal K-12 Pricelist for 2015Document9 pagesBasal K-12 Pricelist for 2015FrederichNietszcheNo ratings yet

- The 13th Month Pay Decree: Key Provisions and GuidelinesDocument13 pagesThe 13th Month Pay Decree: Key Provisions and GuidelinesHardlyjun NaquilaNo ratings yet

- Wage Benefits OverviewDocument4 pagesWage Benefits OverviewDough and SlicesNo ratings yet

- 13THMONTH Revised by EkelDocument7 pages13THMONTH Revised by EkelEzekiel EnriquezNo ratings yet

- Naming of CompoundsDocument6 pagesNaming of CompoundsKezia Del SocorroNo ratings yet

- Labor Code Faq1Document26 pagesLabor Code Faq1junneauNo ratings yet

- Human Rights ViolationsDocument121 pagesHuman Rights ViolationsJohn Mark ParacadNo ratings yet

- Forensic ScienceDocument15 pagesForensic ScienceJohn Mark ParacadNo ratings yet

- Special Power of Attorney ConveyanceDocument2 pagesSpecial Power of Attorney ConveyanceJohn Mark ParacadNo ratings yet

- Disciplinary Authority of SchoolsDocument2 pagesDisciplinary Authority of SchoolsJohn Mark ParacadNo ratings yet

- Special Power of Attorney-SampleDocument1 pageSpecial Power of Attorney-SampleJohn Mark ParacadNo ratings yet

- Special Power of Attorney-To ProcessDocument1 pageSpecial Power of Attorney-To ProcessJohn Mark ParacadNo ratings yet

- Brief Intro SB 205Document1 pageBrief Intro SB 205John Mark ParacadNo ratings yet

- The Department of Disaster ResilienceDocument2 pagesThe Department of Disaster ResilienceJohn Mark ParacadNo ratings yet

- Final Paper Requirement-ResilienceDocument5 pagesFinal Paper Requirement-ResilienceJohn Mark ParacadNo ratings yet

- Last WillDocument3 pagesLast WillJohn Mark ParacadNo ratings yet

- Protest BiddingDocument10 pagesProtest BiddingJohn Mark ParacadNo ratings yet

- Acknowledgement of DebtDocument2 pagesAcknowledgement of DebtJohn Mark ParacadNo ratings yet

- Confirmation of SaleDocument1 pageConfirmation of SaleJohn Mark ParacadNo ratings yet

- Affidavit of Change of Use or Purpose of VehicleDocument1 pageAffidavit of Change of Use or Purpose of VehicleJohn Mark ParacadNo ratings yet

- Deed of Absolute SaleDocument1 pageDeed of Absolute SaleJohn Mark ParacadNo ratings yet

- Acknowledgment of Assumption of ObligationDocument2 pagesAcknowledgment of Assumption of ObligationJohn Mark ParacadNo ratings yet

- Philippines affidavit details past homosexual relationship and present situationDocument2 pagesPhilippines affidavit details past homosexual relationship and present situationJoshua ReyesNo ratings yet

- Acknowledgment Receipt-Purchase PriceDocument1 pageAcknowledgment Receipt-Purchase PriceJohn Mark ParacadNo ratings yet

- Acknowledgment ReceiptDocument1 pageAcknowledgment ReceiptJohn Mark ParacadNo ratings yet

- Boost Your Profile in PrintDocument45 pagesBoost Your Profile in PrintJaya KrishnaNo ratings yet

- Project Costs and Expenses ReportDocument206 pagesProject Costs and Expenses ReportBaburaj ApparsamyNo ratings yet

- South Indian Bank Result UpdatedDocument13 pagesSouth Indian Bank Result UpdatedAngel BrokingNo ratings yet

- Law of Supply and Demand ExplainedDocument2 pagesLaw of Supply and Demand ExplainedLhoy Guisihan Asoy Idulsa100% (1)

- NebicoDocument6 pagesNebicomaharjanaarya21No ratings yet

- Entrepreneurship and Enterprise Development Final ExamDocument3 pagesEntrepreneurship and Enterprise Development Final ExammelakuNo ratings yet

- Brochure - B2B - Manufacturing - Urban CarnivalDocument8 pagesBrochure - B2B - Manufacturing - Urban CarnivalGaurav GoyalNo ratings yet

- One of The World's Leading Suppliers of Crane ComponentsDocument24 pagesOne of The World's Leading Suppliers of Crane ComponentsKalin StamatovNo ratings yet

- Construction Management: ENCE4331: Cost and Price ExamplesDocument7 pagesConstruction Management: ENCE4331: Cost and Price ExamplesTania MassadNo ratings yet

- How to Become a Successful EntrepreneurDocument43 pagesHow to Become a Successful EntrepreneurKyla Francine Tiglao100% (1)

- The Future Challenges of Local Authorities in Mala PDFDocument6 pagesThe Future Challenges of Local Authorities in Mala PDFMuhammad IzwanNo ratings yet

- Ax40 Enus BSC 01 Dynamics Ax Balanced Score CardDocument12 pagesAx40 Enus BSC 01 Dynamics Ax Balanced Score CarddareosikoyaNo ratings yet

- Inventory Management - MIDAS SafetyDocument22 pagesInventory Management - MIDAS Safetysupplier13No ratings yet

- Erlk CGD enDocument322 pagesErlk CGD enkabjiNo ratings yet

- RTO ProcessDocument5 pagesRTO Processashutosh mauryaNo ratings yet

- BDC 071182 Ec 9Document12 pagesBDC 071182 Ec 9Morty LevinsonNo ratings yet

- Disaster Recovery Using VMware Vsphere Replication and Vcenter Site Recovery Manager Sample ChapterDocument41 pagesDisaster Recovery Using VMware Vsphere Replication and Vcenter Site Recovery Manager Sample ChapterPackt PublishingNo ratings yet

- Battle Card MFG For SAP 3.0Document8 pagesBattle Card MFG For SAP 3.0anishthankachanNo ratings yet

- Entry Test Sample Paper ForDocument5 pagesEntry Test Sample Paper ForShawn Parker100% (3)