Professional Documents

Culture Documents

NDC v. CIR (Interest Income)

Uploaded by

AMBCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NDC v. CIR (Interest Income)

Uploaded by

AMBCopyright:

Available Formats

G.R. No. L-53961 June 30, 1987 NATIONAL DEVELOPMENT COMPANY, petitioner, vs. COMMISSIONER OF INTERNAL REVENUE, respondent.

FACTS: The national Development Company entered into contracts in Tokyo with several Japanese shipbuilding companies for the construction of twelve ocean-going vessels. The purchase price was to come from the proceeds of bonds issued by the Central Bank. Initial payments were made in cash and through irrevocable letters of credit. Fourteen promissory notes were signed for the balance by the NDC and, as required by the shipbuilders, guaranteed by the Republic of the Philippines. Pursuant thereto, the remaining payments and the interests thereon were remitted in due time by the NDC to Tokyo. The vessels were eventually completed and delivered to the NDC in Tokyo. The NDC remitted to the shipbuilders in Tokyo the total amount of US$4,066,580.70 as interest on the balance of the purchase price. No tax was withheld. The Commissioner then held the NDC liable on such tax in the total sum of P5,115,234.74. Negotiations followed but failed. The BIR thereupon served on the NDC a warrant of distraint and levy to enforce collection of the claimed amount. The NDC went to the Court of Tax Appeals. The BIR was sustained by the CTA except for a slight reduction of the tax deficiency in the sum of P900.00, representing the compromise penalty. The NDC then filed a petition for certiorari with the SC. ISSUE: Whether the Japanese shipbuilders were not subject to tax under Section 37 of the Tax Code because all the related activities to the signing of the contract were done in Tokyo. HELD: No. The law does not speak of activity but of "source," which in this case is the NDC. This is a domestic and resident corporation with principal offices in Manila. (NOTE: This is the summary of the point of the SC but they quoted the CA's decision which is an expanded version of the summary. You can check the case if you feel like it but it says the same thing.) There is no basis for saying that the interest payments were obligations of the Republic of the Philippines and that the promissory notes of the NDC were government securities exempt from taxation under Section 29(b)[4] of the Tax Code. The law invoked by the petitioner as authorizing the issuance of securities is R.A. No. 1407, which in fact is silent on this matter. C.A. No. 182 as amended by C.A. No. 311 does carry such authorization but, like R.A. No. 1407, does not exempt from taxes the interests on such securities. It is also incorrect to suggest that the Republic of the Philippines could not collect taxes on the interest remitted because of the undertaking signed by the Secretary of Finance in each of the promissory notes that: Upon authority of the President of the Republic of the Philippines, the undersigned, for value received, hereby absolutely and unconditionally guarantee (sic), on behalf of the Republic of the Philippines, the due and punctual payment of both principal and interest of the above note. There is nothing in the above undertaking exempting the interests from taxes. Petitioner has not established a clear waiver therein of the right to tax interests. Tax exemptions cannot be merely implied

but must be categorically and unmistakably expressed. Any doubt concerning this question must be resolved in favor of the taxing power. Nowhere in the said undertaking do we find any inhibition against the collection of the disputed taxes. In fact, such undertaking was made by the government in consonance with and certainly not against the Sec. 53(b) and Sec. 54 of the Tax Code. Manifestly, the said undertaking of the Republic of the Philippines merely guaranteed the obligations of the NDC but without diminution of its taxing power under existing laws. In suggesting that the NDC is merely an administrator of the funds of the Republic of the Philippines, the petitioner closes its eyes to the nature of this entity as a corporation. As such, it is governed in its proprietary activities not only by its charter but also by the Corporation Code and other pertinent laws. The petitioner also forgets that it is not the NDC that is being taxed. The tax was due on the interests earned by the Japanese shipbuilders. It was the income of these companies and not the Republic of the Philippines that was subject to the tax the NDC did not withhold. In effect, therefore, the imposition of the deficiency taxes on the NDC is a penalty for its failure to withhold the same from the Japanese shipbuilders. Such liability is imposed by Section 53(c) of the Tax Code. The petitioner was remiss in the discharge of its obligation as the withholding agent of the government an so should be held liable for its omission.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Navi Mumbai MidcDocument132 pagesNavi Mumbai MidcKedar Parab67% (15)

- DEPED MEDIATION POLICY GUIDELINESDocument36 pagesDEPED MEDIATION POLICY GUIDELINESAMB100% (2)

- PhilippinesDocument55 pagesPhilippinesArbie Llesis0% (1)

- Waiver of 125Document2 pagesWaiver of 125AMBNo ratings yet

- People V Lopez, Et. Al.Document2 pagesPeople V Lopez, Et. Al.AMB100% (1)

- Better Handwriting For AdultsDocument48 pagesBetter Handwriting For Adultsnala_finance84% (19)

- Balakrishnan MGRL Solutions Ch06Document64 pagesBalakrishnan MGRL Solutions Ch06deeNo ratings yet

- Emirates Airlines Pilots Salary StructureDocument6 pagesEmirates Airlines Pilots Salary StructureShreyas Sinha0% (1)

- Advanced Engineering Economy & CostingDocument84 pagesAdvanced Engineering Economy & Costingduraiprakash83No ratings yet

- Assn of Small LandownersDocument2 pagesAssn of Small LandownersAMBNo ratings yet

- Estoppel by LachesDocument10 pagesEstoppel by LachesAMB100% (1)

- 2011 WE Application FormDocument6 pages2011 WE Application FormcrisjavaNo ratings yet

- Credit Trans (Deposit)Document32 pagesCredit Trans (Deposit)AMBNo ratings yet

- Concorde Condominium Inc Vs Baculio Et AlDocument19 pagesConcorde Condominium Inc Vs Baculio Et Alpatricia.aniyaNo ratings yet

- Cordillera Region LiteratureDocument15 pagesCordillera Region LiteratureLouie Alejandro83% (36)

- Gma Network v. NatelcoDocument11 pagesGma Network v. NatelcoWan WanNo ratings yet

- Obligations (18 34)Document41 pagesObligations (18 34)AMBNo ratings yet

- International Trade in Human Eggs Surrogacy and OrgansDocument103 pagesInternational Trade in Human Eggs Surrogacy and OrgansAMBNo ratings yet

- Prillbrett ArtDocument26 pagesPrillbrett ArtAMBNo ratings yet

- Credit Trans (Guaranty)Document41 pagesCredit Trans (Guaranty)AMBNo ratings yet

- Austria CaseDocument2 pagesAustria CaseAMBNo ratings yet

- CODE OF JUDICIAL CONDUCTDocument21 pagesCODE OF JUDICIAL CONDUCTAMBNo ratings yet

- Blas Ople CaseDocument2 pagesBlas Ople CaseAMBNo ratings yet

- Logic Puzzle No.1Document1 pageLogic Puzzle No.1AMBNo ratings yet

- War and Peace NTDocument2,882 pagesWar and Peace NTAMBNo ratings yet

- Labor and Social Legislation (Bar Exam Questions 2007-2014)Document72 pagesLabor and Social Legislation (Bar Exam Questions 2007-2014)AMBNo ratings yet

- ART and Its Legal InnuendosDocument35 pagesART and Its Legal InnuendosAMBNo ratings yet

- Authors Guild V Google Fair Use Summary JudgmentDocument30 pagesAuthors Guild V Google Fair Use Summary JudgmentAMBNo ratings yet

- Motivation and Reward: What Does It Mean To Be Motivated?Document23 pagesMotivation and Reward: What Does It Mean To Be Motivated?AMBNo ratings yet

- RDO No 4 - Calasiao (Cities & All Municipalities)Document827 pagesRDO No 4 - Calasiao (Cities & All Municipalities)AMB71% (7)

- Insurance Cases Set 2 (DIGESTS)Document5 pagesInsurance Cases Set 2 (DIGESTS)AMB100% (1)

- Chattel Mortgage CasesDocument4 pagesChattel Mortgage CasesAMBNo ratings yet

- Digest (Esacano, Tupaz, Palmarez)Document3 pagesDigest (Esacano, Tupaz, Palmarez)AMBNo ratings yet

- The Human Skeleton: Anterior ViewDocument0 pagesThe Human Skeleton: Anterior VieweduardoarcticNo ratings yet

- Government Sanctions 27% Interim Relief for PensionersDocument4 pagesGovernment Sanctions 27% Interim Relief for PensionersThappetla SrinivasNo ratings yet

- Description of Empirical Data Sets: 1. The ExamplesDocument3 pagesDescription of Empirical Data Sets: 1. The ExamplesMANOJ KUMARNo ratings yet

- Inflation Title: Price Stability Definition, Causes, EffectsDocument20 pagesInflation Title: Price Stability Definition, Causes, EffectsSadj GHorbyNo ratings yet

- 13 Marginal CostingDocument5 pages13 Marginal CostingPriyanka ShewaleNo ratings yet

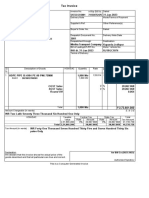

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- "Tsogttetsii Soum Solid Waste Management Plan" Environ LLCDocument49 pages"Tsogttetsii Soum Solid Waste Management Plan" Environ LLCbatmunkh.eNo ratings yet

- Cover NoteDocument1 pageCover NoteSheera IsmawiNo ratings yet

- PLCPD Popdev Media AwardsDocument21 pagesPLCPD Popdev Media AwardsMulat Pinoy-Kabataan News NetworkNo ratings yet

- Bahrain - Kuwait HFC Outlook VisualizationDocument32 pagesBahrain - Kuwait HFC Outlook VisualizationElias GomezNo ratings yet

- Bid Data SheetDocument3 pagesBid Data SheetEdwin Cob GuriNo ratings yet

- UberPOOL AddendumDocument4 pagesUberPOOL AddendumEfrRireNo ratings yet

- Partnership Dissolution and Liquidation ProcessDocument3 pagesPartnership Dissolution and Liquidation Processattiva jadeNo ratings yet

- SHFL Posting With AddressDocument8 pagesSHFL Posting With AddressPrachi diwateNo ratings yet

- AE 5 Midterm TopicDocument9 pagesAE 5 Midterm TopicMary Ann GurreaNo ratings yet

- Principle of Economics1 (Chapter2)Document7 pagesPrinciple of Economics1 (Chapter2)MA ValdezNo ratings yet

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDocument1 pageShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNo ratings yet

- CH North&south PDFDocument24 pagesCH North&south PDFNelson Vinod KumarNo ratings yet

- Beximco Pharmaceuticals International Business AnalysisDocument5 pagesBeximco Pharmaceuticals International Business AnalysisEhsan KarimNo ratings yet

- (Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)Document165 pages(Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)gootNo ratings yet

- ALO StrategyDocument1 pageALO StrategyChayse BarrNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateMANJUNATH GOWDANo ratings yet

- Rationale Behind The Issue of Bonus SharesDocument31 pagesRationale Behind The Issue of Bonus SharesSandeep ReddyNo ratings yet

- CareEdge Ratings Update On Tyre IndustryDocument5 pagesCareEdge Ratings Update On Tyre IndustryIshan GuptaNo ratings yet

- Extra Oligopolio PDFDocument17 pagesExtra Oligopolio PDFkako_1984No ratings yet

- Book No. 13 Accountancy Financial Sybcom FinalDocument380 pagesBook No. 13 Accountancy Financial Sybcom FinalPratik DevarkarNo ratings yet

- ProjectDocument17 pagesProjectfirman tri ajie75% (4)